Friday, July 01, 2016 10:22:36 PM

Here’s an article talking about the potential to pay off the US...

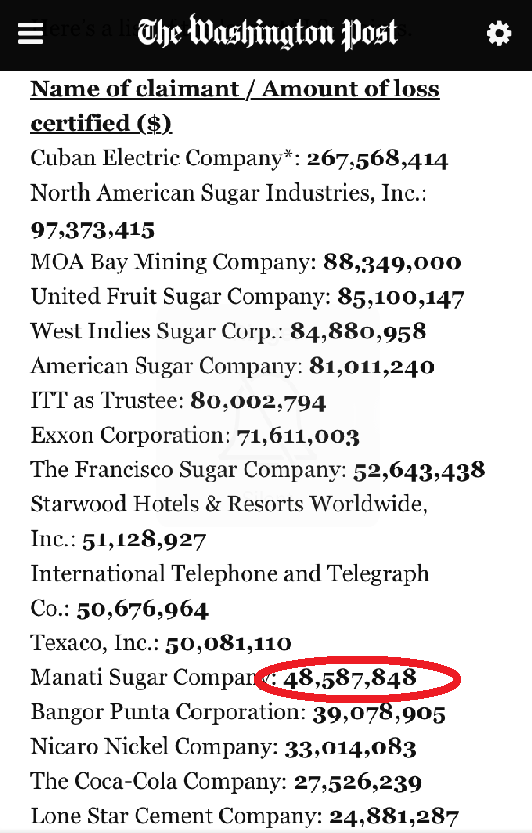

Only 15% of the total value is held by individual claimants, while 85% are held by corporate claimants. Given that the Top 20 claims — all of them corporate — make up two-thirds of the value of all certified U.S. claims, these large claims are the lynchpin for any successful approach to an eventual settlement. Of the top 20 claims ($1.25 billion in 1972), 42.5% ($530.6 million) were companies taken over by Cuba…

https://www.cubastandard.com/?p=14594

Sugar-related

Due to sugar’s prominent role in the Cuban economy, both before and during much of the revolutionary period, the biggest U.S.-owned properties seized during the Revolution included entities such as North American Sugar, United Fruit Sugar, West Indies Sugar, American Sugar, Francisco Sugar Company, Manati Sugar Company, and New Tuinucu Sugar Company.

While there doesn’t seem to be a hurry right now, the negotiations may be propelled forward by upcoming elections in the United States.”

“2016 is a pivotal year in U.S.-Cuban relations, because there is great uncertainty about what happens in November elections here in the United States,” said Brookings Institution Latin America expert Ted Piccone. “Some of the leading presidential candidates on the Republican side have made it very clear that they intend to pull back, reverse, do various things that would change Obama’s policy of opening up to Cuba. So that creates a certain sense of urgency to see how much progress can be made in this next, say, six to 10 months, to take advantage of that window of opportunity.”

“Keep in mind that some of these claims have probably not been continuously held by U.S. citizens or firms majority-owned by U.S. citizens and hence are no longer compensable according to FCSC rules. Furthermore, the Cuban government might challenge the procedures and valuations of some of the awards. The corporate claimants could be given the opportunity to be included in a lump-sum settlement—albeit possibly facing an equity hair-cut to limit the burden on Cuba and to ensure a minimum payment to the smaller claimants—or to “opt out” of the general settlement and instead seek alternative remedies. 64 As a precedent, the 1992 agreement with Germany allowed claimants to elect either to accept payment of their FCSC awards or to waive their right to payment in order to pursue claims for their properties under German law.”

Here’s the U.S. Justice Departments official claim authorized by the gov’t officials. This is the basis of the cost recovery for Manati Industries…

https://www.justice.gov/fcsc/cuba/documents/1501-3000/2525.pdf

Here’s the Helms-Burton Act that calls out the resolution of confiscated property before the Embargo can be lifted:

https://www.congress.gov/bill/104th-congress/house-bill/927/text

Questions about the Cuban Claims answered…

http://www.certifiedcubanclaims.org/faqs.htm

An article about the ways Cuba would reimburse the US Corps for what they owe…

http://www.brookings.edu/~/media/research/files/papers/2015/12/01-reconciling-us-property-claims-cuba-feinberg/reconciling-us-property-claims-in-cuba-feinberg.pdf

