Friday, February 05, 2016 8:49:59 AM

A 100-share AH $1.58 trade makes my TFH quiver. Open high suggested. Followed by down?

There were twelve pre-market trades, $1.40-$1.43, totaling 4,775 shares.

The day opened with a 4,415 share sell for $1.41 and traded as high as $1.47 that minute and, in a nice change of behavior, did a two-minute ~8.8K rise to $1.45/9 and, after one minute of no trades, began a low-rising-to-medium-volume $1.45/9, but for ~11.2K $1.42/8 at 9:40 and 300 shares $1.42/6 at 9:44, and ended the period at 9:48 for $1.46. 09:49-09:56 began a medium-volume climb with 3.1K $1.46/7, hitting $1.50 at 9:53 and ended the period on medium volume at $1.50. 09:57-10:22, after three minutes of no trades, began another climb on high volume, doing ~23.1K $1.50/2 at 10:00, dropping to $1.48/9 at 10:02 on medium volume, began climbing again at 10:03 and did a six-minute ~62.7K rise to $1.57 by 10:08, hit $1.59 at 10:16, and hit $1.69 on ~30.2K to end the period. 10:23-11:09 began a variable, but mostly medium and high volume, move down, hitting $1.52/7 on ~20.6K and then began a medium/high-volume step back up, hitting $1.61 on 11.5K at 10:51. Then medium-volume sideways $1.57/61 led to a low-volume, beginning at 10:56, series of steps down that began at 11:03, hitting $1.52 to end the period. 11:10-11:51 began a low-volume $1.54/6 that started moving to $1.51/5 at 11:18, and settled in there on mostly low volume to end at $1.55. 11:52-13:07 began with a two-minute ~1.9K pop to $1.57 and fell back to no/low-volume flat $1.55 through 12:04. Then began a long series of flat, up, flat, up, ... when range moved to $1.55/6, still low/no-volume, and $1.56/7 at 12:13, $1.56/9 at 12:36, and $1.59/61 at 12:48. The period ended at $1.57/9. 13:08-14:11 did 1.1K $1.58->$1.55 and began low/no-volume $1.56/8 until 23.9K $1.56/9 at 13:28 moved range to a low/no-volume $1.57/9, and the period ended at $1.58. 14:12-15:15 began a five-minute rise on ~17.2K (15.9 at 14:16) to $1.61 with a low of $1.55 that minute) and initially did low/no-volume $1.59/60. At 14:27 range went flat $1.59, 14:38 flat $1.60, but for $1.61 at 14:48 that started a $1.60 flat period that turned into $1.59/61 at 15:00. The period ended at $1.59/60. 15:16-15:34 began with ~2.8K $1.59->$1.56 followed by low/medium-volume $1.56/9 moving quickly to $1.57/8 and ended at $1.57. 15:35-15:45 began with a four-minute ~45.3K move to $1.59/60 and did another two-minutes of ~11K in that range, followed by high-volume trading in that range and ended at $1.60. 15:46-16:00 began the normal EOD high-volume volatility with a three-minute ~17.1K drop to $1.55 and traded up to $1.57/60 by 15:53 and traded $1.57/9 into the close on an 899 share buy for $1.58.

There was one AH trade of 100 shares for $1.58.

Excluding the opening trade, there were 25 larger trades (>= 5K & 6 4K+) totaling 194,098, 22.09% of day's volume, with a $1.5721 VWAP.

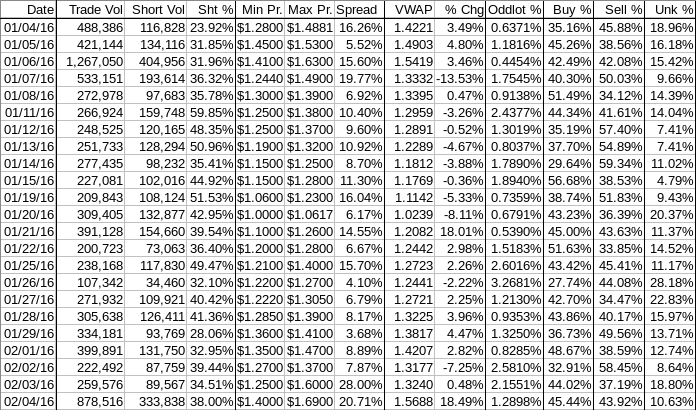

On the traditional TA front, movements were:Ending Period Period Period Per. Trade_ Period_ % Day_ Per. End

Period Volume Low High Dollar Val. VWAP___ Volume Buy ~%

09:07 4700 $1.4000 $1.4300 $6,591.50 $1.4024 0.53% 0.00%

09:48 49819 $1.4100 $1.4900 $72,536.76 $1.4560 5.67% 35.25% Incl 09:36 $1.4900 4,746

09:56 25049 $1.4564 $1.5000 $37,272.47 $1.4880 2.85% 35.69%

10:22 182408 $1.4800 $1.6900 $286,669.08 $1.5716 20.76% 50.13% Incl 10:00 $1.5000 13,100 10:07 $1.5556 8,000

10:08 $1.5700 12,200 12,300 10:20 $1.6000 5,000

10:22 $1.6500 5,000 $1.6400 8,700

11:09 205048 $1.5200 $1.6800 $327,551.00 $1.5974 23.34% 42.80% Incl 10:29 $1.6500 9,280 10:35 $1.6290 5,000

10:40 $1.5200 7,200 10:43 $1.5701 4,700

10:45 $1.5700 4,300 $1.5701 4,300

10:51 $1.5902 6,500

11:51 65537 $1.5100 $1.5600 $101,168.84 $1.5437 7.46% 45.05% Incl 11:29 $1.5499 10,000 11:46 $1.5413 5,000

13:07 72700 $1.5489 $1.6100 $114,046.82 $1.5687 8.28% 45.13% Incl 12:30 $1.5603 5,000 12:31 4,800

12:31 $1.5501 4,600

14:11 48068 $1.5500 $1.5900 $75,621.15 $1.5732 5.47% 44.22% Incl 13:28 $1.5700 20,000

15:15 58681 $1.5500 $1.6100 $93,100.50 $1.5866 6.68% 44.15% Incl 14:16 $1.5500 10,550 14:26 $1.5899 6,000

15:34 16622 $1.5600 $1.5900 $26,212.08 $1.5770 1.89% 44.40%

15:45 81229 $1.5800 $1.6000 $129,511.04 $1.5944 9.25% 45.66% Incl 15:38 $1.6000 11,037 15:43 $1.5900 6,785

16:00 57368 $1.5500 $1.6000 $90,263.76 $1.5734 6.53% 45.50%

18:52 100 $1.5800 $1.5800 $158.00 $1.5800 0.01% 45.50%

A very nice follow-through to the quarterly report! Another two days are needed to see how it settles out I think.__Open_ ___Low_ __High_ _Close_ Volume_

Today 6.82% 12.00% 28.03% 23.44% 238.44%

Prior -2.22% -1.57% -3.65% 0.00% 16.67%

On my minimal chart we confirmed yesterday's break above those resistance lines (bottom-most blue and orange lines) by trading completely at and above them. Intra-day we penetrated the second from the bottom blue line and top orange line, which would be the resistance lines now, and came back to above the blue line, making a confirmation needed tomorrow to confirm that break out, and closed right on the top orange line, meaning no break out from that short-term channel yet.

But as mentioned yesterday, a few days are needed for stabilization to appear and we can start looking for a new trend. My experience has been most catalysts cause a two or three day pop or fall before a new reliable trend starts to appear. I guess this is an effect of day traders and momo traders and long-term investors all making various moves at the same time. I suspect that after two or three days the momo and many day traders are back to normal behavior, permitting assessment of a trend to begin.

Regardless, the huge volume pop suggests we have some more upside available. But there are some possible counters to that assessment. See below.

On my one-year chart chart the 10-day SMA continues to rise and now the 20-day is beginning to rise as well. They are at $1.3280 and $1.2670 respectively ($1.2870 and $1.2610 yesterday). The 50-day SMA is still falling, as one would expect, and being at $1.3686 ($1.3780 yesterday) with lots of higher prices yet to fall off the tail (up in the $1.8x area) we can expect it to take a couple weeks to flip up unless we continue to make a strong push higher. Given my view about a few days of aberrant behavior I suspect some pull-back to appear no later than a couple days from now. That would be the time to start considering a new trend.

The oscillators I watch all improved and Williams %R and MFI (untrusted by me) are overbought. RSI is very near there. Everything but full stochastic is above neutral and it should get there tomorrow sans some big price drop. I don't expect that yet.

The 13-period Bollinger limits, $1.0095 and $1.5412 ($1.0418 and $1.4475 yesterday), now have an increasing rate of divergence, with the upper limit rising much faster than the lower limit. We are trading well above the mid-point and it will be interesting to see if the old behavior re-appears, mid-point moving towards price for the most part (a good thing when rising!) or behavior becomes more normal with price moving toward mid-point for the most part. I have no guess for a few more days for sure.

All in, everything's coming up roses for now. Just keep in mind this is still in the period following a fairly positive catalyst, the quarterly report, in which behavior is very short-term driven and reliable assessment of trends is not possible IMO.

Percentages for daily short sales and buys moved in the same direction and short percentage is within the low end of my preferred range (needs re-check). I think much of this is due to lots of intra-broker trades, which would not generate many short sale flags. Normally the VWAP movement we saw would make me expect a higher level of short sales as profit-taking occurred and shorters took advantage as fundamentals still have a way to go. I also note that MMs may have been short-term long as there were lots of attractive covering opportunities yesterday, as well as the day prior that. This may have helped hold the short percentage down.

I can't make a confident guess as to if this combination is suggesting anything up or down.

The spread is still very wide, but being apparently moving up it's not a bad sign in and of itself.

VWAP movement was impressive and is the only thing that makes me feel fairly certain that we'll see some re-trace start in a day or two. This is mostly because of the volume rise though - just too much enthusiasm in too shart a period for this to go without some re-trace.

Stockconsultant is as uncertain as I, signalling poor trades in either direction. I guess they are also reflecting the few days after a catalyst effect.

All in, the buy percentage still leaves me less bullish than I am naturally inclined to be and the low short percentage, although within my desired range, is anemic relative to the price movement and volume.

As always, much is experimental and should be treated as such.

Bill

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.