Wednesday, August 24, 2016 12:47:34 PM

Yesterday I said { I'm remaining, hesitantly, near-term bullish and strongly longer-term bullish. The reason for the hesitation is the early signs of short-term profit taking has appeared in my unconventional stuff and conventional TA has two overbought and two near-overbought oscillators. I expect if we don't start to re-trace, or at least pause, tomorrow we'll have four overbought indications in the oscillators. We do have to bear in mind that we can enter overbought and remain there for extended periods but it would be unusual for $CPST.

I do suspect that the PR effect will go at least one more day though and allow us to take a stab at the $1.67/70 potential resistance area. But if profit-taking is occurring it will be a tough slog I think. }

Well, the "stab at ..." was correct but for the fact that it was as if that potential resistance didn't even exist!

With no fundamentals reason for today's behavior none of my TA stuff should be taken seriously, other than the buy and short percentages from my unconventional stuff.

For those reasons I'm bearish near-term and will wait a few days before seriously considering any of this stuff as useful.

Due to the volume and rapidity of changes in trade range and b/a, I'll have less detail and all my intra-day breakdowns will be on 15-minute intervals, with the exception of a couple early periods when I was able to keep up with the changes.

B/a at 8:35 was 5.1K:100 $1.51/60, 9:23 79:100 $1.52/60, just before open 2.1K:100 $1.56/60.

There were no pre-market trades.

09:30-09:47 opened the day with a 5,510 buy for $1.60 and b/a went 8.3K:300 $1.58/9. Then came 9:32's ~4K $1.5804->$1.58, 9:34's b/a 6.9K:200 $1.58/9, 9:35's ~10K $1.5850->$1.59->$1.5950->$1.60->$1.59, 9:36's 2.3K $1.59, 9:38's ~25.3K (incl. $1.58 x 12.5K x 2) $1.59, 9:46's b/a 7.2K:600 $1.58/9, and 9:47's 340 $1.5860 ended the period.

9:48-09:57 did a short small push up on 9:48's 10.8K $1.58/$1.5854, 9:49's ~1.8K $1.5850, 9:50's b/a of 7.4K:600 $1.58/9, 9:52's ~1.6K $1.59->$1.5850->$1.5830, 9:53's ~7.8K $1.5857, 9:54's 10.1K $1.5890/$1.59, 9:55's b/a 7.9K:1.3K $1.58/9, and 9:57's ~7.7K $1.59->1.5925->$1.60->$1.595->$1.59 ended the period.

9:58-10:49 began low/no-volume $1.58/9 on 9:58's 1K $1.595/$1.596 ans switched to mostly very low/no-volume at ~11:02. B/a at 10:22 was 8.8K:9.7K $1.58/9, 10:27 9.1K:9.7K $1.58/9. 10:49's 100 $1.585 ended the period.

10:50-11:03, after six no-trades minutes did a medium->high-volume move up on 10:56's ~13.6K $1.59->$1.5950->$1.60, 10:57's 6.1K $1.59->$1.60, 10:59's ~13K $1.60->$1.6001->$1.6050->$1.6082->$1.61->$1.62->$1.6190->$1.61, 11:02's ~29.9K $1.6199->$1.61->$1.6150->$1.6199->$1.62->$1.63->$1.62->$1.63->$1.64->$1.65->$1.63->$1.64 and 11:03's ~8.6K $1.63->$1.6201->$1.61/2->$1.6050->$1.6001 ended the period.

11:04-11:27 began a mostly low/no-volume $1.61/2 on 11:04's 30.6K $1.61->$1.60->$1.62 and ended the period on 11:27's ~3.4K $1.62.

11:28-11:45 did a medium/high-volume move upward from $1.62/3 to $1.71/2.

11:45-12:15 did first a high and declining volume, then a mostly low volume, sideways mostly $1.70/2 and a couple $1.73s.

12:16-12:30 did a very high-volume rocket-shot from $1.71 to $1.88.

12:31-12:45 did an initially high-volume, and then medium-volume, drop down to $1.78.

12:46-13:15 did a mostly medium/low-volume drop from $1.78/9 to $1.72 by 13:08 and small bounce to $1.75 by 13:15.

13:16-13:45 did a mostly low-volume dip to 13:25's $1.70/2 and then initiated a climb on mostly low-volume, and some medium-volume, to $1.76/77.

13:46-14:30 did a medium/high-volume drop to 14:01's $1.73/4, a medium/high-volume rise to 14:15's $1.76/8 and then went sideways there.

14:31-15:00 did a low/medium-volume sideways $1.77/8 through 14:37, did a quick high-volume step up to $1.82 by 14:39 and a medium-volume sideways $1.80/1 through 14:57, and a low-volume step up to $1.82/3 by 15:00.

15:01-15:30 did sideways $1.80/3 low/medium-volume sideways through 15:12's $1.81/2 and then initiated another high-volume, and rising, "rocket-shot" through 15:25's $1.97. That was followed by a very high-volume drop to 15:30's $1.88/$1.91.

15:31-15:45 continued the high-volume drop through 15:38's $1.75 and did a high/medium-volume move up to 15:45's $1.81/3.

15:46-16:00 continued the move higher, but on reduced mostly medium/high-volume, to 15:59's ~55.6K $1.87/9 and 16:00's 239 $1.89 to end the period and day.

There were ten AH trades totaling 8,730 shares traded $1.88/$1.90.

Including the opening trade (closing didn't qualify), there were 135 larger trades (>=5K & 25 4K+) totaling 1,048,943, 28.44% of day's volume, with a $1.7569 VWAP. Excluding the opening trade, there were 134 larger trades totaling 1,043,433, 28.29% of day's volume, with a $1.7577 VWAP.

On the traditional TA front, movements were:

Ending Period Period Period __Per. Trade_ Period_ % Day_ Per. End

Period Volume Low High _Dollar Val._ VWAP___ Volume Buy ~%

09:47 56665 $1.5800 $1.6000 $90,152.55 $1.5910 1.54% 68.91% Incl 09:30 $1.6000 5,510

09:38 $1.5900 12,500 12,500

09:57 39070 $1.5800 $1.6000 $61,977.42 $1.5863 1.06% 60.27% Incl 09:48 $1.5800 9,900 09:53 $1.5857 7,750

10:49 34570 $1.5800 $1.5960 $54,868.57 $1.5872 0.94% 53.60% Incl 10:11 $1.5900 7,900

11:03 70619 $1.5900 $1.6500 $113,828.62 $1.6119 1.91% 52.03% Incl 10:57 $1.5900 6,000 11:02 $1.6300 4,800

11:27 117450 $1.6001 $1.6201 $189,822.96 $1.6162 3.18% 43.27% Incl 11:04 $1.6100 12,500 12,500

11:05 $1.6110 6,300

11:25 $1.6200 12,500 12,500

11:45 436731 $1.6200 $1.7250 $727,063.31 $1.6648 11.84% 45.79% Incl 11:28 $1.6300 4,900 6,800 4,600

11:28 $1.6301 4,600

12:15 290766 $1.6900 $1.7400 $497,296.87 $1.7103 7.88% 39.04% Incl 11:30 $1.6300 12,500 12,500 18,400

11:32 $1.6500 10,000 $1.6799 4,900

11:32 $1.6800 4,900 $1.6700 20,900

11:33 $1.6600 12,500 12,500 6,100

11:34 $1.6501 7,500 11:36 $1.6601 7,500

11:38 $1.6599 4,800 $1.6600 4,800

11:43 $1.6857 7,500 $1.6900 4,223 7,300

11:43 $1.6901 7,500 11:44 $1.7010 5,000

11:45 $1.7200 5,000 $1.7100 7,900

11:48 $1.7000 5,400 11:49 $1.7100 8,800

11:52 $1.7100 9,600 11:53 $1.7147 6,000

11:53 $1.7147 9,500 $1.7300 9,500

11:59 $1.7010 5,000

12:30 432514 $1.7050 $1.8800 $784,511.82 $1.8138 11.73% 39.93% Incl 12:17 $1.7056 5,000 12:20 $1.7200 7,200

12:22 $1.7310 5,000 12:23 $1.7480 8,600

12:25 $1.7700 5,000

12:45 254288 $1.7700 $1.8500 $458,699.42 $1.8039 6.89% 42.11% Incl 12:25 $1.7700 7,500 12:27 $1.8000 4,500

12:27 $1.8170 5,000 12:28 $1.8400 5,000

12:28 $1.8500 19,900 4,800 $1.8307 5,000

12:28 $1.8688 6,000 $1.8700 5,000

12:29 $1.8500 19,400 12:30 $1.8300 5,326

13:15 206639 $1.7200 $1.7900 $362,092.32 $1.7523 5.60% 41.99% Incl 12:31 $1.8300 4,009 12:32 $1.8400 5,000

12:32 $1.8300 6,300 $1.8120 6,000

12:32 $1.8225 5,000 12:34 $1.8200 5,000

12:34 $1.8100 6,100 $1.8130 6,300

12:35 $1.8075 4,000 12:39 $1.7900 4,000

12:40 $1.7700 5,650 18,100

12:50 $1.7544 5,326 $1.7500 7,900

13:08 $1.7500 4,000

13:45 146572 $1.7000 $1.7700 $254,428.33 $1.7359 3.97% 41.52% Incl 13:21 $1.7300 5,400 13:25 $1.7000 6,500

13:25 $1.7001 6,800

14:30 259605 $1.7300 $1.7800 $457,105.39 $1.7608 7.04% 42.04% Incl 13:51 $1.7699 4,800 13:56 $1.7600 10,400

13:56 $1.7600 6,600 $1.7500 4,000

13:56 $1.7500 5,000 4,000 4,400 7,500

14:14 $1.7590 5,200 14:17 $1.7800 43,109

14:30 $1.7663 5,050

15:00 129834 $1.7654 $1.8270 $233,856.88 $1.8012 3.52% 41.89% Incl 14:38 $1.7900 5,700 14:40 $1.8000 32,600

15:30 607798 $1.8000 $1.9700 $1,151,233.65 $1.8941 16.48% 44.30% Incl 15:05 $1.8299 5,000 $1.8010 5,000

15:07 $1.8300 14,600 15:14 $1.8200 4,000

15:15 $1.8300 7,000 15:18 $1.8401 5,000

15:19 $1.8600 6,800 $1.8572 5,000

15:22 $1.8800 10,000 $1.9000 5,000

15:23 $1.9010 4,500 15:24 $1.9199 5,000

15:24 $1.8900 7,488 $1.9400 7,000

15:25 $1.9500 4,000 $1.9497 4,900

15:25 $1.9501 5,000 $1.9500 7,441

15:25 $1.9200 5,000 15:26 $1.9490 4,800

15:26 $1.9600 12,100 15:28 $1.8900 7,670

15:30 $1.8900 5,700

15:45 359584 $1.7500 $1.9100 $653,928.14 $1.8186 9.75% 41.86% Incl 15:31 $1.8700 10,700 15:35 $1.7900 9,300

15:35 $1.7900 15,600 $1.8111 6,000

15:36 $1.8400 5,000 15:37 $1.7500 15,450

15:39 $1.8001 4,000 15:41 $1.8300 5,460

15:43 $1.8241 5,700 15:44 $1.8241 5,100

15:44 $1.8299 6,000 15:45 $1.8200 8,389

15:45 $1.8200 12,362

16:00 218627 $1.8000 $1.8900 $405,788.13 $1.8561 5.93% 42.56% Incl 15:49 $1.8400 5,000 15:54 $1.8410 5,000

15:55 $1.8490 5,700 15:56 $1.8500 6,700

15:57 $1.8560 7,000 15:59 $1.8800 5,900

16:57 8230 $1.8800 $1.9000 $15,554.70 $1.8900 0.22% 42.50% 16:15 $1.8900 6,530

On my minimal chart we had a big high-volume pop. My assumption is some of the day and momo trader alert sites noticed and got that crowd active. This would fit with the needs of the warrant holders and would be supported by the resent string of positive $CPST PRs, which indicate that things are improving. The pop we got is totally without foundation so there's no point in attempting to glean any clues from today's behavior.__Open_ ___Low_ __High_ _Close_ Volume_

Today 1.27% 1.28% 23.13% 18.87% 403.97%

Prior 1.94% 1.96% 1.27% 2.58% 155.77%

On my one-year chart there's nothing worth discussing as the pop we got is totally without foundation. The SMAs all got a nice improvement with the 10 and 20-day SMAs getting above the 200-day and the 50-day close to crossing above. I don't believe we'll hold this price range, so more can be gleaned in a few days when the momo and day traders have gotten scalped and exited.

The oscillators I watch are also meaningless today.

The 13-period Bollinger limits, $1.3324 and $1.7528 ($1.4413 and $1.5803 yesterday) don't mean anything right now. In a few days maybe.

All in, nothing in the TA I want to consider. Fundamentals and TFH rule today and so I expect an immediate re-trace to begin. How far it will re-trace I don't know.

Percentages for daily short sales and buys moved in the same direction, both down, which is surprising. With the pop we got one could assume that buying pressure was substantial. Instead we saw a big increase in sell percentage and short percentage held about steady. This suggests that lots of folks were waiting for an opportunity to exit and hit the bids and a substantial portion of the shares were not yet settled into the accounts of the sellers or the shorters saw this move in the same light I did and started shorting the crap out of it, feeling as I do, that a very quick re-trace would come.

The spread should be ignored today.

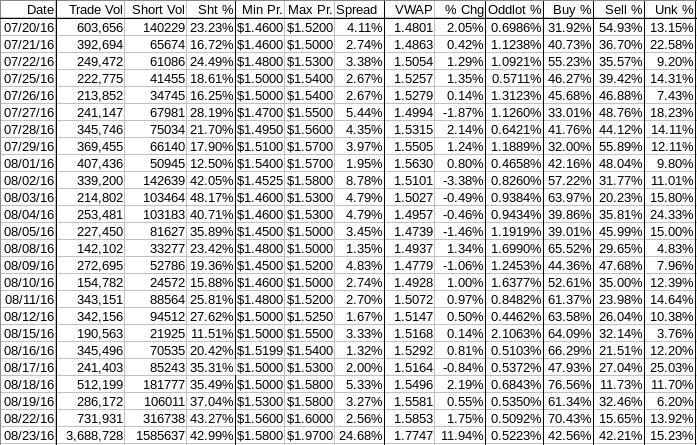

The VWAP's last twenty-four readings continued for the third day the best readings since I started tracking this, holding at 7 negatives and 17 positives. Change since 07/20 is $0.2946, 19.90%, and the averages of the rolling 24-day period seen in the last few days (latest first) are 0.7927%, 0.3806%, 0.5715%, 0.3934%, 0.4850%, 0.4435%, 0.4761%, 0.4766%, 0.2227%, and 0.4407%.

Today move is certainly a short-term abberation and we'll see more normal numbers in the VWAP movements return in just a few days at most.

All in, the short and buy/sell percentages tell today's true story and make me call bearish near-term.

Bill

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.