Wednesday, October 11, 2017 2:59:36 PM

Oct. 11, 2017 | by DIYSI

http://diy-stock-investor.com/article/fannie-mae/fanniegate-gse-documents/

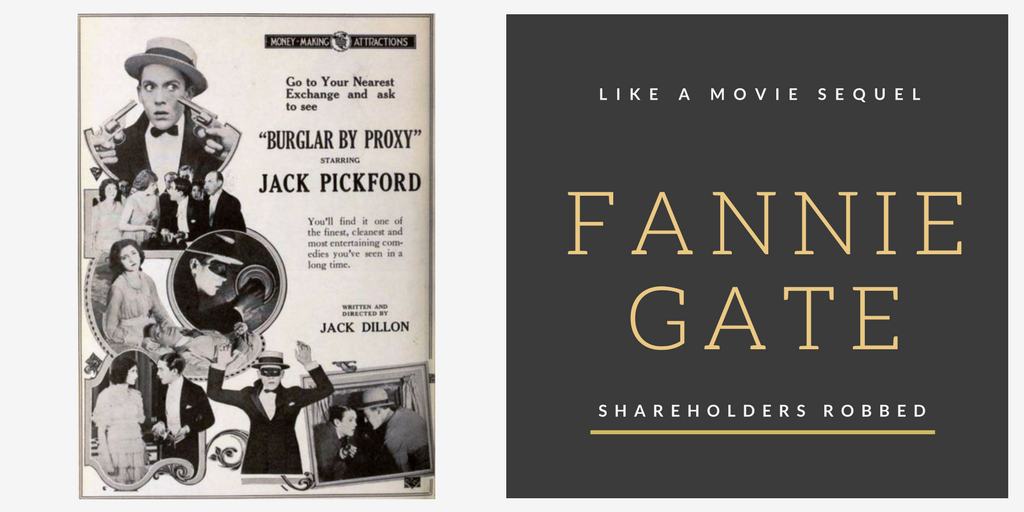

FannieGate robbed shareholders and free market

Fannie Mae (OTC: FNMA) and Freddie Mac (OTC: FMCC) were long standing GSEs that once traded on the New York Stock Exchange. That was before an unconstitutional sweep of all profits was executed in a conservatorship arrangement. Fast-forward to the present, the GSEs have paid billions of dollars exceeding what was owed and still haven't been released from the pilfering scheme. Where did all this money go? Some had speculated it went to fund ObamaCare. The new U.S. Treasury Secretary, Steve Mnuchin later confirmed the speculation, "It is true. They used the profits of Fannie and Freddie to pay for other parts of the government while they kept taxpayers at risk.”

Outrage is not simply coming from retail investors and obscure analysts (yours truly, but I do have 5-stars at TipRanks), rather large political advocates and congressional bodies are also declaring foul. The following is a short compilation of their FannieGate publications; summaries with downloadable files.

CMLA Supports Bipartisan Call For GSE Capital Cushion (09/14/2017)

Common GSE Reform Principles By The Main Street GSE Reform Coalition (06/2017)

GSE Reform: Creating Sustainable Vibrant Secondary Mortgage Market MBA (04/2017)

GSE Reform Principles And Guardrails Mortgage Banker Association (01/30/2017)

Committee Banking Housing Urban Affairs Letter To Mnuchin (12/21/2016)

Letter From LULAC, NAACP, NCRC To Obama On GSEs (10/27/2015)

Letter From Ralph Nader On GSE Reform To The Senator Johnson (04/09/2014)

National Community Reinvestment Coalition Regarding Reform Of Government Sponsored Enterprises (06/21/2010)

Republican National Committee Resolution On Government Sponsored Enterprises

CMLA Supports Bipartisan Call For GSE Capital Cushion

"CMLA calls upon the U.S. Treasury Department and the Federal Housing Finance Agency (FHFA) to heed the calls from Democratic Senators and the Republican National Committee to permit Fannie Mae and Freddie Mac to begin retaining capital in order to build a cushion..." (Document download)

Common GSE Reform Principles By The Main Street GSE Reform Coalition

This one page letter is believed to have circulated in the summer of 2017. The Main Street GSE Coalition is made up of:

The NAACP has been outspoken for Fannie Mae and Freddie Mac resolve for a long time. Community Mortgage Lenders of America (CMILA) keeps an active presence in Washington and also on the internet. It's a good website to visit among many. (Document download)

GSE Reform: Creating Sustainable Vibrant Secondary Mortgage Market MBA

This is an April 2017 study and proposal by the Mortgage Bankers Association (MBA). With over fifty pages including charts and graphic art, this is a longer read. In summary, they want Fannie Mae and Freddie Mac to be released from government conservatorship. They are also looking for more institutions to provide the same service, called Guarantors: "A credible threat of additional entrants would encourage dynamism and spur the Guarantors to provide better service to their seller/servicers and ultimately to consumers... [and] have an incentive to compete against each other..." (Document download)

GSE End State Model

GSE Reform Principles And Guardrails Mortgage Banker Association

The MBA produced a brief preliminary work before the lager "GSE Reform: Creating Sustainable ..." In this six page writing, the group does call for, "recap and release approach or the suspension or modification of the dividend owed to Treasury..." However, they state these measures can't happen alone or the mortgage crises would repeat. Therefore, the principles and guardrails are laid out for review. (Document download)

Committee Banking Housing Urban Affairs Letter To Mnuchin

Senator Sherrod Brown of Ohio signed the December 21, 2016 letter to U.S. Treasury Secretary Steve Mnuchin. This letter was written on behalf of the greater membership of the Committee Banking Housing Urban Affairs. Eleven questions with a provocative tone are laid out for Mnuchin. The tone likely off-putting for any recipient started like this, "Many of your predecessors had long histories and extensive experience relevant to these areas, but I am currently unaware of your views and record..." Fast forward to question number six/ten to see Senator Brown get straight to it, "You recently stated that, 'We've got to get Fannie and Freddie out of government ownership. It makes no sense...' Please explain what you meant by this statement." (Document download)

Letter From LULAC, NAACP, NCRC To Obama On GSEs

The concern for the illegal net worth sweep of the GSEs has been bi-partisan. It's not just a shareholder concern either. Three reputable entities: League of United Latin American Citizens (LULAC), NAACP, NCRC; also called for GSEs recapitalization and release from conservatorship. In a letter to then President Obama, they took objection to, "seemingly taking recapitalization of Fannie Mae and Freddie Mac off the table..." and also stated, "we have grown increasingly uneasy about the uncertainty that these political realities raise. Given a seemingly interminable conservatorship..." Essentially, they were asking the president to fix the situation by releasing the GSEs. (Document download)

Letter From Ralph Nader On GSE Reform To The Senator Johnson

Ralph Nader has had many successes in his or his organizations' petitions to the Capital. However, we have yet to see his early letter and efforts bring resolution. During this time in 2014, top senators were attempting to end Fannie Mae and Freddie Mac. They had erroneous alternatives too. A few favorite quotes:

"The GSEs were certainly not blameless for transgressions similar to those larger ones committed by the Wall Street crowd prior to the financial crisis in 2008. But to eliminate them and unravel this intricate market further, could open the door wide for runaway corporate exploitation."

"Fannie Mae and Freddie Mac shareholders are left in limbo with this legislation, and it ignores them in the process of winding down the agencies. The FHFA is directed to sell off and liquidate the GSEs’ assets."

"Further, just as the GSEs began a swift turnaround and were on the verge of repaying the taxpayers for their investment, the Treasury in 2012, arbitrarily amended the government’s preferred stock purchase agreement to indefinitely sweep all profits of the GSEs into the Treasury’s coffers. This arrangement has allowed the federal government, and the budget, to benefit from the GSEs’ recoveries while at the same time keeping the GSEs’ liabilities off of the federal government’s books. Meanwhile, the shareholders continue to be used and remain beaten down."

I think the FannieGate mission and groups such as NAACP would benefit with further cooperation from Ralph Nader. Read the full letter (Document download).

NCRC Regarding Reform Of Government Sponsored Enterprises

One of the first, big voices on the matter was the National Community Reinvestment Coalition (NCRC), "Without GSEs or any government involvement, the private sector by itself will be unable to consistently provide liquidity and the standardization necessary to produce reliable and affordable products." As the NCRC mid-letter heading stated in 2010, "...Return Fannie Mae and Freddie Mac to Public-Private Status." They were also quick to point out that Fannie Mae and Freddie Mac were being misdiagnosed with the full blame for the mortgage collapse, "A lack of oversight, not the structure of the GSEs, bedeviled the GSEs. We should not lose sight of the proverbial forest through the trees. The GSEs performed extremely well for 95 percent of their history. It was the lack of regulation of both the private sector and GSEs that led Fannie Mae and Freddie Mac into the subprime abyss." (Document download)

RNC Resolution On Government Sponsored Enterprises

This was printed on Republican National Committee (RNC) letterhead. At their website, GOP.com, I'm unable to locate the document in their archives. Unsure of its date of circulation, the letter does not beat around the bush, "The Obama Administration misused Fannie Mae and Freddie Mac as an illegal piggybank to advance its domestic policy agenda, unlawfully usurping over $130 billion from both companies to (i) avoid earnest negotiations with congressional Republicans on the debt ceiling, (ii) support administration prerogatives without seeking congressional authorization, and (iii) artificially reducing the federal budget deficit to create a false 'legacy of fiscal responsibility'..." (Document download)

Image credit: Burglary by Proxy (Jack Pickford Productions 1919) / First National - Exhibitors Herald.

Disclosure: I/we own shares in FNMA. I/we have no positions in FMCC, and no plans to initiate any positions within the next 72 hours. Visit DIY Stock Investor, the finance site regarding stock analysis. Follow DIYSI's founder and 5-star TipRanks expert, Travis Brown.

*****

FEATURED Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • Apr 25, 2024 8:52 AM

Kona Gold Beverages, Inc. Announces Name Change to NuVibe, Inc. and Initiation of Ticker Symbol Application Process • KGKG • Apr 25, 2024 8:30 AM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM

Avant Technologies Launches Advanced AI Supercomputing Network and Expansive Data Solutions • AVAI • Apr 23, 2024 8:00 AM