Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

I swear, I can never make a good move. NOW this stock is being destroyed, for no apparent reason! One day, I'll make one good decision.

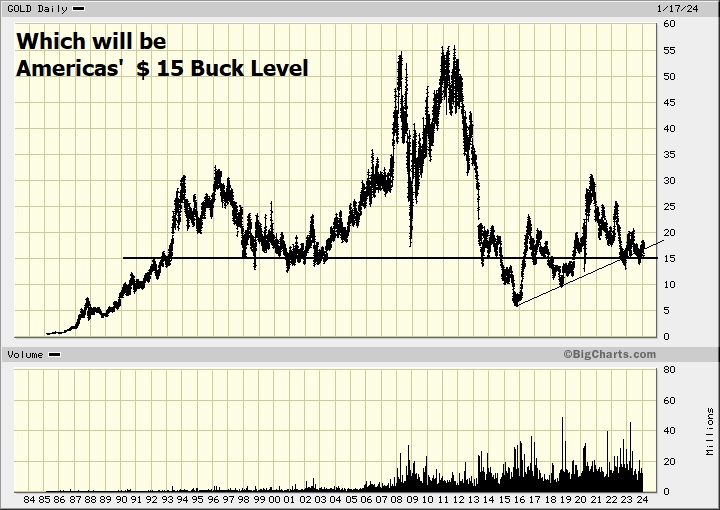

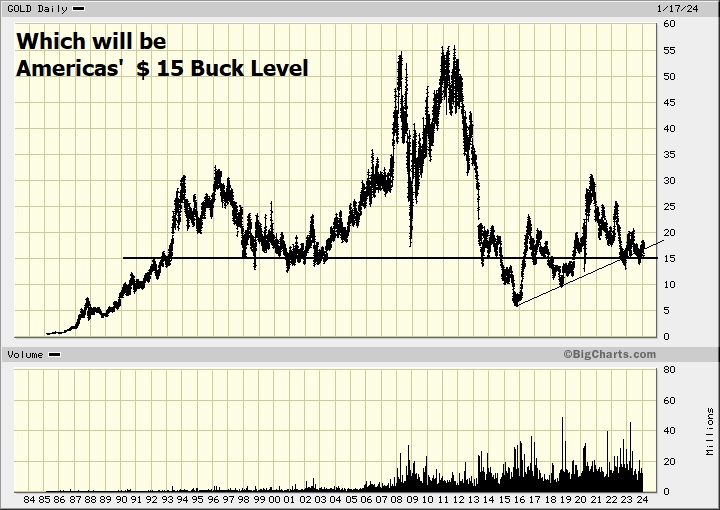

15 ish may show, in 5 years from now when Barrick cracks 100 bucks, to have been the bottom of a huge 5+ year bull market in the now hated gold miners. .....boasting a 7 percent dividend and wild capital gains. The world is gonna change, there is no question about that. The financial markets are living in the past. As if they can defy the debt and the change that must ensue. This guy sees the future.

THANK YOU for all of the info!!!!!

i bought around another 25,000 shares of barrick this a.m.....here is a nice article on why is it much cheaper than AEM....

https://www.pgpf.org/blog/2022/07/national-debt-could-be-over-twice-the-size-of-the-economy-in-just-30-years

--------------

Dividends Analysis

Barrick Gold Vs. Agnico Eagle Mines: Only One Of These Is A Strong Buy

Dec. 23, 2023 7:15 AM ETBarrick Gold Corporation (GOLD) Stock, AEM Stock, ABX:CA Stock, AEM:CA StockGDX, NEM, NGT:CA129 Comments

Samuel Smith profile picture

Samuel Smith

Investing Group Leader

About this article

Ticker

Analyst rating

STRONG BUY

Price at publication

$18.31

Last price

$15.68

Change since publication

-14.39%

S&P 500 change since publication

3.44%

Days since publication

39

Summary

Barrick Gold and Agnico Eagle Mines are leading gold miners with strong balance sheets and diversified asset portfolios.

While we are bullish on the long-term outlook for gold, we think only one of these miners is a Strong Buy at the moment.

We compare them side-by-side and offer our take on which is the better buy right now.

I am Samuel Smith, Vice President of Leonberg Capital. I lead the investing group High Yield Investor where we do our best to find the right balance between safety, growth, yield, and value.

Stack of gold bars

brightstars

Barrick Gold Corporation (NYSE:GOLD) and Agnico Eagle Mines Limited (NYSE:AEM) are leading blue-chip gold miners (GDX) with decent dividends and promising growth profiles alongside high-quality asset portfolios and strong balance sheets. In this article, we will compare them side by side and offer our take on which one is a Strong Buy right now.

GOLD Stock Vs. AEM Stock: Asset Portfolios

Agnico Eagle is the third-largest gold miner in the world, with a strong presence in low geopolitical risk geographies such as Canada, Mexico, Finland, and Australia. The company's portfolio includes five main assets: Detour Lake, Canadian Malartic, Meadowbank, Meliadine, and Fosterville. These mines contribute significantly to Agnico's annual production of 3.1 million ounces of gold, along with minor production of copper, zinc, and silver. That being said, the company's overall portfolio contains both low-cost and higher-cost mines, resulting in an average all-in-sustaining cost (AISC) of USD $1,100 per ounce in 2022.

AEM's portfolio growth has been notable over the years, expanding from one operating mine in 2008 to 11 by 2022, including the addition of high-grade, low-cost mines through its recent merger with Kirkland Lake Gold. However, recently, the company's return on invested capital has fallen below its weighted average cost of capital, indicating challenges in generating sustainable economic returns. Agnico's strategic focus on the Abitibi region, along with developments like Hope Bay and Hammond Reef projects, aims to increase production, but cost management and capital efficiency remain critical for long-term success.

Meanwhile, Barrick Gold ranks one spot ahead of AEM as the world's second-largest gold miner, with operations in more geographically diverse and geopolitically risky regions, including the Americas, Africa, the Middle East, and Asia. The acquisition of Randgold in 2019 and the formation of Nevada Gold Mines ("NGM") in a joint venture with Newmont (NEM) were significant steps in its expansion and increased focus on what it calls "tier 1" mines in a strong move to improve production quality and efficiency. NGM exemplifies the company's emphasis on cost reduction through its operational synergies. However, despite the quality of its assets, GOLD's significant presence in higher geopolitical risk areas poses lingering risks to the company's bottom line despite its efforts to adhere to high environmental standards and contribute to local communities at all of its operations.

Like AEM, GOLD's asset base is diversified across both low-cost and higher-cost mines, leading to an average AISC of USD $1,200 per ounce in 2022. Barrick's growth prospects include expanding production at the NGM joint venture, Pueblo Viejo mine, and Lumwana copper mine, with potential developments like Fourmile and Reko Diq promising substantial increases in production (including a large increase in copper production) in the years to come.

Despite their diversified portfolios, both companies face similar challenges in generating returns above their cost of capital. Agnico Eagle's focus on lower-risk areas is a strategic advantage, but its portfolio's cost structure and return metrics suggest a need for improved efficiency. Barrick's diversified global presence, coupled with strategic joint ventures like NGM, highlights its scale and operational synergies. However, Barrick also grapples with balancing its portfolio's costs and maximizing returns on invested capital while also dealing with higher geopolitical risks.

Both companies are focusing on optimizing existing operations and expanding through strategic organic projects whenever possible instead of pursuing expensive acquisitions such as their peer Newmont recently did through its acquisition of Newcrest. Agnico Eagle's attention to the Abitibi region and its expansion through mergers and acquisitions highlight its growth-oriented approach. In contrast, Barrick's emphasis on organic growth, as seen in developments like Fourmile and Reko Diq, suggests a long-term view aimed at leveraging existing infrastructure and maximizing resource potential.

GOLD Stock Vs. AEM Stock: Balance Sheets

Both Barrick Gold and Agnico Eagle Mines Limited have solid balance sheets. Barrick Gold has a strong liquidity profile (with billions of dollars in cash and undrawn liquidity on its credit line), an investment-grade credit rating, and basically zero net debt. Moreover, it also consistently generates free cash flow from its operations, giving it a steady stream of cash combined with existing balance sheet liquidity to pay a nice dividend to shareholders, buy back shares opportunistically, and also be positioned to make other opportunistic growth investments that align with its overall corporate strategy and long-term vision.

Agnico Eagle Mines also has a strong balance sheet with a very manageable amount of debt and also has plenty of liquidity and consistently generates free cash flow. Moreover, its less geopolitical risk than Barrick puts less potential stress on its balance sheet should a worst-case scenario play out for either company.

As the chart below shows, GOLD has come a long way in reducing its debt burden over the years whereas AEM has had consistently low debt levels.

Chart

Data by YCharts

GOLD Stock Vs. AEM Stock: Growth Profiles

Barrick Gold plans to double its copper production by the end of the decade and increase it further to an estimated 1 billion pounds or 450,000 tonnes per annum by 2031. The Reko Diq project in Pakistan and the Lumwana Super Pit Expansion are two critical projects that will help achieve this growth. When at full production, Reko Diq is expected to be among the world's top 10 copper mines, while the Lumwana Super Pit Expansion is expected to deliver up to 240,000 tonnes of copper per year.

Barrick's gold growth initiatives are expected to increase the company's production by around 30% to 6.8 million gold-equivalent ounces by 2031. The company is also exploring the high-grade opportunity at Horsham in the Carlin District and multi-million-ounce potential growth opportunities at Turquoise Ridge.

Agnico Eagle aims to expand its mill at Detour beyond 28Mtpa and conduct a study for an underground component, combining to potentially contribute around 300koz pa to production. Meanwhile, the Canadian Malartic Complex is progressing with the Odyssey development and evaluating exploration opportunities. Agnico Eagle has partnered with Teck Resources in a 50/50 joint venture for the San Nicolás copper-zinc project in Zacatecas, Mexico. The San Nicolás project is one of the largest undeveloped volcanic-hosted massive sulfide deposits globally and is expected to produce 63 thousand tonnes per annum of copper and 147 ktpa of zinc in concentrate over its initial five years.

In addition to both GOLD's and AEM's production growth initiatives, we are bullish on the long-term outlook for both copper and gold prices. We expect factors such as accelerating central bank purchases of gold, escalating geopolitical tensions, and the likelihood of Federal Reserve interest rate cuts next year to drive gold prices meaningfully higher. Moreover, Goldman Sachs has predicted a significant jump in copper prices in the coming years due to an existing supply deficit and strong anticipated demand growth, particularly from electrification and electric vehicle growth.

Combining strong production volume growth potential with favorable price outlooks for the underlying metals produced gives both businesses a substantial long-term growth outlook. Production costs will also have a significant impact on profitability levels, though increased robotics and artificial intelligence technologies should help provide some deflationary relief on that side of the profitability equation as well (and some already is via increased digitization of mining operations and the growing use of autonomous trucks at some mining sites), though it may be several years before any noticeable impact is felt.

GOLD Stock Vs. AEM Stock: Valuations

On a head-to-head basis, GOLD is more attractively priced than AEM. GOLD's Price to Net Asset Value (P/NAV) ratio stands at 1.04x, indicating that its stock is trading near its net asset value. In contrast, AEM's P/NAV ratio is significantly higher at 1.48x, indicating that its stock is priced at a premium relative to its net assets.

On an EV/EBITDA basis, GOLD is trading at just 6.05x, which is significantly lower than AEM's 8.19x. This lower ratio for GOLD implies a more attractive valuation in terms of operational earnings. Furthermore, GOLD's NTM Price-to-earnings (P/E) ratio of 16.78x is substantially lower than AEM's 28.51x, which further highlights that investors are paying a higher price for AEM's earnings compared to GOLD's. In terms of free cash flow generation, the Price to Free Cash Flow (P/FCF) ratio for GOLD is 20.42x, compared to AEM's higher 24.91x, further reinforcing the narrative that GOLD is cheaper than AEM.

Both offer pretty attractive dividend yields by gold mining industry standards (north of 2%), with AEM paying out a stable quarterly dividend that has grown over time:

Chart

Data by YCharts

Meanwhile, GOLD has a variable rate dividend payout policy based on the amount of cash on hand at the end of each quarter. While not as attractive as a fixed policy like AEM's, GOLD's policy gives it much more capital allocation flexibility and also enables management to buy back stock aggressively whenever it is opportunistic to do so without compromising its balance sheet strength. Given the nature of the mining industry, we think that GOLD's dividend policy actually makes more sense.

After comparing them across the spectrum of major valuation metrics, we can confidently conclude that GOLD stock is far less expensive than AEM at the moment, and we also think that its dividend/buyback/capital allocation policy makes more sense for the gold mining business model than AEM's does.

GOLD Stocks Vs. AEM Stock: Investor Takeaway

Both GOLD and AEM are blue-chip stocks, and - given our bullish long-term outlook on gold and copper - we think both are reasonable, if not attractive, investments right now. While AEM has the edge in terms of lower geopolitical risk in its locations, GOLD is larger, has a stronger balance sheet at the moment, and also has more promising growth potential in copper.

Last but not least, GOLD's stock price is far cheaper than AEM's. As a result, we rate Barrick Gold Corporation a Strong Buy and rate Agnico Eagle Mines Limited a Buy.

This article was written by

Samuel Smith profile picture

Samuel Smith

28.84K Followers

Samuel Smith is Vice President of Leonberg Capital,

don't sell, add. This little rangebound thing is coming to an end. they always do. this stock is a double in 1 year to 18 months.

All you need to do is look at the big picture, which is U.S. debt now going parabolic. while they have indeed cut liquidity, on the fiscal side we are going in debt by trillions per year due to government spending.......and it will get far worse than any of these projections which are horrendous already....

remember, we are now like a new born argentina where today they have 200 percent annual inflation. we will catch up.

https://www.pgpf.org/blog/2022/07/national-debt-could-be-over-twice-the-size-of-the-economy-in-just-30-years

rossy beaty interview yesterday, pounding the table... he says this bull is very soon to kick off, that it must. He will not always be wrong....

Pierre Lassonde in this and more recent interviews says the miners are the most pricing in his lifetime.

this will change.

when the POG breaks upwards which should be any day now, people will start to see how much money gold companies can make. Investors will start to do some calculations about how much barrack for instance, will make with POG at 2500, with the divi being raised....Bull Markets tend to turn slowly from Bear, and the miners are as cheap as they have ever been since the mid 1970s, cheaper than even year 2000/2001. We are very close now.

barrack is cheapest by far of the 3 majors, all of which will perform extremely well the next 5 years. This stock reminds me of X, u.,s. steel that languished around 22 bucks for about 3 years and then boom, in about 8 months it exploded to 48 and was bought out....

Bought this over a month ago and now 10% down, but gold is still at the same value. Can I expect this to go back up or is this the way it works. Truly thought this would follow gold or even better....

u speak for who??? u want a following, i could care less, this will be my last post on the subject.

lol. Ok u think what u want.

Fair enough but can not help but wonder - Why would THIS be ?.......

Since, me, I AM (evidently ?) here to share.......

I have many tools i have used over the years, im here to make money, not show anyone my tools.

like i said many times to you, i dont use your analysis, never will, its good and wont criticize it. I have many tools i have used over the years, im here to make money, not show anyone my tools.

Yeah but I don't see anyone puttin' up any kind of analysis.....

Especially weedtrader- It's all simply "bluster".

Why's all this happening also too (there's no one with any ideas)......

Everyone's just simply just using their PHONES !.........All too lazy to do any WORK

Requiring ME to come along and clear eveything up (make everything crystal clear).

I've had my eyes on OUR $ 20 Level for an awfully long time......(something like 22 years)

Bitcoin !.......Bitcoin !.......Woooo-Wooo-Woooo !

* All just poking FUN at "ya'll" !.........hahaha - Relax.

.

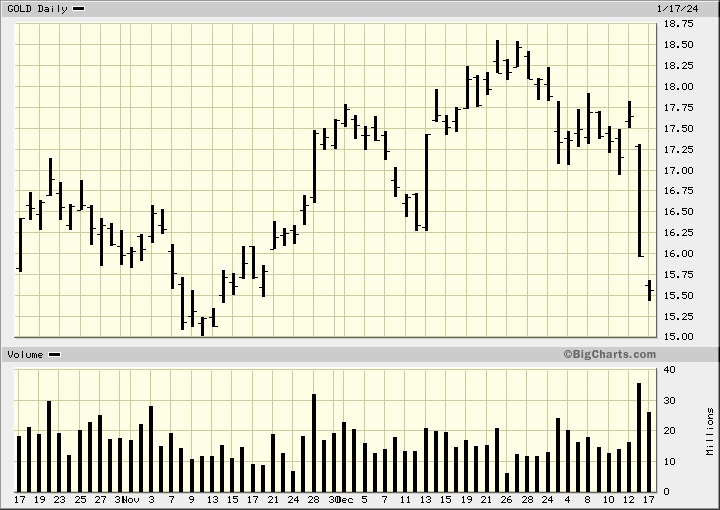

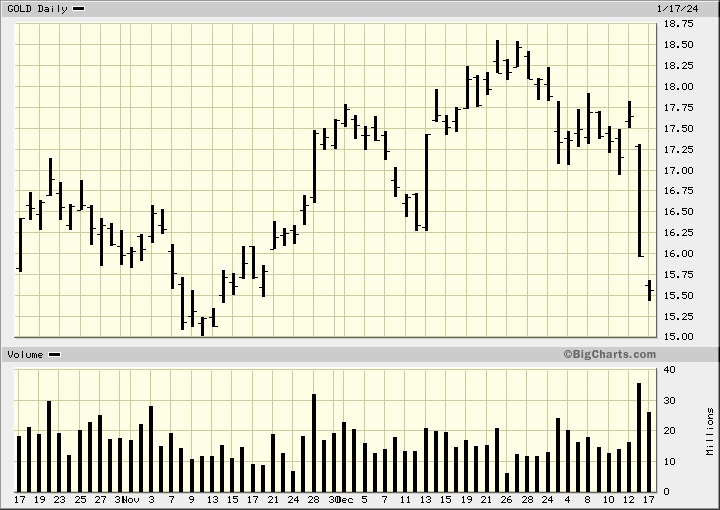

Getting ready to catch the bounce

Bought on Friday, Barron's top pick......Downgraded today.....I SUCK at this!

Surferr 44,

"Donlin Gold Project

Novagold's Donlin Gold project, which the company owns equally with Barrick, is a Tier One gold development project. The project boasts approximately 39 million ounces of gold with an impressive grade for an open pit project of 2.24 grams per tonne in Measured and Indicated Mineral Resources including Proven and Probable Mineral Reserves, and a projected mine life over 27 years. The project is located on private land designated by law for mining in Alaska, making it an extremely appealing investment for those seeking peace of mind."

Boing X 2

Could be a buy out here for $24 to $26 a share GOLD💫💪😎💵💵💵💵💵

GOLD 911 I want to report a robbery 😤

GOLD$ Is worth $23 a share trading near $14 a share, this is ridiculous. barrick gold needs a new owner.

Gold Off One-Month Lows As U.S. Dollar, Yields Retreat

PUBLISHED WED, AUG 9 2023

CNBC

On display at Agosi AG in Pforzheim is a gold bar that weighs 12.5 kilograms (400 ounces), has a fine gold content of 99.99 percent and lies on gold granules.

Uli Deck | Picture Alliance | Getty Images

Gold prices bounced back on Wednesday from one-month lows hit in the previous session, as the dollar and bond yields weakened a day ahead of the release of U.S. consumer price data that could build the case for or against further interest rates hikes.

Spot gold was up 0.1% at $1,926.09 per ounce, having dropped to its lowest since July 10 at $1,922 on Tuesday. U.S. gold futures was flat at $1,960.

“For a sustained recovery (in gold), we believe the market will need to see increased certainty on 2024 U.S. rate cuts,” said Baden Moore, head of carbon and commodity strategy at National Australia Bank.

“We continue to be cautious on the outlook here as Fed rate-cut expectations continue to face risks of deferral or reduction,” Moore said, adding that U.S. CPI, initial jobless claims and ISM data were key market indicators in focus along with China stimulus.

Data earlier showed China’s consumer prices fell into deflation in July as the world’s second-largest economy struggled to revive demand and pressure mounted on authorities to release more direct stimulus.

Gold, which is usually seen as a hedge against economic risks, was also supported by renewed worries about the health of the world’s largest economy after ratings agency Moody’s downgraded several U.S. lenders.

Longer-dated U.S. Treasury yields fell in response, making non-interest-bearing bullion more attractive. The dollar index was also off Tuesday’s high, down 0.2%.

“With safe-haven flows remaining elusive, the precious metal will be relying on a dip from the U.S. dollar if it is to mount a move to the upside,” Tim Waterer, chief market analyst at KCM Trade, said in a note.

TRUISM

Gold Rate Today: Prices Recover On Slowing US Jobs Growth, Trade Near $1940 Per Ounce

MONEYCONTROL NEWS-AUGUST 07, 2023

LINK

Market participants are now closely watching the US CPI data, a significant gauge of inflationary pressures. Fluctuations in CPI often correlate with changes in gold prices as the precious metal is often sought after as a hedge against inflation. Investors are also looking forward to the release of inflation and trade data from China

The lower-than-expected economic data prompted investors to turn to the safe-haven metal.

Gold kicked off the new week on a positive note, surpassing the $1940 an ounce mark. The uptick came on the back of the dollar's strong performance, which rose after the US added 187,000 jobs in July, slightly below the estimated 200,000.

The lower-than-expected economic data prompted investors to turn to the safe-haven metal. Moreover, this ascent follows a one percent dip in gold prices the previous week.

Moving forward, market participants are now closely watching the US consumer price index (CPI) data, a significant gauge of inflationary pressures. Fluctuations in CPI often correlate with changes in gold prices as the precious metal is often sought after as a hedge against inflation.

Investors are also looking forward to the release of inflation and trade data from China.

Latest Gold Prices:

The latest Mumbai Gold Rate on August 7 is as follows:

The 24-carat 999 gold bar of 10 grams is trading at Rs 5,940. On the other hand, the 22-carat gold rate for a 10-gm piece of jewellery stands at Rs 5,680, while the rate for an 18-carat jewellery item is Rs 4,680. These prices have been sourced from Shree MumbaDevi Dagina Bazaar Association, and do not include a 3 per cent Goods and Services Tax (GST).

TRUISM

BARRICK GOLD is so cheap Compared to the price of gold

BARRICK GOLD is so cheap Compared to the price of gold

$GOLD: $20 GOLD calls are hot....... 3/24 expiration

WOW.............. these are gonna boost even higher

Now at $0.07

GET SOME

GO $GOLD

Found some gold,

https://finance.yahoo.com/news/donlin-gold-announces-final-assay-221000274.html

Boing X 2

Technically, with a still declining dollar, this is setting up nicely…

2023 could be huge for Barrick Gold. GOLD price weekly close above $1820 and a GOLD trigger faster move $2000 direction imho. Gold miner whal like Barrick very undervalued based then. Massiv upward potential for 2023/24 in my eyes.

This is huge for Barrick.

Barrick win,

"Pakistan's Supreme Court endorsed on Friday a settlement for Barrick Gold to resume mining at the Reko Diq project, one of the world's largest underdeveloped sites of copper and gold deposits, it said in an order."

Boing X 2

GOLD will probably have 200% 300% potential in the next 2 years. Until then, hold a large position and collect a good dividend. A win win situation for me. Barrick has great potential and the gold price could develop very positively over the next few months. The market situation speaks for it. Barrick won't be around as cheap as it is now for much longer.

|

Followers

|

62

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

527

|

|

Created

|

08/04/11

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |