Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

RWB Investors Deck

https://tinyurl.com/RWB-Investors-Presentation

Red-White-&-Bloom-and-Tidal-Royalty-Sign-Definitive-Agreement to Complete Merger, IPO Drawing Near

https://www.thecannabisinvestor.ca/red-white-bloom-and-tidal-royalty-sign-definitive-agreement-to-complete-merger-ipo-drawing-near

*This is a little dated, but it sums up what is going on with the Tidal Royalty and Red White & Bloom merger.

Michigan Medical Marijuana Sales Top $42 Million in 4 Months, Introducing the Next Big Player in the State

Read full article here

Going to be fun here real soon. Stay tuned in all.

Tidal Royalty Corp. and CannaRoyalty Corp. Agree to Terms On Purchase of AltMed Royalty and Equity

Toronto, Ontario--(Newsfile Corp. - August 27, 2018) - Tidal Royalty Corp. (CSE: RLTY.U) (OTC: TDRYF) ("Tidal Royalty"), a leading provider of royalty financing to licensed U.S. cannabis operators, is pleased to announce it has entered into a binding letter of intent ("Agreement") to acquire certain assets that are strategic to Tidal Royalty from CannaRoyalty Corp. (CSE: CRZ) (OTC: CNNRF) ("CannaRoyalty"), a leading North American cannabis products and brands company.

Pursuant to the Agreement, Tidal Royalty will acquire a royalty entitlement and equity interest in Alternative Medical Enterprises, LLC, doing business as AltMed, ("AltMed") a leading multi-state, vertically-integrated operator. The aggregate consideration for the acquisition is C$8 million, in a combination of cash and Tidal Royalty's stock.

AltMed is led by former senior pharmaceutical executives and has captured market share by implementing pharma industry standards to the development, production and dispensing of medical cannabis. AltMed has vertically-integrated operations in both Florida and Arizona, pursuant to such states' regulated cannabis programs, and currently has applications for licenses pending in Ohio. In addition to distributing its own award-winning product line (MüV™) of topicals, gels, concentrates and transdermal patches, AltMed has distribution partnerships with leading cannabis brands — including with Wana Brands, a leading producer of cannabis-infused products.

Pursuant to the Agreement, Tidal Royalty will acquire a royalty on U.S. and international sales of the MüV™ product line. Tidal Royalty will also acquire an equity interest in AltMed.

"We've been following AltMed for quite some time now and have watched them expand their footprint very strategically and methodically. They are led by an extremely entrepreneurial and capable management team and we feel that they are positioned to be a leading player in the U.S. industry. We are excited to be in this position and look forward to finding additional ways that we can support their growth plans," said Paul Rosen, CEO & Chairman of Tidal Royalty. "This transaction was really made possible by our strong synergistic relationship with CannaRoyalty, a company whom we have a great deal of respect and admiration for. We are confident that our companies will identify additional mutually-strategic opportunities in the emerging U.S. regulated cannabis industry."

"This Agreement advances our stated strategy of realizing value for shareholders on non-core assets. The gains from our successful investment in AltMed will provide CannaRoyalty with capital to continue to expand its distribution and brand network in the California market. We are confident that AltMed will be a valuable addition to Tidal Royalty's portfolio, and as CannaRoyalty continues to grow and build a solid presence in California, we look forward to opportunities to partner with the experienced team at Tidal Royalty," said Marc Lustig, Chairman and CEO of CannaRoyalty.

Closing of the transaction is subject to, among other things, the satisfactory completion of due diligence, which is currently underway, and the receipt of all corporate and regulatory approvals.

With the execution of this Agreement, Tidal Royalty has now entered into letters of intent with cannabis operators in Florida, Arizona, California, Nevada, Massachusetts and Illinois. In addition, Tidal Royalty is in the process of evaluating multiple additional opportunities across the U.S., including in New York, Ohio, Pennsylvania, Texas and Michigan. Tidal Royalty intends to provide further information on those discussions when the respective parties reach an agreement and execute letters of intent.

About Tidal Royalty

Tidal Royalty provides royalty financing to the U.S. regulated cannabis industry. Led by an executive team with extensive industry experience in Canada and the U.S., Tidal Royalty provides operators with the funding they need to grow their business. Operators benefit from non-dilutive capital and investors get top-line access to a diversified portfolio of companies that will form the future of this transformative industry.

