Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

I have lowered Membership prices to the lowest in my 10-year history of providing this successful service . . .

go to http://www.blashing.com/_products_/ .

Enjoy !!

hey Steven .. great! to hear from you.

Quite a day to stand aside today, eh.

Use today to pick up some of the Members' Stock Picks at a discount.

hey Steven .. great! to hear from you.

Quite a day to stand aside today, eh.

Use today to pick up some of the Members' Stock Picks at a discount.

I plan on lowering Membership prices this new year . . .

hurry and lock in current prices now before they drop !!

http://www.blashing.com/ . . go to the PRODUCTS link.

I thought you all might be interested in this -- it's 100% up to YOU .. AND . . .

it's FREE !!!

the E-Wave Investor Open House has started

It's here! For one week only, you have free access to the whole kit 'n' caboodle of investor services from Elliott Wave International, the world's largest market forecasting firm. During this week-long event, you'll see their U.S., European and Asian-Pacific Financial Forecast Services. Each of these three services comprises two regional publications plus the flagship, big-picture investor publication, The Elliott Wave Theorist, by EWI Founder and President Robert Prechter.

Get complete details and access your Investor Open House now >>

We are thrilled to announce EWI's first-ever Investor Open House!

For one exciting week -- from noon Eastern time Thursday, Sept. 25, to noon Wednesday, Oct. 1 -- EWI has thrown open the doors to ALL of their investor services. And it's free.

All told, you get complete, subscriber-level access to virtually everything they have to offer investors, anywhere in the world.

It includes: from long- to near-term outlook, every major stock index, every major currency relationship, and even precious metals and energy markets, covering: DJIA, S&P 500, FTSE, DAX, CAC40, Euro Stoxx 50, Shanghai Composite, HSI, STI, KOSPI, ASX, EURUSD, USDCHF, GBPUSD, USDJPY, AUDUSD, EURJPY, EURCAD, AUDJPY, gold, silver, crude oil, natural gas -- the list goes on!

Additionally, you get instant access to their library of subscriber extras, including audio/video presentations from top global analysts and special reports on the biggest risks and opportunities in the regions they cover.

Please join this exciting event now, and stay tuned for important updates and your exclusive links during the week-long event.

See you inside the Open House!

Think the current conditions in the stock market are normal? Think again.

Robert Prechter explains in this excerpt from pages 3-4 of his just-published Elliott Wave Theorist ...

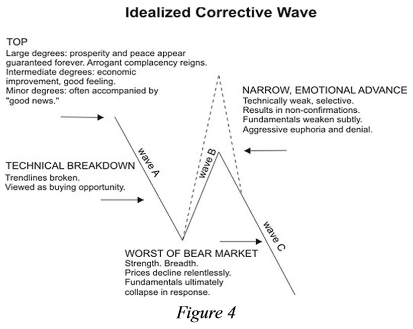

Figure 4 (below) is a diagram from Chapter 2 of Elliott Wave Principle. It displays a typical progression of prices and psychology in a bear market. We can apply this picture to the stock market since 2000. The real-life pattern is a bit more complex than this picture, because wave a itself was a flat correction, which ended in 2009. The dashed line in Figure 4 represents what the market has been doing since then: rallying to a new high in a b-wave. The entire formation has been tracing out an "expanded flat" correction (see text, p.47) of Supercycle degree.

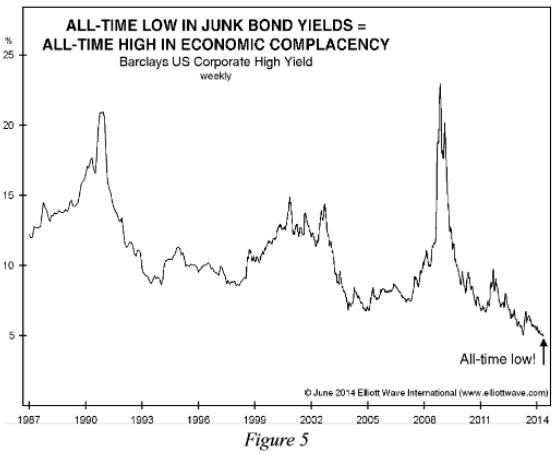

Per Figure 4, among the characteristics we should expect to see in wave b are: "Technically weak," "Aggressive euphoria and denial" and "Fundamentals weaken subtly." The volume contraction in the stock market has now lasted over five years, which is extreme technical weakness, albeit only in that indicator. The 30+ charts we have shown of market sentiment reveal historically high levels of optimism regarding stocks. No doubt bulls would dismiss the idea that investors today exhibit "aggressive euphoria and denial." But look at Figure 5.

