Thursday, October 30, 2014 9:58:31 PM

Thomas Preston

EDITOR’S NOTE: This article first appeared in the Spring 2014 issue of thinkMoney. (TDAmeritrade's house mag.)

Inverse and leveraged ETFs have become some of the most actively traded financial products. And why not? These instruments can offer opportunities to take interesting positions. For example, an ETF that tracks the Russell 2000 moves three times the amount of the underlying index. Another, a leveraged inverse ETF that tracks the Standard & Poor’s 500 index, moves inversely from the U.S. equity benchmark by a factor of two. Because it goes up when the S&P 500 goes down, it can be a way to hold a bearish position where you’d otherwise be prohibited from shorting stock. Still, you can get tripped up if you don’t understand how these work.

Less Than Zero?

Stocks, bonds, indexes, and ETFs can’t have negative prices. So, imagine an inverse ETF whose price moves in the opposite direction point for point from its benchmark price—when the benchmark moves up one point, the inverse ETF moves down one point. But what happens if the index moves up more points than the inverse ETF is worth? For example, if the benchmark is $50 and the inverse ETF is $50, the inverse ETF would have a negative value if the benchmark moved up 51 points to $101. This is also a consideration with leveraged ETFs.

The creators of inverse and leveraged ETFs solved this problem by basing the price change for the inverse and leveraged ETFs on the daily percentage change of the benchmark. If the benchmark moves up 1% in one day, the inverse ETF moves down the same amount. But what happens if the benchmark keeps going up, day after day? The inverse ETF keeps moving down in price, but never below $0. That’s because when inverse ETF’s price is lower, the percent change equates to a smaller change in points.

For example, say a benchmark is at $100 and the 1x inverse ETF is $100. If the price of the benchmark moves up $2 to $102 in a day, that’s 2%, meaning the ETF moves down 2% of $100, to $98. If the benchmark on the following day moves up another 2% ($2.04, to $104.04), the ETF moves down 2% of $98 ($1.96, to $96.04). The inverse ETF had a smaller price change on the second 2% drop than it did on the first because its starting price was lower. Thus, the inverse ETF can never go below $0. Very clever—but that also creates another problem.

The leveraged, inverse ETFs track the daily percentage price change of the benchmark. Those ETFs can sometimes move in ways that are counterintuitive because the prices of the leveraged and inverse are path-dependent. If the benchmark moves up $1 today and down $1 tomorrow, that has a different impact on the ETF than down $1 today and up $1 tomorrow. Huh?

Connective Financial Tissue

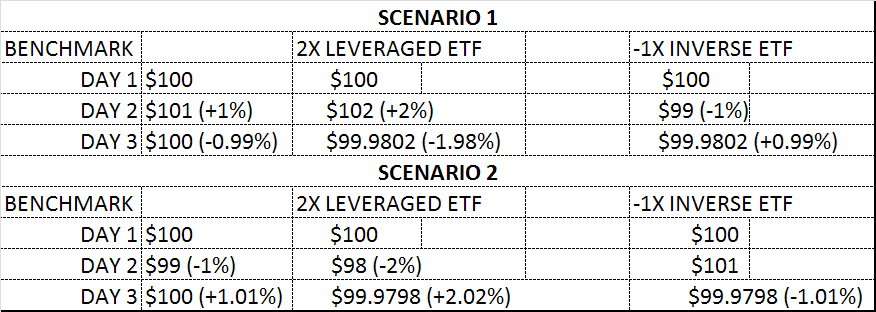

Let’s look at two scenarios for a leveraged ETF that moves 2x the percent change of the benchmark, and an inverse ETF that moves –1x the percent change of the benchmark. Let’s assume that the benchmark and the leveraged or inverse ETFs each start at $100.

In Scenario 1, the benchmark starts at $100 and moves up 1% on day 2 to $101. The leveraged ETF starts at $100 and moves up 2% to $102, and the inverse ETF moves down 1% to $99. When the benchmark drops $1 to $100 on day 3, that’s not quite 1%. It’s 0.99%. The price of the leveraged drops 2x 0.99% (1.98% of $102) to $99.9802. The inverse rises 0.99%, from $99 to $99.9802. Both the leveraged and inverse ETFs are a little lower than where they started ($100), while the benchmark didn’t change at all (see figure 1).

FIGURE 1: PULLING LEVERS. The leveraged ETF in this example would effectively allow you to double down on the underlying benchmark. But remember, it works both ways, whether the price goes up or down.For illustrative purposes only. Past performance does not guarantee future results.

In Scenario 2, the benchmark drops $1 on day 2, and the leveraged ETF drops 1% x2, to $98. When the benchmark rises $1 back to $100 on day 3, that’s a 1.01% increase. The leveraged rises 1.01% x 2 to $99.9798. It doesn’t rise $2 back up to $100.

The inverse ETF exhibits similar behavior. That’s the nature of percentage price changes: 1% on a higher price is a bigger change than 1% on a lower price. In both scenarios, the benchmark started at $100 and ended at $100, but the leveraged and inverse ETFs neither ended at $100, nor had the same ending value in the two scenarios. Their prices depend on the specific price path of the benchmark.

Track Your Expectations

Take note: These are simplified scenarios involving only three price changes. Imagine the difference that could accumulate over some 260 trading days through the year. Although the benchmark didn’t have a net change—it started at $100 and ended at $100—in the three-price-change examples above, the leveraged and inverse ETFs both lost value to different degrees, depending on the path of the benchmark’s price changes.

That doesn’t necessarily mean there’s something wrong with the leveraged and inverse ETFs. It’s just how they work. Because the leveraged and inverse ETFs track the daily percent changes of the benchmark, the performance of those ETFs can be quite different from the percent changes in the benchmark over longer periods. That’s what many investors can find confusing. It looks like the leveraged and inverse ETFs should have done one thing, but they actually did another.

What does that mean? Should you avoid trading leveraged and inverse ETFs long-term, if at all? That’s for you to decide. All trading products present risk. But some have nuances that can surprise you if you don’t understand them. In the case of leveraged and inverse ETFs, their particular nuance is that the daily, percentage price changes create discrepancies compared to the benchmark’s longer-term performance. So, if you’re looking for an exact leveraged or inverse replica of the benchmark, you might not get that. Go in with an educated expectation, though, and the leveraged and inverse ETFs might provide opportunity.

Best,

Allen

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.