Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

two charts showing S&P 500 & S&P 100 index internals weakening since their October highs + JPM daily chart:

SPY daily closes chart with internals for 4 US indices, showing the recent weakening trend

vs. the October highs for these internals --

http://stockcharts.com/c-sc/sc?s=SPY&p=D&yr=2&mn=1&dy=0&i=p22856070881&a=585817572&r=1602537496889

SPY daily closes chart #2 with volatile & weakening S&P 500 internals since the October highs for these internals -

http://stockcharts.com/c-sc/sc?s=SPY&p=D&yr=0&mn=6&dy=0&i=p10524699971&a=581521323&r=1593359472151

====================

my customized JPM daily chart,

with the JPM to SPY ratio -

* for the JPM to SPY ratio, notice the September/October absence of

daily closes below the 63,2 lower Bollinger Band while JPM price was achieving

a potential double-bottom that is yet to be confirmed by actual lasting price action above the

$105 to $106 levels

http://stockcharts.com/c-sc/sc?s=JPM&p=D&yr=2&mn=4&dy=0&i=p66639851886&a=625243568&r=1603544357803

JPM chart gallery is worth a look, and we shall see how the JPM charts develop in the days/weeks ahead --

https://stockcharts.com/freecharts/gallery.html?JPM

daily RSI-14 level summary for Wednesday September 23 close -

37.04 - $SPX

37.57 - $OEX

40.92 - $NDX

40.14 - $COMPQ

* it is a firmly bearish chart condition only while it persists

that all four indices' cumulative net Advancers minus Decliners lines

reside below their 50-day SMA by a decent margin

daily RSI-14 40 level vigilance for $SPX $OEX $NDX $COMPQ -

* bears need a lasting hold below the RSI-14 40 level, while

bulls must defend the 40 level on a lasting basis

** bulls must hold the cumulative net Advancers minus Decliners lines for each index above the 50-day SMA on a lasting basis

or

bears have an opportunity to continue the price damage beyond Monday September 21, 2020

$SPX -

http://stockcharts.com/c-sc/sc?s=%24SPX&p=D&yr=0&mn=10&dy=20&i=p49247007131&a=589367469&r=1600706818845

$OEX -

http://stockcharts.com/c-sc/sc?s=%24OEX&p=D&yr=0&mn=10&dy=20&i=p30367571549&a=589367470&r=1600706985596

$NDX -

http://stockcharts.com/c-sc/sc?s=%24NDX&p=D&yr=0&mn=10&dy=20&i=p50115875913&a=589367468&r=1600706595552

$COMPQ -

http://stockcharts.com/c-sc/sc?s=%24COMPQ&p=D&yr=0&mn=10&dy=20&i=p47098174265&a=589367467&r=1600706069250

==========================

charts above display cumulative net Advance-Decline breadth lines

which are the cumulative total of daily net Advance-Decline values

The McClellan Oscillator is the difference between the 19-EMA & 39-EMA of daily advances minus declines.

It reflects the short-term strength and direction of market liquidity.

A longer-term view is provided by the McClellan Summation Index, which is the cumulative total of the daily McClellan Oscillator values.

These indicators move within a trading range and often identify the overbought/oversold condition of the market

( McSum = McClellan Summation Index )

the dominant rule is: price will eventually follow the direction of the McSum, except for brief periods of price divergence

The McSum is neutral at the zero line,

bullish while above,

and confirmed bearish while below zero

* the distance down to the McSum zero line currently represents

one objective measure of the minimum downside risk

Confirmed sell signals are a lasting decline below the McSum zero line,

though price action has usually declined by a large amount by the time

zero is reached from the McSum peak above.

Large distances between the McSum daily chart values represent acceleration events in the A-D breadth decline or advance,

and the follow-on price impact has a high correlation with the McSum's direction, and usually has several days staying power

daily RSI-14 level summary for Tuesday September 22 close -

43.70 - $SPX

44.26 - $OEX

47.27 - $NDX

46.85 - $COMPQ

* it is a firmly bearish chart condition only while it persists

that all four indices' cumulative net Advancers minus Decliners lines

reside below their 50-day SMA by a decent margin

daily RSI-14 40 level vigilance for $SPX $OEX $NDX $COMPQ -

* bears need a lasting hold below the RSI-14 40 level, while

bulls must defend the 40 level on a lasting basis

** bulls must hold the cumulative net Advancers minus Decliners lines for each index above the 50-day SMA on a lasting basis

or

bears have an opportunity to continue the price damage beyond Monday September 21, 2020

$SPX -

http://stockcharts.com/c-sc/sc?s=%24SPX&p=D&yr=0&mn=10&dy=20&i=p49247007131&a=589367469&r=1600706818845

$OEX -

http://stockcharts.com/c-sc/sc?s=%24OEX&p=D&yr=0&mn=10&dy=20&i=p30367571549&a=589367470&r=1600706985596

$NDX -

http://stockcharts.com/c-sc/sc?s=%24NDX&p=D&yr=0&mn=10&dy=20&i=p50115875913&a=589367468&r=1600706595552

$COMPQ -

http://stockcharts.com/c-sc/sc?s=%24COMPQ&p=D&yr=0&mn=10&dy=20&i=p47098174265&a=589367467&r=1600706069250

==========================

charts above display cumulative net Advance-Decline breadth lines

which are the cumulative total of daily net Advance-Decline values

The McClellan Oscillator is the difference between the 19-EMA & 39-EMA of daily advances minus declines.

It reflects the short-term strength and direction of market liquidity.

A longer-term view is provided by the McClellan Summation Index, which is the cumulative total of the daily McClellan Oscillator values.

These indicators move within a trading range and often identify the overbought/oversold condition of the market

( McSum = McClellan Summation Index )

the dominant rule is: price will eventually follow the direction of the McSum, except for brief periods of price divergence

The McSum is neutral at the zero line,

bullish while above,

and confirmed bearish while below zero

* the distance down to the McSum zero line currently represents

one objective measure of the minimum downside risk

Confirmed sell signals are a lasting decline below the McSum zero line,

though price action has usually declined by a large amount by the time

zero is reached from the McSum peak above.

Large distances between the McSum daily chart values represent acceleration events in the A-D breadth decline or advance,

and the follow-on price impact has a high correlation with the McSum's direction, and usually has several days staying power

daily RSI-14 level summary for Monday September 21st close -

39.25 - $SPX

39.33 - $OEX

42.43 - $NDX

41.80 - $COMPQ

* it is a firmly bearish chart condition only while it persists

that all four indices' cumulative net Advancers minus Decliners lines

reside below their 50-day SMA by a decent margin

daily RSI-14 40 level vigilance for $SPX $OEX $NDX $COMPQ -

* bears need a lasting hold below the RSI-14 40 level, while

bulls must defend the 40 level on a lasting basis

** bulls must hold the cumulative net Advancers minus Decliners lines for each index above the 50-day SMA on a lasting basis

or

bears have an opportunity to continue the price damage beyond Monday September 21, 2020

$SPX -

http://stockcharts.com/c-sc/sc?s=%24SPX&p=D&yr=0&mn=10&dy=20&i=p49247007131&a=589367469&r=1600706818845

$OEX -

http://stockcharts.com/c-sc/sc?s=%24OEX&p=D&yr=0&mn=10&dy=20&i=p30367571549&a=589367470&r=1600706985596

$NDX -

http://stockcharts.com/c-sc/sc?s=%24NDX&p=D&yr=0&mn=10&dy=20&i=p50115875913&a=589367468&r=1600706595552

$COMPQ -

http://stockcharts.com/c-sc/sc?s=%24COMPQ&p=D&yr=0&mn=10&dy=20&i=p47098174265&a=589367467&r=1600706069250

==========================

charts above display cumulative net Advance-Decline breadth lines

which are the cumulative total of daily net Advance-Decline values

The McClellan Oscillator is the difference between the 19-EMA & 39-EMA of daily advances minus declines.

It reflects the short-term strength and direction of market liquidity.

A longer-term view is provided by the McClellan Summation Index, which is the cumulative total of the daily McClellan Oscillator values.

These indicators move within a trading range and often identify the overbought/oversold condition of the market

( McSum = McClellan Summation Index )

the dominant rule is: price will eventually follow the direction of the McSum, except for brief periods of price divergence

The McSum is neutral at the zero line,

bullish while above,

and confirmed bearish while below zero

* the distance down to the McSum zero line currently represents

one objective measure of the minimum downside risk

Confirmed sell signals are a lasting decline below the McSum zero line,

though price action has usually declined by a large amount by the time

zero is reached from the McSum peak above.

Large distances between the McSum daily chart values represent acceleration events in the A-D breadth decline or advance,

and the follow-on price impact has a high correlation with the McSum's direction, and usually has several days staying power

daily RSI-14 40 level vigilance for $SPX $OEX $NDX $COMPQ -

* bears need a lasting hold below the RSI-14 40 level, while

bulls must defend the 40 level on a lasting basis

** bulls must hold the cumulative net Advancers minus Decliners lines for each index above the 50-day SMA on a lasting basis

or

bears have an opportunity to continue the price damage beyond Monday September 21, 2020

$SPX -

http://stockcharts.com/c-sc/sc?s=%24SPX&p=D&yr=0&mn=10&dy=20&i=p49247007131&a=589367469&r=1600706818845

$OEX -

http://stockcharts.com/c-sc/sc?s=%24OEX&p=D&yr=0&mn=10&dy=20&i=p30367571549&a=589367470&r=1600706985596

$NDX -

http://stockcharts.com/c-sc/sc?s=%24NDX&p=D&yr=0&mn=10&dy=20&i=p50115875913&a=589367468&r=1600706595552

$COMPQ -

http://stockcharts.com/c-sc/sc?s=%24COMPQ&p=D&yr=0&mn=10&dy=20&i=p47098174265&a=589367467&r=1600706069250

monthly ITBM for $SPX in Point & Figure chart form -

* Carl Swenlin's Intermediate Term Advance-Decline Breath Momentum continues to decline in September 2020,

and now the ITBM resides briefly below its zero line

http://c.stockcharts.com/pnf/chart?c=!ITBMRASPX,PFTBMDNRNO[PA][D][F1!3!!!2!20]&r=5556&pnf=y

==========================

charts above display cumulative net Advance-Decline breadth lines

which are the cumulative total of daily net Advance-Decline values

The McClellan Oscillator is the difference between the 19-EMA & 39-EMA of daily advances minus declines.

It reflects the short-term strength and direction of market liquidity.

A longer-term view is provided by the McClellan Summation Index, which is the cumulative total of the daily McClellan Oscillator values.

These indicators move within a trading range and often identify the overbought/oversold condition of the market

( McSum = McClellan Summation Index )

the dominant rule is: price will eventually follow the direction of the McSum, except for brief periods of price divergence

The McSum is neutral at the zero line,

bullish while above,

and confirmed bearish while below zero

* the distance down to the McSum zero line currently represents

one objective measure of the minimum downside risk

Confirmed sell signals are a lasting decline below the McSum zero line,

though price action has usually declined by a large amount by the time

zero is reached from the McSum peak above.

Large distances between the McSum daily chart values represent acceleration events in the A-D breadth decline or advance,

and the follow-on price impact has a high correlation with the McSum's direction, and usually has several days staying power

$SPX daily with S&P 500 McO and McSum -

http://stockcharts.com/c-sc/sc?s=%24SPX&p=D&yr=1&mn=2&dy=0&i=p70101912448&a=340963635&r=1600476939042

$NDX daily with McO & McSum -

* the Nasdaq 100 index cumulative net Advancers minus Decliners line resides

below the 50-day simple moving average,

which is a firmly bearish chart condition while it persists

http://stockcharts.com/c-sc/sc?s=%24NDX&p=D&yr=0&mn=10&dy=20&i=p41661412538&a=589367468&r=1600477313184

$COMPQ daily with McO & McSum -

http://stockcharts.com/c-sc/sc?s=%24COMPQ&p=D&yr=0&mn=10&dy=20&i=p71160816970&a=589367467&r=1600477160148

AAPL daily -

http://stockcharts.com/c-sc/sc?s=AAPL&p=D&yr=0&mn=6&dy=0&i=p47882052067&a=809318976&r=1600476364168

* for a bullish case to re-establish itself for AAPL

and

for SPY & QQQ

the AAPL daily RSI-14 needs to hold above the important

60 level for multiple consecutive days/weeks

SPY daily -

* today represents the 1st daily close

below the 50-day EMA since mid-May 2020 ...

bulls do not want to see multiple days below the 50

http://stockcharts.com/c-sc/sc?s=SPY&p=D&yr=0&mn=7&dy=0&i=p50167057108&a=702407785&r=1596941621860

SPY and $OEX today approached the daily 21,2 lower Bollinger Band,

and

closed somewhat higher than the lower BB location, which

is a near-term mildly bullish signature while the chart condition persists

http://stockcharts.com/c-sc/sc?s=%24SPX%3A%24OEX&p=D&yr=1&mn=3&dy=0&i=p10961456838&a=578604193&r=1596723552943

Scott's live-updating chart set for $SPX -

https://www.traders-talk.com/mb2/index.php?/topic/163492-spx-bullbear-updated/

$NYA has not recently violated its

daily 21,2 lower Bollinger Band

daily $NYA -

http://stockcharts.com/c-sc/sc?s=%24NYA&p=D&yr=0&mn=7&dy=0&i=p82937600528&a=340963633&r=1599439896608

** bulls need to hold the $NYA daily closes above the lower

Bollinger Band

SPY has yet to achieve a daily close below

its 21-day SMA, as of Friday September 4, 2020

SPY 21-day SMA has not been not violated since early July, which means the 21-day SMA

will be instructive during current & future price declines

* ditto the 50-day EMA

daily SPY -

http://stockcharts.com/c-sc/sc?s=SPY&p=D&yr=0&mn=7&dy=0&i=p50167057108&a=702407785&r=1596941621860

AAPL daily --

http://stockcharts.com/c-sc/sc?s=AAPL&p=D&yr=0&mn=6&dy=0&i=p63318754523&a=809318976&r=1599439454625

* for a bullish case to re-establish itself for AAPL

and

for SPY & QQQ

the AAPL daily RSI-14 needs to hold above the important

60 level for multiple consecutive days/weeks

$SPXEW weekly chart with SPY price bars -

http://stockcharts.com/c-sc/sc?s=%24SPXEW&p=W&yr=2&mn=0&dy=0&i=p54544292044&a=808727626&r=1599020608796

* as of the Tuesday September 1, 2020 close the

weekly RSI-14 remains below the important 60 value

for multiple weeks/months ... bulls need a lasting

hold above 60 for the RSI-14

CHART BELOW - .0006 Look at the 5Min Chart and the 90Min

https://www.barchart.com/stocks/quotes/VISM/technical-chart?plot=CANDLE&volume=total&data=I:90&density=M90&pricesOn=1&asPctChange=0&logscale=0&im=90&startDate=2020-07-30&indicators=NVI(255);AROON(25);SMACD(12,26,9);RSI(12,100);SMA(200);STOSL(14,3)&sym=VISM&grid=1&height=500&studyheight=200

SPY 21-day SMA has not been not violated since early July, which means the 21-day SMA

will be instructive during future price declines when they occur

* ditto 50-day EMA

daily SPY -

http://stockcharts.com/c-sc/sc?s=SPY&p=D&yr=0&mn=7&dy=0&i=p50167057108&a=702407785&r=1596941621860

look at the message the $SPX to $OEX daily ratio provided with the "false" improvement

to the upside in February 2020 which followed the major horizontal breakdown by this ratio

in January and early February 2020 which is marked by the

dashed red horizontal line

http://stockcharts.com/c-sc/sc?s=%24SPX%3A%24OEX&p=D&yr=1&mn=3&dy=0&i=p10961456838&a=578604193&r=1596723552943

* $SPX is again under performing the $OEX for multiple days

* this prior ratio behavior can possibly be instructive again in the future

SPY and $OEX daily 21,2 Bollinger Bands shown on a single chart

with the $SPX to $OEX daily ratio

http://stockcharts.com/c-sc/sc?s=%24SPX%3A%24OEX&p=D&yr=0&mn=9&dy=0&i=p24733875804&a=523770661&r=1596145655521

* the ratio currently displays a sequence of lower highs since

February 2020, and the bullish case is somewhat

weakened by the stark lack of equal participation in the price advances

which do occur when the $OEX is outperforming the

entire 500 stocks comprising the S&P 500 index

alternate SPY weekly with 20,2 Bollinger Band

http://stockcharts.com/c-sc/sc?s=SPY&p=W&yr=1&mn=6&dy=0&i=p02204479376&a=734076515&r=1588253628442

key chart collection #2 posted without my interpretation comments,

that enables my review of this chart set from any mobile device I have handy when recreating outdoors -

AAPL 15-minute

http://stockcharts.com/c-sc/sc?s=AAPL&p=15&yr=0&mn=0&dy=10&i=p27130319213&a=375550741&r=1596502253050

SPY 15-minute

http://stockcharts.com/c-sc/sc?s=SPY&p=15&yr=0&mn=0&dy=9&i=p48833334514&a=375550360&r=1596502421347

SPY weekly with 15,2 Bollinger Band and the 50,9.4 EMA envelope for using to locate potential top & bottom "breaks" OR "failures to launch"

which are:

1. likely to continue in the current price direction

2. likely to reverse the current price direction with an outcome that is more than a slight and brief change

in the price action

http://stockcharts.com/c-sc/sc?s=SPY&p=W&yr=3&mn=0&dy=0&i=p76626574790&a=587618186&r=1594949676404

Percentage performance since a fixed start date for the six

largest market capitalization stocks in the S&P 500 index --

* this is a daily plot of the cumulative percentage gain for each stock vs. its 20,2 Bollinger Band

http://stockcharts.com/c-sc/sc?s=AAPL&p=D&st=2018-01-01&i=p41598448964&a=485657843&r=1590207966075

RSP daily Point & Figure chart -

http://c.stockcharts.com/pnf/chart?c=RSP,PFTBDHNRBO[PA][D][F1!3!!!2!20]&r=4939&pnf=y

* current setup favors the bears

over the bulls for the near-term

and potentially for the intermediate-term

SPY and RSP price action,

though the condition could improve

quickly

OR

become a worsening setup for

the rosy outcome some expect

$SPX daily closes chart with

three S&P 500 internals -

* key $SPX selected price horizontals in play for

the current time period

* 200-day EMA

http://stockcharts.com/c-sc/sc?s=%24SPX&p=D&yr=1&mn=10&dy=0&i=p48145416080&a=747130146&r=1588437201539

$NYA daily closes chart with four moving averages, and

selected NYSE Composite index internals

http://c.stockcharts.com/c-sc/sc?s=%24NYA&p=D&yr=3&mn=0&dy=0&i=p28567946383&a=340963886&r=1575377866387

S&P 500 daily net cumulative Advancing stocks minus Declining

stocks plot with its 50,2 Bollinger Band -

* bullish case for $SPX requires the A-D line to reside

on a lasting basis within its Upper BB channel

http://c.stockcharts.com/c-sc/sc?s=!ADLINESPX&p=D&yr=1&mn=9&dy=0&i=p36288757650&a=357464422&r=1573882274862

SPY daily chart with 20, 50 & 200-day EMA's

http://c.stockcharts.com/c-sc/sc?s=SPY&p=D&b=5&g=0&i=p55781308059&a=588696709&r=1573882085043

2836.50 = high of day on March 15th Friday - /ES June contract

2826.50 = high of day on March 13th - /ES June contract

2825.00 = bullish imbalance level starts here and continues the imbalance at levels above 2825.00 using Volume Profile

2741.75 = /ES low of week, so far - taking place near Sunday's open

2726.50 = /ES low of March 2019, so far

=======================================

pullback lows by /ES S&P 500 futures of interest since June 2018:

2726.50 - all-sessions low in the week ended March 8, 2019

2775.00 - all-sessions low in the week ended March 1, 2019

2316.75 - late December 2018 low

2401.00 - Sunday December 23rd low near the globex open

2409.25 - December 21 very late day

2441.50 - mid day

2476.25 - December 20 morning globex session

2489.50 - December 19 day session

2531.00 - December 18 late day

2533.xx - December 17 late day

* the sharp decline lower started

after October 5, 2018 and continued into October 26, 2018, followed by

a brief pause

2712.25 - in week ended October 12

2873.25 - October 5 late day

2887.75 - October 4 mid-day

2865.00 - September 7 a.m.

2877.50 - September 5

2885.50 - September 4

2891.75 - August 31

2876.75 - low in week ended August 31

2850.00

2831.00's

2803.00

2791 August low

2790 late July low

2788 to 2767 = the often tested horizontal support zone in June to July 2018

2826.50 = high of day on March 13th - /ES June contract

2825.00 = bullish imbalance level starts here and continues the imbalance at levels above 2825.00 using Volume Profile

2741.75 = /ES low of week, so far - taking place near Sunday's open

2726.50 = /ES low of March 2019, so far

2823.75 = March 13th - /ES June contract, high of day so far

2825.00 = bullish imbalance level starts here and continues the imbalance at levels above 2825.00 using Volume Profile

2741.75 = /ES low of week, so far - taking place near Sunday's open

2726.50 = /ES low of March 2019, so far

/ES hourly -

pullback lows by /ES S&P 500 futures of interest since June 2018:

2726.50 - all-sessions low in the week ended March 8, 2019

2775.00 - all-sessions low in the week ended March 1, 2019

2316.75 - late December 2018 low

2401.00 - Sunday December 23rd low near the globex open

2409.25 - December 21 very late day

2441.50 - mid day

2476.25 - December 20 morning globex session

2489.50 - December 19 day session

2531.00 - December 18 late day

2533.xx - December 17 late day

* the sharp decline lower started

after October 5, 2018 and continued into October 26, 2018, followed by

a brief pause

2712.25 - in week ended October 12

2873.25 - October 5 late day

2887.75 - October 4 mid-day

2865.00 - September 7 a.m.

2877.50 - September 5

2885.50 - September 4

2891.75 - August 31

2876.75 - low in week ended August 31

2850.00

2831.00's

2803.00

2791 August low

2790 late July low

2788 to 2767 = the often tested horizontal support zone in June to July 2018

March 12, 2019

Moving the Market

Most S&P 500 sectors trade higher;

continuation from yesterday's buy-the-dip trade

Some softening inflation data in the Consumer Price Index report for February 2019 has provided some support for the broader market.

February CPI was up 0.2%, as expected, while core CPI, which excludes food and energy, was up just 0.1% in February. On a year-over-year basis, total CPI eased to 1.5% from 1.6% in January while core CPI eased to 2.1% from 2.2% in January. It is this year-over-year trend that will keep the Fed in a patient mindset, which is a supportive consideration for risk assets.

- briefing.com 11:25 a.m. ET

==============================

Real Time Economics

@WSJecon

5 hours ago

A rise in the consumer-price index in February “provides the Fed with additional reason to pause its tightening of monetary policy.”

===============================

high vigilance daily chart for all the displayed chart elements -

http://stockcharts.com/h-sc/ui?s=%21NETADSPX&p=D&yr=0&mn=6&dy=0&id=p50372395723&a=382915177

/ES S&P 500 index futures $2712.25 / 2690.00 levels must eventually be surpassed on

a lasting basis, OR the bears continue to rule

the day for many months or years to come ...

/ES 2548 region is one of the major lower levels

of some significance which must be held during future declines

in order to gain upside traction having highly probable

staying power on a very long-term basis

pullback lows by /ES S&P 500 futures of interest since June 2018:

2726.50 - all-sessions low in the week ended March 8, 2019

2775.00 - all-sessions low in the week ended March 1, 2019

2316.75 - late December 2018 low

2401.00 - Sunday December 23rd low near the globex open

2409.25 - December 21 very late day

2441.50 - mid day

2476.25 - December 20 morning globex session

2489.50 - December 19 day session

2531.00 - December 18 late day

2533.xx - December 17 late day

* the sharp decline lower started

after October 5, 2018 and continued into October 26, 2018, followed by

a brief pause

2712.25 - in week ended October 12

2873.25 - October 5 late day

2887.75 - October 4 mid-day

2865.00 - September 7 a.m.

2877.50 - September 5

2885.50 - September 4

2891.75 - August 31

2876.75 - low in week ended August 31

2850.00

2831.00's

2803.00

2791 August low

2790 late July low

2788 to 2767 = the often tested horizontal support zone in June to July 2018

$SPX $2709.80 = the unfilled gap below last week's

price action

* the bullish case remains alive and well while the

$SPX price action remains above the $2714.00 level,

and declines which do not violate this level with

daily closes are to be considered "bait for the bears"

$SPX daily chart with $VIX and the $VIX 63,1 Bollinger Band

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=1&mn=3&dy=0&id=p69567235682&a=588455757

John Bollinger's Market Timing report updated for the March 8, 2019 close -

a PDF file will open

https://docs.wixstatic.com/ugd/58be43_e3338ce898914d30b98e43aa0ee74ca1.pdf

the design for the 30 charts is explained here -

https://docs.wixstatic.com/ugd/58be43_1c39c082d1494945ac4a3dd53a74082c.pdf

this is a cut & paste of my emails last week to

the private group using the Google Groups server that I moderate --

March 8, 2019 7:51 AM

$SPXEW daily Bollinger Band & Moving Average vigilance -

http://stockcharts.com/h-sc/ui?s=%24SPXEW&p=D&yr=0&mn=5&dy=0&id=p7015164400c&a=554139761

March 6, 2019 6:54 AM

follow-up #1 >>> XLF - Carl Swenlin's new PMO sell signal vigilance & XLF 200-day simple moving average vigilance

* follow-up #1 to the March 5th morning email about the XLF and Berkshire Hathaway daily charts --

PMO sell signals on the daily charts which were initiated on March 5, 2019 for the 1st time in several months for the symbols listed below:

* vigilance is prudent whether the numerous PMO sell signals are now followed by multiple days/weeks of PMO declines

for all symbols, the PMO remains above its zero line in spite of the declining trend which has now started or been underway several days

$NYA

$INDU

$MID

$SML

XLF

XLY

XLP

XLV

XLI

XLC - PMO sell signal initiated February 28, 2019

Carl Swenlin's PMO explained -

https://stockcharts.com/school/doku.php?id=chart_school:technical_indicators:dppmo

On Tue, Mar 5, 2019 at 9:32 AM wrote:

XLF daily chart -

Carl Swenlin's PMO sell signal vigilance & XLF 200-day simple moving average vigilance --

S&P 500 Financial sector

* the PMO is now on a sell signal

, so vigilance is prudent whether this PMO decline by XLF continues

* XLF price action remains below the 200-day simple moving average for several weeks, except for the rare daily close by XLF above its 200-day sma

http://stockcharts.com/h-sc/ui?s=XLF&p=D&yr=1&mn=0&dy=0&id=p3812545393c&a=649288070

BRK/B daily chart since Berkshire Hathaway is the largest percentage weighted stock component in the daily calculation of XLF's price -

* BRK/B daily closes above its 200-day sma are completely absent since the start of last week ended March 1, 2019

http://stockcharts.com/h-sc/ui?s=BRK%2FB&p=D&yr=1&mn=2&dy=0&id=p7193118545c&a=625243563

March 4, 2019 5:10 AM

$2819.75 = /ES futures Globex high, March 3/4, 2019 - printed near the Sunday open

$2819.75 is the /ES futures Globex high, March 3/4, 2019 - printed near the Sunday open

(see the summary at the end of this email of the 2nd half 2018 /ES price action

key decline lows which now in 2019 must be surpassed

on a lasting basis to confirm the current multi-week

advance has a high probability for

further upside staying power)

shown below is the SPY daily chart displaying potentially negative setup by Carl Swenlin's A-D breadth & volume oscillators --

as the lowest visible chart element in this SPY daily chart,

Carl Swenlin's net Advance-Decline breadth oscillator & A-D volume oscillator for the S&P 500 index declined on most days in the week ended March 1, 2019

which does not support a high probability for a near-term bullish outcome for the SPY and for the $SPX price action

until these two oscillators return to the upside

while also remaining above their zero line ...

the time is approaching the turn back up by the two oscillators either takes place or not

without an ever increasing opportunity to experience significant price damage at some near-term future day/week

in the overall context - vigilance is required vs. the /ES futures all-sessions and day session low for the week ended March 1, 2019 of $2775 keeping in mind that $2767 to $2788 is an inflection zone of great importance relative to the future technical developments for the /ES the SPY and the $SPX price action with XLF - S&P 500 Financial sector - likely to determine this outcome for the S&P 500 index price action.

XLK is also highly influential in the mix of considerations.

Not constructive for a high probability of an immediate continued price advance by XLF in the coming days is the fact that XLF's downside price reversal on March 1st took place after printing a new intraday price high for 2019 while its largest influential stock component, Berkshire Hathaway, closed the day near its high of day and XLF closed the day near its low of day.

http://stockcharts.com/h-sc/ui?s=SPY&p=D&yr=1&mn=4&dy=0&id=p3936254646c&a=588696944

the S&P 1500 either holds or not above the $650.36 price level not surpassed since

first printed in October 2018, daily chart -

http://stockcharts.com/h-sc/ui?s=%24SPSUPX&p=D&yr=0&mn=8&dy=0&id=p1037911672c&a=524593808

vigilance monitoring key technical elements for the

daily SPY, QQQ, XLK, XLF, XLV and ACWI -

* 21,2 Bollinger Bands for each symbol

100-day simple moving averages

200-day simple moving averages

http://stockcharts.com/h-sc/ui?s=SPY&p=D&yr=1&mn=3&dy=0&id=p3336983610c&a=625947950

XLF daily Point and Figure chart displays an undeclared overall setup,

and can break either Up or Down from this price configuration ...

time is approaching the near-term and intermediate-term bullish case for XLF must be proven or not

http://stockcharts.com/freecharts/pnf.php?c=XLF,PFTBDHNRBO[PA][D][F1!3!!!2!20]&dt=201903030952

smoothed bar closes for the 1-minute NYSE $TICK for an 8-day duration will be useful in the future in

this combo which displays the price action for five indices with the 200,3 standard deviation Bollinger Band -

http://stockcharts.com/h-sc/ui?s=%24TICK&p=1&yr=0&mn=0&dy=8&id=p38811912468&a=579744020

================

/ES 2775 level actually printed today Wednesday February 27th = the SPY 10-day ema price value as well - as of the achievement of the day session low on Wednesday February 27, 2019

the SPY 10-day ema - day session only - is a rising moving average at this time, so if this advance continues the value for the EMA will continue higher while /ES futures $2775 price level remains the all-sessions /ES price low, at this time, for the week ended March 1, 2019

at the moment that the February 27th intraday low of 277.48 was actually printed, I believe the SPY 10-day ema value was approximately 277.39 or 277.40, while the Fidelity Trade Armor function on the Fidelity Active Trader Pro platform shows the 10-day look-back analysis calculating the appropriate horizontal support value is at 277.40

and the 100-day look-back analysis for the major horizontal resistance next above Tuesday's day session high is 280.40 ( ** notice that value resides only slightly below Monday's new 2019 intraday high print for SPY ** ).

SPY daily with the Feb. 27th intraday low marked with a Pink H line, and the 10-day EMA is visible -

http://stockcharts.com/h-sc/ui?s=SPY&p=D&yr=1&mn=4&dy=0&id=p5027650269c&a=588696944

S&P 500 sector analysis for 9 of 11 industry sector symbols -

* daily charts with the focus on the 100-day simple moving average plus the PMO analysis for each symbol -

* the 126,2 daily Bollinger Band is the selected setting

for a long-term analytical context

http://stockcharts.com/h-sc/ui?s=XLK&p=D&yr=0&mn=10&dy=0&id=p5129377307c&a=552043929

http://stockcharts.com/h-sc/ui?s=XLF&p=D&yr=0&mn=10&dy=0&id=p5017360177c&a=552043925

http://stockcharts.com/h-sc/ui?s=XLV&p=D&yr=0&mn=10&dy=0&id=p3536923173c&a=552043926

http://stockcharts.com/h-sc/ui?s=XLY&p=D&yr=0&mn=10&dy=0&id=p0069061724c&a=552043922

http://stockcharts.com/h-sc/ui?s=XLI&p=D&yr=0&mn=10&dy=0&id=p3901417840c&a=552043927

http://stockcharts.com/h-sc/ui?s=XLP&p=D&yr=0&mn=10&dy=0&id=p9852599196c&a=552043923

http://stockcharts.com/h-sc/ui?s=XLE&p=D&yr=0&mn=10&dy=0&id=p7950866438c&a=552043924

http://stockcharts.com/h-sc/ui?s=XLB&p=D&yr=0&mn=10&dy=0&id=p3594318861c&a=552043928

http://stockcharts.com/h-sc/ui?s=XLU&p=D&yr=0&mn=10&dy=0&id=p7029432950c&a=552043930

Monday, February 4, 2019 mid-day review with related chart views which will now update for the current & future price action -

SPY weekly displaying both the 20,2 Bollinger Band

and

the 104,2 Bollinger Band ( 2 years of price action )

http://stockcharts.com/h-sc/ui?s=SPY&p=W&st=2013-08-26&id=p6401602239c&a=369089730

SPY monthly displaying:

20,2 BB

15,2 BB

36,2 BB ( 3 years of price action )

http://stockcharts.com/h-sc/ui?s=SPY&p=M&st=2013-08-26&id=p0491153556c&a=643883237

The NYSE all-issues weekly cumulative Advance-Decline line

has been higher for six straight weeks.

That has happened only two other times in the past six years.

the NYSE all-issues Advance-Decline breadth line is displayed

as the lowest chart element in this daily chart

for the $NYAD -

http://stockcharts.com/h-sc/ui?s=%24NYAD&p=D&yr=0&mn=8&dy=13&id=p1851879573c&a=624707621

$NYA monthly with 5 other indices,

and

displaying the 15,2 Bollinger Bands

http://stockcharts.com/h-sc/ui?s=%24NYA&p=M&yr=3&mn=10&dy=0&id=p1601538367c&listNum=87&a=568822129

S&P 1500 Composite index

interpretation of daily and weekly charts -

daily chart -

http://stockcharts.com/h-sc/ui?s=%24SPSUPX&p=D&yr=1&mn=4&dy=0&id=p7089314153c&a=524593808

S&P 1500 Composite index price action now resides above the

important upper boundary of the

599-609 bull/bear divider

price zone located in the middle of

the price ranges of prior

highs and lows

* bears need price back below the 21,2 daily lower BB

for a long duration lasting weeks

AND

a lasting hold below 599 price level

===============================

On Fri, Feb 1, 2019 at 2:01 AM --

net Advance-Decline lines with other analytical data sets for 5 major US indices, with numerous related charts -

( the A-D lines are cumulative from a floating start date, based on the duration of the chart period which I have selected, while many analysts often select a fixed date from which the accumulation of the A-D math actually starts ... for this purpose, I have only fixed the chart period in number of weeks that are plotted on each A-D chart, so the accumulation start date moves forward by one day upon the completion of another trading day of price action )

selected key charts for evaluating

the US equity market as a whole -

SPY daily with selected internals

http://stockcharts.com/h-sc/ui?s=SPY&p=D&yr=5&mn=6&dy=0&id=p3758866087c&a=581689599

$SPX daily with three S&P 500 internals - $2813.89 must be surpassed on a lasting basis for the bullish case confirmation

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=2&mn=10&dy=0&id=p3149591940c&a=422231931

daily S&P 500 internal with the SPY price action plot vs.

the 21,3 Bollinger Band

http://stockcharts.com/h-sc/ui?s=%21NEWHISPX&p=D&yr=2&mn=0&dy=0&id=p1367909886c&a=382915190

S&P 1500 daily

http://stockcharts.com/h-sc/ui?s=%24SPSUPX&p=D&yr=2&mn=4&dy=0&id=p8278556979c&a=524593808

daily S&P 1500 Composite index

and one internal for this index

and the 1500 with several different Bollinger Band

settings displayed

http://stockcharts.com/h-sc/ui?s=%24SUPADP&p=D&st=2014-07-01&id=p9018513511c&a=625302380

SPY daily with the 200,2 Bollinger Band

and with Carl Swenlin's PMO indicator

http://stockcharts.com/h-sc/ui?s=SPY&p=D&yr=1&mn=4&dy=0&id=p3501807804c&a=588696944

SPY daily with two versions of one internal for the S&P 500

http://stockcharts.com/h-sc/ui?s=SPY&p=D&yr=5&mn=6&dy=0id=p3580505100c&a=581689599

$SPXEW daily Point & Figure chart, for the

S&P 500 Equally Weighted index

http://stockcharts.com/freecharts/pnf.php?c=%24SPXEW,PFTADDNRNO[PA][D][F1!3!!!2!20]&dt=201902010201

$SPXEW daily chart

http://stockcharts.com/h-sc/ui?s=%24SPXEW&p=D&yr=0&mn=7&dy=0&id=p87689352907&a=624740202

$SPX daily chart with XLK, XLF and XLY

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&st=2016-06-30&id=p6208542183c&a=627033842

SPY weekly chart

http://stockcharts.com/h-sc/ui?s=SPY&p=W&yr=1&mn=11&dy=20&id=p2584872579c&a=625675189

$BKX - Banking index - weekly closes chart with

$SPX, $NYA and BAC

http://stockcharts.com/h-sc/ui?s=%24BKX&p=W&yr=2&mn=8&dy=0&id=p3041536295c&a=624176835

$SPX daily with internals for four indices, a cumulative

data set for the internals

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=3&mn=8&dy=0&id=p9727396257c&a=588693282

S&P 500 Advance-Decline line, with the daily values in histogram format

http://stockcharts.com/h-sc/ui?s=%21ADLINESPX&p=D&st=2018-05-01&id=p6125333052c&a=607135436

http://stockcharts.com/h-sc/ui?s=%21ADLINESPX&p=D&yr=1&mn=9&dy=0&id=p8850836555c&a=357464422

$OEX daily price action with

the S&P 100 Advance-Decline line

http://stockcharts.com/h-sc/ui?s=%24OEX&p=D&yr=0&mn=10&dy=20&id=p22002749421&a=589367470

Nasdaq 100 Advance-Decline line, with the daily values in histogram format

http://stockcharts.com/h-sc/ui?s=%21ADLINENDX&p=D&st=2018-05-01&id=p78839151810&a=607135438

Dow Jones Industrials Advance-Decline line, with the daily values in histogram format

http://stockcharts.com/h-sc/ui?s=%21ADLINEDOW&p=D&st=2018-05-01&id=p93734795529&a=607135439

NYSE Composite index common-stocks-only data set Advance-Decline line,

with the daily values

in histogram format

http://stockcharts.com/h-sc/ui?s=%21ADLINENYC&p=D&st=2018-05-01&id=p15253297673&a=607135437

Nasdaq Composite index daily price action and

the Advance-Decline line

http://stockcharts.com/h-sc/ui?s=%24COMPQ&p=D&yr=0&mn=10&dy=20&id=p07044983061&a=589367467

$NYA daily, $NYA daily with $TRAN & other indices, & the

$NYA weekly, with revised chart settings as of January 31, 2019 -

http://stockcharts.com/h-sc/ui?s=%24NYA&p=D&yr=2&mn=11&dy=0&id=p0568389960c&a=206235190

http://stockcharts.com/h-sc/ui?s=%24NYA&p=D&st=2016-08-01&id=p4928170551c&a=260296468

http://stockcharts.com/h-sc/ui?s=%24NYA&p=W&yr=9&mn=0&dy=0&id=p4353110424c&a=394435875

===========================

/ES S&P 500 index futures $2712.25 / 2690.00 levels must eventually be surpassed on

a lasting basis, OR the bears continue to rule

the day for many months or years to come ...

/ES 2548 region is the next major lower level

of some significance which must be held during future declines

in order to gain upside traction having highly probable

staying power on a very long-term basis

pullback lows by /ES S&P 500 futures of interest since June 2018:

2775.00 - all-sessions low in the week ended March 1, 2019

2316.75 - late December 2018 low

2401.00 - Sunday December 23rd low near the globex open

2409.25 - December 21 very late day

2441.50 - mid day

2476.25 - December 20 morning globex session

2489.50 - December 19 day session

2531.00 - December 18 late day

2533.xx - December 17 late day

* the sharp decline lower started

after October 5, 2018 and continued into October 26, 2018, followed by

a brief pause

2712.25 - in week ended October 12

2873.25 - October 5 late day

2887.75 - October 4 mid-day

2865.00 - September 7 a.m.

2877.50 - September 5

2885.50 - September 4

2891.75 - August 31

2876.75 - low in week ended August 31

2850.00

2831.00's

2803.00

2791 August low

2790 late July low

2788 to 2767 = the often tested horizontal support zone in June to July 2018

/ES futures hourly --

$SPX 2813.89 is one key horizontal inflection level based on the prior daily closes for the S&P 500 index

$SPX $2690.16 is a key level which the bullish case depends upon for

a continuing stair stepping higher price structure to be alive and well in the long-term

$SPX daily closes chart, with customized chartsettings updated for the March 1, 2019 close

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=2&mn=10&dy=0&id=p7970865907c&a=422231931

Market Snapshot - February 14, 2019

* S&P 500 index closed above its 200-day simple moving average for the third consecutive day -

1st times above since December 3, 2018

* S&P 1500 Composite index closed above its 100-day sma for

the ninth consecutive day, a firmly bullish condition

* Transports and US Dollar index print another new 2019 price high today

daily chart shows these symbols above

the 89-day ema for multiple days -- a firmly

bullish condition -

$NYA, $SPX, $TRAN, $XBD and $USD

"Year-to-Date percentage change -

Russell 2000 +14.6% YTD

Nasdaq Composite +11.9% YTD

S&P 500 +9.5% YTD

Dow Jones Industrial Average +9.1% YTD

Snapshot -

Dow 25439.39 -103.88 (-0.41%)

Nasdaq 7426.97 +6.58 (0.09%)

SP 500 2745.69 -7.30 (-0.27%)

10-yr Note +14/32 2.652

NYSE Adv 1527 Dec 1319 Vol 950.5 mln

Nasdaq Adv 1510 Dec 1511 Vol 2.1 bln

Industry Watch

Strong: Real Estate, Health Care, Communication Services, Energy, Information Technology

Weak: Financials, Consumer Staples

Moving the Market

Market overcomes lower start to finish well above its session lows

Retail Sales for December declined 1.2%

(Briefing.com consensus +0.2%); playing into market's concerns about the U.S. economy slowing down

U.S. and China remain far apart on reform demand issues, according to Bloomberg

Mixed earnings reports: Coca-Cola (KO) disappoints, Cisco (CSCO) beats earnings estimates"

-- briefing.com

$SPXEW $4182.83 = current multi-month high achieved

in November 2018

* price action this week approaches the 4182.83 level

from below...

bulls want to see a permanent hold above the 4182.83 level

$SPXEW daily chart with five ratios --

( S&P 500 Equally Weighted index )

* the ratios are bullish for $SPXEW and for

$SPX price action while they continue to advance upward

http://stockcharts.com/h-sc/ui?s=%24SPXEW&p=D&yr=0&mn=5&dy=0&id=p9678364347c&a=554139761

S&P 1500 Composite index daily price action and internals,

with a chart settings revision as of February 13th -

* no evidence yet exists on this chart to

justify top picking the price action

or

to justify a near-term large sized pullback by the S&P 1500 price action

http://stockcharts.com/h-sc/ui?s=%24SUPHLP&p=D&yr=0&mn=10&dy=0&id=p9294679994c&a=623831152

Market Snapshot - February 13, 2019 close

** "the early buying interest faded today after news hit that Senator Marco Rubio (R-FL) plans to file a bill

that would make expensing permanent and tax corporate

buybacks the same way as dividends.

If that bill ultimately came to pass, it could potentially

lead to lower share buyback activity that leads

to lower EPS growth.

It was an implication that served to take a little steam

out of the market." -- briefing.com

* S&P 500 index closed above its 200-day moving average for the second

consecutive day - 1st times above since December 3, 2018

the index closed above its 150-day sma for the 1st time since November 2018

Transports print another new 2019 price high today

$NYA, $SPX and $XBD print another new 2019 price high today

daily chart shows these symbols above

the 89-day ema for multiple days -- a firmly

bullish condition -

$NYA, $SPX, $TRAN, $XBD and $USD

$NYA - next overhead chart milestone above the 400-day simple moving average

that was briefly violated to the upside today is the 300-day sma,

which the bulls need to see permanently surpassed

http://stockcharts.com/h-sc/ui?s=%24NYA&p=D&yr=1&mn=10&dy=0&id=p8737803898c&a=627156801

Year-to-Date percentage change -

Russell 2000 +14.4% YTD

Nasdaq Composite +11.8% YTD

S&P 500 +9.8% YTD

Dow Jones Industrial Average +9.5% YTD

Snapshot -

Dow 25543.27 +117.51 (0.46%)

Nasdaq 7420.39 +5.76 (0.08%)

SP 500 2752.99 +8.30 (0.30%)

10-yr Note -5/32 2.704

NYSE Adv 1895 Dec 1004 Vol 820.0 mln

Nasdaq Adv 1716 Dec 1296 Vol 2.1 bln

Industry Watch

Strong: Energy, Consumer Discretionary, Industrials

Weak: Utilities, Communication Services

Moving the Market

Continued optimism that U.S.-China trade talks have been progressing favorably contributed to higher start

Senator Marco Rubio (R-FL) plans to file a bill that could potentially lead to lower share buyback activity that leads to lower EPS growth

Nine of 11 S&P 500 sectors finish higher; energy outperforms, utilities under performs

-- partial excerpts from briefing.com

Market Snapshot - February 12, 2019 close

* S&P 500 index closed above its 200-day moving average for the first time since December 3, 2018

Transports print another new 2019 price high today

$NYA, $SPX and $XBD print a new 2019 price high today

daily chart shows these symbols above

the 89-day ema for multiple days -- a firmly

bullish condition -

$NYA, $SPX, $TRAN, $XBD and $USD

$NYA - next overhead chart milestone is the 400-day simple moving average, which the bulls need to see permanently surpassed

... the $NYA 300-day sma is located at an even higher level

http://stockcharts.com/h-sc/ui?s=%24NYA&p=D&yr=1&mn=10&dy=0&id=p8737803898c&a=627156801

Year-to-Date percentage change

Russell 2000 +14.1% YTD

Nasdaq Composite +11.8% YTD

S&P 500 +9.5% YTD

Dow Jones Industrial Average +9.0% YTD

Snapshot

Dow 25425.76 +372.65 (1.49%)

Nasdaq 7414.63 +106.71 (1.46%)

SP 500 2744.69 +34.93 (1.29%)

10-yr Note -7/32 2.681

NYSE Adv 2178 Dec 718 Vol 872.8 mln

Nasdaq Adv 2243 Dec 777 Vol 2.1 bln

Industry Watch

Strong: Materials, Consumer Discretionary, Industrials, Financials

Weak: Real Estate

Moving the Market

U.S. lawmakers reach tentative agreement to avoid government shutdown

Continued optimism regarding ongoing U.S.-China trade talks

S&P 500 closes above its 200-day moving average for first time since December 3

Broad-based advance and

10 of the 11 S&P 500 industry sectors finished with gains today

XLF Financial sector of the S&P 500 index -

It's a good sight to see the sector outperforming today

after it has underperformed the broader market so far this month. Most XLF components printed gains today.

XLF daily chart with PMO analysis,

and with

XLF to SPY ratio

http://stockcharts.com/h-sc/ui?s=XLF&p=D&yr=0&mn=10&dy=0&id=p5017360177c&a=552043925

$SPXEW 200-day sma = 4112.83 at the February 12th close

vs.

4150.70 is the February 12th close,

a firmly bullish condition

while the price action holds above the 200-day sma which has

not taken place for more than a period of two days since October 2018

vs. 4182.83 is the intraday high of early November 2018

$SPXEW - S&P 500 Equally Weighted index daily chart is shown below

-------------------

Sunday February 10, 2019 -

" Smaller stocks in the S&P 500 carrying the load in latest gain

Bulls see breadth of rally as sign gains can continue"

"In a week when U.S. stocks failed to rise past their 200-day moving average,

the gauge of equal-weighted stocks provided a cushion.

Broader market participation and a break-out in small and medium-sized stocks

is generally welcome by analysts

and is good for stock pickers, too."

full article from Bloomberg published today -

https://www.bloomberg.com/news/articles/2019-02-10/equal-opportunity-recovery-weaning-s-p-500-of-its-megacap-habit

$SPXEW - S&P 500 Equally Weighted index daily chart -

* 89-day ema and 50-day ema -- bullish while $SPXEW remains above, which is the current condition

* 200-day ema -- seven daily closes above, which is required

for the continued bullish case

the 200-day simple moving average value area has acted as resistance since mid-October 2018

Note the 200-day sma has zero slope since early January 2019,

and the bullish case needs to see this moving average

eventually display an upward slope

** the lowest chart element displays the

$SPXEW to $SPX daily ratio, which is generally

rising since the final trading day in December 2018 ...

meaning broadening participation by the 500 stocks

which make up the Market Capitalization Size weighted S&P 500 index

http://stockcharts.com/h-sc/ui?s=%24SPXEW&p=D&yr=0&mn=5&dy=0&id=p7015164400c&a=554139761

$SPX 126-day sma = 2735.46

vs.

2735.71 morning high on Tuesday February 12, 2019, so far

126 trading days = two quarters of duration

** a lasting price advance above the 126-day simple moving average for $SPX will represent a bullish confirmation signature

$SPX 2-hour chart displays the technical environment with the

USO and the UUP price action -

* the $SPX 55-period ema has provided support since early January 2019, a bullish characteristic while the condition continues

http://stockcharts.com/h-sc/ui?s=%24SPX&p=120&yr=0&mn=1&dy=15&id=p5429505208c&a=625257080

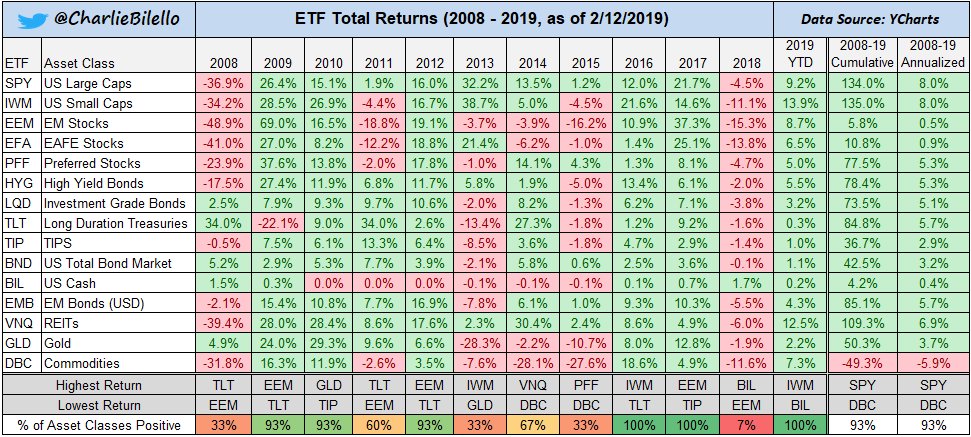

Charlie Bilello

@charliebilello

13 minutes ago

Asset Class ETF Returns Since 2008 and Year to Date,

as of February 12, 2019 early morning

US Small Caps ( IWM ) at 13.9% gain in 2019

** IWM rises above its 200-day exponential moving average for

the first time in 2019 on February 12, 2019 -

IWM 151.88 = 200-day ema as of February 12th morning

https://stockcharts.com/articles/sharedcharts.php?cc=8512197

verniman

@verniman

27 minutes ago

/ES_F Bullish targets after news.

------------------------------

repeat from the December 27, 2018 post -

/ES 2712.25 / 2690.00 levels must eventually be surpassed on

a lasting basis, OR the bears continue to rule

the day for many months or years to come ...

/ES 2548 region is the next level below, which

the bulls must permanently surpass with future price

bounces to gain upside traction having probable

staying power

/ES above the 2470 to 2488 zone is needed on

a permanent basis to argue for a probable

lasting upside

------------------------------

pullback lows by /ES S&P 500 futures of interest since June 2018:

2316.75 - late December low

2401.00 - Sunday December 23rd low near the globex open

2409.25 - December 21 very late day

2441.50 - mid day

2476.25 - December 20 morning globex session

2489.50 - December 19 day session

2531.00 - December 18 late day

2533.xx - December 17 late day

* the sharp decline lower started

after October 5 and continued into October 26, 2018, followed by

a brief pause

2712.25 - in week ended October 12

2873.25 - October 5 late day

2887.75 - October 4 mid-day

2865.00 - September 7 a.m.

2877.50 - September 5

2885.50 - September 4

2891.75 - August 31

2876.75 - low in week ended August 31

2850.00

2831.00's

2803.00

2791 August low

2790 late July low

2788 to 2767 = the often tested horizontal support zone in June to July 2018

Larry Tomlinson

@mrktlarry

14 hours ago

2/11,

Weekly resistance 2726/2739

support 2690/2677.

Daily resistance 2716/2722

support 2700/2694.

Odds remain with a minor wave 4 in progress this week.

Weekly resistance would hold price if true.

$SPX daily with 5 other indices vs. the 100-day simple moving average

and

the $SPX 126,2 Bollinger Band & the 15,2 Bollinger Band

four charts are shown below

* status vs. the 100-day sma as of Monday February 11, 2019 -

above 100 dsma, which is firmly bullish

$SPX

$NYA

$COMPQ

$NDX

$RUT

slightly below 100 dsma, which is bearish

$OEX

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=1&mn=4&dy=0&id=p8838582817c&a=417728869

chart #2 - $SPX daily closes chart with

3 internals for the S&P 500 index -

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=2&mn=8&dy=0&id=p4678571212c&a=422231931

chart #3 - S&P 500 net Advance-Decline line

with the 50,2 Bollinger Band showing a current

bullish status for this internal until the A-D line

is below its 50-day sma as a minimum event -

http://stockcharts.com/h-sc/ui?s=%21ADLINESPX&p=D&st=2018-05-01&id=p2308037885c&a=644369805

chart #4 - the S&P 1500 has closed several days above

its 100-day sma which is bullish

and

closed above the rising 15-day sma since early January

which is firmly bullish

http://stockcharts.com/h-sc/ui?s=%24SPSUPX&p=D&yr=0&mn=8&dy=0&id=p6992720337c&a=524593808

Market Snapshot - February 11, 2019 close

Transports print a new 2019 price high today

daily chart shows these symbols above

the 89-day ema for multiple days -

$NYA, $SPX, $TRAN, $XBD and $USD

http://stockcharts.com/h-sc/ui?s=%24NYA&p=D&yr=1&mn=10&dy=0&id=p8737803898c&a=627156801

note the $OEX largest caps & multi-national companies ( not shown on the chart ) is recently weak

and

the $USD index strengthening further is likely

a partial reason for this $OEX weakness, so be vigilant if

the $USD continues to move upward

* Relative strength from the transport stocks

underpinned the out performance of

the industrial sector

* The U.S. Dollar Index rose 0.4% to 97.05,

setting a new high for 2019

Russell 2000 +12.6% YTD

Nasdaq Composite +10.1% YTD

S&P 500 +8.1% YTD

Dow Jones Industrial Average +7.4% YTD

Dow 25053.11 -53.22 (-0.21%)

Nasdaq 7307.92 +9.71 (0.13%)

SP 500 2709.76 +1.92 (0.07%)

10-yr Note -7/32 2.656

NYSE Adv 1898 Dec 997 Vol 813.3 mln

Nasdaq Adv 1855 Dec 1148 Vol 1.9 bln

Industry Watch

Strong: Industrials, Energy

Weak: Communication Services, Utilities, Health Care

Moving the Market

Major averages mixed in lackluster session

U.S.-China trade talks resume in Beijing

Transport stocks lift S&P 500 industrial sector

The U.S. Dollar Index rose for eighth straight session; sets 2019 high

" Smaller stocks in the S&P 500 carrying the load in latest gain

Bulls see breadth of rally as sign gains can continue"

"In a week when U.S. stocks failed to rise past their 200-day moving average,

the gauge of equal-weighted stocks provided a cushion.

Broader market participation and a break-out in small and medium-sized stocks

is generally welcome by analysts

and is good for stock pickers, too."

full article from Bloomberg published today -

https://www.bloomberg.com/news/articles/2019-02-10/equal-opportunity-recovery-weaning-s-p-500-of-its-megacap-habit

$SPXEW - S&P 500 Equally Weighted index daily chart -

* 89-day ema and 50-day ema -- bullish while $SPXEW remains above, which is the current condition

* 200-day ema -- seven daily closes above, which is required

for the continued bullish case

the 200-day simple moving average value area has acted as resistance since mid-October 2018

Note the 200-day sma has zero slope since early January 2019,

and the bullish case needs to see this moving average

eventually display an upward slope

** the lowest chart element displays the

$SPXEW to $SPX daily ratio, which is generally

rising since the final trading day in December 2018 ...

meaning broadening participation by the 500 stocks

which make up the Market Capitalization Size weighted S&P 500 index

http://stockcharts.com/h-sc/ui?s=%24SPXEW&p=D&yr=0&mn=5&dy=0&id=p7015164400c&a=554139761

AAPL cumulative percentage change since

early October 2017, with selected other

large Market Cap size stock components

in the S&P 500 index -

* chart displays the daily 15,2 Bollinger Band

http://stockcharts.com/h-sc/ui?s=AAPL&p=D&st=2017-10-06&id=p4823508546c&a=549204096

$NYA monthly with 5 other indices

displaying

the 15,2 Bollinger Bands

* this week ended February 8, 2019

saw the 15-month simple moving average

acting as resistance very near the

week's price highs for the indices ...and

$NYA's high did not approach its

15-month sma this week

* bulls need the $NYA to continue above

the 5-month simple moving average ...

$NYA closed January above the declining 5-month sma

the Dow Jones Industrial Average currently resides above

the 15-month sma, which is bullish while

it continues

http://stockcharts.com/h-sc/ui?s=%24NYA&p=M&yr=3&mn=10&dy=0&id=p4478440283c&a=568822129

$SPX daily with 5 other indices vs. the 100-day simple moving average

and

the $SPX 126,2 Bollinger Band & the 15,2 Bollinger Band

four charts are shown below

* status vs. the 100-day sma as of Friday February 8, 2019 -

above 100 dsma

$SPX

$NYA

$COMPQ

$NDX

slightly below 100 dsma

$OEX

$RUT

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=1&mn=4&dy=0&id=p8838582817c&a=417728869

chart #2 - $SPX daily closes chart with

3 internals for the S&P 500 index -

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=2&mn=8&dy=0&id=p4678571212c&a=422231931

chart #3 - S&P 500 net Advance-Decline line

with the 50,2 Bollinger Band showing a current

bullish status for this internal until the A-D line

is below its 50-day sma as a minimum event -

http://stockcharts.com/h-sc/ui?s=%21ADLINESPX&p=D&st=2018-05-01&id=p2308037885c&a=644369805

chart #4 - the S&P 1500 has closed several days above

its 100-day sma which is bullish

and

closed above the rising 15-day sma since early January

which is bullish

http://stockcharts.com/h-sc/ui?s=%24SPSUPX&p=D&yr=0&mn=8&dy=0&id=p6992720337c&a=524593808

Market Snapshot - February 8, 2019 close

* the S&P Composite 1500 index day's low was

contained by its rising 15-day simple moving average,

which has seen multiple weeks acting as support

* SPY closed Friday very near & above its

50-week simple moving average

* SPY's low of this week was the declining 21-week sma

SPY weekly -

http://stockcharts.com/h-sc/ui?s=SPY&p=W&yr=1&mn=11&dy=20&id=p5372927872c&a=644369322

* $OEX has under performed the $SPX for 6 weekly closes,

which means the largest capitalization size stocks in the

S&P 500 index are lagging the overall index price action

Dow 25106.33 -63.20 (-0.25%)

Nasdaq 7298.21 +9.85 (0.14%)

SP 500 2707.84 +1.83 (0.07%)

10-yr Note +7/32 2.634

NYSE Adv 1384 Dec 1477 Vol 833.0 mln

Nasdaq Adv 1465 Dec 1499 Vol 2.1 bln

Industry Watch

Strong: Consumer Staples, Utilities, Information Technology, Communication Services

Weak: Energy, Consumer Discretionary, Financials

Moving the Market

Early follow-through selling and an effort to de-risk sent the broader market lower

Steady afternoon rebound, and a late swarm of buyers, helped the S&P 500 eke out a slim gain

Amazon (AMZN) dragged on the broader market following CEO Jeff Bezos accusing National Enquirer's publisher of blackmail

revised $SPX daily closes chart -

89-day exponential moving average added in black color

* the 233-day exponential moving average is key for

both bulls and bears

bullish while above the 233 dema

bearish only while holding below the 233 dema and the 89-day ema

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=1&mn=8&dy=0&id=p6958013757c&a=588693282\

$SPX daily since 2014 with

the 100-day simple moving average for

6 indices

and

the $SPX 126,2 Bollinger Band ( 2 quarters of trading days )

* $SPX, $OEX, $NDX, and $RUT are slightly below the 100-day sma at this moment

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&st=2014-12-01&id=p0859399900c&a=417728869

89-day exponential moving average vigilance

for 6 indices -

$NYA daily with $SPX and others

$SPX 89-day ema = 2673

* $TRAN is only approx. 20 points below its

89-day ema at this moment and $XBD is testing

http://stockcharts.com/h-sc/ui?s=%24NYA&p=D&yr=2&mn=11&dy=0&id=p2156861935c&a=206235190

revised # of NYSE Advancing issues 15-minute chart

with

price action vs. the 21,2 Bollinger Bands

for five indices -

http://stockcharts.com/h-sc/ui?s=%24NYADV&p=15&yr=0&mn=0&dy=12&id=p8754474580c&a=382915335

February 8th - price action for 5 indices resides in the a.m. near the 21,2 lower Bollinger Band ...

bulls eventually need to see a bounce which has staying power

February 7th, the mid-day bounces for the 5 indices are pausing/halting

at the declining 15-minute 21-day simple moving average ... as of 1 hour before today's market close

not shown on the chart -- the $NYA resides below its 15-minute

200 simple moving average by the price bar closes for the 1st time

since January 28th ... check out the other symbols for this metric

===================

daily cumulative Advance-Decline line and the A-D daily values

in histogram format for

both the S&P 500

and

for the NYSE

http://stockcharts.com/h-sc/ui?s=%21NETADSPX&p=D&yr=0&mn=6&dy=0&id=p8095667411c&a=382915177

Larry Tomlinson

@mrktlarry

2 hours ago

2/8,

daily support 2696/2689

weekly support is now below bullish levels with 2678/2656 critical.

Market is now in a high risk situation next two weeks.

Walter Murphy

@waltergmurphy

10 hours ago

Today marked only the second time this year

that the SP 500 daily cumulative a-d line was negative

on consecutive days.

======================

S&P 500 index net Advance-Decline line -

http://stockcharts.com/h-sc/ui?s=%21ADLINESPX&p=D&st=2018-05-01&id=p6892084114c&a=644369805

corrected Post, corrected in two items

SPY 233-day exponential moving average = 266.59

bullish while above

bearish while below the 233-day ema

US Dollar daily chart with SPY price bars -

http://stockcharts.com/h-sc/ui?s=%24USD&p=D&st=2012-06-15&id=p2956011864c&a=624846613

$SPX 100-day simple moving average = 2704.30

as of the February 7, 2019 close

* bullish while above

* bearish while below 100 dsma

* bullish only while above $SPX 2690 key horizontal level

fyi - $SPX 2714 level = the 61.8% advancing retracement level of the major decline into late December 2018

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=4&mn=0&dy=0&id=p9047502418c&a=422054357

S&P 1500 index 100-day sma = 624.22

15-day sma = 617.92, above this MA in most of the January to February 7th

* bullish for SPY while above

* bearish for SPY while below 15-day sma, while a decline

below the 100-day sma is an early warning

http://stockcharts.com/h-sc/ui?s=%24SUPHLP&p=D&yr=0&mn=10&dy=0&id=p1576293323c&a=623831152

RSP 15-week simple moving average = 97.28

* bullish for SPY while above

* bearish for SPY while below 15-week sma

http://stockcharts.com/h-sc/ui?s=RSP%3ASPY&p=W&yr=5&mn=0&dy=0&id=p20258996629&a=625134013

RSP daily Point & Figure chart now shows

a minor pullback within the multi-week bounce

and nothing of downside importance has

yet taken place for SPY or for RSP -

http://stockcharts.com/freecharts/pnf.php?c=RSP,PFTBDHNRBO[PA][D][F1!3!!!2!20]&dt=201902080005

|

Followers

|

20

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

758

|

|

Created

|

03/05/11

|

Type

|

Free

|

| Moderator CopperDollar | |||

| Assistants rimshot | |||

one of our other Investors Hub board is shown at the Link below & provides infrequent summary updates for Sector & Index ETF's -

* we keep four of our six IHub boards current -- the boards are separated to promote author time efficiency

https://investorshub.advfn.com/Sector-&-Index-summary-20715/

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

THE ITEMS BELOW ARE CAREFULLY SELECTED & DATED TO PROVIDE CLUES WHEN OVERALL SENTIMENT IS SHIFTING DIRECTION

April 25, 2011 Bloomberg article: Federal Reserve officials are staking their inflation-fighting credibility on an untested tool: the power to pay interest on bank reserves."Fed Officials Count on Untested Tool to Hold Off Inflation http://bloom.bg/hudK7I

April 26, 2011 article by Bloomberg: S&P 500 Rises Above Highest Closing Level Since 2008 on Earnings http://bloom.bg/fw0RwL

April 27, 2011, 12:35 pm - the Fed acknowledges an increase in inflation but still thinks it is transitory. FOMC statement http://bit.ly/iel00W

April 27, 2011 1:50 pm - Parsing the Fed: How the Statement Changed http://on.wsj.com/jrRCx8

April 27, 2011 1:50 pm - FOMC will complete purchases of $600B of longer-term Treasury securities by the end of current quarter http://1.usa.gov/m1aoAV

April 27, 2011 - FOMC members see a great deal of uncertainty going forward - Mid East, Africa, emrg mkts, comm prices, European situation.

April 27, 2:30 pm - Fed Chairman Bernanke recently began his press conference. He has outlined revisions to the GDP forecast, which now suggests that the economy will grow between 3.1% and 3.3% in 2011 after it had previously been forecasted to grow between 3.4% and 3.9%. For 2012, GDP is now expected to grow between 3.5% and 4.2% after it had been forecasted to grow between 3.5% and 4.4%. For 2013, GDP is expected to grow between 3.5% and 4.3% after it had been forecasted to grow between 3.5% and 4.6%. Long-run growth is now expected to range from 2.5% to 2.8%, versus the range of 2.4% to 3.0% that had been issued previously. While GDP growth is expected to moderate, the Fed now expects that unemployment in 2011 will be between 8.4% and 8.7%, which is down from the range of 8.8% to 9.0% that had been previously estimated.

April 27 - Bernanke press conference ends. See the full recap here: http://on.wsj.com/itoIzU

April 27 - archived video of Bernanke press conference http://ht.ly/4IqjF

April 27- Ben Bernanke goes on record to warn the US deficit is not sustainable http://gu.com/p/2zyk9/tf

April 27 - St. Louis Fed - FOMC is prepared to adjust its securities holdings as needed in light of incoming information http://1.usa.gov/m1aoAV

April 27 - Cleveland Fed - Is a sustainable consumer recovery finally here? http://ow.ly/4IooY

April 27 - Cleveland Fed - NEW Economic Trends article: The Federal Reserve's Influence over Excess Reserves http://ow.ly/4JWKT

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |