| Followers | 184 |

| Posts | 33005 |

| Boards Moderated | 8 |

| Alias Born | 04/14/2010 |

Saturday, October 25, 2014 12:44:11 PM

LOL!!!

Treaty's History of Fraud and Fake oil-Update 13

Lawsuits against Treaty... That I know of so far.

This is how Treaty operates... Robert McManus is out $130,000 bucks... and Ronald Blackburn is right in the middle of it...

Robert McManus vs Treaty Energy...

Full filing here...

https://docs.google.com/file/d/0B8fPIL-cKPM-X1pMZGxqVGhFbWc/edit

New Lawsuit filed by Anderson Perforating for breach of contract August 25th...

Funny thing is... The lawyer for Anderson Perforating is none other than the lawyer that filed the slander suit against Mack, Colton P. Johnson... And by the way Colton has filed with the court to withdraw from that slander case and Treaty has taken no further action. Likely because what was said was all true. Can't be sued for telling the truth and there is loads of evidence to support that it was in fact true.

Colton Johnson has also been involved with many of the lease assignments...

So now Treaty is being sued by thier own lawyer! LOL!!

The Anderson suit

Seems Tesarski has been ignoring all the bills as well...

Same ole Treaty...

US. Fuels and Treaty Energy being sued for fraud in Callahan County

Has to do with 2 leases Treaty sold Merkaz Oil and Gas Development Company. They say Treaty sold them the Henderson and long lease by fraudulently misrepresenting the facts. Like the fact that there were TRRC issues as in a well plugging and severances. They are looking for more than $200,000 but less than 1 million bucks from Treaty and US. Fuels.

Sounds just like Treaty...

The full filing here...

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=104560250

Fraud, fraud and more fraud... Gwyn with the help of Reid ripped off his childhood friend... Treaty rips off anybody and everybody.

In the lawsuit, New Orleans resident George Demmas claims that Gwyn -- a childhood friend -- convinced him in May 2012 to invest $65,000 in a "fictional undivided interest in an oil well" on promises that he would earn $700,000 over 10 years in return.

That sale agreement was made through Rampant Leon Financial Corp. and signed by Reid, according to the lawsuit.

At Gwyn's urging, Demmas also decided to buy more than 810,000 shares in Treaty Energy for a total of $15,000 with an agreement that Demmas had to hold onto the shares for one year before selling them on the market, according to the lawsuit.

The lawsuit claims Gwyn "knowingly misrepresented material facts to and omitted material facts from" Demmas in both investments.

"In addition, Gwyn made continuing misrepresentations about the investments to induce plaintiff to hold the investments for a longer period of time than he otherwise would have and to delay plaintiff's actions in recovering or mitigating his losses," the lawsuit says.

Rather than the promised $3,000 or $4,000 per month, the lawsuit says, Demmas has received only a total of $700 on the oil well investment.

At one point, when Demmas complained about a lack of payments, Gwyn told him "that a supposed unnamed Russian investor had invested about $20 million in the investment and that Rampant needed to pay him back first before any of the other investors," the lawsuit says.

Meanwhile, Demmas' shares in Treaty Energy did not increase as Gwyn had promised, the lawsuit says, and Demmas couldn't find a brokerage firm willing to sell the shares after the one-year holding period.

Treaty Energy was trading Thursday at .0036 cents per share with a 52-week high of 4 cents per share.

Holly Crap... Yet another lawsuit, this one for $56,570.00 plus 12% interest that so far as accrued in the amount of $20,365.20 for a total of $76,935.20 for breach of contract and filling filed August 22nd looking for a default judgment because Treaty Energy continues to refuse to pay even after the new great puppet Chris Tesarski has supposedly "taken over"...

Same ole Treaty...

This last suit posted is from a ways back and they are STILL trying to collect from Treaty and taking them to court AGAIN for like the 3rd time... Treaty doesn't intend on paying anybody these guys should get together a take legal action to freeze anything Treaty and co-crooks have... Though it may already be to late... Seems Treaty about to file bankruptcy...

https://docs.google.com/file/d/0B8fPIL-cKPM-Qmw3V3Z6cVV5aFE/edit

Treaty loses in court again... This is a document service company that has something to do with preparing docs for court and Treaty decided to not pay them or even bother to show up in court... Again.

This one for $48,859.50 and the Judgment is final... Treaty must also pay attorneys fees of 25% for $12,214.86 for a total due to WarRoom of $61,074.37 plus 18% interest until paid...

This suit all took place well after Chris Tesarski was appointed.

Blackburn still pulling the strings at Treaty Energy.

Petition.

https://docs.google.com/file/d/0B8fPIL-cKPM-QUI0VlBPdzdTX1E/edit

Judgment...

https://docs.google.com/file/d/0B8fPIL-cKPM-bkhEeUFEbXg3djg/edit

https://docs.google.com/file/d/0B8fPIL-cKPM-U2l4WExDLWhVTVk/edit

Another default Judgment against Treaty Energy. This after a "payment plan" was set up... And guess what? Treaty didn't make the payments. Treaty has done this many times before, 1 payment then another year of excuses from Treaty and then back to court and Treaty didn't bother to even show up...

This judgment is for 14,142.62 plus 18% interest and attorneys fee's...

Archer Drilling Default Judgment Documents File Date 10/4/2014...

https://drive.google.com/file/d/0B8fPIL-cKPM-SGdnbmFpNVhjX1k/view

Final Default Judgment

https://drive.google.com/file/d/0B8fPIL-cKPM-Vnh5R2g3TjROckU/view

The petition...

https://drive.google.com/file/d/0B8fPIL-cKPM-R3plN1BWSnJDbEk/view

The liens, Court filings and "payment plan"...

New Archer Drilling Oct 4th filling

https://docs.google.com/file/d/0B8fPIL-cKPM-aktuVkFCWG5KR00/edit?usp=sharing&pli=1

Archer Drilling Exhibit A Oct 4th filling

https://docs.google.com/file/d/0B8fPIL-cKPM-RFViQmYxME1rTjA/edit?usp=sharing&pli=1

Archer drilling lien, The folks that drilled the Madeley $26,785.25

https://docs.google.com/file/d/0B8fPIL-cKPM-a2Z0RDl2STcwUU0/edit?pli=1

And yet ANOTHER!

Universal Well Services suit 8/5/2014...

No Bullshit just Truth...

