Sunday, January 08, 2017 10:19:21 AM

LymPro

Sept. 2, 2014 - We are extremely pleased to be working with ICON, and we anticipate completion of the Fit for Purpose Flow Cytometry Assay Validation in the fourth quarter.

Oct. 9, 2014 - Amarantus anticipates completing enrollment of the 68 patient LP-002 extension in the fourth quarter and will announce data from an in-depth analysis from the full cohort of 140 subjects (72 patients + 68 patient extension) shortly thereafter.

2b.) LymPro - incl. patients w/ mild AZ, enrollment 68 patient LP-002 exten. (est. 4Q14)

Oct. 9, 2014 - Amarantus plans to launch LymPro for RUO in the fourth quarter of 2014, primarily targeting pharmaceutical clinical trials.

05.) LymPro - Partner valid. of APP & CLIA cert. (est. 4Q14)

Oct. 9, 2014 - The company anticipates launching LymPro under CLIA shortly after product launch in the RUO marketplace.

Eltoprazine

Oct. 27, 2014 - We are looking forward to receiving pre-IND feedback from the FDA later in the fourth quarter and being able to open a new IND in the Neurology Division of FDA shortly thereafter. The Phase 2b trial is on schedule to start in early 2015.

06.) Eltoprazine - 200 patient Ph. 2b trial PD-LID (est. 4Q14)

Oct. 27, 2014 - We previously outlined our intentions to initiate a Phase 2b trial for Eltoprazine in Adult ADHD following the initiation of the Phase 2b PD LID clinical trial, and we remain on track to achieve this as much of the groundwork for the Adult ADHD trial is being completed for the Phase 2b PD LID trial.

07.) Eltoprazine - US IND filed & apvd. for PD-LID (est. 4Q14)

MANF

Oct. 7, 2014 - These data clearly support our focus on the further development of MANF in orphan ophthalmic indications, such as retinitis pigmentosa and CRVO. We plan to pursue complementary IND pathways in these indications, as well as in glaucoma.

08.) MANF - Ophthalmological ear toxicology complete data sets (est. 4Q14)

Oct. 27, 2014 - We recently applied to the FDA for orphan drug designation for MANF in Retinitis Pigmentosa and expect additional orphan filings in the near future in the area of ophthalmology.

13.) MANF DB-1 Wolframs - Retinal eye data test results (est. 4Q14)

Oct. 27, 2014 - We expect to initiate GMP manufacturing for MANF this quarter to support multiple IND filings for MANF in various indications.

15.) MANF - Goods Mfg. Practices (GMP) for 1st in-man studies (est. 4Q14)

What's Missing:

10.) MANF / GDNF - Renishaw CED Ph. 2B test trial results (est. 4Q14)

12.) MANF OIS - Ocular Ischemic Syndrome - ODD applic. filed (est. 4Q14)

14.) MANF DB-1 Wolframs - ODD potential (est. 4Q14)

25.) NASDAQ up-listing (est. 4Q14)

Company

Oct. 27, 2014 - As a holding company, Amarantus is continuing to evaluate methods of returning value to shareholders, including a potential spinoff of the company’s diagnostic division. In addition to LymPro and our NuroPro Parkinson’s diagnostic, we are actively evaluating additional complementary late-stage neurology-focused diagnostic assets that would bolster our diagnostic division and make for a successful ‘spin-out’ while concurrently returning value to our shareholders. We believe we will be able to execute on this strategy in the near-term.

Oct. 27, 2014 - With this strategy we are insulated from enterprise risk from any one program, thereby giving us leverage as we look for additional product opportunities and allowing us to return value to our long-term shareholders either through equity gains or dividends.

July 27th, 2012 - "A cure for Parkinsons - a cure for Parkinsons - who here would like to invest in a company who can cure Parkinsons - raise your hand"

Gerald Commissioning, CEO states the following between 08:02 and 08:23 minute marks - yet they removed the video:

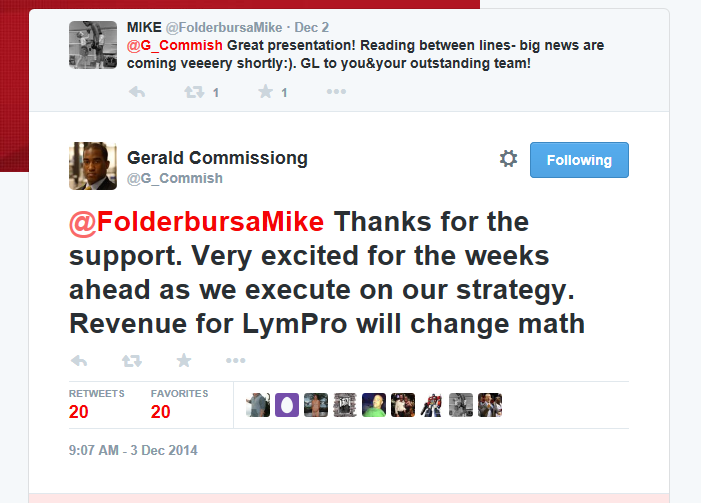

"We think this represents a $300-Mil. opportunity and a potential acquisition because in the diagnostic space, things are usually acquired as a multiple of sales. So if we ramp up to $3, $4, $5, $10-Mil. in sales, you can expect to see a 10 times sales, 15 times sales, or a 20 times sales "buy-out" of our technology"

Amarantus BioSciences - What a Total Disgrace

FEATURED Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • Apr 25, 2024 8:52 AM

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Kona Gold Beverages, Inc. Announces Name Change to NuVibe, Inc. and Initiation of Ticker Symbol Application Process • KGKG • Apr 25, 2024 8:30 AM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM