Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Ok..I will looksie

So here's a new one I want you and this group to check out. $FEMFF. Thank me later.

I posted a new investment idea, it's just an idea, something for you and others to check out. Otherwise have a great weekend

So I'm going to give my followers a lead on an IPO that will making its debut soon, best to look into it, do your DD and see if this investment fits into your investment style. Cerebras Systems. Here's a little bit of a background: Cerebras develops AI and deep learning applications. The company's flagship product, the powerful CS-2 system, is used by enterprises across a variety of industries.

Here is there website: https://www.cerebras.net/product-cluster/

If anyone believes in the AI space then this is the stock that in the long run beats out Nvidia, in my opinion, this can be worth upwards of 300-500 dollars within the next 7 to 10 years.

No need to be noisy, I been doing investments in land, I'm buying up properties right now.

Grand you have been quiet. You ok ?

Do me a fave, give me the load down of what is going on with the two stocks $VIRI and $GSAC, from your set of eyes though.

Unfortunately everything is rigged.

I completely agree. Re-elect Trump for the reasons you just pointed out.

Forget his personality - he’s good for the Country. $$$, Growth etc.

Hey CJ, check out $COOL the SPAC is merging in something that could be a wonderful play. have a great day

I'm going to be quite frank with you all, I'm honestly thinking the next president will not be democrat, look at everything that has happened under this term, horrible, anyone with sense is not re-electing sleepy pants to another term. If its republican, oil, transportation, and metals stocks go up day 1, So I'm positioning my portfolio for 4 years of gains. I'm investing in undervalued oil, transportation and metals stocks, the keystone pipeline will be opened again, which will send oil and transportation re-valuations through the roof. So all in all, you can follow the hype, or you can look at the best way to position your long term portfolio.

I know we both got disappointed with the last play, but let the naysayers talk, you're still one of the best, and honest traders out here in the OTC arena. That said, I need a second look, RING ENERGY INC ($REI), I feel like this is severely undervalued, even if played as an earnings play, what do you think? I want to pull the trigger, but not so sure.

CarJockey I have something ambitious that I need some help on, if you can email me at myselfzabala@gmail.com. thanks in advance. This can be really rewarding for everyone that gets in early.

I need you to help me with something, email me at myselfzabala@gmail.com, I have a lead on something that can make us a lot of money in the near future

No problem, glad to have helped

Great post and that was with a much higher share structure. Thank You!

Found it, you can post it if you like.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=167702741

I'll try to find them I'll post them here so you can post. ??

Grand was looking for your old posts about Veemost and PPS possibilities. Can you rehash them for GDVM/Veemost current shareholders?

Thank You!

It's got a little more to go, not much, just grab as much as you can

Great call my friend!

Before anyone quotes that I was right, I hope you are averaging more shares and grabbing them at these nicer prices

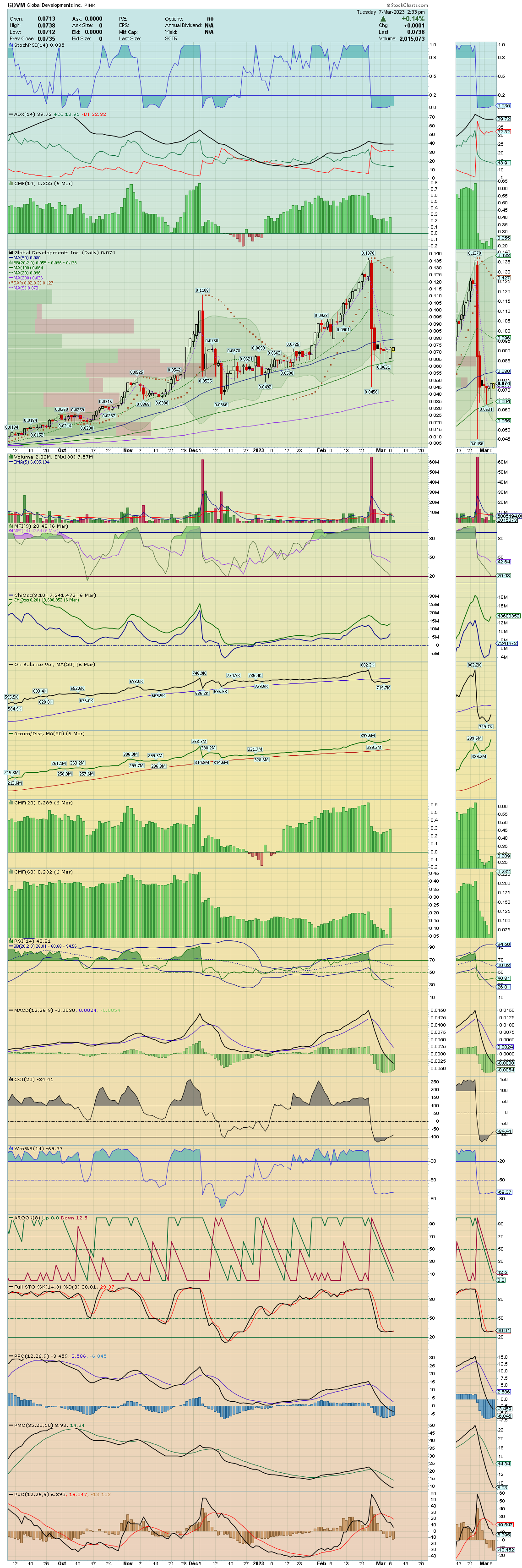

I believe its always better to expect the unforseen, rather than to think the unforseen is not possible. I know with the current economic woes, penny stocks are about to take a hit, but how big or how small is about to be determined. But either way you look at it, $GDVM benefits greatly from having no debt, which means the CEO cares about the overall health of his company going forward, and the happiness of the shareholders. I predict a fall to .065 before we go up the hill. My own opinion and what I see.

Been through two dips so far. Not due another one until MACD extends again but it’s wound up tighter than last two dips.

Those dips are going to cause a major panic but if you know what's coming, which we do, it shouldn't cause too much harm. There's a couple of missing areas on the chart that needs small corrections if any, but there's definitely a big dip on the horizon. It might take us below .04 but we will see.

Agree; It will be our third time through this.

* The V top.

https://thepatternsite.com/extendvtopbot.html

https://stockcharts.com/h-sc/ui?s=GDVM&p=D&yr=0&mn=6&dy=0&id=p24986097784&listNum=23&a=1113701411

To be absolutely honest, there's going to be 2 more major dips, they are clear as day to see, I looked at the chart, I see two major dips incoming before the rip north. Just an observation. $GDVM, I plan on buying a ton more on those dips, then if other traders are smart, they will buy those dips heavy, lock up those shares with pre-sells, and just sit back and enjoy the show.

Great post by FigherJet on GDVM on the last drop.

$GDVM 44% drop (0.13 -->0.07) on Feb24th was on on a total volume of ... ~3.6M shares or 1.1% of all outstanding shares(!). IMO this low volume move took out all stops and liquidated a bunch of accounts. We are roughly ~45% below 0.13 high right now... tick tock! pic.twitter.com/q3rc6WVH5E

— FighterJet (@_FighterJet_) March 3, 2023

This is a good post here.

$GDVM New highs on accumulation and a mismatch in price. Someone is swimming naked here. MMs pulled the same stunt back in December and we went on to set new highs. https://t.co/i4DRDxHJZf pic.twitter.com/hvjBPBqpeB

— John Kent (@KentsBrokerage) March 6, 2023

Melvin owns majority of GDVM, not making same mistake as before is what I see.

Look forward to your good posts again, except this time, there will be no legacy shareholders that will cock block this.

Yeah took a break. I'll be back soon. I think the CEO will start announcing stuff in the sweet spot of the year, which is April through July. Can't say this is quiet period, because this has been too long for a quiet period, but my guess is ticker change, then the announcement of full ownership, because the ticker hasn't changed, it tells me there's partial ownership, not a bad thing, btw. Then I'm very sure that during this "quiet time" Veemost has been working some back office deals that I'm sure they can't wait to share with us. So this is a patience game. You see the price come down, you accumulate, you see the price go up, you smile. Rinse and Repeat.

Great to hear you doing well!

Hey guys don't worry I'm making a comeback, just been doing a lot of traveling. Will be back soon

Grand has left the building…. Pumping from the shadows like the third leg now.

Hello where is Grand? Hope you are well.

Don’t you kinda hope all this is not true…

https://www.thestreet.com/investors/sec-fintwit-bros-hundred-million-pump-and-dump-scheme

Wonder who will be next cause you know it can’t stop here….

Man… so much more clarity now that true colors were finally shown. Good luck… we on an mission now!!!!

New GDVM DD packet by Gaby!

Wow

1/8- $GDVM imo is setting up nicely to merge with VeeMost very soon. With the same news last year, $JPEX saw a run of 6167% between June & October before merger was blocked by a lawsuit, and news broke about the deal not moving forward. pic.twitter.com/XxjxXEqK3H

— Bibi_G (@BRZ_GoddessOTC) November 2, 2022

GDVM had a massive share reduction over 3.1B by the Veemost CEO Melvin.

I miss your posts when you said JPEX could hit multi dollars because of Veemost rolling into it.

All we are waiting on now for GDVM is Melvin to confirm.

https://twitter.com/Harv09400583/status/1586036607748288519?s=20&t=77p6mv61px7-E8IAcY4SXQ

It means BankTank/PerpeTraders board.

lol what does that mean HoldEm?

GDVM continues to rise. No Dilution, Veemost CEO took over the clean shell. This has .50 soon. Check chart.

Good Evening, Grand please don't sleep on this GDVM.$JPEX: Attention all that like Veemost. The CEO of Veemost took over a super clean shell called $GDVM and its a done deal with only 324M shares float.

This GDVM is a clean shell with no debt and he promised no dilution.

https://www.otcmarkets.com/stock/GDVM/security

Melvin Ejiogu

@MelvinEjiogu

$GDVM majority control acquired and all outstanding debt purchased. I also purchased 12% of outstanding shares and returned them to the treasury. No dilution will occur. I’ll be sharing updates soon with everyone on our new journey.

$GDVM majority control acquired and all outstanding debt purchased. I also purchased 12% of outstanding shares and returned them to the treasury. No dilution will occur. I’ll be sharing updates soon with everyone on our new journey.

— Melvin Ejiogu (@MelvinEjiogu) September 21, 2022

Yes I do, but right now my long plays are the ones listed. I am heavy in CFVI and GEGI, those two are my main ones GEGI will prove to be a cash machine for those who are patient, I'm adding more and more by the week.

Hello GrandAdmiral, good to see ya. I know you were very bullish for the VEEMOST RM into JPEX.

Did you know the CEO of VEEMOST took over a clean shell GDVM?

GDVM has nothing to do with DA Frank.

$GDVM is a clean shell on a 325m float awaiting news regarding @veemost possibly coming in due to them adding the CEO as an officer on the OTCM website. They are awaiting access to upload the Q2 2022 report to become Pink Current first. https://t.co/rRuK7Q7afn pic.twitter.com/3PVdblGA4c

— Nole (@thenextpennyy) September 16, 2022

|

Followers

|

14

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

428

|

|

Created

|

07/13/20

|

Type

|

Free

|

| Moderator GrandAdmiralThrawn | |||

| Assistants Eagle1 Carjockey2 tomj1 | |||

A special purpose acquisition company (SPAC) is a company with no commercial operations that is formed strictly to raise capital through an initial public offering (IPO) for the purpose of acquiring an existing company. Also known as "blank check companies," SPACs have been around for decades. In recent years, they've become more popular, attracting big-name underwriters and investors and raising a record amount of IPO money in 2019. In 2020, as of the beginning of August, more than 50 SPACs have been formed in the U.S. which have raised some $21.5 billion.

|

Posts Today

|

0

|

|

Posts (Total)

|

428

|

|

Posters

|

|

|

Moderator

|

|

|

Assistants

|

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |