Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Mystical... what makes you think that pdmi is coming back to trading status????pink status???

Attorney Randall Mackey

Mystical are you on medication????

This is a shell company!!!

It's closed...dead...the old man/attorney who was running pdmi is like dying...

Mystical are you on medication????

This is a shell company!!!

It's closed...dead...the old man/attorney who was running pdmi is like dying...

I I’m hoping pdmi has good plans this time and starts go up soon

Who would do that?...who would spend a whole nickel on a dead stock????

Oh smack....25 thousand shares sold today.at .000001... that's like 5 cents total... lmao

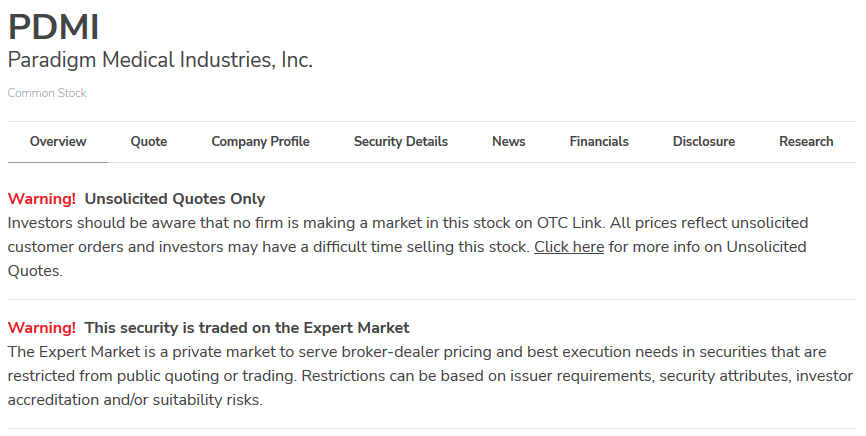

If anyone here is super lucky to be able to Liquidate 1B shares of this TOXIC Expert-Market Non-Reporting PDMI at the Minimal bidding price $0.0001 then he/she can Easily collect $100,000 Huge cash which can be used to buy 500,000,000 shares of its two Sought-After Pink-Sheet Fully-Reporting peers (such as SUTI and PBHG) at $0.0002 or 1B shares at Bottom $0.0001 or 333,333,333 shares at 52-week-high $0.0003!

In this way he/she can Easily recover the Huge Losses from investing in PDMI because SUTI and PBHG can Easily surge back to their recent highs ($0.0034 and $0.0055 respectively) again while both are trading at Super Cheap Great Discount Basement price levels $0.0003 ~ $0.0001 now!

Anyway who ever pushed this junk Up to 0.0007 TWICE recently? Why?

can you see your totally wrong!! how many years more you want to wait for nothing....

Why there is nothing happening here lol?

I doubt it... I have been waiting for this to hit for 13! years

Is there any hope for this?

302,500 sold today.....@ 0000000000001.... that might be 3cent.... lmao

Someone sold 3.7 million shares today...at least we see some movement here and there....

How did it go today to .0002?????

If anyone here is Super Lucky to Liquidate 1B shares of TOXIC Expert-Market Non-Reporting PDMI at the New Ceiling $0.0001 then he/she can Easily collect $100,000 Huge cash which can be used to buy 500M shares of its Sought-After Pink-Sheet Fully-Reporting peers (such as PBHG and SUTI) at $0.0002 or 250M shares at $0.0004 or 125M shares at $0.0008!

In this way he/she Easily recover the Huge Losses from investing in PDMI because the peers can Easily surge back to their recent highs ($0.0055 and $0.0034 respectively) again while they are at Super Cheap Basement price levels $0.0003 ~ $0.0001 now!

I'm wondering who pushed PDMI Up to 0.0007 TWICE most recently? Why?

and all the smart shareholder wich had everething figured out about the rs...you know something is much better than nothing!!!!!!

That’s priceless lmao !!!

Somebody grabbed 3 mill today. Nice to see some action

It's all over except the deletion of the ticker

13 years or so STILL nothing on this POS!!!!

Nothing that I've heard.

Been very quiet, anyone hear ANYTHING on this Disgrace of a stock?

Well, I'm still getting them. He quit for a while now he's back.

Wonder how the peers are holding up?

I forward his message from docusign back to him with words to File the Paperwork to become Pink Current without changing the share structure.

Anyway…..it just hit me that he could click on the links in the email and sign everything for me.

Hopefully he’s not willing to risk this fraudulent activity.

I will not forward the docusign again…..but rather just email blast him daily from regular mail!

Mackey has a dead shell...unless he gets the filings to the OTC Mackey has nothing but a pathetic dead shell... Mackey needs to register pdmi or it stays dormant..

Nobody has control ... We would need to wait for mackeys retirement or death....

I'm with you setti....I consider my pdmi shares a loss already....I hope Mackey sells the shell and whoever buys this shell does something great with it... Mackey is a sham..... Mackey is too old to run a company...

Still scamming for the last 15 years.. I have millions of shares and I rather lose them all then go for the reverse split.. enough is enough

If he needs shareholders to approve then that means that he does not have control of the company though majority of outstanding or preferred shares.

Can anyone who has the document post the full wording of it here?

Mackey needs about 600-700 million shares to do the 1:400 share reversal... Mackey needs more than half of the outstanding shares...that will not happen unless he gets a few major shareholders...lm one of the major shareholders...but that would mean for every 1000 shares I will have 2.5 shares!... that is a pathetic joke!!!! And even if by any chance he does get some idiot shareholders to sign for the 1:400 reversal Mackey is not going to file anything to bring PDMI to a viable pink otc shell / business... Mackey will short PDMI to the ground... and you can kiss your shares good bye forever....

This whole thing stinks. There's no reason for anyone to solicit support in this manner. I doubt it's even legal as something like this needs to be sent to all shareholders of record, not some select few from a message board.

PDMI never used that web address either. Ever. So somebody set up a webpage a few months ago to get people to share info with them. Who and why?

We should all send daily emails to Randall stating:

File the paperwork and pay the fees with OTC and save the company with the current share structure!

rmackey@paradigmmedicalindustries.com

I told Mackey to stop sending me emails and the DocuSign garbage...he hesitated...he finally sent me an email stating that I will no longer receive emails and DocuSign from him....that is a form of harassment to me...you Shareholders should tell him the same...I would of filed a complaint against him if Mackey would of harrassed me with more emails...

I know... I get emails daily!!! NO WAY R/S!!!... After 15 years of BS... Let him do this without that R/S... Lets not give him another shot of jerking us around

Emails come daily. He really wants to revive it……well, he’s gonna have to do it without a RS1

Mr Mackey just won't give up with he?

I still own large amount of PDMI shares now. But I won't support any R/S plan let alone an Huge one --- 400 Old shares for only one New share!

In fact I've even not registered with that toxic website yet! I only support any keeping-the-Same-SS new initiative to make PDMI "Current" like its peer (PTEL) did on 09/27/2021 so that we can see 0.0017 or higher again!

Mr Mackey is at it again we can save the company no he can save the company do not sign

I agree No way should we R/S... ALL its gonna do is help him take our money.. Don't sign!!!!!!!

Hi Marty....has Mr. Mackey ever sent you an email or called you or sent you a DocuSign in the last 10 years???????……noooooo

Mr Mackey is a lazy skeemer....a 84 years Mr Mackey wants to do one more play with pdmi before he dies...a 400 to 1 reversal that would be no good to anyone but Mackey...

Wish I still owned this stock so I could tell him NO too, sounds like fun

Got another email from Mr Mackey this morning wanting to sign the document won't do it time to man up

It hasn’t been or done anything in 11 years… what the hell is he saving? It’s a total F’n dead company.

It will never be anything not to mention it’s now on the dogshit market to never see the light of day again

|

Followers

|

320

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

25790

|

|

Created

|

09/29/05

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |