Tuesday, October 17, 2017 12:34:32 AM

Link to presentation Video: https://www.youtube.com/watch?v=ZUF5W_zof0o

Hey guys, I’ve taken the liberty of transcribing the whole video for you, writing it out word for word...only took me about 8 hours to do. Last time I analyzed DD the price jumped the next day 100%+. You really need to check out the new catalysts explained in this video that Ambicom released last week! Over the next 6 months, starting at any point within the next 4 weeks, ABHI is going to start a real nice upward trend to test 0.01. Dilution is now down to a minimum, if at all still, and SEC filings are imminent. You REALLY need to take a look at the markets that these guys are entered into, and the information on the slides of projects and business deals they are already in the process of making!

Slide 1 – Intro

Slide 2 – Ambicom & Voosh are now one company

Slide 3 – NEW CATALYSTS! – Company guidance by the CEO through March 31, 2018! MUST READ!

Slide 4 – What they do

Slide 5 – Companies they have worked with

Slide 6 – How they do it

Slide 7 – IBM TEST BENCHMARKS! AMAZING STATISTICS!

Slide 8 – THIS IS WHERE ALL THE MONEY IS!!! $$$$ MARKETS ARE ENDLESS MONEY TENS OF BILLIONS OF $$$ PER YEAR! ALREADY WORKING WITH MICROSOFT, IBM, KASAEYA, CANONICAL, AND MORE!!!

Slide 9 – MARKETING CHANNELS AND PACKAGING – DISCUSSIONS ALREADY UNDERWAY WITH NEVERFAIL, AVG, LABTECH, N-ABLE, AND SYMANTEC! Also is listed on IBM, Citrix, VMWare, and Microsoft partner sites!

Slide 10 – More Information

Slide 11 – Application architecture

Slide 12 – ACO: Settings Calculated

Slide 13 – Why it is a good investment opportunity

Slide 14 – CEO Contact information

GUYS – ABHI is involved in this WAY bigger than we thought. This video has only been seen less than 400 times. This information NEEDS to be distributed! Imagine the potential here in such a short period of time? And the deals that are already being made? Remember on the live conference call in September when Alain was still the CEO, it was stated that there is no plan to reverse split or increase Authorized share count! With revenue about to pour into Ambicom…this is a NO BRAINER AT 0.0009/0.0010!!

Slide 1 of 14 – 0:00

My name’s Kevin Cornell and this is a repeat of a presentation that Alain Lewand and I made back in September at a discussion on Ambicom ABHI as a company and an SEC filing company - some of the steps we’re taking with that and the status of that – plus Voosh as a distribution company, and that was taking a licensed product from Ambicom into the marketplace: Active Continuous Optimization.

Slide 2 of 14 – 0:24

Since that time, the two companies have come together. On 9/29 Ambicom Holdings and Voosh executed an asset purchase agreement whereby the assets of Voosh became the assets of Ambicom, and that means that the software application itself that Voosh had, it matches the patent that Ambicom has, and became one together. Now, Ambicom owns not only the operating application itself but also the patent, and as people that have followed the company know, there was a bit of a court case in the past to get the patent in, and now with the Asset Purchase Agreement the actual application itself is back within Ambicom , and along with that goes the marketing materials, and all the sales relationships, including contracts with customers and Distribution Agreements, and Technology Alliance Agreements that Voosh has executed. That’s all now back within Ambicom itself.

Slide 3 of 14 – 1:27

We’re setting some goals for ourselves Q1 being the 4th quarter calendar year of 2017 - Q2 is the calendar year January, February , March 2018. One of the top things that we’ve got to do within Ambicom is to get those SEC filings current, get the stop sign off the stock and make it a fully-fledged fully trading fully supported company on the SEC. There’s a fairly large debt load that was added to the company by previous administrations, (not Alain), Alain did his best efforts to reduce and get control of that, he did quite a good job of that, I think. We’re going to finish that job off.

We want to open up two markets for the product, and we have several to choose from. The one that seems to be the most advanced and “top of the line” is our relationship with Kasayea, and entering into managed service providers, that is people that are outsourced IT they would use our product, integrated with the Kasayea application, to manage their endpoints and give them better operating environments - actually cheaper because they run more efficiently - basically you tune all the endpoints of the customers. We’re always in the process of scrubbing the applications, that’s something that never ends, so we’re going to be doing a full scrub of the application itself, and make sure it’s all current and make sure that it’s got all the bells and whistles that we want on it, and again that’s ongoing.

We’re moving the lawsuits over (from our active involvement as management), over to the lawyers. So we’ll take a step back as management, let the lawyers handle it, and we’ll focus on the business. For anyone that saw one of our press releases, we have a court date in the month of October 2018. We’re not sure what day it is, but we’ll be told that around the end of September 2018. There’s a lot of steps that have to happen between now and then that the lawyers can handle, that is: depositions; gaining information; going through the different files that we’re going to receive; and really scoping out what the extent of the damages are that we’re going to be asking for once we get a look at the books and the customer base for PC Drivers. So that we’ll be handling, but our involvement will be a lot less because we’ve contracted the lawyers and got them started. We’re now focusing on the business. Revenue is the key, relationships is the key - getting the product into the market place.

In the beginning of next year when we’ve got a bit of a track record, we’re going to take a look at establishing an operating line that allows us to flesh out the sales, support, and the marketing staff, and expand our presence in the market. That will allow us to increase the revenue ramp, and then we’re looking to open up a third market in the beginning of next year. When I talk about markets we’re talking about MSPs (Managed Service Providers), we talk about dealing with companies like Canonical that have an open stack cloud environment, or approaching companies that have tools that allow you to manage and reduce your costs in the cloud environment. There are companies like Data Dog that are there to manage how much people pay, and people are paying upwards of a million dollars per month to run some of their applications in the cloud. Wouldn’t it be nice to have a button on it that says “watch this, click here – and we’ll give you a reduction of cost just because we’re now going to tune your environment.” That’s what we’re talking about when we talk about opening up new markets.

Slide 4 of 14 – 5:03

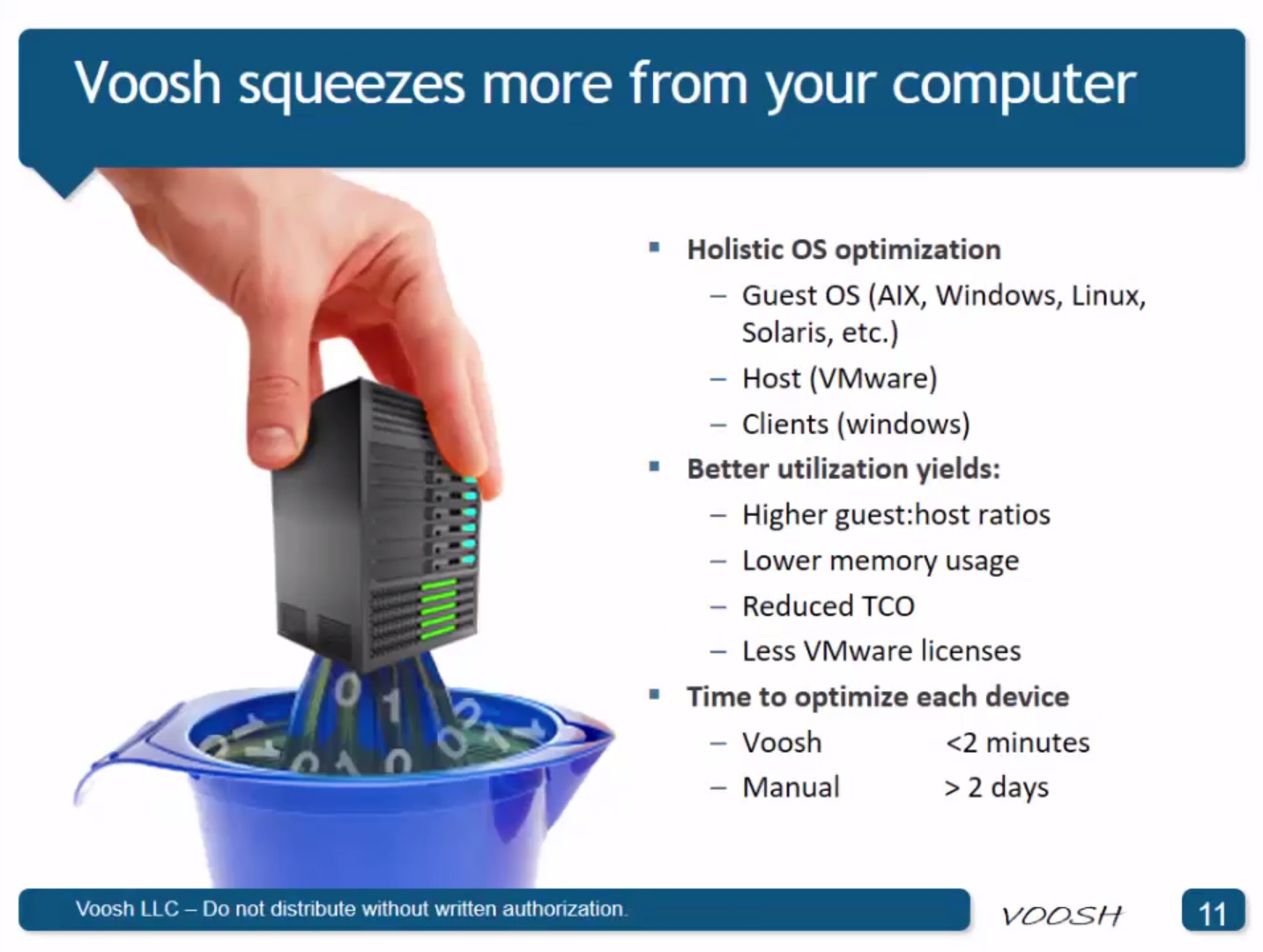

So what do we do? And when I say “we”, these are the slides I took from Voosh - Voosh’s assets are now part of Amibcom. So what do we do? We actively and continuously optimize servers and personal computer. We increase the performance - we tune the systems just like you would tune them manually. So when you tune them manually you go in and take a look at all the different aspects of it and you tune the Memory, the CPU, the Disk I/O, and the Network. And all the components within that to act like a holistic view of how you’re supposed to handle the workload with the assets given to you. If you’re an expert that does it, that’s great, you can do that fairly quickly (and when I say quickly we’re talking two days), or you can ignore it, and just buy more, buy more, buy more, but that doesn’t mean you’re doing it efficiently.

Slide 5 of 14 – 5:55

The company has a history of selling this product into all different sizes of companies. We’ll go to the largest companies all the way down to the consumer market place. You’ll see the top left corner “DriverSupport with Active Optimization” that is the company called PC Drivers or DriverSupport they go by a number of different names out of Austin, TX that license the software within the consumer marketplace, and then with the previous administration got into a legal battle with them when they felt that they didn’t need to pay for the software. That’s the ongoing lawsuit. They are still using it, they’re still selling it - you can still buy it from them. Others are mainly enterprises that bought the product, and installed it, used it, and gained the benefit for it.

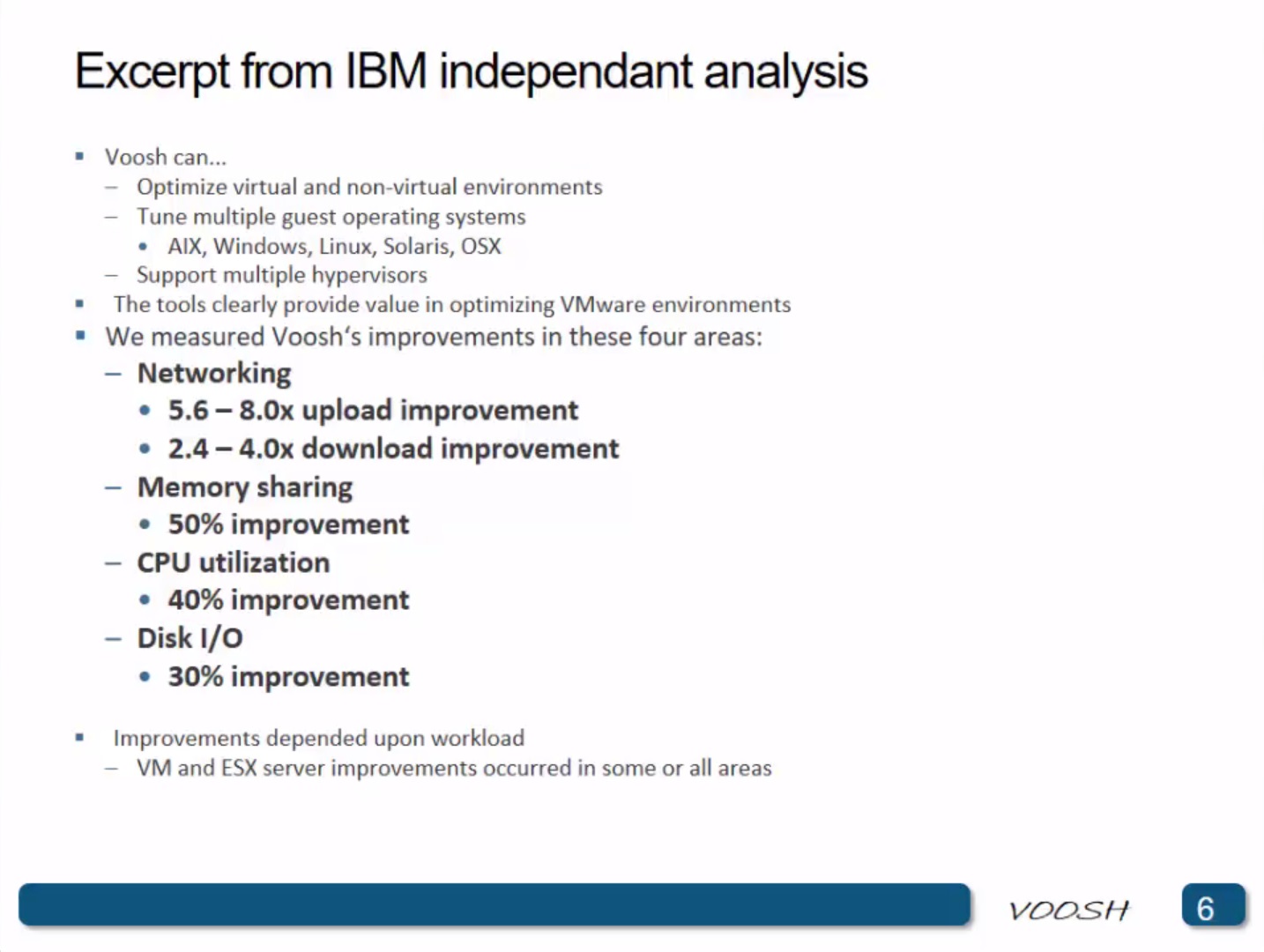

Slide 6 of 14 – 6:43

Let’s talk about one thing that the product delivers to the customers, and this is collected from an independent analysis by IBM. IBM took it into their Tivoli Labs and independently analyzed the product to see if it did what it said it was going to do, and as you can see, we came out with flying colors. The networking increased by a factor of 8x in the upload improvement, and by a factor of 4x in the download improvement. Increased Memory Sharing 50% improvement, CPU utilization 40% improvement – that means that the CPU dropped, even though it’s using our system – and our system is going to use some of that CPU – even with that, the CPU gave back 40% more power because it was utilized better. And the Disk I/O itself, moving things on and off the disk, had a 30% improvement. The way a computer works is you’ve got four particular areas, Networking, Memory Sharing, CPU and Disk I/O, and they have to work together so that they’re not robbing Peter to pay Paul – in other words you’re suddenly not doing very fast Networking that’s puts a burden on the CPU – you want to make sure holistically that all those four areas that are governed by some 200 to 300 settings, all those areas are working together so that they all benefit – you’re finding a balance point where they can all get the most out of the environment, without robbing the other one out of the balance point it had. So it’s a holistic way of doing it – it’s tuning – it’s done very similar to the way you’d tune your car.

Slide 7 of 14 – 8:16

Here’s a test that was done by a cloud operator before and after to show some of the network improvement upload and download speeds that we’re able to get with a single tune. You can probably tell where we impact the network stream and the management of the networking; it seems to be pretty dramatic.

Slide 8 of 14 – 8:34

The markets we’re going into – who can benefit from this? It’s pretty well anybody with a computer. We look at Managed Service Providers, we mentioned them before, that’s a very growing trend – outsourced IT – there’s about 22,000 worldwide. If we take a look at on average, an MSP would pay us $500 to manage all their endpoints. We’re working with Kaseya – Kaseya is over half of those 22,000 using that platform, we’re integrating into that Kaseya platform, we would be a simple button that they would add-on.

The Enterprise side is 160,000,000 servers worldwide, and if we simply charge them $200 per year each, that comes out to $32 BILLION dollars per year market size. Now, how do we slice and dice it? That’s where we get into working with like the Canonicals of the world, and people that are managing cloud services or people that are working their own in house systems, we integrate with (IBM) Tivoli, we integrate with an Operations Manager from Microsoft. So those are tools that those people use to manage those servers, we integrate with them seamlessly so they can run all the reports through those tools that they’re comfortable with, and they can even manage our product through those tools.

And then there’s the Consumer Marketplace. Now that’s being actively sold, PC Drivers, we talked about that there’s a lawsuit involved with it. We understand they’ve got some 4,000,000 registered users. All of those numbers are recurring revenue - that means that every one of those people would buy that on an annual basis and that’s the annual amount that would come in.

Slide 9 of 14 – 10:07

So how do we go to market? What’s the channel? What’s the packaging? We’re looking to leverage existing channels, that is, we talk about some of those customers like the Kaseya’s – they’ve already got the customers, the already have the relationships – lets add on to that and be an additional feature that they can offer to their existing customers. That means for them that’s a very low cost sale, it’s an add-on sale, and for us it’s access to a wonderful sales channel. We’re looking at Telco’s and how we’d go to market with that. We talked about Canonical.

Slide 10 of 14 – 10:37

Some systems are physical - that is your laptop that you’re sitting in front of if you’re looking at this. A server that can be sitting in a physical data center, and some can be virtual sitting on top of a virtualized environment, like Amazon Web Services, VMWare, or Oracle cloud offering – it doesn’t matter we’ll optimize whether its physical or virtual, and we’ll also optimize the virtualization layer, and everything benefits.

Slide 11 of 14 – 11:08

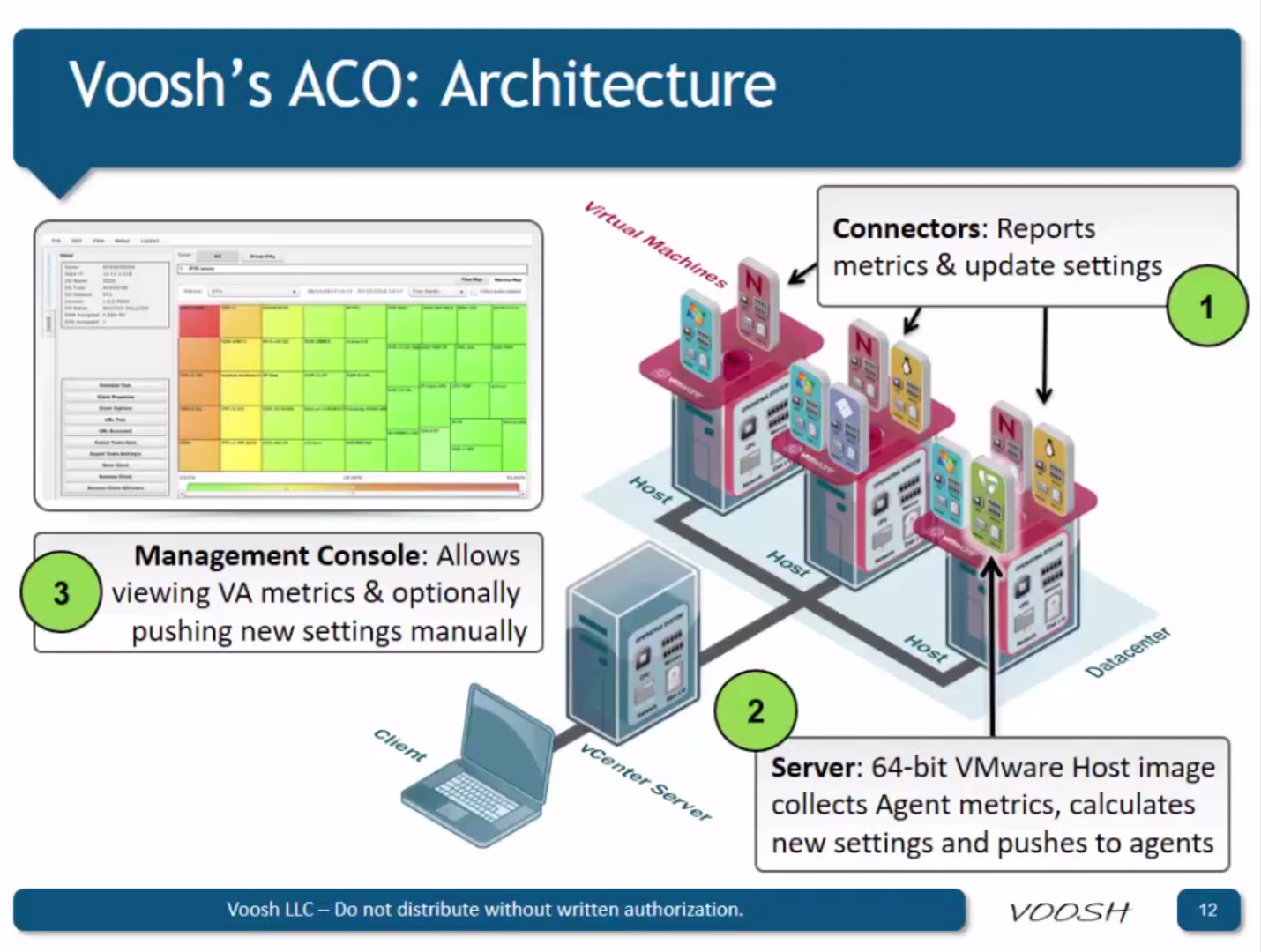

There’s our architecture if you’re interested, it works with connectors if you’re running with V-Center, all we do is connect to the V-Center and everything that the V-Center manages is automatically tuned. So if it’s an individual device that you want to do, an agents sits on it and the agent talks as its needed to our data center, and the system is automatically adjusted to run a lot better.

Slide 12 of 14 – 11:32

We talked about the different aspects of the Memory, CPU, Network, and Storage, but we also have specific functions that are designed to optimize particularly poorly run applications – Exchange, SQLserver, Oracle, Sharepoint – those are applications that we found typically need a lot of adjustments, and we’ve built that into the application.

Slide 13 of 14 – 11:54

Why do we think this is a very compelling investment opportunity? The revenue metrics work very much in our favor. They’re recurring revenue and it adapts very, very well to where the hotpoints in terms of the technology’s moving – that’s Cloud Offerings and more and more servers, and more and more burden of those servers and the applications that are stressing them. There’s a very clear pain point, that is the capacity and the performance of all these different applications are affecting all sizes of computer users. Everything we’re working on today involves computers in one way shape or form, and the systems that are being written and the tools that are being used to write those systems are a real burden on the underlying architecture. There’s also very large market opportunity that’s just getting bigger. The complexity of computers is not getting simpler.

Slide 14 of 14 – 12:45

Thank you for listening to the presentation, we hope you got something out of it and understand a little bit more about what we’re looking to do with Ambicom and Voosh. Our goal is to increase shareholders’ value with a very unique application that can be used by a very large market worldwide. If you’d like to contact me directly – send me an email (kcornell@ambicom.com) or call my cell (831-252-1685). Thank you.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.