| Followers | 149 |

| Posts | 17888 |

| Boards Moderated | 0 |

| Alias Born | 04/12/2012 |

Monday, July 21, 2014 6:23:50 AM

Jul. 18, 2014 2:24 PM ET | Includes: AR, CHK, CNX, COG, CQP, EQT, LNG, OGZPY, RICE, RRC

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.

Summary

The explosive growth of natural gas production from the Marcellus and Utica have created regional supply surplus in the Northeast.

Given the region’s overwhelming cost advantage and vast resource base, an LNG solution appears logical.

Despite the sheer size of the currently proposed U.S. LNG capacity, the majority of the Atlantic Basin facilities are already “spoken for.”.

Demand for additional facilities may be strong.

East Coast LNG projects would make sense from the economic and public interest perspectives.

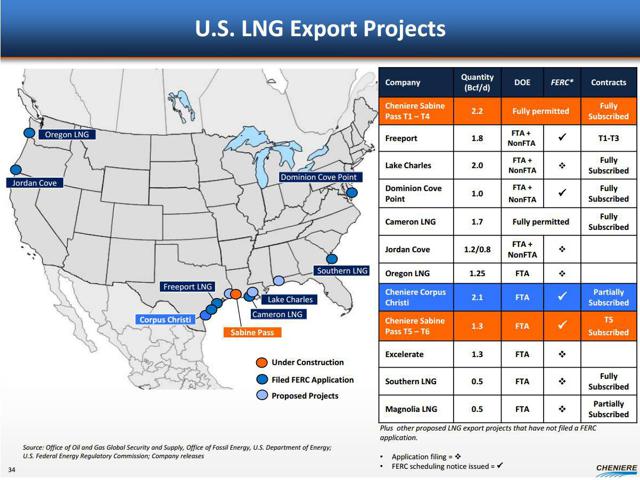

Just as recently as three years ago, the idea of U.S. LNG exports appeared to be a daring business concept that, however, seemed unlikely to materialize on a large scale. Skeptics would have to admit, the pioneers of this concept - such as Cheniere Energy (LNG, CQP) - have proven themselves correct. The U.S. LNG exports are becoming a reality a lot quicker than even optimists could anticipate. Six large Atlantic Basin LNG projects with combined export capacity of over 9 Bcf/d are either fully subscribed or are getting close to being fully subscribed. The majority of these facilities are estimated to see their first shipments during the 2016-2020 period.

(Source: Cheniere Energy, June 2014)

While permitting and construction delays are fairly common in highly complex, multi-billion dollar projects, there is less and less doubt that a large portion of the facilities that have already found subscribers will come to fruition and be in-service reasonably close to their currently indicated time frames.

U.S. LNG - Cost Advantage

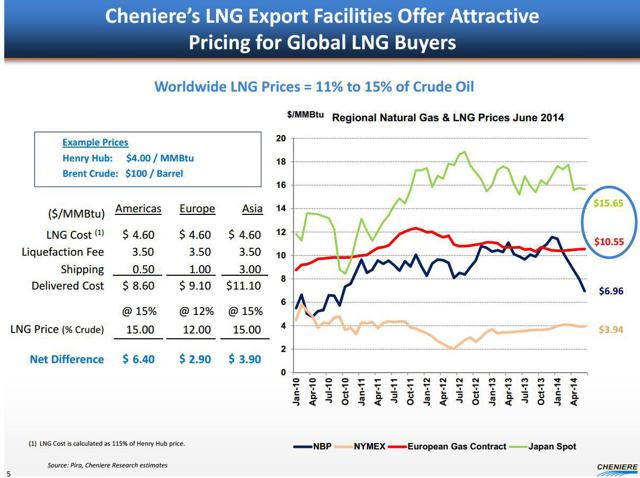

The concept of exporting natural gas from the U.S. is based on the simple thesis that the U.S. LNG can compete on the cost of supply with the majority of new LNG projects proposed elsewhere in the world and, increasingly, Gazprom's (OTCPK:OGZPY) pipeline supply to Europe. As an illustration, Cheniere often presents a comparison of current natural gas price at delivery points in key LNG-importing regions to what would be the effective price of U.S.-originated LNG based on the structure of Cheniere's contracts. The comparison shows that, at current pricing, the U.S. LNG would be the cheapest alternative.

It is important to note that the majority of the U.S. LNG export contracts are "tolling" arrangements. The customer pays the LNG operator, typically on a take-or-pay basis, for a certain amount of liquefaction capacity and pipeline access to the pipeline grid (i.e., liquid pricing points). In other words, the customer effectively buys U.S. natural gas at Henry Hub or similar benchmark and pays a fee for liquefaction and transportation.

The following slide shows a price calculation for Cheniere's LNG assuming $4.00/MMBtu Henry Hub price. Fully delivered cost to the consumer comes out at ~$11/MMBtu for deliveries in Asia, which compares to the recent Japan Spot Pricing of over $15/MMBtu. Even more impressive is the comparison versus the European Gas Contract (which is heavily influenced by the price of Gazprom's gas delivered via pipeline). The slide shows that in this specific example the U.S.-originated LNG would have a ~$1.45 cost advantage relative to the European Contract.

Some analysts argue that it would be difficult for Gazprom, for a variety of reasons, to reduce the price of its natural gas so that the price of LNG imports from the U.S. can be matched. As a result, given that Gazprom currently holds a very large market share in Europe, potential additional European demand for the U.S. LNG to displace the more expensive (and risky) pipeline imports from Russia can be significant in the future.

(Source: Cheniere Energy, June 2014)

Will LNG Exports Upset Domestic Supply/Demand Balance?

The onset of demand from LNG exports in the U.S. will coincide with the continuing demand growth from the petrochemical complex, power generation and exports to Mexico. Combined demand growth by 2020 could exceed 25%, based on my estimate. Will the confluence of these demand factors create a spike in the domestic natural gas prices towards the end of this decade?

In my opinion, there are strong reasons to believe that the U.S. natural gas industry will be able to deliver sufficient volumes to match this anticipated increase in demand without a major change in the price for natural gas. Supporting this thesis is the continuing trend towards improving natural gas drilling economics that is driven by technological innovation and operating learning curves. This powerful trend is visible not only in relatively new plays but also is continuing to bear fruit in well established dry gas producing fields, including some Tier 2 dry gas areas that are experiencing a drilling renaissance.

A year ago, many of these Tier 2 areas seemed to be priced out on the supply curve by the vastly more economic liquids-rich plays and Tier 1 dry gas sweet spots. (To explain what I mean by Tier 1 and Tier 2, Susquehanna County in the Marcellus Shale is an example of a Tier 1 area, whereas the Haynesville Shale would be an example of the Tier 2). Several factors are contributing to the trend:

Technical innovation has yielded impressive results in terms of well productivity. In fact, some former Tier 2 areas increasingly look like Tier 1. As a result, the footprint of the Tier 1 has grown substantially.

Infrastructure is often a sunk cost. Some Tier 1 areas have experienced explosive production growth and face take-away bottlenecks and reduced price realizations. Exploding basis in the Marcellus North is a vivid example. At the same time, some Tier 2 areas saw their production decline and take-away capacity become under-utilized (gathering costs, therefore, in some situations are "sunk"). As a result, once one takes into account the impact of transportation costs on net price realizations, the difference in economics between Tier 1 and Tier 2 is in some cases substantially reduced.

Redefined Regional Flows. The changing structure of inter-regional natural gas flows is a powerful market mechanism that helps to even out differences in the cost of supply between different producing areas.

The net effect of this continuing evolution of the U.S. gas industry is a much more broadly and evenly distributed competitive supply capacity. A wide range of resource plays can generate healthy returns at a relatively low natural gas price (let's call it $4.00-$4.50/MMBtu). Moreover, given that the differential in drilling economics between different supply areas has contracted, the supply response to a price signal will have a greater magnitude.

Importantly, the cost of supply in many important dry gas plays continues to decline steadily.

To appreciate the magnitude of these trends, it may be helpful to look at two specific examples.

Haynesville Shale

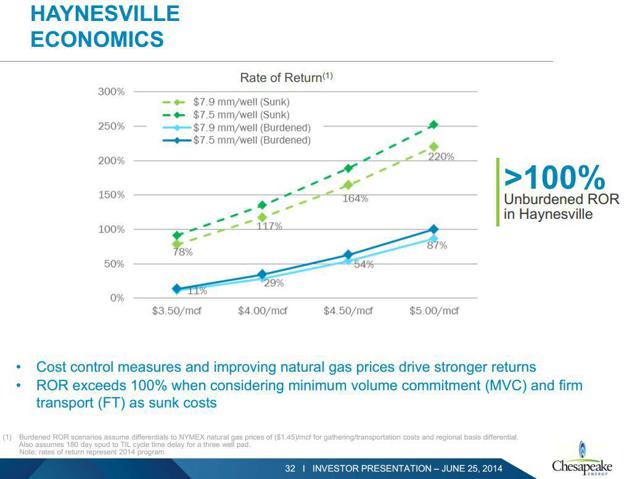

The following is a slide from Chesapeake's (NYSE:CHK) latest investor presentation that illustrates the company's drilling economics in the Haynesville Shale. The slide shows that at $4.00/MMBtu Henry Hub and assuming $7.5 million well cost, the company can generate 30%+ returns at the well level. Generally speaking, such return would be only marginally competitive in the context of Chesapeake's portfolio. However, when considering the company's minimum volume commitments and firm transport contracts in the Haynesville as sunk cost, the effective return that the company "sees" increases to well over 130%

(Source: Chesapeake Energy, July 2014)

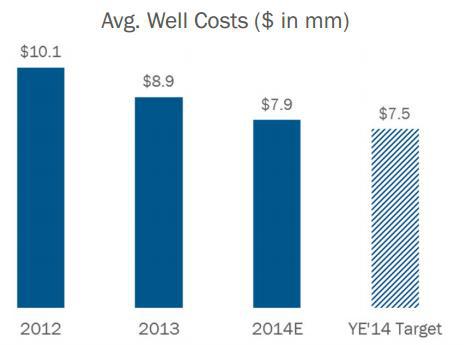

Fixed costs aside, Chesapeake has made major progress in improving the play's economics. The company estimates its average EUR in the play in 2014 at 8.9 Bcfe per well, an impressive result for the Haynesville. Even greater progress is being made on the cost side. During the first quarter, Chesapeake already achieved its 2014 cost goal of $7.5 million per well. This represents a ~25% reduction from 2012 (the graph below). The $7.5 million cost may not be the limit: the company's best well to date is $6.9 million.

(Source: Chesapeake Energy, July 2014)

All these factors come together to render the Haynesville a highly economic play for Chesapeake with effective returns exceeding some of the prominent "oily" opportunities, at least up to the point when the minimum throughput commitments are satisfied. Of note, the Haynesville will likely remain a Tier 2 play in terms of its competitive position on the cost of supply curve.

As one would expect, Chesapeake has resumed an active drilling operation in the play and plans to run 7 to 9 operated rigs this year. This compares to just two rigs that the company operated a year ago.

Marcellus South

The southern portion of the Marcellus trend is an example of a dry gas sweet spot that has transitioned from Tier 2 to Tier 1.

Below are several bullet points from Rice Energy's (NYSE:RICE) most recent investor presentation with regard to well productivity in the Southern Marcellus:

Marcellus productivity per rig skyrockets

Producing wells have exhibited strong production profiles on track to recover 15-20 Bcf

Rice reached 300 MMcf/d of gross operated production with 41 wells

Within a localized geologic area, performance variability is mostly attributable to operator execution; not rock quality

Marcellus wells have IP'd at over 35 MMcf/d

Utica Core wells coming online stronger than Marcellus Cores

While Rice's wells still lag Cabot's (NYSE:COG) wells in Susquehanna County in terms of productivity per foot (1.9 Bcf versus 3.5 Bcf, respectively, per 1,000 feet of lateral length), well productivity in South Marcellus is spectacular in absolute terms and drilling economics are very strong at $4.00/MMBtu gas price.

The most important aspect of the South Marcellus dry gas sweet spot is its sheer size: the prolific area includes hundreds of thousands acres in Pennsylvania and West Virginia.

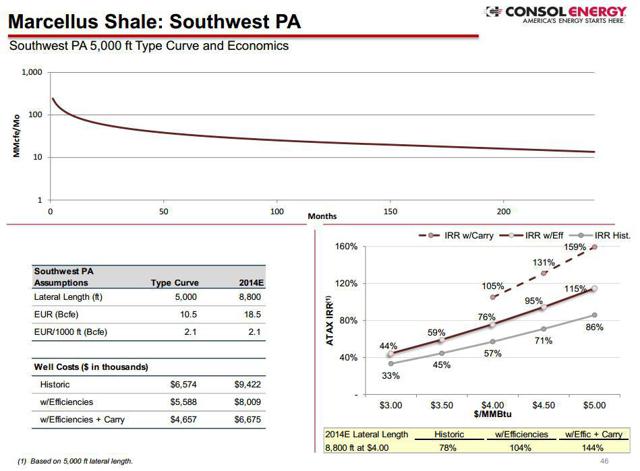

Rice is not the only operator reporting exceptionally strong drilling results in the Marcellus South. The 1.8-2.5 Bcf/1,000' metric is confirmed in presentations by EQT Corporation (NYSE:EQT), Antero Resources (NYSE:AR), Consol Energy (NYSE:CNX) and Range Resources (NYSE:RRC). Consol, for example, expects average EUR of 18.5 Bcf per well on its Southwest Pennsylvania acreage in 2014. All these operators hold very large dry gas positions in the Marcellus South.

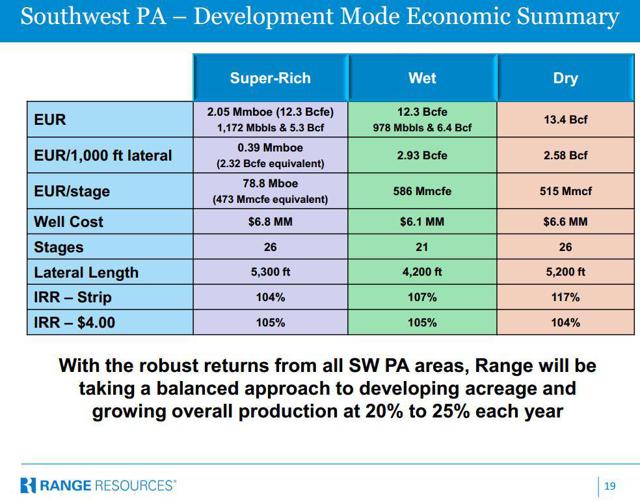

Below are slides from Range and Consol that show results similar to Rice's. Of note, the slides indicate drilling IRRs in the 50%-100% range at $4.00/MMBtu gas price.

(Range Resources: July 2014)

(Source: Consol Energy, June 2014)

I should note that dry gas areas in the Marcellus South typically lag behind the adjacent wet gas and super-rich areas in terms of their drilling returns. However, the entire sweet spot - wet and dry - is capable of producing very compelling returns. Take-away capacity remains the primary limiting factor to an even faster growth.

Vast Low-Cost Supply Base

The key point of the above discussion is that the competitiveness of the U.S. LNG takes its roots in the technological revolution that is still continuing and is just in its second inning. The vast low-cost resource base already identified on the North American continent will likely get larger with time. Even assuming significant demand growth, the U.S. already has sufficient supply capacity to meet the expected demand without a step-change in price.

The bottom line, the U.S. LNG concept will continue to remain viable.

East Coast LNG Facilities Would Make Economic Sense

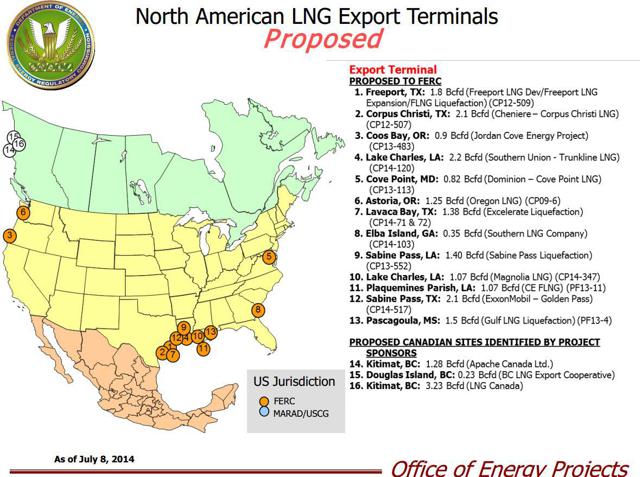

Despite the sheer size of the existing project book, the larger part of the announced LNG capacity in the U.S. that can be delivered before 2020 is already "spoken for" (particularly if one takes into account contracts that have not been announced yet - it often takes half a year or more to negotiate a long-term purchase agreement). However, given the cost advantage of the U.S. supply, there may be enough additional demand for the U.S. LNG and new projects may need to be proposed.

So far, the overwhelming majority of proposed facilities have been concentrated along the U.S. Gulf Coast (map below). This configuration reflects an antiquated picture of the nation's cost-competitive supply. The Marcellus and Utica have emerged as by far the largest and fastest growing producing area in North America and the Northeast has already become a surplus region in terms of supply/demand balance. Production in the Northeast would have grown even faster if the region could address its take-away limitations.

Truth be told, take-away solutions for the surplus production from the Northeast region do exist: the large interstate pipelines that have traditionally transported gas from the Gulf Coast and the Mid-Continent to the Northeast and Mid-Atlantic regions. With the emergence of the Marcellus "natural gas tsunami," pipeline operators have been busy reversing flows on their massive trunk lines to send Marcellus and Utica gas in the southern and western directions. Very soon, the Northeast region may be shipping its natural gas all the way to the LNG terminals on the Gulf Coast for loading on LNG carriers.

Gulf Coast terminal locations actually make some sense for shipping natural gas from the U.S. Northeast region to Asia, which is the largest and fastest growing market for LNG. However, an East Coast location would make more sense for LNG shipments to Europe. Assuming that the cost of constructing an LNG terminal in the Northeast is comparable to the Gulf Coast, savings could be substantial, both on the pipeline tariffs to the Gulf Coast and on the tanker route time to Europe. However, only one LNG terminal, Dominion's 1 Bcf/d Cove Point facility, provides a direct answer to the Marcellus & Utica production surplus.

In light of Europe's growing desire to diversify its sources of natural gas supply to reduce dependence on Gazprom, the call on the U.S. LNG may actually be much higher than previously estimated. Constructing additional facilities on the East Coast to provide an outlet to the Marcellus and Utica gas would be logical and would benefit producers and local communities in the Northeast region.

NIMBY and BANANA

The Northeast region is notorious for its high ecological sensitivity and resistance to new construction projects. The NIMBY (Not In My Back Yard) mentality in the Northeast often means BANANA (Build Absolutely Nothing Anywhere Near Anything).

While permitting uncertainties may be a serious obstacle, Dominion's Cove Point project vividly demonstrates that LNG facilities in the Northeast can be permitted and built cost-effectively and relatively quickly.

Given the strong negative impact that the existing transportation bottlenecks have on many constituencies in the Northeast - E&P operators, mineral owners, municipalities that receive lower tax receipts, reduced job creation for local communities, unproductive use of resources to reverse flows on existing pipelines that translates into higher consumer prices, etc. - building LNG export facilities on the East Coast is, in my opinion, necessitated by both the economic logic and public interest. Constructing one or two additional large-scale facilities could be justified by demand.

Industry associations may be one of the channels to educate broad public about the merits of the LNG solution for the Northeast natural gas. In reality, LNG facilities are among the cleanest from the ecologic perspective as they do not involve conversion. Multi-billion investments in LNG facilities would stimulate employment in the Northeast region (which very much needs such stimulus), creating thousands of new jobs during the three-four year construction period and hundreds permanent jobs thereafter.

East Coast LNG, which I expect to be anchored by long-term supply contracts with European gas companies, would offer Europe a cost-effective solution to its energy security challenge.

Disclaimer: Opinions expressed herein by the author are not an investment recommendation and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity. This is not an investment research report. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings, and consult a qualified investment advisor. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Editor's Note: This article discusses one or more securities that do not trade on a major exchange. Please be aware of the risks associated with these stocks.

seekingalpha.com/article/2323345-the-u-s-should-build-east-coast-lng-capacity

Recent CQP News

- Cheniere Announces Timing of First Quarter 2024 Earnings Release and Conference Call • Business Wire • 04/05/2024 12:00:00 PM

- Cheniere Energy Partners, L.P. 2023 Annual Report • Business Wire • 03/28/2024 08:30:00 PM

- Cheniere Partners Reports Fourth Quarter and Full Year 2023 Results and Introduces Full Year 2024 Distribution Guidance • Business Wire • 02/22/2024 12:30:00 PM

Coinllectibles' Subsidiary, Grand Town Development Limited, Acquires Rare Song Dynasty Ceramics Worth Over USD28million • COSG • Apr 18, 2024 8:03 AM

ILUS Provides Form 10-K Filing Update • ILUS • Apr 17, 2024 9:54 AM

Glucotrack Announces Expansion of Its Continuous Glucose Monitoring Technology to Epidural Glucose Monitoring • GCTK • Apr 17, 2024 8:00 AM

Maybacks Global Entertainment To Fire Up 24 New Stations in Louisiana • AHRO • Apr 16, 2024 1:30 PM

Cannabix Technologies Begins Certification of Contactless Alcohol Breathalyzer, Re-Brands product series to Breath Logix • BLOZF • Apr 16, 2024 8:52 AM

Kona Gold Beverages, Inc. Acquires Surge Distribution LLC from Loud Beverage Group, Inc. (LBEV) • KGKG • Apr 16, 2024 8:30 AM