Friday, October 20, 2017 8:29:32 PM

Chart Source - Spencer Osborne

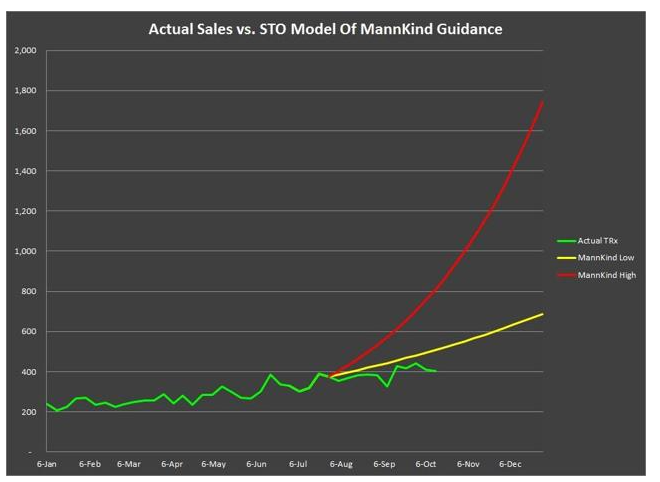

The next chart is a conversion of MannKind revenue guidance to scripts. The chart contains actual sales vs. a low guidance and high guidance of MannKind.

As you can see in the chart, actual sales are trending below the lower end of MannKind guidance. This is something that savvy investors will consider. The delta between what actual sales are and the lower end of guidance is growing wider as each week passes. In essence, the only hope of MannKind being able to meet its guidance rests on Afrezza sales accelerating at a greater rate over the remaining 11 weeks of the year. While many want to give the company time to really work the new Afrezza label, it is the company itself that boxed itself into this second half guidance. With the Q3 call a few weeks away, this matter will either need to be addressed head on with a reasonable explanation or glossed over in hopes that people have a short memory. Unless sales begin to see immediate traction that is better than anything we have seen thus far, MannKind will likely need to find a way to explain itself. CEO Mike Castangna is very well spoken, and certainly capable of putting an explanation onto the table, but if the company misses its guidance, his believably will take a hit of some nature. In my opinion the current mission is getting as close as they can to the lower end of guidance more-so than actually hitting it.

It is my belief that the potential of the new label will be a Q1 measure instead of a Q4 measure.

Recent MNKD News

- MannKind Repays Certain Debt Obligations • GlobeNewswire Inc. • 04/03/2024 10:00:00 AM

- MannKind Announces CFO Transition • GlobeNewswire Inc. • 03/26/2024 08:05:00 PM

- INHALE-3 Study’s Initial Meal Challenge Results Comparing Afrezza® Head-To-Head With Multiple Daily Injections (MDI) and Insulin Pumps • GlobeNewswire Inc. • 03/11/2024 10:05:00 AM

- MannKind Announces New Clinical Data From Inhale-3 Study to be Presented by Dr. Irl B. Hirsch at ATTD on March 8 • GlobeNewswire Inc. • 03/05/2024 11:05:00 AM

- MannKind Corporation Announces Participation at Upcoming Conferences • GlobeNewswire Inc. • 03/04/2024 06:01:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 02/27/2024 09:05:20 PM

- MannKind Corporation Reports 2023 Fourth Quarter and Full Year Financial Results: Provides Clinical Development Update • GlobeNewswire Inc. • 02/27/2024 09:00:00 PM

- MannKind Corporation to Hold 2023 Fourth Quarter and Full Year Financial Results Conference Call on February 27, 2024 • GlobeNewswire Inc. • 02/20/2024 11:00:00 AM

- MannKind Announces Enrollment Goal Completion of INHALE-1 Pediatric Diabetes Trial Utilizing Afrezza® • GlobeNewswire Inc. • 02/15/2024 11:05:00 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/05/2024 11:00:31 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/05/2024 11:00:23 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/05/2024 11:00:15 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/05/2024 11:00:15 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/05/2024 11:00:14 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/05/2024 11:00:12 AM

- Form 8-K - Current report • Edgar (US Regulatory) • 01/02/2024 11:06:28 AM

- MannKind and Sagard Healthcare Enter Into Royalty Purchase Agreement for Up to $200 Million • GlobeNewswire Inc. • 01/02/2024 11:05:00 AM

- MannKind Corporation to Present at 42nd Annual J.P. Morgan Healthcare Conference • GlobeNewswire Inc. • 12/28/2023 11:00:00 AM

- Form 8-K - Current report • Edgar (US Regulatory) • 12/27/2023 09:15:30 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/16/2023 02:00:12 AM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 12/15/2023 09:09:12 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 12/15/2023 12:56:53 AM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 12/14/2023 09:08:46 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 11/07/2023 09:05:18 PM

- MannKind Corporation Reports 2023 Third Quarter Financial Results • GlobeNewswire Inc. • 11/07/2023 09:00:00 PM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM

Avant Technologies Launches Advanced AI Supercomputing Network and Expansive Data Solutions • AVAI • Apr 23, 2024 8:00 AM

BestGrowthStocks.com Issues Comprehensive Analysis of Triller Merger with AGBA Group Holding Limited • AGBA • Apr 22, 2024 1:00 PM

Cannabix Technologies to Present Marijuana Breathalyzer Technology at International Association for Chemical Testing (IACT) Conference in California • BLO • Apr 22, 2024 8:49 AM