It shows that the yield on junk bonds has just reached its lowest level ever. Junk bonds did not even exist prior to 1989. In 2009, investors were deathly afraid of them. Now they cannot get enough of them. They are thinking only about yield; they are ignoring risk to principal. That's denial. Finally, fundamentals have not just weakened a bit but rather are awful. The economy is flat, the amount of debt is at a record high, and as shown in the June issue of The Elliott Wave Financial Forecast the quality of debt is at a record low.

There has never been an expanded flat pattern as large as Supercycle degree in recorded stock market history, going back 300 years. It's a first. So, we are getting commensurate expressions of stupendous optimism, which will prove worthy of the record books. People think today's market conditions are normal, because a benign present is always considered normal. But it's not normal. It's unprecedented.

For more details, our complete wave count, and our forecast for how we believe it will all play out, continue reading Prechter's 10-page June Theorist now, completely risk-free.

You can read the entire issue, plus the Financial Forecast and Short Term Update. This group of publications, the Financial Forecast Service, is EWI's most popular package for U.S. investors.

The Financial Forecast Service gives you in-depth coverage of U.S. markets three times a week plus intermediate-term forecasts once a month and big-picture analysis at least 12 times a year. Be prepared for the risks and opportunities to come. You won't find a more valuable big-picture technical analysis package available anywhere. Period.

For a limited time, you can get your first month of all three publications for just $29 -- risk free for 30 days. That's more than half off the already discounted package price.

Get your special offer, and prepare now for risks and opportunities in U.S. markets >> SPECIAL OFFEER

original location

.

thanks! SB . . it sure has started off to be another great year !!

good weed pick.

CKEC Target Hit! . . looking for more now.

Blashing.com members were in around 26 .. now @ 29 !!

Thank you Blasher! Great board here! :)

MDRM

MDRM will be the top contender in MJ plays this week. You don't want I miss the gains on this one. Chart is extremely bullish.

Weed plays are going to be extremely bullish this week. Look for MDRM to lead the pack in gains.

WoWser! . . . CKEC is Strong Up today even when the Market was a Strong Down.

This is a lesson on Trading with good Seasonal Stocks like CKEC.

Like I pointed out, CKEC's Stock Seasonality is a Strong Up through the February and March time-frame every year.

Buying in a Dip before the seasonal period usually brings good results.

I am looking for a further increase in CKEC based on its strength today.

Do your own DD of course.

I just Bought a lot of CKEC for 26.48 . . . it usually goes Up every February/March ... ref: CKEC Seasonality.

The February Monthly Seasonal Stock Picks I have listed

are setting up real nicely today for their annual run higher in February.

Wait until they start Up again and you'll be able to get them at a nice Discount!

go into the MEMBERS Tab to check them out @ BLASHING.com

.

Blashing.com is FREE today . . .

in celebration of the memory of Dr. King.

You may access ALL directories, tabs, and Tools!

Try it out for yourself ... explore everywhere FREE.

Just go to Blashing.com.

NNVC closed at 5.79 .. a nice run.

I hope some of you were able to follow me IN when I posted before the rise.

I now see 6.20 next, before the ultimate 7.50.

just bought a bunch of NNVC in the low 5.50's . . .

breaking out with a lot of UP room to go.

I have an initial Target of 7.50 during a wave 5

.

awesome! Trade .. continued Profits . . .

there is more Down to come in the Yen . . .

so Buy/Add Yen Downers on any little Rallies.

Yen Downers List:

ETFs

YCS

ETF Options

FXY Put options << my preferred method

YCS Call options

Futures

Short JY

Buy JY Put options

Good Luck !!!!!!!!

new 2014 Weekly Calendar has been posted

for you Seasonal Stock Traders (Weekly and Monthly)

2014 Weekly Calendar

Enjoy !!!

.

15 Hand-Picked Charts to Help You See What's Coming in the Markets

Everyone uses gas: See this chart that shows why its price is heading lower

by Elliott Wave International

Have you ever seen price charts that tell a story clearly?

Here is a perfect example from Robert Prechter's most recent monthly publication, The Elliott Wave Theorist. Read more.

WoW! . . . most of my Week-50 Picks from this past weekend are exploding today.

Make sure you get to see these Stock Picks !!

hopefully everyone is Profiting handsomely from my FXY-put and JDSU-call option recommendations !!

Blashing.com sure makes us money!

Blashing.com

The moving average is a technical indicator which has stood the test of time. It's been 27 years since Robert Prechter described this vital tool in his famous essay, "What a Trader Really Needs to be Successful." What he said then remains true today:

"A simple 10-day moving average of the daily advance-decline net, probably the first indicator a stock market technician learns, can be used as a trading tool, if objectively defined rules are created for its use."

also Buying JDSU Call options.

short the Yen ..OR .. Buy FXY Put options !!

thanks! . . great to hear from you.

Very happy to see you are still enjoying your lifetime membership.

good memories my friend.

God Bless,

GREAT JOB JOHN........

KEEP UP THE GOOD WORK ..........JAKE

WoW! .. they continue to move higher all week!

Blashing.com

.

WoW! . . every single stock pick from this weekend is exploding higher today!

http://www.blashing.com/

Enjoy!

I hope you all took my Stock Picks from this past weekend.

Lots of great! Big winners.

I will post on them this weekend.

Blashing.com Members get stock picks every weekend.

I am looking back on my Blashing.com picks over the past year

in order to update my Stock Pick History Performance charts . . .

and I run across quite a number of charts (stock picks) like this:

sweet !!!!

OT: WoW! .. Alistair Begg is awesome!

I listen to him every morning on the radio HERE.

Often has me in tears.

a Little More Down this past week as I predicted last weekend . . .

our October Monthly Seasonal Stock Picks have been Up, though !!

yep . . the recent Down has come

as I predicted HERE.

I will post my coming predictions over the weekend.

Today is 1/2 way through the cycle ![]() should be interesting to watch..

should be interesting to watch..

A mid-week update was posted this morning (BMO)

for Blashing.com Members at the website.

Enjoy !!

Thanks!! LoL!, what a small world . . .

I am originally from Florida.

Born and raised in Miami, graduated college then moved to Tampa . . .

before moving all around the country as an adult.

Take Care.

Sounds good my friend - moved from the Cleveland area last year - I don't miss the snow in lake county one bit ![]()

Loving Florida more and more... Good luck with your move stay safe...

yep .. thanks! gixxer . . .

1 - I post more on SiliconInvestor now ... here is my post about today's move .. YESTERDAY: http://www.siliconinvestor.com/readmsg.aspx?msgid=29065739

2 - I have been REAL busy with my pending move from D.C. to Cleveland for business purposes. Was out for a while with wife finding a house to Buy and have been gathering my monies together (not opening new positions).

I'll be light a bit longer around here . . then will come back full-force once I get settled in Cleveland.

Good Luck !!!

We're ya been blash ? Usually your on top of these moves :)

Flat (Up/Down slightly) tomorrow and then Down next week.

Nice calls! What are your thoughts on the broad markets?

WoW! . . this week has been fantastic for Trading Seasonal Stock picks . . .

every single one of the Weekly Seasonal Stock Picks are doing excellent!

ALLT and TXT started their week-29 (next week) move yesterday . . .

exploding higher in anticipation.

The other Week-29 HOT picks Dipped and are gurgling higher .. ready to blast.

This is why I always like Buying stocks during the Week or Month before their Seasonal period.

I will begin posting my Stock Commentary and Picks on my home page

@ BLASHING.com

Here is the first one from this past weekend:

http://www.blashing.com/390/390/

.

Enjoy !!

NO Signals today . . but rather each of those possibilities

are making themselves stronger for the near future.

my Short-Term Day-Trading Commentary for today . . .

AAPL - Apple should Open slightly Up ...

but I then look for it to ultimately Drop some today.

I would love to see it Drop to 420 .. a Major Buy Signal then!

CRM - SalesForce should Open slightly Down

a little bit of a Drop and then a rise

makes me want to Buy Call options

IOC - InterOil should Open near unchanged ...

a little bit of a Drop and then a rise makes me want to Buy Call options

Sold SCTY 37.5 Calls @ 130 . . .

got a little Greedy near the top of 150 or so,

but still happy with well over 50% Profits.

This board is dedicated to Buying Low And Selling High (BLASH)

... with a concentration on Seasonal Stocks and the short-term Trading of stocks given by our proprietary stocks scans.

This is connected to our subscription website Blashing.com

... where we Buy Low And Sell High stocks with Seasonality every week!

... where we Buy stocks just before their Big runs by using our proprietary stock scans!

It's a pretty steady, stable, and profitable method by just following our simple Trading Techniques.

We will focus on stocks and on options of a stock or index with Seasonality or a great Technical Analysis setup.

Go to our Blashing.com website if you are interested in using either of our services.

The Members Only areas have our Highlighted Stocks and/or Charts with Commentary.It is very important to me to be open with everyone.

I do not try to hide anything or trick anyone into subscribing.

You can read all of my posts and see what I am doing in real life.

The numerous subscribers that also read this board also act as verification of what I post.

I make the bulk of my money from developing software for various commercial and government entities ...

then I make the next chunk of my money from my own trading stocks/options ...

then I make some extra money from subscriptions to Blashing.com that pay for my tools of trading and developing software.

It is most important to me to help others ...

I have been so Blessed in my life that I want to share with others.

Good Luck & Prosperity !!

... and always remember:

So do not worry, saying, 'What shall we eat?' or 'What shall we drink?' or 'What shall we wear?'

For the pagans run after all these things, and your heavenly Father knows that you need them.

But seek first His kingdom and his righteousness, and all these things will be given to you as well.

Matthew 6:31-33

Jesus ... I AM

Saved by His Amazing Grace

Sustained by His Unequaled Mercy

Blown away by His Never Ending Love!

Jesus Loves you!

Ask me how you can know His Love.

AWESOME! Seasonal Tools and Scans .

Click for FREE News Feed .

LEARN! How to Trade through Technical Analysis .

DISCLAIMER

All materials posted on this board are for informational purposes only and in no way should be taken as a recommendation to purchase or sell any of the securities mentioned. Stocks rise and fall due to the normal fluctuations of the market, as well as in accordance with unforeseen events and news announcements. Any investments made in any of the securities mentioned on this board are the sole liability of the investor. Posters on this board accept no liability whatsoever for any loss arising from any use of any contents on it.

Any poster on this board, including the moderator, may have his/her own methods for buying and selling. Just because they list a stock or an entry price does not mean that they will post a time to exit. Exit criteria may, and probably will, differ for each poster/reader and even if you buy on the same day and/or at the same price, it does not mean that you will exit on the same day and/or price. A poster of entry criteria is not requred to post exit criteria and if you enter a position posted, you may not know the same exit criteria as the original poster. Furthermore, even if the original poster does post his/her exit criteria, he/she is not required to follow his/her own advice should he/she later decide to sell based on different criteria than originally posted.

The bottom line is that no matter where an investor gets his/her entry criteria or reasons for entering a stock position, it is the investor's responsibility to define his/her own exit criteria and he/she alone is responsible for any profits or losses on that investment.

And finally, the moderator(s) of this board accept no liability whatsoever for any loss arising from any use of any contents on this board. The moderator(s) are not a broker nor an investment advisor.

The sole purpose of this board is to publish filtered output that meet certain criteria representing characteristics associated with the described trading strategies. If you buy or sell any stock listed here solely because it appears on this board, you may lose money. Individual traders must do their homework and analyze featured stocks to determine if they represent a profit opportunity. It is solely the trader's responsibility to make proper execution choices. The moderator(s) of this board hold no positions in any stocks listed at the time of initial posting, nor receive any financial incentive for their display. They do, however, reserve the right to enter a position in a stock after its initial posting. The moderator(s) of this board do not, nor has have they ever, received payment of any kind for posting stocks on this board.

.

investorshub.advfn.com/images/emoticonXX.gif

01 - ![]() 02 -

02 - ![]()

03 - ![]() 04 -

04 - ![]()

05 - ![]() 06 -

06 - ![]()

07 - ![]() 08 -

08 - ![]()

10 - ![]() 11 -

11 - ![]()

12 - ![]() 13 -

13 - ![]()

16 - ![]() 18 -

18 - ![]()

19 - ![]() 20 -

20 - ![]()

24 - ![]() 25 -

25 - ![]()

26 - ![]() 28 -

28 - ![]()

29 - ![]() 30 -

30 - ![]()

31 - ![]() 32 -

32 - ![]()

33 - ![]() 34 -

34 - ![]()

38 - ![]() 39 -

39 - ![]()

40 - ![]() 41 -

41 - ![]()

43 - ![]() 44 -

44 - ![]()

46 - ![]() 47 -

47 - ![]()

48 - ![]()

09 - ![]() 14 -

14 - ![]() 15 -

15 - ![]()

17 - ![]() 21 -

21 - ![]() 22 -

22 - ![]()

23 - ![]() 27 -

27 - ![]() 35 -

35 - ![]()

36 - ![]() 37 -

37 - ![]() 42 -

42 - ![]()

45 - ![]() 49 -

49 - ![]()

To follow all of my posts on all of my boards . . .

please remember to Member Mark (Follow) Blasher in order to have my posts highlighted for you.

Thanks !!!

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |