Tuesday, September 16, 2014 1:25:19 PM

Sep. 16, 2014 5:47 AM ET

About: Odyssey Marine Exploration, Inc. (OMEX)

Meson Capital Partners

Disclosure: The author is short OMEX.

http://seekingalpha.com/article/2497805-ssca-salvage-22-double-eagles-no-ingots

Summary

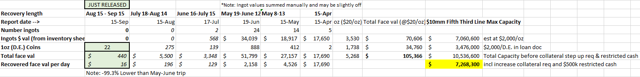

•The latest inventory sheet is now available on the SSCA Court website - total salvage was 22 double eagles, no ingots and some misc coins.

•22 Double Eagles allow OMEX to borrow $22,000 on their Fifth Third $10mm credit line, bringing the total net capacity up to $7.27mm today (net of $500k restricted cash).

•Latest salvage is -99.3% smaller vs May-June period based on bank collateral value estimate - project seems finished now.

•If treasure is sold as wholesale value in near term, could it cover the current debt?

Odyssey Marine Exploration Co (NASDAQ:OMEX)'s Odyssey Explorer is back in port and just posted is the latest inventory sheet from the last month of salvage. LINK TO INVENTORY

In total the inventory sheet is just 2 pages and includes only 22 double eagle coins and some misc other smaller coins and objects and no ingots (no "Army Gold"...). Based on the $10mm Fifth Third credit line collateral requirements - they should be able to borrow an additional $1,000 per coin or $22,000 total to finance current operations. This is approximately 1/4 of a day of cash burn at $2.5mm/month.

numbers from inventory sheets

Table of inventory sheets: total ingots and double eagles which are allowable collateral under the Fifth Third credit line (i.e. cash available immediately)

meson source

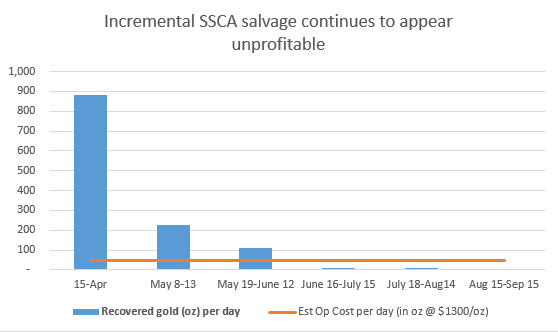

After a slight increase in the prior month July-Aug over June-July month of salvage, it appears the bones of the SS Central America have been picked pretty clean now - to OMEX's credit.

What happens now? When does OMEX get the cash?

Since April when OMEX began the salvage efforts on the SSCA, we admit that they have exceeded our initial expectations on how much they would be able to salvage and full credit to the crew working hard in the choppy seas.

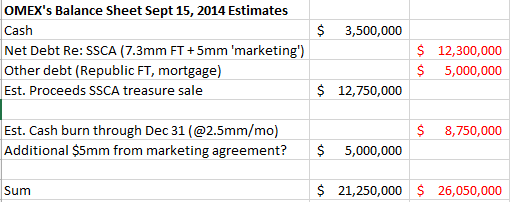

To date, OMEX has been able to borrow about $12.3mm by using the SSCA salvage as collateral: $7.3mm from Fifth Third's $10mm credit line and $5mm from the recent "Marketing Agreement" that has not been elaborated upon aside from the fact that shares of an unnamed subsidiary were granted to the lender as a closing fee.

It seems OMEX has one of two options:

1) Conserve the coins and sell over time like the SS Republic coins (which currently have $4mm of debt against the remaining coins, 10 years later): Maximize cash but over longer time.

2) Sell to a coin dealer in one package at unconserved / wholesale prices (lower price but faster cash).

At a recent investor conference, OMEX's CFO stated that they expect to be able to monetize the SSCA around the year end by selling it as one package on an unconserved / wholesale basis. Given that their debt is only a 1 year term, it seems they would need to sell it as a package this way so this makes sense.

How much could this bring in vs $12.3mm of debt?

We will leave it to the coin experts in the comments section to estimate themselves but our back of the envelope estimate, not knowing the quality of the coins exactly, seems that it will be a pretty close call to cover the debt.

Prior to the most recent inventory sheet with 275 double eagles, there was a document claiming appraised value so far was $25mm. Assuming this is a retail value and if we estimate that there has been $10mm salvaged since then that brings the potential total retail value of the SSCA package to $35mm.

Assuming a conservator & wholesaler margin of 40%, the value to sell soon as a package might be $21mm ($35mm * 40%).

$21mm gets paid first as a day rate to OMEX and then 45% of the proceeds after this. Based on $3.6mm increase in accounts receivable for work done prior to June 30 in the most recent 10Q, we estimate they are owed $6mm for their day rate as of now.

So, if the treasure sold as a package sells for $21mm cash, OMEX should get $6mm + (21-6)*45% = $12.75mm cash - which is right around their debt level (excluding the other ~$5mm of debt not linked in some way to the SSCA).

meson est balance sheet

Meson estimate of current OMEX balance sheet as of 9/15/2014 (note cash balance estimated on $5mm marketing loan - $1.5mm cash burn first 2 weeks of Sept vs last 10Q which claimed 2 months of cash left as of June 30)

Rabbits have been pulled out of hats before to OMEX's credit but this seems like a challenging situation to say the least.

Editor's Note: This article covers a stock trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Additional disclosure: Ryan Morris, President, Meson Capital, has pledged to donate his personal profits from OMEX short sales to charity. Full disclaimer at omextruth.com

http://seekingalpha.com/article/2497805-ssca-salvage-22-double-eagles-no-ingots

Recent OMEX News

- Odyssey Marine Exploration Addresses NASDAQ Compliance Matters • Business Wire • 04/19/2024 08:30:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 03/08/2024 09:31:02 PM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 02/28/2024 09:57:42 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 02/26/2024 09:40:03 PM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 02/14/2024 03:38:44 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/31/2024 09:05:22 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/31/2024 09:05:19 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/31/2024 09:05:11 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/31/2024 09:05:07 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/31/2024 09:05:06 PM

- Form SC 13G - Statement of acquisition of beneficial ownership by individuals • Edgar (US Regulatory) • 01/04/2024 06:34:14 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/21/2023 10:48:58 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/21/2023 10:45:53 PM

- Odyssey Marine Exploration Secures Strategic Debt Financing Deal • Business Wire • 12/04/2023 11:04:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 12/04/2023 10:26:29 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/04/2023 09:05:24 PM

- Odyssey Marine Exploration Addresses NASDAQ Compliance Matters • Business Wire • 11/28/2023 11:05:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 11/28/2023 10:15:53 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 10/10/2023 01:00:29 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 09/26/2023 09:50:28 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 08/14/2023 08:05:45 PM

- Odyssey Marine Exploration Announces the Departure of its Chief Financial Officer • Business Wire • 06/13/2023 12:30:00 PM

- Odyssey Marine Exploration Announces Partnership with Ocean Minerals LLC for a New Cook Islands Exploration Project • Business Wire • 06/05/2023 12:43:00 PM

VPR Brands LP Reports Record Annual Financial Performance for Fiscal Year 2023 • VPRB • Apr 19, 2024 11:24 AM

Coinllectibles' Subsidiary, Grand Town Development Limited, Acquires Rare Song Dynasty Ceramics Worth Over USD28million • COSG • Apr 18, 2024 8:03 AM

ILUS Provides Form 10-K Filing Update • ILUS • Apr 17, 2024 9:54 AM

Glucotrack Announces Expansion of Its Continuous Glucose Monitoring Technology to Epidural Glucose Monitoring • GCTK • Apr 17, 2024 8:00 AM

Maybacks Global Entertainment To Fire Up 24 New Stations in Louisiana • AHRO • Apr 16, 2024 1:30 PM

Cannabix Technologies Begins Certification of Contactless Alcohol Breathalyzer, Re-Brands product series to Breath Logix • BLOZF • Apr 16, 2024 8:52 AM