Wednesday, June 29, 2016 10:38:50 AM

My most optimistic outlook is flattish at best and mild weakness the most likely. Both scenarios either get back into the prior consolidation range or start consolidation at a slightly lower level. IOW, no big moves in either direction are suggested by what I can see here.

The intra-day's pre-market spread combined with an essentially long flattish day supports my guess that we exited "Window dressing". There was nothing bullish about it though other than a good buy percentage. That's not enough to suggest any near-term big move up. Neither does it suggest a big move lower.

There were two pre-market trades totaling 430 shares, $1.31-$1.45.

09:30-10:02 opened the day with a 5,286 sell for $1.29 & 2.1K more for $1.33. Then came 9:31-:40's no-trades, 9:37's b/a of ~9K:7.6K $1.33/4, 9:41's 2K $1.3399 and b/a became ~9.1K:7.2K $1.33/4, 9:42's 100 $1.34, 9:43-:44's ~11.9K $1.3391->$1.33->$1.32 and b/a became 200:2K $1.31/3, 9:48's 5K $1.3299, 9:50's 100 $1.3180, 9:51's 825 $1.3185-$1.3118, 9:52's 100 $1.32 and b/a became 200:2.7K $1.31/2, 9:54's 2K $1.3163, 9:56's 200 $1.3150, and 10:01-:02's ~6.3K $1.31->$1.30->$1.3099->$1.31->$1.32 ended the period and b/a became 200:2.9K $1.31/2.

10:03-11:17, after a no-trades minute, began low/no-volume $1.30/$1.32 on 10:04's $1.32->$1.31->$1.30->$1.2901->$1.29->$1.32->$1.3199. Notable is that in spite of the long period of best bid $1.29 no $1.29 trades went after 10:04 until 10:39's 2.1K $1.2901/30. That resulted in only two trades in the $1.29xx range - 2K $1.29001 and 250 $1.2980 and b/a went ~4K:3.5K $1.29/31. 11:17's 200 $1.30/1 ended the period and b/a became 5.4K:4.8K $1.29/31

B/a at 10:06 became 3.8K:2.5K $1.30/2, 10:07 4.2K:2.5K $1.30/2, 10:17 3.9K:2.9K $1.30/2, 10:19 3.7K:2.9K $1.29/32, 10:19 2.3K:2.6K $1.29/31, 10:20 2.9K:2.6K $1.29/31, 10:24 3.1K:2.6K $1.29/31, 10:29 4.2K:2.3K $1.29/31, 10:41 4.6K:4K $1.29/31, 10:45 500:3.7K $1.30/1, 10:51 900:1.1K $1.30/1.

11:18-12:20, after seven no-trades minutes, began very low/no-volume $1.29/30 (mostly $1.29 & .29xx until 11:48) on 11:25's 200 $1.29. B/a at 11:21 was 4.1K:4.7K $1.29/30, 11:32 3.4K:3.2K $1.29/30, 11:47 3.7K:2.1K $1.29/30. Range moved to $1.29/31 on 11:53's 200 $1.29/31. B/a became 3.5K:2.3K $1.29/31 and 12:10 3.7K:3.1K $1.29/31. 12:20's 100 $1.29 ended the period.

12:21-13:40 began verylow/no-volume $1.30/1, while b/a was still $1.29/31, on 12:21's 200 $1.31. Range was interrupted by 13:31's 800 $1.31/2. B/a at 12:52 was 8.8K 2.5K $1.29/31, 12:59 1.6K:2.8K $1.30/1, 13:18 2.1K:4K $1.30/1, 13:32 8.3K:300 $1.30/1, 13:42 ~8.7K:300 $1.30/1. 13:40's 400 $1.31 ended the period.

13:41-15:09, after three no-trades minutes, began very low/no-volume $1.31/2 on 13:44's 200 $1.32. Range was interrupted by 14:22's 6.6K $1.30 (600)->$1.32, 14:56's 1K $1.32, and 14:57-:58's 900 $1.33->$1.34->$1.33. B/a at 13:48 was 8.9K:4.4K $1.30/2, 14:03 10.4K:3.5K $1.30/2, 14:30 100:2.2K $1.31/2, 14:44 4.9K:3.1K $1.31/2, 15:01 5.9K:800 $1.31/2. 15:09's 150 $1.31 ended the period.

15:10-16:00, after five no-trades minutes, did a move up on 15:15-:17's ~14.1K $1.32->$1.33->$1.34->$1.35->$1.36 to begin EOD volatility doing medium/low-volume $1.34/6 through 15:26, $1.33/4 15:27-:38, $1.34/5 15:39 through 15:59. B/a 15:20 was 700:3.3K $1.35/6, 15:36 2.5K:1.9K $1.32/4, 15:43 4.5K:4.7K $1.32/5, and 15:46 2.8K:1K $1.32/4. 16:00's 299 buy for $1.35 closed the period and day.

There were four AH trades: three at 16:03 totaling 1.6K for $1.35 each; one 17:39 500 buy for $1.36.

Including the opening trade (closing didn't qualify), there were 4 larger trades (>=5K) totaling 23,876, 19.55% of day's volume, with a $1.3174 VWAP. Excluding the opening trade, there were 3 larger trades totaling 18,590, 15.22% of day's volume, with a $1.3253 VWAP.

Buy percentage held up much better than recently. Combined with the reduced volume and slightly improved VWAP, I think this indicates "Window Dressing" was in play and has indeed finished.Ending Period Period Period __Per. Trade_ Period_ % Day_ Per. End

Period Volume Low High _Dollar Val._ VWAP___ Volume Buy ~%

10:02 36331 $1.2900 $1.4500 $48,022.37 $1.3218 29.75% 66.43% Incl 09:30 $1.2900 5,286 09:43 $1.3391 7,890

09:48 $1.3299 5,000

11:17 28004 $1.2900 $1.3200 $36,472.25 $1.3024 22.93% 48.73%

12:20 7140 $1.2900 $1.3100 $9,266.45 $1.2978 5.85% 48.08%

13:40 5609 $1.3000 $1.3200 $7,342.04 $1.3090 4.59% 49.33%

15:09 14459 $1.3000 $1.3400 $18,958.37 $1.3112 11.84% 49.74% Incl 14:22 $1.3020 5,700

16:00 26899 $1.3200 $1.3600 $36,097.07 $1.3419 22.03% 55.46%

17:39 2100 $1.3500 $1.3600 $2,840.00 $1.3524 1.72% 56.23%

On the traditional TA front, movements were:

On my minimal chart the important thing was we closed above the $1.34 resistance, so the break down is not confirmed. Combined with the volume and intra-day behavior I suspect "Window Dressing" was done and this seems to confirm that.__Open_ ___Low_ __High_ _Close_ Volume_

Today -6.52% 3.20% -2.86% 8.00% -78.13%

Prior 0.00% -6.72% 0.00% -10.71% -14.07%

We don't have a lot of room before we hit the short-term descending resistance (upper descending green line), ~$1.38 crossing the medium-term rising resistance. This situation argues for another break of some kind, likely up or sideways out of the triangle formed by those two lines if my "Window Dressing" guess is correct.

On my one-year chart it's looking like we may try to go back into consolidation as spread narrowed and we had a higher open and low, lower high, and higher close - above both yesterday's close and today's open. This thought is supported by the substantially reduced volume. The 10, 20 and 50-day SMAs continue falling and if we hold this range will continue so.

The oscillators I watch, which were all down with RSI and Williams %R in oversold and full stochastic nearly so, had RSI, accumulation/distribution, momentum, and Williams %R, improved markedly today with lesser improvement in full stochastic and ADX-related. Only MFI (untrusted by me) deteriorated. Williams %R exited oversold.

Combined with my "exiting Window Dressing" thoughts I think the change in the oscillators suggests less short-term weakness (like for a day or two).

The 13-period Bollinger limits, $1.2932 and $1.4822 ($1.2904 and $1.5081 yesterday) continue converging with the upper limit falling and the lower limit rising slightly. Mid-point is still migrating lower. A notable point is that yesterday we penetrated the lower limit, including closing below it, and today our low "pushed" it. Normally I'd worry we would do our usual and push it for several days, taking it lower, but if "Window Dressing" is really over I can see us not pushing it much longer.

All in, no real suggestions of near-term weakness and a couple hints from the oscillators leave me ... neutral for now with some bullishness lurking in the back of my mind. The trouble is it is just too soon after leaving "Window Dressing" to buy into the hints of bullishness.

Percentages for daily short sales and buys moved in opposite directions but the short percentage movement was so small I'll call it flat. Considering at the bottom of my desired range and combining with a nice move of the buy percentage into a range that if it was the trend would give sustainable appreciation, I think the combination of these two are "good" today. I don't expect buy percentage to hold here yet - need some catalyst for that to be possible I think. So some weakness, likely in the form of re-entering consolidation, seems like just looking at these two.

The spread was again quite large and was produced exclusively in the pre-market. The normal trading day was much less dramatic after the open, being essentially flattish all day. Since we haven't definitively exited the down leg yet I think today's wide spread combined with intra-day flatness is not suggesting strength. I'd look for some near-term flat or weakness based on this one.

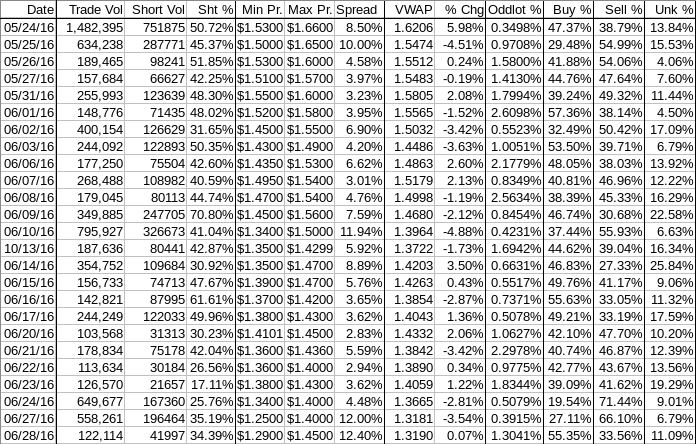

VWAP has the last twenty-four readings still with thirteen negatives and eleven positives, remaining in the longer-term trend. Change since 05/24 is -$0.3015, -18.61%.

All in, the improvement of 0.07% in VWAP was insufficient to allow any real bullishness to creep in here regardless of exiting "Window Dressing". Best guess is flat at best and more likely mild short-term weakness.

As always, much is experimental and should be treated as such.

Bill

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.