Page showing that people were paying $8.50 per share back in 1955…

https://books.google.com/books?id=BRV3PDh-A54C&pg=PA33&lpg=PA33&dq=manati+sugar+stock&source=bl&ots=wUKUZd4Cvu&sig=psdgiH79xbuwUNFLbuT_D_H_foM&hl=en&sa=X&ved=0ahUKEwjRuqXlsenMAhUS42MKHc1sDvM4ChDoAQg-MAk#v=onepage&q=manati%20sugar%20stock&f=false

An article showing why people are passionate about getting their full amount paid back… The U.S. Gov’t agrees!!!

http://www.latinamericanstudies.org/us-cuba/claims-hearings.htm

Another article showing proof that people were paying multiple dollars per share before the company was seized by Cuba…

https://www.justice.gov/fcsc/cuba/documents/1501-3000/1887.pdf

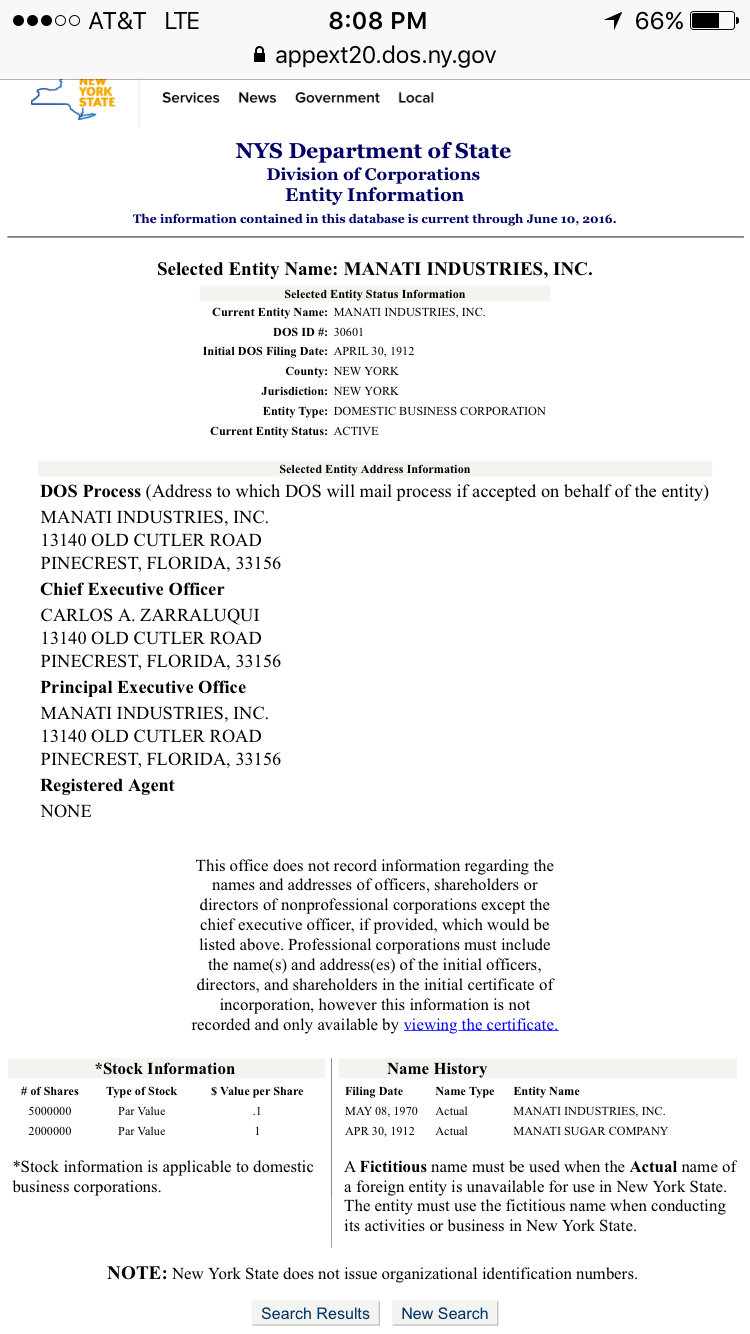

NY Business Search showing Manati still active and authorized shares are 5 million.

https://appext20.dos.ny.gov/corp_public/CORPSEARCH.ENTITY_INFORMATION?p_nameid=36183&p_corpid=30601&p_entity_name=manati&p_name_type=A&p_search_type=BEGINS&p_srch_results_page=0

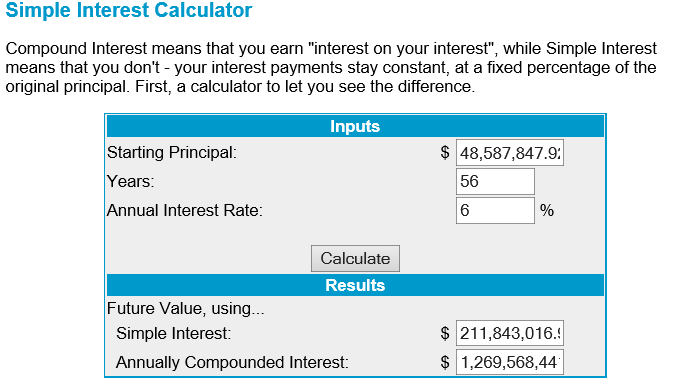

The current principal is the amount Cuba owes the US for Manati in 1960. Now add in the 6% annum per the U.S. gov’t for 56 years and you can see the final amount owed is almost $212 Million!!!

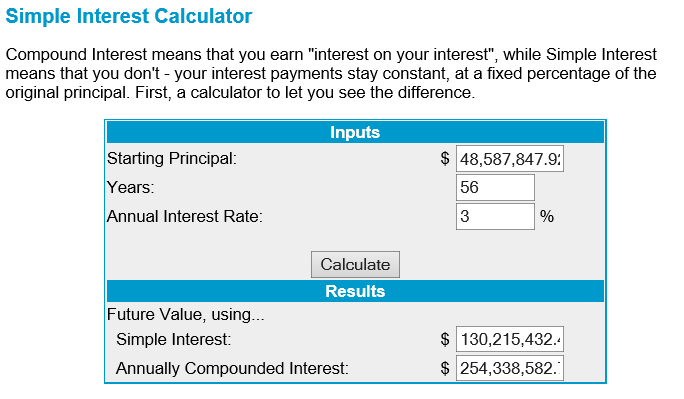

Now let’s assume they don’t settle for the full amount. In the past they settled with Vietnam for 80% of interest and 100% of principal. They also had some settlements with Germany for 50% of interest and 100% of principal. So let’s take the 50% of interest (so 3% instead of 6%) for 56 years and it comes to $130 MILLION.

The company has confirmed the OS to be 1,280,597 shares. If the shareholders see the full distribution of the payment, that would be $130,215,432/1,280,597 = $101.68/Share… so 10,000 shares now equates to $1,016,833.80. Now that’s assuming the 50% interest paid, and shareholders see the entire payment. Interest could be much higher or none at all. With no business the assumption is we would see most of it?!?!

So the best case scenario is $211,843,017 payout and 1,280,597 OS = $165.43/share!!! X 10,000 shares = $1,654,252.02 WOW!!!

Worst case scenario is $48,587,847 (principal only) divided by 1,280,597 shares = $37.94 per share. X 10,000 shares = $379,415.59!!!

So essentially a $1,000 investment now could net you $380k to $1.6M in a few years!!!

That’s assuming the shareholders get the majority of the money (tbd). Not sure who else would get it?????

"One of the funny things about the stock market is that every time one person buys, another sells, and both think they are astute." - William Feather.

FEATURED Glucotrack Announces Expansion of Its Continuous Glucose Monitoring Technology to Epidural Glucose Monitoring • Apr 17, 2024 8:00 AM

ILUS Provides Form 10-K Filing Update • ILUS • Apr 17, 2024 9:54 AM

Maybacks Global Entertainment To Fire Up 24 New Stations in Louisiana • AHRO • Apr 16, 2024 1:30 PM

Cannabix Technologies Begins Certification of Contactless Alcohol Breathalyzer, Re-Brands product series to Breath Logix • BLOZF • Apr 16, 2024 8:52 AM

Kona Gold Beverages, Inc. Acquires Surge Distribution LLC from Loud Beverage Group, Inc. (LBEV) • KGKG • Apr 16, 2024 8:30 AM

Branded Legacy, Inc. Reports Significant Net Income of Over $3.8 Million • BLEG • Apr 16, 2024 8:30 AM