Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

It’s almost been a week since the $16.00 trade.

This turd needs better pumpers.

No One is Fooled by the CONdog96 🤡©️

Clown anymore.

They didn’t “agree” on any such thing CONdog96 🤡©️ Clown.

Just another lie

Do you think management should work for free? 🤡 They could be dumping shares right now to take their pay, but they agreed on waiting till they uplist to the OTCQB Markets first. Where is the scam in that? 🤡

"The shares are being issued idiot. Please

They have boadloads that can be off restriction in an hour."

Why would you think they will take any shares off restriction in an hour when they have not taken any shares off restriction in over 3yrs. They guys have been protecting their unrestricted share count (float) for years. Like 95% of their micro O/S is still restricted. They would rather not get paid then take any shares off restriction and sell them into the market. You want to give everyone trading advice, but you are not even letting anyone know this. Why hide the facts Jimmyboysham® 🤡 SMH

The no proof scam theory promo is a total sham!!

$ATMH

The shares are being issued idiot. Please

They have boadloads that can be off restriction in an hour.

Best to reread what's in their fillings because no one gets paid till they uplist to the OTCQB Markets and when they do get those shares, they will be restricted shares. I'm thinking they won't start their marketing campaign till those shares come off restriction. Why should they market her before then when they won't have any shares to put into the market till then? You say you know how this stuff works but you overlooked all those important facts 🤡 LMAO. What a moron!! 👀

"Not knowing how these Self Enrichment Scams Work can be costly.

Every 30 days another $7,500 of 30% discount to market shares get gifted to insiders.

All the shares are “Unregistered”"

Below is what their fillings say. I figured I would post it since you are trying to use no proof scam theory promo propaganda to mislead traders into selling their shares at the bottom of one of the lightest tickers in the OTC before the uplisting happens. With ATMH still only having 2.9 million unrestricted shares in her micro O/S and trading under 10 cents a share that would be a huge trading mistake. 🤡 https://www.otcmarkets.com/stock/ATMH/security

"On June 1, 2023, the Company entered into employment agreements with Massimo Meneghello, Chief Executive Officer, and with Massimo Travagli, Chief Financial Officer. Mr. Meneghello will receive $2,500 per month and Mr. Travagli will receive $5,000 per month.

Mr. Meneghello and Mr. Travagli shall be paid the monthly salary by way of the quarterly issuance of unregistered restricted shares of common stock of ATMH (the “Shares”), valued at a 30% discount to the market price of the Shares based on the Market price on the OTCQB Market, on the last day of each quarter, until the Company, at its sole discretion, is in a position to pay the Employee in cash "

SORRY NO PROOF SCAM THEORY PROMOTER CLOWN🤡 NO ONE IS GETTING MY SHARES BEFORE THEY START MARKETING HER. NO ONE!!!!!!! 🤡

The no proof scam theory promo is a total sham!!

$ATMH

Not knowing how these Self Enrichment Scams Work can be costly.

Every 30 days another $7,500 of 30% discount to market shares get gifted to insiders.

All the shares are “Unregistered”

devil dog 96

Member Level

Re: None

Friday, 06/23/2023 2:20:23 PM

BID support growing!! Over 30k on the BID now. Something seems to be brewing.

$0.09 0.00 (+9.97%)

Bid/Ask

0.078 / 0.09

B/A Size

30,200 X 10,000

Everyone should take note that no one is selling any shares into the BID even though anyone can. This proves it to be a fact that everyone is holding tight.

Why is everyone holding so tight with her being heavily promoted as a huge scam?

Why is the BID building where traders are wanting more shares while the scam theory promo is in full swing?

Someone left holding the condog bag.

“ ASK moving up to 10 cents this morning!

$0.10 0.01 (+23.45%)

Bid/Ask

0.0831 / 0.10

B/A Size

10,000 X 10,000”

Ouch

I BID sit everyday but for some reason no one will sell their shares to me and take my money. It's not my fault that everyone is holding tight. Even the insiders won't take my money and the no proof scam theory promoter clowns🤡 tell me every day that the insiders get free shares. So why won't they trade their "free shares" for my money I have on the BID? They can get free money that way. Why would scammers not want free money? 🤡

"Plenty of proof. You have “been on the bid with your free money” for years.

Just type in “I’m bid sitting” if anyone wants free money.

You will then know who is either full of shit or the biggest bag holder.

Lmao Moron"

The only morons here are the ones that say they have no interest in this ticker but have been posting their fake no proof nonsense here every day for years. 🤡

The no proof scam theory promo is a total sham!!

$ATMH

Plenty of proof. You have “been on the bid with your free money” for years.

Just type in “I’m bid sitting” if anyone wants free money.

You will then know who is either full of shit or the biggest bag holder.

Lmao Moron

More no proof scam theory promo filler from Jimmyboysham® 🤡 when he could have just shown us a ticker with a share structure as light as ATMH's with a share price anywhere near as low as ATMH's share price proving she does not have the best setup in the OTC. Instead, Jimmyboysham® 🤡 wanted to keep the no proof scam theory promo going in hopes to trick traders out of their shares on one of the lightest tickers in the OTC at the bottom before it gets marketed. 🤡 Who would fall for this no proof nonsense. 🤡 LMAO

"Time for you to load another 16 bucks and average down for the 1,100th time.

Lmfao fool[/i]"

The no proof scam theory promo is a total sham!!

$ATMH

Time for you to load another 16 bucks and average down for the 1,100th time.

Lmfao fool

Even Jimmyboysham® 🤡 can't find a better setup with how micro ATMH's unrestricted share count (float) is https://www.otcmarkets.com/stock/ATMH/security but him and all the other no proof scam theory promoter clowns🤡 working this ticker will surely tell you what a huge scam ATMH is over & over without one bit of proof of them doing any scamming 🤡. (PAY ATTENTION TO HOW THE PROMO WORKS. IT'S A TOTAL CLOWN SHOW) 🤡

"And… The Illiquidity of this Self Enrichment sham tells you what the market believes.

Most are not Fooled by the

CONdog96 🤡©️ Clown!

Knowing How These Clowns Work Helps."

The no proof scam theory promo is a total sham!!

$ATMH

Pickme2 since you seem like you think you understand how the OTC works maybe you can help prove me wrong that ATMH does not have one of the best setups in the OTC right now. I put out a Challange a long time ago and not one person can prove me wrong. Be the hero and show everyone I'm full of sh*t and ATMH does not have one of the best setups in the OTC. 👀 You can go from a no proof scam theory promoter clown🤡 to a hero that quick if you can prove me wrong. 👀

"There is no theory and there is no promotion…pure facts that your little mind can’t comprehend you’re the only pumper here"

Below is the challenge I put out Mr. No Proof Scam Theory promoter clown🤡. Seems like you missed it because you never proved me wrong. 🤡

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=173104197&txt2find=%3Cspan%20style=

Where is all the real DDers??? We need someone that knows how the OTC works to get on this challenge ASAP!!!

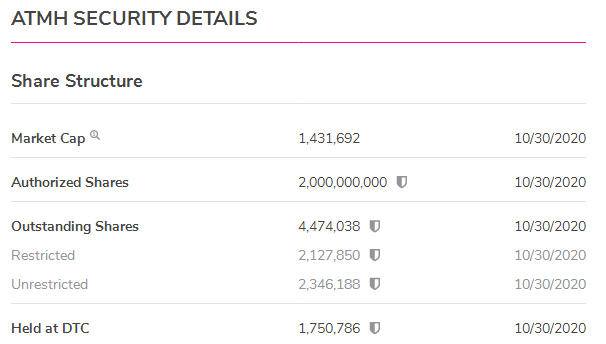

I challenge anyone to find a ticker with only 2.9 million unrestricted shares like ATMH has with a share price under 10 cents like ATMH has. It can be a scam or not, makes no difference with this challenge being NO ticker will be found in the whole OTC with an unrestricted share count (float) that tiny and a share price that low. This is a fact. Someone needs to prove me wrong and show us a ticker with a better setup. This is a self-proving challenge so no excuses!!

https://www.otcmarkets.com/stock/ATMH/security

My bet is one won't be found, and we will just get more no proof scam theory promo propaganda. Real DD is more than repeating no proof nonsense over and over in hopes it will get traders to sell down here. LMAO

The no proof scam theory promo is a total sham!!

$ATMH

And… The Illiquidity of this Self Enrichment sham tells you what the market believes.

Most are not Fooled by the

CONdog96 🤡©️ Clown!

Knowing How These Clowns Work Helps.

I know imagine that for an OTC ticker. 👀 These guys don't use the market that's why. That's how they kept her setup so good for so long. https://www.otcmarkets.com/stock/ATMH/security

“Best set up” 7th straight year Zzzzz Imagine putting your money into a blatant scam like this and pumping it to no avail for 7 years.

LMAO at the CONdog96 🤡©️ Clown"

Ever since the InMed deal fell through in 2018 when old management was running the company their marketing efforts stopped, they have been protecting her unrestricted share count (float) since, and they allowed her to lose all her value since then from no marketing. This is the reason she still has one of the best setups in the OTC. 🏆️

She still only has 2.9 million shares unrestricted in her whole O/S and her O/S is still micro as well with only having 34 million shares in it total. https://www.otcmarkets.com/stock/ATMH/security They have an ungagged transfer agent proving this.

Yes, she still has one of the best setups in the OTC. 🏆️ We just have to wait till their new management starts marketing her like old management was from 2016 to 2018. She is just as light today as she was back then when the shareholders were banking big here. Check out the chart below if I'm not believed. I'm still spending my gains from those huge POPs. 🤑

Seems like new management is choosing to quietly build the company and are not worried about marketing her yet. Why should they market her right now when they don't even use the market for anything? They have not let 1 share off restriction in over 3yrs now. 👀 Seems like marketing her right now when they don't even use the market would be a waste of company funds just to make some of us shareholders happy right now. 🤡

I think most of the shareholders understand this play and are waiting for what's coming being everyone seems to be holding tight. Even the insiders that the no proof scam theory promoter clowns🤡 tell us about all the time are not letting any of their shares go either. They never do. No one ever does. 👀

The only ones that have a problem with the wait here is the no proof scam theory promoter clowns🤡 that tell us day & night that they have no interest in this ticker and would never own shares. 🤡HONK-HONK🤡

The no proof scam theory promo is a total sham!!

$ATMH

“Best set up” 7th straight year Zzzzz Imagine putting your money into a blatant scam like this and pumping it to no avail for 7 years.

LMAO at the CONdog96 🤡©️ Clown

There is no theory and there is no promotion…pure facts that your little mind can’t comprehend you’re the only pumper here

The only garbage we see here is all the no proof scam theory nonsense being heavily promoted by the no proof scam theory promoter clowns🤡. Your one of the clowns🤡 spreading no proof nonsense. Everyone can look at your post history to see this for themselves. 🤡HONK-HONK🤡

"You make no sense rambling nonsense garbage dogboy"

The no proof scam theory promo is a total sham!!

$ATMH

You make no sense rambling nonsense garbage dogboy

Monday, 09/20/2021. 9:31:43 AM

It's not been above 35 cents in a year because the news flow has not begun yet. She has a micro O/S and a micro market cap with an ungagged transfer agent proving all of this. It's a proven setup for huge gains. Do not miss them. Time is running out to load these levels. When she goes she will go up real quick with her super micro float. https://www.otcmarkets.com/stock/ATMH/security

What an Idiot

Don’t get left holding the CONdog96 🤡©️

Clown Bag!

"When it’s claimed definitively that “a mega move is setting up here”, “a multi dollar run”, does that qualify as financial advice or is that an opinion? Buying into it would be stupid when it's easy to see it’s not been above $.35 cents in the last year."

To answer the question above it's experience and understanding how this stuff works that tells me a mega move is coming. By no means it's financial advice. Some will take advantage to my experience and some will miss the POP. It's that simple.

My best advice would be to load now and just wait for the news flow to begin if big gains are the goal.

You’re twisted in the mind…you’re the promoter pumper clown 🤡 your theories are Ridiculous

This is just more no proof scam theory promo filler to keep the no proof scam theory promo going in hopes to trick traders out of their shares at the bottom of one of the lightest tickers in the OTC. It's not going to work Mr. No Proof Scam Theory promoter clown🤡. Traders are smarter than believing no proof nonsense. 🤡HONK-HONK🤡

"You don’t make any since…and never have! You’re the pumper clown 🤡 go buy 50 more shares and screams it’s running…fool"

ATMH only has 2.9 million shares unrestricted. https://www.otcmarkets.com/stock/ATMH/security She is one of the lightest tickers in the OTC and is trading the bottom before management has started marketing her. What are you not seeing here? 👀

Your eighter one of the promoter clowns🤡 here trying to trick traders out of their shares with no proof of anything, or you don't understand how the OTC works, or maybe your just an overconfident delusional fool that already lost all their money trading the OTC and now wants to give everyone else trading advice. 🤡

Whatever it is it's not going to get me to sell my shares before the marketing starts here. You're wasting your time trying. 🤡 She has an ungagged transfer agent telling us her share counts and her setup is way too good for me to be tricked. 🤡 I know how this stuff works Bubba!! Too bad too sad. 🖕 LMAO

The no proof scam theory promo is a total sham!!

$ATMH

You don’t make any since…and never have! You’re the pumper clown 🤡 go buy 50 more shares and screams it’s running…fool

What do you mean for what? Reread my post. It explains everything. 🤡

"Nice catch for what?"

Jimmyboysham® 🤡 thought he was telling us something that would get traders to sell the bottom of this micro floater. He did not realize it was a good thing for shareholders. 🤡 Now you are coming in for damage control because Jimmyboysham® 🤡 did not understand what he was posting. 🤡 LMAO

You guys need better promoter clowns🤡 if you will have any chance to get the shareholders to sell down here before management fires their marketing campaign up. 🤡

Remember there is proof ATMH has one of the lightest unrestricted share counts (floats) in the OTC. https://www.otcmarkets.com/stock/ATMH/security

It's incredible how light that have kept her over the years. Only 2.9 million unrestricted still. That's the same micro unrestricted share count (float) they had in early 2021. Did you even know that? 🤡 They have an ungagged transfer agent proving it Mr. no proof scam theory promoter clown🤡. Should we not believe their transfer agent and fall for the no proof scam theory promo propaganda and sell the bottom of one of the lightest tickers in the OTC before any marketing begins? 🤡 Sorry no one is getting my shares down here before the POP. NO ONE!!!

The no proof scam theory promo is a total sham!!

$ATMH

Nice catch for what? Remember these statements are not guarantees of future performance and are subject to numerous risks, uncertainties, and assumptions, many of which are beyond ATMH's control, and which could cause actual results to differ materially from the results expressed or implied by the statements.

Nothing has become of the empty insider owned corporation shells bot with millions of shares. Ever!! Big RED flags any trader can see for themselves…enriching themselves shares with a 30% discount (because they have no revenues to speak of) won’t get them uplisted!! Buyer beware of the pumper clown 🤡 dog…

What is not true about them getting unrestricted shares for their pay that will be based off the share price when they uplist to the OTCQB markets? You're promoting it and now you're saying it's untrue when I agree with your promoting. 🤡 LMAO

"Incorrect once again.. They are getting unrestricted free shares by the truckload"

How can anyone believe a no proof scam theory flip flopper promoter clown🤡? Do you think ATMH shareholders are too stupid to notice your flip flopping now? 🤡

The no proof scam theory promo is a total sham!!

$ATMH

Incorrect once again.. They are getting unrestricted free shares by the truckload

Nice catch!!!! Management agreed to wait to get paid till they uplist to OTCQB Markets. Looks like we got an uplist coming folks!!! Probably why they just hired these guys at the end of 2023 https://www.otcmarkets.com/stock/ATMH/news/All-Things-Mobile-Analytic-Incis-pleased-to-announce-the-engagement-of-GreenGrowth-CPAs--httpsgreengrowthcpascom--as-the?id=422087 HUGE!!!!! Great catch bro!!!!! 🏆️

"On June 1, 2023, the Company entered into employment agreements with Massimo Meneghello, Chief Executive Officer, and with Massimo Travagli, Chief Financial Officer. Mr. Meneghello will receive $2,500 per month and Mr. Travagli will receive $5,000 per month.

Mr. Meneghello and Mr. Travagli shall be paid the monthly salary by way of the quarterly issuance of unregistered restricted shares of common stock of ATMH (the “Shares”), valued at a 30% discount to the market price of the Shares based on the Market price on the OTCQB Market, on the last day of each quarter, until the Company, at its sole discretion, is in a position to pay the Employee in cash "

This is the kind of DD we need here 🤜

The no proof scam theory promo is a total sham!!

$ATMH

It's a shame that out of all the shareholders only $16 bucks of shares sold all day. Is that your smoking gun that they are scamming the market? 🤡 LMAO What a freak'en clown🤡 LMAO

"$16 Bucks!! Someone is “Loading Now”. Lmao at this blatant sham."

The no proof scam theory promo needs new promoter clowns🤡. They tell us that the company and its insiders are scamming us every day and the proof they show us is $16 in volume. 🤡 Is that really how you think the company and its insiders are scamming us? 🤡 $16 bucks at a time? 🤡 LMAO

Let us know the last time you think the company or it's insiders scammed the market where our money is so we can see what you're seeing. Show us some proof of some scamming already since you're heavily promoting the no proof scam theory promo day and night here. 🤡

The volume will come once management start their marketing campaign. How will new traders find her till then? Stay tuned and be ready. Her float is way too tiny for chasing this one once the volume starts. https://www.otcmarkets.com/stock/ATMH/security

The no proof scam theory promo is a total sham!!

$ATMH

🏆️ ATMH DD>> On June 1, 2023, the Company entered into employment agreements with Massimo Meneghello, Chief Executive Officer, and with Massimo Travagli, Chief Financial Officer. Mr. Meneghello will receive $2,500 per month and Mr. Travagli will receive $5,000 per month.

Mr. Meneghello and Mr. Travagli shall be paid the monthly salary by way of the quarterly issuance of unregistered restricted shares of common stock of ATMH (the “Shares”), valued at a 30% discount to the market price of the Shares based on the Market price on the OTCQB Market, on the last day of each quarter, until the Company, at its sole discretion, is in a position to pay the Employee in cash.

Accumulated deficit (7,953,349)

TOTAL LIABILITIES 1,801,674

Revenue $ 1,795,519

Cost of revenue $-1,780,948 -

Gross profit 14,571

Net loss $ (11,016)

The Company has an accumulated deficit of $7,953,349 as of April 30, 2023 and has incurred operating losses to date. The Company expects that while it is restructuring and completing certain identified acquisition targets it will continue to incur operating losses. The Company has been funded to date by current management and expects this funding to continue until such time as initial revenues from currently planned operations commence. There can be no assurance that the Company will continue to receive funding from management or that it will be able to raise sufficient funds from the sale of securities or debt, or that the funding it does receive will be sufficient to pay for its operations.

Management’s plans for the continuation of the Company as a going concern include the identification and completion of acquisitions, the financing of the Company’s operations through issuance of its common stock and shareholder advances. Its continuation as a going concern is dependent upon its ability to, to obtain additional financing as may

be required to meet its obligations on a timely basis, to identify, acquire and develop a commercially viable business and ultimately to establish profitable operations.

$16 Bucks!! Someone is “Loading Now”. Lmao at this blatant sham.

I smell Fox poo 💩💩💩 mixed with a spicy blend of no proof scam theory promo propaganda. Yuck!! 🦨

"Indeed, “the family” is working on self enrichment! They’ll need to change their pumper clown if they ever intend to make headway. All but 1 of the promoter clowns:🤡 gave up promoting the sham here after we exposed his plan to trick traders with his ‘Load Now’ propaganda!

“Good always triumphs over bad, no matter the odds."

The last 2 no proof scam theory promoter clowns🤡 left are bouncing their no proof nonsense off of each other in hopes it will convince traders that what they are saying must be true because 2 of the no proof scam theory promoter clowns🤡 are saying it together. 🤡 LMAO

Should we really think no proof becomes proof if 2 no proof scam theory promoter clowns🤡 agree with each other? 🤡 LMAO

The no proof scam theory promo is a total sham!!

$ATMH

Indeed, “the family” is working on self enrichment! They’ll need to change their pumper clown if they ever intend to make headway. All but 1 of the promoter clowns:🤡 gave up promoting the sham here after we exposed his plan to trick traders with his ‘Load Now’ propaganda!

“Good always triumphs over bad, no matter the odds."

Most of the promoter clowns🤡 gave up promoting the no proof scam theory sham here after I exposed their plan to trick traders out of their shares at the bottom of one of the lightest tickers in the OTC before management starts marketing her.

We have 2 promoter clowns🤡 left still pumping their promo here because they know what an amazing setup ATMH has and won't give up till they get the shares they want on the BID down here. 🤡 Some of the other scam theory promoter clowns🤡 had to slap the ASK because they were smart enough to see no one is really selling down here so BID sitting is no guarantee you will get any. Not even the insiders are letting any go. Everyone is waiting for managements marketing to begin.

Time is ticking and we don't know how much longer it will be before the POP, but the last 2 promoter clowns🤡 seem to be starting to panic now with how everyone is holding super tight. I can understand why. ATMH has the best setup in the OTC by far with her micro unrestricted share count (float) and with her super low share price. Why would anyone want to miss the huge gains that are coming when the DD is so solid?? https://www.otcmarkets.com/stock/ATMH/security

$ATMH

LMAO Idiot! This is an “All in the Family” self enrichment fraud

Notice how the no proof scam theory promoter clowns🤡 feed off the other no proof scam theory promoter clowns🤡 no proof nonsense. It's a total clown🤡 show. LMAO

This is needed to keep their no proof scam theory promo going if they will have any chance to trick traders out of their shares at these bottom levels. 🤡 Once you see how their promo works you can't unsee it. 👀 It's way too obvious when your experienced in trading the OTC.

" Nice find and to think that it takes just a couple of minutes to see this along with all of the share gifting to Family, Friends and of course the CONsultants.

No One Is Fooled by the one and only

CONdog96 🤡©️ Clown. No One"

No one is getting my shares down here before management starts their marketing campaign. NO ONE!!!!

The no proof scam theory promo is a total sham!!

$ATMH

Can you show us some proof of your findings that they are scamming us, or should we just take this as being part of the no proof scam theory promo that you and the rest of the no proof scam theory promoter clowns🤡 are running here in hopes to trick traders out of their shares on one of the lightest tickers in the OTC before any marketing begins? 🤡

"I peeked to see what we are talking about today, it’s all in the family, as usual:

Florida Limited Liability Company

SPEEDTELECOM1 LLC

Registered Agent Name & Address

TRAVAGLI, JEREMY

3865 w 9th av

Hialiah, FL 33012

Name Changed: 01/09/2020

Address Changed: 03/28/2022

Authorized Person(s) Detail

Name & Address

Title MGR

TRAVAGLI, JOSHUA"

ATMH's ungagged transfer agent just verified her share structure on their OTC Markets page today, and they still have only 2.9 million shares unrestricted. https://www.otcmarkets.com/stock/ATMH/security That's the same micro unrestricted share count they had in early 2021. Have you ever seen an OTC company protect their unrestricted share count (float) like they have? Set aside the fake ass promo you're running here for 1 minute and just answer that honestly. 🤡

Everyone sees the proof ATMH does not use the market for anything so saying they are scamming the market makes it easy to see you're not being honest unless you don't know how share structures work and you think you know what you are saying. 🤡 I don't know what to call that but it's still not being honest. It's more like being reckless with other traders' money. 🤡 Do you even know that a 2.9 million unrestricted share count is not very common to see in the OTC and for them to have one that tiny for years is kind a crazy if you understand this stuff.

You should tell everyone in your best clown🤡 show way how they are scamming the market where our money is without them having any shares to sell into the market for many years. 🤡HONK-HONK🤡

The no proof scam theory promo is a total sham!!

$ATMH

Absolutely! I can’t tell you how awesome it is to not read all the propaganda from the Travagli Family & CONsultants.

Nice find and to think that it takes just a couple of minutes to see this along with all of the share gifting to Family, Friends and of course the CONsultants.

No One Is Fooled by the one and only

CONdog96 🤡©️ Clown. No One

Nice find and to think that it takes just a couple of minutes to see this along with all of the share gifting to Family, Friends and of course the CONsultants.

No One Is Fooled by the one and only

CONdog96 🤡©️ Clown. No One

I peeked to see what we are talking about today, it’s all in the family, as usual:

Florida Limited Liability Company

SPEEDTELECOM1 LLC

Registered Agent Name & Address

TRAVAGLI, JEREMY

3865 w 9th av

Hialiah, FL 33012

Name Changed: 01/09/2020

Address Changed: 03/28/2022

Authorized Person(s) Detail

Name & Address

Title MGR

TRAVAGLI, JOSHUA

It would only take 2.5 minutes of someone’s time looking at the filings to figure out that this is just another No company self enrichment shit pile.

The most important thing is to Not get

Conned by the CONdog96 🤡©️ Clown.

It would only take 2.5 minutes of someone’s time looking at the filings to figure out that this is just another No company self enrichment shit pile.

The most important thing is to Not get

Conned by the CONdog96 🤡©️ Clown.

I would start doing some real DD before this micro floater is not trading down here anymore. You might want to check this out and do some digging on SPEEDTELECOM1. https://pitchbook.com/profiles/company/502693-57#overview

Maybe since you can't find any scamming by ATMH or it's insiders you can find some scamming with SPEEDTELECOM1. 👀

I have not heard you or any of the no proof scam theory promoter clowns🤡 do any posting on SPEEDTELECOM1. Do you not think SPEEDTELECOM1. is a scam also? If so, can you show us any proof or will we just get more no proof scam theory promo propaganda in hopes to trick traders out of their shares at the bottom of one of the lightest tickers in the OTC before management starts marketing her. 🤡

The no proof scam theory promo is a total sham!!

$ATMH

Incorrect once again.

“ ATMH will outperform all markets in 2023. Mark it down.”

You have been preforming the best out of all the promoter clowns🤡 here. Most are too lazy to entertain us now.

🤡HONK-HONK🤡

'Moving On the CONdog96 🤡©️ clown

needs you back asap! This 5 cent pile of shit needs your “$1.00 - $2.00 pump back.

“ News Pending, $1.00 to $2.00 soon.

Buy - Hold - Profit.”

The no proof scam theory promo is a total sham!!

$ATMH

Moving On the CONdog96 🤡©️ clown

needs you back asap! This 5 cent pile of shit needs your “$1.00 - $2.00 pump back.

“ News Pending, $1.00 to $2.00 soon.

Buy - Hold - Profit.”

This is just more made up no proof scam theory promo propaganda. 🤡 Why never any proof of anything with your promoting?

"Lmfao your big 50 buck bid got filled!

Someone decided to not “Hold Tight” for another 6 years.

Knowing how these frauds work helps.

The number one thing is to Not get

Conned by the CONdog96 🤡©️ Clown"

My BID was @ .051 but there was hidden BID'er higher that got those shares. I never got one share filled. ☹️

You no proof scam theory promoter clowns🤡 need better material if I will even have a chance to get a decent fill down here. Pull up the clown🤡 car already and let all the no proof scam theory promoter clowns🤡 out. One promoter clown🤡 can't do it on his own. All the rest of the clowns🤡 gave up once I proved The no proof scam theory promo to be a total sham!!

🤡HONK-HONK🤡

$ATMH

|

Followers

|

276

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

107341

|

|

Created

|

11/07/11

|

Type

|

Free

|

| Moderators VeronicaFox jimr1717 devil dog 96 | |||

ALL THINGS MOBILE ANALYTIC INC ATMH changed its focus in 2019 to form partnerships with companies and acquire brands that provide disruptive technology for mobile applications for Telecommunications and Fintech services & solutions. We are concentrating on development and management of innovative solutions for in-demand, practical products that make it easier for businesses and consumers to communicate, manage their finances, and process payments. Our team is driven by strong principles of continual improvement, investing in research and development to create powerful new solutions to meet the challenging needs of today's marketplace. Our first such application is "PayToGo". PayToGo allows for electronic payment transactions, purchase of gift cards, GSM Top Ups, and payment processing.

One Penn Plaza

Suite 6241

New York, NY 10119

NEW YORK, NY / ACCESSWIRE / October 20, 2020 / All Things Mobile Analytic Inc. (OTC PINK:ATMH) a U.S based publicly listed company offering a leading-edge 21st Century Enhanced Fintechnology and Telecommunications Services is pleased to announce that the 100% acquisition of Nextchampions Holding Limited has been completed, an Internet of Things-Technology and Mobile Developer Holding Company including Brands and Digital Platform and Web Marketplace.

Nextchampions Holding Limited

We are passionate about transforming the relationship between customers and their final public smart solutions through technology, in an agile and easy to understand manner, that is always focused on their needs. We own Intellectual Properties - Software and Brands.

PayToGo.io - New Payment platform and Wallet Application currently for Brazil, and moving to more Latin America countries. Despite continuing to follow a very antiquated process, the mobile prepaid market in Latin America accounts for over 500 million phones and 10 billion top-ups annually. This is due, in part, to the staggering amount of unbanked people across the collective countries. In Brazil alone, over 55 million consumers do not have a bank account.

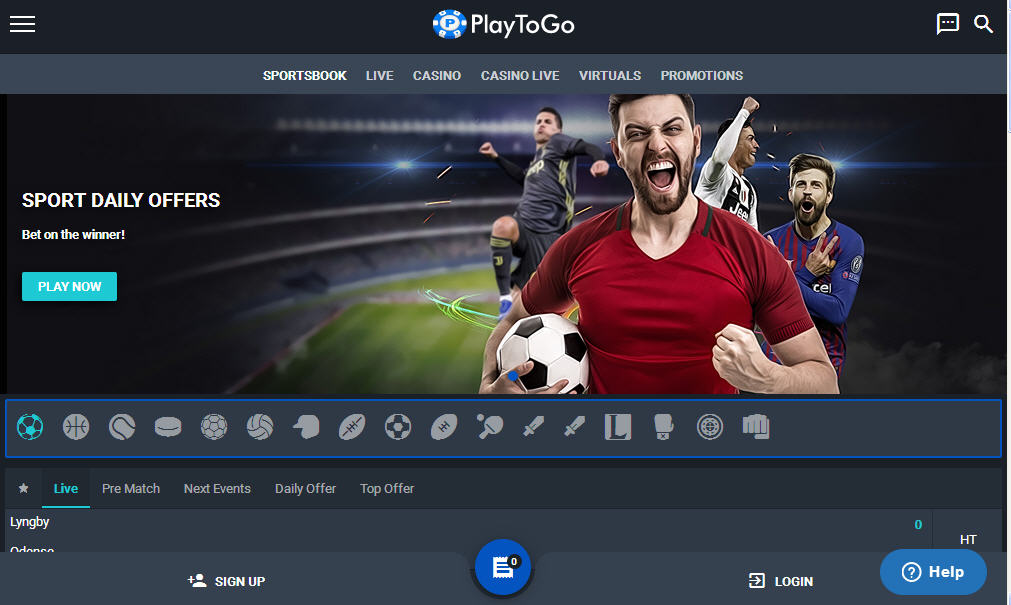

PlayToGo.io - Online Betting and Gaming Platform, Legally Licensed partnership with Betstarters a taylor-made sports betting and technology services, intuitive and very easy to navigate and able to find any sports on both Mobile and Desktop platforms. Banking to be a simple process with options available in desired currency and crypto currency as well; operating in different languages, English, Portuguese and Spanish, among others. PlayToGo will offer customer support to address any login issues as well.

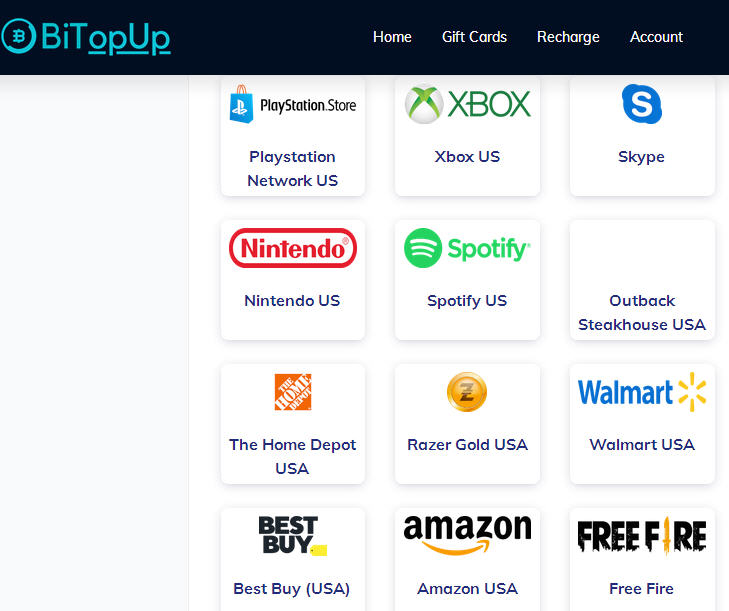

BiTopUp.com - A crypto web platform that offers eGift Cards, prepaid mobile refills and other products on a global scale, to final customer and business. Its API allow access to more than 1700 products in 160 countries and use any crypto currencies at the best rate exchange. Our Innovative line of custom consumer applications center around our e-money digital bank account and linked to PayToGo Mastercard. We strive to provide the ultimate consumer engagement platform by linking banking, health, entertainment, gaming, communication, telecom and marketplace. All our apps are developed in house by our IT tech team in Brazil, Europe and USA.

All Things Mobile Analytic Inc.

It is the intent of management that the Company, through various acquisitions and partnerships, will undertake operations that will allow it to offer one ubiquitous global platform to securely connect any communication provider worldwide. The Company's management will pursue, through acquisition and agreements with providers, International Project Financing, development and management of innovative technologies that provide in-demand, practical products that make it easier for businesses and consumers to communicate, manage their finances, and process payments. Management of the Company intends to be driven by principles of continual improvement - constantly investing in research and development to create powerful new solutions to meet the challenging needs of today's marketplace. They intend to bring these same principles to the Company and its projects. The brands that the Company intends to acquire or partner with have been developed in Europe and South America. Targeted acquisitions include disruptive technology for mobile applications for Telecommunications and Fintech services & solutions. These potential target acquisitions are currently developing and/or have developed applications for strategic growth and using their technologies and customer base.

As of October 20, 2020 ATMH owns 100% of Playtogo, Paytogo and BiTopUp.

(Click Image to visit Web-site)

The Current ATMH Web-site is https://atma-inc.us/

Paytogo Can Be Downloaded on the Google App Store here https://play.google.com/store/apps/details?id=com.paytog

The Web-site for Playtogo Offering 100s of Casino Games and Sports betting is https://www.playtogo.io

The crypto web platform web-site for BiTopUp can be accessed here https://BiTopUp.com

4,474,038

As of 10/30/2020

*****************************

(Per IHUB Admin, all new ATMH information must be appended at the end of the currently existing iBox data)

** The information below is maintained by VeronicaFox

This portion of the IBox is Accurate. It's the background of TRON / ATMH

and H. Wayne Hayes. It's imperative to read the whole story, not just the

part the promoters want traders to read - take Nothing for granted, this is

the OTC where scams are a dime a dozen.

~

Now the insiders have a "new" website that's even

worse than the old one. The site fraudulently states

ATMH is a PUBLIC LISTED COMPANY.

Stocks that trade on exchanges are considered

listed stocks,

ATMH IS NOT LISTED

MISINFORMATION was on their website

AND in Two (2) PRs:

DON'T BE FOOLED BY ATMH INSIDERS

WHO APPEAR TO LIE THAT THEY'RE

LISTED WHEN THEY ARE NOT.

ALL IN A SAD EFFORT TO SELL SHARES.

~

Master researcher NoDummy did the research and provided

the FACTS below. It was NOT just considered as of 2022, that claim is

irrefutably false. Note the Company formerly know as Toron Inc.,

DID NOT do a symbol change in January, 2020 as falsely claimed.

The correct dates are as follows:

01/09/20 - TRON voted to Reverse Split

01/17/20 - TRON submitted an effective date

01/21/20 - TRON votes to changes names

01/23/20 - TRON Files with the NVSOS for name change

01/30/20 - TRON’s Effective date of RS

04/20/20 TRON releases a PR announcing 1:200 Reverse Split

08/05/20 TRON releases a PR announcing 1:200 Reverse Split - AGAIN

09/02/20 TRON changes the symbol from TROND to ATMH

EIGHT MONTHS LATER.

The above mentioned Mr. Hayes is still involved with ATMH.

ATMH's Current Management has been in place since APRIL, 2019.

ATMH RESTRICTED SHARES WERE ERRONEOUSLY CLAIMED TO BE

AS FOLLOWS ON 01/27/21:

AS: 2,000,000,000

OS: 4,474,038

Restricted: 2,127,850

Unrestricted: 2,346,188

IN REALITY, THE SS HAD ALREADY BEEN INCREASED BY 555,000

SHARES TO:

AS: 2,000,000,000

OS: 4,474,038

Restricted: 1,572,850

Unrestricted: 2,901,188

Unrestricted Shares increased by 555,000 Shares

THOROUGH DD IS IMPERATIVE WITH

THESE OTC P&Ds.....

DON'T BE FOOLED !!

~

IMPROVED TRON FACTUAL

INFORMATION

The goal is to NOT BE FOOLED by baseless claims that merely attempt to promote the

selling of shares. THIS MIDDLE SECTION is solid & FACTUAL, providing both past and present factual

data. We all know the past is prologue - A company like TRON / ATMH can never rid itself of its

history, as much as they may try.

~

ATMH, the Company formerly know as TRON, did a name change and enacted

a 1:200 Reverse Split in August 2020. The reverse split took every 10,000

shares owned by shareholders and left them with a paltry 50 shares.

The symbol was changed from TROND to ATMH on September 2, 2020.

It took over 8 months to get FINRA to process the reverse split. No doubt they

had numerous questions for this company whose CEOs have included:

Fabrizio Bosticco

Rene Morentin

Vinu Patel

Massimo Meneghello

Rene Morentin and Colin Morentin are still ATMH control persons. Thorough DD on both is imperative.

Below is a picture of Rene Morentin. What kind of person posts a picture of himself holding a

cigarette as he enters a meeting with a Healthcare / Health & Wellness organization? If he doesn't care

for his own health, he should at least be aware of others.

During the entire process, there were serial and completely baseless

claims of "shorts". There were & are No abusive shorts, however -

None whatsoever, nor have there ever been. It was all just an effort to

sell shares, meanwhile ATMH has had PAID PROMOTIONS.

Contrary to False Information, ATMH has indeed had PAID PROMOS, this

one illegally doesn't disclose the amount of compensation:

"We have been paid cash only for this report. We do not take shares in

payment for out work."

___________________________

A COMPLETE LIE BY ATMH

DON'T BE FOOLED BY ATMH INSIDERS

WHO APPEAR TO LIE THAT THEY'RE

LISTED

WHEN THEY ARE NOT.

____________________________________________________

Travagli lists Himself as a “Marketing Strategist Developer”. Says he was with

Nextchampions since January 2019.

https://www.linkedin.com/in/massimo-travagli-6a875347

Yet documents show Nextchampions Holding Ltd was incorporated November 14,

2013 with 1 officer a/o November 14, 2013. Massimo Travagli is a director who was

appointed November 14, 2013.

WHICH IS IT?

WHY THE DISCREPANCY???

WHAT'S BEING HIDDEN ??

Massimo Travagli is a member of ATMH board of directors, secretary/treasurer, chief

financial officer, interpreter, and translator for ATMH.He’s also the controlling

shareholder with 2,500,000 shares with voting rights of 500 shares of common per

share.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |