| Followers | 372 |

| Posts | 16735 |

| Boards Moderated | 3 |

| Alias Born | 03/07/2014 |

Friday, April 24, 2015 10:25:24 AM

Question to me is, What are the expected LOSSES and DILUTION for 2015??

What difference does "revenue" make when there is no positive cash flow, let alone even a remote shot at actual profitability IMO?

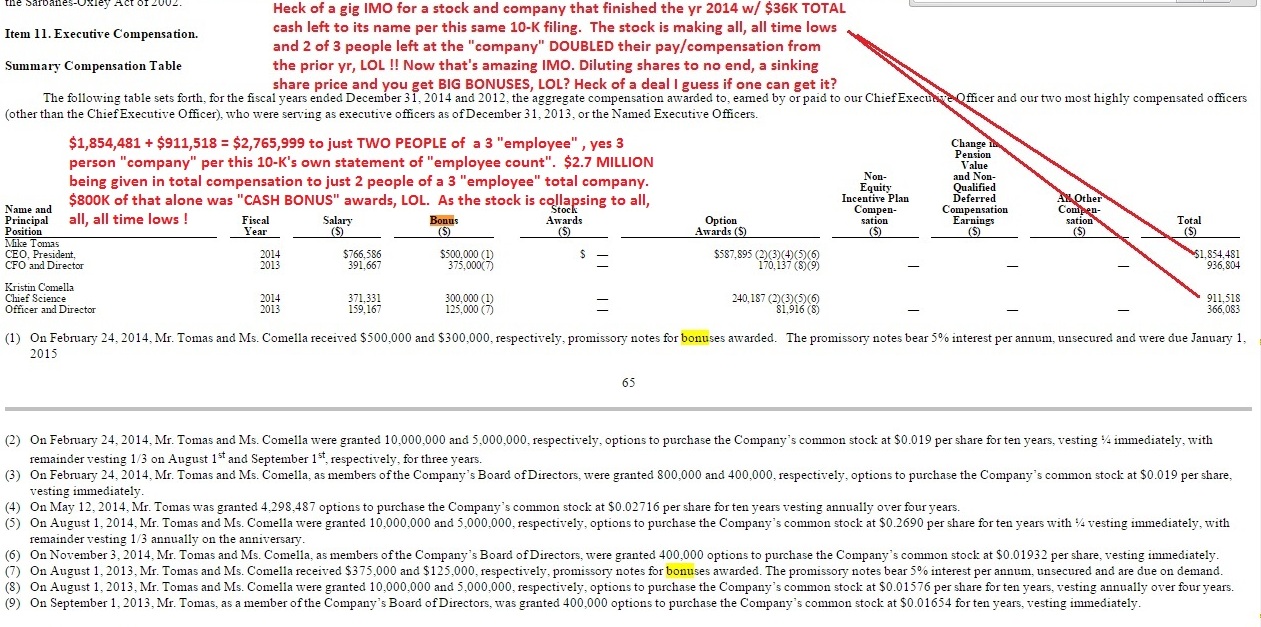

Just the salaries and bonuses of TWO people of a 3 person company (most recent filed 10-K, March 2015, PAGE F-11, "The Company has three full-time employees and no part-time employees. ")- the salaries and "cash" bonuses awarded for just TWO people of a 3 person company, those 2 alone now are a combined $766,586 base + $500K (bonus) + $371,331 base + $300K = $1,937,917. $1.9 MILLION in just base salary + "cash" bonus awards to TWO people of a 3 person company. Let alone overhead and what's left of the pittance of an R&D budget they have left after hacking out most of it in 2014, etc The "revenues" are gross. Once the cost of sales is subtracted out, it's not even enough to pay the salaries and bonuses for just those two- let alone fund and run a company, fund R&D, fund any "big phase 3" trials, fund day to day overhead, fund their debt, fund accounts payable which per the same 10-K exceeded $2 MILLION end of 2014 against just $36K cash left on-hand for the end of yr, etc

"revenues"?? It's not "revenues" that matter is it?? It's CASH FLOW and PROFIT and ability to throw off cash to fund their own operations IMO that matter most- and I don't see a single indicator showing them to be remotely close to that happening? WHERE in the 10-K does it show that? They ended 2014 with $36K TOTAL cash on-hand and a big ole "GOING CONCERN WARNING" from their own auditors. The "revenues" didn't change anything that I could see??

Latest filed 10-K, PAGE 55:

"Research and Development

Research and development expenses were $66,420 in 2014, a decrease of $560,563 from research and development expenses of $626,983 in 2013. The decrease was primarily attributable to a decrease in the amount of available funds.

The timing and amount of our planned research and development expenditures is dependent on our ability to obtain additional financing."

Latest filed 10-K, covering to end of 2014 w/ updates to early March 2015, PAGE 56:

"At December 31, 2014, we had cash and cash equivalents totaling $36,674; our working capital deficit as of such date was $10,957,443. Our independent registered public accounting firm has issued its report dated March 16th, 2015 in connection with the audit of our financial statements as of December 31, 2014 that included an explanatory paragraph describing the existence of conditions that raise substantial doubt about our ability to continue as a going concern."

Same recent 10-K, PAGE F-12:

"NOTE 2 — GOING CONCERN MATTERS

The accompanying consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. As shown in the accompanying consolidated financial statements during year ended December 31, 2014, the Company incurred net losses of $2,253,511 and used $1,108,647 in cash for operating activities. These factors among others may indicate that the Company will be unable to continue as a going concern for a reasonable period of time.

The Company’s existence is dependent upon management’s ability to develop profitable operations and to obtain additional funding sources. There can be no assurance that the Company’s financing efforts will result in profitable operations or the resolution of the Company’s liquidity problems. The accompanying statements do not include any adjustments that might result should the Company be unable to continue as a going concern."

I'm not sure it's really "revenues" that are the biggest deal here right now IMO? Cash flows and "liquidity" would seem more pertinent IMO.

My .0073 CENTS worth

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM

Avant Technologies Launches Advanced AI Supercomputing Network and Expansive Data Solutions • AVAI • Apr 23, 2024 8:00 AM

BestGrowthStocks.com Issues Comprehensive Analysis of Triller Merger with AGBA Group Holding Limited • AGBA • Apr 22, 2024 1:00 PM

Cannabix Technologies to Present Marijuana Breathalyzer Technology at International Association for Chemical Testing (IACT) Conference in California • BLO • Apr 22, 2024 8:49 AM