| Followers | 80 |

| Posts | 8266 |

| Boards Moderated | 0 |

| Alias Born | 04/20/2014 |

Monday, March 14, 2016 9:36:48 AM

Click chart to enlarge.

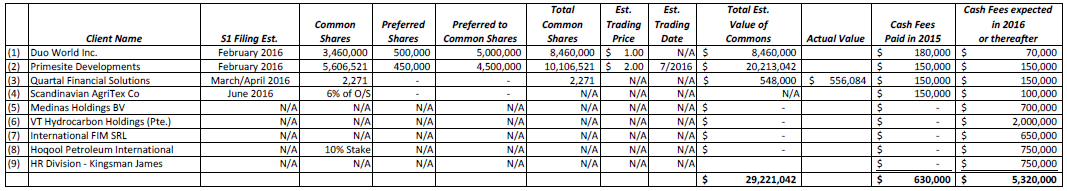

(1) Duo World Inc.

Our client is currently finalizing its 2014 and 2015 PCAOB audit. Once the audit report is issued, we intend to

file an S1 Registration statement with the SEC. We estimate that our client will file the S1 in February of

2016. We currently own 3,460,000 common shares and a further 500,000 preferred shares (equivalent to 5

million common shares) of Duo World Inc. We expect Duo´s initial trading price to be north of $1 per share.

This client paid us $180,000 in cash fees in 2015 and will pay us a further $70,000 in 2016.

(2)Primesite Developments Inc.

Our client is currently finalizing its 2014 and 2015 PCAOB audit. Once the audit report is issued, we intend to

file an S1 Registration statement with the SEC. We estimate that our client will file the S1 in also in February

of 2016. We currently own 5,606,521 common shares and a further 450,000 preferred shares (equivalent to

4.5 million common shares) of Primesite Developments Inc. We expect Primesite´s initial trading price to be

in the region of $2 per share. This company should start trading on the OTCQB in July of 2016 and has a very

good possibility, in our opinion, of up-listing to the NYSE Markets (previous AMEX) by December 2016 or

early 2017. This client has already paid us $150,000 in cash fees in 2015 and will pay us a further $150,000 in

2016.

(3) Quartal Financial Solutions AG - Completed See 8k dated 3-14-16

We are current in the process of restructuring this company. Their PCAOB audit for the years ended 2014 and

2015 will commence on or before January 15, 2016 and we expect said audit to be finalized early March of

2016. Once the audit reports are issued, we intend to file an S1 Registration statement with the SEC. We

estimate that our client will file the S1 late March or early April of 2016. We currently own 2,271 common

shares Quartal Financial Solutions AG value at $548,000 or $241 per share. This client has already paid us

$150,000 in cash fees in 2015 and will pay us a further $150,000 during 2016.

Source: http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=11254808

(4) Scandinavian AgriTex Co. Limited

We are current in the process of also restructuring this company. We believe that by June of 2016 our client

will have filed an S1 Registration statement with the SEC. We currently own 6% of the company´s issued and

outstanding common shares. This client has already paid us $150,000 in cash fees so far and will pay us a

further $100,000 in 2016.

(5) Medinas Holdings BV

Our client is currently in negotiations with a Middle Eastern group to invest up to $23,000,000. At this

moment, it is hard for us to determine when this funding will close. Once closed, our agreed cash commission,

on the basis that the full amount is invested, will amount to approximately $700,000. We have also agreed on

a percentage of common shares on the basis that we secure their funding.

(6) VT Hydrocarbon Holdings (Pte.)

We have already sourced a debt funder from the Middle East for our client that is willing to lend $90,000,000.

We have also sourced two equity investors in the same region looking to invest up to $48,000,000. We expect

the funding to close in February or March 2016. Our contractually agreed cash commission will be in excess

of $2,000,000

(7) International FIM SRL

We have sourced a US funder for our client and we expect the funding to close in late January or early

February 2016. Our agreed cash commission will amount to approximately $650,000.

(8) Hoqool Petroleum International

Our client requires a $50,000,000 investment. We are currently talking to various groups in the Middle East

with a road show planned in February (2016). We have agreed with our client a 1.5% cash commission and a

10% equity stake in the Company.

(9) HR Division - Kingsman James

Our human resources division, “Kingsman James” has been hard at work since we started this division of our business in August 2015. Kingsman James has gone from strength to strength, building relationships in key markets and across new industries, attracting a wide and varied quality client base ahead of time. Kingsman James is currently working on mandates amounting more than $750,000 of placement fees, with the first $114,000 expected to be invoiced in the coming weeks (Feb 2016) which will make this division of our company revenue positive and profitable within the first quarter of 2016. (http://ih.advfn.com/p.php?pid=nmona&article=70234635&symbol=GEQU)

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM

Avant Technologies Launches Advanced AI Supercomputing Network and Expansive Data Solutions • AVAI • Apr 23, 2024 8:00 AM

BestGrowthStocks.com Issues Comprehensive Analysis of Triller Merger with AGBA Group Holding Limited • AGBA • Apr 22, 2024 1:00 PM

Cannabix Technologies to Present Marijuana Breathalyzer Technology at International Association for Chemical Testing (IACT) Conference in California • BLO • Apr 22, 2024 8:49 AM