Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Swede, thanks for the info! I will not sell any shares in SIAF before the COSO. I plan my earliest part-sell to 2020. SIAF also have the Capital Award that will inpact bigtime on the SP of SIAF!

I know this forum is about Tri-way, but at the moment they are so close linked toghether with SIAF.....

Tri-way Operations Update

http://www.sinoagrofood.com/sites/default/files/Tri-way_Status_Nov-2017.pdf

Thanks for starting this board, Swede!

All of us who own shares of SAIF will soon be owners of this company, with stock, and also indirectly through SIAF's ownership of 36%

Chinese article about AF4

http://www.oeofo.com/news/201710/25/list232132.html

New pictures of the Mega Farm

https://www.undercurrentnews.com/galleries/inside-sino-agros-megafarm-in-zhongshan-china/

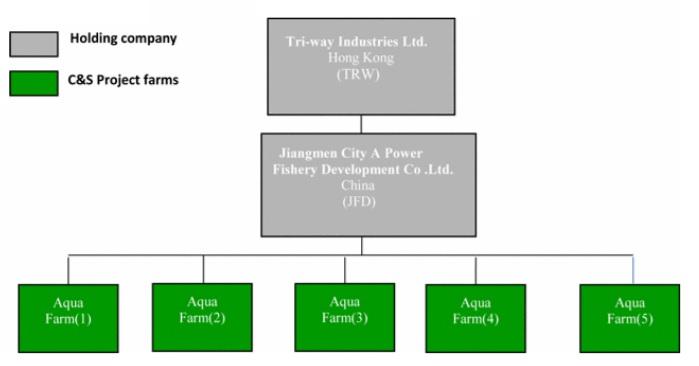

Owners of Triway Industries

Total Outstanding Shares 99,000,000

Sino Agro Food (OTCBB:SIAF) 36,590,000 36,95%

Ample Rise Limited 2,750,000 2,8%

Fortune Legend Investments Limited 2,750,000 2,8%

Sino Agro Food (HK) Limited (Nominee) 31,998,572 32,3%

Good Sea Limited 4,250,000 4,3%

Green & Natural Limited 3,250,000 3,3%

Lucky Shine Development Limited 2,750,000 2,8%

Yongfeng Agricultural Investment Co 4,180,068 4,2%

The Business Advocate, Inc 4,521,360 4,6%

Fine Happy Limited 2,750,000 2,8%

Flying Cristal Limited 4,200,000 4,2%

Don't expect to see any quarterly numbers from Triway until the company is listed. Hopefully we will see a balance sheet and a prospectus soon.

Swede will they make quarterly numbers public soon or will we have to wait until the pre-ipo?

Agricultural Bank of China Co. Ltd. Signs Bank-Enterprise Comprehensive Agreement with Jiangman Yili Fisheries

Revolving Credit Facility and Premier Banking Privileges Highlight Strategic Partnership

Agricultural Bank of China (“ABC”) and Jiangman Yili Fisheries Co. Ltd. China (“JFD”), a fully owned subsidiary of Tri-way Industries Ltd. (“TW”) have signed a Bank-Enterprise Comprehensive Strategic Cooperation Agreement (“BECSCA”) this past week in Guangzhou. JFD is one of the select companies afforded this level of partnership with ABC in the Guangdong region.

ABC is providing a revolving credit facility to TW/JFD, which is eligible to be drawn incrementally up to its maximum line of RMB 100 million, with the maximum line intermittently increased as experience and corollaries between ABC and TW/JFD materialize. The monetary amount designated for each draw and its use will be determined in consultation between both parties. A rolling audit of TW/JFD by ABC is one of the conditions that must be met satisfactorily to permit continued use and increase of the revolving credit facility.

In addition to the revolving credit facility, the other major provisions of the agreement include:

•Personal banking VIP channel, which provides one-on-one consultation and expedited services to its clients;

•Bond and debt advisory, including bond underwriting, debt financing, and/or direct (equity) investment in the Company;

•Foreign lending and/or foreign investment facilitation, utilizing ABC’s international network of investors and lenders to obtain outside funding sources in addition to those provided by ABC.

According to the BECSCA, these and other provisions afforded TW/JFD culminate in what best can be described as a “win-win” joint venture.

Agricultural Bank of China Co., Ltd., the world’s third largest bank based on reported assets, is oriented to create partnerships with well-vetted corporations with an international focus.

TW plans to develop an aggressive export sales side to complement its already strong domestic sales operations. This is one of the primary reasons ABC has requested the Company to become an Enterprise Partner during the build-out phase of its development.

http://sinoagrofood.investorroom.com/TW-ABC_BECSCA

Upgraded Fish Species Developed at Aquafarm 2

http://sinoagrofood.investorroom.com/AF1-2_news

http://www.sinoagrofood.com/content/AF1-2_2017

Progress at Aquafarm 4

http://sinoagrofood.com/content/traceability-progress

Aquafarm 4 Update

Aquafarm 4 was prominently featured in two television broadcasts.

http://sinoagrofood.com/content/AF4_2017

July 2017 Status of “AF3”

A presentation used in China to support SIAF’s carve-out of its aquaculture business (into Tri-way Industries, Ltd.) is published here along with a status update about Aquafarm 3.

http://sinoagrofood.com/content/AF3_2017

From a financing perspective you would expect them to halt construction of the 3rd building. The first 2 buildings are 95% complete as of March 31 and they are also spending money on ODRAS.

I don't think it's concrete. These buildings have a fair amount of sub grade work for the pumps and recirculation between the oxidation ponds. "Ground and infrastructure" could refer to only grading and civil even at 100%. If we turn on the infrared wave bands it looks this way. Doesn't look like concrete to me.

But it also doesn't really matter, IMO. We know they're experiencing a cash crunch until the funding is finalized And we know they can crank these out pretty fast when everything is lined up. Once they have the funding in hand you're going to see the vertical construction go pretty quick. Right now call it whatever you like, the point is that they aren't building, otherwise you'd already see building structure and maybe even a roof.

Thank you, DougS!

You and your vegetation. LOL. Building nr. 3 was 40% completed (ground and infrastructure work) as of March 30 (from 10-Q). It has to be concrete you're looking at. They are probably working on the tanks now so you can't tell the difference.

There's a cloud hanging over the Open Dam Ras. But here's Landsat 8 on April 30. The brownish region to the North West of the 2 buildings could be covered ODRAS. Showing plactic coverings instead of greenish water.

Also, the Land Viewer portal now has (almost) real time posting of Landsat 7 and Sentinel 2. You used to have to download the individual spectrum bands and compile them in an image editing program. But now anyone can look at the satellite flyovers like you would in google maps.

https://lv.eosda.com

SIAF updates “COSO” progress: Tri-way Industries, Ltd. earns a strong credit rating from Dun and Bradstreet. http://sinoagrofood.investorroom.com/Tri-way_5A1

Chinese firm says it may match Vietnam’s total shrimp output, 300,000t, by 2025

Production is ramping up at Sino Agro Foods’s flagship shrimp aquaculture project in southeastern China, which is planning to stock its first commercial harvests by Q4 2016 and then scale up from there, company officials said.

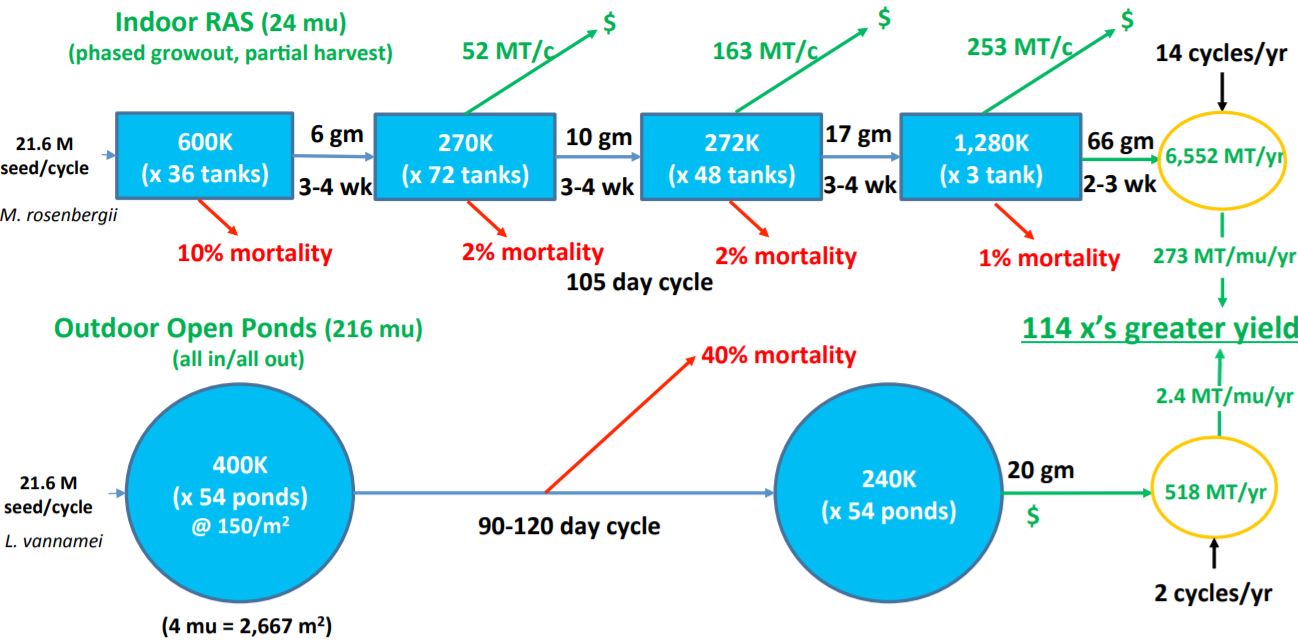

Sino Agro, a US- and Norway-listed public company that focuses on selling meat and seafood to China’s middle classes, first announced the Zhongshan New Prawn Project (ZSNPP) in 2014, billing it as the world’s largest such shrimp farm. The company has claimed that its use of recirculating aquaculture systems (RAS) on such a grand scale in an urban area that amounts to no less than a “paradigm shift” in aquaculture.

Built on 600 acres in the middle of China’s Pearl River Delta, a region home to 120 million people, construction is expected to be fully complete by the end of 2025.

When complete, construction of the first phase of the project is expected to have cost $180m, plus or minus 15%.

Test stocking of the facility’s tanks — which will be filled with 80% freshwater prawns (Macrobrachium rosenbergii) and the rest with finfish species such as Asian cod, eels and jade perch — began in February.

Tony Ostrowski, Sino’s chief scientific officer, told investors during a June earnings call that the initial stockings were meant as "trial and shakedown runs" used to test the new systems.

"We’ll plan to begin commercial stocking as soon as our settling ponds, our new ponds and all of the tanks are complete which should be by the end of this year. We’ll work out the bugs in the system, which aren’t major bugs at all, and training the staff,” he said.

Ostrowski said that the biggest hurdle to achieving full production is the completion of the settling ponds which will be needed to handle large volumes of water from the tanks.

“Even though it’s a recirculating system, we’re going to be draining water out because of harvests and filling up water and taking out water out of the tanks,” he said.

He told Undercurrent News in an email this week that production at the farm is expected to be 1,000t by the end of 2016, 10,000t by 2017, 70,000t by 2020 and at least 130,000t but as much as 300,000t by the time the project is expected to be fully built out by 2025.

“These are minimal operational targets. I don’t like to say that our target is 300,000 metric tons because when I even say 100,000t people go, ‘like, yeah, really?’” he told Undercurrent in an interview earlier this year.

The system's biofilters — which Ostrowski said are the key factor in determining the facility’s output — are being built with a theoretical production capacity of 300,000t by 2025. But reaching that figure will depend "on further research on biology, selective breeding, nutrition, and system efficiencies," he added.

The figure would match Vietnam's 2015 shrimp production, he said. However, the company has said that when eventually built out, the facility's minimum operating output will be around 130,000t annually.

The project’s ambitious scale is one of the things that attracted Ostrowski, a former president and CEO at Hawaii's Oceanic Institute, to the project, he said.

“This model makes you think differently about how we’re doing aquaculture today. And that’s what’s really exciting about it,” he said.

He added that if the company’s approach works in China, it can be replicated elsewhere.

“What we’re trying to develop is a sustainable system in one of the most urbanized regions of the world,” he said.

Company history

The ZNPP isn’t the first aquaculture venture for Sino Agro in China but it is the largest.

In securities filings, Sino Agro describes as an “engineering and consulting company that specializes in building and operating agriculture and aquaculture farms” in China. What that means in practice is that Sino Agro, a Nevada-registered corporation with shares for sale in the US and Norway, enters into joint ventures with China-based investors to undertake large-scale projects.

The joint-venture model is needed to marry foreign capital with Chinese land and government licenses, which generally have to remain in Chinese hands under the country’s laws.

The Chinese government, Ostrowski said, has been “very supportive” of the project as it comes as part of a national economic plan to raise the living standards of the Chinese people and better food produced domestically is seen as one way to achieve that.

“In China it’s very, very difficult to get as big of a piece of land as we just got” Ostrowski said.

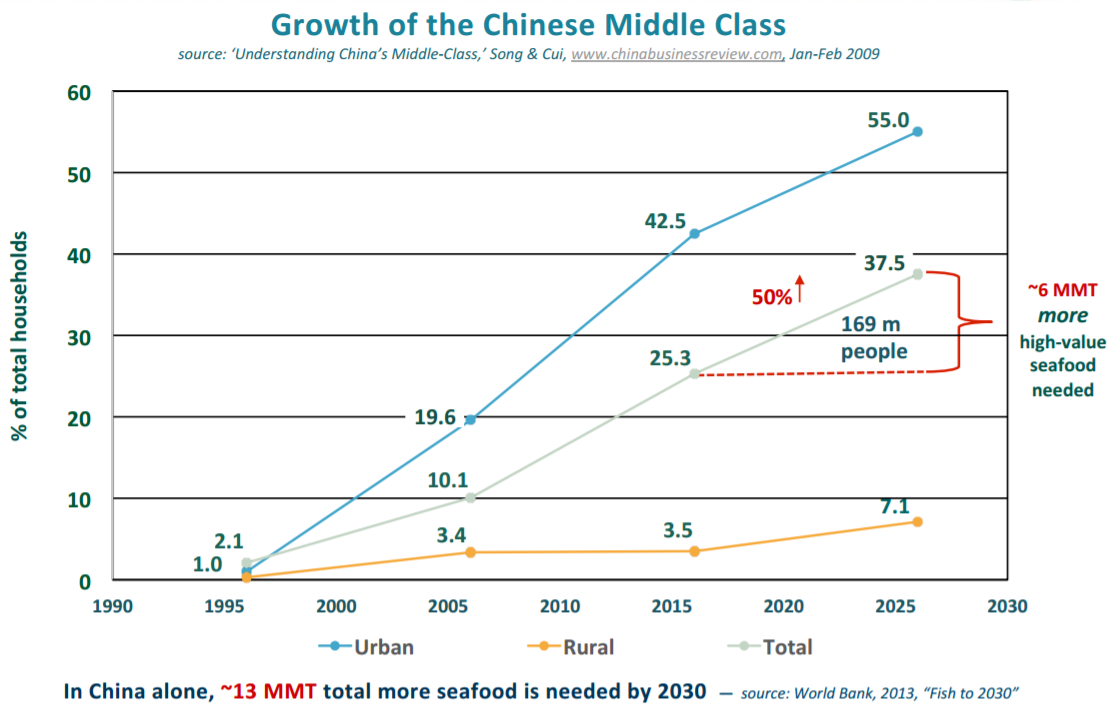

According to its annual report filed March 31, the company’s divisions include a feed and fertilizer manufacturer, a vertically integrated cattle farm, a livestock trading arm and a dragonfruit flower plantation in addition to aquaculture. The common theme running through those projects is the target market: China’s middle class.

By middle class, Sino Agro means Chinese earning $9,000 per year, which is about 25% of the total, Ostrowski said.

“If you project for the next 10 years, a 50% rise in that middle class will occur,” he said, which he estimated will spur a demand for an extra 25mt more of "high-quality" seafood.

Business model

Sino Agro’s business model is to act as the technology licenser, developer and contractor for its projects, and maintains at least a minority ownership stake, at least 25% in each of them.

The company’s CEO Solomon Lee and executives had experience developing similar efforts in Australia and Malaysia before beginning to consult on Chinese projects in 2006.

In addition to the ZSNPP, the company has two other aquaculture facilities near Emping City with a combined capacity of 2,200t per year and shrimp and prawn hatchery in Zhongshan.

Lately though, sales of eels and finfish have been a drag on earnings.

The company's Capital Award and Tri-Way subsidiaries farmed 1,900t of species such as shrimp, sleepy cod and eels during Q1 2016, an increase from 1,380t a year prior. However, a shortage of eel elvers resulted in a switch in product mix to lower cost species, which reduced revenues.

Currently, about 40% of Sino Agro’s total revenues come from its aquaculture interests but the company plans to spin off some of the non-aquaculture ventures and focus on the ZSNPP and aquaculture, Ostrowski said.

“We’ve decided that aquaculture is really the thing that we want to focus on, so what we’re going to do is we’re going to carve out some of these,” he said.

The company said in a press release earlier this month that it has completed all 'stage one' Hong Kong and China legal and commercial documents related to the asset transfers. Now, aquaculture assets can now be moved into the Tri-Way Industries subsidiary in preparation for its carve-out and subsequent IPO, the firm said.

Contact the reporter jason.smith@undercurrentnews.com

https://www.undercurrentnews.com/2016/07/29/chinese-firm-says-it-may-match-vietnams-total-shrimp-output-300000t-by-2025/

A Paradigm Shift in 21st Century Aquaculture

A very informative video about the Zhongshan Mega Farm Project by Anthony C. Ostrowski, Ph. D., Chief Scientific Officer

https://vimeo.com/158286943

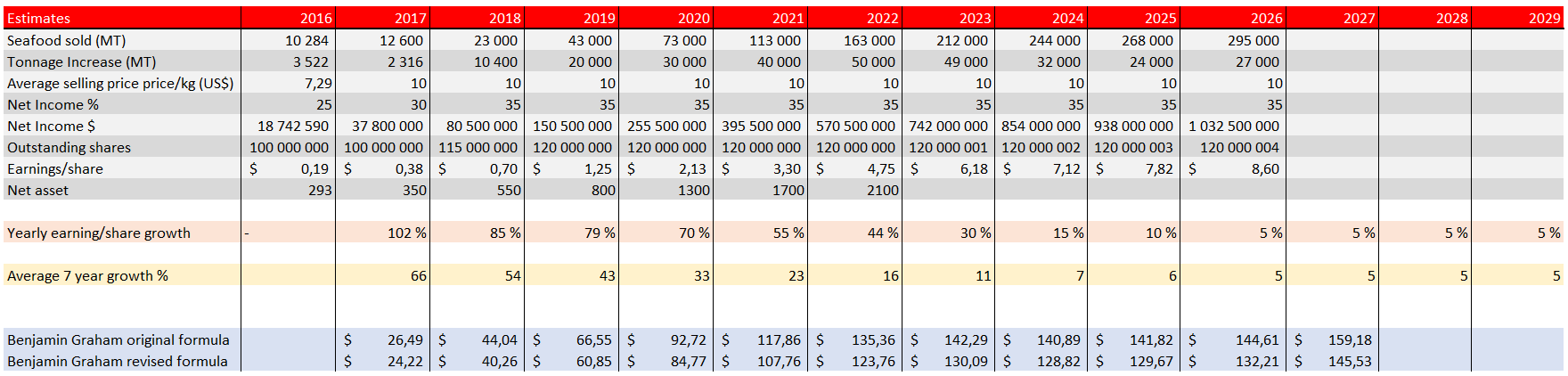

Valuation of Tri-Way Industries

What is the current value and the future value of Tri-Way?

According to the appraisal that was performed earlier this year, the enterprise value was assessed at US$340.6M. The enterprise value of Tri-Way does increase day by day, but it does not give us a fair valuation of the company as if it would be valued by the stock market.

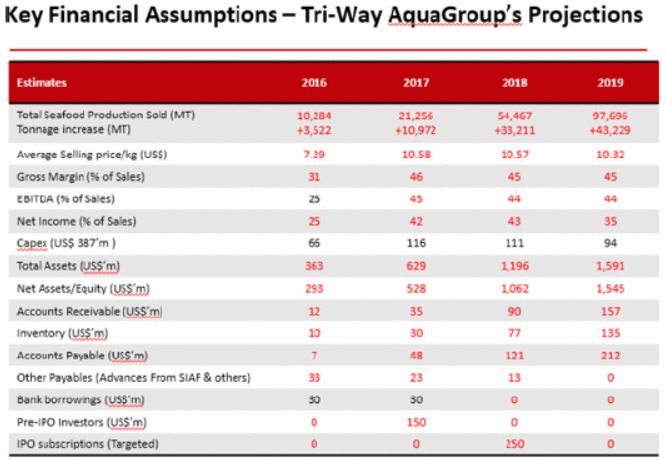

Following Financial Assumptions for Tri-Way was presented in October 2016. However, these assumptions was made based on that financing would be in place to rapidly increase growt. The growth rate presented in the assumptions is a bit optimistic in my opinion.

I will revise the financial assumptions based on my personal expectations. I have basically cut the growth speed by 30% compared to the initial assumptions made by the company, and increased the number of outstanding shares, so the safety margin is quite high.

Since Tri-Way is a fast growing company with a very short operational history high initial capital expenditures and not paying dividends, there is only one applicable valuation model – the Benjamin Graham Valuation Formula.

According to the Graham Formulas and my assumptions, the current market value of Tri-Way industries would be $24-$26/share if Tri-Way would be listed on a major exchange today. I expect that Tri-Way will list in Hong Kong by the year 2019, which would give Tri-Way a listing price of $60-$66/share.

There's an updated version of the Aquaculture FAQ available from SIAF:

http://sinoagrofood.investorroom.com/download/Tri-way_Carve-out_FAQ_v2.pdf

Tri-way Industries is well positioned to gain significant market share in Chinese aquaculture.

Since this board's intro contains good information about China's aquatic markets, it may be interesting to discuss what we see as Tri-way's critical success factors, risk factors, etc. in China's markets.

Also, here's a good article about the changing world of seafood:

https://worldpositive.com/your-relationship-with-seafood-is-about-to-change-86383e7ff82d

|

Followers

|

12

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

28

|

|

Created

|

04/24/17

|

Type

|

Free

|

| Moderators | |||

| |

| Company Description |

| Management Team and Directors |

Mr. Lee is the founder of Sino Agro Food, Inc., and has served as Executive Director and President, Chairman and Chief Executive Officer since August 2007. From March 2004 to date he has been Group Managing Director of Capital Award Inc. Since May, 1993, he has been the CEO of Irama Edaran Sdn. Bhd. (Malaysia), a modern fishery developer. Mr. Lee received a B.A. in Accounting and Economics from Monash University, Australia in July 1972.

As a member of the board, Mr. Lee contributes his holistic knowledge of the company and a deep understanding of all aspects of our business, products and markets, as well substantial experience developing corporate strategy, assessing emerging industry trends, and business operations. His experience, skills and know-how encompass over twenty years of project management and financial management in agriculture, aquaculture and food industries.

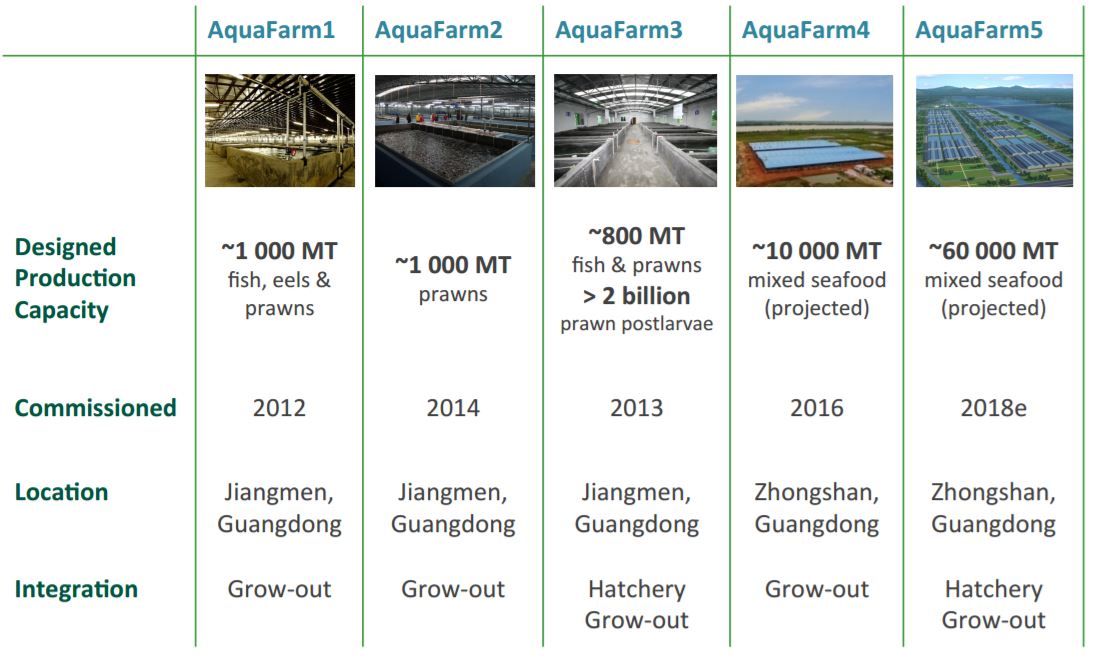

Citizen of Australia| The Aquaculture Farms |

AF1 represents the typical development model and is built on a block of land measuring 9,900 square meters that contain staff quarters providing accommodation for up to 15 workers, a self-contained office, a laboratory, external live bait holding tanks, all season red worms nurturing tanks, dry and cold storage, workshops, processing facilities, a heating room, 500 MT of water holding tanks, landscape gardens, standby generator rooms, all related underground and above ground infrastructure, and a 4,000 square meter fish grow-out farm supporting 16 RAS tanks, each measuring 10 m x 10 m x 3 m in depth holding up to 240,000 liters (or 240 Metric Tons (MT) of water with the production capacity to grow up to 80 MT of aquatic animals per year depending on its stocking cycles (or frequency of stocking of fish) and the initial size of the fish being stocked in each cycle.

Currently, AF1 grows sleepy cod, Flower Pattern eels, prawns (or shrimp), and other fish species. AF1's operations are expected to produce up to 2,000 metric tons of seafood annually.

AF3 raises postlarvae of the giant freshwater prawn (Macrobrachium rosenbergii), and the marine Pacific white shrimp (Litopenaeus vannmei) and tiger shrimp (Penaeus monodon).

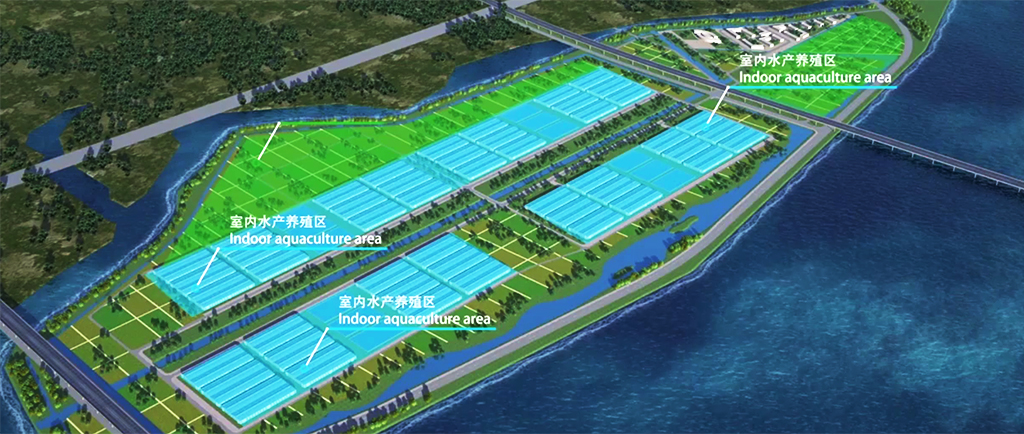

In Guangdong province, between Guangzhou, China’s third largest city, and China’s Special Administrative Region of Macau, Triway is building the largest integrated and sustainable indoor aquaculture project in the world.

Located in the largest urban agglomeration on our planet, the New Zhongshan Prawn Project commands 1,300 acres of valuable land on the Pearl River estuary. Over 600 acres will showcase the Company’s A Power Recirculating Aquaculture System (APRAS). Target production is 300,000 MT of aquaculture products per year by 2035.

Known as “the Mega Farm,” the project is unprecedented in size and scope, and promises to be a model of sustainable farming practices. It will continue to advance the use of environmentally, biologically, and socially responsible technologies that support and promote Zhongshan’s progressive urban development plans.

The Original project brochoure of the Mega Farm

Google Map coordinates - 22°32'38.47"N 113°34'36.83"E

Google Map link

Video Presentation of the Mega Farm

https://vimeo.com/143432871

| Valuation of Tri-way Industries |

| How to invest? |

| Owner | No of shares | Ownership in % |

| Sino Agro Food (OTCBB:SIAF) | 36,590,000 | 36,6% |

| Ample Rise Limited | 2,750,000 | 2,8% |

| Fortune Legend Investments Limited | 2,750,000 | 2,8% |

| Sino Agro Food (HK) Limited | 31,998,572 | 32% |

| Good Sea Limited | 4,250,000 | 4,3% |

| Green & Natural Limited | 3,250,000 | 3,3% |

| Lucky Shine Development Limited | 2,750,000 | 2,8% |

| Yongfeng Agricultural Investment Co | 4,180,068 | 4,2% |

| The Business Advocate | 4,521,360 | 4,5% |

| Fine Happy Limited | 2,750,000 | 2,8% |

| Flying Cristal Limited | 4,200,000 | 4,2% |

| Tri-way Industries Technology Advantage |

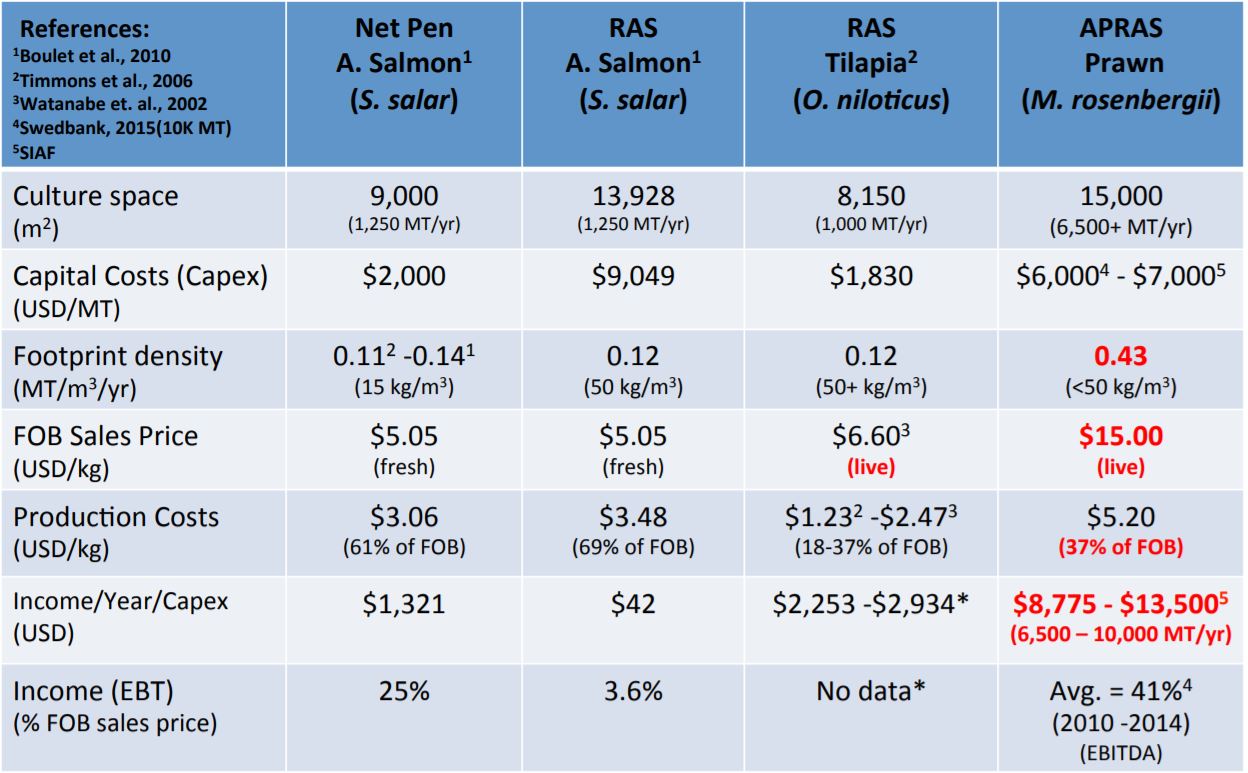

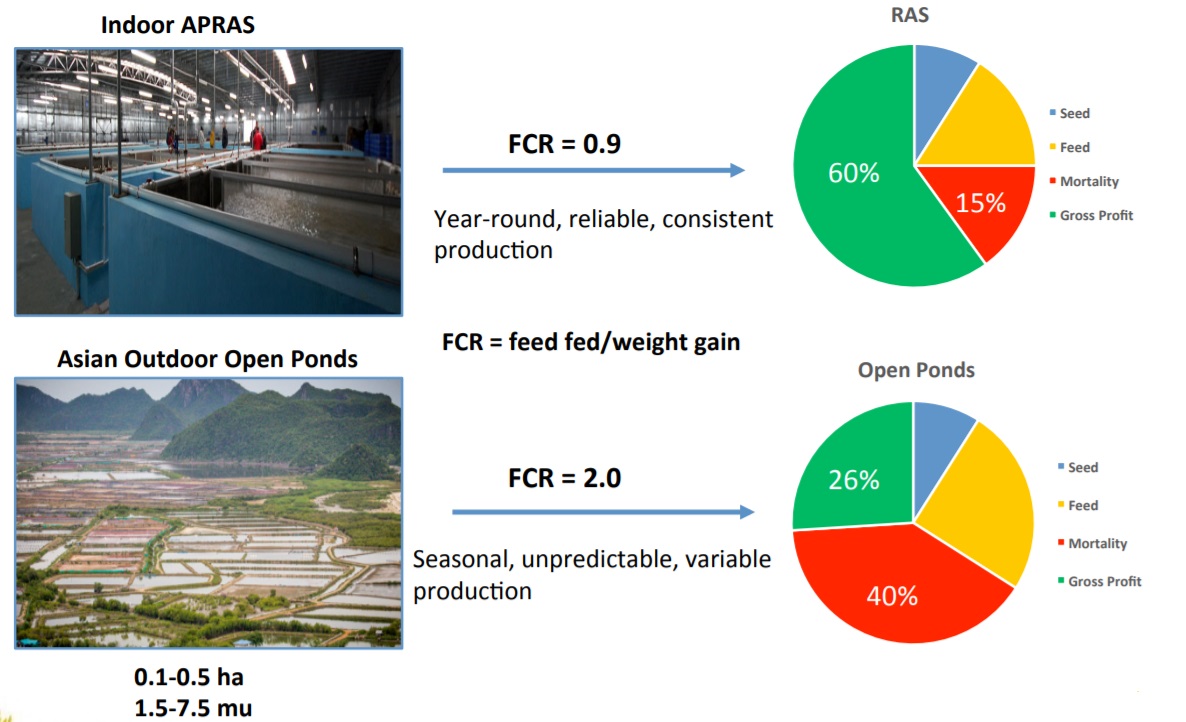

| APRAS Technology – Increased survival • Pathogen exclusion, stable environment – Increased efficiency • Increased density, feed efficiency – Greater yield • Phased & partial harvest strategy | Focus on Live Seafood – Higher price vs. fresh/frozen seafood – Pearl River delta is world’s largest live seafood market • 120,000,000 populaCon • 35.1 kg per capita seafood consumpCon since 2010 (FAO, 2014) – Rest of world = 15.4 kg per capita |

| Low Cost of Production – Guangzhou Consumer Price Index = 43.5 vs. NYC, USA – Small APRAS footprint – Large-scale/modular design | Sustainable Production – Biologically, environmentally, socially responsible • Genetic conservation, water reuse, waste abatement, chemical & polluCon free, good labor practices – Third party process certificaCon– Product traceability |

| • Low water consumption – Recirculation (<5% loss/d) • Minimal land use – Higher densities (50 vs. 15 kg/m3 for salmon net pen) • Better hygiene and disease management – Eliminates “excludable” diseases & controlled environment reduces stress on animals • Reduces environmental effects – Controlled waste management & nutrient cycling • Prevents biological effects – No escapees • Reduces visual effects – Minimal land use • Reduces carbon footprint – Can locate farm close to markets |  |

| The market for aquatic products and aquaculture in China |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |