-13M Float

-No dilution

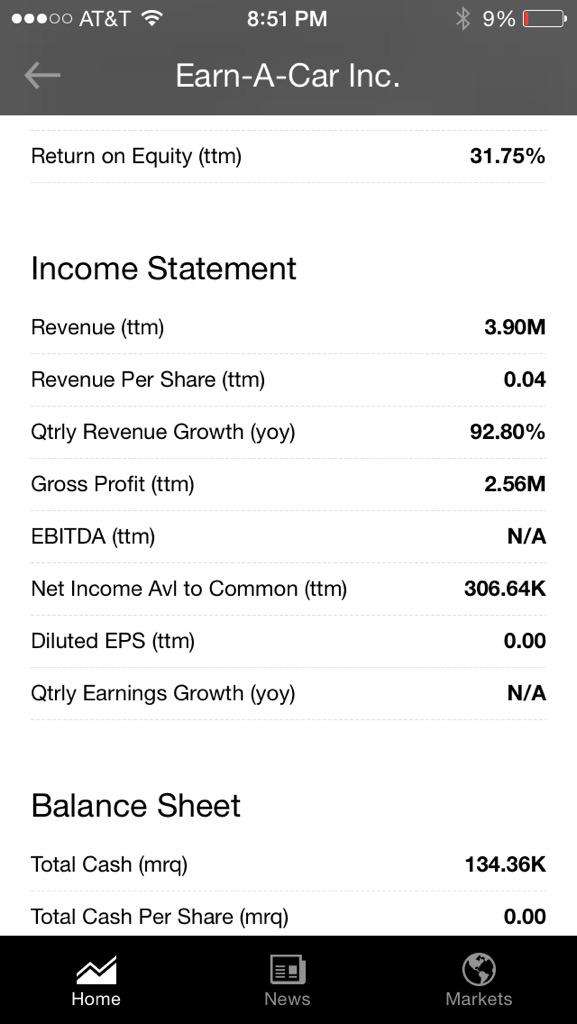

-Over 3M in revenue

-private investor owns over 80% of the o/s

http://www.otcmarkets.com/financialReportViewer?symbol=EACR&id=139532&utm_source

https://www.facebook.com/EarnaCar

https://twitter.com/EarnaCar

https://www.linkedin.com/company/earn-a-car

Business Description ~ Earn-A-Car Inc. through its subsidary provides mid to low-range automobiles to individuals with sub-prime credit on a "rent-to-own" basis. The company's business model is structured to take advantage of the opportunity that exists in the southern African market, where cars for personal and business use are in high demand, but where traditional bank financing is difficult to access. Approximately 45% of credit rated South Africans have impaired credit. All vehicles are fitted with the latest in anti-theft technology, as well as "disabling" devices which allow for its vehicles to be immobilized and retrieved immediately in the event of theft, or non-payment by the customer (monthly in advance) with the result that bad debts are minimal. Loyal customers are rewarded for each completed month with cash back that, typically over 4 years, is sufficient to buy the car from Earn-A-Car.

Earn-A-Car is the brainchild of millionaire Graeme T. Hardie. Started back on July 2, 2005 as Easycars Rental and Sales (Pty) Ltd., the company has once focus: enter car rental agreements that allow the renter to return the car with one calendar months’ notice, but, at the same time, allow the renter to earn their car by providing customers with a cash back bonus on termination of the rental agreement for each month that the customer was in good standing with Earn-A-Car.

Nearly 50% of all credit rated South Africans are blacklisted at credit bureaus, an increase of nearly 27% over the last 4 years, and are consequentially unable to access typical car finance. Targeting these driver’s who have been “blacklisted,” the significant up-front administration fee Earn-A-Car charges have proven to be a deciding factor as to how the Company has been able to guarantee sufficient cash to allow their customer’s to buy the car they rent, or a similar car of their choice, at the end of approximately 4 years.

For the fiscal year ended February 28, 2013, Earn-A-Car booked car rental revenues of $3.478 million versus $2.187 million for the same period the year prior. The roughly 59% increase in revenues was significant enough to record a net income of $524,559 for the 12 months ended February 28, 2013 versus $60,792 for the same period the year prior.

Earn-A-Car reported revenue-earning vehicles worth $4,858,545 net as of February 28, 2013 and $2,982,060 net as of February 29, 2012. Taking the depreciation expense out of the equation (EBITDA) and the Company booked net income of $1,036,358 and $576,911 for the last 2 fiscal years. That’s pretty darn good if you ask any accountant or value investor.

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM

Avant Technologies Launches Advanced AI Supercomputing Network and Expansive Data Solutions • AVAI • Apr 23, 2024 8:00 AM

BestGrowthStocks.com Issues Comprehensive Analysis of Triller Merger with AGBA Group Holding Limited • AGBA • Apr 22, 2024 1:00 PM

Cannabix Technologies to Present Marijuana Breathalyzer Technology at International Association for Chemical Testing (IACT) Conference in California • BLO • Apr 22, 2024 8:49 AM