Wednesday, November 30, 2016 10:13:37 AM

Nothing but volume offers the possibility of near-term bottoming, much less appreciation. Everything else says near-weakness is the most likely scenario.

There was a 16-unit multi-MW Order for O & G Customer. Unfortunately, we got the all-too-common response of price sinking.

Today was a typical open high and fall. But it was atypical in that there was almost no intra-day recovery, which is the more common scenario. This due to the shorters, I think, and the folks that try to do low-volume manipulation higher were apparently absent. I wonder if they are on-and-the-same. Shorters do low-volume (and therefore "cheap") pushes up, get believers in, then short the $hit out of it? I'd rather believe the warrant holders where the ones pushing it up though - that offers some hope of sustained appreciation.

Notably absent in my intra-day observations were the almost continuous extremely low/no-volume hitting of the offers to push price upward. With the PR, which did the common sinking of price, the price could have used the help today.

Conversely, looking at my unconventional stuff at the bottom, we see the shorters were out in force, fitting with the recent short interest report trends, comprising ~64% of the day's trades.

There were two pre-market trades, 900 and 100 for $0.9238.

09:30-10:07 opened the day with a 2,255 sell for $0.90 & 8.7K more: $0.90 x 6.6K, $0.9082 x 1.6K, $0.91 x 400, $0.8901 x 100. B/a after the open was 2.2K:200 $0.9000/11. As expected (I guess) when we get a positive PR, price immediately began medium/low-volume decline after ending 9:30 at $0.8901. Then came 9:31's b/a 3K:900 $0.8900/95, 9:34's 2.7K $0.89->$0.87->$0.895, and then the drop ended by doing 9:36-:37's 1.9K $0.87/$0.8915 and $0.8843->$0.8703. B/a at 9:54 was 100:400 $0.8806/$0.8933. Price began clawing back up, on near-zip volume, and 9:48 had price back up to $0.8948 but 9:56 was back at down at $0.8800/3. B/a at 9:56 was 3.5K:1.2K $0.8800/92, 9:57 100:100 $0.8801/9, ... a technical issue caused me temporarily stop getting b/a. The period ended on 10:07's 200 $0.8801.

10:08-10:12 did a relatively high-volume drop doing 10:08's 21.8K $0.8809->$0.871->$0.8713, 10:09's 1.2K $0.87->$0.8715->$0.87, 10:01's 17K $0.8709->$0.8715->$0.87, and ending the period on 10:12's 7.2K $0.8704->$0.8518->$0.8586.

10:13-10:47 began a mostly very low/medium-volume $0.852/$0.867 with converging highs and lows and ended the period on 10:47's 100 $0.8622.

10:48-11:11 Began an extremely low/no-volume clawing upward on 10:51's 2.6K $0.8622/$0.87. 10:52's 100 hit $0.8799, and 11:08's 285 hit $0.8924. B/a at 11:06 was 1.6K:200 $0.8705/$0.8970, 11:10 1.6K:300 $0.8705/$0.8847. The period ended on 11:11's 3.4K $0.8705/$0.8802.

11:12-12:08 began extremely low/no-volume $0.8705/32 on 11:18's 200 $0.8718. B/a at 11:19 was 100:300 $0.8731/2, 11:32 1.6K:600 $0.8705/14, 11:51 1.5K:100 $0.8705/14, 12:02 1.3K:600 $0.8705/6. The period ended on 12:08's 2.2K $0.8706.

12:09-12:25 B/a at 12:17 was 9.3K:100 $0.8601/2, 200:400 $0.8608/13, the period ended on 12:25's 100 $0.8603.

12:26-13:06 began an extremely low/no-volume creep higher on 12:32's 100 $0.8613, did 12:42's$0.8613/22, 12:45's 3.1K $0.8699, 12:47's b/a 200:700 $0.8620/65, and 10:48's 151 fall back to $0.8642 ended the climb. That kicked off extremely low/no-volume $0.864x with falling range. B/a at was 13:03 100:100 $0.8620/29. The period ended on 13:06's 467 $0.862.

13:07-14:16 began extremely low/no-volume $0.8601/2 on 13:07's 14.2K $0.862->$0.8602->$0.8623. B/a at 13:11 was 3K:400 $0.8601/2, 13:18 2.7K:500 $0.8601/2, 13:32 2.6K:800 $0.8601/2, 13:46 2.4K:1.1K $0.8601/2, 14:01 1K:900 $0.8600/1. The period ended on 14:16's ~1.6K $0.8601->$0.86.

14:17-15:41 began trying a move higher by first going lower on 14:18's 2K $0.8524->$0.8523->$0.8526 but the move higher failed. B/a at 14:17 was 500:400 $0.8600/1. After a few minutes of very low-volume $0.8523/7, trade did 14:24's 200 $0.8523->$0.8627, 14:26's 100 $0.8674, 14:29's 390 $0.8629/77, 14:30's 650 $0.8563. B/a at 14:32 was 3.5K:200 $0.8523/24. Trade settled in at $0.852x/50, with reducing highs. B/a at 14:43 was 100:200 $0.8525/$0.8677, 14:53 300:600 $0.8526/97, 15:01 100:500 $0.8525/47, 15:36 2.9K:200 $0.8520/1. The period ended on 15:41's 515 $0.852.

15:42-16:00 began very low/no-volume $0.8500/12 after 15:42's 11.2K $0.8520->$0.8518, 15:43's 1.4K $0.8500/19/03 and 15:44's 300 $0.8500/03. B/a at 15:47 was 34K:600 $0.8500/03, 15:58 35.7K:200 $0.8500/9. The period and day ended on 15:59's 2.6K $0.8501/0/5/1/0/9->$0.8900->$0.8885->$0.85 and 16:00's 854 buy for $0.8782.

There were no AH trades.

Excluding the opening and closing trades (didn't qualify), there were 16 larger trades (>=5K & 5 4K+) totaling 101,600, 25.10% of day's volume, with a $0.8662 VWAP. Both metrics are in what I think is a normal range for the day's volume. The VWAP was above the day's $0.8656. Given the short percent this makes me think we had shorters selling to less-aware folks responding to the PR.

Look at the VWAP and buy percentage movements to see the effect of the short sales. With these buy percentages it's uncommon to see VWAP be almost completely uni-directional down.Ending Period Period Period __Per. Trade_ Period_ % Day_ Per. End

Period Volume Low High _Dollar Val._ VWAP___ Volume Buy ~%

08:30 1000 $0.9238 $0.9238 $923.80 $0.9238 0.25% 100%

10:07 51009 $0.8700 $0.9100 $45,402.64 $0.8901 12.60% 41.55% Incl 10:01 $0.8900 4,000

10:12 47143 $0.8518 $0.8809 $41,188.22 $0.8737 11.65% 35.55% Incl 10:08 $0.8800 13,800 10:10 $0.8700 4,000

10:47 56506 $0.8518 $0.8697 $48,696.67 $0.8618 13.96% 49.22% Incl 10:13 $0.8600 5,000 10:27 $0.8669 10,000

10:28 $0.8668 9,200

11:11 11300 $0.8622 $0.8924 $9,898.12 $0.8759 2.79% 49.06%

12:08 29836 $0.8705 $0.8732 $26,005.97 $0.8716 7.37% 49.58% Incl 11:25 $0.8720 5,300 11:50 $0.8706 4,700

12:25 19846 $0.8601 $0.8705 $17,177.66 $0.8655 4.90% 49.99% Incl 12:12 $0.8700 4,100 5,000

13:06 16115 $0.8613 $0.8699 $13,911.57 $0.8633 3.98% 51.61%

14:16 32198 $0.8600 $0.8623 $27,696.34 $0.8602 7.95% 47.13%

15:41 115677 $0.8518 $0.8677 $98,837.86 $0.8544 28.58% 49.46% Incl 14:18 $0.8600 9,050 $0.8593 5,000

14:33 $0.8600 5,000 14:54 $0.8525 4,450

15:40 $0.8521 7,000

16:00 21465 $0.8500 $0.8900 $18,302.44 $0.8527 5.30% 47.98% Incl 15:42 $0.8520 6,000

On the traditional TA front, movements were:

Continuing the predominantly negative movements with very much higher volume is a bad sign ... unless the 400K+ is thought to be large enough to be a "flush", suggesting a bottom. If we hadn't had a positive PR today I might be willing to go there. Having seen the short percentage combined with the PR makes me avoid drawing that conclusion. I will lean to near-term reducing volume, an easy call I think, with continuing price weakness.__Open_ ___Low_ __High_ _Close_ Volume_

Today -0.11% -2.30% 0.00% -1.10% 402.51%

Prior -0.33% 4.82% -4.21% -2.42% -78.89%

On my minimal chart, recall that I again adjusted the rising triangle's (lower right orange lines) rising leg after the we confirmed that the old placement was no longer in play. Recall also that this is currently tentative in that the origin and first touch are consecutive days, being considered as one point by me, and there's only one more touch at the low of 11/25. So to get an effective confirmation of the line validity we need another touch and rebound.

