Tuesday, October 13, 2015 9:28:37 AM

There was one 400 share $0.2490 sell pre-market.

Trade opened with a 26,326 share sell(?) at $0.25, and began very low-volume trading at $0.25/$0.257 for just three minutes before the plunge to $0.2405 began with a ~22.8K drop to $0.2487 at 9:37 followed by ~11K drop to $0.244 and a low-volume drop to $0.2405 at 9:42. There after it was predominantly low-volume trading, with a couple one-minute spikes to 29K and two 13K spikes, in the range of $0.2408/$0.2469 with falling highs, ending the period at 10:05 for $0.2408. 10:06-10:24 began with a three-minute 27.4K push to $0.255 and dropping to $0.2447 over the next three minutes before starting a low-volume climb from $0.2433 to $0.2502 at 10:21, when it dropped back down on 4K to $0.243, where it ended the period. 10:25-11:12 started with a 21.3K range of $0.2484->$0.2521 and began a medium volume sideways range initially at $0.2495/$0.2521, spiked to $0.2549 on 3.7K at 10:36 and range fell back into a low-volume sideways range at $0.247/$0.2499. Then at 10:52 37.7K traded $0.25->$0.247 but the range didn't move until the range began narrowing at 11:07 and the period ended at $0.2485/$0.2488. 11:13-12:05 began with 40.6K taking price $0.2485-$0.2436, three low-volume minutes at $0.2436/$0.2469 and then 28.8K at that range, followed by medium-volume trading in that range, with rising lows and at 11:41 falling highs, ending the period at $0.2461. 12:06-12:58 began with two-minutes of 46.7K trading from $0.2451->$0.$0.248 and then started $0.2467/$0.2484 sideways trading, on low-volume, but for 25K in two minutes at 12:13/:14 that hit $0.2489. That started the highs falling, coming back to $0.2484, $0.2481, $0.2480, ... ending the period at $0.2478. 12:59-14:39 began with 24K $0.2467-?$0.2451 and began low-volume sideways trading at $0.2451/$0.2471 with falling highs hitting $0.2453 at 13:31. Around 14:35 the lows finally started rising and the highs recovered a bit, with trading ending the period at $0.2451. 14:40-14:49 began with 48.3K over the first eight minutes taking price to $0.2485 followed by low-volume, ending at $0.2456/$0.2475. 15:00-15:44 had 27.9K over two minutes took price to $0.2517 and trading began at a medium-volume $0.2487/$0.25 range and at 15:17 $0.25/$0.2502 (46.7K traded 15:21/:22) followed by $0.2485/$0.25 beginning at 15:25 and ending the period at $0.2486. 15:45-15:59 began with ~22.4K at $2486/$0.2511 and in two minutes dropped to low-volume trading $0.2486/$0.2511 and there was no eod volatility and no closing block!. The period ended at $0.2487 on 600 shares.

Including the opening block, there were three larger trades (>=20K plus one 19.9K), totaling 66,226, 7.21% of day's volume, with a VWAP of $0.2496. Excluding the opening block, there were two larger blocks totaling 39,900, 4.34% of day's volume, with a VWAP $0.2494.

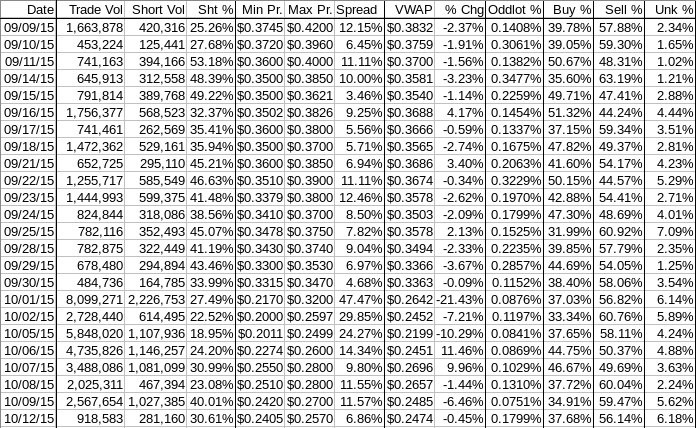

On the traditional TA front, movements of the open, low, high, close and volume were -7.41%, -0.62%, -4.81%, 0.04%, -64.22% vs. yesterday's 3.97%, -1.38%, -3.43%, -3.43%, and -41.94% respectively. With everything down, and relatively significantly but for the day's low, it looks like the current lack of a strong trend maybe be ending. Especially since volume is tanking and the open/close forms (almost) a "spinning top", indicating indecision. Some kind of a move usually follows this - a definite sideways, down or up trend. The compression of the spread I expected to appear yesterday finally started to appear today, it being 6.86% today, down from 11%+ the prior two days and even higher before that (see table below).Ending Period Period Period Per. Trade_ Period_ % Day_ Per. End

Period Volume Low High Dollar Val. VWAP___ Volume Buy ~%

10:05 128529 $0.2405 $0.2570 $31,663.09 $0.2463 13.99% 34.68% Incl 09:30 $0.2500 26,326

10:24 69700 $0.2408 $0.2550 $17,242.14 $0.2474 7.59% 34.32%

11:12 112078 $0.2470 $0.2549 $27,994.83 $0.2498 12.20% 35.33%

12:05 160988 $0.2436 $0.2485 $39,592.34 $0.2459 17.53% 35.98%

12:58 94721 $0.2451 $0.2489 $23,433.79 $0.2474 10.31% 39.02%

14:39 123307 $0.2450 $0.2471 $30,269.88 $0.2455 13.42% 39.82%

14:49 38455 $0.2453 $0.2485 $9,484.55 $0.2466 4.19% 40.38%

15:44 156845 $0.2455 $0.2517 $39,115.82 $0.2494 17.07% 37.52% Incl 15:08 $0.2487 19,900 15:22 $0.2500 20,000

15:59 32310 $0.2486 $0.2511 $8,069.74 $0.2498 3.52% 37.68%

Today's action did produce, on my minimal chart, the first potential semi-reliable trend line - a rising support originating at the low of 10/1, $0.217 (above the low the day of the pre-announced bad news), with exact touches at the lows of 10/5 ($0.2274) and today's 10/12 low of $0.2405. I expect we should test it tomorrow (~$0.2435) and if it's a valid trend line either close above it tomorrow or below tomorrow and back above it (~$0.2465) the following day (Wed. 10/14). If my assessment that the pre-announcement effects have abated, a trend should then start to emerge.

On my one-year chart all the oscillators I watch, except full stochastic, had marginal moves that were generally flattish. Full stochastic continued to improve and got above neutral. All others are below neutral but not in oversold.

Since we are roughly at the middle of the down trend, I'm guessing that we'll start to trend sideways initially.

Percentages for daily short sales and buys moved in opposite directions, not good, but the short percentage is just a wee bit below my desired range (needs re-check) and the buy percentage has stopped weakening. Combined with the narrowing price spread, I think this suggests most of the downward pressure is over.

I'm looking for a sideways move to start developing now.

As always, much is experimental and should be treated as such.

Bill

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.