Sunday, October 16, 2016 9:39:05 AM

What The 'Pros' Say About Today's Markets

Oct. 16, 2016

As I write this, it's Friday evening and I'm staying in.

Between surviving a hurricane on vacation and building out the new site, I'm flat out tired and not even the promise of blue cheese and bacon stuffed olives (for those of you who've worked in restaurants, apparently they use a bar spear to pull out the pimento and then a piping bag to inject the blue cheese/bacon paste) submerged in Chopin is enough to lure me onto a bar stool tonight.

Besides, Deutsche's Dominic Konstam's weekly missive comes out Friday evening which means they'll be something new from derivatives strategist Aleksandar Kocic, Donald Trump is imploding in real-time on national television, and as an added bonus, there's a new piece by Citi's Matt King, who stands virtually alone as a voice of reason (and genius) in the post-crisis world.

So, I plop a few ice cubes into (way too much) Tito's, throw in a splash of tonic and start on Kocic. To my delight (and surprise), it's about politics, which fits perfectly with the firestorm currently unfolding live on every news channel I can find.

As you might have heard, the Trump campaign is in trouble thanks to allegations that the bellicose billionaire made unwanted advances on a number of women over the course of the last several decades. This statement will irritate some readers but it's the truth: barring some kind of miracle, he's not going to win.

And there's a point to my saying that. Trump and Sanders won't end up in the White House, but they've left their mark, and that mark has very real implications for politics and thus for the economy and markets.

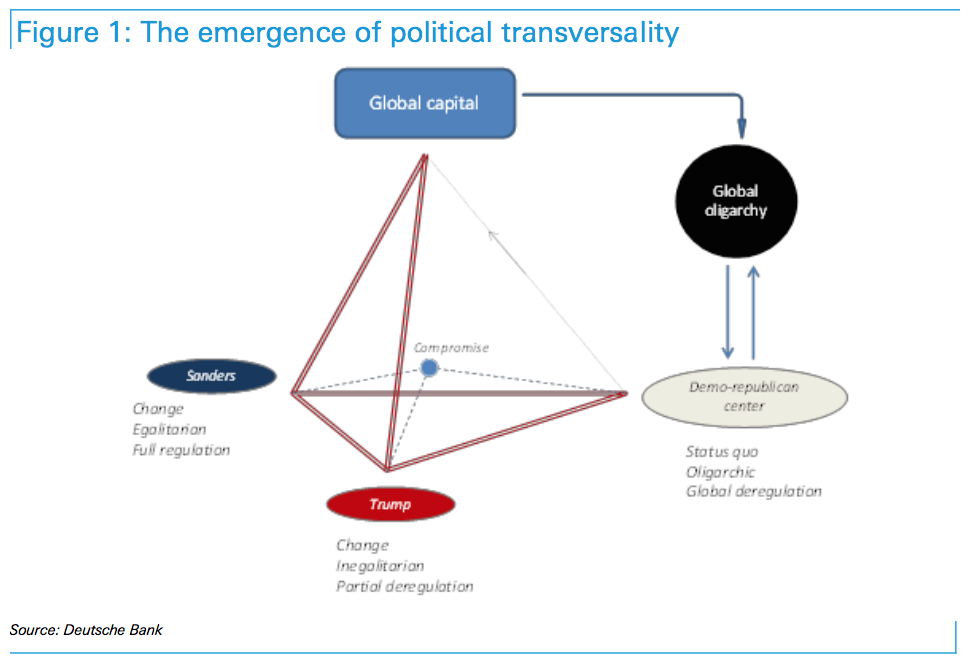

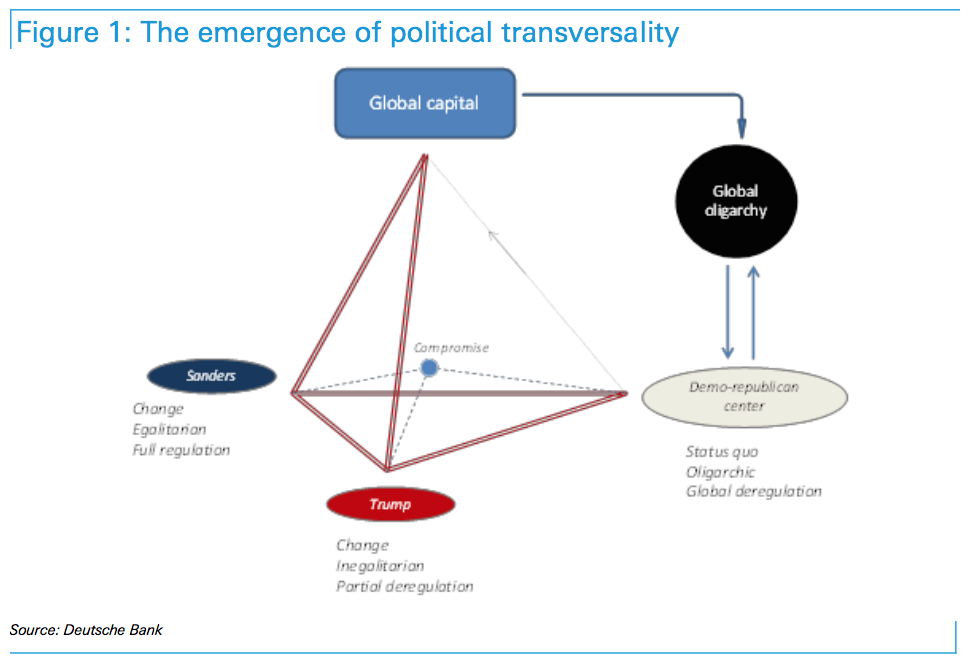

That's the entire theme of Kocic's piece. His point is that politics has failed to globalize at the same pace as economics and finance, which has created a schism that may now be unbridgeable. Here are some key excerpts (emphasis mine):

The underlying problem can be traced back to the fact that economic interests have become increasingly global while politics, the ability to decide, remained passionately local and, as such, unable to operate effectively at the planetary level.

Power to act has been moving away to the politically uncontrollable, global space and political institutions have become irrelevant to the life problems. In that configuration, growth comes at social costs. Impotence of politics reinforces dominance of the global which undermines political power further. As a consequence, mainstream parties are being blamed for bad economic situations and losing their power and public support. Their representatives, both left and right, are seen as representing interests of global capital and are perceived as defenders of status quo.

Politics is viewed as a problem, instead of a solution while social costs caused by this state of affairs are being recognized and articulated by the emerging populist wings, whose main novelty has been their hostility to global oligarchies. These parties have been gaining traction in these elections. The erosion of cohesion within the mainstream parties has been causing political reorganizations that transcend traditional division into political left and right.

As I've been over on countless occasions previously, this state of affairs isn't desirable. It represents a step back for society.

Yes, globalization has cost the US its manufacturing sector, but at this point, trying to figure out how to restore it is like trying to figure out how to argue that the earth is flat. This debate is over. Those jobs aren't coming back. Period. And as Kocic notes, the longer it takes for the electorate to embrace economic globalization, the more impotent politics and diplomacy will become when it comes to solving problems.

That is exactly the dynamic we do not need in the post-crisis world. We need solutions, not antagonism and when it comes to solutions, monetary policy isn't going to cut it - well, unless your definition of "success" is inflating asset (NYSEARCA:SPY) bubbles.

But we're at the end of the rope when it comes to what inflating financial assets can do for the global economy. At this juncture, all central banks are doing is perpetuating an increasingly precarious dynamic. And that's where Matt King comes in. As usual, out of respect for the original, I won't copy the whole thing here, but I will highlight some of the points I've been making for some time now.

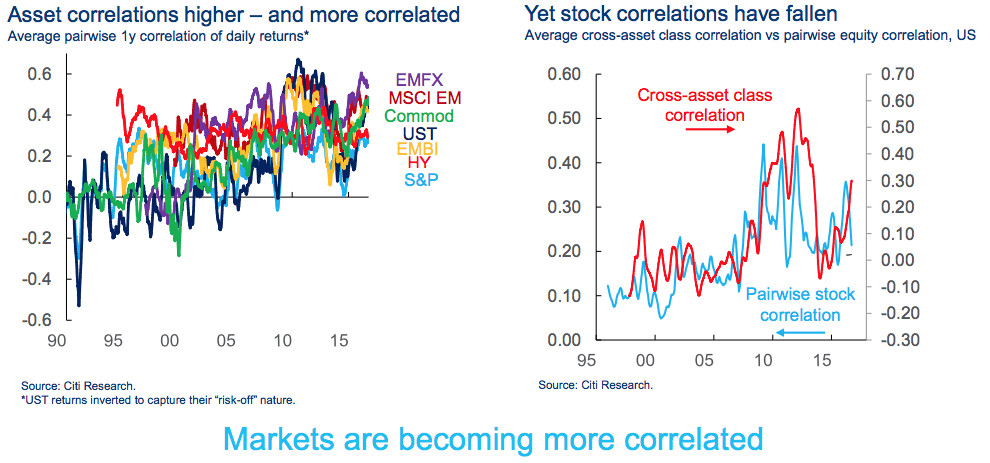

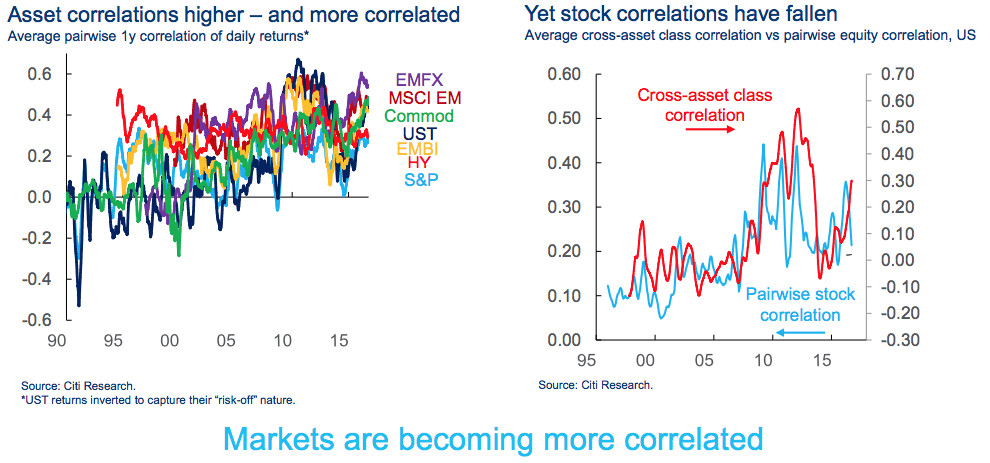

First, there's the ever present increase in cross-asset correlation:

That of course makes it more difficult to hedge and increases the likelihood of forced selling by risk-parity and vol targeting strats (see here for more).

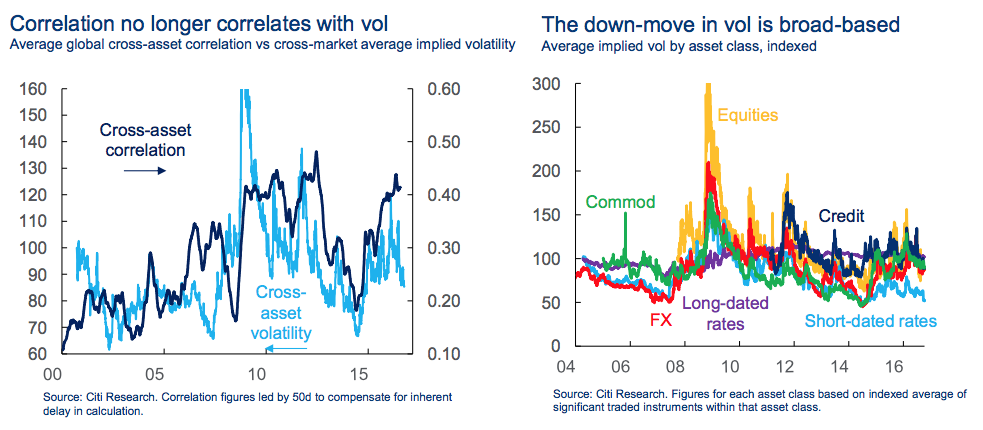

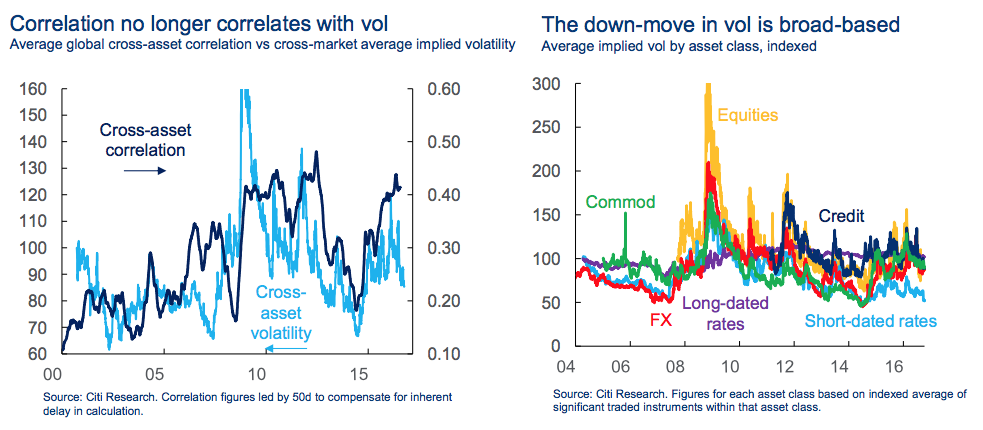

But thankfully, central banks have managed to keep a lid on vol:

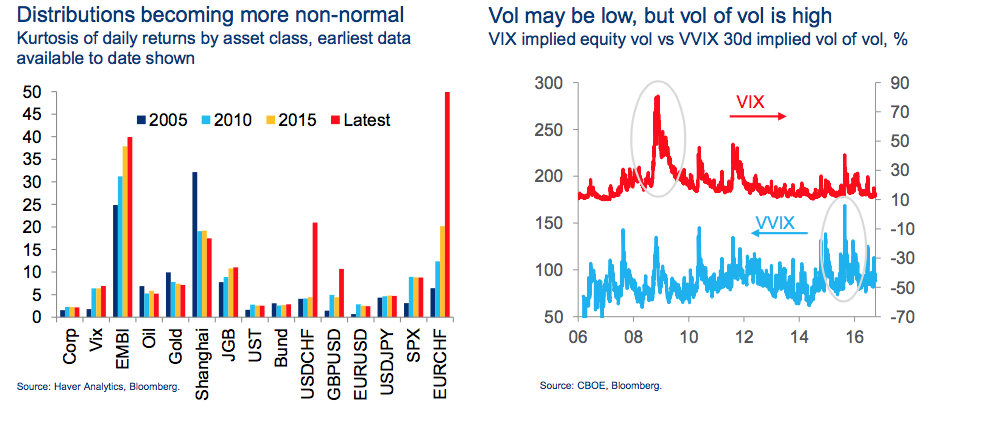

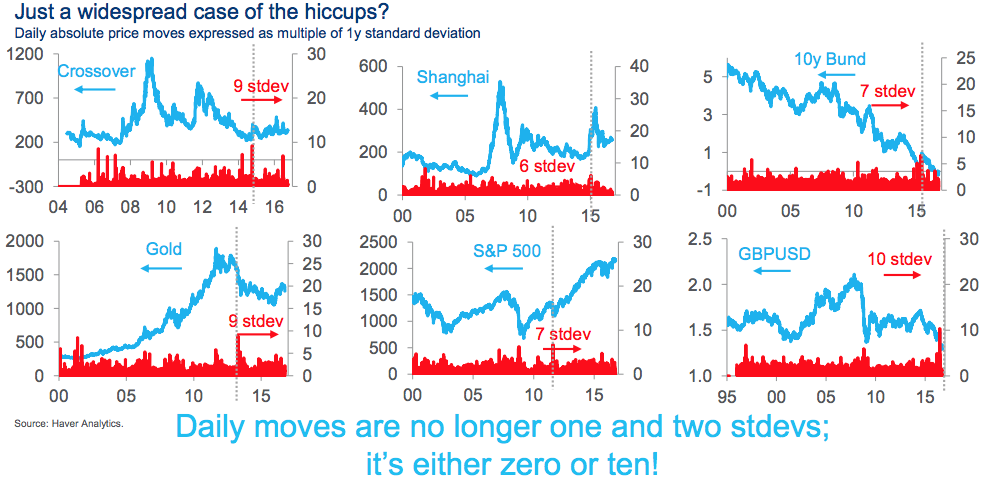

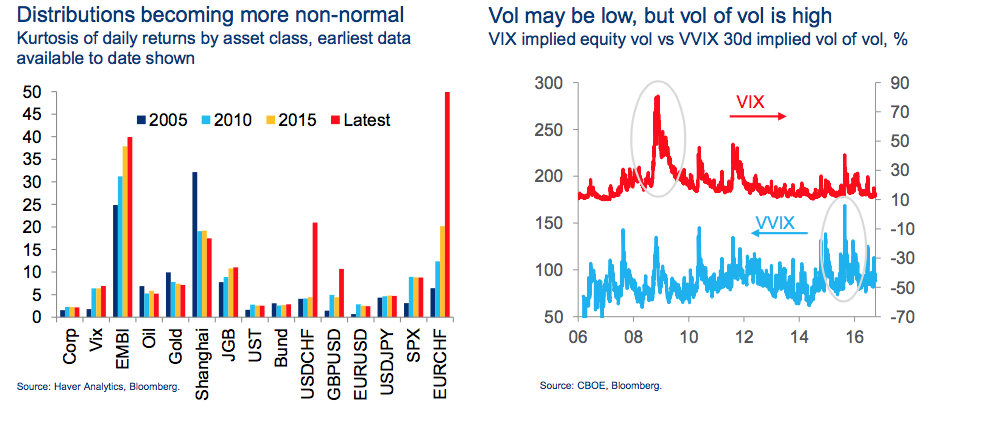

But that's misleading. Have a look at the kurtosis across asset classes as well as vol of vol:

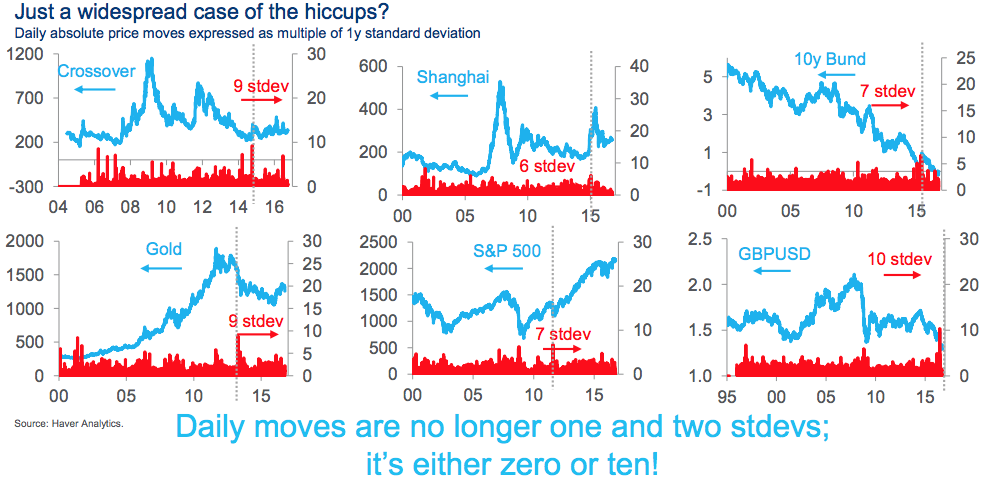

The point: you may be looking at a subdued VIX, but you need to look deeper than that. Have a look at all of these recent "anomalies":

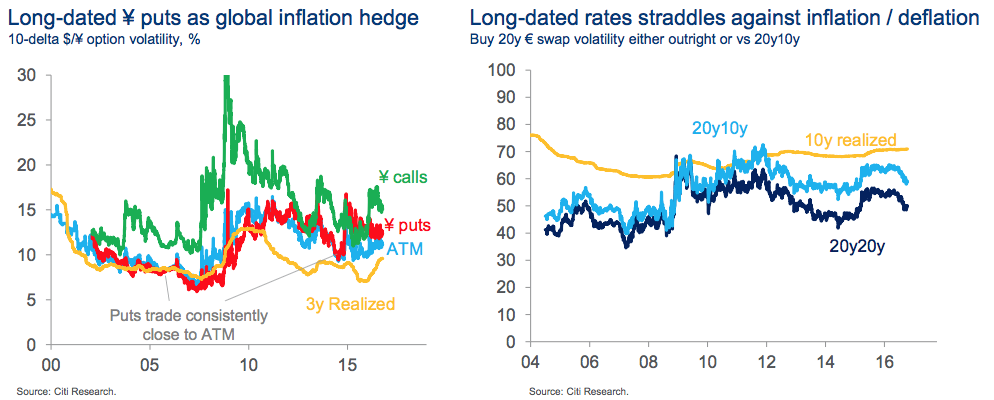

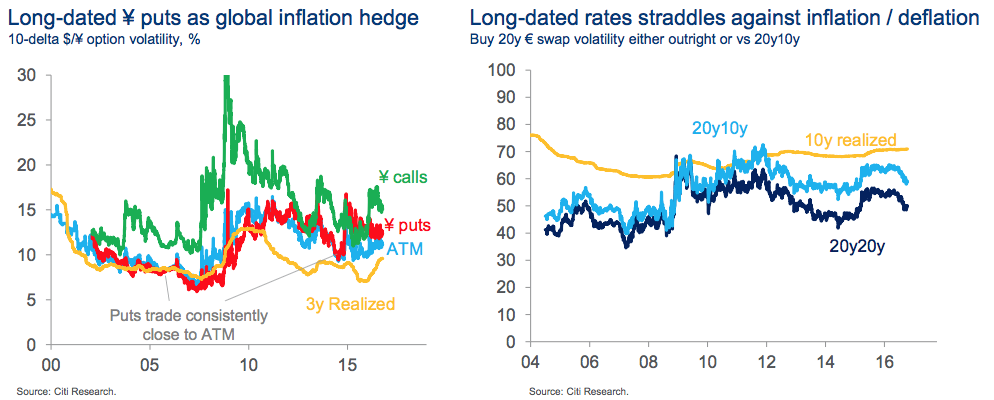

So what do you do? Well, that depends on what you're trying to achieve. Wanna hedge, well try this:

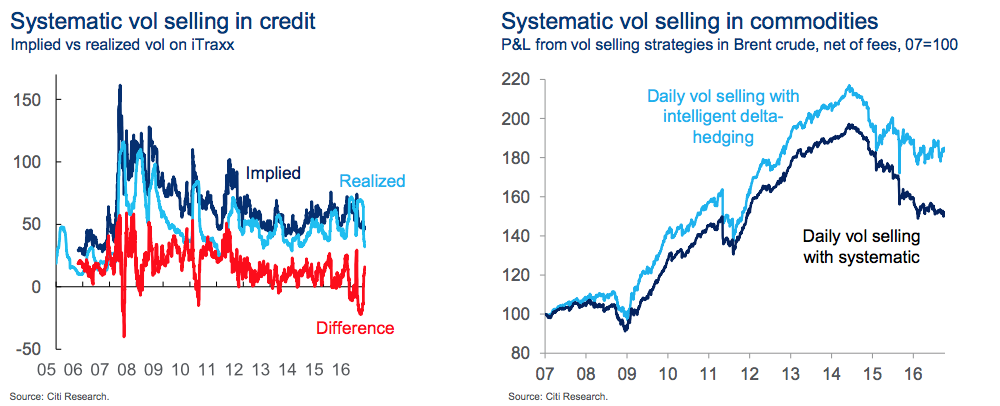

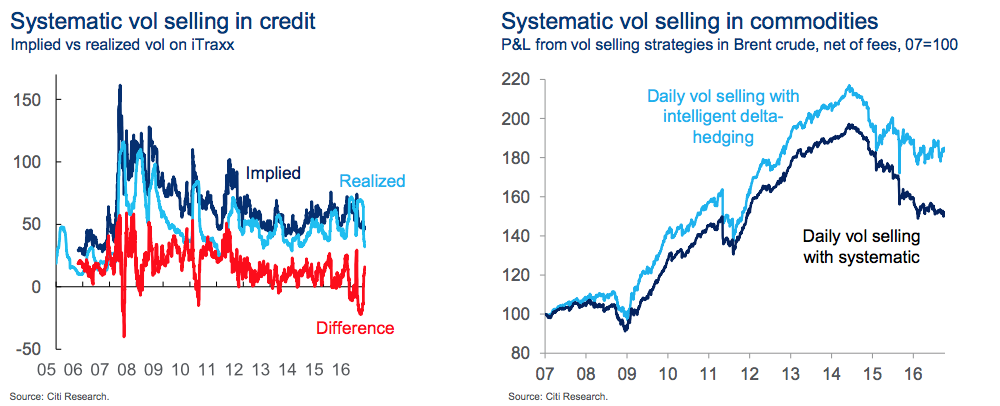

Want to take advantage of the hedgers? Well here's your play:

Now look, I realize that not a lot of the above is applicable to the armchair investor. But see, that's the damn problem.

This stuff sounds complicated on paper, but it's really not. It's a matter of access both to information and to trading platforms.

I did a social experiment on Thursday which you'll find interesting.

My local BofA branch has been encouraging me to sit down with a Merrill Lynch Edge advisor. I finally did for entertainment purposes (full disclosure: I don't need BofAML for Level 2 quotes; this was strictly entertainment). The rep - who is a really nice lady - started telling me all about $6.95 trades. And they'll tout the same damn thing to you if you've got any money.

You know what they won't do? Give you access to research like that which I cited above. At the risk of sounding like Donald Trump (although that kind of ties my piece together), this game is rigged. If you have a local broker they are a) reading the research cited above and not forwarding it to you, and worse, b) not understanding what they're reading.

Fortunately you've got someone in your corner, and his name is Heisenberg...

http://seekingalpha.com/article/4012326-pros-say-todays-markets

Oct. 16, 2016

As I write this, it's Friday evening and I'm staying in.

Between surviving a hurricane on vacation and building out the new site, I'm flat out tired and not even the promise of blue cheese and bacon stuffed olives (for those of you who've worked in restaurants, apparently they use a bar spear to pull out the pimento and then a piping bag to inject the blue cheese/bacon paste) submerged in Chopin is enough to lure me onto a bar stool tonight.

Besides, Deutsche's Dominic Konstam's weekly missive comes out Friday evening which means they'll be something new from derivatives strategist Aleksandar Kocic, Donald Trump is imploding in real-time on national television, and as an added bonus, there's a new piece by Citi's Matt King, who stands virtually alone as a voice of reason (and genius) in the post-crisis world.

So, I plop a few ice cubes into (way too much) Tito's, throw in a splash of tonic and start on Kocic. To my delight (and surprise), it's about politics, which fits perfectly with the firestorm currently unfolding live on every news channel I can find.

As you might have heard, the Trump campaign is in trouble thanks to allegations that the bellicose billionaire made unwanted advances on a number of women over the course of the last several decades. This statement will irritate some readers but it's the truth: barring some kind of miracle, he's not going to win.

And there's a point to my saying that. Trump and Sanders won't end up in the White House, but they've left their mark, and that mark has very real implications for politics and thus for the economy and markets.

That's the entire theme of Kocic's piece. His point is that politics has failed to globalize at the same pace as economics and finance, which has created a schism that may now be unbridgeable. Here are some key excerpts (emphasis mine):

The underlying problem can be traced back to the fact that economic interests have become increasingly global while politics, the ability to decide, remained passionately local and, as such, unable to operate effectively at the planetary level.

Power to act has been moving away to the politically uncontrollable, global space and political institutions have become irrelevant to the life problems. In that configuration, growth comes at social costs. Impotence of politics reinforces dominance of the global which undermines political power further. As a consequence, mainstream parties are being blamed for bad economic situations and losing their power and public support. Their representatives, both left and right, are seen as representing interests of global capital and are perceived as defenders of status quo.

Politics is viewed as a problem, instead of a solution while social costs caused by this state of affairs are being recognized and articulated by the emerging populist wings, whose main novelty has been their hostility to global oligarchies. These parties have been gaining traction in these elections. The erosion of cohesion within the mainstream parties has been causing political reorganizations that transcend traditional division into political left and right.

As I've been over on countless occasions previously, this state of affairs isn't desirable. It represents a step back for society.

Yes, globalization has cost the US its manufacturing sector, but at this point, trying to figure out how to restore it is like trying to figure out how to argue that the earth is flat. This debate is over. Those jobs aren't coming back. Period. And as Kocic notes, the longer it takes for the electorate to embrace economic globalization, the more impotent politics and diplomacy will become when it comes to solving problems.

That is exactly the dynamic we do not need in the post-crisis world. We need solutions, not antagonism and when it comes to solutions, monetary policy isn't going to cut it - well, unless your definition of "success" is inflating asset (NYSEARCA:SPY) bubbles.

But we're at the end of the rope when it comes to what inflating financial assets can do for the global economy. At this juncture, all central banks are doing is perpetuating an increasingly precarious dynamic. And that's where Matt King comes in. As usual, out of respect for the original, I won't copy the whole thing here, but I will highlight some of the points I've been making for some time now.

First, there's the ever present increase in cross-asset correlation:

That of course makes it more difficult to hedge and increases the likelihood of forced selling by risk-parity and vol targeting strats (see here for more).

But thankfully, central banks have managed to keep a lid on vol:

But that's misleading. Have a look at the kurtosis across asset classes as well as vol of vol:

The point: you may be looking at a subdued VIX, but you need to look deeper than that. Have a look at all of these recent "anomalies":

So what do you do? Well, that depends on what you're trying to achieve. Wanna hedge, well try this:

Want to take advantage of the hedgers? Well here's your play:

Now look, I realize that not a lot of the above is applicable to the armchair investor. But see, that's the damn problem.

This stuff sounds complicated on paper, but it's really not. It's a matter of access both to information and to trading platforms.

I did a social experiment on Thursday which you'll find interesting.

My local BofA branch has been encouraging me to sit down with a Merrill Lynch Edge advisor. I finally did for entertainment purposes (full disclosure: I don't need BofAML for Level 2 quotes; this was strictly entertainment). The rep - who is a really nice lady - started telling me all about $6.95 trades. And they'll tout the same damn thing to you if you've got any money.

You know what they won't do? Give you access to research like that which I cited above. At the risk of sounding like Donald Trump (although that kind of ties my piece together), this game is rigged. If you have a local broker they are a) reading the research cited above and not forwarding it to you, and worse, b) not understanding what they're reading.

Fortunately you've got someone in your corner, and his name is Heisenberg...

http://seekingalpha.com/article/4012326-pros-say-todays-markets

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.