Regardless, that put trade range back into the triangle. The trade is nearing the lateral portion of the triangle that often produces a break. Using recent behavior as a basis I don't think we'll break "soon" though. Most likely near-term is continued short-term, and now I know we are in medium-term, consolidation. Countering that that is concern with today's short percentage. Follow-on from the most recent occurrence of a percentage in this range was an aggregate substantial VWAP decline the next three days, including today. If that behavior repeats we could break below the rising support quite quickly.

Let's hope there's no more positive PRs in store. I'm guessing the shorters are operating on the thesis that every sale is a larger loss and as bullish folks try to buy the shorters are more than willing to short to them.

Back to basics, we see volume about five times yesterday's. This suggests strength to the downside. However, knowing the short percentage and that shorts are unlikely to hit such short percentage on consecutive days, I think that we will get a breather of at least a couple days and maybe more if there's no positive news.

Yesterday's extremely low volume offered hope that there was no strength lower and if the PR had not appeared, so likely would the shorters not have appeared. I'm expecting tomorrow will see reduced shorting.

For the near term, it looks like weakness should continue. But we are pushing the experimental 13-period Bollinger lower limit and normal behavior for other symbols would be a bias to move toward the mid-point. CPST has frequently exhibited a behavior of "pushing" on the lower limit. This is one factor that has me leaning toward near-term weakness continuing.

On my one-year chart the 20-day was flat (well, down 1/100th of a penny) and the rest continue descending.

Yesterday the oscillators I watch had improvement in MFI (untrusted by me), momentum, and full stochastic. Weakening was seen in the rest of the oscillators. All were still below neutral.

Today every oscillator weakened. All are below neutral. All but full stochastic are nearing oversold territory.

The experimental 13-period Bollinger limits, $0.8707 and $0.9563 ($0.8790 and $0.9568 yesterday), have begun diverging as the lower limit falls faster than the upper limit. This move the mid-point lower so even if price migrates in that direction there will be reduced up-side.

All in, nothing other than possible "blow-off volume" could be seen as positive. This doesn't seem likely to me. I remain in the camp of consolidation with a bearish bias. I'd like to say "mild bearish bias" but I'll need one more day.

Percentages for daily short sales and buys moved the same direction, good, but the short percentage is excessive and the buy percentage is only in the area where some short-term appreciation is possible. Combined, these two don't suggest that's likely though.

The spread expanded and was produced by the typical open high and go low, but with almost no recovery intra-day. Thanks to the shorters I would guess.

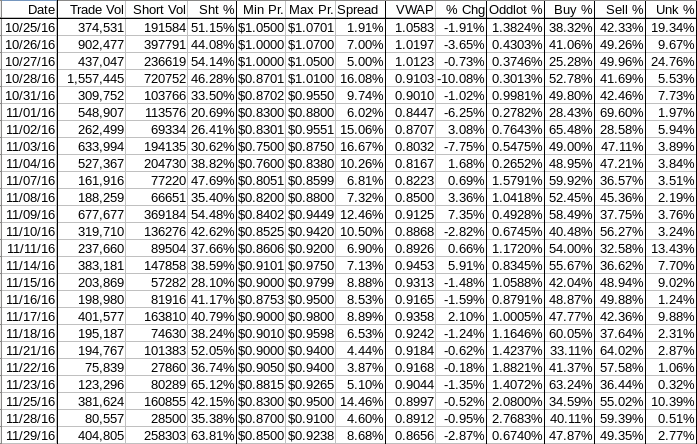

The VWAP's last twenty-four readings held 16 negatives and 8 positives for the second day. Change since 10/25 is -$0.1927, -18.21%, and the averages of the rolling 24-day period seen in the last few days (latest first) are now -0.7608%, -0.7208%, -0.6795%, -0.7820%, -0.5530%, -0.9605%, -1.4049%, -1.3868%, -1.4232%, and -1.3956%.

All in, all negatives here but for the buy percentage. It' just neutral though, saying we could see some near-term appreciation, not "likely to see".

Bill

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.