Tuesday, July 24, 2012 9:32:57 AM

July 23, 2012 by: Vytautas Drumelis

http://seekingalpha.com/article/741251-earnings-preview-nabors-industries

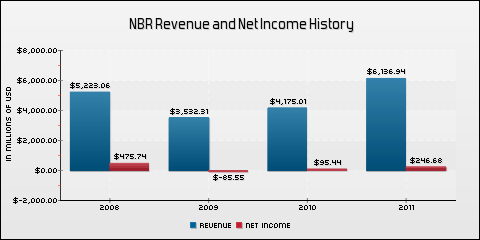

Nabors Industries Ltd. (NBR) is scheduled to report its Q2 2012 results on July 25, 2012, before market opens. The street expects EPS and revenue of $0.39 and $1.74B, respectively.

In this article I will recap the historical results of the company, its latest EPS estimates vs. surprises, the latest news from NBR and the news from its closest competitors.

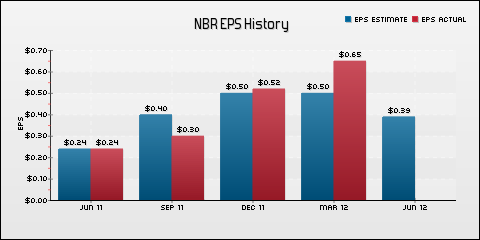

Recent EPS Actuals vs. Estimates

The company has met or beaten analysts' estimates in the last two quarters. In the last quarter it reported $0.65 EPS, beating analyst estimates of $0.50.

The consensus EPS estimate is $0.39 based on 26 analysts' estimates, up from $0.24 a year ago. Revenue estimates are $1.74B, up from $1.36B a year ago. The median target price by analysts for the stock is $21.00.

Average recommendation: Overweight

Source: Marketwatch

Analyst Upgrades and Downgrades

On February 23, 2012, UBS reiterated Neutral rating for the company.

On February 23, 2012, RBC Capital Mkts reiterated Sector Perform rating for the company.

On February 23, 2012, Argus upgraded the company from Hold to Buy.

Latest News

On July 17, 2012, Nabors Industries Ltd announced that it expects second quarter 2012 operating results to be below consensus estimates. The shortfall is attributable to lower than expected results primarily from its Pressure Pumping and, to a lesser extent, its International operations, partially offset by better results in its other US land operations.

On April 24, 2012, Nabors Industries Ltd. reported its financial results for the first quarter of 2012. Adjusted income derived from operating activities was $321.2 million, compared to $207.6 million in the first quarter of 2011 and $272.7 million in the quarter ended December 31, 2011.

On April 19, 2012, TransForce Inc announced that, through its subsidiary I.E. Miller Services, Inc, it has acquired certain assets of Peak USA Energy Services, Ltd. Peak USA, a subsidiary of Nabors Industries Ltd., is a diversified oilfield service company specializing in rig moving, custom heavy hauling, crane and rigging services, and oilfield transportation.

Competitors

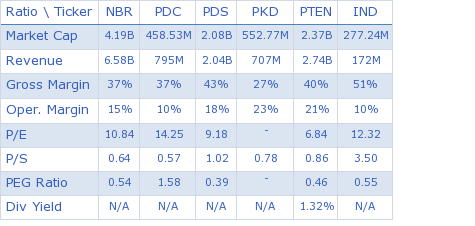

Pioneer Drilling (PDC), Precision Drilling (PDS), Parker Drilling (PKD), and Patterson-UTI Energy (PTEN) are considered major competitors for Nabors Industries and the table below provides the key metrics for these companies and the industry.

The chart below compares the stock price changes as a percentage for the selected companies and S&P 500 index for the last one year period.

NBR data by YCharts

Competitors' Latest Development

On June 25, 2012, Pioneer Drilling Co announced that it has received authorization to transfer the listing of its common stock, par value $0.10 per share, from the NYSE MKT to the New York Stock Exchange (NYSE).

On April 26, 2012, Parker Drilling Company announced that it has closed its previously announced sale of $125 million aggregate principal amount of 9 1/8% senior notes due 2018 in ? private offering.

On April 12, 2012, Parker Drilling Company announced that it has agreed to sell to eligible purchasers an additional $125 million aggregate principal amount of its 9 1/8% Senior Notes due 2018.

On March 6, 2012, Gulf Oil & Gas reported that Parker Drilling Company announced the departure of David C. Mannon, President, Chief Executive Officer (CEO) and Director, to pursue other interests effective March 9, 2012.

Technical Overview

The stock has a market capitalization of $4.19B and is currently trading at $14.33 with a 52 week range of $11.05 - $27.63. The stock's year-to-date performance has been -16.84%. It is currently trading above 20 and 50 SMA, but below 200 SMA.

Sources: Yahoo Finance, Google Finance, Marketwatch, Finviz, Reuters.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

If at first you don’t succeed, try, try again. Then give up. There’s no sense being a fool about it.

Recent NBR News

- Nabors Industries Ltd. 1st Quarter 2024 Earnings Conference Call Invitation • PR Newswire (US) • 04/03/2024 08:15:00 PM

- Form PRER14A - Preliminary Proxy Soliciting materials • Edgar (US Regulatory) • 03/07/2024 10:05:05 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/21/2024 09:20:54 PM

- Form 5 - Annual statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/13/2024 11:42:25 PM

- Form 10-K - Annual report [Section 13 and 15(d), not S-K Item 405] • Edgar (US Regulatory) • 02/12/2024 08:18:23 PM

- Form PRE 14A - Other preliminary proxy statements • Edgar (US Regulatory) • 02/09/2024 09:57:05 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 02/06/2024 10:14:25 PM

- Nabors Announces Fourth Quarter 2023 Results • PR Newswire (US) • 02/06/2024 09:15:00 PM

- SLB und Nabors geben Zusammenarbeit bekannt, um die Einführung von Automatisierungslösungen für Bohranlagen auszuweiten • Business Wire • 01/11/2024 08:22:00 PM

- SLBとネイバーズ、掘削自動化ソリューションの導入拡大に向けた提携を発表 • Business Wire • 01/11/2024 08:22:00 PM

- SLB and Nabors Announce Collaboration to Scale Adoption of Drilling Automation Solutions • Business Wire • 01/11/2024 02:00:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/03/2024 11:57:31 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/03/2024 11:51:26 PM

- Nabors Industries Ltd. Fourth Quarter 2023 Earnings Conference Call Invitation • PR Newswire (US) • 01/03/2024 09:05:00 PM

- Nabors Industries Completes Its Most Impactful Energy Transition Investment to Date • PR Newswire (US) • 12/19/2023 12:01:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 11/20/2023 09:08:48 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 11/16/2023 11:03:14 AM

- Nabors Prices $650 Million in Senior Priority Guaranteed Notes • PR Newswire (US) • 11/16/2023 03:47:00 AM

- Nabors Announces Offering of $550 Million Senior Priority Guaranteed Notes • PR Newswire (US) • 11/15/2023 12:16:00 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 10/27/2023 06:32:42 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 10/26/2023 10:01:18 AM

- Nabors Announces Third Quarter 2023 Results • PR Newswire (US) • 10/25/2023 09:14:00 PM

- Nabors Industries Ltd. Third Quarter 2023 Earnings Conference Call Invitation • PR Newswire (US) • 10/06/2023 09:23:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 09/06/2023 01:50:27 AM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 09/05/2023 08:10:50 PM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM

Avant Technologies Launches Advanced AI Supercomputing Network and Expansive Data Solutions • AVAI • Apr 23, 2024 8:00 AM

BestGrowthStocks.com Issues Comprehensive Analysis of Triller Merger with AGBA Group Holding Limited • AGBA • Apr 22, 2024 1:00 PM

Cannabix Technologies to Present Marijuana Breathalyzer Technology at International Association for Chemical Testing (IACT) Conference in California • BLO • Apr 22, 2024 8:49 AM