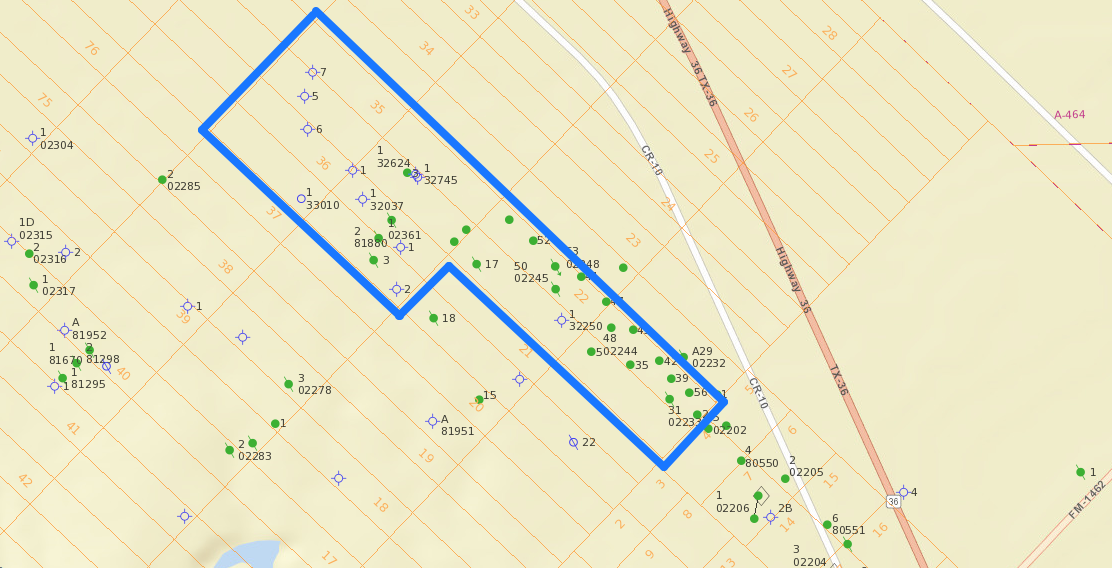

Click image to enlarge.

Universal well Services liens that pertain to this case and Obviously have not been dealt with since Chris Tesarski the new "Great Treaty leader" took over May 1st...

https://docs.google.com/file/d/0B8fPIL-cKPM-QjBOQllVNVJENDQ/edit

https://docs.google.com/file/d/0B8fPIL-cKPM-Y3Z6Qjg5aEZsM28/edit

Here is the recorded assignment to Aquinas and a map that outlines the 60 acres...

https://docs.google.com/file/d/0B8fPIL-cKPM-a00tMmdON2hnMHM/edit

This "deal" has since fallen apart like many "deals" Treaty claims to have made. The Kanses deal went on for a year before Treaty finnaly admited that the deal did not happen. Turns out it was just more PR fodder...

..

Click image to enlarge

There are no current operators for the leases that make up this area. The 2 operators of the wells that were producing are now delinquent and both have TNR 91.114 flags... The production from these wells has been near zero since 1993 and the wells that have not already been plugged, and at least 4 of them by the state have been, will soon need to be plugged. There are currently at least 4 orphaned wells in this area.

former operators are... 844053 and 777175.

This area is complete garbage, any new wells will produce little oil. Not one well on this 60 acres ever produced 100 BOPD like Treaty claims... There have been 9 dry holes already drilled in this area and the rest are plugging liability's that these folks are unloading on Treaty, and I believe Treaty is aware of this. This is nothing but another scam to unload plugging liability's on another operator and to be use for PR fodder to sell shares...

Treaty has done this scam several times before...

..

April Production for Texas Sands leases...

332 barrels for 11.06 BOPD... AGAIN Treaty has been proven to be full of bullshit with the claims they make in there PR's. The PR's are obviously misleading with Treaty's claim of and the same ole same ole bullshit. The in bold statement by Treaty has been proven and proven again to be more PR Bullshit...

Andrew V. Reid, Chairman and Chief Executive Officer of Treaty Energy Corporation, is pleased to announce the acquisition of the assets of Texas Sands Resources, LLC of Abilene, Texas (TSR). TSRs assets currently include ten (10) leases in the Texas 7B Oil District. These leases have a current, consistent and provable production of 25 BOPD (Barrels of Oil per Day). At current production levels, the Company anticipates that this acquisition will generate estimated revenues of $800,000 per year, with revenues expected to increase as the ten (10) leases are more fully developed. TSR also holds a number of additional lease opportunities that if completed, will be included in this purchase. The purchase price was $1,250,000.

http://ih.advfn.com/p.php?pid=nmona&article=62045951

The REAL Production rates taken from a year of data from January 2013 to January 2014... And the current production from

Texas Sands...

Lease 29495... No reports.

Lease 29359... 210 barrels or 17 barrels a month for .57 BOPD

Lease 11225... 541 barrels or 45 barrels a month for 1.48 BOPD

Lease 23568... No reports.

Lease 21570... 739 barrels or 61 barrels a month for 2.02 BOPD

Lease 21849... No reports.

Lease 22814... 609 barrels or 50 barrels a month for 1.66 BOPD

Lease 26287... 347 barrels or 28.91 a month for .95 BOPD

Lease 125878... All zero's.

Lease 139445... All zero's.

Total production for the 12 months was 2446 barrels or 203 a month for 6.07 BOPD. A far cry from the 25 claimed by Treaty in the May 1st PR...

Texas Sands monthly production.

February.. 305 barrels for 10.89 BOPD.

March.....253 barrels for 8.16 BOPD

April.....332 barrels for 11.06 BOPD

Treaty Energy aquires Texas Sands May 1st.

May.......218 barrels for 7.04 BOPD

June......222 barrels for 7.4 BOPD

So.... Again Nowhere near what Treaty claims in thier PR... And I just proved they are exaggerating the production numbers by a factor of 3 times what was reported to the TRRC...

Andrew V. Reid, Chairman and Chief Executive Officer of Treaty Energy Corporation, is pleased to announce the acquisition of the assets of Texas Sands Resources, LLC of Abilene, Texas (TSR). TSRs assets currently include ten (10) leases in the Texas 7B Oil District. These leases have a current, consistent and provable production of 25 BOPD (Barrels of Oil per Day).

Same ole Treaty Bullshit to sell shares...

Treaty is also trying to move C&C Petroleum liability's that Heritage oil refused to except because they were not told of those liability's over to Texas Sands...

The scam beat's on...

The Leases TECO sold to Heritage were quitclaimed to Chris Tesarski and Texas Sands... Treaty gives Chris Tesarski 1.25 million to buy them back along with a few more pluggers and TRRC liability's. Not only that but then Chris takes out loans against the Evans lease for 62,000 bucks...

How is all this beneficial to investors???? Seems it's nothing more than PR fodder to sell more shares...

Some old Treaty leases that Treaty unsuccessfully tried to unload to Heritage Oil looks like are now a plungers responsibility for Texas Sands... LOL!

Brown Unit...

https://drive.google.com/file/d/0B8fPIL-cKPM-WXFnZFh2OHluak0/edit

Compton, Love Compton, Kenard Mabel and Kenard Fiscuss.

https://drive.google.com/file/d/0B8fPIL-cKPM-M2ZjbHZDdWVlVjA/edit

And of course Texas Sands is in need of Money... This Texas Sands and Chris Tesarski thing is really, and I mean really... looking like a new extension of Treaty Energy to get around TRRC compliance issues...

https://drive.google.com/file/d/0B8fPIL-cKPM-OGRZNkx0OExFMVE/edit

Treaty has finally admitted that this "deal" fell apart. Treaty in all likelihood could not come up with the money and the drilling rig Treaty claimed they would use has been repossessed...

Another funny thing...

2 of the guys on the board of Aquinas Energy Resources are recent ex-CEO's of Treaty Energy and were paid with boatloads of Treaty stock and a third is a current lawyer...

Samuel Whitney is a lawyer for Treaty and Randall Newton is a past Director and Chairman of Directors for Treaty Energy and Joe Grace was also a CEO for Treaty Energy... It's the same ole gang!

Recycled front men it seems. There are very likely other connections as well.

http://www.sec.gov/Archives/edgar/data/1075773/000111650209001642/teco_8k.htm

http://www.sec.gov/Archives/edgar/data/1075773/000135448809001210/treat8k.htm

As of 9-8-2014 still no 10-K, 10-Q1 or 10-Q2 nor the 8-Ks' for The appointment of Chris Tesarski or of the acquisition of Texas Sands.... Seems something has gone wrong again... There is no disputing that 8-K's are required for both those events...

Also no 8-K's for the 3 "new" board members of the the opointment of Chris Tesarskit to CEO of Treaty.

No 8-K's for these as well that Treaty has yet to inform investors about...

The LOI with Aquinas Energy Resources.

Farm out contract with Aquinas Energy Resources.

The appointment of Andrew L. Kramer as Vice President, General Counsel, and Corporate Secretary.

Losing the contract as operator for the Belize Princess Petroleum concession...

The results of drilling in Belize.

The fact that the Paradise concession acquisition fell apart and was not completed.

The 500 well drilling contract.

The involuntary bankruptcy filing.

The Heart Land lawsuit.

C&C Petroleum being put out of business by the TRRC with the denial of a renewed P-5.

Why does Treaty have a bad reputation?

Because they don't pay their bills. Contactors need to resort to legal action to get paid. Nobody likes to have to do that. It's Treaty's MO and it's BS...

Proof...

List of judgments and liens against Treaty Energy.

Stockton lease now 7 liens deep and for close to $650,000.00...

2 more liens against the Stockton lease for a running total of 7...Geeezz!!!

https://docs.google.com/file/d/0B8fPIL-cKPM-VXh1UTRnYzAtOGs/edit

https://docs.google.com/file/d/0B8fPIL-cKPM-V2xGRVY2em5mYWs/edit

Included are two invoices for Port a Johns for like $1400.00 bucks...

Treaty doesn't pay anybody for anything!!!

Heartland law suit for over $400,000.00

https://docs.google.com/file/d/0B8fPIL-cKPM-eDdHM21GdmNKVjg/edit

Universal Well Services $62,482.96...

https://docs.google.com/file/d/0B8fPIL-cKPM-QjBOQllVNVJENDQ/edit

Beasley Drilling Fluids for $26,514.83

https://docs.google.com/file/d/0B8fPIL-cKPM-d2ZXM2taSk1JYzQ/edit

And David Jakobot, Treaty's Operator for the Stockton claims he also has a lien on the Stockton and that he is owed $100,000 bucks. No wonder he wants nothing more to do with Treaty Energy...

Filed by Universal well services.

The Mitchell for $5,496.39...

https://docs.google.com/file/d/0B8fPIL-cKPM-Y3Z6Qjg5aEZsM28/edit

Several of these contracts are sighed by Platon Petratos.

Since when are common investors allowed to sign contracts???

Heartland lien for $383,742.54 That would explain why their is no drilling or completion of the Stockton 3 going on. Treaty has been misleading investors AGAIN...

Also $52,500.00 of it is standby time.

Was it Treaty that said this was not a issue???

https://docs.google.com/file/d/0B8fPIL-cKPM-RGRvZFRkXzVaYVU/edit

New Treaty Judgment...

Treaty needs to pay $141,764.25 To All Energy...

https://docs.google.com/file/d/0B8fPIL-cKPM-SXl3cmlFYW11aFU/edit

Basic Energy services 5,590.35

https://docs.google.com/file/d/0B8fPIL-cKPM-RE1rQXVmM0Z6ZG8/edit

Archer drilling lien, The folks that drilled the Madeley $26,785.25

https://docs.google.com/file/d/0B8fPIL-cKPM-a2Z0RDl2STcwUU0/edit?pli=1

Driller in Belize $65,000.00

https://docs.google.com/file/d/0B8fPIL-cKPM-eng2M0MzajJ1ME0/edit?pli=1

Jims rental lien, $111,810.17

https://docs.google.com/file/d/0B8fPIL-cKPM-ODdhd2dtaTVDYm8/edit?pli=1

J&L Trucking lien &3,388.00

https://docs.google.com/file/d/0B8fPIL-cKPM-SzFETUxUMndEYlE/edit?pli=1

Another J&L Trucking lien $2,653.00

https://docs.google.com/file/d/0B8fPIL-cKPM-TTdHUDhTZHhXTE0/edit?pli=1

Mud company lien $6,726.88

https://docs.google.com/file/d/0B8fPIL-cKPM-LXhxWUE1ZHlOMDQ/edit?pli=1

Recovery equipment for work on the Brown lease $18,444.83

https://docs.google.com/file/d/0B8fPIL-cKPM-N0pGaC1BTGhHUkk/edit?pli=1

Recovery Energy Judgment

https://docs.google.com/file/d/0B8fPIL-cKPM-WmxNNGhtc2l1eU0/edit?pli=1

Shack Energy Services $2,451.55

https://docs.google.com/file/d/0B8fPIL-cKPM-UmFBRDNLeXk1VEE/edit?pli=1

New Archer Drilling Oct 4th filling

https://docs.google.com/file/d/0B8fPIL-cKPM-aktuVkFCWG5KR00/edit?usp=sharing&pli=1

Archer Drilling Exhibit A Oct 4th filling

https://docs.google.com/file/d/0B8fPIL-cKPM-RFViQmYxME1rTjA/edit?usp=sharing&pli=1

Oct 2nd Circle K judgment $27,397.40

https://docs.google.com/file/d/0B8fPIL-cKPM-NjhGZTY3NUhZcm8/edit?usp=sharing&pli=1

Treaty also owes Princess Petroleum and the Government of Belize money. Treaty owes the TRRC like $16,000.00 in fines and the Barnes land owner an estimated $70,000.00 in damages as well as the cementer $ 65,000.00. Treaty also still needs to plug the mine well, that is another $60,000.00 - $70,000.00. I'm sure there are many others Treaty has screwed along the way as well.

News about the Inspire group...

These guys are all Crooks too...

Paul Henley FINRA report... Not good and many mentions of fraud and non-disclosure and misrepresentation... He is also no longer licensed.

https://docs.google.com/file/d/0B8fPIL-cKPM-UlkzSjQ3QzJwWnM/edit

And Bo Ritz. Same kind of stuff and also no longer licensed...

These guys will make a swell fit with Treaty Energy.

https://docs.google.com/file/d/0B8fPIL-cKPM-cVhJWTVocloxWG8/edit

And Bo's Ritz BK case...

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98887253

John Bell has knowingly filed many fraudulent H-15 test reports to the TRRC. That's a very good way to piss them off.

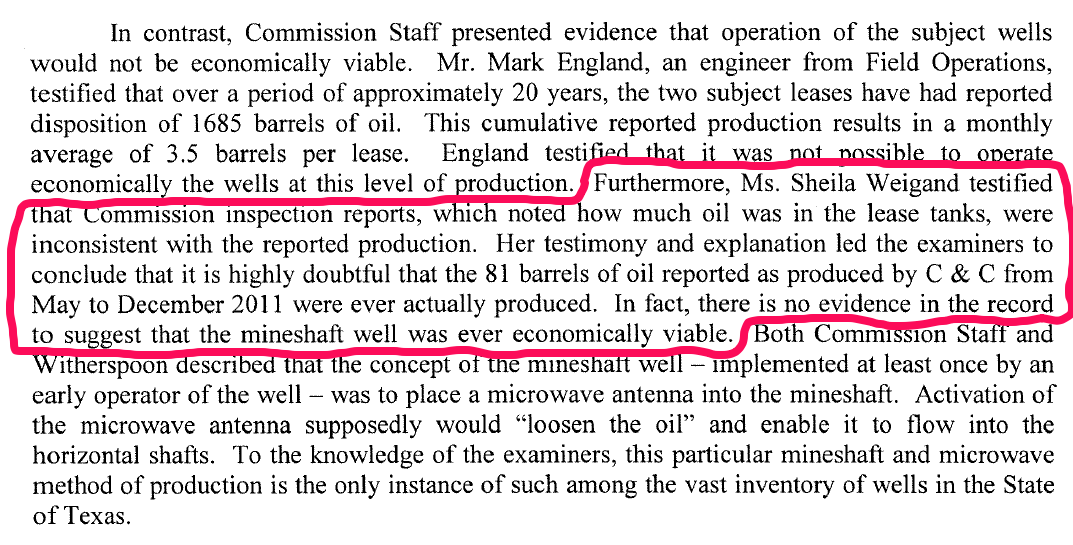

From the Master Default Order...

18. On July 31, 2008, Respondent filed Commission Form H15 (Test On An Inactive Well More Than 25 Years Old) with the Commission showing that: (1) Well No. 1 of the Christian, L. (06930) Lease was tested on June 17, 2008 and had a fluid level of 1380'; (2) Well No. 2 was tested on June 17, 2008 and had a fluid level of 1380'; (3) Well No. 4 was tested on June 17, 2008 and had a fluid level of 1410'; (4) Well No. 5 was tested on June 17, 2008 and had a fluid level of 1410'; (5) Well No. 7 was tested on June 17, 2008 and had a fluid level of 1410'; and (6) Well No. 9 was tested on June 17, 2008 and had a fluid level of 1410'.

19. Each Commission Form H-15 (Test On An Inactive Well More Than 25 Years Old) referenced above was certified by Respondent to have been prepared by it or under its supervision and direction, and that the data and facts stated therein to contain true, correct and complete information to the best of Respondent’s knowledge as evidenced by the signature of its Trustee, John F. Bell.

20. On August 11, 2008, the Commission conducted its own fluid level tests of Well Nos. 1, 2, 4, 5, 7 and 9 of the Christian, L. (06930) Lease and found the following fluid levels: (1) 0' for Well No. 1; (2) 290' for Well No. 2; (3) 600' for Well No. 4;(4) 0' for Well No. 5; (5) 0' for Well No. 7; and (6) 200' for Well No. 9.

21. By filing Forms H-15 (Test On An Inactive Well More Than 25 Years Old) with the Commission which reflected inaccurate fluid levels for Well Nos. 1, 2, 4, 5, 7 and 9 of the Christian, L. (06930) Lease, Respondent knowingly submitted forms containing information which was false or untrue in a material fact in violation of Tex. Nat. Res. Code Ann. §91.143(a)(1).

22. The Respondent has not demonstrated good faith since it failed to timely plug or otherwise place the subject leases and subject wells in compliance after being notified of the violations by the District Office and failed to appear at the hearing to explain its inaction.

http://www.rrc.state.tx.us/media/15327/6e-60807-def.pdf

John Bell Treaty's "Operations Manager" get's another Master Default Order...

MASTER DEFAULT ORDERS (9 items; numbers 79 - 87)

79. O&G 6E-0277265: Enforcement action against Bell, John F., Sole Proprietor, Glade Operating Co. (307603) for violation of Statewide Rules on the McGeorge (06690) Lease, Well Nos. 4 and 5, and the Willis, Lillie (07765) Lease, Well Nos. 1, 2, 3, 4 and 5, East Texas Field, Gregg County, Texas; Violation of 16 TAC §§3.3, 3.8(d)(1), 3.13(b)(1)(B), 3.14(b)(2) and 3.21(i).

http://www.rrc.state.tx.us/media/24282/agenda-october-14-2014.pdf

The same John Bell that has apparently ripped off Heritage Oil... These guys are all thieves that get involved with Treaty.

The theft case against John Bell...

https://docs.google.com/file/d/0B8fPIL-cKPM-VUx5SUNqV3ltNjQ/edit

Looks as though John Bell, Treaty's "operations manager", has refused to sign off on his deposition in his theft case with Heritage Oil... That would be a move made by a guilty person.

https://docs.google.com/file/d/0B8fPIL-cKPM-cmNUVHpudVhldkk/edit

Paul Henley Judgment and another P-5 with a TNR 91.114 flag on it with his and John Bells name on it...

Judgment for $295,821.70... Seems some retirement money went somewhere it wasn't supposed too...

https://docs.google.com/file/d/0B8fPIL-cKPM-WUZTVVAzcC1zQTA/edit

HP Operating Here

And another two delinquent P-5's connected to Inspire. All 3 have TNR 91.114 Flags on them...

Glade Operating Here ( John Bell)

Extreme Operating Here (Heritage Oil)

As of 9-8-2014 Non- of the issues with these Operators have been resolved... In fact there are many, many more TRRC regulatory issues that have been added by the TRRC...

Treaty also has serious TRRC compliance issues.

Proof...

Master Default Order for Non-compliance...

http://www.rrc.state.tx.us/media/9562/12-04-12-mdo.pdf

TRRC order to plug 8 wells on the McComas lease. All the wells in this order have now been plugged by the State of Texas.

https://docs.google.com/file/d/0B8fPIL-cKPM-dmVRWXota1d1eXM/edit

Treaty's new and the second Master Default Order...

Treaty didn't bother to show up for this one either...

http://www.rrc.state.tx.us/media/9554/01-07-14-mdo.pdf

The violations...

http://www.rrc.state.tx.us/media/15648/7b-82750-def.pdf

Turns out the February 14th "Newsletter" about the McComas Hearing was complete bullshit just as suspected...

The only thing true was that Sean Douglas and a lawyer was at the hearing and apparently didn't have a clue. The hearing was for Treaty to show cause of a good faith claim to having a valid lease on the McComas. Treaty tried to claim they had a lease and wanted to transfer it to another entity. The McComas landowner said otherwise and proved they did not. People attending said both Douglas and Treaty's lawyer were disaster representatives and were ill prepared. There was nothing in the hearing about the Barnes lease said and there was NO AGREEMENT with anybody.

The next step in the process will be a "proposal for decision" for the commissioners to rule on written up by the TRRC enforcement attorneys.

Looks like Treaty lied again and will not be compliant until they can get past all the plugging and damage issues on both the Barnes and McComas leases.

Next to little to nothing ever turns out to be true when it come to Treaty. Treaty's nothing but a bullshitting share selling scam and will say anything to keep investors on the hook...

As of 8-31-2014 none of the claims by Treaty of any sort of compliance with the TRRC have been even remotely true.

Investors should be furious with all the misleading information and down right lies by Treaty Energy...

For Treaty to bring C&C Petroleum back into compliance like Treaty has promised they would a dozen times over the last 2 years, they need to...

Reimburse the State of Texas for plugging the 8 wells on the McComas lease. That's estimated by the State at $94,062.00 and could be more if they ran into problems.

Plug the remaining wells on the Barnes lease that includes the mine well and estimated at $60,000.00 plus the $70,000 in damages and mess left to the surface when Treaty abandoned the lease. Treaty has run out of time to do this... The State of Texas is scheduled to plug them next month. Guess Treaty will need to reimburse the State for these too...

Pay lease fee's of $21,000.00.

Pay the Master Default Order fines of $26,000.00.

Bring into compliance or plug 8 other wells on the leases under C&C for a estimate of $45,000.00

Treaty must also deal with the current 25 Severance issues with the 6 leases under C&C Petroleum... That's 25 Severance issues.

Treaty has done virtually NOTHING to bring C&C Petroleum back into compliance. Treaty has been LYING to investors for years concerning the issues with the TRRC and Lying to the TRRC and they are not amused.

These total $316,062.00

Time estimate... Forever.

The State of Texas will be coming for Treaty Energy soon...

These are all FACTS...That can be found on the TRRC website and that I have post links to and screenshots of many, many times some of which are in this post...

This is how Bruce Gwyn the former President of Treaty Energy conducts "business"... (Resigned March 24th 2014 and now a "consultant")

A Metairie-based futures fund manager was suspended and his two companies permanently banned from the U.S. futures industry after allegations he misled investors, the regulatory National Futures Association said Friday.

Bruce A. Gwyn, of Metairie, the two firms' former principal, agreed to a seven-year withdrawal from membership in the National Futures Association, authorities said. His companies, Level III Management LLC and Level III Trading LLC, were barred.

The action came after the National Futures Association alleged that Gwyn willfully misled investors, including New Orleans area residents, by exaggerating the fund's value by the millions and using fund profits for personal expenses. Investors put their money in Level III Trading Partners LP, the commodity pool that the management firm operated.

The National Futures Association is a Chicago-based regulatory agency for the U.S. futures industry. Membership is necessary to conduct business on U.S. futures exchanges.

Gwyn could not immediately be reached for comment Friday. The NFA's decision says that Gwyn and his companies agreed to withdraw without admitting or denying any of the allegations.

According to the complaint, Gwyn told investors that the fund was valued at $1.7 million in December 2011 and $3.7 million in February 2012. The NFA said that in fact, the fund was invested in over-the-counter penny stocks worth at most $200,000 and stock in private companies that was worthless.

Gwyn used more than $200,000 from the fund on personal expenses including food, gas and spa services, according to the complaint.

National Futures Association also noted transfers to Gwyn's personal account that occurred soon after deposits came into the fund. For example, on Dec. 21, 2011, the fund received a wire for $44,000 from Alpine Securities Corp., a firm that held some of the fund's investments, the complaint alleges.

The next day, the fund transferred $44,000 to Gwyn's personal bank account, according to the complaint.

The remaining assets were in stock in privately held companies that "supposedly included oil and energy companies, a management company for businesses that own and operate specialty retail meat stores, and an entertainment production company that booked magic shows," the complaint says.

The report continues: "L3M and Gwyn failed to provide NFA with any current bank statements or other supporting documents from independent sources to demonstrate that the fund was actually invested in the above companies in 2011, and, if so, what the value of these investments were." The National Futures Association decided that those interests had no market value, despite the fund reporting the value at $650,000.

Gwyn would be required to pay a $50,000 fine before applying for membership after the seven-year disbarment.

Gwyn is listed as president, chief operating officer and director of New Orleans-based Treaty Energy Corp on the company's website. A message left at the company's office late Friday was not immediately returned.

He was also listed as a director of Axiom Global Properties, the New Orleans-based company that once operated under the name Orpheum Property Inc. and owned the shuttered Orpheum Theater. Disgruntled investors in that venture wrested control of the property in court last year and put it up for sale. A phone number listed on Axiom's website was disconnected Friday.

http://www.nola.com/business/index.ssf/2014/02/metairie_commodity_fund_manage.html#cmpid=nwsltrhead?_wcsid=01C1CA27A5E9FDF25DDFA9AA5EB135A4BE9FB61161E00C691B89DE01E74AF513

NFA...

http://www.nfa.futures.org/basicnet/Case.aspx?entityid=0190801&case=13BCC00007&contrib=NFA

Then to top the NFA stuff all off Bruce Gwyn refuses to pay his lawyer...

More problems for Bruce Gwyn. Breach of contract.

Of course...

GRETNA – An Illinois-based financial services law firm is suing a Metairie man it claims did not pay him for services his business provided in representing him in a business complaint.

Peter J. Berman Ltd. filed suit against Bruce A. Gwyn in the 24th Judicial District Court on Feb. 26.

Peter J. Berman Ltd. alleges it was contracted by Gwyn to represent him in a complaint that was filed against him by the Business Conduct Committee of the National Futures Association. The plaintiff clams he provided a letter to the defendant explaining the fee and cost structure of their agreement and that the defendant never complained about the services that were provided to him. Despite providing legal representation to Gwyn that eventually resulted in a settlement that resolved the business complaint, Peter J. Berman Ltd. claims it was never paid the contracted fees owed.

The defendant is accused of failing to fulfill all his obligations, breaching the representation agreement and violating state law.

Damages in the amount of $179,828.79 is sought by the plaintiff.

Peter J. Berman Ltd. is represented by Thomas A. Roberts of New Olreans-based Barrasso, Usdin, Kupperman, Freeman & Sarver LLC.

The case has been assigned to Division E Judge John J. Molaison Jr.

Case no. 735-908.

Sounds just like Treaty Energy doesn't it! LOL!!!

http://louisianarecord.com/news/259546-financial-service-attorney-sues-client-for-allegedly-not-paying-179k-for-representation

All investors and potential investors in Treaty should read this... Particularly paragraphs 12,13,14,15 and 18...

Gwyn apparently has misappropriated and used for his own expenses from these "funds" that he was managing more that $200,000.00 bucks.

http://www.nfa.futures.org/basicnet/CaseDocument.aspx?seqnum=3322

On June 12, 2013, NFA issued a Complaint charging L3M and Gwyn with willfully providing incomplete and misleading information to pool participants; failing to observe high standards of commercial honor and just and equitable principles of trade; and providing misleading information to NFA. The Complaint also charged L3M with failing to file a disclosure document or annual financial statement for the fund with NFA; failing to furnish participants in the fund with a financial statement; and failing to comply with CPO quarterly reporting requirements. Finally, the Complaint charged L3M, L3T and Gwyn with failing to cooperate with NFA

http://www.nfa.futures.org/basicnet/Case.aspx?entityid=0190801&case=13BCC00007&contrib=NFA

That's what the NFA has concluded. It's all right here...

http://www.nfa.futures.org/basicnet/CaseDocument.aspx?seqnum=3322

And the NFA has already taken action...

NOTICE OF MEMBER RESPONSIBILITY ACTION AND ASSOCIATE RESPONSIBILITY ACTION:

On June 12, 2012, NFA issued a Member Responsibility Action ("MRA") against Level III Management LLC ("L3M") and Level III Trading LLC ("L3T")and an Associate Responsibility Action ("ARA") against Bruce A. Gwyn ("Gwyn") whereby:

1. L3M, L3T and Gwyn are suspended from NFA membership and associate membership, respectively, effective immediately and until further notice;

2. L3M, L3T and Gwyn, and any person acting on behalf of L3M and L3T, are prohibited from soliciting or accepting any funds from customers, pool participants or investors, soliciting investments for any managed accounts, pools or other investment vehicles, including the Level III Trading Partners LP ("L3LP" or "the Fund"); or placing any trades, except liquidation trades in L3LP or any other customer account or fund over which L3M, L3T and Gwyn exercise control;

3. L3M, L3T and Gwyn, and any person acting on behalf of L3M and L3T, are prohibited from disbursing or transferring any funds over which they or any person acting on their behalf exercises control (including bank, trading and other types of accounts), without prior approval from NFA; and

4. L3M, L3T and Gwyn are required to provide copies of this MRA/ARA by overnight courier or e-mail to all: a) customers; b) participants in L3LP; c) other investors; and d) banks, brokerage firms, and other financial institutions with which money, securities or other property is on deposit in the name of L3M, L3T, L3LP, or Gwyn or over which L3M, L3T, L3LP or Gwyn exercise control.

This action is effective immediately and deemed necessary to protect customers of L3M and L3T since L3M and Gwyn have misappropriated L3LP's funds and misled customers regarding the value of their investments in L3LP by providing customers with false and misleading performance information about those investments. Moreover, L3M and Gwyn appear to have acted in a manner that placed Gwyn's interests above the interests of his customers by knowingly investing the pool participants' assets in several investment ventures without adequately disclosing the investments' risky nature and Gwyn's relationship to them. In addition, L3M and Gwyn have not provided certain L3M customers with a current disclosure document ("DD") approved by NFA that adequately discusses the true nature of the Fund's investments. Lastly, L3M and Gwyn have failed to cooperate with NFA's investigation because they have refused to make Gwyn available in person to answer NFA's questions about L3M's and L3T's activities, and Gwyn and L3M have failed to produce requested records regarding the Fund's riskiest investments (i.e., all supporting documents for the Fund's asset balances).

The MRA and ARA will remain in effect until such time as L3M, L3T and Gwyn have demonstrated to the satisfaction of NFA that they are in complete compliance with all NFA Requirements.

Andrew Reid barred from working as a broker by FINRA...

https://docs.google.com/file/d/0B8fPIL-cKPM-ZHZfaV9KSWVEQUE/edit

The Financial Industry Regulatory Authority's database indicates that Reid is no stranger to securities fraud.

In 2002, while working for Williams Financial Group in Dallas, Reid took a $10,090.58 check from a customer and deposited it in his own account rather than forwarding it to the firm. When Reid failed to respond, the National Association of Securities Dealers barred him from association with any member firm.

In 2004, Reid was accused of unsuitable trading and investing, fraud, negligence and violating state and federal securities regulations that caused $6 million in damage to investors. After arbitration, the case was settled in 2006 for $35,000.

In 2003, Reid's employer, Corporate Securities Group, filed a complaint alleging "unsuitable investment" in municipal bonds that caused more than $100,000 of damage. Arbitration is pending.

In 2001, while working for First Allied Securities in San Diego, Reid was accused of having an unexplained debit balance of $60,321.09. The case was settled for $290.

In 2001, GMS Group of New Jersey accused Reid, who worked for the firm, of making "unsuitable recommendations, misrepresentations and breach of contract in connection with their investments in certain high yield corporate debt and other securities" resulting in damages of $200,000. The case was settled in arbitration for $106,275.

http://www.nola.com/business/index.ssf/2010/12/new_orleans_newest_public_comp.html

Judgment against Andrew Reid for breach of contract and for $206,798.93 bucks. And he didn't bother to show up for court.

https://docs.google.com/file/d/0B8fPIL-cKPM-U2QtOW11ZF81cU0/edit

Treaty's History of Fake Oil....

Looks like Treaty was salting the Barns lease.

And Jakobot (US Fuels) tried to pull a fast one with the TRRC... Looks a lot like fraud to me...

..

Here's the Proposal for Decision and the Statement of the case. The Supersede was not allowed...

http://www.rrc.state.tx.us/media/9908/7b-80369-mrc.pdf

..

Bruce A. Gwyn and Lee C. Schlesinger banned from doing business in Texas in the oil and gas business.

9. As a person in a position of ownership or control of respondent at the time respondent violated Commission rules related to safety and the control of pollution, Bruce A. Gwyn, and any other organization in which he may hold a position of ownership or control, shall be subject to the restrictions of Texas Natural Resource Code Section 91.114(a)(2) for a period of no more than seven years from the date the order entered in this matter becomes final, or until the conditions that constituted the violations herein are corrected or are being corrected in accordance with a schedule to which the Commission and the organization have agreed; and all administrative, civil, and criminal penalties and all cleanup and plugging costs incurred by the State relating to those conditions are paid or are being paid in accordance with a schedule to which the Commission and the organization have agreed,

whichever is earlier.

10. As a person in a position of ownership or control of respondent at the time respondent violated Commission rules related to safety and the control of pollution, Lee C. Schlesinger, II, and any other organization in which he may hold a position of ownership or control, shall be subject to the restrictions of Texas Natural Resource Code Section 91.114(a)(2) for a period of no more than seven years from the date the order entered in this matter becomes final, or until the conditions that constituted the violations herein are corrected or are being

corrected in accordance with a schedule to which the Commission and the organization have agreed; and all administrative, civil, and criminal penalties and all cleanup and plugging costs incurred by the State relating to those conditions are paid or are being paid in accordance with a schedule to which the Commission and the organization have agreed, whichever is earlier.

http://www.rrc.state.tx.us/media/15648/7b-82750-def.pdf

What is Texas Natural Resource Code Section 91.114(a)(2)?

Oil & Gas Division

General Information about Enforcement Orders and Natural Resources Code §91.114

Texas Natural Resources Code §91.114 contains provisions that apply to operators who have violated a statute or commission rule related to safety or the prevention/control of pollution. For purposes of this statute, a “violation” means that a commission order or court ruling has been issued in a matter following notice and opportunity for hearing, and that order or ruling has become final and all appeals have been exhausted. An order in such a matter is commonly referred to as an “Enforcement Order”.

In simplified terms, the statute applies when an Enforcement Order has been issued and the operator has not complied with that order. In that event, the statute prohibits the commission from accepting Organization Report renewals (Form P-5), certain permit applications (including Drilling Permits among others) and requests for Certifications of Compliance and Transportation Authority (Form P-4) for any wells it may operate. The statute also applies to the individuals in control of the company: any other companies controlled by a tagged person are similarly barred from filing with the Commission. Because an “Active” organization report is required for a company to conduct operations subject to the commission’s jurisdiction, the restrictions imposed by §91.114 effectively bar that company (and those who control it) from continuing those activities beyond the current P-5 year.

http://www.rrc.state.tx.us/oil-gas/compliance-enforcement/enforcement-activities/91114-general-information/

Then there is Belize!!

PM says Treaty Oil lied about oil find

On Monday, reports from legitimate international news sources went viral with information that Treaty Energy had struck black gold or Texas tea in Beverly Hillbilly proportions. But like the defunct sitcom from the eighties, it seems that it was all just a badly written script. The news articles quoted Andrew Reid, co-chief executive chairman of Treaty Energy who claimed that the they have found about six million barrels of untapped oil near Independence Village in the Stann Creek District. Today the Prime Minister said that it’s simply not true. And as a matter of fact, the Chief Geologist couldn’t find a wet rock.

Dean Barrow

http://belizenews.com/

No oil in Belize.

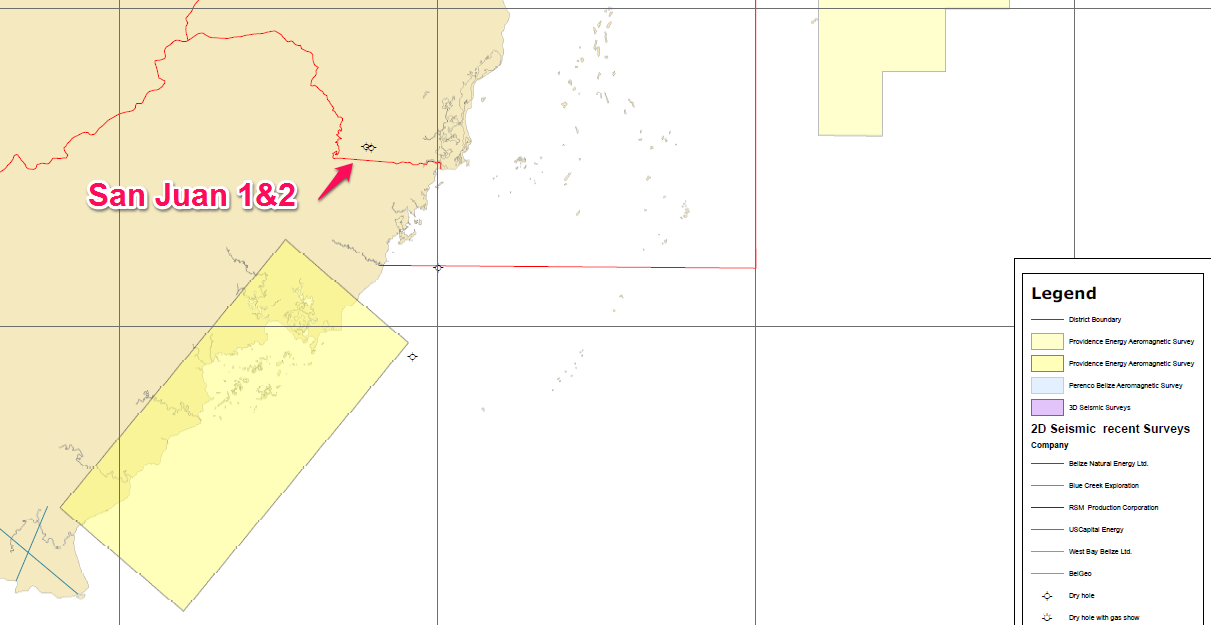

New Belize Map out dated June 2013... It shows San Juan well 1 & 2 as "dry holes"... Not even dry hole with gas or oil shows but a "dry hole"...

Treaty calling them not commercially viably is very misleading. Calling them that would imply that some oil was found. The TRUTH is that NO oil was found... NOTHING.

http://estpu.gov.bz/images/GPD/Geophysical/Seismic%20Aeromagnetic%20Surveys%20and%20Wells%20Drilled%20in%20Belize%202000%20-%202013.pdf

It also does not show the Aeromagnetic Survey that Treaty started to do. That is likely because it was never completed.

Screen shot below...

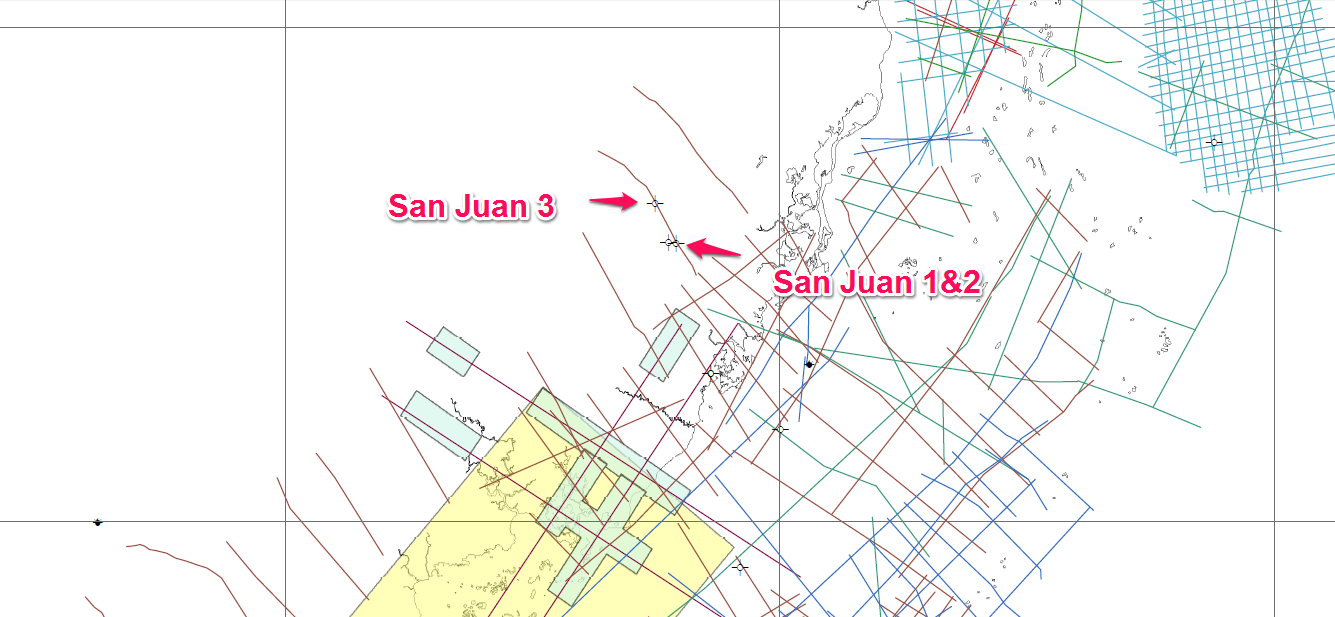

Another map showing all the wells drilled in Belize. There have been some wells with oil shows to the South and West of Treaty's concession. But nowhere near where Treaty is drilling.

Treaty is drilling in the wrong area...

San Juan 3 is another dry hole as shown in this recently updated map from the Belize Geology and Petroleum Department, the same as 1&2 which are only a mile to the south. Like I have said before Treaty went in the WRONG direction in choosing the drilling site for San Juan 3.

No oil in San Juan 3...

http://estpu.gov.bz/images/GPD/Geophysical/Seismic%20Aeromagnetic%20Surveys%20and%20Wells%20Drilled%20in%20Belize.pdf

Screen Shot Below...

That brings something else to mind... How in the heck does Treaty get a claim of 6 million barrels from a dry hole???

It looks as if the whole Belize thing is nothing but a ruse to sell shares.

Wonder what the SEC thinks of this PR about a dry hole??

Our internal analysis indicates that the Stann Creek Field covers an area of around 350 acres, and with 4-acre spacing we would expect to drill up to 90 wells in this oil field. Based on our initial findings, we estimate there are about 5,000,000-6,000,000 Barrels of recoverable oil in place in this first finding."

http://ih.advfn.com/p.php?pid=nmona&article=50943326

All complete Treaty BS...

And how does Treaty report in a 8-K a "pay zone" in a dry hole???

Treaty Energy Corporation (“Treaty” or the “Company”) today reported drilling success on its first oil well, San Juan #2, in Belize, Central America. Treaty reached the initial pay zone of 1235 to 1290 feet and found hydrocarbons at this depth.

http://www.sec.gov/Archives/edgar/data/1075773/000135448812000365/teco_8k.htm

More Treaty BS...

The Belize Geology and Petroleum Department says the well was a dry hole without ANY gas or oil shows. Soooo it now appears that Treaty was in fact very misleading in reporting the findings in Belize and that the Belize Geology and Petroleum Department was the reality...

Fake Belize Oil Strike in the News...

http://www.youtube.com/watch?v=NbkQouLFmuM&feature=youtu.be

http://www.youtube.com/watch?feature=player_embedded&v=SqXNtQJFg84

http://www.upstreamonline.com/live/article1231931.ece

Treaty's been deceiving investors, the public and the people of Belize all along Treaty has known for some time that they were going to plug San Juan 1,2 and 3.

Treaty has yet to make this info public....

http://edition.channel5belize.com/archives/93511

Belize was nothing but a show for investors.

Jeffrey Mercer VS Ron Blackburn-Treaty Energy

Check out Paragraphs 5,6, and 7 of this court filing from a former investor suing Treaty Energy to get is money back when he realized what Treaty was telling him was a load of BS...

https://docs.google.com/file/d/0B8fPIL-cKPM-YU5yUWxOT3ZhTjQ/edit

.

Treaty also makes wild claims of great things that never happen...

Proof...

Here is a list of the actual..

July 13.0 BOPD 403 Barrels For The Month

June 6.8 BOPD 204 Barrels For The Month

May 3.38 BOPD 105 Barrels For The Month

April 4.36 BOPD 131 Barrels For The Month

March 9.23 BOPD 286 Barrels For The Month

Feb. 17 BOPD 476 Barrels For The Month

Jan. 8.53 BOPD 256 Barrels For The Month

2012

Dec. 5.80 BOPD 180 Barrels For The Month

Nov. 9.83 BOPD 295 Barrels For The Month

Oct. 9.06 BOPD 281 Barrels For The Month

Sept. 9.6 BOPD 288 Barrels For The Month

Aug. 8.06 BOPD 250 Barrels For The Month

July 10.09 BOPD 313 Barrels For The Month

June 10.37 BOPD 311 Barrels For The Month

May 0.32 BOPD 10 Barrels For The Month

April 0 BOPD 0 Barrels For The Month

March 0 Treaty acquired C&C Petroleum, operator #120104

Feb 0 BOPD 0 Barrels For The Month

Jan 0 BOPD 0 Barrels For The Month

2011

C&C Petroleum Operator #120104

Production by Filing Operator

http://webapps.rrc.state.tx.us/PR/initializePublicQueriesMenuAction.do

This is what Treaty told the world and investors. All turned out to be a complete fantasy...

On 4/12/2011

"Production on these leases for the last reported month of January 2011 was 379 BBLS of sweet crude oil."

http://ih.advfn.com/p.php?pid=nmona&article=47263045

On 4/20/2011

"SHOTWELL W. F. and the SHOTWELL "C" leases.

Treaty indicated that production on these leases is currently 4.18 barrels of oil per day"

http://ih.advfn.com/p.php?pid=nmona&article=47375429

On 5/23/2011

"Mr. Reid added, "With the addition of the 8 leases announced today, I believe that Texas oil production should reach 1200 barrels in June and will grow monthly, as wells are reworked on all of our Texas leases. The goal that we have set for Treaty is to be producing at the rate of 900-1000 BOPD by the end of this year."

http://ih.advfn.com/p.php?pid=nmona&article=47788854

On 7/6/2011

"Therefore we are projecting monthly oil production for August to be about 1000 BBLS and for September to be about 1250 BBLS."

http://ih.advfn.com/p.php?pid=nmona&article=48339951

On 7/8/2011

"Stephen L. York, President and COO of Treaty Energy Corporation, stated, "With the completion of the SHOTWELL acquisition we now have 13 leases covering 1,900 acres with current production of 35-40 barrels of oil per day."

http://ih.advfn.com/p.php?pid=nmona&article=48373870

On 8/1/2011

"Mr. York commented, "These rework activities are expected to increase our oil production by 300-420 barrels per month over the next two weeks, to about 1500 to 2000 barrels per month. While our stated goal is to bring our Texas oil production to 30,000 barrels of oil per month as soon as practical, the economical steps being taken at this time are crucial to us meeting our long term goals in Texas."

http://ih.advfn.com/p.php?pid=nmona&article=48644305

On 9/8/2011

Mr. York added, "The best estimate of Texas production on the currently owned and paid for leases will be 75 to 90 barrels of oil per day after the rework of the 15 shut in wells. Our goal by the end of 2011 is to be at 200 to 350 barrels of oil per day. This production number can vary based on the number of new wells that are expected to be drilled and completed. We expect to exceed 1,000 barrels per day by the end of June 2012. At $80 per barrel, this will translate to about $29.2 million in gross revenues annually from our Texas oil production alone."

http://ih.advfn.com/p.php?pid=nmona&article=49102561

On 10/4/2011

"Our current production from 35 wells is about 50 BOPD, with production expected to be in excess of 60 BOPD by the end of October."

http://ih.advfn.com/p.php?pid=nmona&article=49409925

On 1/17/2012

"In addition, Mr. York commented, "Treaty remains on track to achieve our previously stated goal of 1000 BOPD by end of June 2012. Current production from existing wells has stabilized and with continuing work-overs we expect production to shortly increase to 1500-2000 barrels per month."

http://ih.advfn.com/p.php?pid=nmona&article=50781875

On 5/7/2012

"With drilling starting almost immediately, Treaty will endeavor to fulfill its goal of 1,000 barrels of oil per day in Texas, as stated in prior news releases."

http://ih.advfn.com/p.php?pid=nmona&article=52304074

Some other links...

1. http://investorshub.advfn.com/boards/read_msg.aspx?message_id=104452399

2. http://investorshub.advfn.com/boards/read_msg.aspx?message_id=100493666

3. http://investorshub.advfn.com/boards/read_msg.aspx?message_id=95864161

4. http://investorshub.advfn.com/boards/read_msg.aspx?message_id=95722393

5. http://investorshub.advfn.com/boards/read_msg.aspx?message_id=97676567

6. http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98096320

7. http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98096353

8. http://investorshub.advfn.com/boards/read_msg.aspx?message_id=86544706

9. http://investorshub.advfn.com/boards/read_msg.aspx?message_id=99265092

10. http://investorshub.advfn.com/boards/read_msg.aspx?message_id=99697077

..

..

..

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.