For further information, please contact:

Tidal Royalty Corp.

Terry Taouss, President

Email: terry@tidalroyalty.com

This news release contains certain "forward-looking information" within the meaning of applicable Canadian securities law. Forward-looking information is frequently characterized by words such as "plan", "continue", "expect", "project", "intend", "believe", "anticipate", "estimate", "may", "will", "potential", "proposed" and other similar words, or information that certain events or conditions "may" or "will" occur. Readers are cautioned that forward-looking information contained in this new release is not based on historical facts but instead is based on reasonable assumptions and estimates of management. Forward-looking information contained in this news release includes, but is not limited to: the ability to enter into definitive documentation in respect of letters of intent currently entered into by Tidal Royalty, the ability of Tidal Royalty to enter into additional letters of intent and associated definitive documentation with current or further proposed investee companies, the operating and financial performance of any investee company to be funded by Tidal Royalty from time to time and the ability of Tidal Royalty to generate revenue or realize profit through royalty agreements or equity investments with any future investee companies. In addition, this news release contains forward-looking statements attributed to third-party sources, the accuracy of which has not been independently verified by Tidal Royalty. Forward-looking information contained herein is based on the opinions and reasonable assumptions and estimates of management as at the date hereof and is subject to a variety of known and unknown risks and uncertainties and other factors, many of which are beyond the control of Tidal Royalty, that could cause actual events or results of Tidal Royalty to differ materially from those expressed or implied in the forward-looking information. Such factors include: U.S. regulatory landscape and enforcement related to cannabis, including political risks and risks relating to regulatory change, risks relating to anti-money laundering laws and regulation, other governmental and environmental regulation, public opinion and perception of the cannabis industry, risks related to the enforceability of contracts, the requirement by Tidal Royalty to obtain additional financing, the limited operating history of Tidal Royalty, timeliness of government approvals for granting of permits and licences needed by any future investee companies, including licences to cultivate cannabis, the actual operating and financial performance of any future investee company, competition and other risks affecting Tidal Royalty in particular and the U.S. cannabis industry generally, and the risk factors effecting Tidal Royalty disclosed in the listing statement of Tidal Royalty available at www.sedar.com. Because of such risks, uncertainties and other factors, investors should not place undue reliance on the forward-looking information contained herein. Tidal Royalty is under no obligation, and expressly disclaims any intention or obligation, to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as expressly required by applicable law. The foregoing statements expressly qualify the forward-looking information contained herein. This release does not constitute an offer for sale of, nor a solicitation for offers to buy, any securities in the United States.

Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

RLTY is going bankrupt imo. This company can't compete and is way to late in the game.... Better stocks out there else where.

|

Followers

|

0

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

7

|

|

Created

|

07/01/18

|

Type

|

Free

|

| Moderators | |||

Source: Streetwise Reports (6/25/18)

Ron Struthers of Struthers' Resource Stock Report says this cannabis royalty company offers experienced management and fills a unique niche.

Ron Struthers of Struthers' Resource Stock Report says this cannabis royalty company offers experienced management and fills a unique niche.

There are more and more pot deals coming to the market every week and not all of them will do well or even survive. I find it best to stick with proven, successful people and those exploiting a niche or where there is little competition.

Tidal Royalty Corp. (RLTY:CSE) fits both bills. CSE:RLTY; Shares outstanding 153.6 million

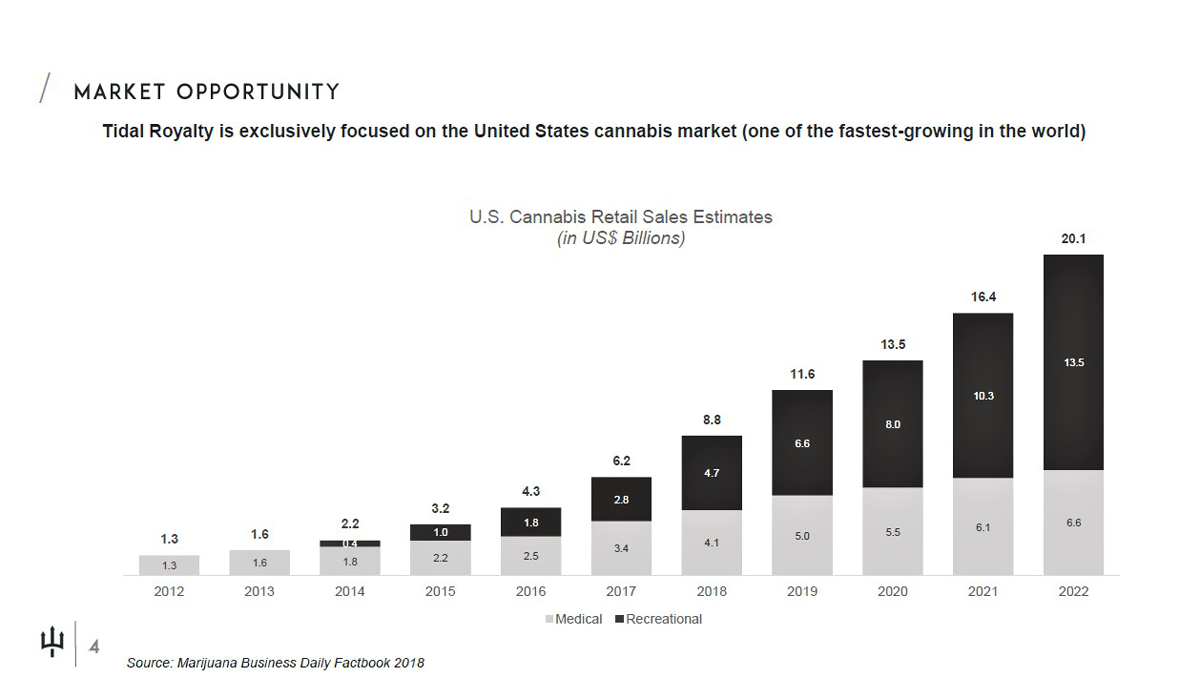

Tidal involves many of the same people who started up Cannabis Wheaton and it has the same royalty stream plan but in this case the focus is on the U.S. market. Most Americans support legalization and every year we see new states adopt some form of legalization. Despite this significant growth, the inconsistency between federal and state laws restricts capital. In Canada, just now have the big banks started to tip their toes in the market and in the U.S. capital investment has been mostly from private investment and some hedge funds.

The Tidal team has built, led and advised some of the most iconic cannabis businesses in Canada and across the world. They plan to leverage this expertise to provide non-dilutive and value-adding capital to exceptional operators and help position them as a model for best-in-class businesses. Tidal investors get top line access to the companies that will form the future of this society-benefiting industry.

Management

Paul Rosen, Chairman & CEO, is a noted career entrepreneur and management consultant. Over the last five years, he has become one of Canada's most active and diversified investors in the emerging cannabis industry. He is the founder and managing director of BreakWater Venture Capital, a private venture capital fund and advisory based in Toronto. Mr. Rosen was a co-founder of PharmaCan Capital, now operating as The Cronos Group (CRON:NASDAQ, CRON.V), where he served as president and CEO for three years. Mr. Rosen sits on the board and chairs the audit committee of iAnthus Capital Holdings (IAN.C), a publicly traded New York-based investment bank, sits on the board of Hill Street Beverages, and acts as an advisory to several companies in the industry. Mr. Rosen is a member of the Law Society of Upper Canada and received a B.A. in Economics from Western University in 1985 and LL.B. from the University of Toronto in 1988.

Terry Taouss, president, is an entrepreneur with operational experience scaling fast-growing businesses. Mr. Taouss was part of the founding management team at SiteScout, an advertising technology company that he helped profitably build through its successful acquisition in 2013. In that role, Mr. Taouss had carriage over all finance, legal and corporate development functions. Mr. Taouss then served as the managing director of Centro Canada, with carriage over strategy, product, marketing and sales, and was a member of the Centro executive team, helping guide strategy for the company's broader technology and services offering. Mr. Taouss received a J.D. from Osgood Hall Law School and an MBA from the University of Toronto.

Theo van der Linde, CFO, is a Chartered Accountant with 20 years of extensive experience in finance, reporting, regulatory requirements, public company administration, equity markets and financing of publicly traded companies. He has served as a CFO & director for a number of TSX Venture Exchange and Canadian Securities Exchange (CSE) listed companies over the past several years.

Courtland Livesley-James, Executive VP, Strategy, is an active investor and entrepreneur with significant experience in corporate finance and investment banking. Mr. Livesley-James helped develop the cannabis practice at Dundee Capital Markets, playing a key role in a wide variety of domestic and international corporate and commercial transactions. His work included advising on some of the largest deals in the cannabis sector. Mr. Livesley-James is also a partner at a private venture capital fund with a focus on emerging companies in a variety of sectors. Mr. Livesley-James received an Honours Degree in Accounting and Financial Management from the University of Waterloo.

Jonathan Beland, VP, corporate development, has been focused on investing and providing corporate advisory to some of the marquee clients in the cannabis sector since 2016. Prior to joining Tidal, Mr. Beland spent seven years in sell-side investment banking roles with BMO, Deloitte and other firms focusing on the cannabis and mining sectors. Some of the core clients Mr. Beland was responsible for covering included Canopy Growth, Aurora Cannabis, MedReleaf, PotashCorp, Mosaic, Agrium, BHP, Vale, CN, CP and Aecon. Mr. Beland holds a B.A. in Architectural Theory and History from Carleton University, an Associate's Degree in Architectural Technology from George Brown College, an M.B.A. from the University of Toronto specializing in investment banking.

Iniataly Tidal will focus on U.S states with adult use markets that are seeing strong growth like California, Massachusetts. Florida, New York, Illinois and Nevada. The company is in advanced talks with about 10 possible royalties deals.

Tidal put out a news release today indicating it has had discussions with over 100 prospect companies, and have entered into three separate Letters of Intent to date. Its pipeline of opportunities to fund high-caliber operators across nearly a dozen key U.S. states continues to grow and it anticipates that current efforts will lead to multiple additional agreements as discussions progress.

Today Tidal also announced four advisors.

Hugo Alves is the president of Auxly Cannabis Group Inc. (TSXV:XLY), formerly known as Cannabis Wheaton Income Corp. Auxly is one of the world’s first and foremost cannabis streaming companies.

Marc Lustig is the founder and CEO of CannaRoyalty Corp. (CSE:CRZ). CannaRoyalty is a North American cannabis consumer product company currently focused on building a leading distribution business in California, the world's largest regulated cannabis market.

Joel Sherlock is the co-founder of Doventi Capital Inc. and the chairman of Vitalis Extraction Technologies. Doventi Capital is a private equity firm specializing in investment in the regulated cannabis industry in North America. Vitalis Extraction is an engineering and manufacturing company producing the highest-flowing industrial extraction systems for the cannabis industry.

Richard Brooks is the managing partner of Brooks Business Lawyers. The Brooks firm provides corporate and commercial legal services to some of the fastest-growing companies in Canada across a number of industries, including cannabis.

Finance

As part of the go public process, Tidal set out to raise $20 million at 33 cents per share and ended up raising $30 million. This gives them about $38 million cash on the balance sheet.

Summary

Tidal has the right people to do the job, but not just the royalty agreements but the influence in financial circles to raise the necessary funds.

I believe as this becomes known in the investment community we will see much higher share prices. That said it is always difficult to know how these new issues will trade. I would use the approach of buying half of the intended position now and the other half after some trading history. With a longer-term view, you could just buy your whole position now and I would bet at some point down the road it will be much higher.

At $0.65, the market cap is about $100 million, not very high in the marijuana field. I bought into the 33 cent financing and currently own 38,000 shares.

For 27 years, Ron Struthers, founder and editor of Struthers' Resource Stock Report and Playstocks.net, has consistently beat the comparable benchmarks selecting stocks in the precious metals, oil and gas, clean-tech and disruptive technology sectors. In 2017, 35 stocks in the precious metals sector saw an average gain of 62% and energy clean-tech an average gain of 65%. In disruptive technology, 16 picks saw an average gain of 55%. Past performance is no guarantee of future gains. Struthers leverages his vast network of contacts, approaches investments from a value perspective seeking several 100% gain potential and uses technical analysis to aid in buy and sell levels.

TORONTO, June 21, 2018 (GLOBE NEWSWIRE) -- Tidal Royalty Corp. (“Tidal Royalty” or the “Company”), a leading provider of royalty financing to licensed US cannabis operators, is pleased to announce that it will commence trading on the Canadian Securities Exchange under the ticker “RLTY” on Monday, June 25, 2018.

In addition, the Company has completed a $30 million equity financing. The financing was a private placement of the Company’s common shares and closed on June 12, 2018. With the completion of this funding round, Tidal Royalty has approximately $38 million in cash on its balance sheet. The Company intends to use the net proceeds of the offering for royalty financings and for working capital and general corporate purposes.

Tidal Royalty was founded by cannabis industry veterans to provide expansion financing to licensed operators across a number of industry verticals. “We are excited to complete this financing, which will enable us to continue our mandate of financing the growth of best-in-class US licensed operators,” said Paul Rosen, Chief Executive Officer and Chairman of Tidal Royalty. “The significant demand from the market for this financing further validates our belief that the outsized returns in the cannabis industry will be made in the US. We thank our shareholders for their continued support in helping us build a world-class enterprise.”

Tidal Royalty Investment Thesis

Tidal Royalty is a unique investment platform designed to generate returns from the rapidly-growing US cannabis market. The company is actively pursuing opportunities across multiple industry verticals, including cultivation, processing and manufacturing, dispensing, and ancillary services. The company provides expansion capital to licensed, qualified operators and receives a royalty on top-line revenue. This product allows Tidal Royalty shareholders to participate in the broader US cannabis market’s growth without being subject to specific operational risks.

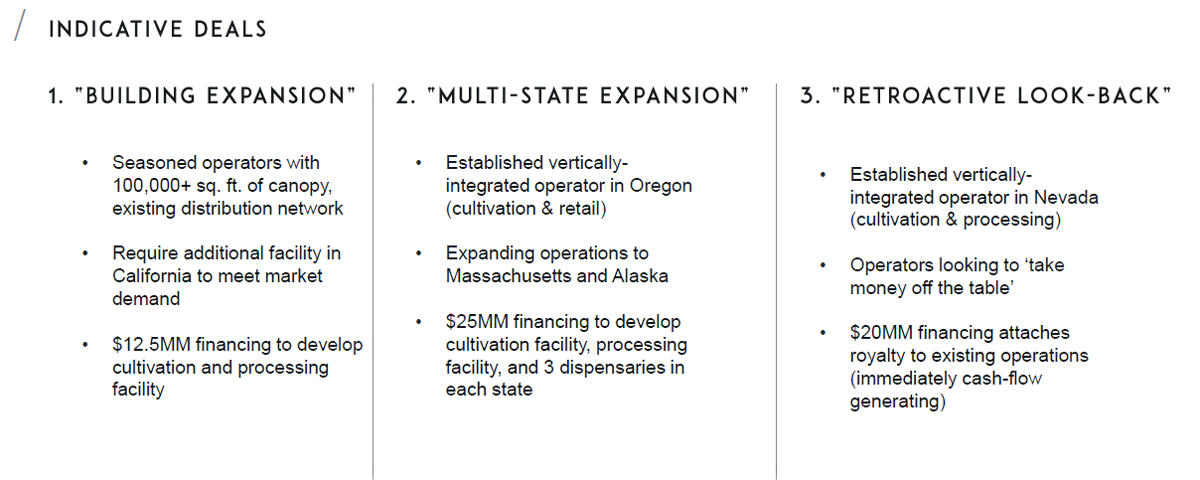

Representative Deal Structures

While Tidal Royalty may customize its royalty financing product to meet the particular needs of exceptional operators, the majority of royalty transactions encompass one of the three following deal types:

Facility Expansion: capital used to build out existing operational assets. This would include opening additional flowing rooms to increase canopy, establishing a manufacturing and processing vertical, and opening additional dispensaries.

Multi-State Expansion: capital used to expand into new states and set up operations. Operators must demonstrate proven operational excellence, the ability to obtain necessary licenses, and a business model that leverages their existing assets and operations.

Market Rollup: allows seasoned operators to expand their footprint by purchasing strategic or undervalued assets. The royalty attaches to existing operations and provides immediate cash flow.

Management Team

Paul Rosen, Chairman & CEO

Mr. Rosen is a noted career entrepreneur and management consultant. Over the last 5 years, he has become one of Canada’s most active and diversified investors in the emerging cannabis industry. He is the founder and Managing Director of BreakWater Venture Capital, a private venture capital fund and advisory based in Toronto. Mr. Rosen was a co-founder of PharmaCan Capital, now operating as The Cronos Group (CRON:NASDAQ, CRON.V), where he served as President and CEO for three years. Mr. Rosen sits on the Board and chairs the Audit Committee of iAnthus Capital Holdings (IAN.C), a publicly-traded New York-based investment bank, sits on the Board of Hill Street Beverages, and acts as an advisory to several companies in the industry. Mr. Rosen is a member of the Law Society of Upper Canada and received a B.A. in Economics from Western University in 1985 and LL.B. from the University of Toronto in 1988.

Terry Taouss, President

Mr. Taouss is an entrepreneur with operational experience scaling fast-growing businesses. Mr. Taouss was part of the founding management team at SiteScout, an advertising technology company that he helped profitably build through its successful acquisition in 2013. In that role, Mr. Taouss had carriage over all finance, legal, and corporate development functions. Mr. Taouss then served as the Managing Director of Centro Canada, with carriage over strategy, product, marketing and sales, and was a member of the Centro executive team, helping guide strategy for the company's broader technology and services offering. Mr. Taouss is a member of the Law Society of Upper Canada and practiced corporate law in Canada for several years. He built a corporate practice advising high-growth clients in a diverse range of industries and led numerous M&A transactions (buy and sell side). Mr. Taouss received a J.D. from Osgood Hall Law School and an MBA from the University of Toronto.

Theo van der Linde, CFO

Mr. van der Linde is a Chartered Accountant with 20 years extensive experience in finance, reporting, regulatory requirements, public company administration, equity markets and financing of publicly traded companies. He has served as a CFO & Director for a number of TSX Venture Exchange and Canadian Securities Exchange (CSE) listed companies over the past several years. Mr. van der Linde has extensive experience in financial services, manufacturing, oil & gas, mining and retail industries. Most recently, he has been involved with future use trends of natural resources as well as other disruptive technologies. Mr. van der Linde received a B.Comm. (Hons) in Finance, is a Chartered Accountant and is a member of good standing of the Institute of the Chartered Public Accountants of British Columbia.

Courtland Livesley-James, Executive VP, Strategy

Mr. Livesley-James is an active investor and entrepreneur with significant experience in corporate finance and investment banking. Mr. Livesley-James helped develop the Cannabis Practice at Dundee Capital Markets, playing a key role in a wide variety of domestic and international corporate and commercial transactions. His work included advising on some of the largest deals in the cannabis sector. Mr. Livesley-James is also a Partner at a private venture capital fund with a focus on emerging companies in a variety of sectors. Mr. Livesley-James has extensive experience with respect to public companies, capital markets, securities law and other facets fundamental to cannabis, technology, healthcare and the natural resources sector. Mr. Livesley-James received an Honours Degree in Accounting and Financial Management from the University of Waterloo.

Jonathan Beland, VP, Corporate Development

Mr. Beland has been focused on investing and providing corporate advisory to some of the marquee clients in the cannabis sector since 2016. Prior to joining Tidal, Mr. Beland spent seven years in sell side investment banking roles with BMO, Deloitte and other firms focusing on the cannabis and mining sectors, and seven years in professional services in both consulting engineering at AECOM and ICI facility construction management working on major projects across Canada. Some of the core clients Mr. Beland was responsible for covering included Canopy Growth, Aurora Cannabis, MedReleaf, PotashCorp, Mosaic, Agrium, BHP, Vale, CN, CP and Aecon. Mr. Beland holds a B.A. in Architectural Theory and History from Carleton University, an Associate’s Degree in Architectural Technology from George Brown College, an M.B.A. from the University of Toronto specializing in Investment Banking and has passed the Level II exam of the Chartered Financial Analyst program. He is also a registered Exempt Market Practitioner licensed to distribute securities.

About Tidal Royalty

Tidal Royalty provides royalty financing to the US regulated cannabis industry. Led by an executive team with extensive industry experience in Canada and the US, Tidal Royalty provides operators with the funding they need to grow their business. Operators benefit from non-dilutive capital and investors get top-line access to a diversified portfolio of companies that will form the future of this transformative industry.

For further information, please contact:

Tidal Royalty Corp.

Terry Taouss, President

Email: terry@tidalroyalty.com

https://webfiles.thecse.com/investorx/RLTY.U/1806291536485967.pdf?44hmY6Z6fx4NwiYc4mpwDWcHef_7d.YG

https://webfiles.thecse.com/investorx/RLTY.U/1806291536373456.pdf?OoeBXxd1.P83tJ7.Nlm0V969D5WykDkJ

https://webfiles.thecse.com/investorx/RLTY.U/1806291534459614.pdf?qWK9_c7kOKGDHLVBFNZkFVhLwV0zgUYf

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |