Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

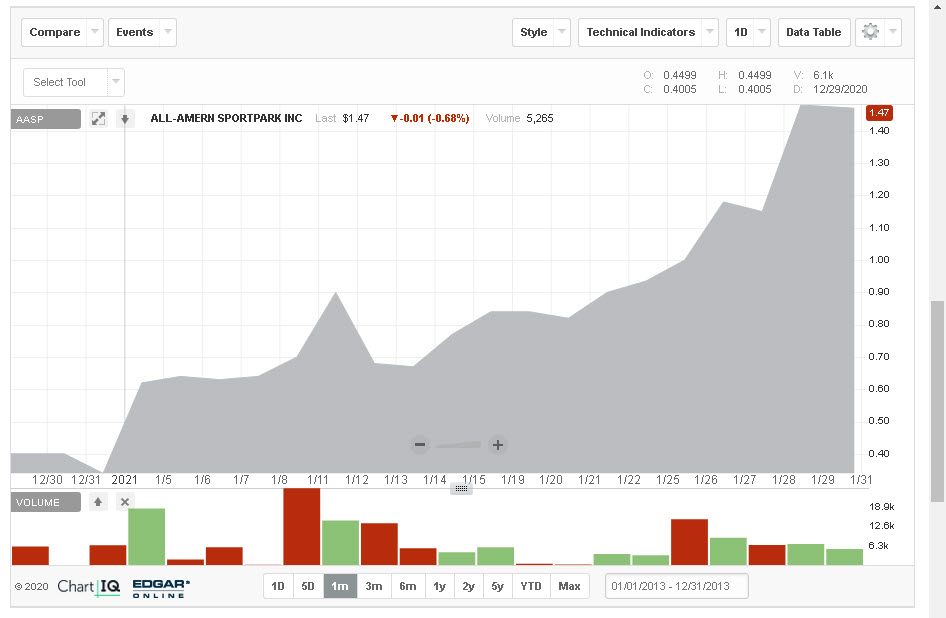

Highest activity for some time this week and curiously high close.

This thing looks dead. No news or activity. Anyone know of anything happening?

I see there's been quite a bit of activity this week after months of

inertia. Interesting?

Anyone heard any updates for this thing? It seems like it's been crickets.

So is this thing dead? The dream over?

Some strange buys today. Not sure why 2500 is the magic number.

Seems there has been a lot of 2,500 blocks being bought over the last couple weeks. No clue what that means but thought it was odd.

$AASP - This one has been dormant for some time.....Seems to be percolating and coming to life the last couple of weeks.

I thought something was going to happen in Jan 2021 - so it's been a little bit of a wait.

Let's hope management has been holding out for a great deal!

What a well informed take! Thanks for the warning!

This company in huge debt. Will probably file for Chapter 7 next. WW3 coming. RUSSIA ATTACKING UKRAINE AND CHINA LOOKING TO ATTACK TAIWAN...

Just here waiting like the rest of us.... nice to see volume this week.

Maybe some news soon…..

Some actual volume this week. Maybe something is happening. Anyone still here?

Some actual volume this week. Maybe something is happening. Anyone still here?

Well at least I will owe less in taxes if this stock ever does anything now since ive owned it a year.

$AASP - November/December would be a good time to get a deal done imo....start out 2022 with a fresh new company!

(SPEA reverse merger with CKXE happened on Dec 16, 2004).

That would be nice! Hope this is it !

Complete guess on my part, but I like the lead investors on this:

https://www.crunchbase.com/organization/viagogo/company_financials

Would be nice if they followed the SPAC lead that Vivid Seats just announced.

$AASP - Always good to see a timely filing!

9/30/21 10-Q has been filed.

No idea just holding and waiting. Wish they would give some sort of update.

No news just people selling shares. Still HODL

A good day but I would feel better about it if we had some news!

You said it what the hell is going on here??

$AASP - Yes, Sir!! But, I can understand people losing patience.

I think most of us thought something was going to be finalized back in January/February of this year.....

It's the best candidate for a Reverse Merger that I've seen with no real liabilities (other than related party loans), no legal issues and a low # of shs outstanding.

jmho

Gotta love the crash on 300 shares traded. Someone wanted it lower.

I thought the same. Thats a lot to spend on an empty shell...

I hope the buyer keeps up the energy!

Another 10,800 share order at $1.80 today. I love this stock more than just about anyone and I’m not dropping $19k at that price with what I know. So maybe someone knows more.

Yea someone spent $57k and $33k on shares this week. Hopefully that person knows something the rest of us don't.

Interesting volume this week.... Big dollar buys definitely seem like something is happening.

The authorized shares has never been updated on OTC markets. Still shows 10m. Think we are waiting on something to happen there?

I feel like we are so close to some big news! Lets hope it is soon!

Guess we aren’t gonna figure out why someone was in such a hurry to buy them shares Monday. Maybe next week.

Big news soon!!!!…..I hope been in this for a while.

Yeah looking really good. I've been holding this forever. Just patiently waiting for some type of big announcement.

Highest volume day for AASP on 2021 so far. Did someone just drop almost $40k on it this morning on hopes and dreams like us or do they know something we don’t.

$AASP - Very nice!! And very thin on the way to $2.00+ imo

That was a big buy. Maybe somebody knows something.

Stock is up 56% with 200 share volume. Imagine how it will fly if we get some good news.

AASP - Pretty strong bid!

Level II

Bid: CSTI - 1,000 shs @ $.88; CDEL - 10,700 shs @ $.87

Ask: CSTI - 100 shs @ $1.10; ETRF - 4,000 shs @ $1.42

|

Followers

|

78

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

4044

|

|

Created

|

05/10/05

|

Type

|

Free

|

| Moderators | |||

12/15/2004 - SPEA traded at $0.10

12/16/2004 - pre-market, SPEA announces that they entered a definitive agreement to acquire a majority interest in the assets comprising the estate of Elvis Presley. Stock opens at $0.37, trades as high as $7.50, closes at $6.41 on volume of 1,339,073.

12/17/2004 - stock opens at $6.44, trades as high as $11.20, closes at $9.10 on volume of 1,705,667.

02/17/2005 - traded as high as $23.40, volume of 158,400.

03/01/2005 - symbol changed to CKXE, listed on NASDAQ.

03/17/2005 - acquires "American Idol" TV show.

05/09/2005 - traded at high of $30.65, volume 57,100.

07/13/2005 - CKXE added To Russell 1000(R) Index.

08/05/2005 - AP Article about company.

04/11/2006 - acquired 80% interest in the name, image, likeness and all other rights of publicity of Muhammad Ali.

This is a news release from 2004 showing some similarities of whats going on with AASP right now.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |