April 26, 2012 by: Jiang Z

http://seekingalpha.com/article/530231-sohu-baidu-tencent-bringing-the-fight-to-youku-tudou?source=yahoo

According to Sina Tech, Sohu (SOHU), Baidu, and Tencent have agreed to form a partnership in their online video units in response to the merger of Youku and Tudou to promote content sharing among the three platforms.

The Sohu-Baidu-Tencent partnership will effectively:

Challenge Youku-Tudou's dominance of China's online video market

Lower the cost of content acquisition

Enhance user experience through platform integration and content sharing

Spur additional M&A activities in the industry

Youku-Tudou's Dominance Is Not Guaranteed

In my March 12th note titled, "Youku-Tudou: A Potent Force In China's Online Video Market", I pointed out that:

China's online video industry is undergoing consolidation amid rising bandwidth and content costs, and companies are trying to establish economies of scale through M&A

Youku-Tudou will become the leading online and mobile video platform in China with no clear number 2 in sight

Smaller players, such as Ku6 Media (KUTV), could become attractive acquisition targets as other large players, such as Sohu and Baidu decide to consolidate them to compete against Youku-Tudou

The Sohu-Baidu-Tencent partnership has established a faction that can effectively challenge Youku-Tudou in China's online video market.

Baidu's online video unit, iQiyi, is a critical piece of the partnership. At the end of last year, the unit accounted for approximately 7% of China's online video market, compared to Sohu's 13%. Despite its relatively small market share, iQiyi generates over 230 million unique visits from PC users alone and ranks second in China on time-spent among China's online video service providers, according to both iResearch and ComScore. iQiyi's participation in this partnership is critical because it is unlikely that Sohu can challenge Youku-Tudou with Tencent alone, because Tencent's online video market is insignificant.

Content Price Should Continue to Decline As Industry Consolidates

According to Deng Ye, CEO of Sohu TV, Sohu-Baidu-Tencent will share 12 TV series total and purchase video copyrights together exclusively under the agreement. As the number of competitors that bid for contents decreases, the cost of acquisition is likely to decline and this could be a signal for margin improvements for all three companies.

Viewers Are The Ultimate Beneficiaries

In my view, the ultimate beneficiaries from the fierce competition among Chinese online video providers are the viewers. The integrated online video platform for Sohu-Baidu-Tencent will allow users to:

Access large content library from multiple channels

View quality videos sooner due to lower acquisition cost

Expect More M&A Activities Ahead

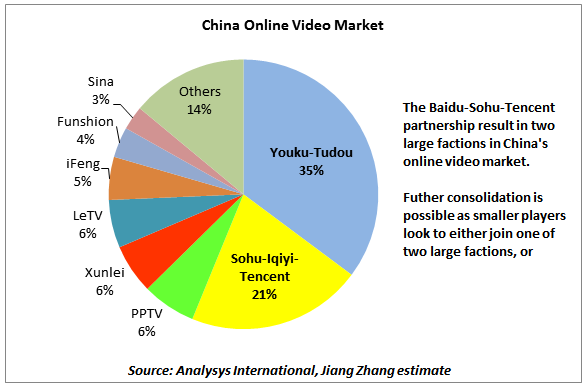

The Sohu-Baidu-Tencent partnership changed the industry landscape in which two large factions account for close to 50% of the industry market share, while smaller players, such as Sina (SINA), Xunlei, PPTV, and LeTV, are fragmented among the remaining portion.

The smaller players have limited option on competing against the two large factions due to lack of competing capital for content acquisition. From a strategic perspective, the choices available to the remaining players are:

Focusing on building in-house productions to attract viewers

Merging with one of the larger factions

Forming a partnership within themselves

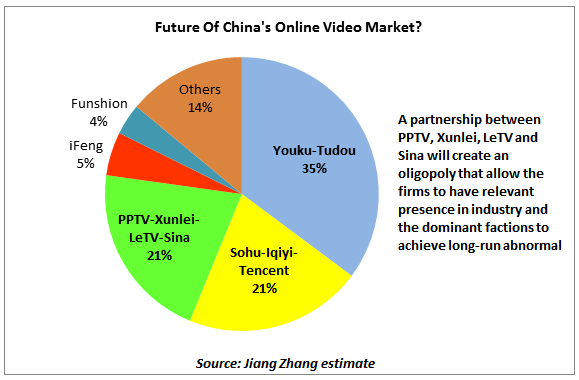

In my view, the third option is a real possibility among Sina, PPTV, Xunlei, and LeTV, which combine for 21% of the online video market share.

A merger or a partnership between these three players will not only result in similar synergy to that of Sohu-Baidu-Tencent pact in terms of content sharing and acquisition, but, most importantly, create an oligopoly that in theory will allow the few dominant firms to achieve long-run abnormal profit.

The reason why I believe Sina will be part of the pact is that Sina is unlikely to bet its entire future on Weibo, therefore it is likely to follow rival Sohu's footsteps to diversify its revenue stream. Since Sina already lags behind rivals in the online video space, it makes sense for the company to maintain a relevant presence via partnerships.

If at first you don’t succeed, remove all evidence you ever tried.

Recent SOHU News

- Sohu.com Limited Announces its 2023 Annual Report on Form 20-F is Available on the Company's Website • PR Newswire (US) • 03/18/2024 10:45:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 03/04/2024 11:07:48 AM

- SOHU.COM REPORTS FOURTH QUARTER AND FISCAL YEAR 2023 UNAUDITED FINANCIAL RESULTS • PR Newswire (US) • 03/04/2024 05:00:00 AM

- Sohu.com to Report Fourth Quarter and Fiscal Year 2023 Financial Results on March 4, 2024 • PR Newswire (US) • 02/20/2024 05:00:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 11/13/2023 11:10:27 AM

- SOHU.COM REPORTS THIRD QUARTER 2023 UNAUDITED FINANCIAL RESULTS • PR Newswire (US) • 11/13/2023 05:00:00 AM

- Sohu.com to Report Third Quarter 2023 Financial Results on November 13, 2023 • PR Newswire (US) • 10/30/2023 05:00:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 09/13/2023 10:06:34 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 08/07/2023 11:04:34 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 08/07/2023 11:00:08 AM

- SOHU.COM REPORTS SECOND QUARTER 2023 UNAUDITED FINANCIAL RESULTS • PR Newswire (US) • 08/07/2023 05:00:00 AM

- Sohu.com to Report Second Quarter 2023 Financial Results on August 7, 2023 • PR Newswire (US) • 07/24/2023 05:00:00 AM

- SOHU.COM REPORTS FIRST QUARTER 2023 UNAUDITED FINANCIAL RESULTS • PR Newswire (US) • 05/15/2023 05:00:00 AM

- Sohu.com to Report First Quarter 2023 Financial Results on May 15, 2023 • PR Newswire (US) • 05/05/2023 08:00:00 AM

FEATURED Glucotrack Announces Expansion of Its Continuous Glucose Monitoring Technology to Epidural Glucose Monitoring • Apr 17, 2024 8:00 AM

ILUS Provides Form 10-K Filing Update • ILUS • Apr 17, 2024 9:54 AM

Maybacks Global Entertainment To Fire Up 24 New Stations in Louisiana • AHRO • Apr 16, 2024 1:30 PM

Cannabix Technologies Begins Certification of Contactless Alcohol Breathalyzer, Re-Brands product series to Breath Logix • BLOZF • Apr 16, 2024 8:52 AM

Kona Gold Beverages, Inc. Acquires Surge Distribution LLC from Loud Beverage Group, Inc. (LBEV) • KGKG • Apr 16, 2024 8:30 AM

Branded Legacy, Inc. Reports Significant Net Income of Over $3.8 Million • BLEG • Apr 16, 2024 8:30 AM