Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

my point exactly in my last post-------------if EVER it was time not to sell it's now- pretty much.....i feel snug as a bug holding long now myself.....

I remain confused about yesterday. Why buy the heck out of it in the AM, running up the pps, and then puke shares out immediately after, busting pps? Huge volume yesterday and very small today. Was it 1 tute or 2? If 2, why not meet in the middle.

Regardless, opportunities for us.

When a big boy buys or sells it moves the markets. Can't see many other reasons for this action today. It surprised me.

the fans are boo-ing those who sold into the possible breakout this day-----taking us down so unnaturally-------keep that up and pays may get stunted in its natural pps growth. Why not let a breakout happen- and sell later?--------------To each their own. But i'm boo-ing you. We might have hit 5.00 this week if you hadn't nickel and dime capitalized. (sigh)

Not a bad 5 minutes

Packed and bulging with shares.

ALL ABOARD, THIS NORTHWARD BOUND TRAIN!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

Friday NASD was down 319 points, but our jem, PAYS. was UP.

We've cut loose from the pack.

WATCH OUT ABOVE, HERE WE COME.

$10.00 After q4 & ye #'s. IMO

Looking at a chart this am, we had a golden cross around $2.55.

Lets name our board "THE BELIVERS CLUB"

and our timing is cool- due to it being an election year, i presuppose the overall mkt will have few fears and far less volatility--------------------------------------------------------------------------------------i feel snug as a bug going into november with our pays prospects. I'm not selling my shares. WE BE DA BULLS NOW. Next earnings should be catalyst for a rocketing in pps, i suspect.

I get giddy when volume kicks in. This will get ridiculous when Patient Affordability proves itself. I'm with you Chil, people just dont understand the SIZE of that market.

I suspect now that this is officially behind us with D&O on the hook, buyback will commence. Blue Skies!!

Paid from the insurance policy. EOM !!!!!

PAYS

4.265$-0.12%

? PAYSIGN, INC.

Real-time Estimate Cboe BZX 09:46:43 2024-04-19 am EDT1st Jan Change4.285 USD+0.35%+52.50%

Summary

Quotes

Charts

News

Ratings

Calendar

Company

Financials

Consensus

Revisions

This BS is officially in our rear-view. D&O insurance for the win

Paysign : Material Event - Form 8-K

April 19, 2024 at 08:33 am EDT

Item 8.01 Other Events.

On April 17, 2024, the United States District Court for the District of Nevada granted final approval of the settlement of the previously disclosed federal securities class action lawsuit entitled In re Paysign, Inc. Securities Litigation, which had been brought against Paysign, Inc. (the "Company") and certain of its current or former directors and officers. As previously described in the Company's Annual Report on Form 10-K filed on March 27, 2024, under the settlement, all claims against the Company and the individual defendants have been dismissed with prejudice, in exchange for payment to the referenced class of purchasers in the amount of $3,750,000, the entirety of which is being paid from proceeds of the Company's directors-and-officers insurance policy.

whoops, that is Dec $2.50's.

Grabbed a bunch of Dec 2.20's. All the sellers have to hold PAYS shares for me till 12/20.

They get a return on their $, but my leverage is immense.

PA will create pps that most can't believe. Including the 4 analysists following PAYS. The highest is $6.00.

DEC options up. Grab'in some 2.50's

Anyone wanting to be long, these are GOLDEN @ $2.20

LoAd 'eM Up!!!!

WOW, Re PA, every pharma ad on TV reminds me to: load on every dip!!

mrd, there are only 4 of us feasters here. Ebrie, while here in spirit, is in the woods.

strong hands is right-------- Bullish.

A LOT of shares going into STRONG hands here lately. My hope is a pile of misguided shorts have come to play too. Less than 3 weeks until mgmt solidifies Patient Affordability trajectory

someone is willing to buy about 700,000 shares @ $5.00.

and paying for the privilege.

=697,700 SHARES

Damn near 7k! Impressive!!

went to bank: sold all $5's

long up the gee gee $2.50's

In case nobody noticed, volume today in June $5's , OVER 6,000.

WHAT DOES THAT TELL MR STOCK MARKET.

as usual, buying dips proves profits.

Hot dawg. Just took another peak from this morning. Volume and pps increase. Very nice

That is a good call.

jp, buy dips has been an excellent strategy. As you know. I buy 2.50 calls instead of shares.

Had to send cash to DC this am. Expect after May 7, we will enter $5 territory.

Filled one PAYS buy order and have 4 more GTC just in case stock market keeps correcting. Each time Pays corrected recently has been a rewarding time to ADD.

New buy orders in on Pays if markets get more spooked for whatever reason. Pays is solid and future is so bright.

agreed---------------exciting days going forward, old pal.

mrd, "Next up- 5+". $5 will be what BBers call a "SLAM DUNK".

Accordingly, I've converted all short $5 calls to $7.50's.

what a grand and steady support we have here now-------------i haven't felt this bullish in a long time. We are the ultimate COMEBACK kid from covid. And wallstreet LOVES comeback kids- because they know the new genesis usually goes as high as high gets in that form for pps going forward. We need no hype. Mark newcomer has done a remarkable job steering us through covid for our comeback: and so importantly- PAYS isn't a political play in any way whatsoever. The niche is needed by ALL americans equally for a variety of reasons. Even if economy gets rocked by some covid, pays perseveres. Spread the word, folks. PAYS is a gem. Next up- 5+

another good day in PAYSVILLE.

HAPPY CAMPER BOARD!

"Energy prices soar across America as Biden relentlessly pursues green agenda"

"Inflation rises more than expected for third straight month"

More reason people need $= selling plasma

More people require assistance to fill Rx

PAYS profits in both places!

Paysign to Attend Asembia Specialty Pharmacy Summit, April 28-May 02, 2024

Paysign will be attending the 2024 Asembia Specialty Pharmacy Summit, taking place April 28-May 02, in Las Vegas. The Patient Affordability team will be hosting cocktail style gatherings, as well as one-on-one meetings with interested clients throughout the week. To get in touch or book a meeting with the PA team, email affordability@paysign.com or visit paysign.com/rx.

HENDERSON, Nev. – April 9, 2024 – (Business Wire) – Paysign, Inc. (NASDAQ: PAYS), a leading provider of prepaid card programs, comprehensive patient affordability offerings, digital banking services and integrated payment processing, will discuss first quarter 2024 earnings at 5:00 p.m. EDT on Tuesday, May 7, 2024.

i agree, it's time.....

My PAYS Mantra: "BUY ALL DIPS"

converted all my short Sept $5 calls to $7.50's.

anticipate pps to put $5.00 in dust way before September.

Received proxy in mail Sat. Signed, dated and mailed.

|

Followers

|

55

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

9610

|

|

Created

|

07/02/10

|

Type

|

Free

|

| Moderators chilar4567 | |||

- Revenue for the year ending December 31, 2018 was $23.4 million, an increase of 54% compared to $15.2 million the prior year.

- Gross profit increased 70% to $11.4 million or 49% of revenues, compared to $6.7 million or 44% of revenues in 2017.period last year.

- Non-GAAP Adjusted EBITDA was $4.9 million, an increase of 65% compared to $3.0 million in 2017. Non-GAAP Fully Diluted EPS was $.09 as compared to $.06 the prior year.

- The company reiterates its previously released revenue guidance for 2019 of $38.0 to $40.0 million, representing a 62% to 71% increase compared to $23.4 million for full year 2018

as well as an adjusted EBITDA guidance at $10.0 to $12.0 million, representing a 104% to 145% increase compared to $4.9 million for full year 2018.

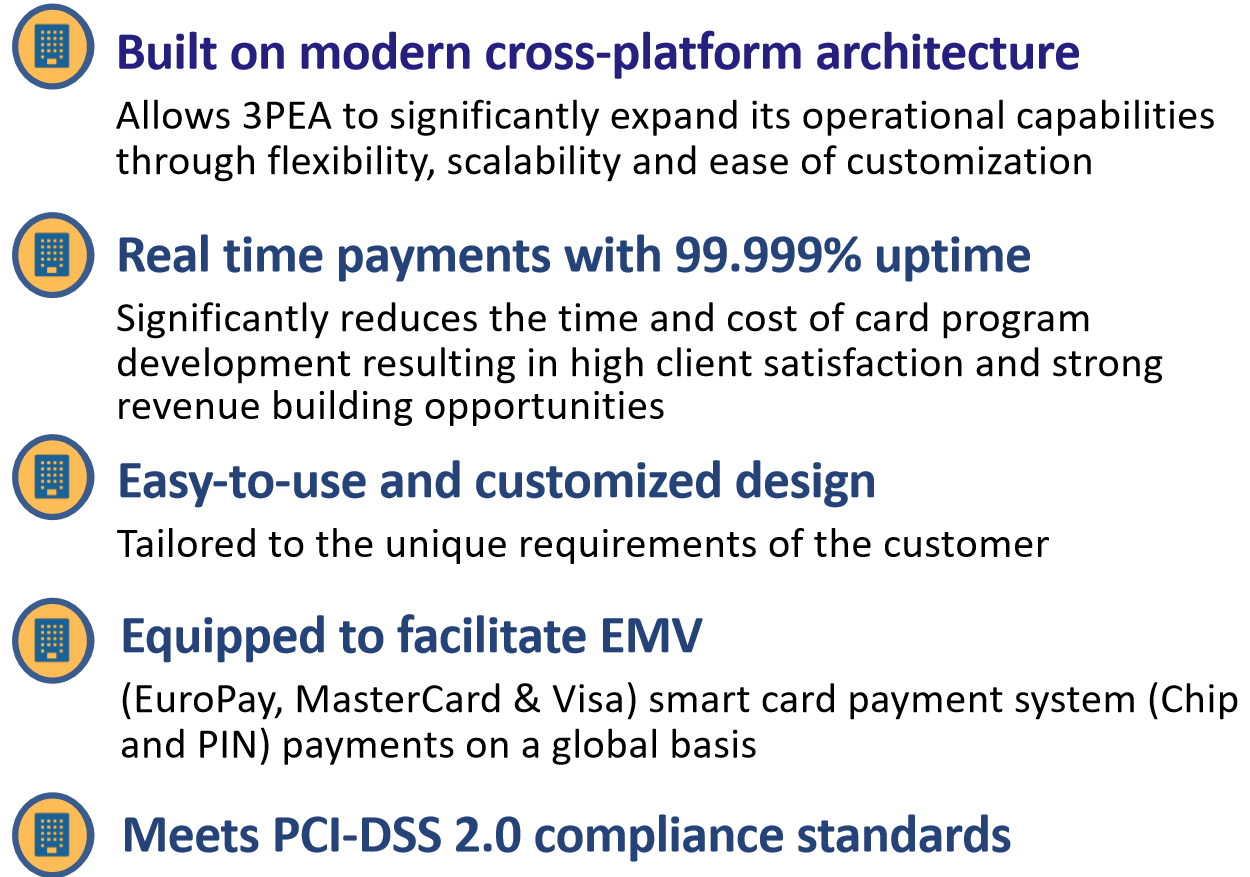

The PaySign platform represents a revolutionary payment processing solution that took years of development. It is a reflection of the Company's commitement to providing innovative, cost effective, customizable payment solutions to a variety of industries for multiple purposes. The platform was designed to easily incorporate new payment technologies and applications as they evolve, keeping Paysign at the forefront of payment innovation.

--> Corporate Incentives: In a market that is expected to grow to $26.5 billion by 2016, PaySign® corporate incentive cards are the perfect vehicle for

corporations looking to engage and motivate their customers, employees, and trade partners. PaySign cards are perfect for customer rebates, employee

bonuses and trade partner commissions. Examples of corporate incentive cards include prepaid cards used as incentives to purchase big ticket items such

as automobiles, smartphones and major appliances.

--> Payroll: PaySign payroll cards reduce administration costs and streamline operations for companies looking to provide an efficient payment method for

unbanked employees. The overall market for prepaid debit cards for payroll is expected to reach $66.4 billion by 2016.

--> Public Sector: Federal and local governments, educational institutions, and other public sector organizations are constantly looking to improve efficiency

and reduce costs. The PaySign card for the public sector provides an effective way to reduce costs and inefficiencies, whether related to disbursements of

public benefits or internal payments. The total prepaid card market for government payments is projected to reach $119.4 billion by 2016.

--> Pharmaceutical Co-Pay Assistance: Paysign's Allegiance Rx card is now available under the PaySign brand. Co-pay assistance cards have been

utilized by major pharmaceutical companies for brands such as Viagra®, Vyvance® and Restasis® to name a few.

--> Source Plasma Donors: Plasma collection companies nationwide can turn to the PaySign brand of cards for a customized payment solution for plasma

donors. The PaySign solution offers either a customized Plasma Web portal solution or direct integration into donor management software.

- Co-founded the Company in 2001; and driving force behind the Company's significant growth and strategic direction

- Shaping the future of the business as a premier prepaid card services leader, delivering a strong value proposition for clients and over 2 million cardholders; oversees all financial, operational, technological and strategic decisions for the company, including: technology investments, the evaluation of strategic acquisitions,new product development and the formation and cultivation of third-party relationships

- Served on the X-9 committee which developed standards for the electronic payments industry alongside IBM, Diebold, First Data, KPMG, MasterCard, Melon Bank, Visa, Wells Fargo, the Federal Reserve and others

- Attended Cal-Poly San Luis Obispo where he majored in Bio-Science

- Co-founded the Company in 2001

- 30+ years of senior IT experience

- Prior experience includes Director of Technology Planning at the Associated Press, Project Manager of implementation of Medicare Easyclaim for ANZ Bank in Australia, Coca-Cola Business Operations & Business analyst for Australia Post

- 30+ years of experience in Financial Services and BPO industries with concentration in Finance, Operations and executive leadership

- Prior experience includes CEO and CFO of Zxerex, CEO of Affina, and Vice President at American Express and Vice President at NextCard

- Bachelor of Science in Finance, minor in Accounting; and Masters in Business Administration (MBA) from Brigham Young University

- 30+ years of industry experience

- Previously at Sunrise Banks as Senior Vice President, Payments Division where she led the new prepaid business

- Prior experience includes various management positions in operations, product development, and sales and marketing at UMB Bank, Heartland Bank, and Boatmen’s Bank

- Board member of the Network Branded Prepaid Card Association and serves as Treasurer

- 13+ years of legal experience in non-traditional banking

- Previously at Republic Bank & Trust Company (Louisville, KY) as Deputy General Counsel and Vice President where he managed all legal affairs for Republic’s non-traditional bank programs, including payments, small-dollar consumer lending, commercial lending and tax related products

- B.A. in Psychology and Philosophy from the University of Kentucky and J.D. from DePaul University College of Law in Chicago, Illinois

- 20 years of experience working in the card industry, focusing on prepaid and credit products

- Previously with Global Cash Card, Inc., Sunrise Banks and Meta Payment Systems (a division of Meta Bank)

- Certified member (CAMS) of the Association of Certified Anti-Money Laundering Specialists.

- Bachelor of Science Degree from South Dakota University

- 30+ years experience in various technical roles providing enterprise IT services at several global companies

- Former Associate Director, Hosting Solutions Bristol-Myers Squibb

- Former Manager of Server Technology, The Associated Press

- 25+ years experience in various marketing roles within the Fintech industry

- Former Senior Product Marketing Manager at Fiserv

- Former Vice President, Marketing, NYSE Governance Services

Board of Directors

- Former CEO of NetSpend (2008-2013). Grew annual revenue from $129M to $351M, with over 2.4 million cardholder accounts. NetSpend acquired by Total System Services: (NYSE: TSS) for $1.4B

- Co-founder, Former President and Chief Operations Officer and Director at Euronet Worldwide (NASDAQ: EEFT). A leader in secure electronic financial transaction processing. Current market cap: 5.4B

- Sits on Board of The Brinks Company. (NYSE: BCO), CARD Corporation (Card.com), RxSavings Solutions, Balance Innovations and Align Income Share Fund

- Received a B.S. in Business Administration with majors in Finance, Economics and Real Estate from the University of Missouri,Columbia

- 35+ years in the banking industry including serving as the President and CEO of two banks in the Midwest

- Former CEO of Healthcare Services at UMB Bank, N.A a leading provider of healthcare payment solutions including health savings account (HSAs), health care spending accounts and payments technology

- 30+ years of legal experience focusing on mergers and acquisitions, public and private securities offerings, and venture capital transaction

- Serves as corporate counsel for numerous public/private companies and was formerly general counsel and board member of Swensen’sInc.

- Mr. Williams is a shareholder with Greenberg Traurig LLP and admitted to the Bar in New York and Arizona

- 30+ years of experience as a Certified Public accountant

- Founder and Managing member of Mina Llano Higgins Group, LLP

- Former CFO of Coal Brick Oven Pizzeria, Inc.

- Currently CFO for Academy of Aviation in Long Island, NY

3PEA International:

Jim McCroy

Investor Relations

Tel: 702.749.7269

IR@3PEA.com

www.3pea.com

Website

Click Here For the Company's Investor Presentation

Articles About 3PEA International

Seeking Alpha (SC Capital Group) - 3Pea Is A Payment Processor With >40% Organic Growth Selling For Half Of Peer Multiples - 2018-05-22

Seeking Alpha (Inefficient Market) - 3Pea: Strong Guidance, Uplisting, Should Propel Shares Higher - 2018-04-03

Seeking Alpha (BW Investment Visibility) - 3Pea International: Undervalued And Undercovered Turnaround Story - 2017-11-20

Analyst Coverage

Cannacord Genuity: Buy 17$ Target

Ladenburg Thalmann: Buy 14.50$ Target

Maxim Group: Buy 10.00$ Target

*This document contains projections and other forward-looking statements regarding future events. Such statements are predictions, which may involve known and unknown risks, uncertainties and other factors, which could cause the actual events or results and objections to differ materially from those expressed.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |