| Followers | 9 |

| Posts | 729 |

| Boards Moderated | 0 |

| Alias Born | 05/06/2014 |

Thursday, April 21, 2016 11:45:19 AM

Letter to Shareholders issued: https://www.sec.gov/Archives/edgar/data/1310527/000154812316000537/exhibit992.htm

Their mission has evolved:

Our prime target market for development of our Resource Ecosystems is comprised of small-scale Waste Water Treatment Plants (“WWTPs”). This also includes farms and commercial operations that utilize Anaerobic Digestion – a proven process that reduces bio-solid volume, treats pathogens, and produces methane as a by-product. We are seeking to become a leading supplier of total waste management solutions for these customers by deploying our proprietary methane-fueled power systems combined with conversion processes and distribution channels to be secured by Q2Power for products produced from bio-solids.

The engine technology (previously the core of the company) is being downplayed. For instance, they have

Deployed our first operating pilot system at a local WWTP (a beta unit designed to prove operating concept, and test and improve individual components of our system, i.e., this was not meant to be a revenue-producing or long-running project);

I.e., it doesn't run long or well enough to generate electricity worth any money.

Over they next year they claim they will:

Achieve critical operating and performance benchmarks for our base engine technology to allow us to enter a more efficient manufacturing stage – we are focused on increasing operating times between maintenance, and have an engineering roadmap to accomplish this goal;

They have also filed a presentation with the SEC: https://www.sec.gov/Archives/edgar/data/1310527/000154812316000537/exhibit991.htm Their projected 44% gross operating profit is primarily derived from processing bio-solids (a polite name for the lumpy bits in sewage). Revenue from electricity sales is just $18K of the predicted $683K annual revenue per system. That's just 2.6% of revenue from all the hassle of trying to make this engine work.

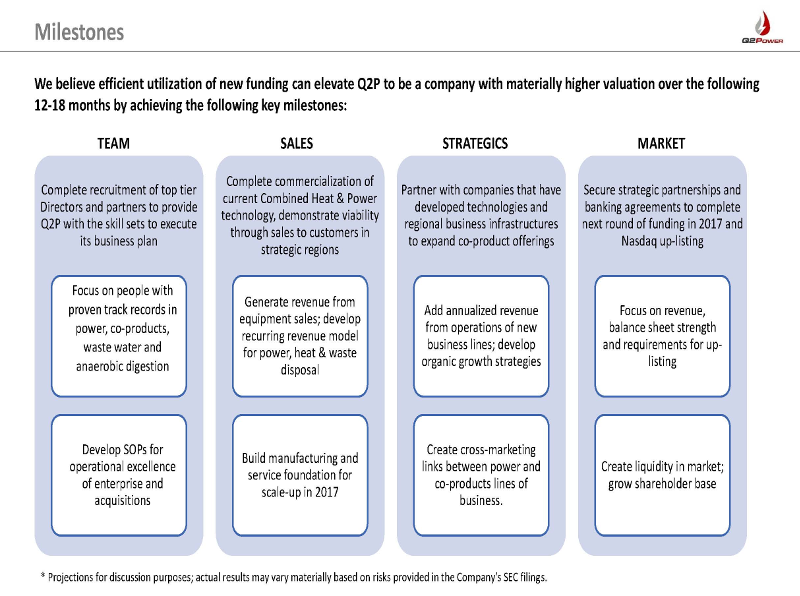

Their stated "Milestones" are:

]

] Notice that making their technology actually work is only mentioned in passing as "complete commercialization" of the technology.

The business model is now to "partner" with other companies to provide equipment for the sewage treatment plants, to transport sewage sludge, compost the sludge then market it to municipalities. While all those partner companies are busy doing all the work, Q2Power will collect the 44% gross operating profit. And none of the companies doing the actual work will think of cutting out the middleman (i.e., Q2Power) and keeping the profits for themselves.

Sure. Why not?

So back to the Q2Power value proposition.

1) Their only IP is for the steam engine they have never made work.

2) That engine would only contribute a tiny portion of their projected revenue stream (i.e., 2.6% from electricity sales).

3) They would be responsible for many years of warranty claims if they sell engines.

4) The other benefit from their system is the potential to sell heat from burning methane produced by sewage plants.

5) That heat could be obtained much less expensively by simply burning the methane in conventional furnaces or boilers.

6) Their focus is turning to becoming a "bio-solids processor", but they have no technology, facilities or expertise in that field.

7) Their current manufacturing partner, Precision CNC, machines small, accurate metal parts which find little application in composting bio-solids.

8) Their strategy is to find partners with the technology, facilities and expertise who are too dumb to sell it themselves.

9) They have no proprietary rights in the bio-solids field.

A year ago Q2Power was planning to go into the industrial waste heat to power market. That's completely gone now. They also no longer mention the waste oil furnace market that had figured so prominently before.

Looks like the Little Engine That Couldn't is fading off into the sunset.

Recent QSAM News

- Form SC 13D/A - General statement of acquisition of beneficial ownership: [Amend] • Edgar (US Regulatory) • 02/20/2024 10:19:46 PM

- Form 5 - Annual statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/20/2024 09:51:43 PM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 02/20/2024 11:09:38 AM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 02/16/2024 02:51:13 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/13/2024 09:00:23 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 02/08/2024 02:56:06 AM

- Form 8-K - Current report • Edgar (US Regulatory) • 01/16/2024 10:08:01 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 11/13/2023 01:43:09 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 09/29/2023 08:51:16 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 08/16/2023 08:00:24 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 08/14/2023 08:30:59 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 06/29/2023 10:14:22 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM

Avant Technologies Launches Advanced AI Supercomputing Network and Expansive Data Solutions • AVAI • Apr 23, 2024 8:00 AM

BestGrowthStocks.com Issues Comprehensive Analysis of Triller Merger with AGBA Group Holding Limited • AGBA • Apr 22, 2024 1:00 PM

Cannabix Technologies to Present Marijuana Breathalyzer Technology at International Association for Chemical Testing (IACT) Conference in California • BLO • Apr 22, 2024 8:49 AM

Kona Gold Beverages, Inc. Prepares for First Production Run Set to Launch May 17, 2024 • KGKG • Apr 22, 2024 8:30 AM