Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Silver's industrial use in green energy could see it soaring in price like gold

By: Yahoo Finance | April 17, 2024

• Gold has been hitting record highs — why there's a bullish case for silver too.

Gold’s (GC=F) recent breakout to record highs has investors optimistic about silver (SI=F) as well.

The commodity often referred to as gold's "little brother" has been hovering above $28 an ounce, up roughly 23% over the past two months, versus a 19% rise for the yellow precious metal during the same period.

“The typical pattern for silver is — gold is the leader. [It] breaks out first, and then within a few months silver kind of takes charge and slingshots by. We’re starting to see that,” Sprott Asset Management CEO John Ciampaglia told Yahoo Finance this week.

The bulls aren't just following price trends. They're also looking at demand, specifically silver's growing industrial use in the green energy transition.

“We see very strong buying coming from India for silver, as well as steady consumption of silver for the use of solar panels, which is being built out at record amounts around the world right now,” Ciampaglia said.

The use of silver in industrial applications hit a new high in 2023 for a third consecutive year, according to data released on Wednesday by the Silver Institute, an industry nonprofit.

“Ongoing structural gains from green economy applications underpinned these advances,” said the report, citing higher-than-expected capacity and adoption for solar panels.

The Silver Institute expects the metal's supply to decrease by 1% this year, resulting in the second-largest market deficit in more than 20 years. The industry group also expects demand to expand beyond the energy transition in coming years.

“For example, silver will become an indispensable material as artificial intelligence (AI) rises. End uses expected to incorporate silver in AI include transportation, nanotechnology, biotechnology, healthcare, consumer wearables, computing, and energy in data centers,” said the report.

Silver last closed at a record high just above $48 per ounce in April 2011.

Read Full Story »»»

DiscoverGold

DiscoverGold

Silver has followed gold's lead and shot higher in recent weeks

By: Markets & Mayhem | April 17, 2024

• Silver has followed gold's lead and shot higher in recent weeks.

@jaykaeppel’s analysis explores several seasonality and sentiment indicators that are currently flashing yellow.

Read Full Story »»»

DiscoverGold

DiscoverGold

Silver Continues to Grind Back And Forth at High Levels

By: Christopher Lewis | April 17, 2024

• The silver market has gone back and forth during the Wednesday session, as we continue to see a lot of froth being worked off in this market.

Silver Markets Technical Analysis

Silver rallied a little bit during the trading session here on Wednesday, as we continue to consolidate around the crucial $28.50 level. This is an area that has been important multiple times, and therefore it does make a certain amount of sense that the market will remember that there are a lot of orders here between here and $30.

I do think there’s a lot of noise, and therefore it’s difficult for silver to continue to go higher. The $28 level underneath is an area that has seen a little bit of short term support, and I think you will have to pay close attention to that. But if we break down below there, then it’s likely that we will go down to the $26 level.

The $26 level also features the 50 day EMA racing toward it and therefore I do think there’s a significant amount of support. The RSI has dropped below the 70 level, so that’s a good sign. But right now, I think silver still has quite a bit to do before it can go higher. And it’s worth noting that the $30 level has been a major level going back decades.

So, with that being the case, I do think it’s going to be very difficult to continue going higher. And I prefer to buy silver on some type of dip if I get the opportunity, especially if it would be closer to the $26 level. If we get back to that level and bounce, I suspect there will be massive buying as it will be a classic technical bounce and continuation signal.

Read Full Story »»»

DiscoverGold

DiscoverGold

$SILVER / #Inflation $USCPI - At the 'Flag' Breakout...

By: Sahara | April 17, 2024

• $SILVER / #Inflation $USCPI - At the 'Flag' Breakout...

Read Full Story »»»

DiscoverGold

DiscoverGold

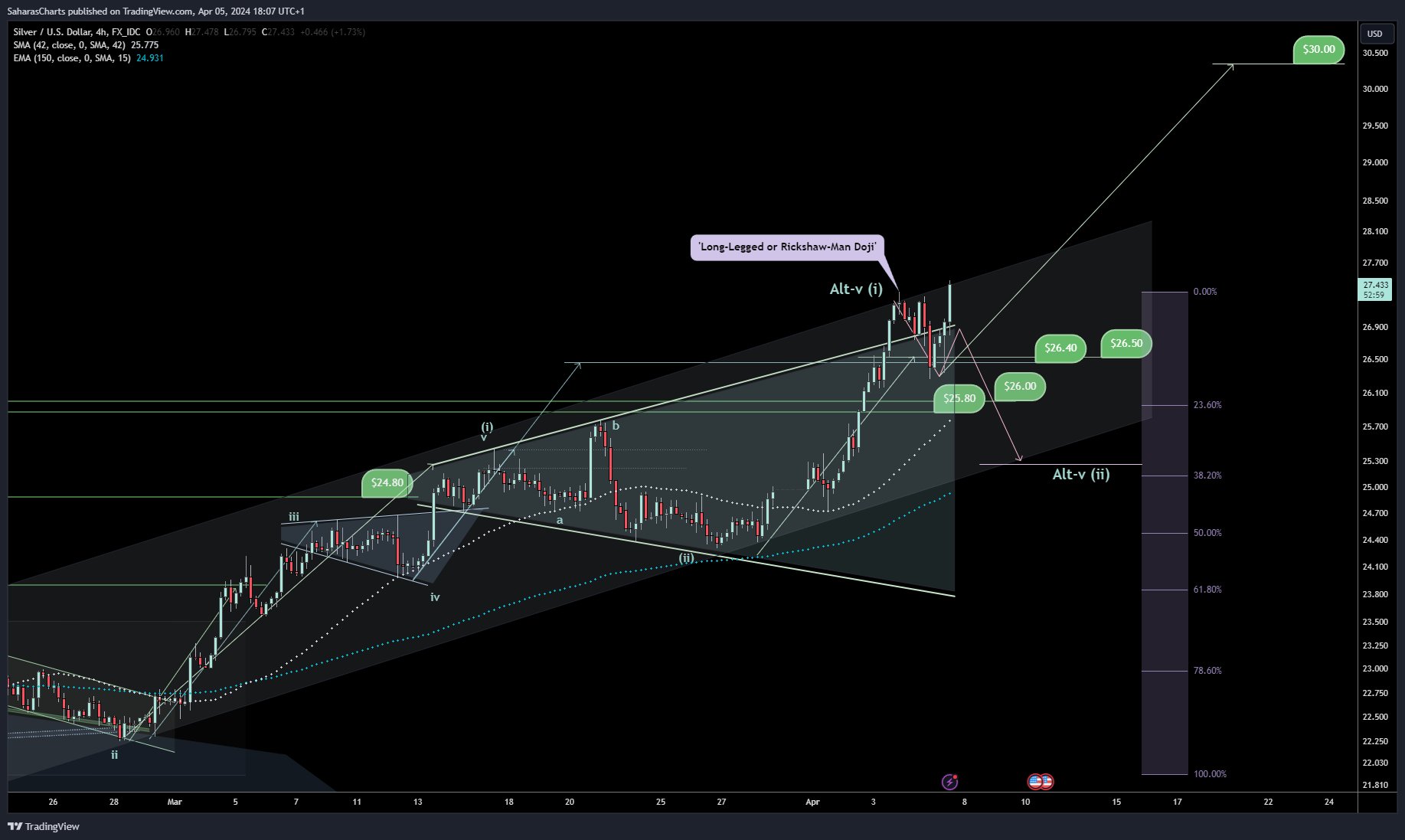

Silver $SLV - I did say we may see some stalling before a B/Out at this final band of the Dn/Trend Channel...

By: Sahara | April 16, 2024

• $SILVER $SLV - Latest

I did say we may see some stalling before a B/Out at this final band of the Dn/Trend Channel...

So no stress, even if it wishes to B/Tap the 'Broadening' Pattern (Blue)...

Read Full Story »»»

DiscoverGold

DiscoverGold

Silver: Potential for 9-Year Highs Ahead

By: Bruce Powers | April 15, 2024

• The monthly chart for silver reveals a large bull flag pattern, suggesting a potential for sharp price rises if the breakout from the flag is sustained.

Following a drop to a three-day low and a decline below the 8-Day MA earlier in Monday’s trading session, silver rebounds sharply intraday to retake the lows and the moving average. It continues to trade near the highs of the day at the time of this writing. The question is, will silver be able to sustain a rally to new trend highs and beyond? Unfortunately, we won’t know the answer until there is a sustained break above last week’s high of 29.80. Given Fridays price action, it is questionable, but given today’s price action, the possibility again exists.

Strong Rebound Following Early Weakness

Silver rallied strong on Friday, but it closed weak. And the weak close came after a 5.47 point or 22.5% advance as of last week’s high. That measures the most recent swing that began from the Marc 28 pullback low. However, today’s bullish price action could lead to higher prices and complete a brief pullback in the price of silver. Silver popped up to test highs from 2020 and 2021 last week with its trend high of 29.80. A decisive breakout above the 30.14 swing high from 2021 would put silver at a greater than 9-year high.

