Friday, November 18, 2016 1:21:05 PM

Today both conventional and unconventional TA suggests consolidation. My observations of the intra-day behavior adds "mild bearish bias" to the suggestion.

This was another day of obvious manipulation. Note the early pattern detailed in intra-day descriptions below. Note the naive mountain in the five-minute chart I felt was warranted today. Not that all the moves up were longer very low/no-volume set-ups. Note my TFH rules me today, so scepticism may be warranted.

Today was, in summary,, open high, go higher, come back to trade around where it started, go a bit lower and sideways until ~11:22, step down a wee bit, go flat, do anther drop to the nadir at ~12:06, and then a very low/no-volume rise from ~0.90 to $0.97 at 14:16. Then a little flat through ~14:45 followed by a sag to $0.9106 by ~15:39. Trade putzed around there until the last six minutes of the day and then managed a rise to $0.92 at 15:59 and closed on 16:00's 699 $0/9130.

There were no pre-market trades.

I thought a 5-minute visual of the detail narrative might impress one with just how manipulated today's behavior was. Take note of the volume bars, most of which are so small as to be invisible. This is not the first day of this sort of behavior.

09:30-10:11 opened the day with a 2,193 sell for $0.91 and 200 more for $0.95.

Check this $0.95 pattern folks! Then came 9:31s 300 $0.95, 9:31's b/a of 1.6K:10.9K $0.91/5, 9:32's 300 $0.95, 9:33's 300 $0.95, 9:34's b/a of 1.1K:12.8K $0.91/5, 9:34's 200 $0.95, 9:35's 300 $0.95, 9:36's 400 $0.95, 9:37's 300 $0.95 (anyone see a pattern yet?), 9:38's 200 $0.95, 9:39's 300 $0.95, 9:39's b/a 2.8K:12.6K $0.91/5, 9:40's 200 $0.95, 9:41's 200 $0.95, 9:42's 400 $0.95, 9:43's b/a 24.2K:11K $0.9210/500, 9:43's 200 $0.95, 9:44's 200 $0.95. Pattern broke with 9:45's $0.9355 x 100/$0.95 x 200, 9:46's 100 $0.95, 9:47's 300 $0.95, 9:48's 200 $0.95, 9:49's 200 $0.95, 9:49's b/a 25.1K:10.2K $0.9210/50, 9:50's 300 $0.95, $0.951's 200 $0.95, 9:52's 200 $0.95.

Pattern broke finally. on 9:53-:54's ~18.9K $0.9500/1/2->$0.9366->$0.9501/2->$0.9451->$0.9501/2->$0.9451->$0.9502. Then comes 9:55's 1.1K $0.9500/2->$0.9495, $0.956's 200 $0.93, 9:57's 2.3K $0.95->$0.9451->$0.9501/2/3/4->$0.96, 9:58's 900 $0.95, 10:00's 200 $0.9405, 10:01's 300 $0.9405/$0.96, 10:02's 200 $0.96, 10:03's 200 $0.9678, 10:04's 810 $0.9678/$0.9301/$0.9689/$0.9495, 10:05's 350 $0.9690/78, 10:06's 300 $0.9678/$0.9495, 10:07's 200 $0.9678, 10:08's 2.4K $0.9300/39/$0.9680/78, 10:09's 950 $0.9301/$0.9496/78, 10:10's 300 $0.9680/78/50, and the period ended on 10:11's 350 $0.9650/36/49.

10:12-10:32 began an initially low/medium-volume weakening from $0.9302/$0.9401 on 10:12's 2.4K $0.9401/$0.9399/51. Volume went mostly medium/no-volume at 10:23. Trade hit 10:24's 5.2K $0.9300/95, 10:26's 5.4K $0.9211/$0.9347, and the period ended on 10:32's 4.4K $0.9210/92.

10:33-10:56 began extremely low/no-volume $0.9312/70 on 10:38's 200 $0.9369/70. B/a at 10:37 was 400:700 $0.9230/$0.9391, 9:47 100:900 $0.9303/87. Volume went mostly very low/medium volume at 10:51. The period ended on 10:56's 6.4K $0.9363/81/67/64/50/40/85.

10:57-11:21 began extremely low/no-volume $0.9250/$0.9377 on 10:57's 3.7K $0.9340/00/$0.9234/83. B/a at 10:59 was 1.3K:800 $0.9235/$0.9377, 11:14 500:600 $0.9251/$0.9377. The period ended on 11:21's 245 $0.9252/$0.9369.

11:22-12:03 began a big very low-volume plunge after 11:22's 35.6K $0.9358/76/59/58/15/59/52/15/51/77/53/14/51/35/34/59/60/77/31/20/12/94. B/a at 11:29 was 200:1.3K $0.9230/98. The period ended on 12:03's 200 $0.921.

12:04-12:44, after two no-trades minutes, began with a dip on 12:06's 19.1K $0.9210/11->$0.9200->$0.9100->$0.9010->$0.92->$0.9016->$0.9188 and then did very low/no-volume $0.9000/10 through 12:18 and then began very low/no-volume $0.9059/$0.9190. B/a at 12:23 was 300:1.3K $0.9060/$0.9190, 12:35 1.4K:100 $0.9060/$0.9190. The period ended on 12:44's 200 $0.919.

12:45-13:11 began a very low-volume step up from $0.919/$0.92, on 12:45's 600 $0.9190/$0.9200, began very low/no-volume $0.925/$0.93 at 12:47, had 12:50's b/a 300:2.4K $0.9200/99, 12:57's b/a 1.6K:1.1K $0.92/$0.9399, hit 12:56's $0.9398, hit 13:01's $0.935/$0.94, had 13:03's b/a 400:100 $0.9399/$0.94. The period ended on 13:11's 500 $0.945/$0.95.

13:12-13:20 began very low-volume $0.925/$0.9399 with declining highs on 13:12's 5.1K $0.95->$0.9399->$0.92->$0.91->$0.9065->$0.92->$0.9062/$0.9060. The period ended on 13:20's 1.1K $0.9298/50/$0.9300/$0.9250/98

13:21-13:46 began an extremely low/no-volume rise on 13:21's 1.6K $0.9299/16/09/$0.9300/->$0.9250/$0.9300->$0.9399->$0.94->$0.95. Trade hit 13:23's 2.3K $0.95/$0.965, 13:26's b/a 600:1.6K $0.9301/$0.95, 13:43's 400 $0.96/7. The period ended on 13:46's 400 $0.9767.

13:47-14:19 began another climb up after doing 13:47's 3.2K $0.9766->$0.9700->$0.9650->$0.9699 and 13:48's 2K $0.95/6->$0.94. B/a at 13:51 was 1K:2.4K $0.9500/99. Trade made it back to 13:59's 600 $0.9599/$0.97, 14:00's b/a of 11K:500 $0.9501/$0.97, 14:15's 12.6K $0.9570/99/51/$0.9600/$0.9700/70/$0.98/$0.9601/$0.97/$0.9685/$0.9601, and the period ended on 14:19's 300 $0.9766.

14:20-14:45 started with b/a at 14:23 of 1K:6.6K $0.96/$0.98. Then it began extremely low/no-volume $0.9609/$0.9774 on 14:24's 400 $0.9752/73. B/a at 14:43 was 100:100 $0.9600/96. The period ended on 14:45's 200 $0.9699.

14:46-15:39 began a very low/no-volume (until low/medium-volume began at 15:02) decline on 14:51's 1.7K $0.9599/$0.9608. Trade hit 14:51's 1.7K $0.9599/$0.9608, 14:52's 600 $0.9512, 14:53's 4/2K $0.9500/35, 15:03's 6/4K $0.933/$0.95, 15:04's 6.1K $0.9401/99, B/a at 15:08 was 100:500 $0.9400/18, 15:18 200:700 $0.9400/14. Then trade hit 15:21's 3K $0.9308/$0.9409. B/a at 15:25 was 1.4K:200 $0.92/$0.9398, then 15:39's 22.6K hit $0.9106/$0.9299, b/a at 15:49 was 2.9K:700 $0.9130/99. The period ended on 15:39's 22.6K $0.9299->$0.9200/1->$0.9152->$0.9117/06->$0.9299->$0.9106/7->$0.9153->$0.9200.

15:40-16:00 began the EOD volatility, mostly low/no-volume, on 15:40's 500 $0.9108/$0.9117. Then came 15:42's 1.4K $0.9118/58, 15:43's 3.4K $0.9118/$0.9299, 15:45-:48's ~3K sag $0.928/9->$0.9200/49->$0.9130/99, 15:51-:54's ~3.5K flattish $0.9190/$0.9200, 15:55's 900 $0.9389, 15:58's 700 $0.92, and ended the period and day on 19:59's 3.1K $0.92->$0.9130->$0.92 and 16:00's 600 $0.9130.

There were no AH trades.

Excluding the opening and closing trades (didn't qualify), there were 11 larger trades (>=5K & 3 4K+) totaling 60,400, 15.04% of day's volume, with a $0.9380 VWAP. For the day's volume, the count is abnormally very low - there were no "larger larger trades" - and I can't recall when I've seen a percentage of day's volume this low (if ever), especially with "good" trade volume, which today's volume was for $CPST. It's quite likely there were more larger trades that could not be identified because they were parceled out in small increments as part of the logistics of manipulating the price up today.

Note the very low share counts in even some "longer" periods in the following breakdown.

Note also the VWAP movements regardless of buy percentage movements appearing to be insufficient to cause elevation of VWAPs. It appears to me that MMs, who are allowed to be on both sides of the trades simultaneously, just kept forcing the bid up, as they have done so frequently when I've believed they were short-term long, forcing other participants to come with better bids to accomplish their objectives. I'm suspecting this was internecine warfare among the MMs, mostly, possibly aided and abetted by warrant holders, most of whom I suspect do both short and long positions intra-day to generate volume to push price while maintaining an essentially market-neutral position to manage risk inherent in trying to boost the market.

On the traditional TA front, movements were:Ending Period Period Period __Per. Trade_ Period_ % Day_ Per. End

Period Volume Low High _Dollar Val._ VWAP___ Volume Buy ~%

10:11 38687 $0.9100 $0.9690 $36,603.88 $0.9462 9.63% 75.35% Incl 09:53 $0.9500 6,600 09:54 $0.9501 5,000

10:32 54641 $0.9210 $0.9401 $50,750.25 $0.9288 13.61% 36.91% Incl 10:23 $0.9380 5,000 10:28 $0.9310 5,000

10:31 $0.9214 6,700

10:56 13849 $0.9300 $0.9391 $12,952.95 $0.9353 3.45% 0.33%

11:21 10538 $0.9234 $0.9383 $9,826.33 $0.9325 2.62% 34.13%

12:03 63588 $0.9210 $0.9377 $58,900.94 $0.9263 15.83% 35.85% Incl 11:22 $0.9253 5,000 $0.9315 6,700 6,700

12:44 41868 $0.9000 $0.9211 $38,282.45 $0.9144 10.43% 38.59%

13:11 19760 $0.9190 $0.9500 $18,464.38 $0.9344 4.92% 42.24%

13:20 9200 $0.9060 $0.9500 $8,558.47 $0.9303 2.29% 42.33%

13:46 20175 $0.9209 $0.9767 $19,285.69 $0.9559 5.02% 43.77%

14:19 38512 $0.9400 $0.9800 $37,289.54 $0.9683 9.59% 49.61% Incl 14:17 $0.9800 4,300

14:45 4542 $0.9609 $0.9774 $4,424.54 $0.9741 1.13% 49.95%

15:39 62550 $0.9106 $0.9608 $58,657.97 $0.9378 15.58% 48.31% Incl 15:17 $0.9410 4,700 15:39 $0.9299 4,700

16:00 19689 $0.9108 $0.9389 $18,069.38 $0.9177 4.90% 47.70%

Higher low, high and volume offset by lower open and close? This has the mark of a candle suggesting lower is most likely near-term - a very long upper shadow with a very short tail. Yesterday in this section I said I thought the strength would dissipate today (and elsewhere, in a day or two). I think the open and close on this kind of volume suggests that has occurred but the VWAP (see below) would suggest otherwise.__Open_ ___Low_ __High_ _Close_ Volume_

Today -0.58% 2.82% 3.16% -1.29% 101.82%

Prior -5.64% -2.74% -3.05% 1.09% -2.40%

On my minimal chart, in addition to the candle pattern mentioned, this continues to look like consolidation in that the top can't seem to make any headway (today's high 1/100th of a penny above 11/15's $0.9799) and the low matches that day's low. We have, of course, broken above the very short-term triangle (lower right orange lines) resistance but no seem to have trouble breaking up and away from the rising leg of that triangle and today closed below it. This can't be good.

Price bottom is right on the former resistance and now right of the apex.

The experimental 13-period Bollinger limits visually ceased converging and appear to be more or less parallel in their rise. This continues giving a slightly rising mid-point.

Yesterday I noted the fast and slow close-based EMAs have been essentially flat and at the same level for three days now. Today the fast broke down, not a good sign.

Yesterday I noted { In aggregate all this suggests what I'm tired of saying - near-term consolidation. The modifier ATM would be "with a bearish bias". } The lower open and close combined with high volume seems to confirm this assessment - bearish bias included.

On my one-year chart, the 10-day SMA continued to rise for the third day while the remaining SMAs continued falling. If we remain at this level, the 10-day will continue rising for still at least four days, the 20-day will fall six more days, and the 50-day would continue falling another 36 days or so

Yesterday the oscillators I watch saw improvement only in RSI and Williams %R (just below overbought) and weakening in MFI (untrusted by me), momentum, full stochastic (exited overbought), and ADX-related.

Today improvement occurred only in MFI (untrusted by me). All others weakened. All but accumulation/distribution and ADX-related are still above neutral.

The experimental 13-period Bollinger limits, $0.7658 and $0.9903 ($0.7651 and $0.9859 yesterday)

re as described above.

All in, I think the open and close combined with the volume and the oscillators tell the true story, contradicting the intra-day behavior. I think they tell the story of continued consolidation with a weakening bias, same as I said yesterday. Of course, my unconventional stuff suggested mild bullishness and the intra-day behavior certainly demonstrated that.

That leaves us with both being right and wrong - intra-day the unconventional stuff was right but based on the close the conventional TA was right. Let's see what my stuff below says today.

Percentages for daily short sales and buys moved in the same direction and both by similar amounts, both good things. The short percentage is in the middle of my desired range (needs re-check) and the buy percentage is still in the range where some appreciation is possible, but a bit less likely now, and still below the range needed for sustainable appreciation.

The spread widened a bit. It was produced by irrational intra-day behavior pushing price up. This is one of the few cases where I say the spread being produced by a nice (normally healthy in every sense of the word) rise is a bad. This rise was not healthy at all. I think it foretells weakness as soon as tomorrow. This fits' with my calls the last two days that the "strength" was just vapor.

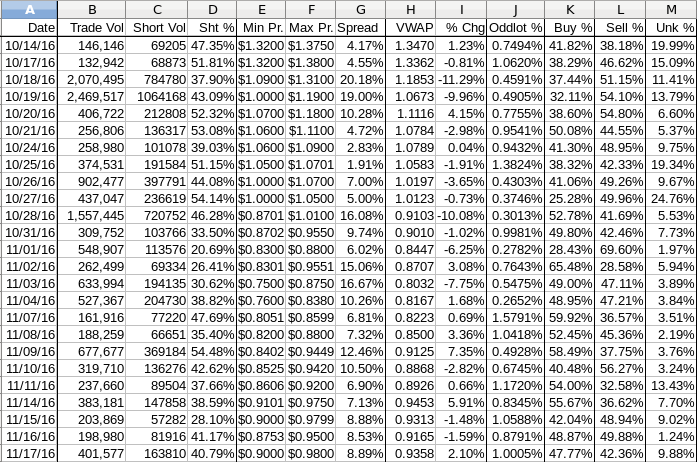

The VWAP's last twenty-four readings held, for the third day, at 14 negatives and 10 positives. Change since 10/14 is-$0.4113, -30.53%, and the averages of the rolling 24-day period seen in the last few days (latest first) are now -1.3868%, -1.4232%, -1.3956%, -1.4743%, -1.7433%, -1.8222%, -1.7635%, -1.8877%, -1.8884%, and 1.9605%.

All in, ignoring the intra-day behavior, this stuff gives no strong indications of near-term strength or weakness today. IOW, it suggests consolidation.

Applying what was observed intra-day, I add the modifier "mild bearish bias" to that.

Bill

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.