Tuesday, September 13, 2016 8:48:07 AM

Overall I'm still thinking very short-term consolidation, but now about to end. The conventional and unconventional stuff are both showing early signs of a change to more bullish behavior. It's making me think we might not even see the $1.37 (w/overshoot, $1.35) minimal chart's rising long-term support (rising white line) get a challenge. I expect no large move yet, but another mildly (at least?) positive day seems to be in the cards.

Today's behavior was a nice contrast to that recently seen. We opened low, did a flat, up, flat, up, ... through almost 13:00, went flattish through ~14:35, and then did a quite reasonable re-trace to close only a penny below the day's mid-range. This is almost like many other stocks behave.

There were no pre-market trades.

09:30-10:20 opened the day with a 422 sell for $1.41 & 200 more at that price. Then came 9:33's 500 $1.41, 9:34's 5.1K $1.41/$1.4150, 9:36's 1.9K $1.41, 9:37's 110 $1.4101, 9:40's b/a of 1K:2K $1.42/3, and 9:43's 100 $1.43 (new intra-day high). That began very low/no-vlume $1.42/3. Then came b/a at 9:45 of 1K:3.5K $1.42/3. Volume was interrupted by 9:57's ~3.3K $1.4250/$1.43. B/a at 9:59 was 9.1K:2K $1.42/3. Volume was interrupted again with 10:08's 2.5K $1.4277/85. B/a at 10:10 was of 8.7K:1.5K $1.42/3. Volume was again interrupted by 10:12's 12K $1.4299->$1.43->$1.4299->$1.4287 (looks like a chunked blk trade on Nasdaq). 10:15's b/a was 8.8K:800 $1.42/3. Volume again interrupted by 10:15's ~2.8K $1.4260. 10:20's 200 $1.43.

10:21-10:30 began a variable-volume, fractional-penny, rapid rise on 10:21-:22's 10K $1.43->$1.4250->$1.43->$1.42/3->$1.44 (new high) hitting $1.45 (new high) on 10:27's 100, 10:29's b/a of 11.3K:3.5K $1.42/5. The period ended on 10:30's 5.3K $1.4350->$1.4490->$1.4499->$1.45.

10:31-12:49 began very low/no-volume $1.43/5 on 10:32's ~1.2K $1.410, had b/a at 10:34 500:1.9K $1.43/5, 10:41 b/a 17.9K:2.4K $1.42/5, 10:54 14.1K:1.3K $1.43/5. Volume was interrupted by 11:01's ~11K $1.45->$1.44/5->$1.4450/$1.45->$1.45->$1.44. B/a at 11:03 was 3.4K:1.4K $1.43/5. 11:11 began mostly no-volume, some low-volume range of $1.44/5. B/a at 11:22 was 1.1K:3.5K $1.44/5, 11:38 9.7K:3.3K $1.44/5, 11:49 9.7K:4.5K $1.44/5, 11:54 9.8K:12K $1.44/5. Volume was interrupted by 12:01's ~5.3K $1.44/4485. B/a at 12:10 was 9.5K:11.7K $1.44/5, 12:21 11K:12.3K $1.44/5. The period ended on 12:49's ~5K $1.45->$1.4450 (100)->$.45.

12:50-13:41, after four no-trades minutes, began mostly low-volume and some low-volume $1.46/7 after doing 12:53's 120 $1.4630 (new high), hitting 12:57's 294 $1.47 (new high)->$1.46 and finally 12:59's 209 $1.46->$1.45. B/a at 12:59 was 1.9K:4.3K $1.45/7, 13:10 1.1K:1.2K $1.45/6, 13:35 ~1.8K:2.3K $1.45/6. The period ended on 13:41's 100 $1.4550.

13:42-14:57, began very low/no-volume $1.45/6 after doing 13:42-:43's ~9.5K $1.4535->$1.45->$1.44->$1.45. B/a at 13:55 was 100:4.1K $1.45/6, 14:12 700:4.9K $1.45/6, 14:36 500:4.7K $1.45/5, 14:50 400:4.9K $1.45/6. The period ended on 14:57's 400 $1.45.

14:58-15:30 began a low-volume, mostly, drop on 14:58's 146 $1.44, hitting 15:10's 4.4K $1.4350/$1.44, 15:19's 631 $1.4301->$1.4311->$1.43->$1.44, 15:23's b/a of 3.7K:5.3K $1.43/4 The period ended on 15:30's 200 $1.44.

15:31-16:00, after two no-trades minutes, began mostly $1.44/5 with a couple odd trades at $1.43/$1.4350 on 15:33's ~11K $1.4377->$1.44->$1.4350->$1.44->$1.45->$1.44. B/a at 15:34 was 4.3K:4.9K, 15:49 4.6K:2.9K $1.43/5 fluctuating as bots in/out), 15:57 1K:2.1K $1.44/5. The period and day ended on 15:59's~4K $1.44->$1.4450->$1.45->$1.44->$1.43->$1.4450->$1.43 and 16:00's 454 sell for $1.43.

There were no AH trades.

Excluding the opening and closing trades (didn't qualify), there were 4 larger trades (>=5K) totaling 24,700, 15.69% of day's volume, with a $1.4408 VWAP. The count and percentage of day's volume is a bit low even considering today's low trade volume. Low trade volume, few larger trades, no "larger larger trades", larger trades low percentage of day's volume all fit in with what we see day over day - consolidation behavior. Today happened to be a couple pennies up from Friday's close but there's no strong bullish indications here.

Similar to so many days, and somewhat like yesterday in particular, good buy percentage and VWAP in the earlier part of the day with weakening later in the day. The difference from yesterday, of course, is we had no major dump in the last hour-and-a-quarter but just a steady slow weakening. This "normalcy" is good.Ending Period Period Period __Per. Trade_ Period_ % Day_ Per. End

Period Volume Low High _Dollar Val._ VWAP___ Volume Buy ~%

10:20 33638 $1.4100 $1.4300 $47,928.06 $1.4248 21.37% 69.46% Incl 10:12 $1.4287 5,000

10:30 23600 $1.4200 $1.4500 $33,903.58 $1.4366 14.99% 57.91% Incl 10:26 $1.4343 7,700

12:49 34276 $1.4210 $1.4500 $49,572.52 $1.4463 21.77% 62.54%

13:41 1710 $1.4500 $1.4700 $2,495.96 $1.4596 1.09% 62.35%

14:57 31756 $1.4400 $1.4600 $46,081.82 $1.4511 20.17% 49.93% Incl 14:49 $1.4500 7,000 14:50 $1.4501 5,000

15:30 7001 $1.4300 $1.4450 $10,063.99 $1.4375 4.45% 50.07%

16:00 22043 $1.4300 $1.4500 $31,793.87 $1.4424 14.00% 49.03%

On the traditional TA front, movements were:

In spite of a "green candle" day, due to a close higher than the open, you can see when the volume is factored in there's no strong sign of a positive bias here. Just a consolidation pattern IMO.__Open_ ___Low_ __High_ _Close_ Volume_

Today -4.73% 0.00% -3.29% 1.42% -52.28%

Prior -0.67% -3.42% 2.01% -4.73% 28.62%

Having said that, I'm not trying duck out of my "I think we're near a reversal" suggestion. A very short consolidation is not abnormal as part of the process. Even a bit longer is not out of the picture. I do believe we're trying to make a turn but a re-test of $1.37, or $1.35 with a little overshoot, is not out of the question during this process.

On my minimal chart, recall yesterday's { Well "move on through later" was the result this time. But it took that nasty last hour's ~67% of days volume to do it. I suspect ... } In other places yesterday I explained why I thought the EOD stuff in my unconventional TA was misleading, essentially the intra-day behavior was in conflict with the EOD stuff.

I think today's behavior lends credence to my concerns about the EOD stuff and why the nasty behavior with the near-EOD "flush" on rising volume didn't bother me. And in the summary near the top of the post I said { So, tomorrow should be up!

N.B. I've entered a GTC order at $1.37 today to get the second part of my trading blocks if we do approach $1.37.

Everything but the experimental 13-period Bollinger limits is not much worth discussing. The Bollinger limits have reversed course, going from diverging to slightly converging as both limits fall, but the upper limit falling faster. This is an effect of entering consolidation, albeit I anticipate a very short one, wherein volatility is reducing.

What I see here doesn't suggest I should change my assessment - we are nearing a reversal. We might not even see the $1.37 (w/overshoot, $1.35) minimal chart's rising long-term support (rising white line) challenged.

On my one-year chart the 10-day SMA continued to drop and the 20-day SMA is continuing to roll over. The 10-day has crossed below the 20-day. If we hold the current range the 10 and 20-day SMAs will continue to fall and at an increasing rate.

Yesterday I noted, regarding the 50-day, if we don't hold here or higher there's a substantial risk of starting to roll over in just a couple days, a possible pause depending on what price range does, and then if we don't start rising substantially within a week or so it'll start falling. Today's small rise in the close, if we can hold it can keep us rising 12 days. That gives us time to make the turn and start rising before the 50-day will be at risk of falling. But it's all sort of "iffy" for the moment.

The 200-day SMA, still falling, is now ~$0.065 below.

The oscillators I watch, which yesterday had all weakened but for MFI and three oversold and another quite close to being so, went mixed today. MFI (untrusted by me), ADX-related and accumulation/distribution weakened while improvement occurred in RSI, momentum, Williams %R, and full stochastic. As before, switching from all weakening to mixed is a good sign. Further, the improved ones are the more important ones I think - the weakening ones less so.

The 13-period Bollinger limits, $1.3774 and $1.8534 ($1.3972 and $1.9043 yesterday), continue to converge as the upper limit falls more quickly than the lower limit falls. The mid-point continues falling with the mid-point now ~$1.60.

All in, holding steady that we're doing a very short-term consolidation with my feeling remaining that it's part of a turn-around in progress.

Percentages for daily short sales and buys moved in the same direction and both moves were "substantial". The short percentage is just a bit above my desired normal range (~35%-45% - needs re-check) and the buy percentage is in the area that allows some appreciation, though not likely substantial nor yet sustainable. In aggregate though, I think it's quite positive, especially is both re-treat a small amount tomorrow, especially short percentage. If short percentage would retreat into my normal range while buy percentage made it just a bit over 50%, I would not view this directional divergence as a big negative.

The spread started moving into a range more compatible with consolidating behavior. This would be expected if we were near/at a bottom and is likely a pre-cursor to the reversal actually occurring.

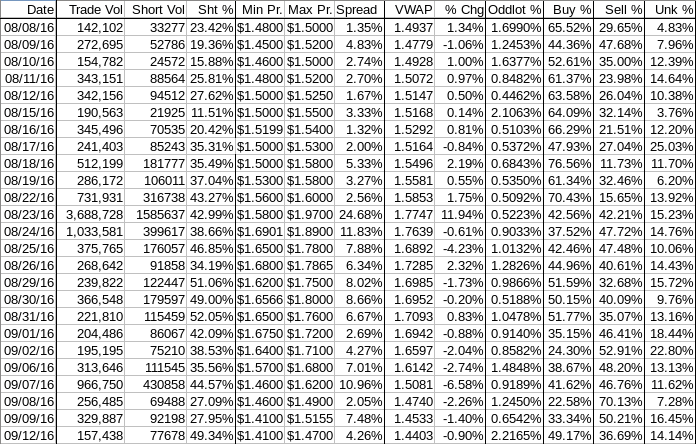

The VWAP's last twenty-four readings deteriorated from 12 negatives and 12 positives to 13 negatives and 11 positives. Change since1s 08/08 is -$0.0534, -3.58%, and the averages of the rolling 24-day period seen in the last few days (latest first) are -0.1021%, -0.0088%, 0.2908%, 0.4090%, 0.4975%, 0.5521%, 0.4824%, 0.5606%, 0.7499%, and 0.7927%. Still waiting for the rolling averages to start turning up.

All in, everything but the rolling VWAP movement averages seem more positive.

Bill

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.