Monthly Bullish Pattern Dominates

In the bigger picture, and seen in the enclosed monthly chart for silver, a large bull flag is present. The sharp move prior to the flag, referred to as the pole, saw silver rise by 156.5% in less than five months. With what looks like a sustainable breakout of the flag that triggered last month, silver has the potential to see prices rise sharply again.

The measuring objective used to identify a target from the flag uses the distance in price seen in the pole and then projects that upward from the flag breakout area. There are two projected price areas then identified. One, based off a price match and the other from a percentage match. A 156.5% rally from the flag breakout, using 23.50, projects to 60.27. However, the dollar-based target is 41.7. That is 18.22 up from the flag breakout level.

Read Full Story »»»

DiscoverGold

DiscoverGold

Silver Prices Stable Amid Middle East Tensions, Inflation Worries

By: James Hyerczyk | April 15, 2024

Rebounding from Early Session Weakness

Silver prices demonstrated resilience, climbing higher on Monday after initially faltering due to geopolitical tensions in the Middle East. This recovery came despite Iran’s significant military actions against Israel over the weekend, marking a rare direct conflict escalation in decades. Meanwhile, gold continued to exhibit stability, maintaining prices near record highs amidst global unrest.

At 10:42 GMT, XAG/USD is trading $28.37, up $0.48 or +1.73%.

Market Response to Middle East Tensions

The silver market reacted to the heightened geopolitical risks by rebounding from its drop last Friday, testing three-year highs near $29.80 per ounce. The initial sell-off was replaced by a moderate recovery as major global powers called for restraint, which provided some relief to the markets. In parallel, gold prices stayed robust, reflecting its enduring appeal as a safe-haven asset during times of crisis.

Dollar Strength and Economic Indicators

The U.S. dollar index remained relatively stable, hovering just below a recent 5-1/2 month peak. The strong dollar, generally a negative for precious metals as it makes them more expensive for holders of other currencies, was countered by ongoing U.S. inflation concerns. These concerns keep expectations of high U.S. interest rates, supporting both the dollar and investor interest in gold as an inflation hedge.

Investor Outlook and Treasury Yields

U.S. Treasury yields saw an uptick, driven by investor recalibration of expectations regarding economic growth and interest rates following recent U.S. inflation data. This week, attention is focused on upcoming U.S. economic reports and Federal Reserve officials’ statements, which are expected to provide further insights into the future monetary policy.

Short-Term Market Forecast

In the short term, the markets are expected to remain sensitive to developments in the Middle East and ongoing economic data releases. For gold, the scenario looks cautiously bullish. Despite the potential headwind from a stronger dollar, persistent inflation concerns are likely to sustain or even boost gold’s attractiveness as a protective asset against price rises. Silver, benefiting from its correlation with gold and industrial demand, could also see continued strength if investor sentiment remains geared towards safety amid uncertainty.

This analysis suggests a generally positive outlook for both silver and gold, as investors weigh ongoing geopolitical risks against economic indicators and central bank policies.

Technical Analysis

Daily Silver (XAG/USD)

Silver (XAG/USD) is trading higher on Monday even after confirming Friday’s closing price reversal top. Nonetheless, the earlier move did shift momentum to the downside.

A trade through $29.80 will signal a resumption of the uptrend, while a move through $27.53 will change the minor trend to down. This could lead to a further break into a pair of support levels at $26.90 and $26.17.

Read Full Story »»»

DiscoverGold

DiscoverGold

Silver Market Update - it's CORRECTION TIME...

By: Clive Maund | April 13, 2024

Silver has done really well in recent weeks ascending towards “round number” resistance at $30 but that’s where it “decided to call it a day” on Friday with a big ugly reversal candle forming on heavy volume – a “gravestone doji”. Silver’s strong rally this month has led to its being supercritically overbought on its RSI indicator for most of this month and reaching its second most overbought extreme on its MACD indicator of the past 10 years. On its 3-month chart below we can also see that its ascent this month has taken it to the top of the uptrend channel shown, a good point to reverse to the downside with the bearish candle that appeared on Friday strongly suggesting that this is what it will do. As set out in the parallel Gold Market update, the fear factor this month associated with an impending attack on Israel by Iran – which is now happening – appears to have been blown out of proportion, with, at the time of writing, it looking like Iran is lobbing face saving firework-like missiles at Israel, most of which are being shot down. So if this attack turns out to be a “nothingburger”, markets will heave a sigh of relief next week – and gold and silver will likely react back as the charts are suggesting.

As with gold stocks, this is thought to be a good time to take some profits on silver stocks with a view to buying back any stock sold at a better price a little later or taking the opportunity to rebalance ones portfolio to include the strongest stocks. We are only talking about a correction here – the powerful PM sector bullmarket should soon reassert itself and take prices much higher. How far might silver react back over the short to medium-term? – probably no lower than about $26.50 before it turns higher again.

Read Full Story »»»

DiscoverGold

DiscoverGold

NY Silver COMEX Futures »» Weekly Summary Analysis

By: Marty Armstrong | April 13, 2024

NY Silver COMEX Futures closed today at 28330 and is trading up about 17% for the year from last year's settlement of 24086. Caution is required for this market is starting to suggest it may now decline on the MONTHLY level. This price action here in April is reflecting that this has been still a bearish reactionary trend on the monthly level. As we stand right now, this market has made a new high exceeding the previous month's high reaching thus far 29905 intraday and is still trading above that high of 25975.

Up to now, we still have only a 3 month reaction decline from the high established during December 2023. We must exceed the 3 month mark in order to imply that a trend is developing.

ECONOMIC CONFIDENCE MODEL CORRELATION

Here in NY Silver COMEX Futures, we do find that this particular market has correlated with our Economic Confidence Model in the past. The Last turning point on the ECM cycle low to line up with this market was 2020 and 2015 and 2001. The Last turning point on the ECM cycle high to line up with this market was 2011 and 1998.

MARKET OVERVIEW

NEAR-TERM OUTLOOK

The historical perspective in the NY Silver COMEX Futures included a rally from 2020 moving into a major high for 2021, the market has been consolidating since the major high with the last significant reaction low established back in 2020. The market is still holding above last year's low. The last Yearly Reversal to be elected was a Bullish at the close of 2020 which signaled the rally would continue into 2021.

This market remains in a positive position on the weekly to yearly levels of our indicating models. Pay attention to the Monthly level for any serious change in long-term trend ahead.

Looking at the indicating ranges on the Daily level in the NY Silver COMEX Futures, this market remains moderately bullish currently with underlying support beginning at 27725 and overhead resistance forming above at 28440. The market is trading closer to the resistance level at this time.

On the weekly level, the last important high was established the week of April 8th at 29905, which was up 8 weeks from the low made back during the week of February 12th. So far, this week is trading within last week's range of 29905 to 26970. Nevertheless, the market is still trading downward more toward support than resistance. A closing beneath last week's low would be a technical signal for a correction to retest support.

When we look deeply into the underlying tone of this immediate market, we see it is currently still in a semi neutral posture despite declining from the previous high at 29905 made 0 week ago. The broader perspective, this current rally into the week of April 8th reaching 29905 has exceeded the previous high of 25975 made back during the week of March 18th.

Right now, the market is above momentum on our weekly models hinting this is still bullish for now as well as trend, long-term trend, and cyclical strength. Looking at this from a wider perspective, this market has been trading up for the past 2 weeks overall.

INTERMEDIATE-TERM OUTLOOK

YEARLY MOMENTUM MODEL INDICATOR

Our Momentum Models are declining at this time with the previous high made 2021 while the last low formed on 2023. However, this market has rallied in price with the last cyclical high formed on 2021 and thus we have a divergence warning that this market is starting to run out of strength on the upside.

Looking at the longer-term monthly level, we did see that the market made a high in December 2023 at 26340. After a nine month rally from the previous low of 22785, it made last high in December. Since this last high, the market has corrected for nine months. However, this market has held important support last month. So far here in April, this market has held above last month's low of 22710 reaching 24855.

Critical support still underlies this market at 22263 and a break of that level on a monthly closing basis would warn that a sustainable decline ahead becomes possible. Nevertheless, the market is trading above last month's high showing some strength.

DiscoverGold

DiscoverGold

Silver $SLV - 1st Target Hit from that 'Broadening' Plot. Piercing the Barricade in fine fashion, but may be some stalling before a B/Out?...

By: Sahara | April 12, 2024

• $SILVER $SLV - 1st Target Hit from that 'Broadening' Plot.

Piercing the Barricade in fine fashion, but may be some stalling before a B/Out?...

