Friday, September 05, 2014 9:57:43 AM

By Anthony Ruben, Inflection Point Consulting Sep. 5, 2014 6:00 AM ET

Click For seekingalpha.com Link

Summary

As the 40-day quiet period following Synchrony Financial's July 31 IPO ends next week, expect "Buys" from several "bulge bracket" firms.

Synchrony has already increased 12% over its $23 IPO price, but could have multiple price targets of $30 or more.

Reaffirm "Buy" based on valuation and likely post-research report "pop".

Synchrony Financial (NYSE:SYF), a General Electric (NYSE:GE) split-off, had its IPO on July 31. After treading water near the IPO price of $23.00/share for several days, likely with the support of underwriters, the stock appreciated 8.7% between August 19 and 20, and now sits at $25.79, 12.1% over the IPO price.

Source: Yahoo Finance

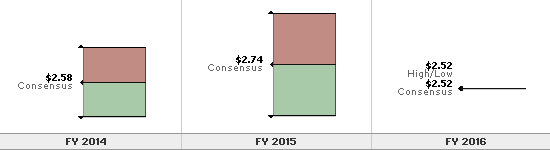

To-date, only one report and two estimates have been published. The report, from a non-underwriting firm (BTIG), is a "Buy" with a target price of $30/share.

Lead underwriters must observe, under an SEC rule, a 40-day quite period following an IPO (25 days for non-leads). As thirty-one firms, including bulge bracket investment banks such as Goldman Sachs (NYSE:GS) and JPMorgan (NYSE:JPM), were involved (and compensated) in SYF's IPO, I would expect at least five to seven detailed reports next week. In an early sign of investment banker optimism (and arbitrage on the post-IPO price appreciation), it was reported (as expected) that the overallotment option was exercised (the underwriters purchased, at the IPO price, 3.5 million shares).

Unless the stock runs up significantly prior to the reports, expect "Buys" or "Outperforms" all the way around.

Source: TDAmeritrade

If the current 2015 consensus estimate of $2.74 holds, I would expect target prices in the $31-$33 range. My original estimate was in the $29-$31 range, based on an extrapolation of trailing numbers (see my article, "Synchrony Financial: Why I Bought This GE Spin-Off").

GE has maintained it will continue to hold the 80%+ position it retains until the latter part of 2015. Current plans are for SYF shares to be swapped for GE shares (from existing shareholders) or sold on the open market. Either way, GE benefits from an appreciating SYF.

I continue to be long SYF; however, I will re-consider my holdings following the release of the reports next week.

TRUTH

I've never claimed to have all the answers but feel i'm beginning to corner the market in questions worthy of solutions.

Recent SYF News

- Synchrony Expands Dental Payment Offerings with Adit Practice Management Software Partnership • PR Newswire (US) • 04/18/2024 01:00:00 PM

- Synchrony Partners with BRP to Provide Retail Financing Options in the United States • PR Newswire (US) • 04/08/2024 01:00:00 PM

- SYNCHRONY RECOGNIZED FOR ITS PEOPLE-CENTRIC CULTURE WITH NEW COMPANY RANKING • PR Newswire (US) • 04/04/2024 12:38:00 PM

- Synchrony to Announce First Quarter 2024 Financial Results on April 24, 2024 • PR Newswire (US) • 03/26/2024 12:00:00 PM

- Skipify and Synchrony Enter into Strategic Partnership to Simplify and Enhance Online Checkout • PR Newswire (US) • 03/13/2024 01:00:00 PM

- IPH ENTERS STRATEGIC PARTNERSHIP WITH SYNCHRONY AND COMPLETES ACQUISITION OF PETS BEST • PR Newswire (US) • 03/06/2024 04:00:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/06/2024 12:30:26 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/06/2024 12:30:09 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/06/2024 12:29:56 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/06/2024 12:29:35 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/06/2024 12:29:20 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/06/2024 12:29:07 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/06/2024 12:28:56 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/06/2024 12:28:41 AM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 03/05/2024 10:24:06 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 03/05/2024 09:40:35 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 03/05/2024 09:00:31 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 03/05/2024 08:45:25 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 03/05/2024 06:52:54 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 03/05/2024 05:41:24 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 03/05/2024 01:30:44 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 03/04/2024 04:42:46 PM

- Synchrony Completes Acquisition of Ally Lending • PR Newswire (US) • 03/04/2024 01:00:00 PM

- Synchrony Dives for a Good Cause • PR Newswire (US) • 02/29/2024 10:05:00 PM

- Form CERT - Certification by an exchange approving securities for listing • Edgar (US Regulatory) • 02/23/2024 09:51:37 PM

VPR Brands LP Reports Record Annual Financial Performance for Fiscal Year 2023 • VPRB • Apr 19, 2024 11:24 AM

Coinllectibles' Subsidiary, Grand Town Development Limited, Acquires Rare Song Dynasty Ceramics Worth Over USD28million • COSG • Apr 18, 2024 8:03 AM

ILUS Provides Form 10-K Filing Update • ILUS • Apr 17, 2024 9:54 AM

Glucotrack Announces Expansion of Its Continuous Glucose Monitoring Technology to Epidural Glucose Monitoring • GCTK • Apr 17, 2024 8:00 AM

Maybacks Global Entertainment To Fire Up 24 New Stations in Louisiana • AHRO • Apr 16, 2024 1:30 PM

Cannabix Technologies Begins Certification of Contactless Alcohol Breathalyzer, Re-Brands product series to Breath Logix • BLOZF • Apr 16, 2024 8:52 AM