Sunday, April 23, 2017 2:43:43 PM

To further ”Compare & Contrast” the old FITX with BLDV, we must discuss the share structure of them both to understand the magnitude of FITX going to trade over .12+ per share and why I believe BLDV will surpass such levels.

I'm going to do my best to try to explain this. The Outstanding Shares (OS) for FITX was 3.4 billion shares and the Float was 2.7 billion shares when it ran to .12+ per share from the .002 per share range. However, a little later somewhere along the way, although it was still trading in the high pennies, the OS went to 4.7 billion shares and the Float grew to 3.8 billion shares as can be confirmed from below:

https://www.otcmarkets.com/stock/FITX/profile

This is where it begins to get a little tricky here with BLDV to ”compare & contrast” its share structure to what the FITX share structure was when it ran to .12+ per share. I will do my best to try to explain this by first saying that here with BLDV, we don’t have any significant dilution concerns where we need to be worried about being dumped on. After doing a little research, it’s not going to happen. We are fine here with BLDV.

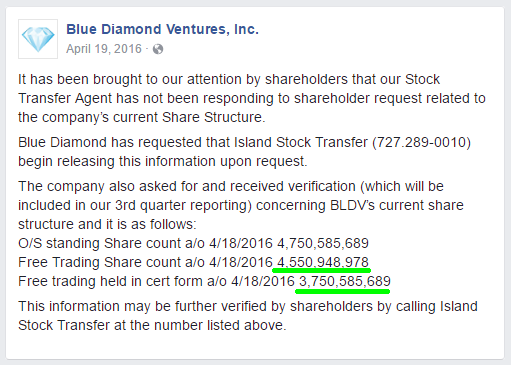

To further elaborate, around a year ago, per the Transfer Agent (TA) for BLDV, Island Stock Transfer, as they are ungagged, I learned that out of 4,550,948,978 shares listed as the ”Complete” Float, there were 3,750,585,689 shares that were held in cert form as ”part” of that Float as of April 18, 2016. The company placed this on their Facebook page last year during such time to update shareholders as indicated below:

This means that if 3,750,585,689 shares were held in cert form as of Apr 2016, but were still considered part of the Float… then this means that the shares at the Depository Trust Company (DTC) is the difference between the two numbers which would mean…

4,550,948,978 Complete Float Shares - 3,750,585,689 Cert Float Shares = 800,363,289 DTC Shares

For inquiring minds, DTC shares are those shares that are Free Trading or the other part of shares that makes up the Float that is available for us retail investors to be able to buy. The Free Trading shares along with those shares held in cert form that are legitimately part of the Float makes up the Complete Float.

So based on what I have explained above, you would have to presume that BLDV only have 800,363,289 shares held at the DTC that are available for retail investors to buy. Or maybe better to say that ”were” remaining to buy. Keep in mind, BLDV have had 1,284,790,711 shares traded on 20 Apr 2017 this past Thursday and 799,925,952 shares traded on 21 Apr 2017 this past Friday... for a total of 2,084,716,663 shares traded over the past two trading days. This number is nearly as much shares “officially” listed to exist to trade as the remaining Float not in cert form. So in my opinion, based on these numbers, I would lean towards believing that most of the Float has been bought up ”over the past two trading days” to a level to where basic ”Supply vs Demand” principles will be begin to kick in since it has been confirmed that the upcoming news is only going to get much stronger. The ”Supply” of shares have greatly diminished.

Before I forget, here’s a little piece of information for those who are only a little aware of the DTC:

http://www.dtcc.com/

The Depository Trust Company (DTC), DTCC’s central securities depository subsidiary, provides depository and book-entry services and operates a securities settlement system. …

http://www.issuerconsulting.com/dtceligibility.html

Once an issuer has been approved for trading by FINRA they must apply to DTC for their initial eligibility to trade. If DTC approves the application they will hold all of the issuer’s free-trading (street name) shares on deposit. These shares will become the company’s “float”. …

Now… with considering all that I have posted above… understand that such was predicated upon the share structure numbers for BLDV as of April 2016. Now I must throw a little bit of a twist into the mix. Let’s fast forward the tape to today and see how such logic would compare. Keep in mind too that based on what most of us longs had learned last year, a huge portion of those shares in cert form are not going to be allowed to be entered into circulation within the market to trade because of regulatory reasons for certs that were issued three managements ago. The current management of BLDV and the company is fine though. All of this was learned back when they were going through getting approval to have the DTC Chill removed of which such approval was granted. I’ll post that info later.

The current Complete Float listed on OTC Markets is still the same 4,550,948,978 shares which can be confirmed from the link below:

https://www.otcmarkets.com/stock/BLDV/profile

However, based on what has been recently verified by the Transfer Agent (TA) per OTC Markets, the amount of shares held at the DTC is 2,417,795,039 shares. This means to get the new presumed amount of shares that are held in cert form that are part of the Float, we must subtract such amount from the 4,550,948,978 shares to equate to below:

4,550,948,978 Complete Float Shares - 2,417,795,039 DTC Shares = 2,133,153,939 Cert Float Shares

If you were to take that number and subtract it from the current BLDV Complete Float shares of 4,550,948,978 shares, you would get 2,133,153,939 shares now held in cert form. This is after having confirmation from OTC Markets per the TA that the "actual Float" (or the “true” Float which is how I think it is officially termed) that exists is 2,417,795,039 shares which are in circulation per the DTC for the public to buy.

Again, it has been confirmed that there is no dilution from the company. So again, to put things into proper perspective, this means that since BLDV have had 1,284,790,711 shares traded on 20 Apr 2017 this past Thursday and 799,925,952 shares traded on 21 Apr 2017 this past Friday... for a total of 2,084,716,663 shares traded over the past two trading days. Still, this number is nearly as much shares “officially” listed to exist to trade as the remaining Float not in cert form. In my opinion, based on these numbers, I would lean towards believing that most of the Float has ”still” been bought up ”over the past two trading days” to a level to where basic ”Supply vs Demand” principles will kick in to expect ”Critical Mass” as more significant updates are released from the company. Again, even with this scenario, the ”Supply” of shares have greatly diminished. Once people learn that what BLDV have going on with a major company out of Israel and AMS out of Canada is bigger than OWCP… no offense… they will come.

Now when you further ”Compare & Contrast” the old FITX that went to over .12+ per share, I think it’s safe to presume that we should easily expect something far higher with BLDV since it is evident that no matter how you choose to view the situation here with BLDV, there is far less than 3.8 billion that exist as the remaining Float here in BLDV. No consider AMS being at Step 6 with health Canada for their Marijuana Cultivation License and FITX never got past Step 1 with Health Canada. Here are some more thoughts to ”compare & contrast” from an earlier post below:

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=130697477

BLDV Huge Israel Connection, AMS, & Health Canada

Israel is considered the Medical Marijuana Capital of the world. There are only two penny stocks that I know of that have had ”confirmed” deals with Israel ties that had huge huge runs. That was OWCP and CNBX. Originally from the sub-penny levels, OWCP ran to hit over $3.00+ per share not long ago in Feb 2017. Also, CNBX ran to hit over $7.00+ per share in Feb 2017. With BLDV closing this huge deal in Israel, this could easily blow past their old highs of .025 per share from some years ago.

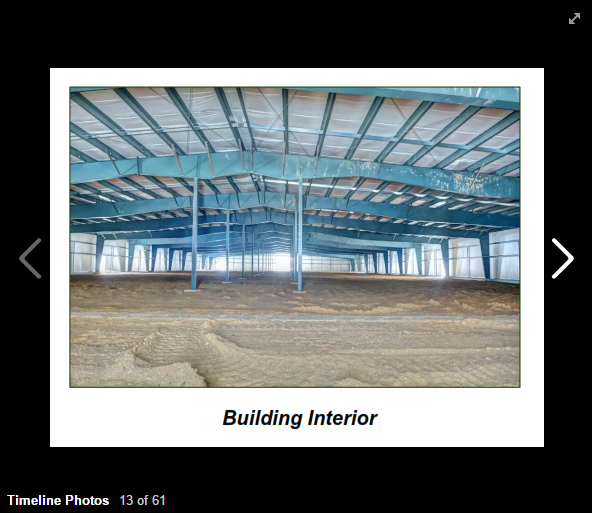

I think what some are not seeing just yet is that BLDV is basically transforming into the old FITX, but on steroids back when FITX ran over .12+ per share. Let’s fully ”compare & contrast” between BLDV and the old FITX when it was healthy. Also, with the closing of the AMS acquisition, this could easily blow that price range out of the ocean. Keep in mind, FITX ran to over .12+ per share when they began to build their 50,000 square foot facility and they never got past Step 1 with the approval process from Health Canada. With AMS and their 50,000 square foot facility, they have completed Step 6 and is working towards the completion of Step 7 approval from Health Canada. Here is a picture of the inside of their facility:

Health Canada Steps 1-7 Marijuana Cultivation Approval Process

http://www.hc-sc.gc.ca/dhp-mps/marihuana/info/application_steps-etapes_lp-pa-eng.php

8. Applications received

9. Preliminary screening

10. Enhanced screening

11. Initiation of security clearance process

12. Review

13. Pre-licence inspection

14. Licensing

I think BLDV will become positively quite popular when the market fully understands the magnitude of this Joint Development Agreement between BLDV, AMS, and the huge Israel company per the PR below:

http://www.marketwired.com/press-release/blue-diamond-ventures-inc-launches-international-cannabis-project-with-ams-canada-pinksheets-bldv-2210922.htm

Alternative Medical Solutions (AMS) is in the final stage to gain a full license to grow, market and sell medicinal cannabis products via Health Canada. BLDV has been working with AMS over the last year to finalize funding for its Fifty (50) thousand square foot cultivation facility. "There has been recognition, by the Canadian Government, for the need to allow import and export in this industry," says Joshua B. Alper, CEO of BLDV. "This new effort will ensure that AMS, when licensed, will be a Global Project, with their products being available worldwide and with access to the ingredients and technology that will continue to make AMS a leader in the Canadian market."

"We are excited to launch this effort with BLDV," said Joseph Groleau, VP Business Development for AMS. "With the specialized products and technologies coming into Canada from Israel, and access to global markets with our finished products, we see this as a separate profit center that could even outgrow our efforts in cultivation."

The website is somewhat still under construction, but this is the correct website for the correct AMS that is connected to BLDV:

There is much more to talk about of which I will get around to chiming in to share thoughts along with others here within the forum over time here. This is a different BLDV from the days of old because of having a different/new management. Those who don't see it now, will see it later.

v/r

Sterling

v/r

Sterling

Exit Strategy & Etiquette Thoughts for a Stock

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=128822531

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM

Avant Technologies Launches Advanced AI Supercomputing Network and Expansive Data Solutions • AVAI • Apr 23, 2024 8:00 AM

BestGrowthStocks.com Issues Comprehensive Analysis of Triller Merger with AGBA Group Holding Limited • AGBA • Apr 22, 2024 1:00 PM

Cannabix Technologies to Present Marijuana Breathalyzer Technology at International Association for Chemical Testing (IACT) Conference in California • BLO • Apr 22, 2024 8:49 AM