Read Full Story »»»

DiscoverGold

DiscoverGold

Silver $SLV - Latest: Following the Bullish Script. Yet we are into the $28-30 Uppr-Band which is a Res-Level as I have shown prior...

By: Sahara | April 9, 2024

• $SILVER $SLV - Latest

Following the Bullish Script. Yet we are into the $28-30 Uppr-Band which is a Res-Level as I have shown prior...

Read Full Story »»»

DiscoverGold

DiscoverGold

Silver Surges to New High, Bulls in Control

By: Bruce Powers | April 8, 2024

• Last week's weekly close confirms bull trend in silver, signaling potential for eventual new highs above 30.14.

Bullish upward momentum took silver to a new trend high of 28.09 on Monday and it is on track to close strong, above last week’s high and in the top third of the day’s trading range. Silver was up by 1.81 points or 26.1% from the February 28 pullback low as of today’s high, and 15.5% above the March 27 minor swing low.

Monday’s low of 26.86 successfully tested support around the prior March 2022 swing high of 26.95 before bouncing. That price area previously marked a zone of potential resistance as there is confluence of several Fibonacci targets. Now, it is an area of support. This is bullish price behavior and shows the bull trend strengthening.

Strong Weekly Close Confirmed Bull Trend

Last week’s weekly close above the May 23 swing high from last year confirmed a continuation of the bull tend that began from the August 2022 swing low. Further, the week also ended above the prior swing high of 26.95 from March 2022. That move further confirmed a reversal of the downtrend that started off the February 2021 peak. In summary, silver has broken out above key levels and is setting the stage for the possibility of eventual new highs, above the 30.14 peak from February 2021.

Measured Move Target of 27.86 Exceeded

A target of 27.86 in silver was reached during today’s advance. It completed a rising ABCD pattern or measured move as marked on the chart with vertical purple arrows. The larger rising ABCD pattern in green has an extended 127.2% target of 28.57, as the first target was already exceeded. Notice that the completion of the 28. 57 target will put silver up near the peaks from 2020 and 2021. Prior to those peaks silver had rallied by over 18 points or 156.5% in only 104 trading days. Might a similar sharp advance be seen again now that silver is coming out of consolidation and has clearly reversed the prior correction?

Moving Average Confirm Strengthening

Recent price behavior for silver relative to its moving averages is also giving bullish signs. Notice that last Friday successfully tested support around the 8-Day MA, leading to an advance. Two weeks ago, and last week the purple 20-Day MA was tested, and price was rejected to the upside. Further, notice the orange 50-Day is increasing its slope after recently breaking back above the 200-Day MA.

Read Full Story »»»

DiscoverGold

DiscoverGold

Silver Continues to See Volatility

By: Christopher Lewis | April 8, 2024

• Silver continues to see a lot of noisy behavior as we have seen a lot of upward pressure over the last several weeks.

Silver Markets Technical Analysis

Silver initially fell during the trading session on Monday but then turned around to show signs of strength again. All things being equal, it certainly looks like we are trying to break out to a much bigger move and a lot of people are looking for $30. For myself, I believe that the $28.50 level is going to be a significant amount resistance and if we could break above there, we could go to the $30 level.

In the meantime, you have to assume that short-term pullbacks are buying opportunities. The $26 level underneath should be a significant amount of support, but I think given enough time, this is a market that I think you have to look at very carefully due to the fact that it has been over stretched that silver is going to snap back sooner or later.

If you’re playing the geopolitical situation around the world, gold’s going to be your better trade, but both the gold market and the silver market are both way overdone. Although on the reading, you could actually make an argument that silver isn’t as overbought as gold, but I digress.

Silver isn’t quite the geopolitical metal that gold is. I think you have to look for a pullback before you get involved. If we were to break down below the $26 level, it could show that silver is settling down again finally, but right now, this is a very dangerous market, and therefore you need to be cautious about your position size, as it is the only thing that you can control overall.

Read Full Story »»»

DiscoverGold

DiscoverGold

Silver $SLV - Popped the Chanel (Shaded). Following the Bullish Script to $30 Target, if ti holds the B/Out...

By: Sahara | April 8, 2024

• $SILVER $SLV - Popped the Chanel (Shaded).

Following the Bullish Script to $30 Target, if ti holds the B/Out...

Read Full Story »»»

DiscoverGold

DiscoverGold

$SLV Highest weekly volume in over TWO YEARS. This breakout could just be getting warmed up.

By: TrendSpider | April 6, 2024

• Highest weekly volume in over TWO YEARS. $SLV

This breakout could just be getting warmed up.

Read Full Story »»»

DiscoverGold

DiscoverGold

NY Silver COMEX Futures »» Weekly Summary Analysis

By: Marty Armstrong | April 6, 2024

NY Silver COMEX Futures closed today at 27503 and is trading up about 14% for the year from last year's settlement of 24086. Caution is required for this market is starting to suggest it may now decline on the MONTHLY level. This price action here in April is reflecting that this has been still a bearish reactionary trend on the monthly level. As we stand right now, this market has made a new high exceeding the previous month's high reaching thus far 27615 intraday and is still trading above that high of 25975.

Up to now, we still have only a 3 month reaction decline from the high established during December 2023. We must exceed the 3 month mark in order to imply that a trend is developing.

ECONOMIC CONFIDENCE MODEL CORRELATION

Here in NY Silver COMEX Futures, we do find that this particular market has correlated with our Economic Confidence Model in the past. The Last turning point on the ECM cycle low to line up with this market was 2020 and 2015 and 2001. The Last turning point on the ECM cycle high to line up with this market was 2011 and 1998.

MARKET OVERVIEW

NEAR-TERM OUTLOOK

The historical perspective in the NY Silver COMEX Futures included a rally from 2020 moving into a major high for 2021, the market has been consolidating since the major high with the last significant reaction low established back in 2020. The market is still holding above last year's low. The last Yearly Reversal to be elected was a Bullish at the close of 2020 which signaled the rally would continue into 2021.

This market remains in a positive position on the weekly to yearly levels of our indicating models. Pay attention to the Monthly level for any serious change in long-term trend ahead.

Looking at the indicating ranges on the Daily level in the NY Silver COMEX Futures, this market remains moderately bullish currently with underlying support beginning at 26295.

On the weekly level, the last important high was established the week of April 1st at 27615, which was up 7 weeks from the low made back during the week of February 12th. So far, this week is trading within last week's range of 27615 to 24855. Nevertheless, the market is still trading upward more toward resistance than support. A closing beneath last week's low would be a technical signal for a correction to retest support.

When we look deeply into the underlying tone of this immediate market, we see it is currently still in a semi neutral posture despite declining from the previous high at 27615 made 0 week ago. The broader perspective, this current rally into the week of April 1st reaching 27615 has exceeded the previous high of 23445 made back during the week of January 29th.

Right now, the market is above momentum on our weekly models hinting this is still bullish for now as well as trend, long-term trend, and cyclical strength. Looking at this from a wider perspective, this market has been trading up for the past 7 weeks overall.

INTERMEDIATE-TERM OUTLOOK

YEARLY MOMENTUM MODEL INDICATOR

Our Momentum Models are declining at this time with the previous high made 2021 while the last low formed on 2023. However, this market has rallied in price with the last cyclical high formed on 2021 and thus we have a divergence warning that this market is starting to run out of strength on the upside.

Looking at the longer-term monthly level, we did see that the market made a high in December 2023 at 26340. After a nine month rally from the previous low of 22785, it made last high in December. Since this last high, the market has corrected for nine months. However, this market has held important support last month. So far here in April, this market has held above last month's low of 22710 reaching 24855.

Critical support still underlies this market at 22263 and a break of that level on a monthly closing basis would warn that a sustainable decline ahead becomes possible. Nevertheless, the market is trading above last month's high showing some strength.

DiscoverGold

DiscoverGold

Silver $SLV - Following the Bullish Script. Yet, has to pop the Channel (Shaded)...

By: Sahara | April 5, 2024

• $SILVER $SLV - Following the Bullish Script.

Yet, has to pop the Channel (Shaded)...

