Saturday, July 29, 2017 7:14:56 AM

See, after the collapse of ISBG's stock from .015+ down to .0001 over a few months in early 2016, accompanied by the loss of Cavoda Vodka and the celebrity endorsements, and the end of the "5 year" MetLife stadium contract after only 6 months (those luxury skybox fees are expensive!), the stock sat dormant at no bid for quite a while. Although the stock got a little bump after the company made some PRs about a huge share buyback that was to take place in May/June 2016 to reduce the float "up to 50%," and also announced a $400k per quarter "agreement already agreed to" to ship product overseas, it went back to no bid after it became clear that none of that was actually happening, and what was happening was continuing massive dilution.

Then in late 2016 there started to be some action here. On December 31, the company put out a PR entitled "ISBG to Report 2nd Consecutive Profitable Quarter" (http://www.pr.com/press-release/700270). Two weeks later it put out financials which showed 6-figure net losses in each of the quarters it was referring to. Go figure!

Still, in January 2017 a new batch of promoters showed up and some groups loaded up, leading to a nice run up into the high teens with a brief pop all the way to .0028. There was little to no dilution during that month. Over the next couple months, the company released various PRs projecting 2017 revenues of $2-3MM, a coming Sirius radio ad campaign, a big distribution contract, etc. etc.

Then in later January, the company released its PRs touting how it "Restructure[d] over 75% of Convertible Debt" and that "ISBG to Retire Over 65% of $294K Debt Note". Sounds great right? Except a few days later is when the dumping began that has not let up since, and, not surprisingly, the share price has been traveling steadily downward since that PR.

It appears to me that they "restructured" the debt in the sense that they extended the maturity date of the notes, but those notes are likely convertible at any time nonetheless, the lenders just have more time to convert them now before ISBG is contractually obligated to pay up. We can't actually know for sure because the company--whose old Twitter motto used to read "Transparency is our MO"--has never really disclosed any details about the restructuring, or its debt notes in general for that matter.

Anyway, at the peak of the January run, when the diluting MMs showed back up on the ask and massive share selling begun, people started to ask what was going on. Talk of dilution began on here and on twitter. In response, the company tweeted the following:

There were at least two other tweets after that one saying that the company doesn't dilute or sell shares, it "sales" booze you know! It's all good! Up from here! Big things coming! Etc. etc.

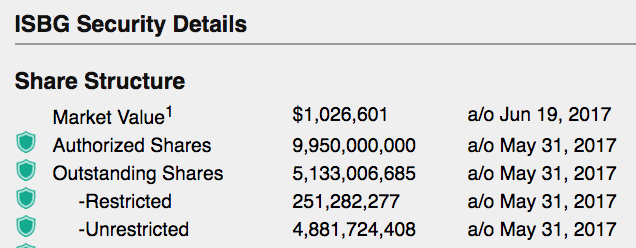

Then, oddly, the share structure update showed that the A/S was maxed out by the end of February, and without notice the company raised the A/S from 3B to 5B in early March. After some on here (ahem) pointed this out, the justifying rationalizations began from ISBG supporters. It's for acquisitions, see! The increase is a good thing!

The company then "addressed" the A/S raise on March 7 as follows:

"I'd like to address our recent share structure changes. The authorized share count was indeed increased, and I want to assure our shareholders past, present, and future, of all our associated businesses, that the increase was necessary to accommodate a critical move by the company that will greatly benefit our investors and be detailed in upcoming press releases and audits. We very much value our loyal investors and plan to demonstrate that appreciation with a tangible return to those who have believed in our mission to make Besado one of the top selling Tequilas on the market."

Again, that was addressing the A/S raise from 3B to 5B. The stock was trading at .0007 then and the O/S was under 3B. We never got those "details" about that "critical move," however. What we did get was another 2B shares dumped into the market.

In the meantime, the company also "addressed" the A/S raise on twitter, explaining that:

Got that? The biggest reason for the A/S raise was to finally pay DKTS shareholders for ISBG's acquisition of Besado from that company. (Both companies were run by Pierce, see, but when DKTS was diluted down to nothing and failed to actually launch Besado, Pierce transferred the assets over here. More specifically, Pierce, as CEO of DKTS, "sold" Besado to ISBG, where he was Chairman, promising DKTS shareholders a dividend that "shall" be distributed by June 2015. That was two years ago. There's never been a distribution--in other words, ISBG has never paid for its acquisition of Besado).

Anyway, as the dilution continued in earnest, the company again "addressed" the issue on April 11 , saying:

Recently, the Company increased the number of authorized shares to 4.95 billion shares with the purpose being to have available, only if necessary, some additional restricted shares to be utilized as part of the acquisition of profitable entities as well as to satisfy the shares owed to the Top Shelf Brands shareholders of record.

Got it? The A/S was raised from 3B to 5B for two reasons, "only if necessary": (1) to acquire profitable entities; and (2) to make the DKTS share distribution.

And yet, those 5B authorized were soon maxed out and sold into the market, and there was never an acquisition or a share distribution. Weird!

In what was surely an unrelated transaction that had nothing to do with dilution to pay off Pierce's legal debts for his own misdeeds, the company also settled a lawsuit by its former VP of Sales, who won a $100k judgment after suing the company last Fall for not paying him his salary.

So where were we? Ah, yes, the 5B A/S is maxed out and the company hasn't accomplished any of the things it said those extra 2B shares were for...

But with that million bucks in convertible notes still on the books, you gotta have shares to sell, right? So, they raised the A/S again, doubling it from 5B to 10B shares on May 17. That's the last filing, in fact, on the company's Nevada SOS page, which is why their business license has been in default since June 30, when their annual list and filing fees were due.

Despite what some suggest on here, since that second raise, the company has never mentioned the second A/S raise to 10B or the dilution that has occurred since. They sure have tweeted some very inspirational quotes though!

And that brings us to today. At last count (July 3), the O/S was 6.78 billion shares. My guess is that the next update early next week will show the O/S has surpassed the 7 billion mark (and I'm usually right about these things). Meanwhile, anyone who invested $1000 in ISBG at the time of it explained that the first A/S raise "was necessary to accommodate a critical move by the company that will greatly benefit our investors and be detailed in upcoming press releases and audits" would now have shares worth about $142. I wouldn't call that a "great benefit," but some here say I'm a liar so what do I know?

If the above post was too long, here's the simple summary:

Have a great weekend!

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM

Avant Technologies Launches Advanced AI Supercomputing Network and Expansive Data Solutions • AVAI • Apr 23, 2024 8:00 AM

BestGrowthStocks.com Issues Comprehensive Analysis of Triller Merger with AGBA Group Holding Limited • AGBA • Apr 22, 2024 1:00 PM

Cannabix Technologies to Present Marijuana Breathalyzer Technology at International Association for Chemical Testing (IACT) Conference in California • BLO • Apr 22, 2024 8:49 AM

Kona Gold Beverages, Inc. Prepares for First Production Run Set to Launch May 17, 2024 • KGKG • Apr 22, 2024 8:30 AM