Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Hi German Col - whats the other company you are looking at ?

Very sorry to hear this GermanCol. YOU are one of my absolute favourite posters. I don't think you ever wrote a post, that was not part of that days best due diligence.

I can understand you. I can understand those who say your decision is emotional based. I am in groups, where some of the most hardcore defendants of NWBO and management are showing signs of "wear and tear" and are litteraly "pissed".

I am pissed too. But for me its just, where do I direct "that anger"? Who are the actual recepients for the situation we have?

Beyond all doubt, NWBO has been "harassed" for better part of a decade by collaborative forces, whether that is Market Makers, hedges, shorters, Adam feuerstein, affiliated non dislosure doctors of competing companies and treatments and a small army of stock board pawns who do their best to direct sentiment to the shitter on all places, where NWBO is debated.

It is only to debate in the minds of the legions of paid shill bashers.

Question is, how should NWBO act upon this.

They have tried, in a distant past, to inform retailers. Information that got skewered, distorted and found its way into Adam Feuerstein +40 hit pieces, that got further "picked up" by the stock board army and fudded around and sometimes even found its way into idiotic lawsuits, that took up time, effort and resources for NWBO.

When Linda Liau was on Al Musellas Webinar, the presentation got stopped immediately on Facebook, the presentation taken down immediately by Al Musella and only within weeks again put up, because someone threatened with litigation. So the Q&A, containing a lot of information, that refuted a lot of the fud narratives, we have been blessed with since then - was suddenly no where to be found ... but the video some of us have saved and the screenshots from it.

The case is, that we are up against incredible powerful and financially empowered forces and that the company have made a decision, that not saying anything, will not be able to be used against them. That includes leaving retailers in the dark.

If they don't have anything of material, substantial POSITIVE news to inform about. Don't!

Consider this and tell me, WHAT are the odds that anyone would accuse NWBO of misinforming or in any way having broken rules for informing retailers? It could very well end in yet another lawsuit, that takes up time, money and effort. Just what they want. Playing right into the hands of yet another fud narrative.

During the Medicines and Healthcare products Regulatory Agency (MHRA) Marketing Authorisation Application (MAA) approval period, pharmaceutical companies must adhere to strict regulations regarding what information they can share about the product pending approval. This includes communications with retailers or the general public.

Under these regulations, companies are restricted from promoting or making claims about the safety, efficacy, or marketing of the product until it has received official approval. The primary reason for this is to ensure that all public information about a drug is accurate and substantiated by the MHRA's assessment, preventing misinformation and protecting public health.

However, companies can share factual, non-promotional information about the product, such as its development status, the progress of the MAA, and general scientific findings that are not directly linked to the promotional claims about the product's benefits or risks. For example, they might inform retailers about the submission of the MAA or general updates on the approval process timeline without making specific claims about the product's potential success or market availability.

Such communications must be carefully managed to avoid crossing into promotional territory, which could be viewed as a breach of regulatory guidelines. Therefore, while not completely restricted from discussing the product, companies must navigate these rules carefully to remain compliant with MHRA regulations.

AstraZeneca profit up on strong sales of cancer drugs

April 25 (AFP) -- British pharmaceutical giant AstraZeneca on Thursday said net profit jumped 21 percent in the first three months of the year thanks to strong growth in sales of cancer drugs.

Profit after tax climbed more than one fifth compared with the first quarter last year to $2.18 billion, AstraZeneca said in a results statement.

"AstraZeneca had a very strong start in 2024," chief executive Pascal Soriot said in the statement, which noted a 26-percent increase in revenue from oncology treatments.

Total group sales increased 19 percent to $12.7 billion in the first quarter.

"Our strong pipeline momentum continued and already this year we announced positive trial results for Imfinzi and Tagrisso that were unprecedented in lung cancer," added Soriot.

The first quarter saw the company agree to buy US biopharma firm Fusion for up to $2.4 billion, in its latest expansion into cancer treatments.

Fusion is developing next-generation radiotherapy to treat cancer via precise targeting that minimises damage to healthy cells.

AstraZeneca's latest push into oncology comes after its net profit almost doubled to $6 billion last year as a strong cancer division helped offset a wipeout for sales of its Covid treatments.

Also in the first quarter, the group struck a deal to purchase French biotech specialist Amolyt Pharma for about $1 billion, bolstering its rare diseases division Alexion.

bcp/rfj/yad

Flip please think of our collective mental health before you share his work soup answer ...

Wherefore, it shall come to pass that an occurrence (herein after referred to as the "material event ") be deemed by the company, by its own determination of the meaning of ` material ` to possess a weight of import (also known as "materiality"). Thus, such a material metamorphosis shall be brought to the fore, announced by means of a press release. However, this pronouncement shall be made at the company's sole discretion ...

They have my vote.

That I agree with -

They have had a number of years to prepare for this, if they really did their job.

I believe that the company, and Drs. primarily in the UK have enough tumors in storage and patients lined up to keep their limited production capacity working for some time. Once word of the approval is out, this will grow dramatically without a major sales or advertising program. Furthermore, we know the company has contracted for all sorts of things, I still believe that both Advent and CRL will be involved in the commercial production, storage and distribution of the vaccine, if there is a need to line up more patients, because they have the capacity, perhaps that too will be their responsibility.

Of course Advent and CRL will do well in this arrangement, but so will NWBO, they'd have almost no added expenses, but would be collecting for every patient being treated with the vaccine. As I see it, it could be a very win-win proposition for all concerned.

Gary

It’s not about the lack of communication. It’s what have management done for shareholders over the years. No one is in this for charity and there is an opportunity cost as well. Let’s see if they come through in the next month or two with large non dilutive funding from big pharma. They have had a number of years to prepare for this, if they really did their job.

Sorry to see you lose patience with NWBO stock and management when we are potentially only a month or two away from what could be game changing sequence of events. Although I do sympathize with you as we have been hearing that we are at 1 yard line comment for a number of years.

This is truly management’s last opportunity to rebuild trust with existing shareholders. If they do not get a big pharma partner (with large non dilutive funding) on board within a couple of weeks of MHRA approval I think many investors will leave, just like you. And shorts will continue to slam the stock down on any UK approval spike we may get.

GermanCol - I wish you well! Thanks for your contribution, especially helping with your statistical analysis.

Margin Buu - Yep, KG makes Madoff look like a choir boy. In the 80's George Green earned a reputation for being a money making financial wizard, and he was quickly courted by the most powerful leaders in the world. He's credited for creating the derivatives market. Here's a brief clip of him describing how psychopathic world leaders are, as he was the one creating the schemes for them at one time: https://drive.google.com/file/d/1gxGrXrUOjwSlTyOnVz86HO_PLg2V9px1/view?usp=drivesdk

I heard a lot of comments directed at management's lack of communication with shareholders, except that management passed the ball to the regulator's side back in Dec. So any lack of communication is on the clockpunching, slow walking, bureaucrats.

A beloved physician friend who passed, who made millions investing in Biotech once said, his biggest regret was selling a ticker when the price was beatup and he just didn't have the patience to wait for it to recover. The very next morning the stock exploded on news of a BO.

That's one hell of an expensive club to join. No thanks.

Accusing GermanCol of being a swing trader.... LOL!!!

You might want to click his username, and read his extremely well research/informative post.

And what MarginBuu doesnt get when they said the following:

What an odd point in time to get demoralized into selling “an important percentage” of your NWBO shares to “offset all the damage” and buy another ticker. But you’re still holding some and expecting a ROI, most likely once we get MHRA approval in the next few months? Okay.

He is NOT holding some and EXPECTING a ROI....

He is holding some and HOPING/WISHING a ROI.

Expecting vs Hoping/Wishing= 2 different things. (Include in this the SP value by the time we get a decision from MHRA (July-Aug ish, maybe Sep-Oct).

Some people here are realistic.

I clearly recall what he said when Joan suddenly passed away. All his posts have one thing in common: hidden bear agenda to create confusion.

You are effing genius bro. 70% of trades are done by computers/algos.

You are most definitely a pump. There is no doubt. So many paid pumps here......

Well Hopeforthefuture, I hope that we hear something about approval by

the end of May, June, July or August and we don't have to wait for this till

the end of 2024 (about one year from submission).

Remember that NWBO applied for the 150 day fast track MAA submission on

12/20/23 and even with 14 days until MAA acceptance and a 60 day RFI, approval

may be granted already by early August.

Cutting losers is not an odd strategy.

What is odd is that you pumpers guilt trip him into fomo. It is just a few months away. It been this way for many many years......on the 1 yard line for 10 years. Okay pumper..

Good luck and best wishes with your other investments. Thank you for drawing our attention to the statistical side of things.

M-A-N-I-P-U-L-A-T-I-O-N !!! Imo

There is no need for NWBO to hire a sales team for GBM. Linda Powers said many years ago that they didn't need a sales force for GBM because it's a small community of doctors that treat this orphan disease and they keep up with new tools to treat it - because there are so few.

operation grift SOP get with the program

I believe he already sold it December last year when price was around $1. I knew this long time ago, a lot of longs here are swing traders, not investors. That caused big drop after news, and no news from the company and this stock just down almost every single day until next news. swing traders are playing this stock over and over again to make money. Too bad this company doesn't know how to release news to pump up the stock, and is being very predictable by the traders and short sellers. I hope LP can release nuclear news to kill all the shorts but I afraid she just don't have any news on hand.

Yes, if in May hallelujah!! If not, get more bourbon.

RobotDroid I just hope we hear something by end of May and get actual approval this year. That will start next challenge of staffing up for marketing and sales

Thats logical, but what is not is silence from management, no pr update or guidance for shareholders, no ASM, no nothing. That is illogical.

Hopefully your other ticker will take off and you can perhaps get back in here. One has to think Operation Grift has to come to an end at some point.

As with any investment, certainly pre-rev biotech, there are no guarantees. Purchase what you can afford. I recently sold my 1000 shares of MRNA, which I purchased in 2019 @ 22.60/shr. It was my first foray into individual stocks & freely admit I watched it go from the 20s, to $495 in about 18 months, then watched it drop all the way down to 60s without selling. I am extremely comfortable with my position & investment in NWBO. I work in BP sales and am CONFIDENT NWBO is about to change the health care landscape for the better.

I’m done trying to speculate what the SP will be & when. What I do know, from my 25 years of experience in the industry, is that when the MASSES learn about how NWBO created a process that can potentially benefit the immune system of 8 BILLION PEOPLE, including those souls suffering from GBM/rGBM and solid tumors, the tsunami of support will wash the MMs, the clowns spreading FUD on this board and every detractor into the gutter, where they belong.

I truly hope you know what you hold! GLTU

I just can't believe that. It'd mean you're all either dumb trust fund babies or so smart having made all that disposable hard earned cash -Only to inexplicably hand it over to nearly invisible-unaccountable management with never a demand or challenge.

...Unless you all obtained the shares through pumping?? LOL

>>It’s not a lie. Many shareholders here have acquired several hundred thousand to millions of shares.

Well to be fair management didn’t say anything about approval in March , April , May etc . They said they submitted the application to be considered under 150 day pathway and also they will be busy answering any questions I.e. RFI . They or MHRA never confirmed or denied that application is actually being considered under 150 day pathway or if RFI was given . All these speculation about MHRA already knows about DcVax so approval right away , in few weeks , in Jan , Feb , Mar etc etc and under SWIFT were started by usual few . So by management’s last statement no one should have expected approval so far

I was implying NWBO. Anytime in the next few months for a multiple x ROI.

My fear is that May brings only more silence from management and no approval. Like April. That would really suck.

Considering his day time job, his attorney probably advised him it could be a conflict of interest if he deleted any post.

MHRA approval will validate DCVax once and for all and will be monumental for raising the share price of NWBO. It will be game over for the naysayers, the fudsters, the shorts, and the Fraudsteins of this world. I think it’s funny you’re preemptively moving the goalposts.

Dear GermanCol: I was very sorry to see this post from you. I know that’s a statement of emotion and know that emotion should play no part in investing. But many of us share your feelings about our past reliance and current conduct of the company. I have terrific respect for your careful and studious diligence as reflected in your posts - those will be missed or perhaps you will continue to share your thoughts which I hope you do. We all make our own decisions but it seems to me likely that we’ll have an answer from MHRA within 30 days or so

and I think we both anticipate that will be positive. I hope you are happier with any new investments. For me the current SP is prohibitive of any selling. I wish it was not the case - not that I’d sell but I’d be a hell of a lot happier holding. Good luck and best wishes.

What an odd point in time to get demoralized into selling “an important percentage” of your NWBO shares to “offset all the damage” and buy another ticker. But you’re still holding some and expecting a ROI, most likely once we get MHRA approval in the next few months? Okay.

Not seeing where the damage is, except if you sell at a loss and miss the boat. Good luck if you have a ticker in mind that you think will pop in the very very near future. I’m already sitting on one.

GermanCol, sorry to hear you’re bailing. Hopefully we only have a few more weeks until approval. Perhaps one day we could get together for a beer. I’ve enjoyed your posts and thank you for sharing your Due Diligence.

It’s not a lie. Many shareholders here have acquired several hundred thousand to millions of shares.

If you want to see someone who’s full of it, whosleftholdindabag constantly posted that he was buying quarter million dollar+ buys of NVCR as it was tanking to 6 year lows.

Sorry to see you go GermanCol, you were/are in top3 posters here.

I hope you recover your loss.

You are the master of negativity and you have always been. Out of curiosity, what made you quit being a moderator?

Excellent post HappyLibrarian. I totally agree with you and take this opportunity to tell you that I really like your posts, you are one of my favorite posters. I think you are very sincere and call the things the way you see them.

I thought the day would never come, but after all these long years, I started selling an important percentage of my shares some weeks ago to buy another ticker, that I hope could offset all the damage from my NWBO investment. Also, I hope that with the shares I kept in NWBO I can recover my losses and have at least some return. I'm tired of this bleeding day by day, also tired of this silence and this disrespectful management. No ASM, no quarterly calls, no adequate communication, no clarity, supposed hidden reasons for a quiet periods, copy-paste answers from DI, supposed hidden reasons for a quiet periods, etc. This is not the way to run a public company.

I continue believing in the science and that’s why I didn't sell all my shares. I hope someday soon the situation changes in NWBO. Some continue blindly defending the indefensible, but I think it is useless to continue defending the company from all that is happening. This is just my opinion and each poster is free to have its own. I don’t have any motives behind this post different to expressing what I feel and think in a sincere way as I always do and maybe to vent a little bit after all these years of impotence and pain.

Time matters, time goes by, life is short, other treatments appear, we get older and money has an opportunity cost.

I think all this company silence and disrespect for shareholders is the main contributor for the iclights, exs, inquirings, learningcurves, etc. that come with their games here to fill the voids.

English is not my native language. All this is just my opinion and not financial advise.

It's all a lie to draw in poor green retail with tactic 101. Tell them to either scan and post their trade or to get lost.

Re: R/S....pretending that the prospect is 'only disinformation' is equally unreasonable."

It's not only unreasonable. it's unthinkable.

Where are you all getting $60,000 to buy shares lol.

Here I am sitting with less than half that 😅

And how is advent generating revenue to hire and pay for those employees

A common sense question from someone on X.

A friend of mine asked me why don't citadel buy NWBO stock.He said it seems so obvious that NWBO will be approved.I ask that same question many times.I come up with only one answer.The shorts must be HUGH.JMHO.

— patrick walsh (@patrickwalsh14) April 24, 2024

let's hope to hear some good news tomorrow!

Tomorrow .44, market will get pounded.

My next bid is .41, which is next week.

“I guess you could also program the computer to violate a regulation, but we haven’t gotten there yet”. - Bernie Madoff

We’ve definitely gotten there.

|

Followers

|

1619

|

Posters

|

|

|

Posts (Today)

|

6

|

Posts (Total)

|

687039

|

|

Created

|

02/02/05

|

Type

|

Free

|

| Moderators XenaLives sentiment_stocks CaptainObvious Poor Man - Doc logic JerryCampbell | |||

“Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.”

~ Winston Churchill

Stylized Dendritic Cell featured on NWBO board since 2015

- Dr. Linda Liau, PhD, MBA, Professor and Chair, Department of Neurosurgery, David Geffen School of Medicine at UCLA

Clinical Trials

DCVax®-L to Treat Newly Diagnosed GBM Brain Cancer (NCT00045968) - Phase III (Double Blind)

UK (MHRA): DCVax-L to Treat Newly Diagnosed GBM Brain Cancer (EudraCT#) 2011-001977-13

DE (Germany - PEI): DCVax-L to Treat Newly Diagnosed GBM Brain Cancer (EudraCT#) 2011-001977-13

Expanded Access Protocol for GBM Patients with Already Manufactured DCVax®-L Who Have Screen-Failed Protocol 020221 (NCT02146066) (Expanded Access)

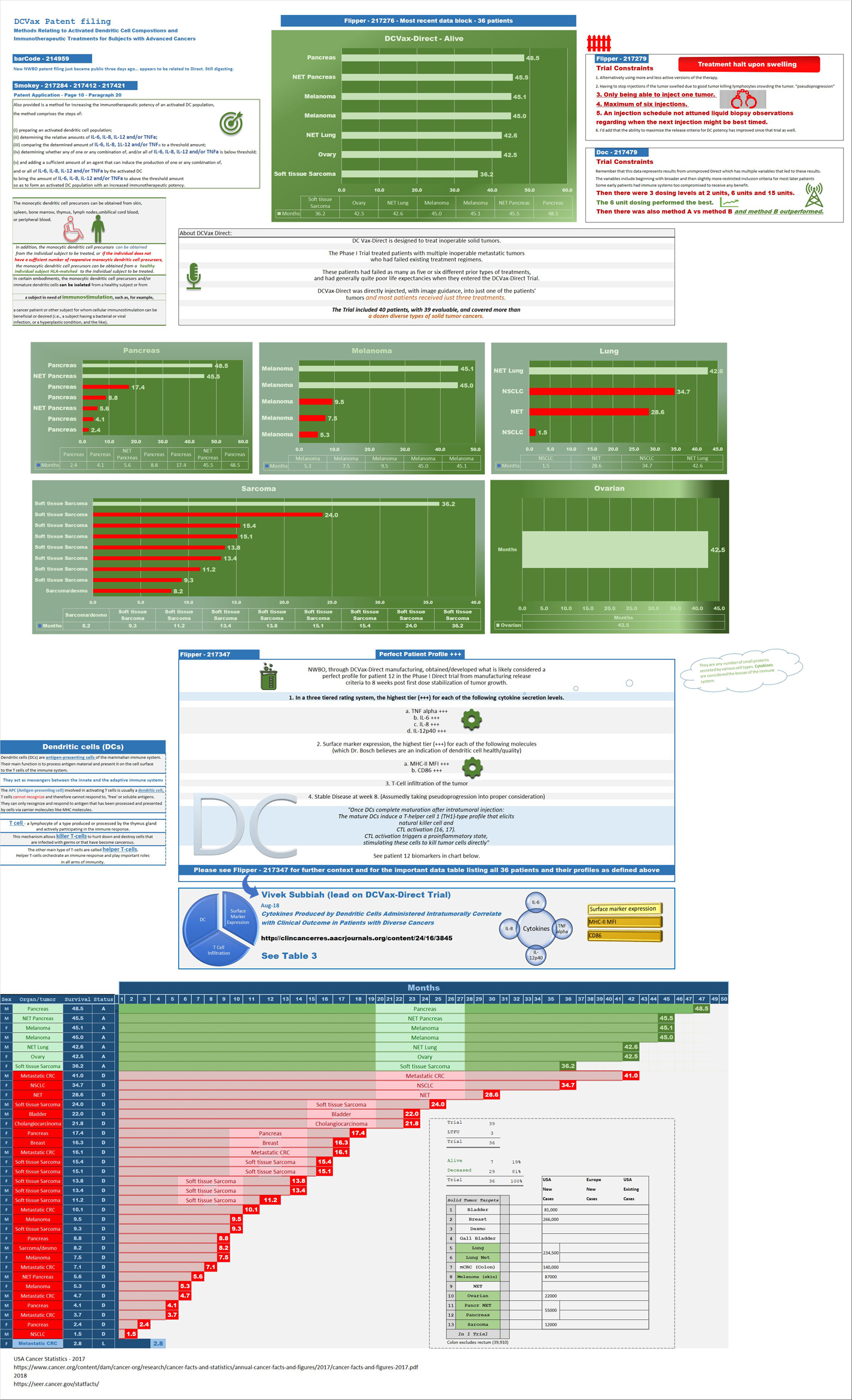

Safety and Efficacy Study of DCVax-Direct in Solid Tumors (NCT01882946) - Phase I/Phase II (Open Label)

UK Clinical Trials - Study of a Drug (DCVax®-L) to Treat Newly Diagnosed GBM Brain Cancer

EU Clinical Trials for DCVax-L - Phase III

Dendritic Cell Vaccine for Patients with Brain Tumors (NCT01204684) - Phase II - at UCLA - Randomized (Open Label) testing DCVaccine with Resiquimod and DC Vaccination with Adjuvant polyICLC