Read Full Story »»»

DiscoverGold

DiscoverGold

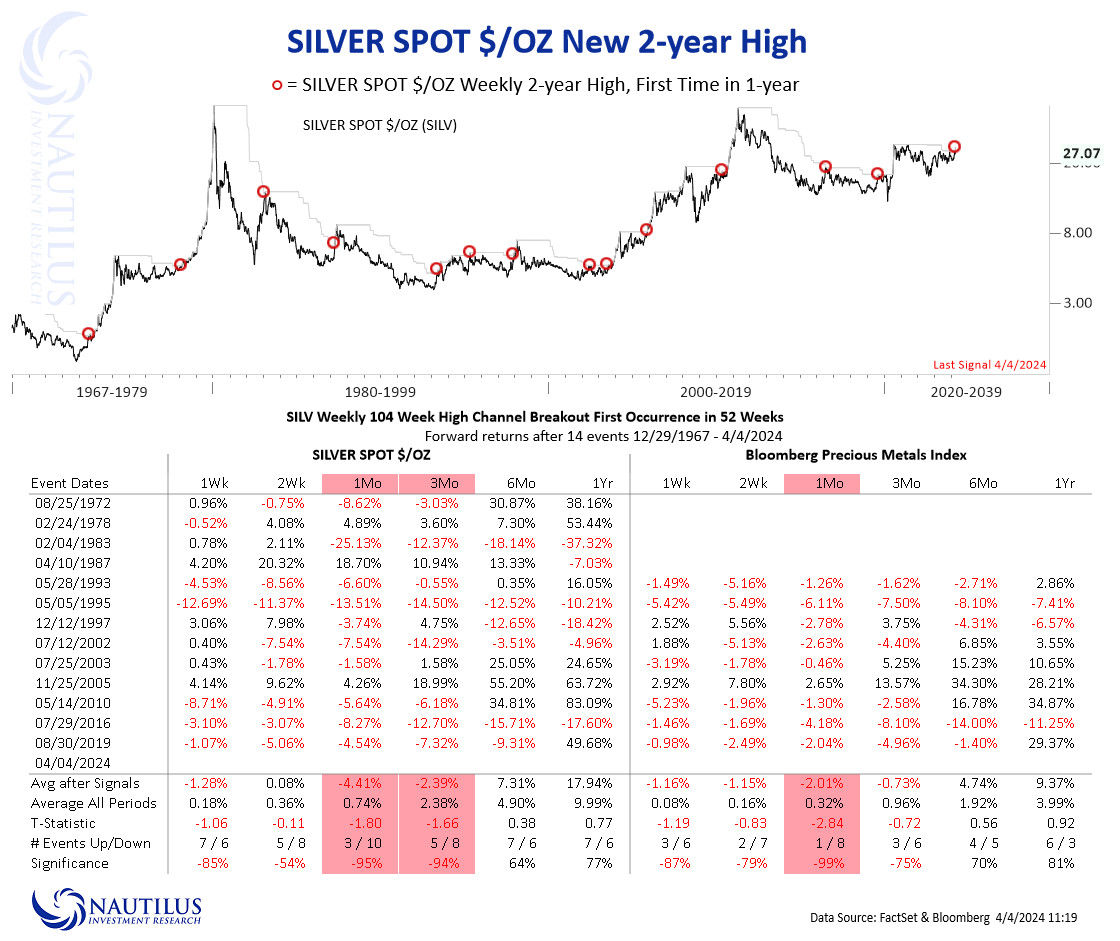

New 2-year highs for Silver ....

By: Nautilus Research | April 4, 2024

• #silver $silv New 2-year highs for Silver ....

Read Full Story »»»

DiscoverGold

DiscoverGold

$SLV Notable size #darkpool print at $24.50 ~ 18% of 30D Avg Vol

By: Flowrensics | April 4, 2024

• $SLV Notable size #darkpool print at $24.50 ~ 18% of 30D Avg Vol.

Read Full Story »»»

DiscoverGold

DiscoverGold

Silver $SLV - Poppin Pent-up energy being released for a Breath-Taking Run...

By: Sahara | April 3, 2024

• $SILVER $SLV - Poppin

Pent-up energy being released for a Breath-Taking Run...

Read Full Story »»»

DiscoverGold

DiscoverGold

Endthefed and have a tragic boating accident

Silver Weekly Bullish Breakout Triggers

By: Bruce Powers | April 1, 2024

• Silver's recent rally signals potential for further gains, but resistance levels and support zones indicate caution amidst bullish sentiment.

Silver pulled back to support last week around the 38.2% Fibonacci retracement and 20-Day MA with a low of 24.33. It was followed by an advance Friday and again today, Monday. Monday’s rally triggered a bullish weekly breakout above last week’s high of 25.01. Resistance was seen at a 25.39 high before silver pulled back. It looks like it should close above the 8-Day MA again today, after doing so on Friday. Given today’s intraday pullback, silver is set to close relatively weak, below the halfway point of the day’s trading range and near the opening price.

Pullback Follows 15.7% Advance

Nevertheless, silver rallied by 3.50 points or 15.7% in the 16 days prior to the recent 25.78 peak, showing new enthusiasm for the precious metal. That peak was just below the swing high from December 4 (B) at 25.91. The more significant previous swing high was at 26.14, as it better defines the price structure of the developing uptrend. A daily close above 26.14 will provide a higher swing high and further confirm strengthening of the trend. It is the next key resistance level to be recaptured. Once exceeded, silver should be freed up to confront higher swing target levels starting with 26.95 from March 2022.

Higher Target of 27.15

Notice the higher long-term target on the chart at 27.15. A large ascending ABCD pattern is completed there as there is symmetry between the first and second legs of the pattern. It begins at the October 2023 swing low of 20.69. Notice that the 27.15 target is slightly higher than the March 2022 swing high. Together, they can be watched as an eventual target zone from 26.95 to 27.15.

Short-term Caution Due to Weak Close

Regardless of the bullish outlook, until there is a rally above 25.78 swing high, the chance for a deeper retracement remains. Especially, given the weak close likely on Monday. Lower Fibonacci retracement levels are marked on the chart and the critical 50-Day and 200-Day MAs are at 23.48 and 23.37, respectively. A drop below today’s low of 24.75 would give the first sign of weakness. However, until there is a drop below the 24.33 swing low there is no clear sign of a continued pullback.

Read Full Story »»»

DiscoverGold

DiscoverGold

This 4-year triangle from Silver looks just about ready to rip

By: TrendSpider | March 29, 2024

• This 4-year triangle from Silver looks just about ready to rip.

Read Full Story »»»

DiscoverGold

DiscoverGold

NY Silver COMEX Futures »» Weekly Summary Analysis

By: Marty Armstrong | March 29, 2024

Today was Good Friday, which is an international holiday. NY Silver COMEX Futures closed today at 24916 and is trading up about 3.44% for the year from last year's settlement of 24086. Caution is now required for this market is starting to suggest it will decline further on the MONTHLY level. Immediately, this market has been declining for 2 years going into 2024 reflecting that this has been only still a bearish reactionary trend.

Up to now, we still have only a 2 month reaction decline from the high established during December 2023. We must exceed the 3 month mark in order to imply that a trend is developing.

MARKET OVERVIEW

NEAR-TERM OUTLOOK

The historical perspective in the NY Silver COMEX Futures included a rally from 2020 moving into a major high for 2021, the market has been consolidating since the major high with the last significant reaction low established back in 2020. The market is still holding above last year's low. The last Yearly Reversal to be elected was a Bullish at the close of 2020 which signaled the rally would continue into 2021. However, the market has been unable to exceed that level intraday since then. This overall rally has been 3 years in the making.

This market remains in a positive position on the weekly to yearly levels of our indicating models. Pay attention to the Monthly level for any serious change in long-term trend ahead.

The perspective using the indicating ranges on the Daily level in the NY Silver COMEX Futures, this market remains moderately bullish currently with underlying support beginning at 24820 and overhead resistance forming above at 25050. The market is trading closer to the support level at this time.

On the weekly level, the last important high was established the week of March 18th at 25975, which was up 5 weeks from the low made back during the week of February 12th. So far, this week is has moved to the downside penetrating last week's low of 24580 reaching 24445. A closing beneath last week's low would be a technical signal for a correction to retest support.

When we look deeply into the underlying tone of this immediate market, we see it is currently still in a semi neutral posture despite declining from the previous high at 25975 made 0 week ago. Still, this market is within our trading envelope which spans between 21985 and 25137. The broader perspective, this current rally into the week of March 18th reaching 25975 has exceeded the previous high of 23445 made back during the week of January 29th.

Right now, the market is above momentum on our weekly models hinting this is still bullish for now as well as trend. Looking at this from a wider perspective, this market has been trading up for the past 5 weeks overall.

INTERMEDIATE-TERM OUTLOOK

Looking at the longer-term monthly level, we did see that the market made a high in December 2023 at 26340. After a nine month rally from the previous low of 22785, it made last high in December. Since this last high, the market has corrected for nine months. However, this market is weak retesting important support last month. So far here in March, this market has held above last month's low of 21975 reaching 22710.

Critical support still underlies this market at 22263 and a break of that level on a monthly closing basis would warn that a sustainable decline ahead becomes possible. Nevertheless, the market is trading above last month's high showing some strength.

DiscoverGold

DiscoverGold

Silver Bearish Retracement or Bullish Reversal?

By: Bruce Powers | March 25, 2024

• Silver struggles for direction, trading in a narrow range with resistance at 24.89 and support at 24.56.

Silver makes no progress on Monday as it trades inside day. Resistance was seen at the day’s high of 24.89 and support at the low of 24.56. Uncertainty is not only reflected in today’s inside day but also silver is on track to close with a doji (open and close same or similar price).

Completed 38.2% Fibonacci Retracement

Last Friday, silver completed a 38.2% Fibonacci retracement with its low of 24.41. That is also last week’s low. If today’s low is busted to the downside, the chance for a continuation of the retracement increases. However, a drop below 24.41 will provide a more confident bearish signal as it would trigger a new retracement low. The 20-Day MA is at 24.22 and would most certainly be tested as support if the pullback deepens. Also, the 50% retracement is at 24.03.

Further down is the 61.8% Fibonacci retracement at 23.51. Traders will be watching for signs of support around these price levels in anticipation of a bullish reversal. Note that the 8-Day MA turned down slightly today, for the first time since February 29. It was resistance Friday, and it is also resistance today.

Either Deeper Retracement or Bullish Continuation on Deck

Silver could continue either way at this point. Either a deeper retracement or a bullish continuation comes next. The bullish continuation becomes more likely on a rally above today’s high. And, especially on a rally above Friday’s high of 24.95. Note that potential resistance is also nearby around the 8-Day MA, which is also at 24.95. Once the high is cleared to the upside, the recent trend high of 25.78 becomes a target, followed by the swing high from early-December at 25.91.

Key Upside Price Level is 26.135

A key price level to watch higher up is 26.135. It was a swing high in May 2023 and is part of the price structure of the downtrend. Therefore, a daily close above that level will be significant as it further confirms the bullish reversal in silver from down to up that began from the 2022 bottom. Silver has been largely chopping around within a range the past year. A decisive advance above 26.135 should be followed by clearer trending action for silver.

Read Full Story »»»

DiscoverGold

DiscoverGold

Silver Continues to Show Support

By: Christopher Lewis | March 25, 2024

• Silver showed a bit of support early on Monday, as we continue to see a lot of interest in silver near the $24.50 region, as it has been important to market participants for some time.

Silver Markets Technical Analysis

You can see that the silver market has shown itself to be a little back and forth as the $24.50 level continues to offer support. At this point in time, I think you have to look at this through the prism of whether or not we can find some type of momentum to break above $24.90, which then opens up the possibility of reaching the highs again.

Whether or not that actually happens remains to be seen, but I do like the idea of taking advantage of this support area right here for an attempt to try to go higher. Do keep in mind that the $26 level above is an area that you need to pay close attention to as it has been significant resistance multiple times in the past. With that being the case, breaking above that would obviously be a huge sign of confidence. If we break down below the $24.50 level, then I think you have a situation where we probably go looking to the 50-day EMA underneath.

That of course is an indicator that a lot of people will pay close attention to, and in that environment, I think you would have to assume that there’ll be some support, not only based on the 50-day EMA, but also the $23.50 level right around that same area. I don’t necessarily want to short silver, although I’m the first to admit that it’s a little stretched. I think silver’s probably going to be dragged higher along with gold, but it doesn’t necessarily make the cleanest, precious metals play as there are other things that affect it. With that being said, I’m cautiously bullish, but not willing to put a huge position on.

Read Full Story »»»

DiscoverGold

DiscoverGold

NY Silver COMEX Futures »» Weekly Summary Analysis

By: Marty Armstrong | March 23, 2024

NY Silver COMEX Futures closed today at 24843 and is trading up about 3.14% for the year from last year's settlement of 24086. Caution is now required for this market is starting to suggest it will decline further on the MONTHLY level. This price action here in March is reflecting that this has been still a bearish reactionary trend on the monthly level. As we stand right now, this market has made a new high exceeding the previous month's high reaching thus far 25975 intraday and is still trading above that high of 23560.

Up to now, we still have only a 2 month reaction decline from the high established during December 2023. We must exceed the 3 month mark in order to imply that a trend is developing.

ECONOMIC CONFIDENCE MODEL CORRELATION

Here in NY Silver COMEX Futures, we do find that this particular market has correlated with our Economic Confidence Model in the past. The Last turning point on the ECM cycle low to line up with this market was 2020 and 2015 and 2001. The Last turning point on the ECM cycle high to line up with this market was 2011 and 1998.

MARKET OVERVIEW

NEAR-TERM OUTLOOK

The historical perspective in the NY Silver COMEX Futures included a rally from 2020 moving into a major high for 2021, the market has been consolidating since the major high with the last significant reaction low established back in 2020. The market is still holding above last year's low. The last Yearly Reversal to be elected was a Bullish at the close of 2020 which signaled the rally would continue into 2021. However, the market has been unable to exceed that level intraday since then. This overall rally has been 3 years in the making.

This market remains in a positive position on the weekly to yearly levels of our indicating models. Pay attention to the Monthly level for any serious change in long-term trend ahead.

Looking at the indicating ranges on the Daily level in the NY Silver COMEX Futures, this market remains neutral with resistance standing at 24920 and support forming below at 24455. The market is trading closer to the resistance level at this time.

On the weekly level, the last important high was established the week of March 18th at 25975, which was up 5 weeks from the low made back during the week of February 12th. So far, this week is trading within last week's range of 25975 to 24580. Nevertheless, the market is still trading downward more toward support than resistance. A closing beneath last week's low would be a technical signal for a correction to retest support.

When we look deeply into the underlying tone of this immediate market, we see it is currently still in a semi neutral posture despite declining from the previous high at 25975 made 0 week ago. Still, this market is within our trading envelope which spans between 21985 and 25137. The broader perspective, this current rally into the week of March 18th reaching 25975 has exceeded the previous high of 23445 made back during the week of January 29th.

Right now, the market is above momentum on our weekly models hinting this is still bullish for now as well as trend. Looking at this from a wider perspective, this market has been trading up for the past 5 weeks overall.

INTERMEDIATE-TERM OUTLOOK

YEARLY MOMENTUM MODEL INDICATOR

Our Momentum Models are declining at this time with the previous high made 2021 while the last low formed on 2023. However, this market has rallied in price with the last cyclical high formed on 2021 and thus we have a divergence warning that this market is starting to run out of strength on the upside.

Looking at the longer-term monthly level, we did see that the market made a high in December 2023 at 26340. After a nine month rally from the previous low of 22785, it made last high in December. Since this last high, the market has corrected for nine months. However, this market is weak retesting important support last month. So far here in March, this market has held above last month's low of 21975 reaching 22710.

Critical support still underlies this market at 22263 and a break of that level on a monthly closing basis would warn that a sustainable decline ahead becomes possible. Nevertheless, the market is trading above last month's high showing some strength.

DiscoverGold

DiscoverGold

Silver $SLV -Slipped that 4Hr Dotted-Ivory/MA. So I have adjusted the Lwr-Line of the pot'l 'Ending Diagonal' fror W-v of (i) from the low.

By: Sahara | March 22, 2024

• $SILVER $SLV -Slipped that 4Hr Dotted-Ivory/MA. So I have adjusted the Lwr-Line of the pot'l 'Ending Diagonal' fror W-v of (i) from the low.

There is an alt-count shown in Green where we have had an 'Expanded Flat' for Wave-(ii). If this is the count the action should prove it..

Read Full Story »»»

DiscoverGold

DiscoverGold

$SILVER $GDX Ratio - Has an 'Inv H&S' Plot. Looks bulliish for Silver to Miners whilst holding over its Mthly 12/MA...

By: Sahara | March 21, 2024

• $SILVER $GDX Ratio - Has an 'Inv H&S' Plot.

Looks bulliish for Silver to Miners whilst holding over its Mthly 12/MA...

Read Full Story »»»

DiscoverGold

DiscoverGold

Hi Ho silver!!!

Silver Hesitates Ahead of Fed

By: Christopher Lewis | March 20, 2024

• Silver has been very choppy over the last several sessions and Wednesday would have been more of the same.

Silver Markets Technical Analysis

The silver market has drifted slightly lower ahead of the Federal Reserve during the trading session here on Wednesday. That being said, this is a situation where I think a lot of traders will continue to look at it through the prism of whether or not we are finding value. I think at this point, it’s a bit difficult to get overly excited about buying silver. At least we have to get the Federal Reserve meeting out of the way. There are a couple of levels that I’m paying attention to, one of which is $23.50, and another is $24.50. These are both areas that I would be interested in buying silver on some type of knee-jerk reaction.

And I think at this point in time, the overall target is probably $26. This is a market that has been extraordinarily choppy until recently, which normally, that’s exactly what it does, it just chops around. So I would anticipate maybe a little bit of a pullback that I can take advantage of sooner or later during the session.

If we don’t get it, then it becomes a little bit trickier as we are most certainly extended. The markets recently have seen the indicators, the moving averages, try to form a more bullish stance as we have had the Golden Cross happen several days ago.

That typically attracts longer term money, but at the same time it can be said that it is quite often late. Interest rates markets will of course have their say. If interest rates start to drop again, that would be very bullish for silver, but quite frankly I think you have to find value.

Read Full Story »»»

DiscoverGold

DiscoverGold

Silver - the Commercials have increased longs, I would love to see them cornered & crushed with a Mahussiff Breakout here and now...

By: Sahara | March 19, 2024

• ... $SILVER $SLV - I don't really wish to end the Qtr with a tight bodied candle within the 'Handle'. As it has bearish connotations.

And as the Commercials have increased longs, I would love to see them cornered & crushed with a Mahussiff Breakout here and now...

Read Full Story »»»

DiscoverGold

DiscoverGold

Silver $SLV - Latest: A 'H&S' would play out to its Cyan 150/EMA...

By: Sahara | March 19, 2024

• $SILVER $SLV - Latest

Has behaved itself and been an easy ride, yet back to its 4Hr Dotted Ivory/MA. So now we'll need to be alert to a 'Right Shoulder' forming if it bounces.

A 'H&S' would play out to its Cyan 150/EMA...

Read Full Story »»»

DiscoverGold

DiscoverGold

GSR probably cut 80 soon

This +3 year Silver squeeze breakout NEEDS to be on your radar in the coming weeks

By: TrendSpider | March 16, 2024

• This +3 year Silver squeeze breakout NEEDS to be on your radar in the coming weeks.

Read Full Story »»»

DiscoverGold

DiscoverGold

NY Silver COMEX Futures »» Weekly Summary Analysis

By: Marty Armstrong | March 16, 2024

The NY Silver COMEX Futures has been in an uptrend for the past 3 days closing above the previous session's high. The broader rally has unfolded over the past 22 days. Currently, the market is trading in a neutral position on our indicators but it is trading strongly higher up some 2.84% from the previous session low. Our projected target for closing resistance for the next session stands at 26140, we need to close above that target to imply a further advance. Failure to even exceed this intraday warns that the upward momentum is starting to decline. Moreover, a lower opening and a penetration of today's low of 25000 with a closing beneath this level would suggest today's high will stand temporarily.

Nevertheless, this session closed below our ideal projection for closing resistance warning that the market which stood at 25945 is forming a high. A break of this session's low of 25000 will warn that we have a potential temporary high in place. Our Stochastics are also turning upward but are still not in a full bullish position warning the momentum is not exceptionally strong.

Up to now, we still have only a 2 month reaction decline from the high established during December 2023. We must exceed the 3 month mark in order to imply that a trend is developing.

ECONOMIC CONFIDENCE MODEL CORRELATION

Here in NY Silver COMEX Futures, we do find that this particular market has correlated with our Economic Confidence Model in the past. The Last turning point on the ECM cycle low to line up with this market was 2020 and 2015 and 2001. The Last turning point on the ECM cycle high to line up with this market was 2011 and 1998.

MARKET OVERVIEW

NEAR-TERM OUTLOOK

The historical perspective in the NY Silver COMEX Futures included a rally from 2020 moving into a major high for 2021, the market has been consolidating since the major high with the last significant reaction low established back in 2020. The market is still holding above last year's low. The last Yearly Reversal to be elected was a Bullish at the close of 2020 which signaled the rally would continue into 2021. However, the market has been unable to exceed that level intraday since then. This overall rally has been 3 years in the making.

This market remains in a positive position on the weekly to yearly levels of our indicating models. Pay attention to the Monthly level for any serious change in long-term trend ahead.

Focusing on our perspective using the indicating ranges on the Daily level in the NY Silver COMEX Futures, this market remains in a bullish position at this time with the underlying support beginning at 24900.

On the weekly level, the last important high was established the week of March 11th at 25660, which was up 4 weeks from the low made back during the week of February 12th. So far, this week is trading within last week's range of 25660 to 24220. Nevertheless, the market is still trading upward more toward resistance than support. A closing beneath last week's low would be a technical signal for a correction to retest support.

When we look deeply into the underlying tone of this immediate market, we see it is currently still in a semi neutral posture despite declining from the previous high at 25660 made 0 week ago. The broader perspective, this current rally into the week of March 11th reaching 25660 has exceeded the previous high of 23445 made back during the week of January 29th.

Right now, the market is above momentum on our weekly models hinting this is still bullish for now as well as trend, long-term trend, and cyclical strength. Looking at this from a wider perspective, this market has been trading up for the past 4 weeks overall.

INTERMEDIATE-TERM OUTLOOK

YEARLY MOMENTUM MODEL INDICATOR

Our Momentum Models are declining at this time with the previous high made 2021 while the last low formed on 2023. However, this market has rallied in price with the last cyclical high formed on 2021 and thus we have a divergence warning that this market is starting to run out of strength on the upside.

Looking at the longer-term monthly level, we did see that the market made a high in December 2023 at 26340. After a nine month rally from the previous low of 22785, it made last high in December. Since this last high, the market has corrected for nine months. However, this market is weak retesting important support last month. So far here in March, this market has held above last month's low of 21975 reaching 22710.

Critical support still underlies this market at 22263 and a break of that level on a monthly closing basis would warn that a sustainable decline ahead becomes possible. Nevertheless, the market is trading above last month's high showing some strength.

DiscoverGold

DiscoverGold

Silver Market Update - the Strongly Bullish Case For Silver Could Not Be Clearer...

By: Clive Maund | March 15, 2024

The bullish case for silver and silver investments could not now be clearer, and this being so it won’t take long to set it out.

We’ll start with the very long-term 20-year chart which makes it crystal clear what is going on. On this chart we see that a huge and magnificant Cup & Handle base has built out in silver over the past 11 years and the pattern is now complete – meaning that breakout is likely imminent, which is hardly surprising given how gold, shown at the top of this chart, has already broken out into a major new bullmarket and is romping ahead. The reasons for this – currency collapse and spreading wars - are not the subject of this article.

This is a good juncture to address the issue of how, in the early stages of a major sector bullmarket, gold and gold investments hog the limelight, usually leaving silver and silver investments to “bring up the rear”. This time round silver looks set to do a lot better in the early stages of this bullmarket – why? – because it is so horribly undervalued relative to gold, as the following long-term silver over gold chart from 1980 makes clear…

Silver has a huge amount of catching up to do and once it breaks out above the resistance at the upper boundary of the Cup & Handle base pattern it is expected to race quickly towards its 2011 highs in the $50 area as an initial objective.

Zooming in via the 5-year chart enables us to examine the “Handle” part of the giant Cup & Handle base in more detail and thus see why silver has been dithering around somewhat this month on gold’s breakout and has comparativley speaking not done very well. The reason for this is easy to spot – unlike gold it has had a considerable amount of overhanging supply to work off before it breaks out of the base pattern, but that said its attacks on the $25 - $26 area over the past year or so have already chewed through a lot of it which means that, with would be sellers having second thoughts as gold continues to ascend, it could bust through the remaining resistance with surprising alacrity in the weeks to come and once it gets above the 2020 – 2021 highs in the $30 ara it could accelerate dramatically.

So we should not be confused by the seemingly “random walk” meanderings that we see on the shorter-term 6-month chart whose main use it to show us gold’s much stronger performance this month and how any further significant gains by silver will quicky lead to its moving averages swinginginto strongly bullish alignment.

The conclusion is that time is fast running out to buy silver and silver related investments at the current bargain basement prices and that if you are minded to do so, you had better get on with it.

We will be looking at a range of large and mid-cap silver stocks soon on the site, to complement the range of large cap gold stocks that we looked at last weekend.

Read Full Story »»»

DiscoverGold

DiscoverGold

Silver Continues to Rally

By: Christopher Lewis | March 15, 2024

• The silver market has rallied again during the trading session on Friday as Wall Street dumps stocks early in the day.

Silver Markets Technical Analysis

You can see we continue to see a lot of upward pressure in general, and I do think at this point you have to look at Silver as likely to go running towards the $26 level. That being said, I think you’ve got a situation where short-term pull backs continue to be thought of as buying opportunities if you get them.

The $24.50 level underneath should be a support level that I think a lot of people will be paying attention to, especially after that massive candlestick on Wednesday. All things being equal, I do think this is a situation where you’re just looking for value and trying to take advantage of it. Now, the question is, can we break above $26? I don’t know because silver has a really hard time following gold once we get truly parabolic.

This is mainly because there have been multiple scandals, like JPMorgan Chase, of rigging in the silver market, and there’s no sign that that’s stopped. The CFTC has fined them millions of dollars multiple times, but considering how much they make doing it, they will continue to do it. So therefore, I think 26, maybe $26.50 is about as good as it gets, but that doesn’t mean you can’t make money along the way.

You just simply take short-term pullbacks and use them to your advantage. From a longer term perspective though, I still like gold better than silver, mainly because silver is so volatile. It’s also an industrial metal, so it does behave a little bit on the fickle side occasionally. But as things stand right now, it is moving lockstep with gold. It continues to pay attention to lower interest rates around the world coming, and possibly an economic growth situation where it spurs demand later this year. We’ll see. But when you look at the longer term charge, $26 is very tough to crack.

Read Full Story »»»

DiscoverGold

DiscoverGold

Silver Continues to Look Strong

By: Christopher Lewis | March 14, 2024

• Silver markets continue to look strong during the Thursday session as we continue to see buyers after that massive Wednesday candlestick.

Silver Markets Technical Analysis

Silver is hovering around the $25 level as I record this video and it certainly looks as if it is trying to break out yet again to the upside. It does make a certain amount of sense because everybody’s banking on the Federal Reserve coming out and saving everybody with loose monetary policy because that, of course, helps precious metals. And it does make for a compelling trade.

The difference of course is silver is not gold and therefore you have to look at it through the prism of whether is it an industrial metal or is it a precious metal depending on whatever trade is going on. Right now, it’s behaving more like a precious metal but keep in mind that there are various green initiatives around the world that could drive out the price of silver as well. That being said, the $26 level above is like a massive ceiling in this market and therefore, I think it gets defended quite vigorously.

Short-term pullbacks at this point in time should continue to find support out in $24.50 level, an area that previously had been resistant. The massive candlestick that formed on Wednesday typically will see follow-through with that type of momentum. So I’m not necessarily looking to short this market. And at this point in time, I think any pullback that this market shows should be thought of as a potential value play. We have recently had the golden cross where the 50 day EMA crosses above the 200 day EMA. So that’s another signal that a lot of longer term traders like. Ultimately, look for value and take advantage of it, that’s probably going to be the best way to play this market. subscribe.

Read Full Story »»»

DiscoverGold

DiscoverGold

$SLV Silver breaking out from a 3 year long triangle pattern!? 50% upside potential.

By: Intelligent Investing | March 13, 2024

• $SLV

Silver breaking out from a 3 year long triangle pattern!? 50% upside potential.

Read Full Story »»»

DiscoverGold

DiscoverGold

Silver $SLV - That's a Hit! Of the $24.80 2nd Target from the Bull 'Wedge'...

By: Sahara | March 13, 2024

• $SILVER $SLV - That's a Hit!

Of the $24.80 2nd Target from the Bull 'Wedge'...

Read Full Story »»»

DiscoverGold

DiscoverGold

Silver Continues to See Volatility And Upward Pressure

By: Christopher Lewis | March 12, 2024

• Silver continues to be very noisy as the markets trying to price in geopolitical risk, central bank behavior, and a whole slew of other issues at the moment.

Silver Markets Technical Analysis

The silver market initially fell during the trading session on Tuesday but has turned around to show signs of life again, as it looks like we are recovering after CPI numbers came out just a little bit hotter than anticipated, but nothing drastic. So, because of this, it looks like we are trying to take out the highs here. And if we can take out the wick from Friday, it’s very likely silver will go looking to the $26 level.

Ultimately, precious metals have been on fire as of late, so that would make a certain amount of sense anyways, so we’ll have to see how that plays out. Short-term pullbacks for my money continue to be bought into it as we obviously have so many buyers out there to begin with. The $23.50 level underneath, I think, is an area you need to pay close attention to as it had been previous resistance, and it should now be support.

With that being said, I like the idea of taking advantage of any value that occurs, but I also recognize that silver is extraordinarily volatile, so you do need to be cautious at this point in time because silver can really be dangerous. I think eventually we will go looking toward the $26 level, that’s probably the high that will contain the market. We are a little overdone at this point, but ultimately it will be all about momentum more than anything else.

So be cautious of short-term pullbacks, but those should offer plenty of value. I have no interest in shorting metals at the moment, as it looks like the US dollar is going to continue to take it on the chin overall. Expect volatility, and of course we have PPI on Thursday, which could cause some issues, but really at this point in time, it looks like we are going to continue to power higher.

Read Full Story »»»

DiscoverGold

DiscoverGold

Silver $SLV - Looking for the 'Megaphone' Pattern to the 4Hr 11/EMA be a continuation plot

By: Sahara | March 12, 2024

• $SILVER $SLV - Looking for the 'Megaphone' Pattern to the 4Hr 11/EMA be a continuation plot.

May want to add the right side for a 'Daimond'...

Read Full Story »»»

DiscoverGold

DiscoverGold

Silver Price Forecast: Uptrend Continuation or Retracement Ahead?

By: Bruce Powers | March 11, 2024

• Silver prices may correct after peaking at 24.64, with potential for short-term bearish signal.

Silver peaked at a high of 24.64 last week thereby completing a 10.6% advance from the February swing low of 22.28. The week ended with a potentially bearish inverted hammer candlestick pattern. There is a reasonable expectation that last week’s high may lead to a correction of some degree. It could be quick and cover a few days or less, or longer than that. Confirmation of at least a short-term top has not occurred yet as silver trades inside day today, Monday. A short-term bearish signal will be given if silver triggers a daily reversal below Friday’s low of 24.18.

Advance Stalls off Last Week’s High

Last week resistance was seen around the prior swing high of 24.61 from December 22. That price area was noted previously as a possible target as it was clearly resistance in the past. The question now is whether silver continues to progress its uptrend, or it retraces first? Certainly, the chance for a pullback has increased following last week’s price action.

Nevertheless, a decisive rally above last week’s high of 24.64 may see silver hit a higher target before a retracement. The next higher target is around 24.81. That is where the rising ABCD pattern (magenta) completes a 161.8% Fibonacci extension of the pattern. That is the third target from the pattern as each of the lower levels have already been exceeded to the upside.

Bigger Picture Bullish

In the bigger picture there is an initial higher target in silver up around 27.15. That is where a larger rising ABCD pattern completes (green). Given the recent impulse rally seen in silver this higher target looks reasonable. Therefore, traders will be watching for bullish reversal off retracement lows during weakness. A drop below last Friday’s low of 24.17 will signal a pullback.

The 8-Day MA is at 23.83 followed by the 38.2% Fibonacci retracement at 23.73. The last solid resistance level that was broken is down at 23.50 (B), right near the 50% retracement at 23.46. If a retracement does come before new trend highs these price levels are where support might be seen, that leads to a bullish reversal.

Finally, another mention about the monthly chart. A bullish reversal was triggered initially this month. The upside follow-through has indicated strong demand pointing to eventual higher prices.

Read Full Story »»»

DiscoverGold

DiscoverGold

$Silver is headed higher into the next 30 week cycle high in early July. It may get to as high 30, though so far it has underperformed gold which isn't an encouraging sign. Keep in mind there's one more weekly cycle low between now and July so it's not going to be straight up.

By: CyclesFan | March 9, 2024

• $Silver is headed higher into the next 30 week cycle high in early July. It may get to as high 30, though so far it has underperformed gold which isn't an encouraging sign. Keep in mind there's one more weekly cycle low between now and July so it's not going to be straight up.

Read Full Story »»»

DiscoverGold

DiscoverGold

Silver is NOT breaking out. It has major overhead resistance at 27.90

By: Marty Armstrong | March 9, 2024

We also see here that silver is NOT breaking out. It has major overhead resistance at 27.90. That is what we would have to get through on a monthly closing basis to imply a breakout is possible. However, because we do not see the same bullish pattern in silver as we do in gold, this always cautions us that this is not the breakout in gold, but that there is war on the horizon since gold outpaces silver in times of war.

DiscoverGold

DiscoverGold

NY Silver COMEX Futures »» Weekly Summary Analysis

By: Marty Armstrong | March 9, 2024

NY Silver COMEX Futures closed today at 24549 and is trading up about 1.92% for the year from last year's settlement of 24086. Caution is now required for this market is starting to suggest it will decline further on the MONTHLY level. This price action here in March is reflecting that this has been still a bearish reactionary trend on the monthly level. As we stand right now, this market has made a new high exceeding the previous month's high reaching thus far 24860 intraday and is still trading above that high of 23560.

Up to now, we still have only a 2 month reaction decline from the high established during December 2023. We must exceed the 3 month mark in order to imply that a trend is developing.

ECONOMIC CONFIDENCE MODEL CORRELATION

Here in NY Silver COMEX Futures, we do find that this particular market has correlated with our Economic Confidence Model in the past. The Last turning point on the ECM cycle low to line up with this market was 2020 and 2015 and 2001. The Last turning point on the ECM cycle high to line up with this market was 2011 and 1998.

MARKET OVERVIEW

NEAR-TERM OUTLOOK

The historical perspective in the NY Silver COMEX Futures included a rally from 2020 moving into a major high for 2021, the market has been consolidating since the major high with the last significant reaction low established back in 2020. The market is still holding above last year's low. The last Yearly Reversal to be elected was a Bullish at the close of 2020 which signaled the rally would continue into 2021. However, the market has been unable to exceed that level intraday since then. This overall rally has been 3 years in the making.

This market remains in a positive position on the weekly to yearly levels of our indicating models. Pay attention to the Monthly level for any serious change in long-term trend ahead.

Focusing on our perspective using the indicating ranges on the Daily level in the NY Silver COMEX Futures, this market remains in a bullish position at this time with the underlying support beginning at 24455.

On the weekly level, the last important high was established the week of March 4th at 24860, which was up 3 weeks from the low made back during the week of February 12th. So far, this week is trading within last week's range of 24860 to 23230. Nevertheless, the market is still trading upward more toward resistance than support. A closing beneath last week's low would be a technical signal for a correction to retest support.

When we look deeply into the underlying tone of this immediate market,

Looking at this from a broader perspective, this last rally into the week of March 4th reaching 24860 failed to exceed the previous high of 26340 made back during the week of December 4th in 2023. That rally amounted to only thirteen weeks.

Right now, the market is above momentum on our weekly models hinting this is still bullish for now as well as trend. Looking at this from a wider perspective, this market has been trading up for the past 3 weeks overall.

INTERMEDIATE-TERM OUTLOOK

YEARLY MOMENTUM MODEL INDICATOR

Our Momentum Models are declining at this time with the previous high made 2021 while the last low formed on 2023. However, this market has rallied in price with the last cyclical high formed on 2021 and thus we have a divergence warning that this market is starting to run out of strength on the upside.

Looking at the longer-term monthly level, we did see that the market made a high in December 2023 at 26340. After a nine month rally from the previous low of 22785, it made last high in December. Since this last high, the market has corrected for nine months. However, this market is weak retesting important support last month. So far here in March, this market has held above last month's low of 21975 reaching 22710.

Critical support still underlies this market at 22263 and a break of that level on a monthly closing basis would warn that a sustainable decline ahead becomes possible. Nevertheless, the market is trading above last month's high showing some strength.

DiscoverGold

DiscoverGold

Silver Continues to Power Higher

By: Christopher Lewis | March 8, 2024

• Silver had another strong week, as we are threatening the $24.50 level. Ultimately, this is a market that I think is ready to break higher, and therefore anytime it pulls back you have to be looking at it as a buying opportunity.

Silver Markets Weekly Technical Analysis

You can see that Silver did rally rather significantly during the course of the trading week to test the $24.50 level. The $24.50 level is an area that I think a lot of people will be paying attention to as it has been a scenario of resistance multiple times, but if we can break above that level on a daily close, then I think we have a shot at the $26 level.

The $26 level, I think, is going to be a very hard ceiling to break. The size of the candlestick is very big and therefore I think it does suggest that you have an opportunity to see a follow through. But that doesn’t mean that it has to happen right away. And in fact, I think it’s probably going to be noisy over the next couple of weeks, but you still have to pay close attention to any value opportunities as an opportunity to get involved.

The $23.50 level I think will continue to be massive support right along with the 50-week EMA. In general, expect volatility and keep your position size reasonable, but we still look very much like a market that you need to be a buyer of, not a seller of. Keep in mind that this is a market that continues to see a lot of volatility, and therefore think we’ve got a situation where you need to be cautious with your position sizing, but ultimately you will see silver continue to rally overall as it has been so strong.

Read Full Story »»»

DiscoverGold

DiscoverGold

|

Followers

|

75

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

3888

|

|

Created

|

07/13/08

|

Type

|

Free

|

| Moderators DiscoverGold | |||

Silver Futures Indexsilver (s |

A Brief History of The Health Support Uses of SilverFor thousands of years silver has been used as a healing agent by civilizations throughout the world. Its medical, preservative and restorative powers can be traced as far back as the ancient Greek and Roman Empires. Long before the development of modern pharmaceuticals, silver was employed as a germicide. Consider these interesting facts:

Silver Re-DiscoveredNot until the late 1800's did western scientists re-discover what had been known for thousands of years - that silver is a powerful germ fighter. Medicinal silver compounds were then developed and silver became commonly used as a medicine. By the early part of the 1900s, the use of silver was becoming widespread. By 1940 there were approximately four dozen different silver compounds on the market. Although there were a few flare-ups of negative publicity regarding medicinal silver in the early 1900s, (due to the overuse of certain types of protein-bound silver compounds causing a discoloration of the skin called argyria and due to a supply of improperly prepared and unstable silver) reputable medical journal reports demonstrated that a properly prepared colloidal dispersion of silver was completely suitable with no adverse side effects. T. H. Anderson Wells reported in the Lancet (February 16th, 1918) that a preparation of colloidal silver was "used intravenously. . . without any irritation of the kidneys and with no pigmentation of the skin. " New knowledge of body chemistry gave rise to the enormous array of applications for colloidal disinfectants and medicines and for on-going research into the capabilities and possibilities for silver colloids. However, Silver's "new-found" fame as a superior infection-fighting agent was short lived. How Silver Lost FavorDuring the 1930s, synthetically manufactured drugs began to make their appearance and the profits, together with the simplicities of manufacturing this new source of treatment, became a powerful force in the marketplace. There was much excitement over the new 'wonder drugs' and at that time, no antibiotic-resistant strains of disease organisms had surfaced. Silver quickly lost its status to modern antibiotics. On-going Uses of Colloidal SilverThe use of some silver preparations in mainstream medicine survived. Among them are the use of dilute silver nitrate in newborn babies' eyes to protect from infection and the use of "Silvadine," a silver based salve, in virtually every burn ward in America to kill infection. A new silver based bandage has recently been approved by the FDA and licensed for sale. Other uses that did not lose favor include:

But for the most part, with the discovery of pharmaceutical antibiotics, interest in silver as an anti-microbial agent declined almost to the point of extinction. The Resurgence of Silver in MedicineThe return of silver to conventional medicine began in the 1970s. The late Dr. Carl Moyer, chairman of Washington University's Department of Surgery, received a grant to develop better methods of treatment for burn victims. Dr. Margraf, as the chief biochemist, worked with Dr. Moyer and other surgeons to find an antiseptic strong enough, yet safe to use over large areas of the body. Dr. Margraf investigated 22 antiseptic compounds and found drawbacks in all of them. Reviewing earlier medical literature, Dr. Margraf found continual references to the use of silver. However, since concentrated silver nitrate is both corrosive and painful, he diluted the silver to a .5 percent solution and found that it killed invasive burn bacteria and permitted wounds to heal. Importantly, resistant strains did not appear. But, silver nitrate was far from ideal. So research continued for more suitable silver preparations. Silver sulphadiazine (Silvadene, Marion Laboratories) is now used in 70 percent of burn centers in America. Discovered by Dr. Charles Fox of Columbia University, sulphadiazine has also been successful in treating cholera, malaria and syphilis. It also stops the herpes virus, which is responsible for cold sores, shingles and worse. The history and uses of colloidal silver are well known and documented. They can be researched easily on the Internet through search engines and any colloid forum, bulletin boards or blogs. We cannot link to them or publish them here because Federal Law prohibits any claims or testimonials associating our products or product ingredients with any disease states. Keep in mind that the particle surface area of our colloidal silver product, MesoSilver, is the highest ever tested. This means it is the most effective of any colloidal silver product ever made. With not a single serious adverse event ever reported, it is also one of the safest supplements on the market today.

|

SILVER IN DEPTHSilver links from LinksMine - InfoMine's Library of Mining Web Sites Site Listings

Associations

Exploration

History

Investment

Publications

Please boardmark us if this i-Message is helpful... Thanks in advance!!!Presently, the Board has 70 Boardmarks, Thank you! |

The Silver Price Will Rise 4.83 Times as Far as Gold Pricehttp://goldprice.org/silver-and-gold-prices/2008/12/silver-price-will-rise-483-times-as-far.html Unless you understand this one principle, you understand nought about precious metals' bull markets: monetary demand, and monetary demand alone, drives both gold AND silver. It's not Indian wedding demand or the popularity of silver jewelry that drives their prices, but sheer monetary demand, holding them as "money" because the alternatives -- national currencies -- are clearly failing. WHEREFORE, before this bull market ends, you will need only 16 ounces of silver to buy one ounce of gold, which means from here that the silver price will rise 4.83 times as far as the gold price. Forget the siren song of the "gold-only" bugs, who have fallen for the myths of the money interest: both silver and gold are money, and always will be. GOLD ENTERING A VIRTUOUS CIRCLESeptember 3rd, 2010 by Egon von Greyerz GOLD ENTERING A VIRTUOUS CIRCLEFundamental and technical factors for gold are now in total harmony and gold is entering a virtuous circle that will drive the price up at its fastest pace since this bull market started in 1999.