Wednesday, July 20, 2016 9:23:10 AM

Strongly bullish today with reservations about high volume possibly ending trend rather that showing accelerating strength and applying "judgement" to the short and buy percentages. Today's high offered a new medium-term descending resistance trend line and, you know me, I couldn't resist. See details below.

Stockcharts.com has "mildly bullish" (link below), where I've been for some time, and continue to lag as I would rather "switch than fight" (old-timers will get it it).

Near-term targets at $1.53/4, $1.67/$1.70 area and, factoring in the A & B warrant holders for whom I have many thanks as I believe they are managing this through September or until $2.25+ is achieved, $2.25+ longer-term. ATM is locked through September, so the warrant holders have the time needed if CPST cooperates at all by showing good progress in this recent quarters results and over this quarter.

The was a Capstone Turbine: Buy The Drop article from Seeking Alpha today. Not very well informed and had some issues, such as claiming the exhaust heat was "stored" (in a purely technical sense, sometimes that is the case, such as heating a boiler) in (C)CHP applications. In most cases it is piped directly to a chiller, provides heat for industrial processes, hot water, building interiors, etc. But it was probably widely read.

I had mentioned in the recent past the outstanding warrants and that the holders likely had the desire and wherewithal to move the market so the warrants, exercisable at $2.25 IIRC, became "in the money". Is the SA article part of their process? I suspect so. If they have a September target, after which CPST can again utilize the ATM, we can expect some more such between now and then. Likely too some "analyst" upgrades, maybe from some that don't normally follow the company?

There were no pre-market trades.

Prior to open b/a was 100:800 $1.38/41 and immediately before open it went 100:~9K $1.38/40 but ...

09:30-09:47 opened the day with a 4,607 sell for $1.36 and 8,636 more at that price followed by 9:32's 143 $1.38 and b/a went 3.4K:2.3K $1.36/9. 9:35's 100 $1.39 had b/a 3.1K:2K $1.37/9 and then came 9:40's 45 $1.3801, 9:46's ~1.5K $1.39/40 and 9:47's 2.3K $1.39 ended the period.

09:48-09:50 bounced up on 9:48's ~131.2K $1.39->$1.44->$1.41->$1.40/1->$1.42->$1.43->$1.44->$1.43/4->$1.45->$1.44/5->$1.46, 9:49's ~23.4K $1.46->$1.45->$1.44/5->$1.46->$1.44/5->$1.43/4, and ended the period on 9:50's ~12.8K $1.44->$1.43/4->$1.44/5.

09:51-10:38 began low, and then low/no, volume $1.43/5 through 9:58 and then very low/no-volume $1.44/5. B/a at 10:20 was 10.1K:4.8K $1.44/5. 10:38's 42.9K ended the period.

10:39-10:56 began with b/a 2.5K:4.4K $1.46/7 and did a rapid rise on 10:39's 50.7K $1.45->1.44->$1.47, 10:40's 37.4K $1.47->$1.48 and 10:41-:43's ~11.5K $1.47->$1.48. Then a rapid drop came on 10:44-:46's ~135K $1.48->$1.47->$1.46->$1.45, 10:48's 2.1K $1.45, and finally 10:55-:56's 17.3K $1.45->$1.44 ended the period.

10:57-11:24 began a very low/no-volume $1.44/5 on 10:57's 800 $1.44. At 11:01 b/a was 4.1K:1.3K $1.44/5, 11:13 4.5K:1.8K $1.44/5, 11:34 5.2K:1.8K $1.44/5. 11:24's 1K $1.45 ended the period.

11:25-12:27, after eighteen no-trade minutes, began mostly very low/no-volume $1.45/6 on 11:42's ~8.9K $1.4450/$1.46. 11:51's 35.7K $1.44/6 interrupted the period. B/a at 11:50 was 1.6K:1.3K $1.45/6, 12:05 3K:2.8K $1.45/6, 12:26 19.9K:3.6K $1.45/6. 12:27's 15.7K $1.4550/$1.46 ended the period.

12:28-13:10 began very low/no-volume $1.44/5 after dropping on 12:30's b/a of 6.5K:800 $1.44/5 and trading 12:30-:31's 11.9K $1.46->$1.45. B/a at 12:32 was 8.4K:1K $1.44/5 and 12:33 finished the drop on 6.9K $1.44/$1.4464. B/a 12:38 was 6K:3.5K $1.44/5, 12:57 10.3K:5.6K $1.44/5. 13:10's 755 $1.4410/$1.45 ended the period.

13:11-14:05 began very low/no-volume $1.45/6 on 13:11's ~5.7K $1.4486/$1.46 and 13:12's 5K $1.4501/$1.4510. 13:13 b/a was 9.2K:4.4K $1.45/6. Volume was interrupted by 13:27-:28's ~64.2K $1.45/6. B/a at 13:31 was 9.1K:6.5K $1.45/6, 13:59 29.3K:4.7K $1.45/6. 14:05's 6.8K $1.46 ended the period.

14:06-14:42 began very low/no-volume $1.46/7, dropping to $1.45/6 at 14:27, on 14:06's 22.3K $1.46->$1.4650->$1.466x/$1.47->$1.4750 and 14:07's 16.8K $1.4750->$1.47->$1.46->$1.45->$1.4550/$1.46->$1.45, 14:25 32.9K:4.2K $1.45/6. At 14:33 b/a was 32.8K:3K $1.45/6. 14:42's 3K $1.4550/$1.46 ended the period.

14:43-15:54, after three no-trades minutes, began very low/no-volume $1.46/7 on 14:46's ~3.7K $1.4580/$1.47. B/a at 14:49 was 1.5K:5.7K $1.46/7, 14:53 3.5K:4.7K $1.46/7, 15:12 15.6K:5.6K $1.46/7, 15:39 15.2K:5.4K $1.46/7. 15:54's ~16.4K $1.46/7 ended the period.

15:55-16:00 began low-volume $1.45/6 on 15:55's 22.8K $1.47->$1.46->$1,45->$1.46->$1.47->$1.45 and ended the period and day on 15:59's $1.45/6->$1.45 and 16:00's 400 sell for $1.45.

There were no AH trades.

Excluding the opening and closing trades (didn't qualify), there were 36 larger trades (>=5K) totaling 228,600, 21.97% of day's volume, with a $1.4469 VWAP. For the day's volume, both the count and percentage of day's volume were reasonable but we had only three "larger larger trades". Some larger orders may have been "chunked" to get them done. The VWAP being slightly below the day's $1.4503 is also a positive as this suggests the mix of folks coming in were not exclusively retail.

The larger trades volume argues for higher than normal numbers of inter/intra-broker trades on behalf of broker customers which generate fewer short sales. So I'm thinking short percentage should be lower than normal. We'll know when I get down to that portion of the post. If that's the case it may also explain the relatively small number of "larger larger trades" - few "behind the curtain" block trades by institutions.

The last thought on that is related to trading volume. With this kind of spike (243% up from yesterday) and well above the 10-day SMA it's likely some volume and price alert publications hit the net bringing in momo traders to augment whatever was brought in by the SA article. If so we can count on this rise being a short-term thing prior to some "reset" begins.

Note how well the VWAP held up - it was a really flat day at a higher price level - and how the buy percentage held up until the larger trades tapered off. This suggests the weakness in the buy percentage was an effect of the MMs becoming predominate again in the market.Ending Period Period Period __Per. Trade_ Period_ % Day_ Per. End

Period Volume Low High _Dollar Val._ VWAP___ Volume Buy ~%

09:47 17476 $1.3600 $1.4000 $23,898.82 $1.3675 1.68% 5.50% Incl 09:30 1.3600 7,200

09:50 169870 $1.3900 $1.4600 $242,595.43 $1.4281 16.33% 23.32% Incl 09:48 1.4000 4,733 1.4100 10,331 20,086

09:48 1.4390 5,000 1.4400 4,400

09:48 1.4490 5,000 1.4500 5,000 5,000

09:50 1.4330 5,000

10:38 140111 $1.4300 $1.4500 $202,481.68 $1.4452 13.47% 54.93% Incl 09:54 1.4410 5,000 10:38 1.4431 6,300

10:38 1.4500 5,000

10:56 261842 $1.4400 $1.4800 $383,389.46 $1.4642 25.17% 54.51% Incl 10:40 1.4700 4,100 10:44 1.4700 5,000

10:44 1.4750 5,000 1.4770 5,000

10:45 1.4645 4,000 1.4690 4,000

10:45 1.4730 5,000 5,000 1.4760 5,000

10:45 1.4799 5,000 10:46 1.4699 5,000

11:24 35419 $1.4400 $1.4500 $51,092.96 $1.4425 3.40% 50.90% Incl 11:13 1.4499 5,000

12:27 79282 $1.4400 $1.4600 $115,159.82 $1.4525 7.62% 48.50% Incl 11:51 1.4573 6,650 1.4500 6,700

13:10 35854 $1.4400 $1.4600 $51,914.84 $1.4480 3.45% 48.62% Incl 12:36 1.4499 7,000 12:42 1.4499 4,000

14:05 108546 $1.4450 $1.4600 $157,640.70 $1.4523 10.43% 45.26% Incl 13:12 1.4510 4,200 13:27 1.4600 8,300

13:28 1.4500 25,000

14:42 79618 $1.4500 $1.4750 $116,450.95 $1.4626 7.65% 45.46% Incl 14:21 1.4670 7,800

15:54 72645 $1.4580 $1.4700 $106,453.44 $1.4654 6.98% 46.49% Incl 15:04 1.4700 4,400 15:23 1.4700 4,500

15:54 1.4600 4,900

16:00 34884 $1.4500 $1.4700 $50,795.47 $1.4561 3.35% 46.23%

On the traditional TA front, movements were:

Good numbers all around. The only concern would be the volume - is it suggesting the end of the very short trend or just building momentum here? Assuming the traders that may be involved see the same thing on charts that I see, they should have a minimal near-term target around $1.53/4 to the upside and even $1.66-$1.70ish. Longer-term something approaching $2 seems possible, with the usual "waves" on the way there. If there's more left to pile in we've got more upside left. Both momo and trend traders ought to be finding a lot potential in this symbol ATM and f there's a substantial cadre of long-term investors not totally disillusioned they could easily soak up the sellers' volume at these levels. I say this because contrary to the usual "sell into strength" today looked much like "buy into strength".__Open_ ___Low_ __High_ _Close_ Volume_

Today 0.74% 1.49% 6.47% 5.07% 243.03%

Prior -2.17% 2.29% -2.11% 2.22% -43.65%

On my minimal chart yesterday I noted { ... and closed right on the rising potential resistance (rising green line) ... } and I then went on to "argue" with an important TA indicator - volume (hubris? Not today at least!

Today we closed above the resistance, confirming a break above that short-term rising resistance. It should now become support, slowing or limiting any down tendency.

I've added another potential medium-term descending resistance with the highs of 4/28, 5/24-5 and today (7/19) serving as the origin and touch points respectively. Two of the three touch points have volume over 1MM and suggest this could a strong resistance. If so, what I'm thinking is we push above it tomorrow and then fall back the following day to begin a short reset before challenging it again. Today it's $1.48 and it descends appx. $0.0048/day - call it 1/2 penny.

Of course, it may not act as I stated. A lot of that was based on lots of "unknowns", such as "is volume building or did it peak", "are there more trader/investors looking for entry than looking for exit", etc. I took a peek at Stockconsultant.com to see what they show.

That site has some agreement with me, somewhat unusual, in areas such as (some of the) support/resistance points, "mild bullish", etc. I won't comment other than to note the agreement with my recent spate of "mild bullish", embedded within consolidation, calls.

On my one-year chart, which had the 10, 20 and 50-day SMAs declining, now has all three rising, and in the "proper" order. If we just hold here the 10 and 20-day will begin an extended rise, and the 50-day will weaken for just a few days and resume rising.

The oscillators I watch, about which yesterday I noted { ... Going from all negative to mixed is suggestive of a turn but not yet conclusive. In aggregate I do think they suggest near-term upside } seem to confirm that prognostication by displaying large improvements in all, including accumulation/distribution, all on rising and relatively "high" volume.

The 13-period Bollinger limits, $1.3053 and $1.4316 ($1.3198 and $1.4063 yesterday), which were converging "but more slowly" yesterday, have begun diverging with a rising mid-point thanks to the more rapid rise of the upper limit. The majority of today's trading, as indicated by the day's VWAP (see below), was well above the approximate mid-point of $1.36xx.

All in, strongly bullish with reservations about the volume suggesting a possible end of trend. ATM I don't think so - I think we'll see it start to taper off first. xxx <<--- fingers crossed.

Percentages for daily short sales and buys moved in the same direction, suggesting "normalcy", and the short and buy percentages are both below my desired ranges (short % needs re-check). The short percentage, as mentioned above, is likely due to higher inter/intra-broker trades though and so being a bit low in not the concern it would be usually. Somewhat similarly, the buy percentage is less of a concern because the intra-day buy percentage was above 50% through 11:45, above 48% through 13:15 and remained above ~44.5% the rest of the day. With 71% of day's volume though 13:10 it's natural that the early day "buy into strength" should be offset as MMs and/or shorters seize control later in the day. As long as we have those days with early raise and long flattish periods with "strong" buy percentages followed by EOD percentages in the mid-to-high 4x% range I think we needn't worry too much. When we get these, or worse, EOD readings without that strong set up we should look for near-term weakness developing.

The spread is wide, of the good kind, produced by a relatively low open and a nice rise that produced a relatively stable high range (check the VWAPs in the intra-day breakdown above). Add in we are in an up tend and it's all good. Having said that, watch out if it moves to low double-digit ranges and/or the high intra-day VWAPs are not sustainable.

Regardless, buy percentages at EOD are preferable at 50%+.

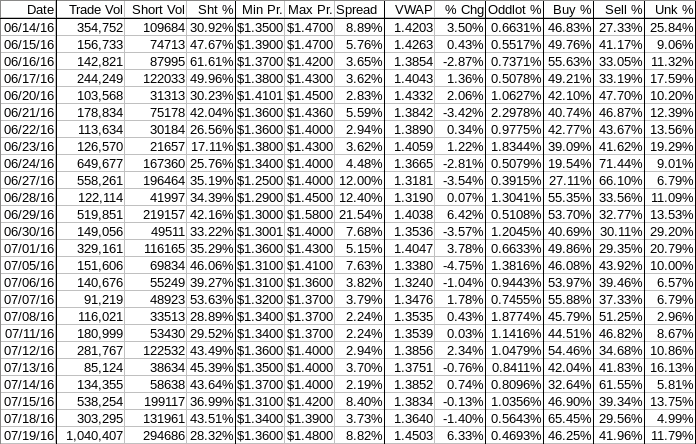

The VWAP's last twenty-four readings remain unchanged and positive at ten negatives and fourteen positives. Change since 06/14 is $0.0301, 2.12%. This is our first positive reading in ages. I expect it is not the last and we'll see positives for some short while at least. The average of the changes over the period is ~0.127% vs. prior readings (latest to oldest) of 0.0091% and -0.0047%. Two out of three positives is a start.

All in, strongly bullish here too, assuming my discounting of the low short and buy percentages are correct. That's always risky though.

As always, much is experimental and should be treated as such.

Bill

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.