Pembrolizumab and a Vaccine (ATL-DC) for the treatment of Surgically Accessible Recurrent Glioblastoma - Phase 1 (NCT04201873)

Dendritic Cell-Autologous Lung Tumor Vaccine (DCVax-L) and Nivolumab in Treating Patients with Recurrent Glioblastoma - Phase 2 (NCT03014804)

Dendritic Cell Therapy for Brain Metastases From Breast or Lung Cancer (NCT0368765) - Phase 1 - Collaborator: Mayo Clinic

Announcement of DCVax-L and Anti-PD-1 Monoclonal Antibody (Pembrolizumab) for Patients with Liver Metastases of Primary Colorectal Carcinoma Phase 2 Trial - November 17, 2016 - University Medical Center (UMC) of the Johannes Gutenberg University of Mainz

Cognate Bioservices - Owned by Charles River Labs

Website

Company Contact Info

Investor Relations:

Les Goldman (Company) (202) 841-7909 lgoldman@nwbio.com

Sign up for Northwest email list here (hit the subscribe to email list button in the lower right)

Company Headquarters

4800 Montgomery Lane, Suite 800, Bethesda, MD 20814 (240) 497-9024

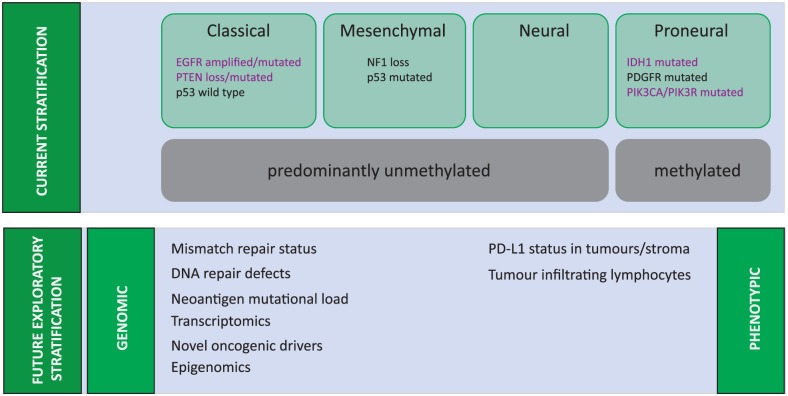

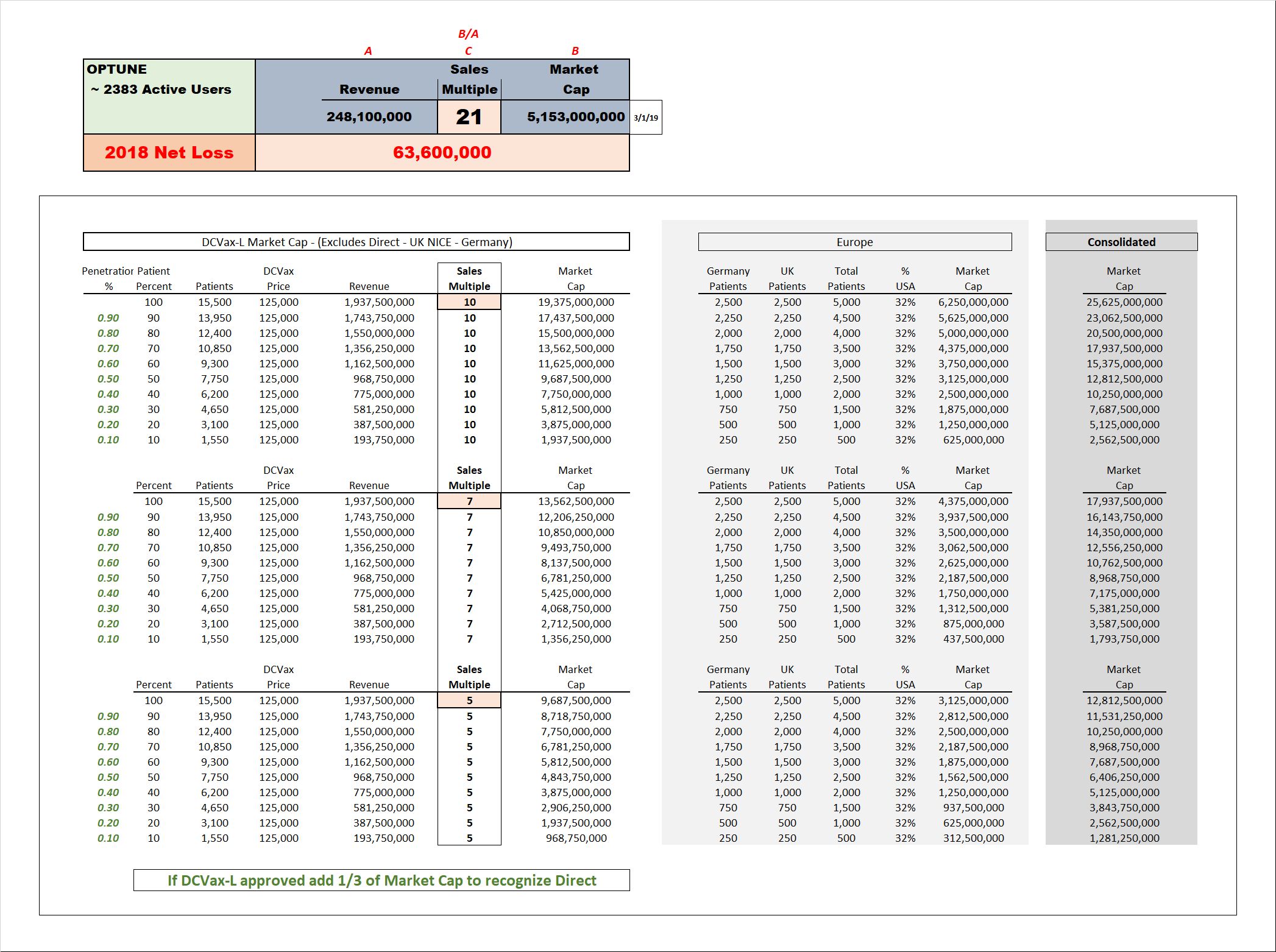

NW Bio is developing cancer vaccines designed to treat a broad range of solid tumor cancers more effectively than current treatments, and without the side effects of chemotherapy drugs. NW Bio’s proprietary manufacturing technology enables them to produce its personalized vaccine in an efficient, cost-effective manner. NW Bio has a broad platform technology for DCVax dendritic cell-based vaccines.

Their lead product, DCVax-L, is currently in a 331-patient Phase III trial for patients with newly diagnosed Glioblastoma multiforme (GBM), the most aggressive and lethal brain cancer. This trial is currently underway at 69 locations thoughout the United States, Germany and the United Kingdom. NW Bio has also conducted a Phase I/II trial with DCVax-L for late stage ovarian cancer together with the University of Pennsylvania.

Their second product, DCVax-Direct, is currently in a 60-patient Phase I/II trial for direct injection into all types of inoperable solid tumor cancers, with trials currently being conducted at both MD Anderson Cancer Center in Texas, as well as Orlando Health in Florida.

They previously received clearance from the FDA for a 612-patient Phase III trial with its third product, DCVax-Prostate, for late stage prostate cancer.

DCVAX Survival Stories & Testimonials

Alice - Metastic Merkel Cell patient from Florida - ASCO 2018

Brad Silver - GBM patient from Huntington Beach, California - ASCO 2018

Sarah Rigby - GBM patient from Hong Kong - ASCO 2018

Kristyn Power - daughter of GBM patient from Canada - ASCO 2018

Kat Charles - GBM patients from UK - ASCO 2018 - as related by her husband Jason (Kat's Cure)

Prospective patients may contact NW Bio at patients@nwbio.com

UCLA Jamil Newirth DCVax-Patient Video - 2015

Allan Butler Video - National Geographic Vice President - DCVax-Direct patient from Phase 1 Trial with Pancreatic Cancer

NWBO - Patients Sunday Dennis and Jami Newirth - Enrolled at UCLA - Vimeo, Uploaded approx. May 2015

NWBO - Vaccine Helps Keep Brain Cancer Patient Alive (Jennifer Sugioka) - NBC Channel 4, Southern California, February 24, 2015

NWBO - National Geographic's Allan Butler Stage IV Pancreatic Patient using DCVax-Direct at MD Anderson

NWBO GBM Brain Cancer Survival Story of Mark Pace

Presentations

UCLA Agreements

Prostrate

DCVax-Phase II

DCVax-Booster

Upcoming Events

Videos

Linda M. Liau, MD, PhD, MBA - April 24, 2019 at University of Washington, Neurosciences Institute

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |