Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Time will tell kahlua. I think carbon credits are a scam, but if they exist and Verde can make a ton off of them, then they should. Cheers

Yeah I don’t quite see it that way. Verde’s ceo has a tendency to be overly promotional, putting out news well before t’s are crossed. This flaw is commonplace in the mining sector so it’s forgivable and thankfully for us longs, his fiscal prudence is a notable anomaly. Let’s see what we get when the credit sales start getting finalized along with the details he provides on the quarterly call. I’ve followed this company long enough to remember that the hype can die an ugly death, most recently in 2022, which was an egg all over face year for the company.

If they were to get carbon credits on it using their #s "Currently, carbon credits for permanent carbon offset similar to Verde’s are being sold at prices up to US$500 per tonne.1 The Company is able to generate up to 300,000 tonnes of carbon credit annually via its existing production facilities." and cut it by 60% that is $200 X 300,000 that is $60 million. And seems no real costs as will happen anyway?

So now 80 million rev (cad too) and CFO of $5 million and FCF of minus 27 million, if you kick in say remove $10 million for expenses then $50 million of Free Cash Flow it would seem that this alone could 5-10 bag Verde? It is $170 mkt cap Cad now. That 5-10 bagger would be justified if main fertilizer biz goes back into profits and growth, which is normal for Verde.

PR https://finance.yahoo.com/news/verde-sell-carbon-credits-113400951.html

Lots going on with this company and apparently still no interest from investors. Let’s see what kind of credit price they’re able to lock in on this upcoming carbon credit sale. The timing on this deal coming together in Q3 is ideal since potash prices are stuck in the low to mid $300 range during the peak sales quarter while farmers are reluctant buyers, which bodes quite poorly for profitability.

DD, that’s really the million dollar question in my mind. Just where do potash prices land if/when we see a significant correction? At $450 US a ton, Verde should still do quite well since production costs for both plant 2 and 3 (once scaled up) will offer exceptional gross margins. I also think bio revolution could see significant demand and that product could juice margins as well to help mitigate a possible halving of MOP. The concern is obviously that just as NTR and MOS expand their production capacity, Belarus sanctions are lifted or they figure a way to regain their exports back to pre-sanction levels and we again see 2019 MOP spot prices, decimating the profit margins.

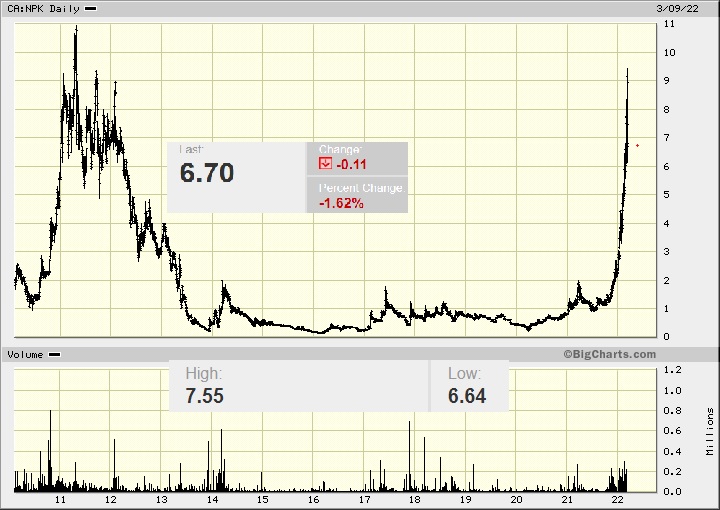

From 50 cents to ~6 dollars. Nice return.

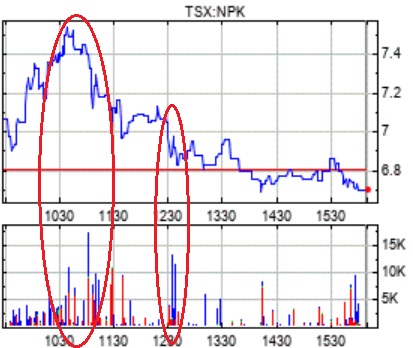

Been trading around the core recently to make use of the volatility.

Right now I find it strange anyone will be long-term short with a cost of ~20% pa, with Q2 release coming, the new plant raming up this July, possible raising of the forecast for 22 with the new capacity AND the dual listing coming in August-Sept.

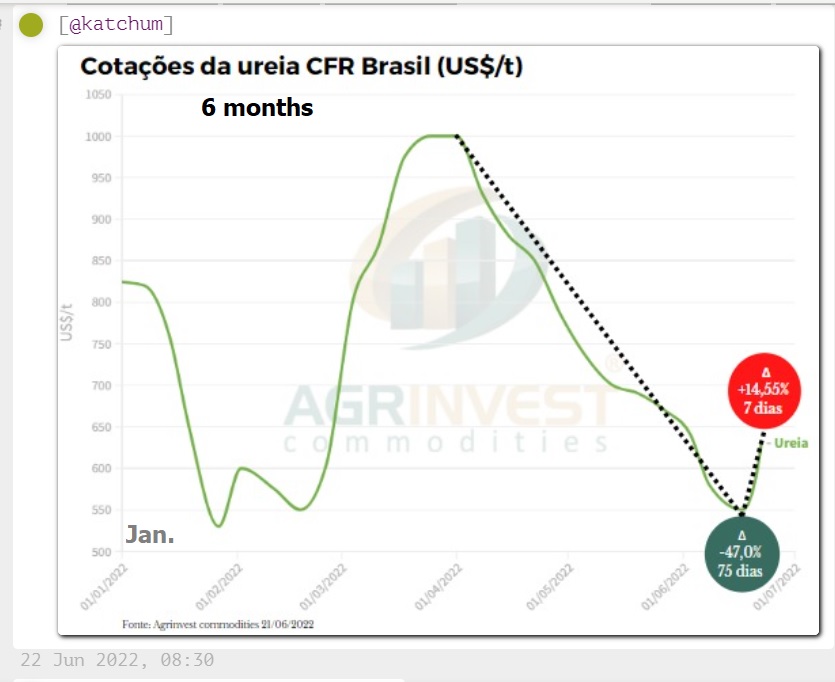

Longer-term, this is still a tonnage growth story and even with potash prices dropping to ~450USD per tonne potash (it is over 1000 usd now in Brazil and I think dropping soon, thankfully) this stock is a very attractive wealth generator and I think I'll see a 100 bagger here.

Massive wealth accrues slowly -- then very fast!

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=162905149

Good luck with those! I may take a closer look at NZP, time permitting. I’m in Verde long term and just recently picked up PLAN.V after doing some research. They just did a smart acquisition and are bringing tolling online for soft rock phosphate - it’s a low hanging fruit project albeit capacity is initially quite limited. They will need phosphate prices to remain robust for that project while they pursue the SCM market. It has potential with a fair portion of itm warrants for added cash and limited capex plans. Also the share structure, while not near as tight as Verde, is still okay.

I'm liking THIS fertilizer play myself :

https://investorshub.advfn.com/Chatham-Rock-Phosphate-Ltd-TSXV-NZP-40946

They'll be going into production VERY soon.....market cap's something like 6.5 million ?

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=169220517

.Am also in DAN but it's (they are) crazy.....I've steered cleatr of Verde (since missing it at $4)

Its' high has been 11.54 !

.

Yes ceo, SH and SI. All those Verde boards are more active than IH, albeit the ceo board has unfortunately turned into more of a hyper bullish echo chamber . That alone raised a major caution flag for me months ago and I assumed the stock would be in for some very volatile chop. So far going according to plan although the contrarian in me says we could get a violent shakeout and a pullback toward either the 50% or 61% Fibonacci levels. 5 is also a key back test support on the P&F chart and these pullback levels would probably scare a lot of traders and weak hands out and prepare the ground for the next upward move. Not saying it happens but I always cringe when a trade gets over crowded with everyone saying “we can’t lose”.

The CEO site ?.....Okay, you're excused.....

I just find I Hub a lot better for sharing stuff.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=169220517

Yes I appreciated your analysis in those days. It certainly buttressed my own due diligence and buying enthusiasm. The project is now significantly de-risked with rapid expansion plans and increased guidance suggesting growing demand and a rapidly expanding farmer customer base, at over 5000 at last count. The big question is global potash availability and commodity pricing strength since kforte and baks are still tethered to the underlying commodity price. For now it appears Belarus is unable to export anywhere close to pre sanction levels enabling an unprecedented supply disruption, so Verde is enjoying far stronger net profits. The situation is in major flux, however, as all producers are incentivized to get every ton to market at these elevated prices so we will have to see if Nutriens recently announced expansion plans are because they’re reading the global market equilibrium correctly or if it’s a contrarian call on commodity market top. With Verde’s PFS using $368 US as the baseline that number will be crucial for investors to watch if indeed the air quickly comes out of the global potash market.

Just back on this forum after a lengthy absence.

I don’t have premium access so am unable to reply to you privately.

Hopefully you’re all up to speed on Verde by now!

The company news flow has been outstanding this year.

What remains to be seen is commodity pricing strength. Noticing a lot of price softening recently.

Last post proved to be prescient.

30M market cap turned into almost half a billion CAD.

Verde, let by cris, has morphed into one of these epic microcap tales, generational wealth creators.

The nice thing about it - Verde is merely starting.

It is much stronger today than when the post was written.

Let's check-in at the 1 BCAD mark.

Swell outlook for Brazilian potash producers

https://www.northernminer.com/news/brazils-bolsanaro-backs-legalization-of-mining-in-indigenous-lands-amidst-russia-invasion/1003839434/

Best to hold off tho until oh, say $6.00 ?

Should'a bought it at 4.40 (when I first came across them but at THAT time it looked a bit too far too fast !)

New $NPK CEO interview: Why This AgriTech Stock is Up Over 65% YTD

Flying completely under the radar -Wow! I’d figured there would be a few excited posts here but only crickets.

Latest guidance is very promising but let’s see them pull it off.

There is certainly some excellent potential with this company but I believe it’s best viewed through a very long term lens. Share structure is very good. Management is very aligned with shareholders. YOY growth was good albeit this year projections are only for half last year’s growth, which begs the question is Kforte and the newly developed baks product just a niche offering? They’ve barely tapped the potential market in Brazil and have expanded the sales/marketing team and grown the customer base and yet already growth is expected to decelerate? All the while not yet achieving scale and therefore showing bottomline erosion of the improved margin profile due to increased delivery and marketing costs.

It also bears mentioning that the bonus for the ceo was as much as 2020 net income. The ceo has been shareholder friendly (a rare occurrence in junior mining), not completely diluting the share base; however, his compensation and annual share incentivizes are egregious and frankly a far higher standard or company achievement base should be set for him to be profiting as he is currently doing. My hope is this unchecked behavior gets reigned in and only exceptional bottom line improvements merit such compensation.

Still I like the potential a lot, which is why I hold. BAKS could prove disruptive if pricing and effectiveness both prove a better option than the tried and true alternatives. Only the farmers can prove this out though so it’s just a rather slow season to season word of mouth type growth trajectory (ie slower than most investors like). That’s just my take.

Monster biz. 50c to 1.7.

This will be 50$ stock

Very competent Owner Operator.

World Bank Potash price forecasts:

http://www.worldbank.org/content/dam/Worldbank/GEP/GEP2015a/Price_Forecast.pdf

More DD data and thoughts -

Yesterday Pr, conversation with management, here are some more thoughts:

- One of the KEY risks in Verde has been, in our eyes, Rampup and acceptance by Farmers. While the product's beneficial effects are proven academically, it is a WHOLE different game penetrating the market and CONVINCING farmers to change proven methods - THAT process is Slow and frustrating. This is why we have been carefully looking for proof of acceptance: will farmers realize the benefits (one-time application => less expansive/effort) + less chlorine + more micronutrient are much greater compared to the same cost as imported Potash?

- Today we learned that the company is Fully soled out to the end of the growing season as in 24/7 production, and will deliver 40 tonnes - 10X 2017 quantities.

- It would seem demand is over what the company can produce and they are turning customers away.

- Here is an important bit we dug up: is seems a significant part of 2017 farmers who ordered K Forte (=Super Greensand) Reordered, with some of them ordering as much as 10X their initial order. This spells retention and expansion.

- for 2019, the company thinks about 200K Tonne with a facility expansion of to 800K pa (well above our forecast).

- We like the fact that so far, Cristiano, the owner, CEO, showed great skill in completing the expansion plans underbudget and in time. We are sure the fact that he is such a significant owner with so much skin in the game ensures he will continue to watch expenses and investment like a hawk.

- two factors will impact the ability of the company to make money - price of potash and cost of buildout. The third, Demand, seems, as this point in time, to be assured.

-Potash prices are held down artificially by Russia. If ever they were to jump up to their higher range, this will all but insures Verde makes a lot more money.

- This is a very simple business (if demand exists): scoop up well exposed available dirt. Grind it. bag it. ship it. collect money. rinse. repeat. It's easy to make lots of money operating this type of business. Its hard to compete with the availability and accessibility (unless tomorrow someone finds other similar resources. Harvest minerals (LON) is a competitor, but it is not the same quality materials, and the management is not local (nor friendly to shareholders). We are not concerned about competition at this point in time / Prices (0.5-0.7$ / ~30 mill market cap).

- Cristiano (CEO/Owner) told us his intention is once the company is profitable, he intends to send back most of the profits to shareholders as Dividends. This remains to be seen, but we think there is ground to plan for this investment to be seen as a dividend growth holding, bought very very cheap and very very early.

- Cristiano continues to accept payment in stock rather than cash - signifying deep belief in the prospects. Stock outstanding remains in a very low 40-ish million, even after complex history and a long path taken to get here (meaning investors still hold a significant claim on future cash flows).

Summary:

Today we think about 40% of the risk has just evaporated from the thesis and even after 20% run-up to 0.77$, July 2014 prices (on the back of a steady drop in price over the recent weeks) - the company is cheap relative to the potential. Management has proven itself to be highly competent and aligned with shareholders. Most importantly, the market agrees with the marketing/sales claims. We like the fact that there is little to no chatter about the name.

Yesterday, about 10 percent of the market cap exchanged hands, which we think shows that traders who do not understand the business or are very short-term in their time horizon provide liquidity for sellers who want to join the ride just on time. We continue to use that liquidity to increase our position at what we see as compelling valuations.

DeepDive.

Verde SOLD OUT for 2018.

Stock up 20%.

The Main issue was farmer acceptance and sales. It would seem there is good reach. Need to confirm follow up order rate, but certainly derisked to a large extent.

https://finance.yahoo.com/news/verde-sold-2018-announces-2019-110000375.html?.tsrc=applewf

Verde sold $166,850 of Super Greensand

Verde Agritech releases Q2 results, talks first sales

2018-08-14 19:18 ET - News Release

Shares issued 40,475,000

NPK Close 2018-08-14 C$ 0.91

Mr. Cristiano Veloso reports

VERDE ANNOUNCES SECOND QUARTER 2018 RESULTS

Verde AgriTech PLC has released its second quarter 2018 results.

Highlights:

- In May 2018, the Group secured funding from BNDES (through Santander Bank) of approximately $350,000 (B$1,040,000) to finance the turnkey agreement to build a 45 tons per hour Super Greensandtrademark production facility.

- In June 2018, the Group confirmed the new processing plant was on budget and schedule. Subsequent Event:

- In July 2018, Verde announced the start-up of its processing plant. The cost of the production facility was US$ 600 thousand, part of which was spent on ground work necessary for an expansion to reach the 600 thousand tons per annum capacity projected for Phase 1 in the pre-feasibility study ("PFS").

Sales update

- Announcement of a broader line of Super Greensandtrademark products, which now has a line of 3 versions: Micronized, Powder and Granular. In May 2018 Verde concluded the first sale of Super Greensandtrademark Granular to its US Distributor. Super Greensandtrademark Micronized has been supplied to Distributor since 2017.

- Verde sold $166,850 of Super Greensandtrademark. In accordance with applicable accounting rules, revenue from delivered sales has been credited against the Cerrado Verde project until commercial production is reached.

Verde's President & CEO, Cristiano Veloso commented: "The first sales of Super Greensandtrademark have not been easy and we expect that will be the case for, at least, the first 50 thousand tons of the product. The pace of sales is accelerating thanks to the sowing season of the second half of 2018 and return costumers who, for the second consecutive harvest, have opted to use Verde's Super Greensandtrademark."

About Verde AgriTech

Verde AgriTech promotes sustainable and profitable agriculture through the development of its Cerrado Verde Project. Cerrado Verde, located in the heart of Brazil's largest agricultural market, is the source of a potassium-rich deposit from which the Company intends to produce solutions for crop nutrition, crop protection, soil improvement and increased sustainability.

We seek Safe Harbor.

Some more DD notes:

* About 50 farmers are in the Pilot stage - one of them upped his order.

* Pilot farmers use the product on small plots (one to several hectares ~ Hectare = 10 Duman).

* While the building plan on the Most recent investor Dec estimates the Capex for Phase 1 at ~3MillUSD, in practice, 600KUSD Capex was enough to build a 45 ton per hour production facility (~280K ton production). Phase one is 600K ton production. Now, take into account that expansion is always cheaper than initial build up due to the fact that the first development includes some one-time expenses such as roads and general facilities that don't need to be rebuilt in an expansion. So - this leaves us with a much cheaper estimation of the real cost of Phase 1 construction and an Idea as to management's execution and conservatism in estimating costs - all great news to investors.

* we believe the cost per tone in the company slide deck is very generous and allows for some cost slippage and errors, and thus turned somewhat less critical of the actual profit margin the company provides.

* rough estimations (before deep check and model) lead us to believe the business will BE at about 100 Mill Tone, probably CF positive earlier. We would believe investors will push valuations much higher well before this point, as some very smart investors have quietly put their attention on the business and are tracking its progress. Watch XPEL PPS meteoric 300% rise over 4 months once the fundamentals materialize.

*Also, management is on the record with distributing excess cash to investors "ASAP".

After contacting management, we are dilling down our risk rating a notch, and we will be closely waiting for signs of Farmer order pickup.

Subject to acknowledging the thesis still needs to prove itself (farmers acceptance) - is far from a sure thing (as to happening at all, in the expected scale or in the expected time frame), placing a small bet to secure initial good entry prices is a smart thing at this time (0.5-0.7 CAD).

Time will tell.

Do your own DD - management is pretty accessible.

Investment thesis

* Survivor owner-operator. 40ish mill. Outstanding. After several years of delay. Lots of skin in the game. Endured trial by fire when Potash prices collapsed. Taking compensation in stock... Door opening director.

* Glauconite mined in Brazil near farmer location aka super green sand is better than Potash and could replace Brazilian farmers import from Canada, Russia, at same prices as Potash.

* lots of it there, enough to supply 100% Brazil for 50 years.

* Green, organic, more nutritious compared to salinated, chlorine packed alternative. Simpler to apply (once only compared to several times with Potash).

* 2 billion usd NVP (8%) over ~40is mill m cap, 40 mill outstanding.

* already sold “samples” to nearby farmers. Brazilian farmers are large operations, orders could explode if farmers observe same superior performance in studies.

* internal cash flow, existing cash funded plan to ramp up to 100, 160 k; 5 mill; 25 mill ton per year, @ ~ 30ish$ per ton profit.

* comparable trade at x,00,000,000 mil cap,

* risk: Brazil (not exactly role model for governance, politics, labor relations), vested interests (there’s a business around importing Potash and they will not lose sales without a fight), one man show, farmers conservative nature and reluctance to change (oh boy that’s a biggy), speed & execution risk which can lead to more dilution; capital allocation risk: what will the owner do with profits when and if they roll in? We hope to see very large distribution of profits. Sensitive to Potash global prices.

* Catalyst: one pilot farmer already reordered at a significant scale for the next order. First sign of adoption? Social proof will be a strong adoption factor in this market.

What we are watching for: signs of pick up in orders. This is the big fat difficult unexpected variable. The rest should be relatively simple to execute.

We like the exposure to Commodities via the business and if it works it could be a good hedge against inflation.

Waking this Board up! $1 BREAKOUT IMMINENT ON NPK.

Our team of analysts has found yet another $1 breakout stock. Dollar breakouts are the most profitable play based on our historical performance.

Verde is a growing fertilizer company located in Brazil. They are currently opening a new mill which is capable of processing 50 million tons per day. This news is very bullish for us.

After in-depth analysis it is our firm opinion that NPK is extremely undervalued and will double in the next 3 weeks.

Read the charts, the writing is on the wall.

New to message boards...Can anyone tell me why Verde was trading at above 8.00 a few years ago? When I first bought in this past year, the low was 44cents....can u give me a place to look this up or does someone kno why this crashed...thanks.

Progress Report: Environmental and Mine Site Design

Verde Builds Development Team

TORONTO, July 26, 2012 /CNW/ - Verde Potash (TSX: "NPK") ("Verde" or the "Company") is pleased to provide an update of recent Company activities and the appointment of two new management personnel to advance the Cerrado Verde Project: Mr. Rubens Mendonça as VP Mining and Dr. Patricia Radino as VP Engineering.

The Company is currently completing the environmental impact assessment report for the Cerrado Verde KCl project, which has been initially reviewed by the government's environmental agency. The Company is pleased with the report and the initial feedback received from the agency, and plans to submit the report in August 2012. Highlights of the report include an independent survey of communities in the vicinity of the project, showing overwhelming support for the project. When residents were asked to answer "yes" or "no" to whether they were in favour of the mine development, over 85% of residents were in favour. The Company also completed a mine site plan for the environmental report, with emphasis on tailings management. The mine site plan contemplates a dam to contain 1/3 of mine life tailings (160 million cubic metres), which is easily accommodated taking advantage of the hilly landscape, with additional tailings to be contained as backfill in mined out areas.

Exploration work continues. Approximately 60% of the infill drilling for the Definitive Feasibility Study ("DFS") is complete and 50% of the assays have been received. Work is expected to be concluded during Q3/2012.

Cristiano Veloso, President and CEO, said: "Verde Potash, throughout its 5 year history as a publicly listed company, has been a disciplined arbiter of its cash and share capital. The Company enjoys a healthy cash position of approximately $28.8M (as of financial statements dated March 31, 2012). The Company has sufficient capital to conclude the on-going DFS, complete the environmental studies and licensing, and cover project finance costs as well as all overhead costs associated with moving the project forward."

Along with continued development of the Cerrado Verde Project, the Company has appointed Mr. Rubens Mendonça (VP Mining) and Dr. Patricia Radino (VP Engineering) to the management team.

Rubens Mendonça, a mining engineer and geostatistics specialist, has worldwide experience working with mineral commodities in technical and managerial roles. As Vale's Senior Mining Engineer, Mr. Mendonça was responsible for mine planning and design, implementation, engineering and feasibility studies for both of Vale's Southern and Northern integrated mine-railroad-port complexes. Subsequently, as the mining manager of the Brazilian division of Snowden Mining Industry Consultants, Mr. Mendonça was responsible for the technical coordination of several mine projects as well as desktop, scoping and feasibility studies worldwide. There he supervised and mentored geologists and mining engineers, and oversaw legal, social and environmental improvements to operations. At London Mining and Paulo Abib Engenharia S.A. (a leading Brazilian engineering consulting company), Mr. Mendonça gained experience with open pit mines, having held managerial positions in the field of minerals processing and engineering that expanded to extractive metallurgy. Mr. Mendonça completed a B.Sc. in Mining Engineering at UFMG (Federal University of Minas Gerais), and an MBA at FDC and PoliUSP.

Dr. Patricia Radino-Rouse has extensive experience as a senior consultant in extractive metallurgy for a wide variety of non-ferrous metals projects in Brazil where she specialized in process development and improvement for companies such as Paranapanema, Itaoeste, Votorantim, Carbocloro and Unisais. As Senior Process Engineer and Project Manager for Paulo Abib Engenharia, Dr. Radino-Rouse was responsible for project development and process engineering. Specifically, she supervised the process of the feasibility study for a 1.5 million tonnes per year potassium chloride project for Petrobras. At Unisais, Dr. Radino- Rouse developed projects for the solar evaporation of residual brines from salt production to obtain potassium chloride and sodium sulphates. She holds a B.Sc. in Chemistry from EQ-UFRJ (Chemical School of the Federal University of Rio de Janeiro) and a Ph.D. in Hydro Metallurgy from the Royal School of Mines, Imperial College, London.

Peter Gundy, Chairman, said: "In terms of risk and reward the Company is stronger than ever. Despite challenging investment markets, project development continues unabated."

About Verde Potash

Verde Potash, a Brazilian fertilizer exploration and development company, is focused on advancing the Cerrado Verde Project located in the heart of Brazil's largest agriculture market. Cerrado Verde is the source of a potash-rich deposit from which the Company intends to produce potassium chloride (KCl). In addition, the Company is developing its Calcario limestone project, limestone being a key raw material in the production of KCl.

About the Cerrado Verde Potash Project

Cerrado Verde is a unique project: 1) its high grade potash rock outcrops and is amenable to strip mining, allowing fast construction of a scalable operation; 2) it is located in the midst of the world's third largest and fastest growing fertilizer market; 3) it connects to Brazil's largest fertilizer distribution districts via existing and high quality infrastructure.; 4) it has the potential to supply KCl to Brazil's local agriculture market from its large potash-rich deposit.

I can't even begin to get into other investors heads when I have a hard enough time trying to control my own. People buy and people sell and I don't worry about it. Not trying to be flip about it but I can only control my own actions and I don't see anything negative here. I've taken profits a few times here and that's probably what others have done. There is not enough volume to make one think anyone is doing anymore than that, in my opinion.

I am not selling, but you still did not answer why some people choose to sell? What they did not like?

You're right, OH MY GOSH sell quick it's all going south! lol

Some people...

You're right, OH MY GOSH sell quick it's all going south! lol

Some people...

if it so good why we took 25% hair cut?

Good the expanding coverage.

Just looking to change that "could" to something like "progressing toward"

The Energy Report Interview with Jaret Anderson (2/9/12) "Verde Potash controls the Cerrado Verde project in Minas Gerais state, which contains a large, at-surface deposit of potash-rich verdete slate. The company has developed and patented a process to convert verdete slate into KCl, the same standardized product that's produced in Saskatchewan and Russia today. This is known as the Cambridge process. It's very exciting, as it could allow for large-scale potash production in Brazil from an open-pit operation—something that hasn't been done anywhere in the world.

Someone posted at Stockhouse yesterday the essential part of the Mackie Research update note by Jaret Anderson.... What i found most tantalizing was the excerpt i've boldfaced in red type, suggesting a MUCH faster ramp-up in production with the help of a financing partner:

-----------------

From Mackie Research:

- Verde Potash (NPK) has completed the Preliminary Economic Analysis for its verdete slate to KCl (ie, Cambridge) process and has published a press release this morning with key highlights.

- Based on the work of SRK, this process looks very attractive, with an operating cost during the early years of production of US$274 per tonne, ramping up to US$291 per tonne over the 30 year life of mine as the stripping ratio increases.

- These opex numbers would appear to make Verde the lowest cost producer on a delivered cost basis to the Cerrado region of Brazil. Recall that Brazil was the largest importer of potash globally in 2011 at 7.5 million tonnes.

- These opex figures also compare favourably to the US$300 per tonne figure we had used as a base case in our earlier work evaluating the value of the Cambridge process to NPK shareholders.

- The scoping study proposes an initial plant with 600,000 tonnes per year of KCl capacity coming online in 2015, which would ultimately ramp up to 3.0 million tonnes of capacity per year.

- Capex for the initial 600k tonnes of capacity is estimated at $654 million (US$1,090 per tonne of capacity), while capex for the full 3.0 million tonne facility is estimated by SRK at US$2.4 billion (US $800 per tonne). The US$800 per tonne figure is right in line with our published assumptions and materially below the cost of greenfield solution mining projects in Saskatchewan which tend to average closer to US$1,081 per tonne (KRN: $928/t; Legacy:$1,136/t; WPX: $1,178/t; Average = $1,081/t).

- SRK estimates an IRR for the project of 23.7% and a NAV at 10% of US$2.3 billion for the full 3.0 million tonne facility. This works out to an NAV of $64.76 per share. Note that this is an SRK figure --we will need to update our own model with the data released today in order to publish our own estimate (note that we have been using more conservative assumptions Re: discount rate (12%) and potash price (US $500 per tonne FOB Vancouver) than SRK seems to have employed.

- Recall that the company is hosting a demonstration of its verdete slate to KCl process on Wednesday in Allentown, PA. We understand there are 20 participants from the buy side and the sell side signed up.

Bottom line: This PEA is a very positive event for NPK and implies more value for NPK from the Cambridge process than we had been baking into our $12.00 target previously. We need to update our model, but at first glance, we expect the Street to begin valuing NPK on the basis of its Cambridge process, as opposed to just the value of the ThermoPotash process (which produces a low grade, slow-release potash product). With a capex of $800 per tonne (ie, ~26% cheaper than a greenfield solution mine), an opex at startup of US$263 per tonne (and US$291 per tonne life of mine), and SRK's estimate of a $64,76 per share NAV, the shares are likely to react very positively today.

It’s also worth noting that this PEA seems to focus on a slow ramp-up schedule in order to fund expansion of the project from cash flow generated by the initial phase of 600k toones of production. This allows the company to minimize dilution. We expect that a well-capitalized corporate buyer of this project though, could employ a much quicker ramp-up, which delivers more cash flow sooner, thereby having a material positive impact on the NAV.

Two interesting articles on NPK yesterday late in day.... Kip Keen, author of the first one, has reported in-depth on NPK before. He gives a balanced view here from the two analysts.

------------

http://www.mineweb.com/mineweb/view/mineweb/en/page72102?oid=144534&sn=Detail&pid=102055

In major course change Verde goes all-in on conventional potash

Verde Potash looks to take on conventional potash giants in Brazil with its Cerrado Verde project.

Author: Kip Keen

Posted: Wednesday , 01 Feb 2012

For now, Verde Potash (TSX-V: NPK), long a junior explorer bent on bringing to market an unconventional potash product from its atypical potash deposit in Brazil, is going mainstream.

Until today, the course Verde had plotted was twofold. First, it was to develop a slow-release potash product, "ThermoPotash", at its Cerrado Verde project for the Brazilian fertilizer market. Then, based on a new technique called the "Cambridge Process", Verde was to try to milk conventional potash from its unusual source of potassium, converting water insoluble potassium silicate in its Cerrado Verde deposit into one of the main potash fertilizers sold and shipped around the world: potassium chloride or KCl.

Now consider those phases reversed. On Tuesday Verde released the results of a scoping study detailing the outlines of a conventional potash producing operation based on successful pilot-testing of the Cambridge process on a non-industrial scale. News of the big change in direction for Verde came in a short note near the end of the press release about the scoping study results. Verde stated it was putting development of its heretofore chief program, ThermoPotash, on hold in favour of going after conventional potash.

"In view of the results of the PEA (scoping study) for KCl, Verde intends to focus its efforts on a KCl product and has therefore decided to temporarily suspend its ongoing feasibility study work on ThermoPotash," Verde said.

While Verde did not expand much on the rationale for shelving ThermoPotash for the time being - a major shift in strategy for the junior - the reasoning appears to be a case of pursuing the path of least resistance and, arguably, maximum reward. With ThermoPotash Verde faces the task of pushing an unfamiliar fertilizer product on Brazilian farmers. But with conventional KCl - a product used by the million of tonnes per year in Brazil - no such marketing dilemma would come to bear. It would only be a question of beating or meeting the competition - chiefly Belarussian and Canadian producers - on price.

In its scoping study Verde proposes to ramp up a KCl operation from 600,000 tonnes to 3 million tonnes per year (and also look at 1 million and 4 million tonne per year scenarios) at a 30-year mine that would initially cost $654 million to build. According to Verde the first 600,000 tonne stage could come online in 2015. Then the operation would jump to 1.6 million tonnes per year in 2019 and then to 3 million tonne per year in 2024, with the final capital cost tally coming in at $2.4 billion.

But can it make money as modeled? Mackie Research analyst Jaret Anderson last told Mineweb that he was intent on $300 per tonne operating costs as the magic number for Verde, what he reckons as the cost of producing and getting conventional potash to Brazil from typical producers, such as those in Canada. According to Verde's scoping study, it has that number beat.

Verde says it can produce KCl at an operating cost of $274 per tonne during the first five years of operation. Life of mine, the figure climbs somewhat to $292 per tonne. All told, assuming granular potash goes for $540 per tonne, Verde estimates a 24 percent after-tax internal rate of return and a $2.3 billion net present value, also after-tax and discounted at ten percent, on the KCl project.

For Anderson, who characterized the scoping study as positive in a note to clients, the impact was clear. He called it a "major de-risking event for NPK (Verde)."

In building his thesis Anderson noted on Tuesday that Verde's estimated capital costs per tonne of potash produced were in line with development projects in Saskatchewan - the centre of the potash universe: $1,081 per tonne in Saskatchewan versus $1,090 per tonne Verde gets based on a 600,000 tonne per year project.

As for Verde's operating costs Anderson was particularly bullish: "These opex numbers would appear to make Verde the lowest cost producer on a delivered cost basis to the Cerrado region of Brazil." To emphasize just what kind of market Verde might access, Anderson then noted, "Recall that Brazil was the largest importer of potash globally in 2011 at 7.5 million tonnes."

Given the scoping study findings, Anderson suggests Verde will be re-rated on the upside, implying "more value for NPK (Verde) from the Cambridge process than we had been baking into our $12.00/share target previously.

"We will be reviewing our valuation, but at first glance, we expect the Street to begin valuing NPK on the basis of its Cambridge process, as opposed to just the value of the ThermoPotash process."

Octagon Capital analyst Max Vichniakov, however, was less rosy about the scoping study's impact. Vichniakov remained neutral on news of the scoping study, and changed his buy rating on Verde to a speculative buy ($10 target) based on what he argued was increased risk for the junior now that ThermoPotash - a more advanced project - had been put on the back burner.

Notable perhaps, Verde's shareprice dropped heavily on news of the scoping study - down 19 percent to C$6.90 as of presstime - after a solid run-up in recent weeks. In an email to Mineweb Tuesday afternoon Vichniakov said that after some anticipation for positive news there might have been "disappointment in fact that (Verde) is re-focusing its strategy on KCI production and away from its previous strategy on ThermoPotash."

Vichniakov also argued that the change in course "basically questions the whole viability of the ThermoPotash as a real commercial-level revenue generating opportunity for Verde going forward."

Verde's KCl testing is still in the early stages, Vichniakov pointed out, "and all questions regarding costs of production and scalability of the process still remain. So, while the company announced (a scoping study) on a KCI production scenario, we think the risks actually increased at this point."

But Verde's President and CEO Cristiano Veloso does not see it that way. In answer to an emailed question about divergent analyst views on the impact of the scoping study, Veloso said: "It is a choice between two excellent projects." He continued, saying, "KCl is a better option for our shareholders as it is a larger project that best allows us to monetize our large, at surface potash deposit in Minas Gerais. We still intend to develop our ThermoPotash project, but will do so once we have brought our first 600k tonnes of KCl capacity."

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

http://www.mining.com/2012/01/31/black-day-for-verde-as-investors-see-red-over-brazil-potash-project-preliminary-economic-assessment/

Black day for Verde as investors see red over Brazil potash project preliminary economic assessment

Frik Els | January 31, 2012

Verde Potash shares fell $1.66 or 19.4% to $6.90 on Tuesday, recovering from even steeper losses earlier in the day, after the company released a preliminary economic assessment report for its Brazil project.

The company, founded as Amazon Mining in 2005, reported capex of US$654 million and opex of US$263 per tonne for 600,000 tonnes of the soil nutrient a year during its Cerrado Verde project’s first five years. Starting in 2015 production is expected to be ramped up to 3 million tonnes annually by 2024 at a cost of $291/tonne.

Investors didn’t like the numbers deeming them on expensive side and beat the stock down 20% on massive volumes of almost 9 times the daily average. Verde is worth $223 million on the venture exchange in Toronto.

Cristiano Veloso, Verde CEO defended the report saying: “We believe that the estimated operating expenses presented in the PEA are competitive with the world’s lowest cost potash producers for buyers in Brazil when importation and distribution costs are included.”

The fertilizer market – worth some $150 billion a year – seems to be heading for an uncertain 2012. Current pricing is around the $500/tonne level after strong gains the past two years. Prices ran up from $100/tonne in 2004 to almost $900/tonne before the 2008 recession when the boom went bust and prices rapidly fell back to $350/tonne.

Earlier in January the Globe & Mail quoted Canada’s National Bank Financial analyst Robert B. Winslow as forecasting that global potash supply will increase more than demand through 2020, which will put a damper on “medium-term” potash prices.

Yep,looking good. The suspension of the Thermo product was a surprise to me however. It had seemed for the BZ local market it was a good low cap-ex way to initiate a cash flow, as well as in ways an agriculturally superior albeit novel and unfamiliar fertilizer. No doubt a matter of how much to chew on at once and their inside numbers on likely market scale over the same years.

Lot of interesting pro and con discussion over at Stockhouse v.NPK board today (Tuesday), and also someone pasted the essential parts of the very positive Mackie Research update note on today's NR by NPK.

01/31/2012 Initial Capex of US$ 654.1 million and initial Opex of US$ 263.23 per tonne for 0.6 million tonnes per year

TORONTO, Jan. 31, 2012 /CNW/ - Verde Potash Plc (TSX-V: NPK) ("Verde" or the "Company") is pleased to announce the results of a Preliminary Economic Assessment ("PEA") for the production of conventional potash: potassium chloride ("KCl"). The PEA was prepared by SRK Consulting ("SRK") on Verde's wholly-owned Cerrado Verde project ("Cerrado Verde" or the "Project") located in Minas Gerais State, Brazil.

The PEA evaluated the technical and financial aspects of two different scenarios. The first scenario has an initial production of 0.6 million tonnes per year ("mtpy") increasing to 3 mtpy of KCl, with production growth financed largely from anticipated internal cash flow. The second scenario has an initial production of 1 mtpy increasing to 4 mtpy, with production growth also financed largely from anticipated internal cash flow. Each scenario was scheduled into three phases, assuming significant cash accumulation and anticipated construction times. This announcement presents the results for the 3 mtpy scenario while results for the 4 mtpy scenario are expected to be available in the coming weeks.

"We believe that the estimated operating expenses ("Opex") presented in the PEA are competitive with the world's lowest cost potash producers for buyers in Brazil when importation and distribution costs are included. According to the PEA, estimated capital expenditures ("Capex") and expected time to production are lower and shorter than most KCl greenfield projects and many brownfield expansions in the pipeline. The proprietary production process we have developed relies entirely on existing proven commercial processes applied successfully to our potash rock, which we believe provides greater certainty in the capital costs and equipment efficiencies," said Cristiano Veloso, President & CEO.

Key Economic Highlights:

• Capex for the initial 0.6 mtpy phase is estimated at US$ 654.1 million.

• Capex for the 3 mtpy phase is estimated at US$ 2,369.3 million (including Capex for the initial 0.6 mtpy plant).

• Life of Mine sustaining capital is US$ 738.4 million.

• Opex for the initial 5 years of operation is estimated to be US$ 273.70 per tonne KCl, starting at US$ 263.23 per tonne in 2015. The weighted average OPEX for 3 mtpy operation is US$ 291.74 per tonne KCl.

• Estimated after tax Internal Rate of Return ("IRR") of approximately 23.7%.

• Estimated after tax Net Present Value ("NPV"), using a 10% discount rate, of US$ 2,258.7 million for the 3 mtpy operation.

The PEA is based on the following assumptions:

• 100% equity

• Phase 1 production of 0.6 mtpy of KCl, start up 2015

• Phase 2 production of 1.6 mtpy of KCl, to be achieved in 2019

• Phase 3 production of 3.0 mtpy of KCl, to be achieved in 2024

• A total 30 years planned production life

• US Dollar-Brazilian Real exchange rate of $1USD=$1.8 BRL

• A 25% Contingency applied to the Capex

• The PEA assumes an average granular KCl price of US$ 539.97 per tonne free on board ("FOB") Vancouver, Canada, based on market research done by CRU International (2012). The net sales price per tonne realized by Verde has been adjusted for the final costs of delivered product in the Brazilian Cerrado, approximately US$ 120 to US$ 180 per tonne.

In 2008, the Company initiated KCl production studies and has since then undertaken over 300 tests in order to develop a simple production flow sheet relying on proven production technology. To such end, the Company established a partnership with Professor Dr. Derek Fray, at the University of Cambridge, and under the leadership of Verde's in house engineers and its now COO, Pedro Ladeira, assembled an Engineering Consortium focused on process scaling and economic optimization of the Project, details of which were disclosed in a news release on November 30, 2011.

"The PEA was focused on developing a construction and production schedule that Verde could finance and execute as a development company gearing towards production. As a consequence, while the PEA does not maximize its NPV or IRR, it takes full advantage of the project's scalability to minimize dilution and shorten timeline to cash flow," said Cristiano Veloso, President & CEO.

Next Steps

Verde will advance a definitive feasibility study for KCl production which is expected to be completed by the end of the year.

ThermoPotash Feasibility Study

In view of the results of the PEA for KCl, Verde intends to focus its efforts on a KCl product and has therefore decided to temporarily suspend its ongoing feasibility study work on ThermoPotash. Verde currently expects that it would resume the feasibility study on ThermoPotash once it completed the proposed Phase 1 of KCl production, anticipated to be in 2015. ThermoPotash registration with the Ministry of Agriculture will continue and is expected to be achieved in the coming months.

Technical Report

A copy of the PEA will be filed on SEDAR at www.sedar.com within a maximum of 45 days of this news release.

The scenarios presented in the PEA are preliminary in nature and make use of Inferred Mineral Resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. Mineral Resources which are not mineral reserves do not have demonstrated economic viability. There is no certainty that the preliminary economic assessment will be realized.

Qualified Person

All scientific and technical disclosures in this press release have been prepared under the supervision of Neal Rigby and Robert Bowell of SRK Consulting who are Qualified Persons within the meaning of National Instrument 43-101.

About SRK Consulting

SRK Consulting ("SRK") is an independent, global consulting practice that provides focused advice and solutions to clients, mainly from earth and water resource industries. For mining projects, SRK offers services from exploration through feasibility, mine planning, and production to mine closure. Formed in 1974, SRK now employs more than 1,000 professionals internationally in 38 permanent staffed offices on 6 continents.

Other Matters

Verde has issued a total of 45,000 stock options exercisable at $8.56 per share, expiring January 31, 2016 to consultants and staff.

About Verde Potash

Verde is a fertilizer exploration and development company; it was founded and is led by Brazilians. Verde is developing the Cerrado Verde project in Brazil, a source of potash-rich rock from which the Company plans to produce a potash fertilizer product. Founded as Amazon Mining Holding Plc in 2005, the Company changed its name to Verde Potash Plc in April 2011 to better reflect its core business.

About the Cerrado Verde Potash Project

Cerrado Verde is a unique project: 1) its high grade potash rock outcrops and is amenable to strip mining, allowing fast construction of a scalable operation; 2) it is located in the midst of the world's third largest and fastest growing fertilizer market; 3) it connects to Brazil's largest fertilizer distribution districts via existing and high quality infrastructure.

On behalf of the Board of Directors of Verde Potash, Cristiano Veloso, President and CEO.

http://www.verdepotash.com/Investors/media-centre/news-releases/news-release-details/2012/Verde-Announces-Preliminary-Economic-Assessment-for-the-Production-of-Conventional-Potash1128081/default.aspx

IMO it is all speculations that the PEA is going to show positive results.

So what is the big catalyst here . . . other than Verde presenting Jan 22 at the Vancouver conference, golden cross, ? delayed reaction to the resource expansion and KCl process ? general rebound in Latin America ? It sure smells like something is afoot.

What a roll ! Can't wait for the PEA and further news on the KCl process.

If we just make a pact to use pounds then we could start making verbal images about how Verde can go to the sun a hundred times and more !!

As my friends 5 year old daughter would say, it's ginormous.

PEA should be released sometime this qtr.

If my math is correct, that's 5.9 TRILLION lbs in the inferred resource category! (though obviously much smaller in the indicated category) Tonnes are of course used as the usual way of reckoning revenues in this potash sector, but still it's fun to use lbs as a way of comparing it with the resources of stocks in other sectors like the base metals.

|

Followers

|

13

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

145

|

|

Created

|

11/24/09

|

Type

|

Free

|

| Moderators | |||

http://dailyreckoning.com/food-the-trade-of-the-decade/ Note Passport Capital in Article as well Passport in AMZ

Brazil poised to be next potash player

Posted: August 19, 2009, 10:22 AM by Jonathan Ratner

Market Call, potash, commodities, Brazil

As one of the world’s largest agriculture-centric economies but the second largest importer of potash, Brazil is positioned to become the next major global producer of the fertilizer component that is essential for large-scale farming. That is the conclusion of a new report from Wellington West Capital Markets that suggests existing potash industry leaders who have benefited from market dominance in recent years, stand to lose the most if Brazil becomes potash self-sufficient and the next major independent exporter of this strategic resource.

“While this import dependency was seemingly of little national significance before potash prices escalated in the last couple of years, we now believe it puts the country’s economic growth engine, driven in large part by agriculture, in a precarious position,” said analyst Robert Winslow.

However, he noted strong evidence that Brazil contains an undeveloped world-class potash ore body with the Amazon basin. If developed, it could could support several multi-million tonne producing mines for decades and lead to Brazil’s potash self-sufficiency.

“Given the potential economic and political benefits at hand, we submit it is only a matter of time before government and private investment moves to develop a domestic potash industry that rivals today’s leading producers,” Mr. Winslow said. “Brazil’s economic growth and as such the country’s future demand for potash fertilizer should remain robust and continue to grow for many years, if not decades.”

Agriculture accounted for an estimated US$110-billion, or 5.5% of Brazil’s GDP in 2008, according to the U.S. State Department. The country is now among the world’s top exporters of many agricultural commodities, including coffee, sugar, orange juice, soybeans, tobacco, beef, and poultry.

Brazil is also one of the few places with the potential to materially increase arable land and has an abundance of renewable frashwater, Mr. Winslow said, noting the government’s 37% year-over-year increase in agricultural spending.

The country must also compete with China and other emerging markets to secure potash. So guaranteeing domestic supply mitigates the risks to economic growth posed by potentially strained global supplies and the possibility of escalating prices.

Establishing lower-cost potash supply due to lower transportation costs and the eliminating duties could also help establish Brazil as a sustainable, lower-cost grain producer, the analyst said.

While Brazil is likely at least five to seven years away from seeing its first large-scale potash mine in the Amazon, Mr. Winslow nonetheless warned that the equity value of publicly-traded market leaders could begin to reflect long-term potash prices well below current contracts.

He identified several Canadian-listed juniors that have exposure to potash in South America and could benefit from an emerging industry in Brazil. The include TSX Venture names like Allana Resources Inc., Amazon Mining Holding Co. and Atacama Minerals Corp., TSX-listed Talon Metals Corp., Sprott Resource Corp. and Western Potash Corp., as well as Lara Exploration Ltd.

Mr. Winslow favours companies that have access to a potash resource with favourable economics, ease of permitting or permits in place, availability and/or proximity to infrastructure, strong management and/or public/private sector partners, and capital or access to it.

Jonathan Ratner

Read more: http://network.nationalpost.com/np/blogs/tradingdesk/archive/2009/08/19/brazil-poised-to-be-next-potash-player.aspx#ixzz0YqD1Q9Af

The Financial Post is now on Facebook. Join our fan community today.

Agrifirma Agrees to Fund Trials of Amazon Mining's ThermoPotash Fertilizer

Press Release

Source: Amazon Mining Holding Plc

On 1:13 pm EST, Tuesday November 24, 2009TORONTO, ONTARIO--(Marketwire - 11/24/09) - Amazon Mining Holding Plc (TSX-V:AMZ - News)("Amazon" or the "Company"), is pleased to announce that the Company has entered into an agreement with Agrifirma Brazil, a United Kingdom based farmland operator and developer, to fund agronomic tests using Amazon Mining's proposed ThermoPotash product, derived from the Cerrado Verde project, Cerrado Verde is a source of potash rich rock from which Amazon plans to produce a slow-release, non- chloride, multi-nutrient, fertilizer product.

Agrifirma plans to test ThermoPotash in real world conditions for use with soybeans, maize and corn. Agrifirma hopes to utilize the slow release characteristics of ThermoPotash to provide a baseload of potash nutrients during the conversion of scrubland and pastureland into fertile farmland for cultivating the crops mentioned above.

Agrifirma endeavours to develop its agricultural land ecologically, to minimize environmental impact. ThermoPotash is expected to be suitable for organic farming not containing environmental pollutants like conventional potash (potassium chloride), known to contaminate groundwater. An off shoot of potassium chloride fertilizer use in Brazil is the use of limestone by farmers to neutralize the acidity created by the chloride left in the soil. This practice releases a large amount of carbon dioxide into the atmosphere and increases the salinity of farm soils. The nature of ThermoPotash should curtail the loss of fertilizer to groundwater and reduce limestone needs, minimizing greenhouse gas emissions. Agrifirma hopes to benefit from these characteristics.

About Agrifirma

Agrifirma is a modern farmland operating and development company, formed in 2008 to buy and convert unproductive scrubland and pastureland into high quality arable land. Currently the company controls 69,112 hectares of land in western Bahia. Brazil currently uses approximately 10% of its potential arable land, estimated at 550 million hectares predominantly in the Cerrado region where its project is located, away from the Amazon rainforest and one of the last major agricultural frontiers still to be developed.

Agrifirma, boasts an impressive management, board and advisory committee that include Donald Coxe, renowned investment strategists and author of "The New Reality on Wall Street"; Jim Rogers author of "Adventure Capitalist" and "Investment Biker"; Julio Bestani, CEO, former CFO of South American agro- industrial giant Adecoagro, funded by George Soros; Ian Watson, Chairman, former Chairman Galahad Gold; and, Roberto Rodrigues, director, former Brazilian minister of Agriculture (2003-2006).

About the Agreement

The memorandum of understanding between Amazon Mining and Agrifirma governs the testing of ThermoPotash product from a proposed pilot plant production. Under the terms of the agreement Amazon will provide ThermoPotash to Agrifirma for use in planting soybeans, maize and corn. Agrifirma will designate a test plot and fund all costs associated with the testing. Argrifirma's investments will include yield comparisons and chemical analysis of nutrient behaviour in the soil, with special attention to barren soils being converted for agricultural use. The companies will jointly define the period in which the fertilizer is employed, and the stages of study. Data from the studies will be jointly owned by Amazon and Agrifirma to be used for development of the product, product marketing and project financing. Agrifirma will have pre-emptive right to the acquisition of 15% of potential ThermoPotash production at market price for a period of 24 months, in the event of successful commissioning of a ThermoPotash production facility by Amazon Mining.

Other Matters

As per press release dated July 27, 2009, 630,000 options were granted to new members of the Board of Directors as well as consultants and staff. These options expire July 23, 2014.

About Amazon

Amazon Mining is a mineral exploration and development company founded by Brazilians in 2005. The company is focused on the development of Cerrado Verde project. Cerrado Verde is source of a potash rich rock from which Amazon plans to produce a slow-release, non-chloride, multi-nutrient, fertilizer product. Amazon Mining is a UK public company with shares listed on the TSX Venture Exchange since November 2007.

On behalf of the Board of Directors of Amazon Mining Holding Plc, Jed Richardson, Vice President of Corporate Development

Cautionary Language and Forward Looking Statements

THIS PRESS RELEASE CONTAINS CERTAIN "FORWARD LOOKING STATEMENTS", WHICH INCLUDE BUT IS NOT LIMITED TO, STATEMENTS WITH RESPECT TO THE FUTURE FINANCIAL OR OPERATING PERFORMANCE OF THE COMPANY, ITS SUBSIDIARIES AND ITS PROJECTS, STATEMENTS REGARDING USE OF PROCEEDS, EXPLORATION PROSPECTS, IDENTIFICATION OF MINERAL RESERVES, COSTS OF AND CAPITAL FOR EXPLORATION PROJECTS, EXPLORATION EXPENDITURES, TIMING OF FUTURE EXPLORATION AND PERMITTING, REQUIREMENTS FOR ADDITIONAL CAPITAL, GOVERNMENT REGULATIONS OF MINING OPERATIONS, ENVIRONMENTAL RISKS, RECLAMATION EXPENSES, TITLE DISPUTES OR CLAIMS, AND LIMITATIONS OF INSURANCE COVERAGE. FORWARD LOOKING STATEMENTS CAN GENERALLY BE IDENTIFIED BY THE USE OF WORDS SUCH AS "PLANS", "EXPECTS", OR "DOES NOT EXPECT" OR "IS EXPECTED", "ANTICIPATES" OR "DOES NOT ANTICIPATE", OR "BELIEVES", "INTENDS", "FORECASTS", "BUDGET", "SCHEDULED", "ESTIMATES" OR VARIATIONS OF SUCH WORDS OR PHRASES OR STATE THAT CERTAIN ACTIONS, EVENT, OR RESULTS "MAY", "COULD", "WOULD", "MIGHT", OR "WILL BE TAKEN", "OCCUR" OR "BE ACHIEVED". FORWARD LOOKING STATEMENTS INVOLVE KNOWN AND UNKNOWN RISKS, UNCERTAINTIES AND OTHER FACTORS WHICH MAY CAUSE THE ACTUAL RESULTS, PERFORMANCE OR ACHIEVEMENTS OF THE COMPANY TO BE MATERIALLY DIFFERENT FROM ANY FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR IMPLIED BY SAID STATEMENTS. THERE CAN BE NO ASSURANCES THAT FORWARD-LOOKING STATEMENTS WILL PROVE TO BE ACCURATE, AS ACTUAL RESULTS AND FUTURE EVENTS COULD DIFFER MATERIALLY FROM THOSE ANTICIPATED IN SAID STATEMENTS. ACCORDINGLY, READERS SHOULD NOT PLACE UNDUE RELIANCE ON FORWARD-LOOKING STATEMENTS.

The potential grades detailed in this release are conceptual in nature. There has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in the targets being delineated as a mineral resource.

Readers are cautioned not to rely solely on the summary of such information contained in this release and are directed to the complete set of drill results posted on Amazon's website (www.amazonplc.com) and filed on SEDAR (www.sedar.com) and any future amendments to such. Readers are also directed to the cautionary notices and disclaimers contained herein.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

#msg-43900575

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |