| Followers | 679 |

| Posts | 140793 |

| Boards Moderated | 36 |

| Alias Born | 03/10/2004 |

Tuesday, January 27, 2015 7:58:53 AM

FOMC may signal rate-hike plans pushed back

* January 26, 2015

• As FOMC meets, markets will be looking for clues on rate-hike timing

• Consensus, which had been betting on mid-year hike, vacillating of late

• Lower-than-expected inflation, strong dollar excuses for Fed not to move

The Federal Open Market Committee begins its two-day meeting today. As usual, market participants will be on pins and needles. Until they read the post-meeting statement. Then they will try to parse the changes between statements to see how FOMC members’ views are evolving. There is no news conference this time around, so all they have left to confuse themselves with is the statement. Routine stuff. Would the statement be any clearer as to when the hike may finally come? Possibly. When it is all said and done, we may find out the can got kicked down the road. Once again!

Markets have been looking for clues for a while. Up until now, if anything, the Fed has been sending mixed signals.

Recently, James Bullard, St. Louis Fed president, said he would like the Fed to start raising rates by March this year. He becomes a voting member in 2016. To his credit, Mr. Bullard has maintained that rather-hawkish view for a while. As far back as April 2014, he felt the FOMC needed to begin hiking rates in 1Q15. Back then, he also thought the Fed funds rate would be at four percent to 4.25 percent in 2016. Talk about lofty expectations!

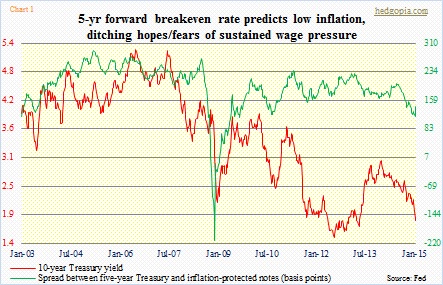

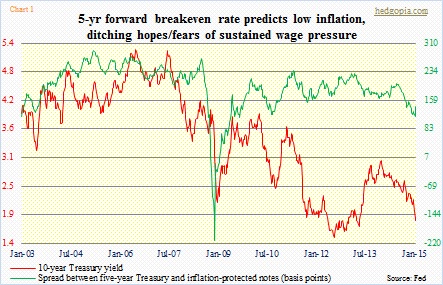

Also recently, John Williams, San Francisco Fed president, thought the middle of the year may be the best time for a rate hike. He is a voting member this year. In the middle of 2014, Bill Dudley, New York Fed president, who always votes, thought market expectations at the time for a rate hike around mid-2015 was a reasonable forecast. Then in the middle of November, Mr. Dudley said it is still too early to raise interest rates given below-target inflation. Inflation expectations, by the way, just keep grinding lower (Chart 1).

Who can blame the markets if they act confused?

Right before the October 28-29 FOMC meeting last year, the consensus believed the first rate hike would be in July 2015. Then the post-meeting statement mentioned “substantial improvement” in the jobs outlook. Investors interpreted that as hawkish and pulled rate-hike expectations forward by a month to June.

Therein lies the problem. With a bunch of regional Fed presidents running around voicing their own opinion, there is no longer cohesion in message. Hence the volatile market expectations.

Post-December 16-17 FOMC meeting, Chair Janet Yellen in her press conference suggested no moves for at least the next two meetings. That left the door wide open for a possible move in June. The FOMC meets eight times a year. After the meeting this week, they meet on March 17-18, April 28-29, and then on June 16-17. So based on Ms. Yellen’s comments, even April was in play. But since a press conference is not scheduled in that meeting, it is safe to assume that if the Fed did indeed move it would prefer to do so in a meeting with a press conference scheduled. June has one scheduled, hence the odds of a Fed move in that month.

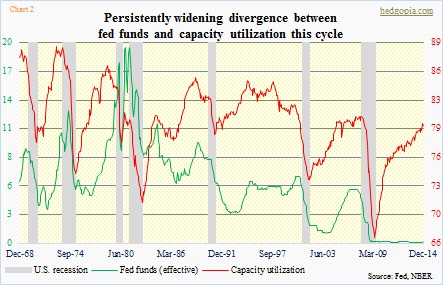

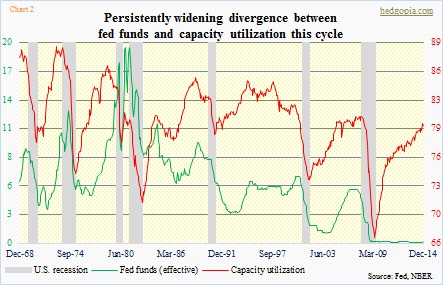

As a reminder, this blog has been going against the crowd on this topic, expecting no hike this year. To be clear, the Fed had ample opportunity to begin a rate-hike process. Look at Chart 2. The divergence between Fed funds and capacity utilization is so wide one can drive a truck through it. It does not make sense to have short rates this low forever. But once the Fed instituted QE3 back in September 2013, it became amply clear that they are more worried about asset prices than normalization of interest rates. Indeed who can forget the Bullard bounce mid-October?

Lately, there are signposts suggesting we can forget about a rate hike toward the middle of the year.

The Wall Street Journal’s Jon Hilsenrath, who many consider a mouthpiece for the Federal Reserve, wrote a piece on January 19 titled “Fed Officials on Track to Raise Short-Term Rates Later in the Year”. While this looks hawkish on the surface, but versus earlier expectations of a mid-year hike, this is dovish.

What changed? Or to put it bluntly, what is the excuse being used? To quote Mr. Dudley, “But, you know, forecasts often go astray.” He said that in a speech he gave in the middle of 2014.

There are several differences between the meeting this week and the one eight weeks ago. Crude oil has dropped even more. Globally, there has been a rush to lower rates – from Canada to India to Turkey to Denmark. The Swiss National Bank not only cut its official interest rate to -0.75 percent but also delinked its currency from the euro. The European Central Bank instituted a €60bn/month QE program, putting further downward pressure on the euro. Across the Eurozone, there is downward pressure on rates, with several countries in the negative zone.

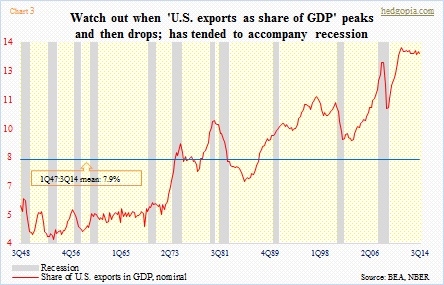

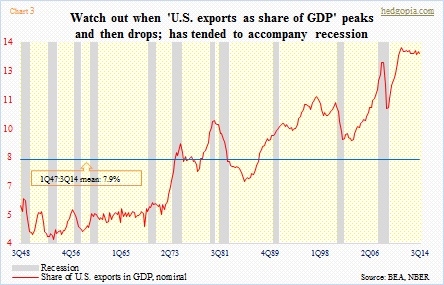

These are disinflationary at best – and deflationary at worst – signals. The strengthening dollar does not help, and a hike can only exacerbate the situation. Commodities priced in dollars cannot catch a break, even as U.S. exports (13-percent-plus as a share of GDP) lose competitiveness (Chart 3). General Motors, just to use as an example, must be complaining to folks at the Treasury how hard it is these days competing against the German and Japanese cars.

So, no. No hike this year.

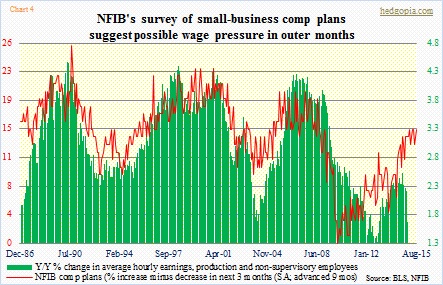

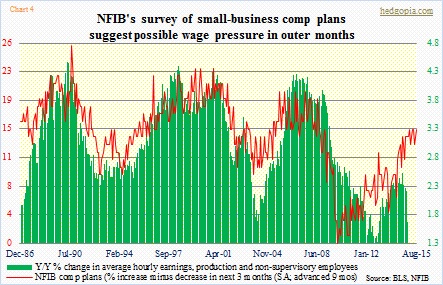

Some forward-looking indicators are pointing to wage pressure in coming months (Chart 4). Not holding my breath. But if it indeed comes to pass and the Fed’s inflation antenna goes up, it is only then that we can seriously discuss the odds of a hike. Otherwise, there is always some excuse.

http://www.hedgopia.com/fomc-may-signal-rate-hike-plans-pushed-back/

George.

* January 26, 2015

• As FOMC meets, markets will be looking for clues on rate-hike timing

• Consensus, which had been betting on mid-year hike, vacillating of late

• Lower-than-expected inflation, strong dollar excuses for Fed not to move

The Federal Open Market Committee begins its two-day meeting today. As usual, market participants will be on pins and needles. Until they read the post-meeting statement. Then they will try to parse the changes between statements to see how FOMC members’ views are evolving. There is no news conference this time around, so all they have left to confuse themselves with is the statement. Routine stuff. Would the statement be any clearer as to when the hike may finally come? Possibly. When it is all said and done, we may find out the can got kicked down the road. Once again!

Markets have been looking for clues for a while. Up until now, if anything, the Fed has been sending mixed signals.

Recently, James Bullard, St. Louis Fed president, said he would like the Fed to start raising rates by March this year. He becomes a voting member in 2016. To his credit, Mr. Bullard has maintained that rather-hawkish view for a while. As far back as April 2014, he felt the FOMC needed to begin hiking rates in 1Q15. Back then, he also thought the Fed funds rate would be at four percent to 4.25 percent in 2016. Talk about lofty expectations!

Also recently, John Williams, San Francisco Fed president, thought the middle of the year may be the best time for a rate hike. He is a voting member this year. In the middle of 2014, Bill Dudley, New York Fed president, who always votes, thought market expectations at the time for a rate hike around mid-2015 was a reasonable forecast. Then in the middle of November, Mr. Dudley said it is still too early to raise interest rates given below-target inflation. Inflation expectations, by the way, just keep grinding lower (Chart 1).

Who can blame the markets if they act confused?

Right before the October 28-29 FOMC meeting last year, the consensus believed the first rate hike would be in July 2015. Then the post-meeting statement mentioned “substantial improvement” in the jobs outlook. Investors interpreted that as hawkish and pulled rate-hike expectations forward by a month to June.

Therein lies the problem. With a bunch of regional Fed presidents running around voicing their own opinion, there is no longer cohesion in message. Hence the volatile market expectations.

Post-December 16-17 FOMC meeting, Chair Janet Yellen in her press conference suggested no moves for at least the next two meetings. That left the door wide open for a possible move in June. The FOMC meets eight times a year. After the meeting this week, they meet on March 17-18, April 28-29, and then on June 16-17. So based on Ms. Yellen’s comments, even April was in play. But since a press conference is not scheduled in that meeting, it is safe to assume that if the Fed did indeed move it would prefer to do so in a meeting with a press conference scheduled. June has one scheduled, hence the odds of a Fed move in that month.

As a reminder, this blog has been going against the crowd on this topic, expecting no hike this year. To be clear, the Fed had ample opportunity to begin a rate-hike process. Look at Chart 2. The divergence between Fed funds and capacity utilization is so wide one can drive a truck through it. It does not make sense to have short rates this low forever. But once the Fed instituted QE3 back in September 2013, it became amply clear that they are more worried about asset prices than normalization of interest rates. Indeed who can forget the Bullard bounce mid-October?

Lately, there are signposts suggesting we can forget about a rate hike toward the middle of the year.

The Wall Street Journal’s Jon Hilsenrath, who many consider a mouthpiece for the Federal Reserve, wrote a piece on January 19 titled “Fed Officials on Track to Raise Short-Term Rates Later in the Year”. While this looks hawkish on the surface, but versus earlier expectations of a mid-year hike, this is dovish.

What changed? Or to put it bluntly, what is the excuse being used? To quote Mr. Dudley, “But, you know, forecasts often go astray.” He said that in a speech he gave in the middle of 2014.

There are several differences between the meeting this week and the one eight weeks ago. Crude oil has dropped even more. Globally, there has been a rush to lower rates – from Canada to India to Turkey to Denmark. The Swiss National Bank not only cut its official interest rate to -0.75 percent but also delinked its currency from the euro. The European Central Bank instituted a €60bn/month QE program, putting further downward pressure on the euro. Across the Eurozone, there is downward pressure on rates, with several countries in the negative zone.

These are disinflationary at best – and deflationary at worst – signals. The strengthening dollar does not help, and a hike can only exacerbate the situation. Commodities priced in dollars cannot catch a break, even as U.S. exports (13-percent-plus as a share of GDP) lose competitiveness (Chart 3). General Motors, just to use as an example, must be complaining to folks at the Treasury how hard it is these days competing against the German and Japanese cars.

So, no. No hike this year.

Some forward-looking indicators are pointing to wage pressure in coming months (Chart 4). Not holding my breath. But if it indeed comes to pass and the Fed’s inflation antenna goes up, it is only then that we can seriously discuss the odds of a hike. Otherwise, there is always some excuse.

http://www.hedgopia.com/fomc-may-signal-rate-hike-plans-pushed-back/

George.

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

gtsourdinis

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.