Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

That was Dan Ahrens purchasing 60,000 shares for the AdvisorShares MSOS ETF during the last 30 minutes of the trading session.

Massive buying and ask slapping in progress!!!!

December 2022 was a good month for sales in NM, then they went down in January and February. March 2023 was a good month. History repeats itself now, December 2023 was a good month, January and February went down and March was a good month. The same has happened in Colorado, California and other states.

Looks like march is not a bad month for cannabis sales in the us.

I wonder what caused the growth in March.

Tilray crushes weed market with earnings miss ![]()

The fact that they aren't providing citizens with an itemized receipt makes it seem like there are some rogue officers writing up dummy receipts and pocketing the goods. I hope a stop is put to this.

Definitely not a good thing. Hope they get a responce on why this is happening.

Anyone able to crunch the numbers from N.M. for total sales in March numbers for SHWZ dispensaries. Looking for a turnaround with new CEO and wholesale numbers. Maybe the stars are starting to allign.

Thanks for posting all those nuggets

Thank you Future2016.

“We are prepared to win in the near-term and the long-term and continue to develop competitive advantages and capabilities. And we’re really built for difficult markets and certainly we’ve had that in Colorado, and we think this is going to be a shakeup year that we’re positioned well for. And certainly proliferation of license count in New Mexico really put a damper on the business last year. However, we’re seeing less of those openings and we’re seeing a lot more closings.

“So we’re going to continue to be a tough operator, we’re going to continue to invest in our stores, our wholesale business and we really want to continue to work for our customers and we’re going to do that and I think we’re positioned well to do that. I think the regulatory backdrop may in fact give us a little bit of tailwind even while we’re participating in these couple of markets. So I think it’s bright going forward and I just want to thank everybody for supporting us and go Schwazze.” - Justin Dye

“We have a couple on the brand development and the launch pad. I want to get a little bit closer to our next earnings release to make those announcements.” - Forrest Hoffmaster

“We’ve invested in automation where it matters and we’ll just continue to evaluate cost efficiencies at all stages of the grows and manufacturing as well and a lot of that will come through ERP as we’ve already seen improve operations in Colorado grows, getting our costs well beyond competitive levels.” - Forrest Hoffmaster

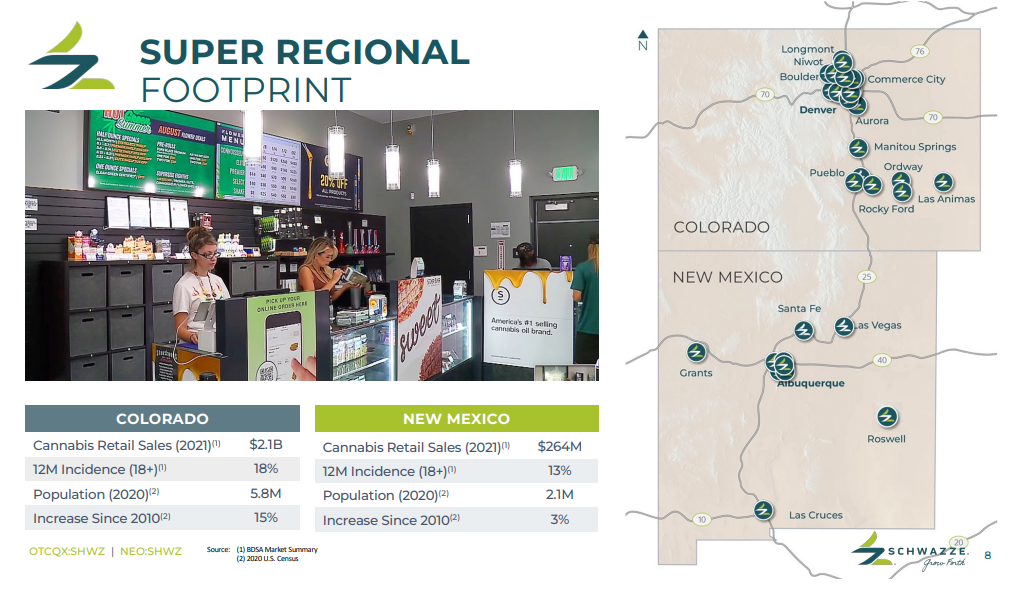

“In terms of the retail market, Colorado sales were down approximately 15% on a year-over-year basis compared to our growth of almost 8%. Population in the state remained flat year-over-year, with overall store count down 3%, driven really by a reduction in medical dispensaries and also offset by low single-digit growth in the recreational stores.

“Sales volume was down about 15% year-over-year in Q4 and we’re seeing sequential improvement and we’re in a developed market and certainly going through some growing pains as demand and supply kind of normalize. But we’re built really to withstand this and I love the opportunity for us to compete in a tough, challenging market, and I think, things are certainly going to improve.

“From a wholesale perspective, cultivation licenses count in Colorado have come down roughly 22%, which is a sizable move from approximately 1,200 licenses at the end of 2022 to over 920 as of Q4 2023, which is below pre-COVID license counts.

“We’re starting to see pricing stabilization, as Forrest mentioned, in the state with flower AMR remaining around $750 in Q4 and plant counts back to 2018, 2019 levels. So we’re certainly starting to see stabilization and we believe there’s improvement around the corner, but we’re going to continue to execute, we believe, in the short-term in a tough market.

“To summarize, we believe it’s going to be leveling out with steady flower AMR and believe shows stability regardless of how we really think about retail pricing pressure. We feel good about where we’re headed from a wholesale perspective standpoint.

“Looking ahead, we believe we can maintain solid retail margins, utilize the wholesale penetration growth to protect our CPG margins and we’ll benefit from modest increase in wholesale pricing as supply settles down.

“This could be a shakeout year for Colorado and our lightweight capital model, strong retail capabilities, we believe position us very well to continue to grow share of wallet from our customers. We’re going to continue to focus on retail execution and optimizing customer acquisition with loyalty and retention and unlocking liquidity through our current asset base.” - Justin Dye

“In New Mexico, it’s still a young market, and as we mentioned on the call, sales have increased 18% year-over-year in quarter four, but store count was up over 50%. So, that’s led to about 20% lower revenue on a per-store basis to levels that we believe cannot be sustained as they’re roughly about 50% of the Colorado market. We’re seeing closures trend upwards in recent months and starting to see net growth rates decline, so all of that is encouraging for us.” - Forrest Hoffmaster

“While we expect continued competitive pressure, we believe these early trends suggest we are entering a shakeout period for New Mexico, which should bode well for our operations in the state as we look to the future.

“In both Colorado and New Mexico, we increased wholesale penetration by over 3 times in 2023 to more than 27% total door penetration in both states. We have also been focused on refining our wholesale product offerings as we aim to provide the best assortment of high quality products with exceptional customer service.” - Forrest Hoffmaster

“In New Mexico, the proliferation of new licenses has continued outpaced market growth and although the illicit market in New Mexico has been pervasive, the state’s regulatory body has increased their license enforcement in recent months, as well as upgraded the severity of illicit market sales from a misdemeanor to a felony charge. Their efforts have resulted in an increase in store closures and we expect this trend to continue throughout 2024.” - Justin Dye

I´m not selling a single share, will buy more if it goes under 0.60.

N.M. cannibus sales set a record of $52.5 sales for March which is 5% higher than record for Dec. It would be Bice to see SHWZ start to get a bigger slice of the pie.

Regardless what they paid I believe they were bleeding money and it was time to unload them. Their focus needs to be retail and wholesale.

Certainly good to see a turnaround in wholesale. I believe Drissen or something like that from SLGWF was hired to turnaround wholesale and it appears they are gaining traction.

Seems like they paid over 10 million dollars for those 2 companies, but I can't remember for sure.

On January 4, 2024, the Company divested substantially all of the operating and intellectual property assets related to the Company’s production, manufacturing, and sale of certain fertilizers and associated products operating under the name Success Nutrients, as well as the distribution and sale of certain cultivation resource materials associated with Three A Light, to Organitek, Inc. a California Corporation. The divested assets included all tangible inventory, customer lists, website and domain names, social media accounts, intellectual property rights held by the Company associated with those brands, and all rights, including but not limited to the copyrights in the Three A Light book. The aggregate consideration was $170,100, which is to be paid in quarterly installments with a final balloon payment due 24 months following the closing date.

I agree that the CEO search is a formality, they have their man, and this was probably that last test before making the formal announcement. They really can't do more than smaller targeted expansions, a dispensary here and there (and I'm not sure one per quarter is likely). They have optimism, if muted, about the fed making a move in the next two months, I wish I could share in that enthusiasm but I can't. I think the best hope is a small bone thrown to the electorate a little closer to November, and that's assuming a congress currently imploding under its own imbecility will be able to muster a bill to move forward. But with the way this sector is, even a small bone is something. I doubt we see the 1.30s again for quite some time. And even over a 2 month timeframe, I don't see a reason why we won't see low volume and drifting back down into the 50s. People won't be rushing in to buy a stock whose best reason to crow is holding their own in a competitive market, making less but not doing as bad as others.

Kudo's to Damacon's synopsis. I noted a few things of what I think added some value: Analyst coverage has grown based on the que. More on this call than ever I believe. The decision on interim CEO may be a "we have our man" already and the BOD wishes to see how his stewardship goes as he was a CEO previously. Finally, the market's rapid growth in start-up competition is going away according to their estimates.

My takeaway is a Green Thumb approach of slower organic growth and making the most of the existing footprint they built out in the last 2-years. For instance, a new dispensary per Q based on curtailed expansion or a one-time smaller buy in the OK-TX border or the West/Mountain area in CO (if mass generated in geographical proximity is keeping the regional approach) Perhaps not sexy, but should be a viable business despite the message board thrashings looking for a new trade entry (So, the company still will be the big fish in their regional small pond) Keeping tabs on the controller and treasurer functions are key to managing the favorable refi of debt --and that is my pinkish-red flag.

Damacon did a great summary. Ugly ER, only saved by the fact that yes, it could have even been uglier. Certainly the ER was a poster child for why executive compensation does not generally lead to stellar stock performance, at least not in proportion to the compensation. Without a fed Hail Mary in the next few months, SHWZ and most MJ plays will be struggling. Perhaps that is what the big fish want, swoop in and buy these companies up for pennies on the dollar just before the feds make their move, benefit from all the previous licensing agreements, branding at bargain rates. Hard not to believe the game is crooked at this stage in terms of MJ legalization, rescheduling, safe banking delays.

My red flags:

Reading --

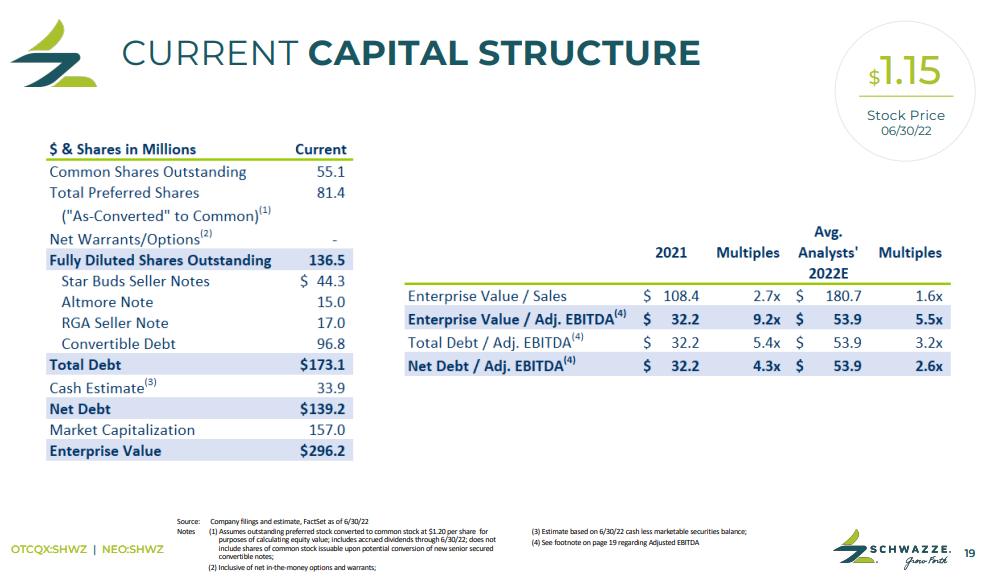

As of December 31, 2023, cash and cash equivalents were $19.2 million compared to $38.9 million on December 31, 2022. Total debt as of December 31, 2023, was $156.8 million compared to $127.8 million on December 31, 2022.

Then hearing --

$2.5M FCF last year

Continued margin pressure

Looking to unlock liquidity and capital to take advantage of the shakeout.

When should we expect an offering?...or will they first need to hold a shareholder vote to increase the common before doing so?

Thanks... A retail organization relying on wholesale.... not good, imo.

I did, here is my unedited/unfiltered notes as I was listening and watching TV (so take them with a grain of salt):

CO

690+ outlets

Market decrease 15% YoY

Outpaced the market

$750/lb

Lowell Preroll #1 preroll in CO

Shakeout year for Colorado

Expect margin pressure in the market to continue to shakeout competition.

NM

675 total stores

Store closures are increasing

Flower price slightly up compared to CO

Rest of metrics on par with CO

Introducing Lowell to NM in April

License count challenged SHWZ business, but that is changing.

GENERAL

18% YoY wholesale growth both states

Wholesale generation up 27% YoY

Closed 301 grow in NM, consolidation

Implemented new ERP system in Q4

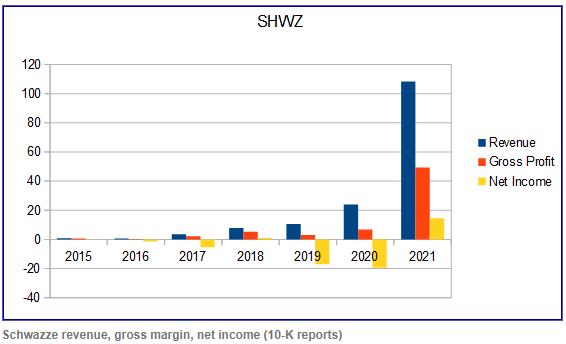

Rev up 8%

13.1M product consolidation of which

5.7M was fair value price converting Everest inventory

Op ex decreased Q4, due to lower impairment costs

Loss from Op, 16.2M, noncash inventory adjustments

3.5M positive cash flow for the Q...2.5M for the year

Q&A

Future M&A? Retail up 50% 2023-2024.

Looking to unlock liquidity and capital to take advantage of the shakeout.

280E approach-- conservative view. 2-3Q lag in payments. Have extended the lag to 5-6 quaters based on federal optimism. Other companies lagging 10-12 quarters. Possible know more about S3 news in the next few months.

Refinancing opportunities? Tactically skirted

Actively looking for additional opportunities similar to Lowell Farms

Bioscience Unit - viewed more of a product development unit to work with vendors and incorporate products into the business. More focused on Quality and less R&D.

2024 - CapEx spend - probably lower than 2023 spend. Investment mostly inside store base, storytelling, other improvements.

Pablo - question about how CO has controlled the illicit market. Tax dollars flowing into enforcement. State has been proactive in enforcing rules.

How quickly the CO market is consolidating.

7.8% above market in CO

Revenue per store of operation? 112K avg dispensary and SHWZ is above that.

Retail forward organization, focused on wholesale and asset lite. Investment is more sales force and promotions.

Did anyone listen to the conference call? I guess there wasn't much to spin about these results. And since they quit making projections, I doubt there were any made in the call either...

At this rate we have to hope some type of federal involvement happens soon, like mgmt...and the X-echo-chamber...is anticipating it will. The company might be proving ability in highly competitive markets, compared to others...or the average...in those markets, but an MSO in established/competitive markets isn't the shiny object to an investor. Until national normalization, investors will seek operators in medical flipping to adult use states where the average flower price is 3x-5x that of CO & NM...and operator inefficiency/inability is easily masked by profit margin.

You are very smart guy and knew it wasn't good. This q was not a guessing game for anyone with half a brain.we added all these dispensaries. Next thing bankruptcy? Or diluted to oblivion. Notes ane coming due in 25 and 26.

Next q no better.probably worse.

I sold most of my shares on that run to $1.50, figuring there would be an opportunity to get back in much cheaper. No wonder the CEO is gone! I don't know what price I would like to try to get back in at now... sheesh

Horrific to say the least!. However, expected from me based on what we knew.. Gaining market is a flat out not true in N.M

Posted on their website. Q4 gross profit was a disaster...to the tune of the company posting an "adjusted gross profit" for the first time in company history (that I can remember).

Guess we will find out in a couple of hours whether the funds buying had a clue. My guess clueless thus not smart money. To think every buy they made is totally red.

With good reason. Revenues gave dropped month after month in N.M We' e had a problem with leadership at the top. Hopefully with the CFO acting as interim CEO we have new ideas and ways to bring people through the doors. Obviously we need change. Really don't expect nothing but same stuff. Talking about gaining market share is insane. Look at N.M growing sales as a whole yet Revenues down.. it really is simple math. Sure hope I'm wrong!!

no vote of confidence shown in the trading today for tomorrow's earnings call.

Steven, did you get the TPS Report Memo yet? Yeah...the Bobs are going to want to talk to you.

Definitely under performing in a big way. Sure hope management surprises on the upside but really doubt it. Time for a management shake-up if the q is what I expect. Also to make matters worse q1 will be no better based on

SHWZ N.M. numbers and probable much worse. They seem to spend more time figuring share bonuses than managing the business. The only possible thing pulling us out of the forementioned sales numbers in N.M. is the guy from SLGWF pulls out a miracle with wholesale. I guess we still have hope!

one of the Canadian pot companies turned in a respectable "turn around" story ER the other day. A sign of what good management can accomplish. Hope to hear a similar story on the 27th here.

The number of posts here is in strict alignment to the volume of shares traded on any given day... Seven more days before earnings and any potential meaningful news.

In case no one saw this - earnings call.

DENVER, March 12, 2024 /PRNewswire/ -- Medicine Man Technologies, Inc. (SHWZ), operating as Schwazze, ("Schwazze" or the "Company"), will host a conference call on Wednesday, March 27, 2024 at 5:00 p.m. Eastern time to discuss its financial and operational results for the fourth quarter and full year ended December 31, 2023. The Company's results will be reported in a press release prior to the call.

The Schwazze management team will host the conference call, followed by a question-and-answer period. Interested parties may submit questions to the Company prior to the call by emailing ir@schwazze.com.

Date: Wednesday, March 27, 2024

Time: 5:00 p.m. Eastern time

Toll-free dial-in: (888) 664-6383

International dial-in: (416) 764-8650

Conference ID: 38840334

Webcast: SHWZ Q4 & FY 2023 Earnings Call

Here is a morning surprise... ✍️

— The Dales Report (@TheDalesReport) March 12, 2024

Take a look at the top year-to-date performers, it may shock you!$TCNNF @Trulieve Cannabis Corp+78.69%$GRUSF @GrownRogue International Inc +78.25%$SHWZ @Schwazze_2021 +64.02%

Take a look at the rest! $MSOS pic.twitter.com/NCWy3VGx6q

below $ 1.00 today , now the long slow crawl to .30 .https://www.marijuanamoment.net/biden-again-proposes-blocking-marijuana-sales-in-d-c-in-budget-despite-promoting-pardons-and-scheduling-review/

No need to throw stones as I think the move was needed and noted. Looking forward to see if this new CEO can turn this around. Do you know for sure if wholesale numbers are excluded from N.M. numbers? I asked before but nobody was 100% sure.

|

Followers

|

127

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

21166

|

|

Created

|

01/10/16

|

Type

|

Free

|

| Moderators StevenRisk Drugdoctor Future2016 damAcon1 | |||

Instagram: https://www.instagram.com/schwazze/

Facebook: https://www.facebook.com/Schwazze/

Meet the "Steve Jobs of Cannabis" and Schwazze's Chief Cultivation Officer, Josh Haupt:

https://www.youtube.com/watch?v=s36OIBT4XiQ&t=1s

Star Buds is one of the Most Recognized and Successful Retail Cannabis Operators in North America

Company Projects Pro Forma Revenue for Schwazze and its Two Acquisitions (Mesa Organics and Star Buds) of $95 Million in 2020

Company Expects to Be Cash Flow Positive Beginning in January 2021

Company Anticipates Acquiring Remaining Seven Star Buds Retail Dispensaries in Colorado during the First Quarter 2021

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |