Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Keep an eye on MOM.v

FDA response is pending along with developments for revenue stream.

MOM.v is active on the stockhouse board.

One PP purchaser sold their shares and the shares got absorbed fast. Now it's looking to get back up to the twenties in anticipation of various news and corporate updates.

A Silent Killer, A White Knight, And A Compelling Long Opportunity: Miraculins Inc. 2 comments

Feb 5, 2015 6:24 AM | about stocks: MCUIF

Summary

Diabetes is a 'silent killer', you can have diabetes for years without any symptoms and the only way to know for sure is to be tested

Huge market opportunity in the early detection of pre-diabetes, type 2 diabetes and coronary artery disease

Scout DS® is cleared for sale as a screen for pre-diabetes and type 2 diabetes in Canada, Mexico, and has been CE-Marked for the EU , with pre-submission documentation for de novo classification in the U.S. in process

Between $40-$50 million has already invested into the Scout DS® technology

Potential to scale quickly once marketing issues have been worked through, currently conducting pilot programs

The world is in the grip of a diabetes pandemic.

Diabetes is a serious health condition of elevated blood sugars where the body doesn't produce enough insulin to meet its needs, or the body does not respond properly to the insulin being made. Insulin is critical as it moves glucose into the body's cells from the blood. It is a disease that can have devastating complications and consequences

In human and financial terms, the burden is immense and it's now hitting the poor especially hard. Traditionally thought of as a disease of the rich, experts say the alarming rise may be fuelled as much by food scarcity and insecurity as it is by excess. New lifestyles, rapid urbanisation and cheap calories in the form of processed foods are putting more and more people at risk of developing Type-2 diabetes.

http://seekingalpha.com/instablog/27523743-po...culins-inc

Miraculins Moves Closer To Commercialization

Follow this company

Companies Mentioned

PK:MCUIF / NASDAQ:PODD / TSX.V:MOM

02/09/2015 [ACCESSWIRE]

WHITEFISH, MT / ACCESSWIRE / February 9, 2015 / Diabetes is the seventh leading cause of death in the United States with over a million new cases each year, according to the American Diabetes Association, costing the healthcare system $176 billion in direct costs and the economy $76 billion in lost productivity in 2012.

The metabolic disease is characterized by the body's inability to produce enough insulin, or more commonly, to not be able to effectively use the insulin it does produce, both of which cause elevated and damaging glucose levels in the blood. While companies like Eli Lilly & Co. (NYSE: LLY) and Novo Nordisk A/S (NYSE: NVO) provide artificial insulin to fill the void, there are no cures for diabetes that alleviate a patient's need for costly lifelong treatment. One of the best ways to prevent or slow down the onset of diabetes and its disastrous complications is to make dietary and lifestyle changes that inhibit its formation from the start.

Unfortunately, it's difficult to predict when diabetes is becoming a major risk as you can have it for years without any symptoms while it causes unseen internal damage. Pre-diabetes affects some 86 million Americans over the age of 20 (9 out of 10 are undiagnosed), but the only way to diagnose it is through invasive blood testing. Patients often delay undergoing these tests, which means that the preventable stage of the disease is often ignored and undiagnosed until it's too late and full-blown diabetes is developed requiring lifelong treatment.

The Advantages of a Non-Invasive Test

Miraculins Inc. (TSX-V: MOM) (OTC: MCUIF), a medical device company that acquires, develops and commercializes non-invasive screening tests to aid physicians in the earlier diagnosis of disease, is introducing a non-invasive diabetes screening test that takes just 90 seconds to complete. It has the potential to affect real change by making early diabetes screening easily accessible without requiring needles, blood draw, fasting, or waiting and by creating a tipping point for action, motivating patients at risk to seek medical care and attention before the disease becomes uncontrollable.

http://www.accesswire.com/viewarticle.aspx?id=425706

Pretty good article on the company by Moriarty - thanks for posting!

Scout DS® is cleared for sale as a screen for pre-diabetes and type 2 diabetes in Canada, Mexico, has been CE-Marked for the EU, with pre-submission documentation for a de novo classification in process with the FDA (1Q2015).

Miraculins holds a strong patent portfolio with multiple patents issued in the U.S., multiple pending patent applications, and patents issued/pending in Europe, Canada, India, Japan, China and Korea.

The company has proprietary encrypted algorithms and instrument standardization methods and materials.

In addition, there has been about $40-$50 million invested in the researching and developing the technology.

Compared to traditional screening methods the process of testing through traditional screening methods can be very difficult and often quite cumbersome for the person involved to the point where the tests become ineffective because people haven't followed proper procedure. Many of these tests require 8-12 hours of fasting, not to mention all alternatives to the Scout DS® are invasive (a big turn-off for those put off by needles and even less reason to be tested in the first place). Since 1 out of 4 of those with Type-2 diabetes are unaware they even have the illness, and 9 out of 10 are unaware they have pre-diabetes, therein lies the very compelling opportunity to encourage people to get tested regularly.

A Few Facts on Diabetes

Diabetes is a silent killer. It is a global pandemic and becoming a major economic problem for our society. Its impact is significant and is only getting worse each day:

•There are 387 million people with Type-2 Diabetes in the world

•World diabetes cases are expected to jump 55 percent by 2035

•Diabetes is the fastest growing disease in history, consuming a disproportionate share of healthcare budgets (over $245 billion is spent annually in the U.S., and over $612 billion is spent worldwide)

•Complications are costly and debilitating. They include: blindness, kidney disease, cardiovascular disease, nerve damage, erectile dysfunction, amputation, and death - every 7 seconds 1 person dies from diabetes)

•Loss of productivity adds significantly to the societal costs of diabetes

•Early detection by screening is key. Multiple studies have shown that with early detection and intervention, the majority of diabetes cases can be prevented

•Interventions are available, scalable, and provide enormous cost-savings

•According to United Healthcare, there is an Incremental cost of $37,000 per patient, per year resulting from the progression from pre-diabetes to diabetes

•Public health organizations, payors, and governments are launching initiatives to combat the issue

Introduction to Miraculins

Winnipeg-based Miraculins (OTC:MCUIF) (or TSX-V: MOM) is a medical device company focused on developing non-invasive diagnostic tests and risk assessment technologies that address unmet clinical needs. The company's two primary medtech programs are in the early commercialization phase in the areas of diabetes and cardiovascular disease.

The diabetes program is focused on the Scout DS® non-invasive diabetes screening test, the first non-invasive diabetes screening system designed to provide an accurate, reliable, and convenient method for diabetes screening based on related biomarkers present in the skin. The technology has previous commercial sales outside of the U.S., and Miraculins is working to continue to build momentum in the marketplace.

Miraculins cardiovascular disease program is focused on the PreVu® Non-Invasive Skin Cholesterol Point-of-Care ("POC") Test, a non-invasive tool to assist with the risk assessment of coronary artery disease ("CAD").

The introduction of new medical device technology into the marketplace is a complex and multi-faceted process that often involves long buying cycles and requires multiple pilot testing programs. These pilot programs, which allow for market feedback to be secured under controlled distribution scenarios, provide important information ahead of future commercial launches. Different market segments require different strategies and different levels of investment to successfully penetrate. This is largely where the company is at now - figuring out a marketing strategy. The technology has been developed and built, now the company needs to focus on sales and distribution in international markets, particularly Europe, Canada and Mexico, while working towards achieving FDA clearance in the U.S., and CFDA approval in China.

"No Blood, No Fasting, No Waiting" Article Written by Bob Moriarty of 321Gold.com

Excerpt from the Article:

"Their primary product is revolutionary. They own the rights to a machine that uses a frequency of light to fluoresce biomarkers in the skin to predict pre-diabetes and Type 2 diabetes. It’s totally non-invasive, no blood, no fasting, no waiting."

Full Article: http://www.321gold.com/editorials/moriarty/moriarty012615.html

"No Blood, No Fasting, No Waiting" Article Written by Bob Moriarty of 321Gold.com

Excerpt from the Article:

"Their primary product is revolutionary. They own the rights to a machine that uses a frequency of light to fluoresce biomarkers in the skin to predict pre-diabetes and Type 2 diabetes. It’s totally non-invasive, no blood, no fasting, no waiting."

Full Article: http://www.321gold.com/editorials/moriarty/moriarty012615.html

I can't understand why this comapny and it's stock hasn't really caught on in the US yet.... Seems the management always does what it says it will do and hits all their targets. Nothing but good news and more to come.... i don;t see why this stock can't hit $.50 or $1 sooner rather than later... IMHO

Alere Executes License Agreement with Miraculins for Preeclampsia Technology

Here is a link to the news release on Miraculins web-site:

http://www.miraculins.com/press_releases.aspx?id=167

Good luck to all,

Sunpillar

Hey Stock,

Thanks for the post, and welcome to the Miraculins board (and I am so glad to not be just talking to myself here anymore LOL)

Yes, you are correct that there has been much good news lately. The Alere announcement today is a very big step, and should hopefully mean ongoing revenues at some point in the future, a very important thing. It seems that this company is slowly but surely transforming itself into a revenue making entity, from a money consuming one.

This company just keeps setting and meeting goals. I have been very impressed by the management ever since I stumbled across this venture a few years ago. They just keep delivering on their promises.

Good luck and welcome aboard,

Sunpillar

Seems like a lot of goods new lately.. growing large in all Canada drug stores.... Sells as MCUIF in US..... This thing can pop soon IMHO.

Finally, here is a link to a recent news release from Miraculins, highlighting the fact that Alere has chosen to renew their final 6-month option period for testing Miraculins biomarkers.

Alere Secures Final Option Period on Miraculins Preeclampsia Technology

Here is a link to a video clip, from a program called "The Next Biggest Winner". They did a segment on Miraculins a few months ago..

Here it is:

www.thenextbiggestwinner.com/miraculins/

Miraculins lead product currently is Prevu. It is a skin cholesterol test that is performed on the palm of your hand..

Here is a link to the products web-site:

prevu website

First post for this new board!

Watch the video on the company shown in the ibox if you have a chance, it is very well done. Is anyone here on iHub following this company at all, or invested in it?

Cheers,

Sunpillar.

|

Followers

|

3

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

19

|

|

Created

|

07/14/12

|

Type

|

Free

|

| Moderators | |||

Summary

The world is in the grip of a diabetes pandemic.

Diabetes is a serious health condition of elevated blood sugars where the body doesn't produce enough insulin to meet its needs, or the body does not respond properly to the insulin being made. Insulin is critical as it moves glucose into the body's cells from the blood. It is a disease that can have devastating complications and consequences

In human and financial terms, the burden is immense and it's now hitting the poor especially hard. Traditionally thought of as a disease of the rich, experts say the alarming rise may be fuelled as much by food scarcity and insecurity as it is by excess. New lifestyles, rapid urbanisation and cheap calories in the form of processed foods are putting more and more people at risk of developing Type-2 diabetes.

When is the last time YOU got checked out?

TABLE OF CONTENTS

1) Introduction to Miraculins

2) A Few Facts On Diabetes

3) What Is The Scout DS®?

4) The Science Behind the Machine

5) Clinical Trials

6) Regulatory Clearances and IP portfolio

7) Revenue Model

9) U.S. Market Potential

10) China Opportunity

11) PreVu® Skin Cholesterol Test

12) Financials/Share Structure

13) Risks

14) Conclusion

INTRODUCTION TO MIRACULINS

Winnipeg-based Miraculins (OTC:MCUIF) (or TSX-V: MOM) is a medical device company focused on developing non-invasive diagnostic tests and risk assessment technologies that address unmet clinical needs. The company's two primary medtech programs are in the early commercialization phase in the areas of diabetes and cardiovascular disease.

The diabetes program is focused on the Scout DS® non-invasive diabetes screening test, the first non-invasive diabetes screening system designed to provide an accurate, reliable, and convenient method for diabetes screening based on related biomarkers present in the skin. The technology has previous commercial sales outside of the U.S., and Miraculins is working to continue to build momentum in the marketplace.

Miraculins cardiovascular disease program is focused on the PreVu® Non-Invasive Skin Cholesterol Point-of-Care ("POC") Test, a non-invasive tool to assist with the risk assessment of coronary artery disease ("CAD").

The introduction of new medical device technology into the marketplace is a complex and multi-faceted process that often involves long buying cycles and requires multiple pilot testing programs. These pilot programs, which allow for market feedback to be secured under controlled distribution scenarios, provide important information ahead of future commercial launches. Different market segments require different strategies and different levels of investment to successfully penetrate. This is largely where the company is at now - figuring out a marketing strategy. The technology has been developed and built, now the company needs to focus on sales and distribution in international markets, particularly Europe, Canada and Mexico, while working towards achieving FDA clearance in the U.S., and CFDA approval in China.

In this article I will discuss the technology in-depth, as well as potential marketplaces, the business plan, what management needs to focus on, and how investors are presented with a compelling risk/reward opportunity.

A FEW FACTS ON DIABETES

Diabetes is a silent killer. It is a global pandemic and becoming a major economic problem for our society. Its impact is significant and is only getting worse each day:

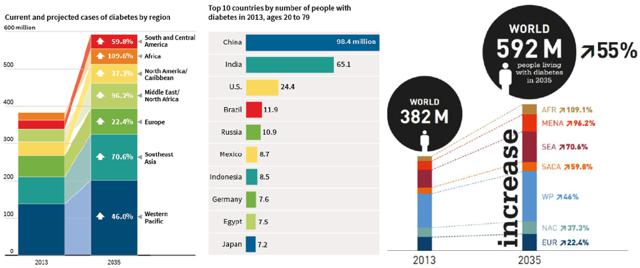

Figure 1: Diabetes Metrics(click to enlarge)

Source: International Diabetes Federation

WHAT IS THE SCOUT DS®?

The Scout DS® is a "sensitive, non-invasive, non-fasting, rapid diabetes screening device that enables opportunistic, cost effective, screening for Pre-Diabetes and Type 2 Diabetes."

Video from Global News:

The Scout DS® is the only diabetes screening device that is non-invasive, does not require fasting, offers high-sensitivity, and delivers immediate results at point-of-care. A recent report on the non-invasive diagnostics market by Veracity Health predicted that the value of the diagnostic testing for cancer alone will grow from $186.8-million to $6.2-billion by 2020 - a CAGR of 65%.

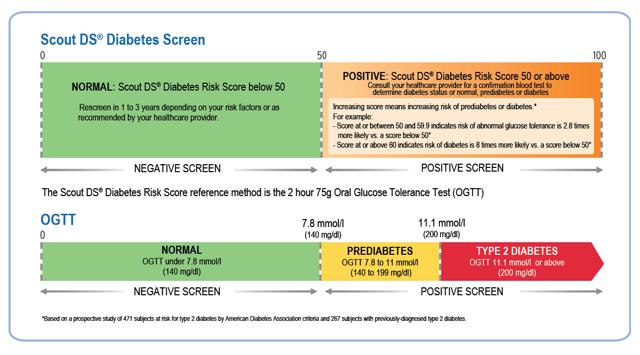

Figure 2: Scout DS® Comparison to Traditional Screening Methods

Source: Company Presentation

The process of testing through traditional screening methods can be very difficult and often quite cumbersome for the person involved to the point where the tests become ineffective because people haven't followed proper procedure. Many of these tests require 8-12 hours of fasting, not to mention all alternatives to the Scout DS® are invasive (a big turn-off for those put off by needles and even less reason to be tested in the first place). Since 1 out of 4 of those with Type-2 diabetes are unaware they even have the illness, and 9 out of 10 are unaware they have pre-diabetes, therein lies the very compelling opportunity to encourage people to get tested regularly.

THE SCIENCE BEHIND THE MACHINE

The technology behind the Scout DS® is based on identifying diabetes related biomarkers in the skin using skin fluorescence spectroscopy.

It's known that Advanced Glycation End Products (AGEs) are in everyone's skin. AGEs are proteins with sugar molecules attached to them that form as we age, but there are more of them present when we can't process blood sugars properly. As a result they are hyper-expressed when one has prediabetes or type 2 diabetes. The AGEs - and other biomarkers the Scout DS® uniquely detects and measures - fluoresce when excited by specific light waves emitted by the device, and this is then captured by the device's sophisticated sensor apparatus and its camera.

The Scout DS® then generates a numerical result after running more than 200 data points collected through a complex and proprietary algorithm that determines one's level of risk for pre-diabetes or type 2 diabetes, based on all the clinical studies that have been done.

Advanced Glycation End Products (AGEs):

Biomarkers of metabolism and oxidative stress:

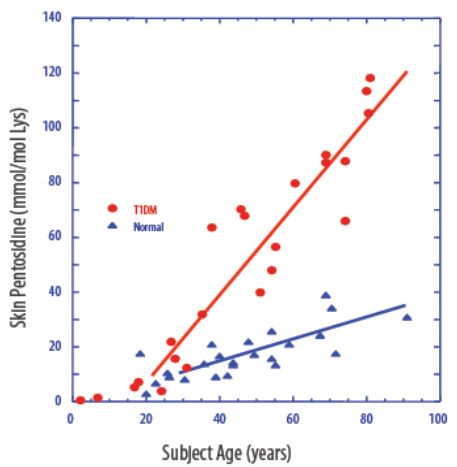

Figure 3: AGEs Elevated in Diabetics

Source: Company Presentation

The best example of an AGE may be pentosidine, which is a part of glycated collagen. When you intake food, some of the blood glucose hooks onto collagen, which has a very slow half-life (glycated collagen turns over about every 15 years, so it's quite a stable metric of glycemic results). You don't manage diabetes with this kind of test, but data suggests that it works exceptionally well for screening for diabetes. A number of variables are taken into consideration from the glycated proteins, including skin and age, the data undergoes a thorough analysis , and the device risk assesses people as either pre-diabetic, undiagnosed type-2s, or normal.

Features of the Scout DS® include:

The results have been extremely positive so far, delivering performance that is comparable to fasting plasma glucose ("FPG") and HbA1c testing for detection of abnormal glucose tolerance.

Figure 4: Interpreting Results

(click to enlarge)

Source: Company Presentation

Since August 2013 five new Scout DS® publications have appeared in peer reviewed journals. If you would like a further look at this research, here are the citations for the articles:

CLINICAL TRIALS

The Scout DS® has been clinically validated and is indicated for Pre-Diabetes and Type-2 Diabetes screening. It's been tested in more than 20 studies, many of which were investigator initiated collaborations, and has been used to test over 15,000 subjects (more than 5,000 commercially screened). Clinical trials have focused on the following three areas:

ENGINE Clinical Trial Info. & Results

GPA Clinical Trial Info. & Results

In short, historic clinical trial results demonstrate that the Scout DS® identified anywhere from 34%-100% more cases of persons with pre-diabetes or diabetes relative to traditional blood tests. False negatives are very dangerous, not to mention extremely costly to the healthcare system. The accuracy of its results, combined with no blood, no fasting, and immediate results is very compelling.

In case you're wondering, the company most likely will not be able to use this data when they go back to the FDA (simply just to bolster their story). Typically, the FDA doesn't accept use of retrospective data, however some exceptions are made (just not generally when screening for such types of diseases and indicators like biomarkers that the Scout DS® is targeting).

REGULATORY CLEARANCES AND IP PORTFOLIO

Scout DS® is cleared for sale as a screen for pre-diabetes and type 2 diabetes in Canada, Mexico, has been CE-Marked for the EU, with pre-submission documentation for a de novo classification in process with the FDA (1Q2015)

Miraculins holds a strong patent portfolio with multiple patents issued in the U.S., multiple pending patent applications, and patents issued/pending in Europe, Canada, India, Japan, China and Korea.

In addition, the company has proprietary encrypted algorithms and instrument standardization methods and materials.

REVENUE MODEL

Miraculins plans to sell Scout DS® devices to established distributors in key market segments, which will then be rented or leased to their clientele on a weekly, monthly or annual basis. The company's revenues will be generated from the initial sale of the devices to the distributors and, in most markets, from a percentage of the recurring rental or leasing revenue as well. Depending on the market, the company may lease Scout DS® devices directly to specific market channels.

Additional revenue may be generated through the sale of proprietary consumable cleaning materials, software upgrades, device calibration, as well as warranty and service programs. Further revenues may also be generated through territorial licensing or marketing/sponsorship agreements with corporate brand partners.

The device is already built and ready to go, it's really just a matter of getting it into the market. This is where the company needs to do the most work, and fortunately, it's where management believes they excel. The VeraLight management team failed at this, so why does the management team from Miraculins believe that they'll do any better? Well, it's simple - they have a new go to market plan and are already executing on it. They have remedied the previous manufacturing issues and are currently running pilot programs to demonstrate hard numbers to potential purchasers, which is a necessity in order to determine ROI per unit.

Management has identified three key market segments:

The distribution and pricing of the Scout DS® are still being considered. Does Miraculins sell the device for a gross margin (and charge annually for warranty servicing), or lease it out? Does it sell locked units, which generate recurring revenue with each test (the company can control inventory on the Scout DS® with electronic codes), or unlocked units? And at what price points? These are all things that still need to be worked out. The machine needs to be to promoted with quantifiable data where if an owner/physician puts a device in their store or clinic, this is the average ROI that will be generated from customer returns, i.e., every time someone comes in the store they'll spend $22, the device lead to 83% more reimbursable tests conducted in-store, etc. The company needs hard data to then go out and try to strike a nationwide deal.

Figure 5: Business Model

Source: Corporate Presentation

(1) Medical Clinics/Physician's Offices

Millions of people go to their GPs every day, for everything other than a physical - they've got a rash, their back is sore, cold symptoms, etc., essentially any acute issue. So you come in to see your physician, you notice and briefly discuss the machine, and 90 seconds later you'll have a consultation with them to determine whether you should follow up your pre-diabetes screening with a blood test - which can all be accomplished in one trip.

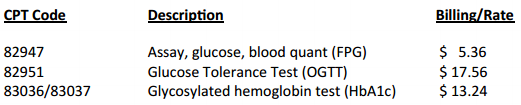

In terms of monetizing the Scout DS®, reimbursement fees are very important. The way to get proper reimbursement is through some usage, to show revenue first; it's a bit of a chicken and egg scenario. Once a company has its research and clinical data, it needs to build usage data, then apply for billing codes. Here is what the current reimbursement landscape looks like in the U.S.:

Source: Company Presentation

If you want to invest in the device market, you need to be prepared to build a certain amount of devices, get them into physicians' hands, and get people to start using the test. The target reimbursement in the U.S. for the Scout DS® is $8 - $10.

Miraculins needs to get regulatory approval in the U.S. first before the company can apply for reimbursement (especially important in socialized healthcare systems like in Canada, United Kingdom, the United States although it's a hybrid system, etc.), however the physician market is tried and true for devices and generating revenue.

Creating value for shareholders immediately thus requires a different approach since there's no previous usage data or revenues. As an example, the Canadian strategy could be to manufacture somewhere between 100-200 devices, place them in strategic high-traffic clinics in every province, get people to start using the machines, then apply provincially for Medicare coverage, in which case those machines could immediately become revenue generators. Whether a different financing model can be structured just for that, is something that needs to be determined.

2) Retail Pharmacies and Grocery Stores

- Attract and retain customers

- Enhance pharmacist-customer relationship

- Identify Diabetic customers - value: up to $4,000/annually

- Identify Pre-diabetic customers - value: up to $800/annually

- Cross-sell reimbursable services (i.e. medication reviews, smoking cessation)

- Consolidate prescription purchases

- Space on the kiosk to advertise

Before Miraculins acquired the Scout DS®, VeraLight ran some pilot programs in chains such as Costco, Rexall, and Zellers, but these were too restrictive and weren't under the control of the company. The new trials that Miraculins is going to run will be directed specifically by them and will be used to track return patients and their spend in order to prove a meaningful financial return on investment ("ROI") for the pharmacy that it would not otherwise have, or readily been achievable.

The big draw here is to use the Scout DS® and its kiosk to promote ancillary pharmacy solutions. Leasing the machines and charging for the test is fine, but if pharmacies cover the cost themselves and partner it with a product and push people to other reimbursable services that they offer, then each machine can generate significant ROI.

Figure 6: Scout DS® Stand-Alone, Turn-Key, Retail Kiosk Concept

Source: Company Presentation

I might add a screen in myself and have some ads playing too, but regardless, for 90-seconds the pharmacist has your undivided attention to discuss your health and sell you (reimbursable) products from the store (medication checks, inoculations, etc.). Miraculins could even partner with Weight Watchers, Goodlife Fitness, etc., where each person that uses the machine would go online and sign-up to get 1-free month of dietary counselling, or something to that effect for promotion and to enhance user adoption.

3) Workplace Screenings

- Concentrated employees

- Reduced absenteeism

- Lower disability claims

- Fewer medical claims

- Enhanced morale

- Diabetics incur 2-3x medical costs; burden on healthcare plans

Large companies (>500 employees) typically spend an average of $394 per person, annually on health and wellness related expenditures including fitness membership subsidization, on-site nurses, and mobile screening tests, of which the Scout DS® would be a great candidate to add to the roster. Healthy living is more than just a concept, it's a lifestyle, and a lot of companies and people understand and embrace it.

For example, let's say a company books a few Scout DS® units. Miraculins would have nurses or registered dieticians there in the morning with the machines, they would advertise the free, confidential diabetes clinic going on throughout the day (week), and employees would simply line up to get tested. I mean, who doesn't like to burn some company time especially when it's encouraged, and for your health, right? No blood draw, no fasting, completely non-invasive. Bottom line, it's a win-win for everyone and an easy market for the company to access and start generating immediate revenue.

The numbers can start to add up fast. In Canada, 60% of employees work for a company that has a healthcare plan. Not only do they get medical and dental, but they also get other benefits such as $500 a year for massage therapy, $500 a year for orthotics, and $500 a year for dieticians. So if Miraculins gets a dietician to run the test, there's already a form of subsidization and reimbursement directly billing insurers.

Once the company has hard numbers, they can then approach insurers and negotiate to bill a flat fee per patient to conduct the tests. In return, insurers are now able to potentially prevent someone from becoming a Type-2 diabetic, which is a very expensive process and costs employers (missed workdays and productivity loss) and insurers significantly.

Here is the sensitivity analysis for net daily revenue of units based on negotiating flat fee with insurers and successful marketing:

| # of Units | Flat Fee Rate | ||

| $5 | $6 | $7 | |

| 20 | $9,346 | $11,266 | $13,186 |

| 50 | $23,746 | $28,546 | $33,346 |

| 100 | $47,746 | $57,346 | $66,946 |

| 200 | $95,746 | $114,946 | $134,146 |

My assumptions are as follows:

- 12 tests/hour (avg. 5 minutes/test with results, cleaning, setting-up, etc.)

- $0.15/test

- $30/hour per unit for labour

- 8 operational hours per day

I believe that those numbers are quite conservative, and even after discounting back another 15%, based on 250 working days, and using the lowest metric (20 units/$5 fees), this market can quickly generate $2 million net, annually.

Here are some photos of the Scout DS® in action:

Diabetes Screening - MasterInvestor Conference 2014 in London, England

Diabetes Screening - Retail Pharmacy Clinic

Diabetes Screening - Mexico City Clinic

U.S. MARKET POTENTIAL

Bit of history here, the previous company who owned the Scout DS® technology, VeraLight, had numerous meetings with the FDA in order to determine the best regulatory pathway for the Scout DS® device. A combination of management decisions, the FDA's more restrictive rules at the time for device classification, and the relative high performance of the Scout DS®, led the company to pursue a utility for screening for Type-2 diabetes.

For those unfamiliar, let me explain a little bit about the medical device market in the U.S. There is a three-tier classification system based on risks and types of controls needed to assure safety:

Source: Cato Research

At the time there were only two ways to get approval in the U.S. for this type of medical device: either a 510(k) or a Pre-Market Approval ("PMA") study. A 510(k) requires a similar device to that you can rely on (which Scout DS® is so novel that there is no predicate), and a PMA takes about 3-5 years, and would cost around $5 million.

When the FDA came back to the company, they were instructed that a PMA was needed. So, VeraLight started preparing for it. They set-up a new manufacturing facility in New Mexico (which added to their overhead) and were planning on manufacturing Scout DS® devices for the study. The additional overhead and projected FDA study costs helped add to the decision for the VC fund behind Veralight to step in on management and find a new buyer for the technology.

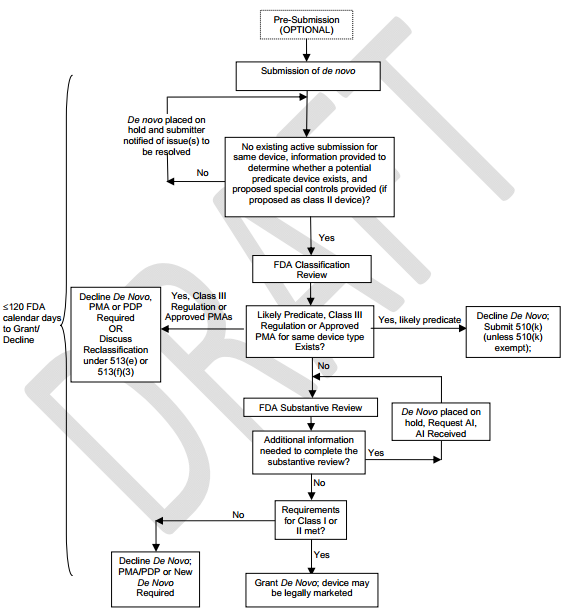

Between the time VeraLight went to the FDA and today, the FDA relaxed the rules for these types of devices by introducing what's known as de novo classification. This process allows the FDA to reclassify devices from a Class III to a Class II or I designation. This means that formerly Not Substantially Equivalent ("NSE") devices (no predicate device could not be found) that received automatic Class III designation, can now be reviewed by making a de novo to have it reclassified and cleared to be legally marketed and follow standard 510(k) process.

Figure 7: De Novo Process

Source: FD

The big change that Miraculins is making in an attempt to get the device a de novo classification is that the Scout DS® is to focus on the test's ability to "aid in the diagnosis of pre-diabetes", which is a condition far more people have and are unaware of, and is the precursor to full-blown diabetes. This actually increases the market and enhances the monetization path, but it de-escalates what is a very high hurdle to overcome, which is to position the test to screen for type 2 diabetes.

The company has indicated it will file a pre-submission document with the FDA within the first quarter of 2015, at which point a formal response from the FDA will be provided within 90 FDA calendar days. Obviously there are no guarantees, but the new strategy sounds very viable to me given: (1) the new de novo classification process; and (2) changing the claim that the device screens "was screening for Type-2 diabetes" to "aid in the diagnosis of pre-diabetes."

CHINA OPPORTUNITY

Studies conducted by the International Diabetes Federation ("IDF") put the number of people in China with Type-2 diabetes at 92.4 million, with 60.7% undiagnosed, and almost 500 million pre-diabetics. The opportunity here is enormous.

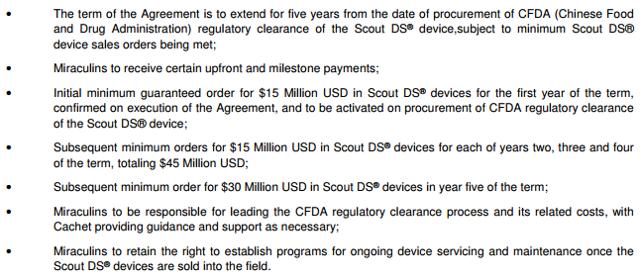

Within months of the new management team acquiring the Scout DS®, they were approached by a Chinese firm, Cachet Pharmaceuticals Co. Ltd., who had seen the device at a tradeshow in Europe, head that the formerly problematic management issues had been resolved, and wanted to send over their science team to do their due diligence. They had a hard look at the data, were very impressed with what they saw, and reached an agreement for sales and distribution.

Key terms of the agreement include:

(click to enlarge)

Source: Company MD&A

The next step to gain approval is to do a study, although Chinese studies are not nearly as comprehensive U.S. clinical trials. The way it will work is that the company will enroll a patient, they will fast for 12 hours, come in, get their blood drawn, and take a Scout DS® test. They don't need to comeback more than once, the study doesn't take years, it's as simple as that. Miraculins will then compare the blood test results and who it identified, with those identified by the Scout DS®, and that's about it (as long as the Scout DS® proves to be efficacious). The study needs about 500 patients, the cost for CFDA approval will be approximately $200k, and it's estimated to take between 12-14 months.

PREVU® SKIN CHOLESTEROL TEST

In September 2010, Miraculins announced the acquisition of the PreVu® Non-Invasive Skin Cholesterol Test technology, a clinical tool to assist with risk assessment of CAD. PreVu measures cholesterol levels in the skin - a new biomarker for risk of CAD - with similar ease to the Scout DS®. CAD is a progressive condition involving formation of atherosclerotic plaques in the coronary arteries. The plaques may gradually impede blood flow through the coronary arteries or they may rupture. CAD may be asymptomatic for many years, but if left untreated, it eventually may lead to angina (chest pain), myocardial infarction (heart attacks), or death.

Elevated levels of skin cholesterol (cholesterol that has deposited and diffused into skin tissue as opposed to circulating freely in the blood stream) have now been clinically shown to be associated with an increased risk of coronary artery disease as measured by treadmill stress testing and coronary angiography, as well as measured by testing for coronary calcium, carotid artery thickening and carotid artery plaque

The PreVu® test is conducted by placing a drop of safe detector reagent on your palm, waiting, adding an indicator reagent, and then using a hand held spectrophotometer (color reader) to analyze the hue of the drop and generate a measurement of a patient's skin cholesterol value, which then places an individual on a risk scale.

The PreVu® test has received Health Canada clearance, and has been CE-marked for sale within the European Union. It has also previously been cleared by the FDA for use as part of risk assessment for CAD.

Miraculins has worked independently and with distribution partners to roll-out introductory units for the Canadian medical professional and the Canadian and U.S. retail pharmacy segments, and conducted some pilot level testing in these segments resulting in nominal revenues during fiscal 2013. Management is still working to determine the best platform for the distribution and delivery of the test in the North American market and abroad, where a highly mobile, affordable, and cost-effective test could significantly increase early screenings worldwide, leading to positive impacts for patients, physicians, and the healthcare economy overall.

The company has found that retail pharmacy culture has traditionally offered risk assessment and prevention programs such as PreVu® and Scout DS® testing on an occasional and rotating basis, including programs dealing with weight loss, quitting smoking, osteoporosis, among others, which often follow the calendar (i.e. February in Canada is traditionally seen as "Heart Health Month" and November is traditionally seen as "Diabetes Awareness Month"). Such a retail culture may limit future testing as well to a cyclical schedule in retail stores and as a result, the company is continuing to explore its options to effectively get to market, including piloting its innovative stand-alone Scout DS® screening kiosks in retail pharmacies and pharmacy/grocery stores to help drive additional revenues for participating retailers.

The business model is essentially the same as it is for the Scout DS®, to sell products in key market segments through established distribution companies, or market them directly to the end consumer. Revenues are expected to be generated from the sale of test kit consumables and the custom designed hand-held readers that are utilized to read the PreVu® POC Test result and guide the test operator through the process. PreVu® POC Test reagent kits contain all of the components required to deliver 40 complete tests.

PreVu® Tradeshow Screening Stations

Demonstration of PreVu® to Chinese Doctors and Nurses - Beijing, China

FINANCIALS / SHARE STRUCTURE

The company has recorded some revenue, but it is extremely nominal as of now.

The company completed one raise in August, and two raises in December, using $500k of the recent proceeds to amend its purchase agreement with Veralight which eliminated the majority of Miraculins' remaining obligations and terminates the obligation to issue equity to Veralight under the purchase agreement.

As of February 5th, there are 39,011,392 shares outstanding.

The history behind the corporate share structure is as follows: last January there were 112 million shares; the company had to do 10:1 reverse split because shares were at $0.035 cents, and as an Exchange requirement didn't meet the $0.05 threshold to raise capital; shares were restructured down to 12 million shares and were trading ~$0.35; there was a period with no news and the stock drifted down to as low as $0.09; then the China deal was closed and the stock rallied but that faded out; recently the company has completed three raises and shares seem to have settled in the low-$0.20s. This gives the company just over an $8.5 million market cap.

As the Scout DS® stands right now, there has been about $40-$50 million invested in the researching and developing the technology. Take a look at the historic raises for VeraLight:

Figure 8: VeraLight Funding Events

Source: Owler

I think that it's really just a matter of time before more people catch onto this story. VeraLight was private, and Miraculins primarily trades in Canada which means that it just does not receive nearly the attention as its American industry counterparts.

RISKS

Miraculins is still considered an early stage company, as such there are a number of risks associated with making an investment at this point in time, including but not limited to:

(1) The company has enough devices on hand to get through all of its proposed pilot programs and milestones (acquired at the time of device acquisition).

(2) Manufacturing has been transitioned to a medium-sized company in the continental United States that specializes in manufacturing medtech devices. Limited production should have already begun, and the line should be fully operational in <6 months.

(3) Marketing the product is the biggest risk here, but management acknowledges this which is why they believed it made sense to acquire the Scout DS® from VeraLight. They have a plan in place, so hopefully it is just a matter of conducting pilot programs, finding out what works, and commercially breaking into its key market segments.

(4) New changes from the FDA by introducing the de novo process, changing its direction to screen for pre-diabetes, as well as quicker, and less stringent standards by the CFDA allow the Scout DS® the best chance it's had to receive regulatory approvals in these countries.

(5) Management hasn't had an issue raising money despite the poor market conditions for companies trading on the TSX Venture. The strategy seems to be to take only what is needed now, and go out and prove to the market what they can do.

CONCLUSION

Miraculins is a medical device company centred on the acquisition, development and commercialization of diagnostic and risk assessment technologies for unmet clinical needs. The strategic direction of the company looks very promising to me.

Looking ahead in 2015, here are the key projected milestones:

For more detailed information on each, please refer to this January 20th, 2015 press release.

Bottom line, I think that there is a very compelling investment opportunity given: (1) the opportunity to start generating revenues over the next 6 months; (2) the significance of forthcoming news releases to act as catalysts to unlock shareholder value; (3) the market opportunity preventing diabetes and coronary artery disease is very attractive; (4) there has been between $40-$50 million already invested into the Scout DS®; and (5) the Scout DS® is so novel there are no direct competitors, and its business model is tried and true.

(For additional liquidity, MCUIF trades in Canada on the TSX Venture as "MOM")

Please feel free to comment below or send me an inbox message if you have any questions or comments about this article.

*If you like what you've read here please click the "+Follow" button and subscribe to my real-time alerts. I just started using the StockTalk function which I find is an excellent resource to communicate real-time trades that I'm making, due diligence that I'm conducting and article alerts.

Disclosure: The author is long MCUIF.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |