Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Aemetis Approved by USCIS for $200 million of EB-5 Investment in Biogas, SAF and Carbon Sequestration Projects

"Ya this one was my bad. I thought it was a post about verb."

Yes, it was bad, just like your DD and scamming techniques.

![]()

Ya this one was my bad. I thought it was a post about verb. Don't worry there are plenty of hilariously wrong and scammy verb posts I can bump instead.

Hey Speedy Gonzalez, you missed it back in November 2021. You do know this is 2024, right?

Hey Speedy Gonzalez, you missed it back in November 2021. You do know it is 2024, right?

Loool, short squeeze? More scam talk by the booty boi

Correction November 9th, 11am PST

RIP and Dip $7.47 x $5.01

D3 RINS, California LCFS and RNG, all government credits used as revenue.

This is tax payers money marked as revenue being generated.

This company has negative earnings.

Government, woke agenda mutual funds and short covering keeping this company stock price up.

Good short @ 4.40

Should be trading under $1

Aemetis, Inc. is a rapidly expanding renewable natural gas company and operates ethanol and biodiesel refineries. Aemetis is currently building a dairy biogas system that will capture methane from nearby dairy farms in California and then transport the methane by pipeline to its Keyes facility. At the Keyes facility the methane can be compressed and cleaned to produce Renewable Natural Gas. Aemetis expects to build 5 new biogas dairies each two quarters for the next five years for a total of 66 dairies. Importantly, each dairy has 35-year contracts, should produce $2.5M average revenue per dairy per year. Aemetis ethanol plant in Keyes, CA produces 65M gallons of ethanol per year in addition to animal feed. It also operates a biodiesel plant on the East Coast of India that can produce 50M gallons per year of distilled biodiesel and refined glycerin. The Company was founded in 2006 by biofuels veteran, Eric McAfee, and is headquartered in Cupertino, CA.

CUPERTINO, CA, Nov. 16, 2022 (GLOBE NEWSWIRE) -- via NewMediaWire – Aemetis, Inc. (NASDAQ: AMTX), a leading producer of renewable natural gas and renewable fuels, announced today that construction has begun for the TotalEnergies and Schneider Electric solar microgrid system with at 2.0 MW photovoltaic (PV) array and a 1.25 MW battery energy storage system. Once construction has been completed, the microgrid will be integrated with the new Rockwell/Allen Bradley distributed control system (DCS) at the Aemetis Advanced Fuels biorefinery in Keyes, California.

The solar array will generate approximately 3.2 million kWh per year and reduce greenhouse gas (GHG) emissions by ~8,000 MT CO2e per year. Foundations for the solar array are now under construction, with project completion expected in the second quarter of 2023. TotalEnergies serves as the project’s PV supplier as well as the engineering, procurement, and construction (EPC) contractor.

CUPERTINO, CA, May 18, 2022 (GLOBE NEWSWIRE) -- via NewMediaWire - Aemetis, Inc. (NASDAQ: AMTX), a renewable fuels company focused on negative carbon intensity products, announced today that its Aemetis Biogas Services subsidiary has signed a six-year supply agreement with Trillium to provide an estimated 600,000 MMBtu of renewable natural gas (RNG) to be used as transportation fuel in California. The RNG replaces up to the equivalent of 4.3 million gallons of diesel fuel, primarily used in heavy duty passenger and cargo vehicles.

"Trillium's mission is to help customers meet their ESG goals, and providing RNG is a big part of that," said Ryan Erickson, vice president of Trillium. "We're excited to partner with Aemetis to use biogas to get drivers back on the road quickly and safely."

Aemetis completed Phase 1 of the Central Dairy Digester network in 2020 with two fully operational digesters and four miles of pipeline. The biogas from Phase 1 has been used as process energy at the Aemetis Keyes biorefinery to reduce the facility's dependency on petroleum-based natural gas and to decrease the carbon intensity (CI) of fuel ethanol produced.

Phase 2 of the network consists of a centralized biogas upgrading facility, a utility gas pipeline interconnection unit, 10 dairy digesters and 32 miles of additional pipeline which are planned to be completed by Q4 2022. Aemetis plans to have more than 60 digesters built and operating by the end of 2026 which are designed to produce approximately 1.6 million MMBtu of RNG per year, displacing approximately 12.5 million gallons of diesel per year.

Aemetis has completed construction and is currently commissioning the centralized gas cleanup facility and utility gas interconnect located at the Keyes Ethanol biorefinery where dairy biogas will be upgraded to RNG and injected into the utility pipeline through an interconnection with Pacific Gas and Electric. Upon receiving pathway certification from the California Air Resources Board (CARB), the fuel is scheduled to begin deliveries to Trillium in late 2022.

good moving up here everyone

Aemetis Signs Agreement with Qantas to Supply 35 Million Gallons of Sustainable Aviation Fuel

Aemetis India to Acquire Site for Biodiesel and Sustainable Aviation Fuel Feedstock Refining Facility

Aemetis Selects SunPower as Supplier and EPC for Keyes Plant Solar Microgrid, Zero Carbon Intensity Electricity Project; Schneider Electric to Supply Battery Storage and Microgrid Technology

Aemetis Completes 7-mile Pipeline to Transport Biogas from Five Dairy Digesters to RNG Production Facility

Aemetis Signs 10-Year Supply Agreement for 450 Million Gallons of Renewable Diesel with Industry-Leading Travel Stop Company

2021-10-28 08:00 ET - News Release

CTCI America to provide proven expertise and engineering services at the Aemetis Carbon Zero plant in Riverbank, California

CUPERTINO, CA, Oct. 28, 2021 (GLOBE NEWSWIRE) -- via NewMediaWire -- Aemetis, Inc. (NASDAQ: AMTX), a renewable natural gas (RNG) and renewable fuels company focused on negative carbon intensity products, announced today it entered into an agreement with engineering and construction firm CTCI America to conduct permitting and engineering work for the Carbon Zero renewable jet/diesel plant to be built in Riverbank, California. CTCI America is a subsidiary of CTCI Corp., a $2 billion revenues Engineering, Procurement and Construction firm with extensive high technology and energy industry project engineering and construction experience.

The Aemetis Carbon Zero plant is being developed at a former U.S. Army ammunition production facility. The process design uses waste wood to produce cellulosic hydrogen with a below zero carbon intensity, which is combined with renewable oils and zero carbon intensity hydroelectric electricity to produce sustainable aviation fuel (SAF) and renewable diesel. The plant will have an initial capacity of 45 million gallons per year, with engineering and other development work underway for expansion to 90 million gallons per year.

“As we complete the permitting and engineering for the Riverbank renewable jet/diesel plant, we are fortunate to have built a team of engineers and construction companies with experience in building renewable diesel plants in California,” said Eric McAfee, Chairman and CEO of Aemetis. “There are a limited number of firms with an ability to execute on large scale renewable fuels projects within California’s environmental requirements. We are pleased to be able to work with a world-class firm such as CTCI to provide engineering for permitting and construction.”

“CTCI brings extensive relevant experience to the Aemetis sustainable aviation fuel and renewable diesel plant,” stated Patrick Jameson, President of CTCI America. “We are currently the EPC constructing a renewable diesel plant in California. We look forward to working with Aemetis for engineering and construction of the Carbon Zero plant.”

Aemetis Signs Agreement with $2 Billion Global Construction Firm CTCI to Provide Engineering for its Carbon Zero Renewable Jet and Diesel Plant

GERS Receives Offer To Restart Litigation Against AMTX...

CleanTech subsequently received an opinion of counsel that its remaining seven of twelve corn oil extraction patents are clearly valid and enforceable, along with a contingency-based offer to restart the infringement litigation from scratch. We are evaluating our rights and remedies in connection with all applicable matters, and we are unable to characterize or evaluate the probability of any outcome at this time

Further, in connection with ongoing patent filings, the USPTO allowed CleanTech’s new corn oil extraction patents after considering the very information that the District Court found to have been withheld, and upon which the bulk of the District Court’s rulings were based. All of the information alleged to have been “knowingly withheld” from the USPTO in connection with the patents in suit was provided to and considered by the USPTO prior to issuance of several additional patents that are not covered by the District Court’s prior rulings (the “New Patents”). The USPTO subsequently disagreed that deception of any kind occurred when, on February 21, 2020, it issued another patent to us after reviewing the very evidence that was allegedly “withheld,” along with everything the defendants ever submitted and claimed, as well as the District Court’s 2014 and 2016 rulings – all in light of the facts that were never presented to a jury. Significantly, the new patent was allowed by the same examiner that the District Court said was deceived. In other words, the same patent examiner that was allegedly deceived looked at the purported evidence and claims of deception, and disagreed that she had ever been deceived. Thus, in issuing that patent, the examiner concluded that the inventive process was not “ready for patenting” in July 2003, that an invalidating “offer for sale” did not occur in July 2003, and that the “ready for patenting” and “offer for sale” information that the District Court determined to have been “deliberately withheld” from the USPTO was immaterial to patentability.

AMTX$19+$2.7+16% will provide Delta Airlines 250 mil gallons sustainable jet fuel. Worth over $1 billion

CUPERTINO, CA, Sept. 22, 2021 (GLOBE NEWSWIRE) -- via NewMediaWire -- Aemetis, Inc. (NASDAQ: AMTX), a renewable natural gas (RNG) and renewable fuels company focused on negative carbon intensity products, announced that Chairman and CEO Eric McAfee will provide an overview of the Aemetis low carbon intensity projects at the Advanced Biofuels Leadership Conference which will be held at Hotel Nikko in San Francisco on October 28, 2021, 9 am Pacific time.

McAfee will also serve on the “Net Zero Future” speakers panel along with other sustainable aviation fuel companies Gevo, LanzaTech, and Neste.

“The 90 million gallon per year Aemetis Carbon Zero sustainable aviation fuel and renewable diesel plant under development in two phases in Riverbank, California is designed to produce below zero carbon intensity renewable fuels by utilizing cellulosic hydrogen from waste forest and orchard wood with one million tonnes of onsite CO2 carbon sequestration capacity,” said McAfee. “We are now developing the facilities to capture and sequester the CO2 from our biogas project, our existing biofuels plant, and California oil refineries in a separate one million tonne CO2 injection well located near the Keyes ethanol plant.”

In addition, Aemetis has already built and currently operates two dairy biogas digesters, on-site dairy gas upgrading and pressurization facilities, and a four-mile biogas pipeline connecting the dairies to the Aemetis Keyes ethanol plant. The Aemetis Biogas Central Dairy Digester project has already obtained a negative 426 carbon intensity from CARB for biogas produced by Phase I. The centralized biogas cleanup and onsite RNG fueling facilities at the Keyes plant are currently under construction for completion in Q4 2021, with the planning and construction of 15 additional dairy biogas digesters in progress for completion during 2022.

When fully built out, the planned 52 dairies in the Aemetis biogas project are expected to capture more than 1.4 million MMBtu of dairy methane and reduce greenhouse gas emissions equivalent to an estimated 5.2 million metric tonnes of CO2 each year, equal to removing the emissions from approximately 1.1 million cars per year.

The Aemetis Biogas dairy RNG project, energy efficiency upgrades to the Aemetis Keyes biofuels plant, and the Aemetis Renewable Jet/Diesel project include $57 million of grant funding and other support from the US Department of Agriculture, the US Forest Service, the California Energy Commission, the California Department of Food and Agriculture, CAEATFA, and Pacific Gas and Electric’s energy efficiency program.

CUPERTINO, CA, Sept. 15, 2021 (GLOBE NEWSWIRE) -- via NewMediaWire -- Aemetis, Inc. (NASDAQ: AMTX), a renewable natural gas (RNG) and renewable fuels company focused on negative carbon intensity products, announced that its subsidiary Aemetis Biogas LLC has signed the Standard Renewable Gas Interconnection Agreement (SRGIA) with the Pacific Gas & Electric Company and funded the final $1.2 million payment for installation of PG&E’s interconnection equipment to deliver renewable natural gas (RNG) into the utility gas pipeline in Q4 2021.

The PG&E RNG interconnect equipment has already been fabricated onto modular units that are now scheduled to be delivered to the Keyes plant and installed during the next three months. When the interconnection unit is completed, the RNG produced by the Aemetis Biogas Central Diary Digester Project will be delivered into the Pacific Gas & Electric natural gas pipeline for sale to customers throughout California as transportation fuel.

“As planned, the engineering, permitting, offsite equipment fabrication, and full payment of $2.3 million to PG&E has been completed,” said Andy Foster, President of the Aemetis Biogas subsidiary of Aemetis, Inc. “PG&E manages the fabrication and installation of the interconnection system connecting the Aemetis biogas cleanup and compression facility to the gas utility pipeline. We are pleased that a significant milestone for completion of the Aemetis Biogas Central Dairy project was completed today.”

Aemetis has already built and currently operates two dairy biogas digesters, on-site dairy gas upgrading and pressurization facilities, and a four-mile biogas pipeline connecting the dairies to the Aemetis Keyes ethanol plant. The centralized biogas cleanup and onsite RNG fueling facilities at the Keyes plant are currently under construction for completion in Q4 2021, and the construction of 15 additional dairy biogas digesters are in progress for completion during 2022.

The PG&E interconnection unit is a gateway for the network of lagoon digesters being built by Aemetis Biogas to produce renewable natural gas (RNG) for use as a transportation fuel. The biogas produced by the first two dairy digesters has received an approved pathway by the California Air Resources Board (CARB) utilizing negative 426 (-426) carbon intensity (CI) and is currently used to displace petroleum based natural gas consumed at the Keyes ethanol production facility for process energy.

When fully built out, the planned 52 dairies in the Aemetis biogas project are expected to capture more than 1.4 million MMBtu of dairy methane and reduce greenhouse gas emissions equivalent to an estimated 5.2 million metric tonnes of CO2 each year, equal to removing the emissions from approximately 1.1 million cars per year.

The Aemetis Biogas dairy RNG project, energy efficiency upgrades to the Aemetis Keyes biofuels plant, and the Aemetis Renewable Jet/Diesel project include $57 million of grant funding and other support from the US Department of Agriculture, the US Forest Service, the California Energy Commission, the California Department of Food and Agriculture, CAEATFA, and Pacific Gas and Electric’s energy efficiency program.

CUPERTINO, CA, Sept. 08, 2021 (GLOBE NEWSWIRE) -- via NewMediaWire -- Aemetis, Inc. (NASDAQ: AMTX), a renewable natural gas (RNG) and renewable fuels company focused on negative carbon intensity products, announced today that it has been issued building permits by Stanislaus County in California to construct the next phase of dairy biogas digesters in the Aemetis Biogas Central Dairy Digester Project which will be connected via private pipeline to the Aemetis ethanol plant near Modesto.

“In addition to the California Environmental Quality Act (CEQA) IS/MND permit for the 32-mile extension of the Aemetis Biogas pipeline, the project has received building permits to begin construction of the next phase of dairy biogas digesters,” said Andy Foster, President of the Aemetis Biogas subsidiary of Aemetis, Inc. “We have already built and currently operate two dairy biogas digesters, on-dairy gas upgrading and pressurization facilities, and a four-mile biogas pipeline connecting to our Keyes ethanol plant. The centralized biogas cleanup and utility pipeline interconnection facilities at the Keyes plant are currently under construction for completion in Q4 2021, and we plan to complete the construction of 15 additional dairy biogas digesters during 2022.”

The next phase of five dairy biogas digesters are part of a network of lagoon digesters being built by Aemetis Biogas to produce renewable natural gas (RNG) for use as a transportation fuel. The RNG produced by the first two dairy digesters has been approved by the California Air Resources Board (CARB) utilizing negative 426 (-426) carbon intensity biogas to displace petroleum based natural gas used at the Keyes ethanol production facility.

The next phase of five dairy digesters is planned for completion in Q1 2022, with an additional ten dairy digesters planned for completion by Q4 2022. When completed, the seventeen dairy digesters built and operated by Aemetis are expected to produce approximately 440,000 MMBtu per year of Renewable Natural Gas for use in trucks and buses to displace carbon based diesel fuel.

The planned 52 dairies in the Aemetis biogas project are expected to capture more than 1.4 million MMBtu of dairy methane and reduce greenhouse gas emissions equivalent to an estimated 5.2 million metric tonnes of CO2 each year, equal to removing the emissions from approximately 1.1 million cars.

The Aemetis Biogas dairy RNG project, energy efficiency upgrades to the Aemetis Keyes biofuels plant, and the Aemetis Renewable Jet/Diesel project include $57 million of grant funding and other support from the US Department of Agriculture, the US Forest Service, the California Energy Commission, the California Department of Food and Agriculture, the California State Treasurer’s Office, and Pacific Gas and Electric’s energy efficiency program

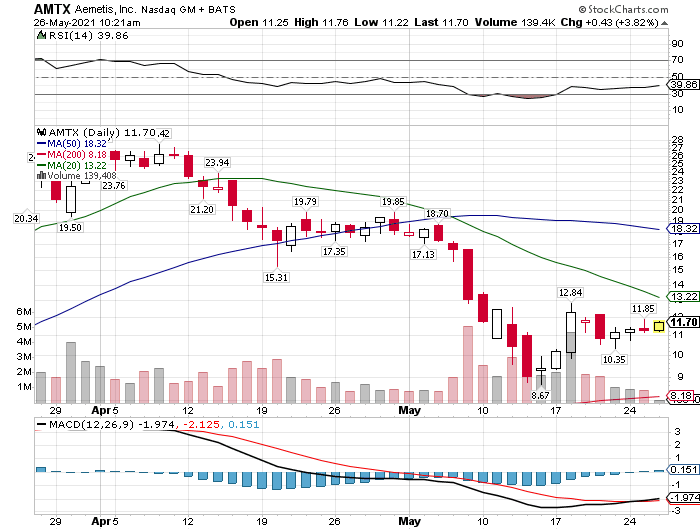

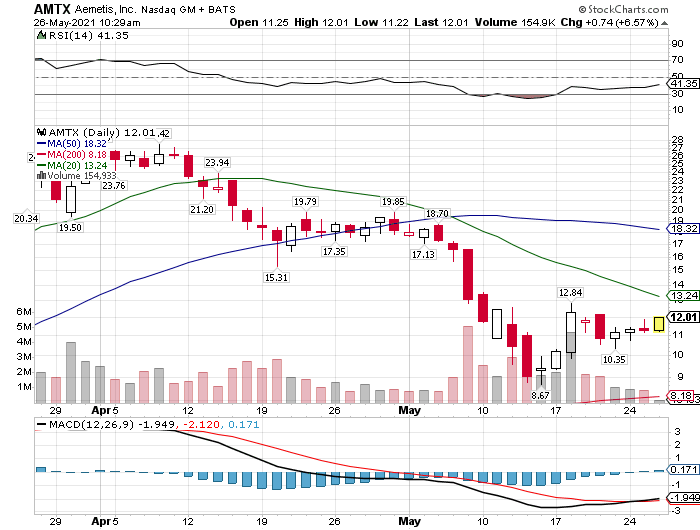

Amtx 11.7 breaking out this morning. See if it can hold. Float has doubled since I started trading this. Massive pile of dilution planned $300 mil I believe was the number I read. Any explosive rallies are likely to be muzzled by new shares hitting float. If I don't Sound excited its cause im not. Im not even going to take the time to post the chart. Diluted POS

CUPERTINO, Calif., Aug. 18, 2021 (GLOBE NEWSWIRE) -- via NewMediaWire -- A new study concluded that more than 2 million metric tonnes (MT) per year of CO2 can be removed from the atmosphere and injected safely into the earth at two ethanol plant sites in California. The study was commissioned by Aemetis, Inc. (NASDAQ: AMTX), a renewable natural gas and renewable fuels company focused on below zero carbon intensity products.

CUPERTINO, Calif., Aug. 18, 2021 (GLOBE NEWSWIRE) -- via NewMediaWire -- A new study concluded that more than 2 million metric tonnes (MT) per year of CO2 can be removed from the atmosphere and injected safely into the earth at two ethanol plant sites in California. The study was commissioned by Aemetis, Inc. (NASDAQ: AMTX), a renewable natural gas and renewable fuels company focused on below zero carbon intensity products.

The Carbon Capture & Sequestration (CCS) geologic formation review and drilling study was completed by Aemetis Carbon Capture, a subsidiary of Aemetis, and was conducted by Baker Hughes, a global energy services company with operations in 120 countries.

The Baker Hughes study estimated that 1.0 million MT per year of CO2 can be sequestered in the saline formations located deep underground at or near the Aemetis Keyes ethanol plant site. The study noted that up to 1.4 million MT per year of CO2 should be injectable at or near the Aemetis Riverbank site due to the favorable permeability of the saline formation and other factors.

“The conclusions from the initial Baker Hughes geologic formation and pre-drilling study confirm the feasibility of Aemetis plans to construct two CO2 injections wells at or near the Aemetis biofuels sites,” stated Brian Fojtasek of ATSI, the project manager for the Aemetis Carbon Capture construction phase. “We have completed Front End Loading engineering and are now working on the Front End Engineering Design (FEED) and permitting for the Aemetis CCS projects.”

Once complete, the Aemetis Carbon Capture CCS project is expected to capture and sequester more than 2 million MT of CO2 per year at the two Aemetis biofuels plant sites in Keyes and Riverbank, California. The amount of CO2 sequestered each year is expected to be equal to the emissions from 460,000 passenger cars each year.

Pension plans, mutual funds, & Ivy League endowments increasing their holdings of AMTX.

Aemetis shares are trading higher after the company reported better-than-expected Q2 EPS and sales results.

Aug 12, 2021

Bi partisans wanting to pass legislation extending a $1 per gallon tax break to biodiesel

while some ponder whether there has been or will be a short squeeze Im up over $170k on 50k shares I bought at $9ish a mere 10 days ago. Summer is looking bright for AMTX. Bi partisans wanting to pass legislation extending a $1 per gallon tax break to biodiesel

Tuesday that Sens. Chuck Grassley (R-Iowa) and Maria Cantwell (D-Wash.) had jointly introduced a bipartisan Biodiesel Tax Credit Extension Act of 2021 to the Senate. If passed, the bill will extend the current federal biodiesel tax credit program -- worth $1 per gallon of biodiesel produced -- through 2025.

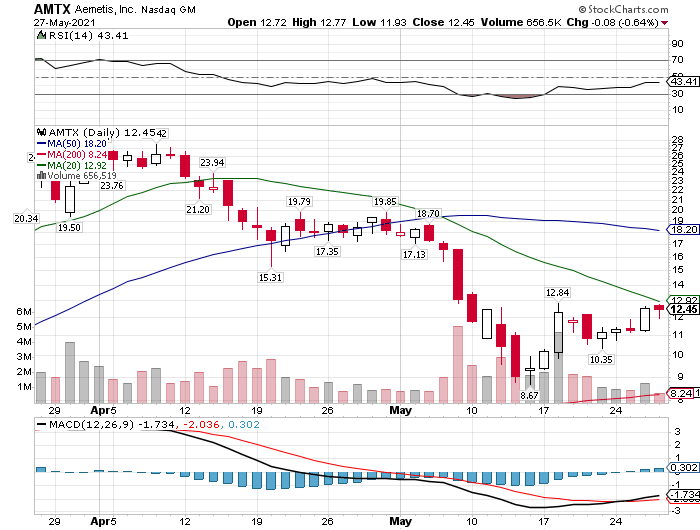

That like occurred on the pop from 8.67 to 12 a week or so ago.

Are we experiencing a short squeeze now?

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=163513598

The Shorts have made a bad trade IMO with almost 20% of the tradable float short AMTX has the makings of a short squeeze.

AMTX $11.75 +.48+4% Solid news today

Second U.S. Patent Awarded and Exclusively Licensed to Aemetis by US Dept of Energy to Use Waste Forest Wood and Other Biomass to Produce High Value Biofuels

Aemetis, Inc.

Wed, May 26, 2021, 7:00am

AMTX

+4.08%

Patented technology extracts sugars from waste wood using ionic liquids to enable production of high value renewable fuels

CUPERTINO, CA, May 26, 2021 (GLOBE NEWSWIRE) -- via NewMediaWire -- Aemetis, Inc. (NASDAQ: AMTX) announced today the grant of a second patent for technology exclusively licensed to Aemetis that enables the production of low carbon intensity renewable fuels from waste wood feedstocks.

U.S. Patent No. 2018/0346938 “High Gravity, Fed-Batch Ionic Liquid Based Process for Deconstructing Biomass” protects the use of ionic liquids to extract sugars from a wide variety of waste biomass, including forest and orchard wood. This process is expected to provide up to a 90% reduction in feedstock cost and to increase the value of renewable fuels by significantly reducing carbon intensity.

“This recently patented ionic liquids technology was funded by the U.S. Department of Energy and the California Energy Commission during development by Sandia National Labs, the Joint Bioenergy Institute and Aemetis,” stated Goutham Vemuri, VP of Technology Development at Aemetis. “The process enables waste wood to be used in two important ways as valuable feedstock: extracting sugar for conversion into cellulosic ethanol at our ethanol plant to generate an estimated $5 of revenue per gallon, and converting the remaining lignin into renewable hydrogen for the hydrotreatment of vegetable oils to produce low carbon intensity jet and diesel fuel.”

“Forest and orchard trees absorb CO2 along with solar energy and nutrients to grow,” stated Eric McAfee, Chairman and CEO of Aemetis. “By using waste wood and other biomass, Aemetis is expanding the range of feedstocks that can be used in the production of high value renewable fuels that work with existing jet, diesel and flex-fuel engines,” McAfee noted.

The first Aemetis Carbon Zero production plant — “Carbon Zero 1” — is scheduled for construction at the 140-acre Riverbank Industrial Complex in Central California, a former Army ammunition production facility with 710,000 square feet of existing production buildings.

The Carbon Zero 1 renewable jet and diesel plant and energy efficiency upgrades to the Aemetis ethanol plant include funding and other support from the USDA, the US Forest Service, the California Energy Commission, the California Department of Food and Agriculture, and PG&E.

About Aemetis

Headquartered in Cupertino, California, Aemetis is a renewable natural gas, renewable fuel and biochemicals company focused on the acquisition, development and commercialization of innovative technologies that replace petroleum-based products and reduce greenhouse gas emissions. Founded in 2006, Aemetis has completed Phase 1 and is expanding a California biogas digester network and pipeline system to convert dairy waste gas into Renewable Natural Gas (RNG). Aemetis owns and operates a 65 million gallon per year ethanol production facility in California’s Central Valley near Modesto that supplies about 80 dairies with animal feed. Aemetis also owns and operates a 50 million gallon per year production facility on the East Coast of India producing high quality distilled biodiesel and refined glycerin for customers in India and Europe. Aemetis is developing the Carbon Zero renewable jet and diesel fuel integrated biorefineries in California to utilize distillers corn oil and other renewable oils to produce low carbon intensity renewable jet and diesel fuel using cellulosic hydrogen from waste orchard and forest wood, while pre-extracting cellulosic sugars from the waste wood to be processed into high value cellulosic ethanol at the Keyes plant. Aemetis holds a portfolio of patents and related technology licenses to produce renewable fuels and biochemicals. For additional information about Aemetis, please visit www.aemetis.com.

AMTX $13.76 -$2.8-16% Blew thru double bottom test $15.31 gap at $9.83-$10.9 with retest low $10.44, 200ma currently $7.56. Good trading op ahead. Playing intraday bounce.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=163516271

Has there been a short squeeze yet? LMAO!

|

Followers

|

25

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

571

|

|

Created

|

10/19/08

|

Type

|

Free

|

| Moderators | |||

The biofuels value chain currently consists of many parts: processing and refining, storage, distribution and marketing, and advanced technology. Most, if not all, biofuels suppliers have primarily been focused on only one portion of the chain, with limited – or no – vertical integration. AE Biofuels is a vertically integrated company developing biofuel solutions for the world’s renewable energy needs on a global basis. Using patent-pending cellulosic ethanol technology, AE Biofuels is reducing production costs and reliance on food-based feedstocks. AE Biofuels is currently producing cleaner burning biodiesel for emerging markets, where demand is growing fastest.

AE Biofuels utilizes an Integrated Plant Approach that allows for the use of cellulose, corn and sugar feed stocks, increasing efficiencies. Our technology also facilitates the upgrading of existing corn ethanol plants to use both corn and cellulosic feedstock and enables sugar cane ethanol plants to convert bagasse into fuel. AE Biofuels patent-pending cellulosic ethanol technology also lowers feedstock costs by using agricultural waste as opposed to potential food crops, and offers lower capital costs.

AE Biofuels has established leading positions in each stage of the biofuels value chain – global and diversified access to feedstock, large scale volume of biofuels production, marketing and distribution, and advanced biofuels technology.

AE Biofuels has permitted sites to develop new ethanol plants in

Read more about Cellulosic Ethanol »

Today’s world is increasingly defined by two inter-related trends: Growing global energy demand and heightened concerns over carbon emissions. By 2050, global crude oil consumption is projected to more than double and oil from proven conventional sources will be insufficient to meet projected global demand.

The rise in standards of living in China and India, in addition to continued high fuel consumption in the US and EU, underscores the need for additional fuel energy sources to satisfy ever-growing demand. Concerns about carbon emissions and their potential contribution to global climate change heightens the need for renewable and low-emission sources of fuel. The largest use of oil, transportation, is also one of the most significant sources of carbon emissions.

Traditional energy solutions have relied on conventional fuels to satisfy the energy needs of modern society. Conventional fuels, primarily fossil fuels comprised of oil and gas, has been primary energy sources for more than a century, generating trillions of dollars of market value. Current conventional fuel consumption is approximately 85 million barrels per day and is projected to grow to more than 140 million barrels per day over the next twenty years.

The vast majority of conventional oil is concentrated in areas with geo-political instability. Yet our energy needs continue to grow.

The world needs a fuel source that is renewable, compatible with existing energy and transportation infrastructure, is scalable to meet future demand and has low net emissions, and is not dependant on unstable geo-political regions.

Renewable fuels offer a unique opportunity to meet the increasing demand for fuel energy. Renewable fuels are all bio-fuels, including ethanol and biodiesel, that can be produced from renewable sources. Both ethanol and biodiesel are produced through a variety of feed-stocks, with new cellulosic ethanol technology enabling the use of inexpensive, non-food energy sources.

The current production of Biofuels is about one million barrels per day and constitutes approximately 1% of global petroleum based oil production. The Renewable fuels industry is one of the fastest growth sectors across all industry segments.

A combination of factors is driving the Renewable fuels industry, including: increasing demand for oil, constraints on oil supply, greenhouse gas emissions concerns and increasing air quality standards. The projected growth of Renewable fuels to 20 million barrels per day worldwide would result in the creation of annual revenues in excess of $600 billion and a combined market value in excess of $1 trillion.

The Biofuels market is in a period of explosive growth. This growth is driven by sustained high price of oil, government incentives, energy security and a global desire for cleaner and renewable fuels. AE Biofuels is uniquely positioned to address these challenges

AE Biofuels is building the world’s first vertically integrated company developing biofuel solutions for the world’s renewable energy needs on a global basis. A management team with deep experience across the biofuels value chain is key to our success.

Eric A. McAfee – Chairman and CEO

Mr. McAfee is an entrepreneur and venture capitalist with a lifelong commitment to agriculture and renewable energy. After growing up on a farm near Fresno, California, he co-founded Organic Pastures Dairy Company, a 400-acre raw milk dairy and distribution company that is now the largest in the United States, and McAfee Farms, a producer of organic almonds.

Mr. McAfee is a founding shareholder of $800 million revenues Pacific Ethanol (Nasdaq: PEIX), a leading ethanol producer in the Western United States. Pacific Ethanol received an $84 million investment from Microsoft Chairman Bill Gates through his investment firm Cascade Investments and then raised $146 million at a $1.1 billion valuation. Mr. McAfee is also a founding shareholder of several publicly-held energy companies: Evolution Petroleum (Amex: NGSY), Pacific Asia Petroleum (symbol: PFAP), Particle Drilling Technologies (Nasdaq: PDRT), and World Waste Technologies (symbol: WDWT).

During his career, Mr. McAfee has funded more than twenty-five companies as a principal investor, and has founded six public companies with a combined high market value of $4 billion.

In 2007, Mr. McAfee was awarded the Opportunity International Founder's Award for his work related to third world development through biofuels. OI is one of the world's largest micro-finance companies, with more than 1 million clients annually in 35 countries.

Mr. McAfee graduated as the Dean’s Medalist from the Fresno State University business school, and is a graduate of the Harvard Business School Private Equity and Venture Capital program and the Stanford Graduate School of Business Executive Program.

Mr. Sorgenti was appointed to the Board of Directors of the Company in November 2007. Since 1998, Mr Sorgenti has been the principal of Sorgenti Investment Partners, a company engaged in pursuing chemical investment opportunities. Sorgenti Investment Partners acquired the French ethanol producer Societe d'Ethanol de Synthese (SODES) in partnership with Donaldson, Lufkin & Jenrette in 1998. Prior to forming Sorgenti Investment Partners, Mr. Sorgenti served a distinguished career that included the position of President/CEO of ARCO Chemical Company from 1979 to 1991, including leadership of the 1987 IPO of the company. Mr. Sorgenti is also the founder of Freedom Chemical Company. Mr. Sorgenti is a member of the board of directors of Provident Mutual Life Insurance Co. and Crown Cork & Seal. Mr. Sorgenti received his B.S. in chemical engineering from City College of New York in 1956 and his M.S. from Ohio State University in 1959. Mr. Sorgenti is the recipient of honorary degrees from Villanova, St. Joseph's, Ohio State, and Drexel Universities.

Mr. Peterson has worked in the securities industry in various capacities for nearly twenty years. For the majority of his career, he was employed by Goldman Sachs & Co., where, as vice president, he was responsible for a team of professionals that advised and managed over $7 billion in assets for high net worth individuals and institutions. Mr. Peterson joined Merrill Lynch in 2000 to form and help launch its Private Investment Group, and most recently he served as a managing partner of American Institutional Partners, LLC. in charge of venture investing. In December 2005, he formed Pascal Investments, a private equity firm. Mr. Peterson received a BS in Computer Science and Statistics, and an MBA from Brigham Young University.

John Block has dedicated his professional career to the fields of agriculture, food, and health. His accomplishments in agriculture began with the building of a large and successful hog operation in his home state of Illinois where he also served as the Director of Agriculture from 1977-1981. He was tapped by President Reagan to serve as the Secretary of the U.S. Department of Agriculture from 1981-1985, where he played a key role in the development of the 1985 Farm Bill. He is now a Senior Legislative Advisor to Olsson Frank Weeda Terman Bode Matz, P.C., an organization that represents the US food industry. Secretary Block was formerly a member of the Board of Directors of John Deere & Co. and Hormel Foods Corp. From January 2002 until January 2005, Secretary Block served as Executive Vice President of the Food Marketing Institute. From February 1986 until January 2002, Secretary Block served as President of Food Distributors International. Secretary Block received his B.A. from the US Military Academy at West Point, NY

Mr. McAfee is an entrepreneur and venture capitalist with a lifelong commitment to agriculture and renewable energy. After growing up on a farm near Fresno, California, he co-founded Organic Pastures Dairy Company, a 400-acre raw milk dairy and distribution company that is now the largest in the United States, and McAfee Farms, a producer of organic almonds.

Mr. McAfee is a founding shareholder of $400 million revenues Pacific Ethanol (Nasdaq: PEIX), a leading ethanol producer in the Western United States. Pacific Ethanol received an $84 million investment from Microsoft Chairman Bill Gates through his investment firm Cascade Investments and then raised $146 million at a $1.1 billion valuation. Mr. McAfee is also a founding shareholder of several publicly-held energy companies: Evolution Petroleum (Amex: NGSY), Pacific Asia Petroleum (symbol: PFAP), Particle Drilling Technologies (Nasdaq: PDRT), and World Waste Technologies (symbol: WDWT).

During his career, Mr. McAfee has funded more than twenty-five companies as a principal investor, and has founded six public companies with a combined high market value of $4 billion.

In 2007, Mr. McAfee was awarded the Opportunity International Founder's Award for his work related to third world development through biofuels. OI is one of the world's largest micro-finance companies, with more than 1 million clients annually in 35 countries.

Mr. McAfee graduated as the Dean’s Medalist from the Fresno State University business school, and is a graduate of the Harvard Business School Private Equity and Venture Capital program and the Stanford Graduate School of Business Executive Program.

Andy Foster has lead organizations with multi-million dollar budgets for the past nine years. He served as Vice President of Corporate Marketing for Marimba, Inc., which was acquired by BMC Software (NYSE: BMC: 2006 revenues $1.4 billion). Following BMC's acquisition of Marimba, Mr. Foster oversaw global public relations. Mr. Foster served as Group Director of Corporate Marketing for Cadence Design Systems, the leading EDA software company (NASDAQ: CDNS: $1.4 billion), and as Director of Corporate Marketing for eSilicon Corporation, a private fabless semiconductor company. In addition, Mr. Foster has ten years of experience in public policy including key roles in the George H.W. Bush White House from 1989 to 1992 as Associate Director of Political Affairs, and in the office of Governor Jim Edgar (Illinois) from 1995 to 1998 as Deputy Chief of Staff. Mr. Foster managed Governor Edgar's successful re-election campaign in 1994. Andy Foster has a Bachelor of Arts degree from Marquette University.

Scott Janssen has over fifteen years of experience in corporate finance and public accounting. He has significant experience in the areas of IPOs, private placement debt offerings and mergers & acquisitions transactions. Prior to joining AE Biofuels, he worked at both public and private technology companies including Avanex (AVNX), ArcSight (ARST), Barcelona Design and Electric Cloud, where he served either as a finance and accounting executive or as a business consultant. Mr. Janssen holds a BS degree in Mathematics from the University of California, Los Angeles and is a licensed CPA in the state of California.

Todd Waltz has served in the capacity of Controller at AE Biofuels since May 2008. His experience covers a range of high-growth, as well as mature and competitive businesses. Prior to joining AE Biofuels, Inc., Todd managed all financial aspects for Apple's Hardware R&D division, and later for the rapid growth Mac and Apple on-line services businesses. Todd was instrumental in implementing the world-wide system for standard and target costing that enabled Apple to manage costs for new products. Previously, Todd worked for Litton Applied Technology where he established a divisional audit program. He received his accounting training in the audit group of Ernst & Young. Todd is a licensed CPA and holds an MBA from Santa Clara University, a MST from San Jose State University, and a BA from Mount Union.

Todd Capser has served as Director of Project Development at AE Biofuels since July of 2007 and is the Project Manager for the company’s next-generation Cellulosic Ethanol Demonstration Plant in Butte, Montana. Prior to joining AE Biofuels, Todd had an extensive political career on Capitol Hill where he served as a legislative aide with expertise in the areas of corporate business and healthcare. He returned to Montana as the Director of the Rocky Mountain Technology Foundation, helping expand Montana's telemedicine network to one of the largest and most advanced in the nation. Most recently, Todd was the State Director for U.S. Senator Conrad Burns. Todd attended the Virginia Military Institute and Rocky Mountain College from where he graduated with a BS degree in Business Administration, and holds an MBA from Vanderbilt University.

As a lifelong corn and soybean farmer, Paul Jeschke brings significant agribusiness experience to AE Biofuels. Paul currently serves as Chairman of Illinois Valley Ethanol (IVE), a wholly-owned subsidiary of AE Biofuels that was founded in 2004. In addition to operating a 3,500 acre family corn and soybean farm, Paul is involved in commercial development. Paul’s wife is a board member of the Illinois Corn Grower’s Marketing Association Board of Directors. Paul helped start a soy food product company, and worked for Agri-Tile, a farm drainage, tilling, and engineering firm. Mr. Jeschke received his BS in Agricultural Science from the University of Illinois.

Mr. Lee is a former corporate associate at Wilson, Sonsini, Goodrich & Rosati, the leading law firm for technology companies in the Silicon Valley. He also served as corporate legal counsel and VP of Acquisitions and Alliances for BarterNet, a consolidator of B2B trading companies, where he was involved in more than 30 acquisitions and alliances. Mr. Lee holds a degree in International Relations from the University of Washington and is a graduate of Stanford University Law School.

Bio forthcoming

Mr. Gupta is an experienced global marketer of specialized chemicals and oils. Previously, Mr. Gupta was in charge of a petrochemical trading company with about $250 Million of annual revenues and offices on several continents, primarily trading products between second and first world sources. Previously, Mr. Gupta was General Manager of International Marketing for Britannia Industries, a subsidiary of Nabisco Brands, in India. Mr. Gupta received an MBA from the Faculty of Management Studies, University of Delhi and holds a bachelors of science (honors) from the University of Delhi.

AE BIOFUELS, INC.

CONSOLIDATED BALANCE SHEETS

|

|

| September 30, |

|

| December 31, |

| ||

|

|

| (Unaudited) |

|

|

|

| ||

| Assets |

|

|

|

|

|

| ||

| Current assets: |

|

|

|

|

|

| ||

| Cash and cash equivalents |

| $ | 107,631 |

|

| $ | 377,905 |

|

| Inventories |

|

| 818,536 |

|

|

| 1,049,583 |

|

| Prepaid expenses |

|

| 21,901 |

|

|

| 110,581 |

|

| Other current assets |

|

| 534,558 |

|

|

| 438,703 |

|

| Total current assets |

|

| 1,482,626 |

|

|

| 1,976,772 |

|

|

|

|

|

|

|

|

|

|

|

| Property, plant and equipment, net |

|

| 18,239,779 |

|

|

| 21,236,604 |

|

| Intangible assets |

|

| –– |

|

|

| 33,333 |

|

| Other assets |

|

| 38,600 |

|

|

| 289,990 |

|

| Total assets |

| $ | 19,761,005 |

|

| $ | 23,536,699 |

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and stockholders' (deficit) equity |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

| $ | 3,574,672 |

|

| $ | 2,829,117 |

|

| Short term borrowings, net of discount |

|

| 6,242,265 |

|

|

| 4,504,062 |

|

| Registration rights liability |

|

| - |

|

|

| 1,807,748 |

|

| Mandatorily redeemable Series B Preferred stock |

|

| 1,750,002 |

|

|

| 1,750,002 |

|

| Other current liabilities |

|

| 2,109,132 |

|

|

| 1,616,259 |

|

| Current portion of long term debt |

|

| 4,084,013 |

|

|

| 816,738 |

|

| Current portion of long term debt (related party) |

|

| 3,650,819 |

|

|

| –– |

|

| Total current liabilities |

|

| 21,410,903 |

|

|

| 13,323,926 |

|

|

|

|

|

|

|

|

|

|

|

| Long term debt, net of discount |

|

| –– |

|

|

| 3,174,275 |

|

| Long term debt (related party) |

|

| –– |

|

|

| 2,044,691 |

|

|

|

|

|

|

|

|

|

|

|

| Commitments and contingencies (Notes 2,4,7,8,9,14,16 and 18 ) |

|

|

|

|

|

|

|

|

| Stockholders' (deficit) equity: |

|

|

|

|

|

|

|

|

| AE Biofuels, Inc. stockholders (deficit) equity |

|

|

|

|

|

|

|

|

| Series B Preferred Stock - $.001 par value - 7,235,565 authorized; 3,330,725 and 3,451,892 shares issued and outstanding, respectively (aggregate liquidation preference of $9,992,175 and $10,355,676, respectively) |

|

| 3,331 |

|

|

| 3,452 |

|

| Common Stock - $.001 par value 400,000,000 authorized; 86,171,532 and 85,643,709 shares issued and outstanding, respectively |

|

| 86,171 |

|

|

| 85,643 |

|

| Additional paid-in capital |

|

| 36,652,175 |

|

|

| 34,238,925 |

|

| Accumulated deficit |

|

| (36,310,127 | ) |

|

| (27,831,340 | ) |

| Accumulated other comprehensive income |

|

| (1,787,557 | ) |

|

| (1,502,873 | ) |

| Total AE Biofuels, Inc. stockholders (deficit) equity |

|

| (1,356,007 | ) |

|

| 4,993,807 |

|

| Noncontrolling interest |

|

| (293,891 | ) |

|

| –– |

|

| Total stockholders' (deficit) equity |

|

| (1,649,898 | ) |

|

| 4,993,807 |

|

| Total liabilities and stockholders' (deficit) equity |

| $ | 19,761,005 |

|

| $ | 23,536,699 |

|

The accompanying notes are an integral part of the financial statements

1

AE BIOFUELS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

|

| For the nine months ended |

|

| For the three months ended |

| |||||||||||

|

|

| September 30, 2009 |

|

| September 30, 2008 |

|

| September 30, 2009 |

|

| September 30, 2008 |

| |||||

| Sales |

| $ | 7,552,938 |

|

| $ | –– |

|

| $ | 4,054,985 |

|

| $ | –– |

| |

| Cost of goods sold |

|

| 7,101,076 |

|

|

| 952,028 |

|

|

| 3,685,366 |

|

|

| 952,028 |

| |

| Gross profit |

|

| 451,862 |

|

|

| (952,028 | ) |

|

| 369,619 |

|

|

| (952,028 | ) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Research and development |

|

| 399,148 |

|

|

| 828,458 |

|

|

| 157,574 |

|

|

| 316,402 |

| |

| Selling, general and administrative expenses |

|

| 4,680,229 |

|

|

| 7,540,720 |

|

|

| 1,256,482 |

|

|

| 1,921,372 |

| |

| Loss on forward purchase commitments |

|

| –– |

|

|

| 532,500 |

|

|

| –– |

|

|

| 532,500 |

| |

| Impairment of long lived assets |

|

| 2,086,350 |

|

|

| –– |

|

|

| 2,086,350 |

|

|

| –– |

| |

| Operating loss |

|

| (6,713,865 | ) |

|

| (9,853,706 | ) |

|

| (3,130,787 | ) |

|

| (3,722,302 | ) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income / (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Interest income |

|

| 19,526 |

|

|

| 32,544 |

|

|

| 6,565 |

|

|

| 58 |

| |

| Interest expense |

|

| (2,137,212 | ) |

|

| (253,020 | ) |

|

| (692,714 | ) |

|

| –– |

| |

| Other income, net of expenses |

|

| 60,535 |

|

|

| 113,321 |

|

|

| 32,258 |

|

|

| 71,160 |

| |

| Share agreement cancellation payment |

|

| –– |

|

|

| (900,000 | ) |

|

| –– |

|

|

| –– |

| |

| Registration rights payment |

|

| –– |

|

|

| (2,274,402 | ) |

|

| –– |

|

|

| –– |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before income taxes |

|

| (8,771,016 | ) |

|

| (13,135,263 | ) |

|

| (3,784,678 | ) |

|

| (3,651,084 | ) | |

| Income taxes |

|

| (1,662 | ) |

|

| (21,560 | ) |

|

| –– |

|

|

| –– |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

| (8,772,678 | ) |

|

| (13,156,823 | ) |

|

| (3,784,678 | ) |

|

| (3,651,084 | ) | |

| Less: Net loss attributable to the noncontrolling interest |

|

| (293,891 | ) |

|

| –– |

|

|

| (117,637 | ) |

|

| –– |

| |

| Net loss attributable to AE Biofuels, Inc. |

| $ | (8,478,787 | ) |

| $ | (13,156,823 | ) |

| $ | (3,667,041 | ) |

| $ | (3,651,084 | ) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive loss, net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Foreign currency translation adjustment |

|

| (284,684 | ) |

|

| 2,537,516 |

|

|

| (180,250 | ) |

|

| 1,090,458 |

| |

| Comprehensive loss, net of tax |

|

| (9,057,362 | ) |

|

| (10,619,307 | ) |

|

| (3,964,928 | ) |

|

| (2,560,626 | ) | |

| Comprehensive loss attributable to the noncontrolling interest |

|

| –– |

|

|

| –– |

|

|

| –– |

|

|

| –– |

| |

| Comprehensive loss attributable to AE Biofuels, Inc. |

| $ | (9,057,362 | ) |

| $ | (10,619,307 | ) |

| $ | (3,964,928 | ) |

| $ | (2,560,626 | ) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per common share attributable to AE Biofuels, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Basic and dilutive |

| $ | (0.10 | ) |

| $ | (0.16 | ) |

| $ | (0.04 | ) |

| $ | (0.04 | ) | |

| Weighted average shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Basic and dilutive |

|

| 86,087,653 |

|

|

| 84,459,343 |

|

|

| 86,171,532 |

|

|

| 84,935,737 | ||

| AE Biofuels, Inc.

|

|

|

CHARTS

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |