Thursday, June 22, 2017 9:22:37 AM

All the technical stuff suggests a near-term consolidation but my gut says immediate weakening. Last time I ignored it I was wrong, so I'll go with weakening immediately.

I'll probably end up wrong again - we know you're not supposed to trust your gut.

There were no pre-market trades.

B/a just before open was 2.5K:100 $0.66/$0.73.

09:30-09:59 opened the day with a 1,382 buy for $0.71 & $0.69 x 243. B/a just after open was 10K:822 $0.69/$0.71. Then came 9:33's b/a 10K:862 $0.69/$0.71, 9:34's 300 $0.6921, 9:35's 4.4K $0.70 (2K)/$0.6900/15 (1.1K), 9:40's 100 $0.71, 9:45's b/a 13.1K:662 $0.69/$0.71, no trades 9:41-:58. B/a at 9:55 was 300:762 $0.6901/$0.71. The period ended on 9:59's 2K $0.71.

10:00-11:14, after one no-trades minute, began extremely low/no-volume (e.g. 10:04-:31's no trades) $0.6900/97 on 10:01's 250 $0.6924/$0.71. B/a at 10:02 was 300:762 $0.6903/$0.71, 10:10 300:700 $0.6999 (offers jiggling $0.69/$0.70), 10:33 300:800 $0.6904/97, 10:47 300:800 $0.6904/96, 11:02 300:1025 $0.6904/97. Volume was interrupted by 11:07's 3.4K $0.6994 (3K)/5/6/5. B/a at 11:11 was 13K:300 $0.6800/91. The period ended on 11:14's 100 $0.6987.

11:15-11:43, during the initial fourteen no-trades minutes had b/a at 11:21 of 12.9K:1.5K $0.6900/79. A quick jump up and back down was done on 11:29's 10K $0.6970 (1K)/73 (1.9K)/97 (1.3K)/$0.70 (5.5K), 11:30's 500 $0.69, 11:31's 1K $0.69/$0.70 (100)/$0.69, 11:33's b/a 11.8K:100 $0.69/$0.71, and 11:43's 35.1K $0.6900 (3K)/05/00 (~12.6K)/$0.68 (20.5K incl. 15K blk).

11:44-12:46, after one no-trades minutes, began extremely low/no-volume $0.69/$0.7079 on 11:45's 300 $0.7001. B/a at 11:47 was 100:218 $0.69,$0.71, 12:02 100:218 $0.69/$0.71, 12:17 4.2K:600 $0.69/$0.7070. 12:28 began an extremely low/no-volume stepping up of the lows. B/a at 12:32 was 4.5K:400 $0.69/$0.7070. The period ended on 12:46's 400 $0.7070.

12:47-15:24 during the initial seventeen no-trades minutes had b/a at 12:47 of 4.2K:100 $0.69/$0.71 and 13:02 4.2K:60 $0.69/$0.7150 (offers backed by presented 1.8K $0.72). Trade began an extremely low/no-volume slow decline from $0.7101 after 13:04's 300 $0.7101. B/a at 13:17 was 300:3.4K $0.6901/99, 13:32 4.2K:2.9K $0.6902/99. By 13:42 range was $0.6968/96. B/a at 13:47 was 300:2.9K $0.6903/99. 13:54's 6.2K hit $0.6996 (6K)/02 and 13:56's 7.5K bounced back to $0.6951 (456)/99 (1.5K)/96 (4.5K). Trade began extremely low/no-volume $0.6927/$0.70. B/a at 14:02 was 200:1,8K $0.6903/48 (offers jiggling 48/49), 14:17 300:2.1K $0.6905/49, 14:32 300:900 $0.6906/48. Volume was interrupted by 14:36's 15K $0.6927 (600)/48 (1.1K)/49/50 (1.9K)/$0.70 (11.1K blk). B/a at 14:48 was 300:5.9K $0.6907/$0.70, 15:02 800:5.8K $0.6954/$0.70, 15:19 200:5.8K $0.6996/$0.70. The period ended on 15:24's 205 $0.6997.

15:25-15:56, after five no-trades minutes, began extremely low/no-volume $0.69/$0.70 on 15:30's 5.8K $0.6915 (2.7K)/00 (1.6K)/10/00 (1K)/10/00 (400). B/a at 15:32 was 500:400 $0.6901/$0.70, 15:47 7.6K:400 $0.69/$0.71. The period ended on 15:56's 3.5K $0.69.

15:57-16:00 The period and day ended on 15:59's 1.8K $0.7099 and 16:00's 473 sell for $0.69.

There were no AH trades.

Excluding the opening and closing trades (didn't qualify), there were 7 larger trades (>=5K & 1 4K+) totaling 54,923, 44.21% of day's volume, with a $0.6899 VWAP. For the day's volume, the count seems reasonable. The percentage of day's volume is a bit on the high side but is likely just an artifact of the low volume as just a few "larger larger trades", which occurred, would have an outsize effect when volume is very low.

The VWAP is below the day's $0.6943, suggesting some larger players likely took most of the volume (notice below buy percentage movements when these larger trades occurred). There's a glitch in that thought though. The first "bunch" went off at prices below the day's VWAP and the second bunch above the day's VWAP.

This makes me think that the MM(s) held price down early to accumulate from spooked retailers or short-term traders and then delivered to a "good customer". The buy percentage movements around these trades suggest that also as the early bunch dropped buy percentage and the later bunch raised it. Both were substantial moves. Maybe shorters or hedgies were doing some covering buys?

Yesterday I surmised that shorters wouldn't be covering at the prices seen because they likely felt (knew?) prices would be dropping more. Today it's the opposite. with a trend lower apparently in place it would make since to start "scaling in" covering buys at lower, and still falling, prices. With volume down to extremely low levels the market is easily moved around, making the achievement of goals easier.

We'll never know.

Volume is really too low to expect much of a connection between buy percentages and VWAP movements, except that the larger trades areas had a stronger correlation in direction. Volume is also too low to try and use this for any indication of coming attractions, other than noting the buy percentage ended in "no man's land", suggesting near-term consolidation (a few days?).Ending Period Period Period __Per. Trade_ Period_ % Day_ Per. End

Period Volume Low High _Dollar Val._ VWAP___ Volume Buy ~%

09:59 7525 $0.6900 $0.7100 $5,284.20 $0.7022 6.06% 54.93%

11:14 4692 $0.6900 $0.6997 $3,271.24 $0.6972 3.78% 61.22%

11:43 46549 $0.6800 $0.7249 $32,114.93 $0.6899 37.47% 29.83% Incl 11:43 $0.6800 15,000 5,100 $0.6900 8,723

12:46 12640 $0.6900 $0.7079 $8,760.18 $0.6931 10.17% 27.23% Incl 11:57 $0.6907 4,000

15:24 39998 $0.6903 $0.7101 $27,923.57 $0.6981 32.20% 50.19% Incl 13:54 $0.6996 6,000 14:02 $0.6948 5,000

14:36 $0.7000 11,100

15:56 9592 $0.6900 $0.7000 $6,625.73 $0.6908 7.72% 46.27%

16:00 2273 $0.6900 $0.7099 $1,604.19 $0.7058 1.83% 45.78%

One thing I can surmise is that the ATM was not in use today. The times I thought it was in use were characterized by generally heavy selling into strong, and in many cases, rising bids of substantial quantity, resulting in falling buy percentage trends. Today didn't present much of that.

On the traditional TA front, movements were:

In aggregate, especially with the lower volume, the move lower appears to be losing strength, suggesting indecision and likely doing a short-term consolidation. However, volume is so low that a snap movement could occur in short order, in either direction, because there's no volume flow to resist change.__Open_ ___Low_ __High_ _Close_ Volume_

Today 0.00% -1.45% 0.68% -2.87% -26.61%

Prior -11.25% 0.00% -10.00% -1.31% -73.51%

On my minimal chart the most notable thing is that the trading range, which yesterday was completely at/below the declining fast EMA's $0.7198 but for 2/100ths of a penny, today was roughly centered on the EMA's $0.7054. Unlike yesterday, the slow EMA, $0.6906, is stopped rising and began to fall. Trading range was about 1/4th below it. I still expect the fast EMA will make a cross below the slow EMA soon.

The trading range yesterday was about 75% above the $0.70 resistance and the close of $0.7104 was still above it. Today range is about 50% above and the close was below the $0.70 known support/resistance.

Volume again dropped substantially and now is low enough that we can look for a very short consolidation (a couple days?). I doubt it can last much longer than that with this kind of volume though.

As suggested yesterday, the descending channel (descending blue lines) upper support/resistance provided support today. This lends credence to "entering short-term consolidation". As before though, the volume being where it's at suggests we won't consolidate for very long - a move up or down should appear shortly.

On my one-year chart, yesterday's trade dipped below the rising 10-day SMA and was more or less centered on the 50-day's $0.7065 and closed just above it at $0.7104. Today's range was about centered around the the 50-day SMA's $0.7048, which continued the decline begun two days back. The 10 and 20-day are still rising, so there is again hope that the price decline will begin to slow. There's currently no other indications of that other than the extremely low volume itself.

Yesterday the oscillators I watch had improvement in accumulation/distribution and weakening in all others. Below neutral were accumulation/distribution and ADX-related. All others were still above neutral. Nothing was overbought or oversold.

Today had weakening, for the second consecutive day, in accumulation/distribution and in all others. RSI is at neutral. Below neutral are Williams %R, full stochastic and ADX-related. Above neutral are momentum and MFI (untrusted by me).

The experimental 13-period Bollinger limits, $0.5989 and $0.7675 ($0.5872 and $0.7694 yesterday),

All in, the bast case for all of the above is a very short-term consolidation. My gut is telling me more immediate weakening. Last time I ignored it and was wrong, so this time I'll go with it and say most likely is near-term weakening beginning almost immediately.

Percentages for daily short sales and buys moved in opposite directions, not good, and short percentage is well below my desired range (needs re-check). Buy percentage is below what's need to hold steady, much less appreciate, and sits in "no man's land", offering no suggestion of near-term direction.

The spread widened and is suggesting movement is likely near-term. with the weakness we're seeing and the low volume I would guess down would be the direction and "soon" is the time-frame.

VWAP fell for the third consecutive day.

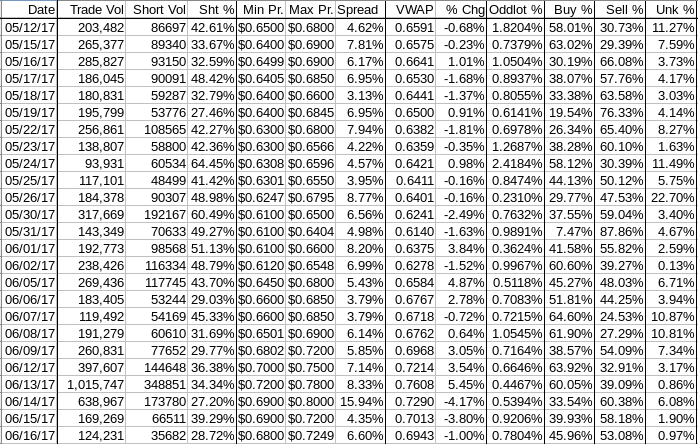

The VWAP's rolling average of the last twenty-four movements held steady for the second consecutive day at 143 negatives and 10 positives. Change since 05/12 is $0.0352, 5.35%, and the averages of the rolling 24-day period seen in the last few days (latest first) are now 0.2486%, 0.2622%, 0.5035%, 0.6348%, 0.3385%,0.1182% and -0.0514%, -0.2146%, -0.2079%, and -0.3689%.

The VWAP average change movements has now developed a weakening trend again.

All in, best case would be a very short-term consolidation but the spread and short percentage combined with VWAP behavior suggest that won't be the case. Most likely is weakening.

Bill

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.