Friday, January 06, 2017 4:04:21 PM

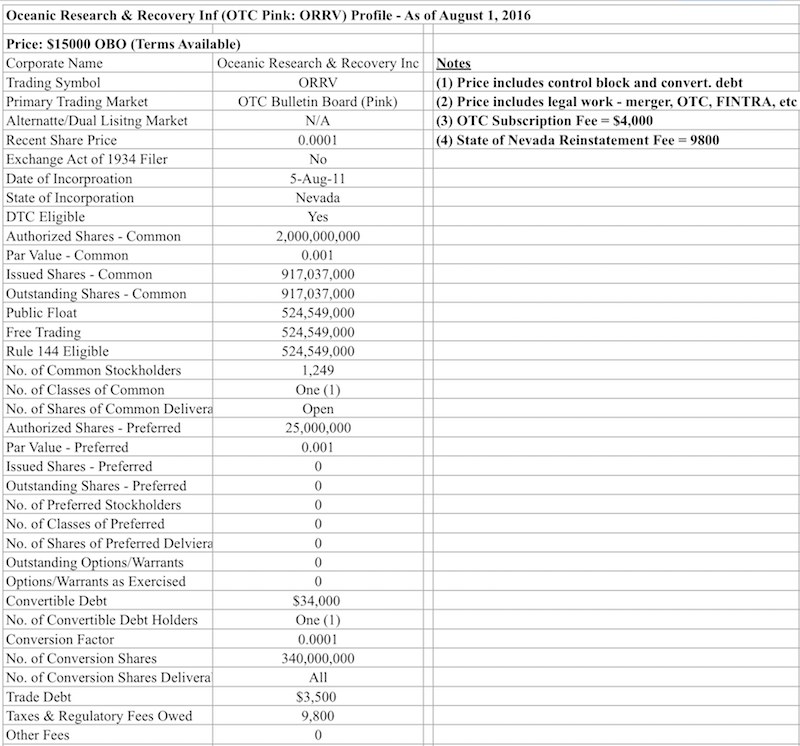

First, here is information put out by Adam Tracy on a spreadsheet he provided on his google plus account for all of the hijacked shells he was offering for sale.

On this screen shot taken off that spreadsheet for ORRV you can see that as of August 1, 2016 the Outstanding share count for ORRV was:

917,037,000 share outstanding

392,488,000 shares were restricted

524,549,000 shares were free trading

According to sources on this forum, the Transfer Agent for ORRV gave the following share count numbers on January 2, 2017

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=127573672

1,469,390,511 shares outstanding

279,606,279 shares restricted

1,189,784,232 shares free trading

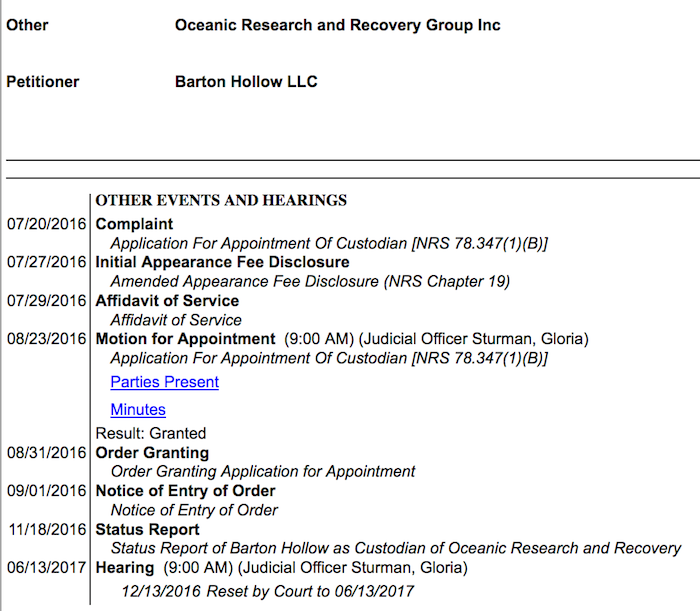

Adam Tracy was granted custodianship of the ORRV shell by the Clark County court on August 31, 2016

So between the time that Adam Tracy successfully gained control of the ORRV shell on August 31, 2016 and January 2, 2017 the float grew by over 650,000,000 shares. The numbers above suggest that 112,881,721 shares of the newly create float were old restricted shares being made free trading. That means that 552,353,511 new free trading shares were issued that didn't exist before.

Somebody would have to explain to me how Adam Tracy managed to create 552,353,511 free trading shares in only 4 months after taking control of the ORRV shell on August 31, 2016. There is no question that ORRV was a shell company over the few years since it was abandoned which creates problems for somebody trying to create new free trading stock. Even if you ignore the whole shell status issue, 4 months is not a long enough holding period to have been able to take any new debts that Adam Tracy created in the process of hijacking the shell then turn those debts into free trading stock.

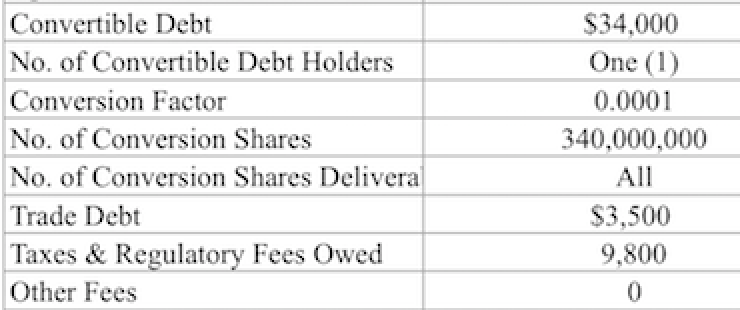

Speaking of new debts. As you can see from the spread sheet above, Adam Tracy created $34,000 in new convertible debt through accumulated court costs, filings fees, and attorney fees during process of gaining control of the ORRV shell through the Clark County, Nevada court system.

That $34,000 in convertible debt was given a conversion ratio of $.0001/share allowing the debt to be turned into 340,000,000 free trading shares of stock. Personally, I'd love to know who that 1 Note holder was that got those 340,000,000 free trading shares of stock especially considering that 340,000,000 free trading shares of stock would have been way more than 10% ownership in ORRV. How did that 1 debt holder manage to avoid the 10% ownership rules? I assume they were converting a little at a time and selling as fast as they could during the recent pumping then going back for more until all $34,000 in debt was converted and dumped into the market. Some how I doubt that any future ORRV filings will disclose who owned that debt.

340,000,000 shares explains part of the newly created free trading stock, but not all.

Where did the other 212,353,511 newly created free trading shares come from?

Again referring to the spreadsheet above we see $13,300 in trade debt and regulatory fees/taxes.

Did that $13,300 get turned into an addition 133,000,000 free trading shares of stock? Even if it did, that doesn't explain all of the newly created free trading stock.

The following link is the Custodianship Petition filed by Adam Tracy back on July 20, 2016 to gain control of the ORRV shell.

https://promotionstocksecrets.com/wp-content/uploads/2017/01/TracyORRVcustodianshippetition.pdf

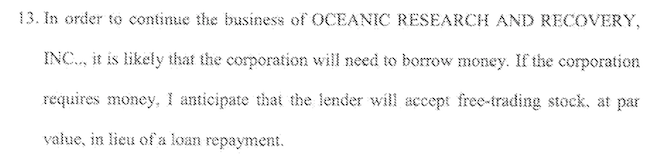

In that Custodianship Petition (page 23 paragraph 13) Adam Tracy told the court that ORRV may need to borrow money, and if ORRV does borrow money, the loan may be repaid in free trading stock at par value ($.0001/share):

Is that what we have going on here? On top of the original $34,000 debt plus $13,3000 in fees that Adam Tracy created from the custodianship costs was more debt created and already turned into free trading stock at $.0001/share? That's the only explanation I can come up with for the additional newly created free trading shares.

Again I ask... how in a such a short time period did Adam Tracy manage to turn convertible debt into free trading stock especially considering that there is absolutely no question that ORRV was for an extended period of time a shell company?

How much more $.0001/share free trading stock will be created and dumped into the market before this proposed merger closes? It is certainly easy to see why so much effort was made into pumping the proposed merger before the merger actually closed.

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM

Avant Technologies Launches Advanced AI Supercomputing Network and Expansive Data Solutions • AVAI • Apr 23, 2024 8:00 AM

BestGrowthStocks.com Issues Comprehensive Analysis of Triller Merger with AGBA Group Holding Limited • AGBA • Apr 22, 2024 1:00 PM

Cannabix Technologies to Present Marijuana Breathalyzer Technology at International Association for Chemical Testing (IACT) Conference in California • BLO • Apr 22, 2024 8:49 AM