Wednesday, November 30, 2016 8:36:02 AM

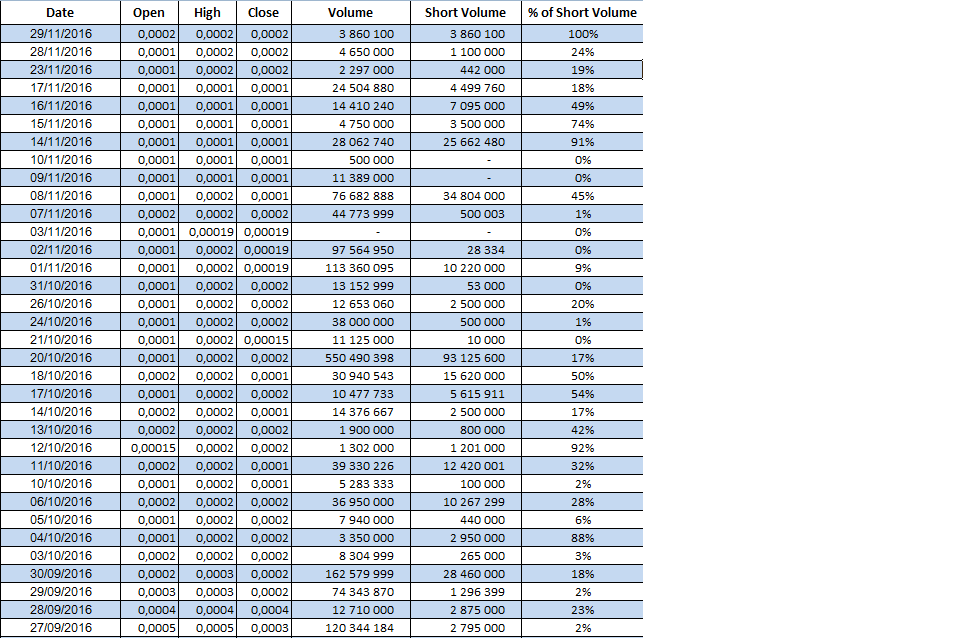

In the period from 07 July to 29 November, PMEA had a total volume of 2.9 Billions, of which over 1 billion is short sales.

The short sales represents 36 % of the total volume during that period.

The last month I noted that the ASK was blocked by shorters :

If it is a buy at .0002 you find the same volume in the short sales.

If it is a sell at.0001 , it isn't a short sales

Example :

29/11/2016 : buy volume is 3 860 100 = 100 % short sales.

28/11/2016 : volume is 4 650 000 (3 550 000 : sell volume at .0001 ) + ( 1 100 000 : buy volume at .0002 are short sales ).

The Shorters blocked the ASK for 4 reasons :

(1) They don't want the PMEA share price increase because they have over 1 Billion shares to cover

(2) They want all the actual shareholders to sell their shares at .0001

(3) They know that PMEA is undervalued and want to make fortune as soon as they get 900 000 000 floats.

(4) The shorter take the risk to shorter the share because they know that PMEA shares has the potential to reach over 1 $ in 2017,

But :

(1) if the company do a small reverse split : the shorter must cover their shorts.

(2) if the company distribute a dividend for the shareholder : the shorter must cover their shorts.

(3) the investor community buy all the short sales, in this case the shorter will resist and block again the ASK and then they will be scared and cover their shorts.

(4) if a FUND enters and buy all the short sales, shorter will be scared and cover their shorts.

The shorter will try to do the maximum to cover their shorts if any of the above mentioned scenarios is realized .

What do you think ?

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM

Avant Technologies Launches Advanced AI Supercomputing Network and Expansive Data Solutions • AVAI • Apr 23, 2024 8:00 AM

BestGrowthStocks.com Issues Comprehensive Analysis of Triller Merger with AGBA Group Holding Limited • AGBA • Apr 22, 2024 1:00 PM

Cannabix Technologies to Present Marijuana Breathalyzer Technology at International Association for Chemical Testing (IACT) Conference in California • BLO • Apr 22, 2024 8:49 AM