Monday, April 25, 2016 5:38:50 PM

I'm bearish near-term. I'm thinking $1.67/$1.70 will be challenged soon.

Today, after a push up to $1.92 by 10:09, was predominantly down to $1.83 through to around 12:30, a recovery up to ~$1.85 that rolled over to hit $1.82 at 14:30 and went sideways between there and $1.86, with a one-minute $1,88 at 15:34 and ended the day at $1.85.

There were four pre-market trades totaling 2K at $1.90.

09:30-10:03 opened the day with 9,873 for $1.86 and traded as high as $1.88 on another 2K shares. Then 9:31-:34's ~12K took price down to $1.83, recovering to $1.87, 9:35-:36's ~7.3K recovered to $1.88/90, 9:37-10:03's trading was mostly medium, some high, volume $1.89/90 to end the period.

10:04-10:05 did ~143K $1.90->$1.88->$1.90->$1.89->$1.89->$1.93->$1.90. These two minutes were ~15% of the whole day's volume and ~50% of all volume through 10:05.

10:06-11:07 began a drop with 10:06-:13's low/medium-volume $1.91/3, hit 10:32's ~8.3K $1.89/91, 10:43's ~8.3K $1.88/9, and recovered on 10:48-:49's 11.5K to $1.89/90 to get low-volume there ending the period on 11:07's 1.1K $1.89/90.

11:08-11:15, after a no-trade minute, did quick step lower with 11:09-:15's ~133.3K to end the period on 100 $1.87.

11:16:-11:51 did mostly low/medium-volume, with one 11:26 12.6K interruption, $1.87/8 and ended the period on 11:51's 400 $1.87.

11:52-12:55 began a longer step lower, doing 11:52's ~32.26 $1.87->$1.88->$1.84, stepped up on low/no-volume to 12:02's 300 $1.86, stepped down again starting with 12:03's ~10.5K $1.87-$1.85, did low/no-volume down hitting 12:10's ~5.1K $1.84 and 12:31's ~1.2K $1.83. Then low-volume $1.83/4 had 12:55's~1.8K $1.84 end the period.

12:56-14:26 began a low/medium-volume sideways $1.84/6 after 12:56's ~11.7K $1.84->$1.88->$1.85. Volume was interrupted by 13:22's ~16.5K $1.85/6. 14:26's 600 $1.84 ended the period.

14:27-14:43 did a step down on 14:27-:30's ~22.7K to $1.82/3, went no/low-volume $1.83/4 through 14:41, and then did 14:42-:43's ~20.3K $1.84->$1.86 to end the period.

14:44-15:45, after a no-trade minute, did a low/no-volume $1.85/6 sideways, interrupted by 15:34's 1.1K $1.86/8, and 15:45 850 $1.85/6 ended the period.

15:46-16:00 started the EOD volatility with 15:46-:47's ~5.2K $1.85-$1.87, 15:48-:49:'s ~17K $1.87->$1.82, 15:50-:54's ~17.3K $$1.82->$1.85, and 15:55-59's ~21.2K $1.84/5 first minute and $1.83/4 until 16:00's closing 3,537 buy for $1.85.

There was one AH trade of 5K for $1.85.

Including the opening and trade (closing didn't qualify), there were 36 larger trades (>=5K & 6 4K+) totaling 266,815, 27.44% of day's volume, with a $1.8840 VWAP. Excluding the opening trade, there were 35 larger trades totaling 261,415, 26.88% of day's volume, with a $1.8849 VWAP.

Notice that although the number of larger trades is still "large", the percentage od day's volume is pretty much normal.

On the traditional TA front, movements were:Ending Period Period Period Per. Trade_ Period_ % Day_ Per. End

Period Volume Low High Dollar Val. VWAP___ Volume Buy ~%

10:03 143758 $1.8301 $1.9000 $271,655.73 $1.8897 14.78% 49.01% Incl 09:30 $1.8600 9,873 09:44 $1.8901 7,500

09:45 $1.8901 8,400 $1.9000 4,600

09:48 $1.8909 5,500 09:53 $1.8901 4,000

09:58 $1.9000 4,756 4,400

10:05 142973 $1.8800 $1.9300 $273,242.73 $1.9111 14.70% 57.61% Incl 10:04 $1.8800 6,900 $1.8899 7,000

10:05 $1.9300 28,902

11:07 144859 $1.8800 $1.9198 $275,043.71 $1.8987 14.90% 44.97% Incl 10:13 $1.9000 5,824 10:33 $1.9050 5,000

10:33 $1.9050 5,000 10:43 $1.8800 4,450

11:15 133227 $1.8700 $1.9000 $252,073.31 $1.8921 13.70% 38.32% Incl 11:10 $1.8950 10,200 6,800 6,400 13,500

10,000 12,600 7,800 5,000

11:10 $1.8950 8,900 11:14 $1.8710 5,000

11:51 36281 $1.8700 $1.8800 $68,058.11 $1.8759 3.73% 39.11%

12:55 87100 $1.8300 $1.8750 $160,811.48 $1.8463 8.96% 37.49% Incl 11:52 $1.8500 4,000 $1.8400 5,400

14:26 76123 $1.8350 $1.8800 $140,964.67 $1.8518 7.83% 38.03%

14:43 54610 $1.8200 $1.8600 $100,140.20 $1.8337 5.62% 38.47% Incl 14:30 $1.8200 10,100 14:31 $1.8399 5,000

14:42 $1.8400 6,875 $1.8500 7,235

15:45 74288 $1.8500 $1.8800 $137,968.46 $1.8572 7.64% 41.12% Incl 15:08 $1.8600 5,400 15:13 $1.8600 9,500

15:32 $1.8536 5,000 15:38 $1.8558 5,000

16:00 64333 $1.8200 $1.8699 $118,382.97 $1.8402 6.62% 41.36%

16:19 5000 $1.8500 $1.8500 $9,250.00 $1.8500 0.51% 41.14% Incl 16:19 $1.8500 5,000

On my minimal chart we see just a normal one day pause (brief consolidation) as most of those wanting to make a move did so on yesterday's wide range and high volume. we could take som optimism from the reduced volume but that doesn't count today because yesterday was excessive and today's is still "hogh", being above the 10-day average of 4/15, before the two days of really big volume, which had an average of ~683K (and that includes two larger days before that). So today's ~972K is still "large".__Open_ ___Low_ __High_ _Close_ Volume_

Today -7.00% 2.82% -12.27% -2.63% -83.66%

Prior 1.01% -7.81% -13.33% -24.30% 80.57%

Considering the intra-day behavior (see above), to me this suggests more downside near-term. considering the new shares and warrants, and believing I know what the financiers will do, I think we are going to resume down and challenge the $1.67/$1.70 support (orange line).

On my one-year chart the 10, 20, and 50-day SMAs are still rising but note that our low is just about on the 10-day $1.8110. I expect we'll violate that but it will take some time for the average to respond as we're still dropping much lower values off the tail. The 20 and 50-day will take even longer. All this supposes not much movement in the range. If the $1.67/70 area holds, we're good for a while. If not it really depends on how fast and far we sink.

The oscillators I watch all weakened today. Williams %R and full stochastic are now below neutral.

The 13-period Bollinger limits, $1.0283 and $2.4024 ($0.9939 and $2.3799 yesterday) are still moving up, dragging the mid-point upwards. The rate of rise looks to be declining though.

All in nothing positive and the volume hasn't reached a level that I think offers hope we are bottoming.

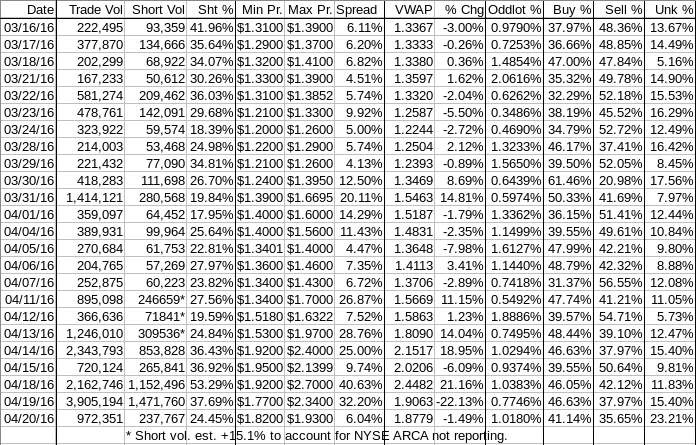

Percentages for daily short sales and buys moved in the same direction and both had moves that were significant enough to be of value. So today we have some normalcy, maybe a result of the "pause" in the price movement with range just below yesterday's close. We didn't tank big-time.

Short percentage is well below it's needed "normal" value (needs re-check, and buy percentage, as is it's long-term habit, remains well below what's needed for sustained appreciation.

The spread narrowed but is still a bit wide, and being the result of the intra-day behavior described above, I think it adds to the likelihood that we've got more near-term downside coming.

VWAP movement wasn't that big, thanks to the early-day strength. Knowing what happened the rest of the day I think it might s well have been much larger - I think it's telling us some more downside is in our near-term future.

All in, nothing positive other than short and buy percentages moving together and reduced volume, although as mentioned above it's not a big positive IMO.

As always, much is experimental and should be treated as such.

Bill

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.