Tuesday, November 01, 2011 9:25:19 PM

This is a Summary of all the "DD" i gathered and from other DD sources of this board and to show proof that this is a producing mine in Ensenada Mexico and on our planet

(special thanks to all DD'ers of this board and myself) :-P

GLTA

> Monthly Pics from 9/2010 to 8/2011 w/member visits

> ITMD's A.I.O DD compilation (from Sept 2010 till March 2011)

> "" M A P S "" of CWRN - PanAm mining concessions

> 1st ever EXPORT PERMIT issued in Mexico for "PanAm"

> Loreto's FE% "SGS Certificate of Analysis"

==================== SOS Corp Info ====================

> SOS Corp COTTON & WESTERN MINING, INC (A/S 6 bil) (Public co)

> Signatory-Page-MOU-Feb-2010-Fremery-Mining-HK (PDF Doc)

> SOS Corp PAN AMERICAN MINERAL VENTURES, LLC (Private co)

> Panamerican Minerals Ventures S.A. de C.V "Mina Guadalupe" in Ensenada,under contract and held in trust for/with CWRN (private company created to comply with Mexican mining laws)

> Other Affiliations: Geo JS Tech Group USA / Geotech Group S.A de C.V Mexico ( by balihi & ontopofit1 )

> SOS Corp Geo JS Tech Group Corp / Agent-EDWARD MUI (Private co)

https://ourcpa.cpa.state.tx.us/coa/servlet/cpa.app.coa.CoaGetTp?Pg=tpid&Search_Nm=GEO%20JS%20TECH%20GROUP%20&Button=search&Search_ID=32041636336

> SOS Corp TMT Global Corp Agent-EDWARD MUI (Private co) http://www.tmtglobalcorp.com/contact_us

http://www.otcmarkets.com/stock/CWRN/company-info

> a/o "News of Sept 29th 2011" (SS included)

A/S: 6 Bil (per otcmarkets + PR + SOS corp)

Current O/S: 4,361,635,980 Bil

Restricted: 2,056,610,879 Bil

Free Trading Float: 2,305,025,101 Bil

Free Trading Float Held Close: 550 Mil

Free Trading Float on the street: 1,755,025,101 Bil

- Investor Relations emilycotton@cottonwestern.com

What Does Closely Held Shares Mean ?

The shares held by individuals closely related to a company and/or maybe some shares are part of the buyback in progress

============== RECENT NEWS ============== ( View Older News Here )

>> Sept 29 2011 Remedial Drilling Underway at Mina Guadalupe

CWRN Management stated today that the original drilling program consisted of 68 shallow drill holes into the Guadalupe iron ore bodies; 66 of the 68 drilled holes contained iron ore lenses varying in thickness from 2 to 14 meters thick. The deepest drilled hole was 20 meters in depth. The last shipment of iron ore and the current stockpiles of finished products have all come from a small section of the 1,500 meters long Coloso Vein (one of four long iron ore veins on the mineral concession) and 26 meters of overburden and iron ore have been extracted out of the section. Currently the company has begun a remedial drilling program to extend the drilling depth to a minimum of 25 meters under the previously discovered iron ore lenses and up to 100 meters deep should the ore body continue at greater depth. In the first of a series of mini drilling programs, four drill sites were chosen approximately 300 meters apart along the 275 degree Northwest Coloso strike in areas of confirmed heavy ore bodies. The results of the program will be made available to our shareholders and the general public upon completion.

Shipping Update: Bulk vessel shipping is currently on hold, pending the evaluation of cost savings on shipment size. The first two shipments of Guadalupe raw crude iron ore were delivered via HandyMax at 38,500 and 36,000 dry metric tons of ore, the latter shipment ended at a cost of $43.00 per wet metric ton of product. Shipping cost has recently decreased, primarily on larger capacity vessels; therefore, Management has asked the John F. Dillon & Company, LLC., to assist in finding and negotiating the best Seaborne dry bulk freight rates available. A decision will be make within the next couple weeks to either ship numbers 3 and 4 separately in HandyMax or combine the two shipments into a SuperMax at 58,000 WMT or a PanaMax at 70-75,000 WMT shipment.

CWRN Current Share Structure: The Company has stated that it is not currently providing any Market Awareness nor is it involved with the market in any way. The share price of the Company's stock is solely dictated by the market.

-A/S: 6 Bil -Current O/S: 4,361,635,980 Bil -Restricted: 2,056,610,879 Bil -Free Trading Float: 2,305,025,101 Bil

>> Aug 8th 2011 Loreto Sailing with 2nd Bulk Iron Ore Shipment

Due to the river draft at the Port of Jiangyin on the Yangtze River, some 750 metric tons of iron ore was removed from the MV Loreto Bulk Vessel.. Remaining ore on the dock will go out on the next shipment. Here is a site with some good pictures in and around the City and river port: The Loreto is a 45k/mt carrier, it was chosen for its width and shallow draft only 36,000 metric tons can be offloaded there, the final draft survey was 36,002 mt.

http://ports.com/china/port-of-jiangyin/photos/#/show-gallery?o=photo-0

Loreto pulled out at 6:00am PST this morning and is scheduled to arrive on Aug 27 at 18:00 hours.

Operations Update: The Company will now begin preparations of its stockpiled 1-3mm Sinter Feedstock Fines for the 3rd shipment of iron ore to China this year, anticipated sailing between the 10th and 15th of September, 2011.

CWRN Current Share Structure: The Company has stated that it is not currently providing any Market Awareness nor is it involved with the market in any way. The share price of the Company's stock is solely dictated by the market.

-A/S: 6 Bil -Current O/S: 4,361,635,980 Bil -Restricted: 2,056,610,879 Bil -Free Trading Float: 2,305,025,101 Bil

" " The loading of the vessel went very smooth requiring only one move due to scheduled container vessels. Below is the load-out break down; All shipping documents have been completed, the last document required to draw down the Domumentary Letter of Credit is the product analysis, which will require about two weeks.... Next shipment will be 1-3mm sinter feedstock fines...... Bob " "

> June 30 2011 "Trucking for 2nd Bulk Iron Ore Shipment Underway"

PanAmMex dispatched Road Runner Trucking on June 29th, 2011 for the heavy haul trucking of processed iron minerals to the Ensenada International Terminal, Baja California, Mexico on the Pacific Ocean. An anticipated load-out date of July 26, 2011 has been set with the execution of a bulk cargo vessel fixture note. The Company will be shipping two grades of raw crude iron ore and two sizes, 1-3mm fines and 3-18mm mixed fines and lump ores in five cargo vessel holds.

> May 26 2011 "Revenues Distributed, 2nd Bulk Shipment Close"

the company under Irrevocable Assignment of Documentary Letter of Credit Proceeds, distributed the revenues from its first bulk shipment of iron ore under the following percentages; 60% to ongoing operations, 30% to Project Investors and 10% to Management. The Project Investors recovered approximately 75% of their cash contributions; The Ensenada International Terminal was paid approximately $320,000.00 for receiving, storage, material handling and cargo loading, $356,000.00 was paid to Road-Runner Trucking, $1,115,000.00 was paid to COSFAR Bulk Cargo Shipping, $220,000.00 was paid in royalty fees and surface rights. The Company was also able to meet its obligations to PowerScreen of California paying a balance of $975,000.00 for the crushing equipment. We would like to thank PowerScreen for their ability to provide us with over $1,500,000.00 in equipment that was paid off under settlement of DLC proceeds, without their help it would have been very difficult to secure the equipment we had specified for the production. The Company will be receiving more equipment from PowerScreen shortly.

" " " Note: Pan American Mineral Ventures, LLC. Officers, Directors, Insiders and Affiliates control over 50% of the Company's Outstanding Shares, Robert L. Cotton and Sharon Vazquez are co-managers of Pan American Mineral Ventures, LLC., State of Nevada, both are Officers and Directors of CWRN.

OTC:PK Status: CWRN is no longer a developing company and as such the non-reporting SEC status in not desirable to maintain a healthy share value for the shareholders; therefore, the Board of Directors have agreed to move on. The company will be merging into a new mining company that will be involved with several other iron ore mining projects and will be an SEC reporting company listed on the OTC:QB; this process shall take some time and will require shareholder's voting approval. A Shareholders meeting will be held, all shareholders of record will be given a 45 day written notice of the time and place of the meeting. A news release will also be issued with the Shareholders notice.

> April 05 2011 M.V. Kriton Sailing Under 1st Ever MexSecEcon Iron Export Permit

The Company announced today that the Bulk Carrier M.V. Kriton loaded out and departed the Ensenada International Terminal at 8:30pm PDT April 2nd on its 24 day journey to The People's Republic of China. This landmark voyage has been marked by two distinctions: the Mexico Secretary of Economy's first ever issued 45,000 metric ton iron mineral export permit following the new iron mineral export law enacted on March 18th, 2011, and the first ever bulk cargo shipment of iron minerals from the Ensenada Pacific Ocean Port. The permit was issued in the name of Subsidiary Panamerican Minerals Ventures, S.A. de C.V.

> March 25 2011 "M.V. Kriton Landed and Loading Iron Ore" (Ship Arrival + CE issue + New Mining Project included)

advises CWRN shareholders that the 42,000 dead weight ton bulk cargo vessel M.V. Kriton has berthed at the Ensenada International Terminal on the Pacific Ocean and that continuous loading is under way of the multimillion dollar iron ore cargo bound for the People's Republic of China.

" " CWRN is currently in talks with the HyVista Corporation (www.hyvista.com) for the acquisition of surface mineral mapping over the 21,000 hectare (52,500 acres) Nazarena Mineral Concession located in south central Baja California. The project is expected to be on line before the end of year 2011 and shipping out of the Sea of Cortez.

> Nov 22 2010 Share buyback after 1st shipment >>>> Buyback Shares explained (posted by microcaps1)

2." " The Company is contemplating a treasury buy back program for sixty (60%) percent of the public free trading common shares in year 2011.

"" Insiders Currently hold over sixty (60%) of the outstanding common shares of CWRN.

" " The B.O.D. has voted to incorporate a structured plan that will provide for a combination of buyback and retirement of CWRN common shares

3." "Currently Pan American Mineral Ventures, LLC State of Nevada, is the largest shareholder controlling 1.75 billion common shares

" "By consent; the Directors of Pan Am LLC., U.S.A. shall retire by deleting a percentage of common shares now held as new common shares that are accumulated though the public market beginning in the later part of the first quarter of 2011.

4. Review and discuss the possibility of a corporate name change from Cotton & Western Mining, Inc. to Pan American Mineral Ventures, Inc. to better reflect the Mexico In-country affiliate operations. The Company shall submit to NASDAQ the request for name change together with a new CUSIP number " "First quarter financials should be completed . . . and shall be immediately posted for the general public together with complete share structure.

==================== MEMBERS POSTS ====================

>> Minerals often rise in negative economic conditions Iron is the highest profit mineral (by microcaps1)

>> ARTICLE The Important Factors to Consider When Investing in Iron Ore (posted by CohibaMan)

>> Wyoming's Email to Bob about the CE & Uplisting subject (May 2011)

>> C.E & DTC issues -- monthly DTC fees not payed? -- Tactics by special groups (by microcaps1)

>> Fake Buyout Offer Info Scrutinized (posted by maxshocker)

>> PIC Updates in July-August before "Loreto's" Ship Arrival showing IRON ORE piles growth (by Pesquero)

>> The mining industry in Baja California (translated by google)

"So we went in Erendira revealed Garzon, where we now have two large foreign companies with mining concessions to extract iron (iron)." " These are the companies Panamerican Minerals Ventures, SA de CV, a subsidiary of another American Cotton & Western Mining Incorporation ....

==================== PICS & VIds ====================

Sept 2010 Day at the Mine Video w/bob source (www.cottonwestern.com/iron_mines.php)

Pic Compilation Video

> CWRN Morning OPerations *March 2010 (johnynothumb & Temeku999 road trip)

> User Pics vs Google maps Pics with viewpoints detailing area of mine

> Mexican Geological Survey: CWRN Mines Listings

http://portaljsp.sgm.gob.mx/SINEM/f4MME/iMinMex0.htm (by tlc2)

(as seen on the website a/o Nov 1 2011)

Phone 711-3165 Ext. 1295, Fax. 711-4266 e-mail: economiaminera@sgm.gob.mx

Blvrd. Felipe Angeles km. 93.50-4, Col Venta Prieta, Pachuca, Hidalgo, Mexico

> "RENTAS JC ENSENADA" Rental Equip Verification BC TEL:177-76-96 (Real company to rent Tools and Equipement)

-Source http://directorios-mexico.blogspot.com/2010/09/maquinaria-para-construccion-ensenada.html

Cotton & Western Mining, Inc. Houston , Texas U.S.A.

Web: http://www.cottonwestern.com

Robert L. Cotton President & C.E.O.

Office Ph: + 1 713 482 7593

Fx to e-mail: + 1 702 387 2347

V.Pres & Dir of Mining Operations PanAmerican Minerals Ventures, S.A. de C.V. Mexico

Home Ph: Ensenada Baja Mex + 52 646 173 3663

Ph: Mobile Mexico: + 52 (1) 646 121 0442 From outside Mex, inside Mex drop the 1

Ph: Mobile U.S.A. : + 1 832 692 3542

E-mail: bobcotton@cottonwestern.com OR cottonwestern@yahoo..com

Investor Relations emilycotton@cottonwestern.com

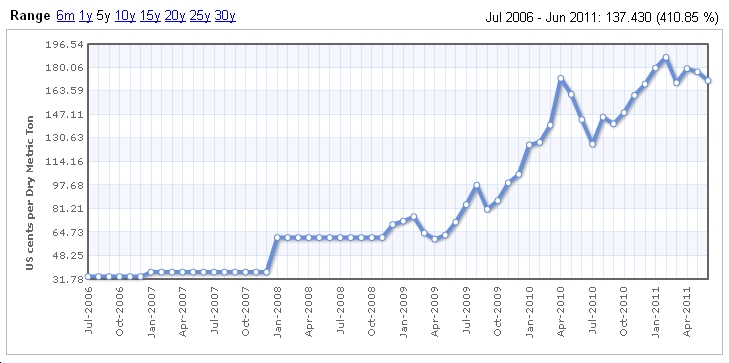

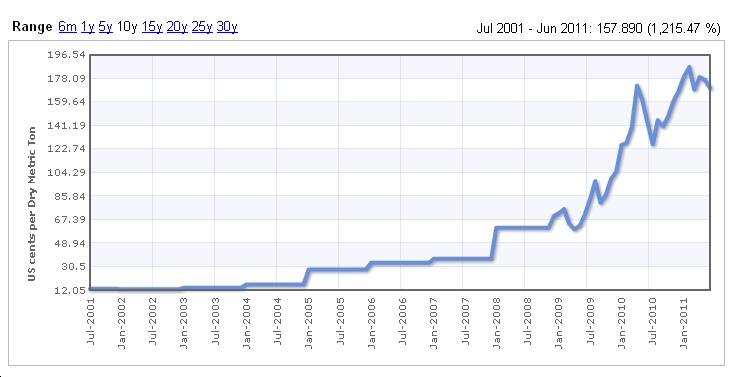

======================= 5yr/10yr IRON ore prices on the Rise =============================

This is to give a perspective why CWRN is way undervalued.and the demand of IRON ore is on the Rise.

> Metal Bulletin Iron Ore Index Link http://www.mbironoreindex.com/

Derivatives traders dive into iron ore market as prices triple .. Frik Els | August 23, 2011/MINING.COM (#51929 posted by johnsync)

New York brokerage GFI’s announcement on Tuesday that it now offers on-screen iron ore swap trading is the latest indication that the economics of the world’s foremost dry bulk commodity are being changed fundamentally.

Started in 2008, derivatives trading in iron ore is up fourfold this year after setting a record in July as investment banks enter the massive market in numbers.

The world’s top three miners – BHP Billiton, Vale and Rio Tinto – control nearly 70% of the 1 billion tonne annual seaborne trade and dominate price talks. The benchmark China import price for iron ore has tripled since late 2008 to $177 a tonne.

MINING.com reported on Monday strong demand in China because of the low quality of its domestic supply and India’s plans to cut exports by half over the next five years should bolster prices in the medium term before huge supplies from Australia start coming on stream from 2014 onwards.

MINING.com reported last week BHP Billiton, the world most valuable miner, is set to report a record $22 billion in annual profit on Wednesday thanks in large part to its iron business.

Credit Suisse and Deutsche Bank began offering swaps in 2008 at the instigation of BHP Billiton as the iron ore producer campaigned to end annual supply contracts and benchmark negotiations against the spot price.

Reuters reports the volume of iron ore swaps cleared reached a record annualised level of almost 50 million tonnes last month, and although it is still small compared with the physical market, it is set to double again before the end of the year.

MINING.com reported in June that pay for star metals traders were reaching $2 – $3 million a year, up 20% over last year.

Iron Ore Monthly Price - US cents per Dry Metric Ton

--- 5 years --- 410.85 % Rise

--- 10 years --- 1,215.47 % Rise

==================== Daily & Weekly Charts =======================

== DAILY CHARTS ===

== WEEKLY CHARTS ===

$CWRN

$PANAM

$IRON

Colosso and upper level 6 with BINGO the Dog

DISCLAIMER its your decision to BUY/SELL/SHORT/HOLD/WATCH, do your own DD, know your risk.

Help Yourself by Helping others Succeed

Facts = Proof via News/Filings/Links/Pics/Corp Profiles etc.

FEATURED Cannabix Technologies to Present Marijuana Breathalyzer Technology at International Association for Chemical Testing (IACT) Conference in California • Apr 22, 2024 8:49 AM

BestGrowthStocks.com Issues Comprehensive Analysis of Triller Merger with AGBA Group Holding Limited • AGBA • Apr 22, 2024 1:00 PM

Kona Gold Beverages, Inc. Prepares for First Production Run Set to Launch May 17, 2024 • KGKG • Apr 22, 2024 8:30 AM

VPR Brands LP Reports Record Annual Financial Performance for Fiscal Year 2023 • VPRB • Apr 19, 2024 11:24 AM

Coinllectibles' Subsidiary, Grand Town Development Limited, Acquires Rare Song Dynasty Ceramics Worth Over USD28million • COSG • Apr 18, 2024 8:03 AM

ILUS Provides Form 10-K Filing Update • ILUS • Apr 17, 2024 9:54 AM