Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

STEVE BRICKNER, stupid janitor criminole

STEVE BRICKNER Janitor-Pinhead-Pencildick

STEVE "Shit-for-Brains" BRICKNER professional janitor

Janitor STEVE BRICKNER the criininole scamster

Janiturd STEVE BRICKNER - criminal eunuch

WAY TO GO, JANITOR STEVE "SHIT FOR BRAINS" BRICKNER!!!!

I knew you could do it, asshole.

Shit-for-Brains STEVE BRICKNER nominated for Janitor of the Week.

Scumbag CONvicted criminole STEVE BRICKNER still swindling widows and orphans.

Scumsucker STEVE BRICKNER financial crook. Bogus pennyscam ticker waiting for FINRA to cancel it anytime.

Shitbag STEVE BRICKNER going nowhere in life. Except prison.

ZERO shares traded so far in 2023. STEVE BRICKNER still a total shitbag.

Shitbag STEVE BRICKNER's STSC ends 2022 with ZERO trades all year.

2023 looks to be exactly the same.

Should be able to close ~OUTT 2022 with ZERO trades of this scam.

ZERO trades in all of 2022

And the biggest ZERO of all - STEVE BRICKNER

Thanks for the information. GLTA

You need to re-read the post of Renee and the link. This STEVE BRICKNER turd will be revoked before Christmas, mebbe before Thanksgiving this year (2022).

The company has 10 days from 18 September 2022 to reply. If they do, then a pre-hearing conference 14 days after the reply is filed. If no reply is filed, which it wont be, then the SEC will revoke the stock, which is what will happen.

Revoked by the Holidaze Season 2022.

Slow Ride ... Take It Easy! ... as the infamous FOGHAT have said ... 12 months is an eternity, and a slow ride last well beyond 2023. STSC LONG STSC STRONG !!! ....Do your own due diligence and know there are people who actually have a vested interest in STSC's future.

Last I checked, 5 zeros proceeded a 1 ... AKA...... .000001 (current price of an STSC share) ..... Is there a better time to send the hounds out to investigate any wrong doing?? .... Allow me to answer ..... YES!!! .... 2018 is a long time from 2022/2023. This is just their date of serious delinquency. I beg to differ, .... if truly foul play was in place, the SEC would have been on to 'the scam' long before 2022/2023. Am I placing too much faith in our GOVERNMENT??? .... a.k.a, the watchdogs of all that is right, good, and equal???? .... WOW, the playing field has changed since I was born over 50 years ago.

There is a very UGLY and SERIOUS side to these fillings, and I would like to personally plead for forgiveness from anyone who was misled by anything I ever stated related to STSC. I was simply following the trail of evidence provided. They didn't gain over 5 million in cash by being forthcoming. Due diligence is a word that is hard to digest after you truly felt due diligence is what you lived and breathed. GOOD LUCK TO ALL, AND HOPEFULLY NEW MANAGEMENT WILL LEAD TO MORE SUCCESS FOR ALL INVESTED.

It is very nice that the SEC has decided to protect investors after seriously delinquent filings have been detected. On behalf of STSC, thank you! .... I cannot thank you enough ... no really, I cannot thank you enough. The SEC is razor sharp on their detection of foul play. I would like to personally thank you for all of your hard work. I mean, what's a life savings? You guys are sharp with your aggressive action to save the poor-investor, ..... after he's/she's lost everything. GOOD WORK .... and again, THANK YOU!!! GO SEC! GO SEC! GO SEC!

Thank you Renee for speaking about something relevant to STSC!!! My humble response is .... 12 months is either a long time, or a short time ....... It is all a matter of perspective, and knowing that everything is relevant ..... I personally believe, a lot can be done in twelve months. Soooo, that being said, STSC LONG STSC STRONG!!!

STSC: SEC Admin. Proceeding for severely delinquent Financials (2018):

https://www.sec.gov/litigation/admin/2022/34-95830.pdf

Dickhead STEVE BRICKNER emptying garbage cans on his janitorial run.

Holding steady at ZERO trades for 2022.

This SCAM is dead. Nott one single trade in all of 2022.

Piece of shit STEVE BRICKNER the janitor still scamming with this turd ticker and still mopping up shitty toilet water that overflowed the toilets in the bathrooms.

Career criminal STEVE BRICKNER is a serial scammer and grifter.

STSC is a shell company that is not up to date on their filings. Hopefully their new accounting firm 'Slack', will get them up to date soon.

My bad, I must not have used the proper response when speaking about douchebags. I believe Steven Bricker is still a janitor. I still do not care. Does Steven Brickner aka 'douchebag' have anything to do with STSC's future?

It is nice to know that someone is paying such close attention to my words about STSC.

This stock has now been cast to the expert market per NEW OTC parameters that say this stock is not fully transparent and needs to get their paper work in order. I believe that is what their last 8k statement explained. They went to a different accounting firm to get their collective ducks in a row.

STSC is not up to date on their public disclosures. Allow me to fill in the blanks .... zero plus zero, plus zero, equals zero. Did I miss anything?

STSC is going to be bigger than of predecessors.

Douchebag STEVE BRICKNER still working as a janitor.

Every once in a while, I feel compelled to remind all STSC investors that LONG is STRONG. GLTA

Scumbag janitor STEVE BRICKNER still looking for work.

Piece of shit janitor STEVE BRICKNER - how is the janitoring these days?

Piece of shit STEVE BRICKNER the janitor still scamming with this turd ticker and still mopping up shitty toilet water that overflowed the toilets in the bathrooms.

Piece of shit STEVE BRICKNER the janitor still scamming with this turd ticker and still mopping up shitty toilet water that overflowed the toilets in the bathrooms.

Piece of shit STEVE BRICKNER the janitor still scamming with this turd ticker.

STSC LONG!!!! AND STSC STRONG!!!! 7/20/21 was not so long ago for an 8K statement. For the time being, STSC has had at least something to say in this year of pure hell on earth, (covid-19 etc) .... God bless all that is STSC and their collective and future endeavors. STSC LONG and STSC STRONG .... keep the faith alive brothers and sisters alike. The USA has not been kind, too any future looking MJ companies, let alone sub-penny "chump" company's like STSC. Especially with maniacs like Steven L. Brickner and Robert A. Hainey at the wheel .... That being said, be smart and hold tight ... merry Xmas and happy new year to all OTC players and played alike. As late as: July 8, 2021 Erwin Vahlsing

Title: Chief Financial Officer and Principal Executive Officer stated there were efforts to bring STSC current. That same 8k statement acknowledges the challenges and also acknowledges the change of their auditors (which by nature have to be completely unbiased) .... Give STSC time to get their I's dotted and T's crossed; who knows, .... maybe the USA will join Mexico, Canada and at least 18 other states to completely, once and for all legalize all that is cannabis. What does STSC have to do with cannabis? Who knows, maybe it's just wishful thinking or a shit ton of research beyond the newspaper headlines.

Get to know the STSC CEO - Crooked STEVE BRICKNER

The many recent companies of Crooked CEO STEVE BRICKNER

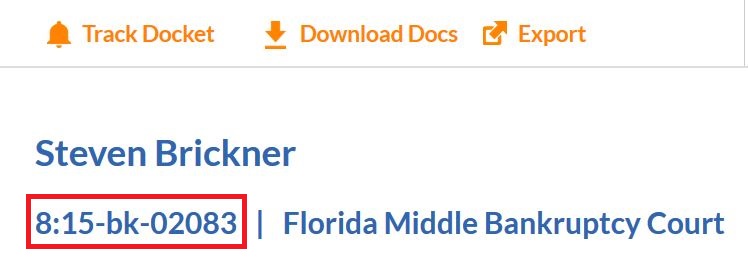

A couple of recent BANKRUPTCY cases of Crooked CEO STEVE BRICKNER

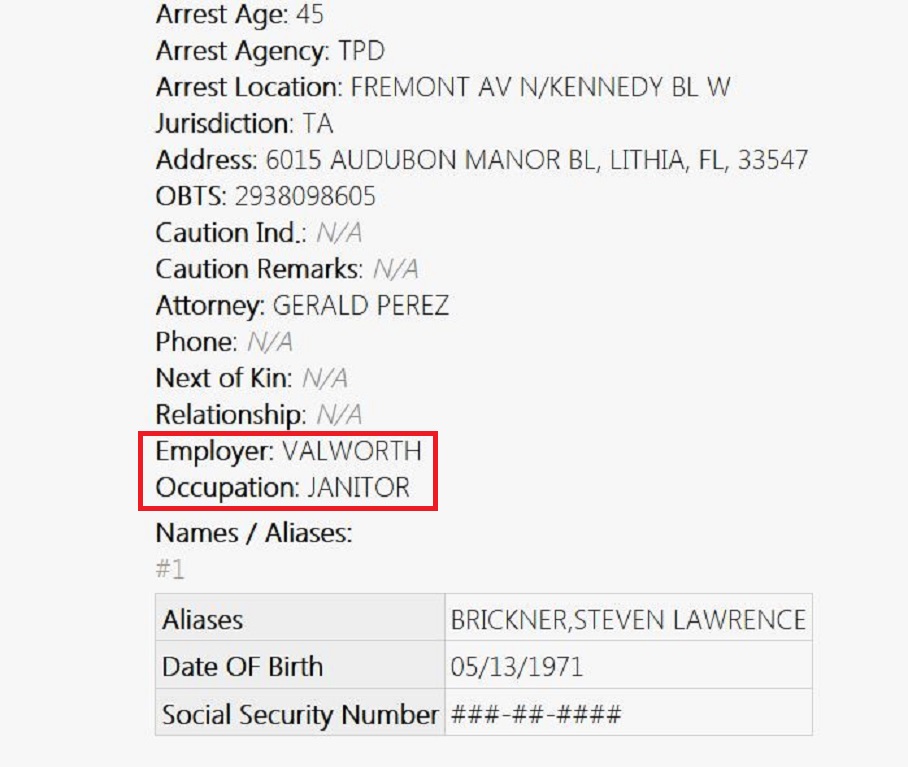

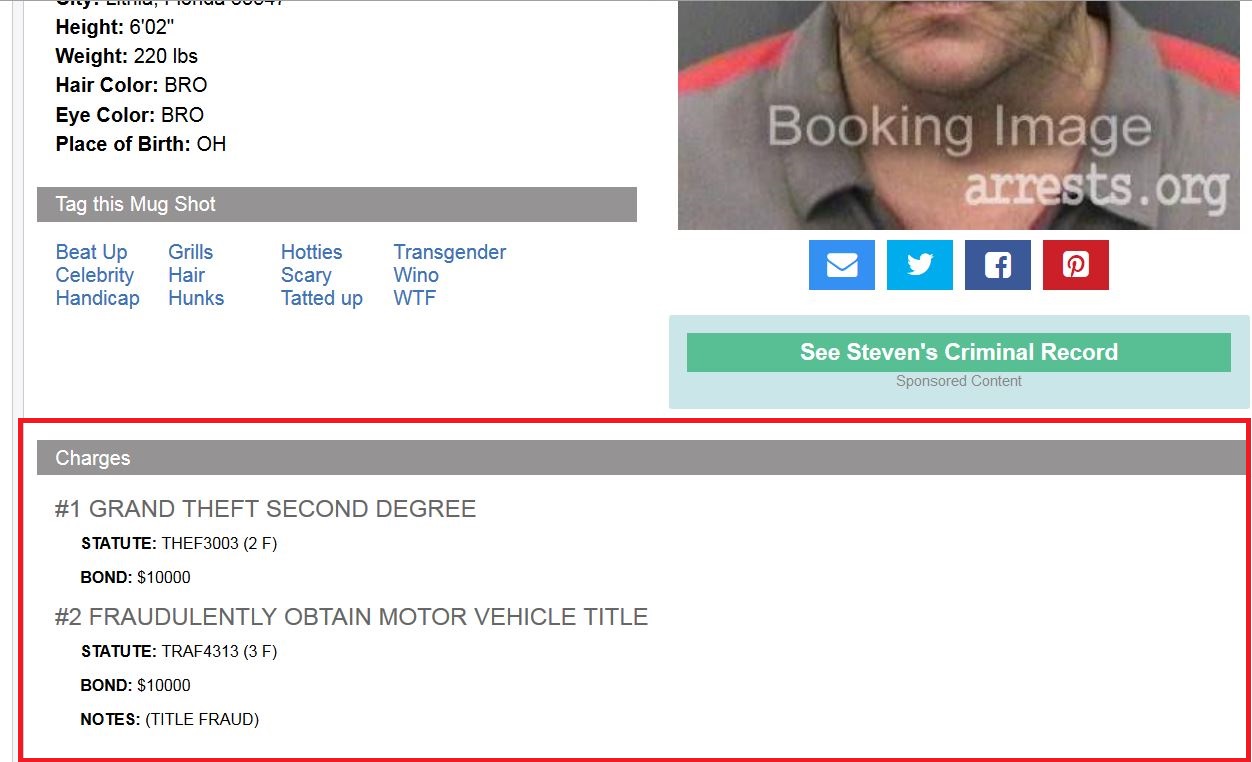

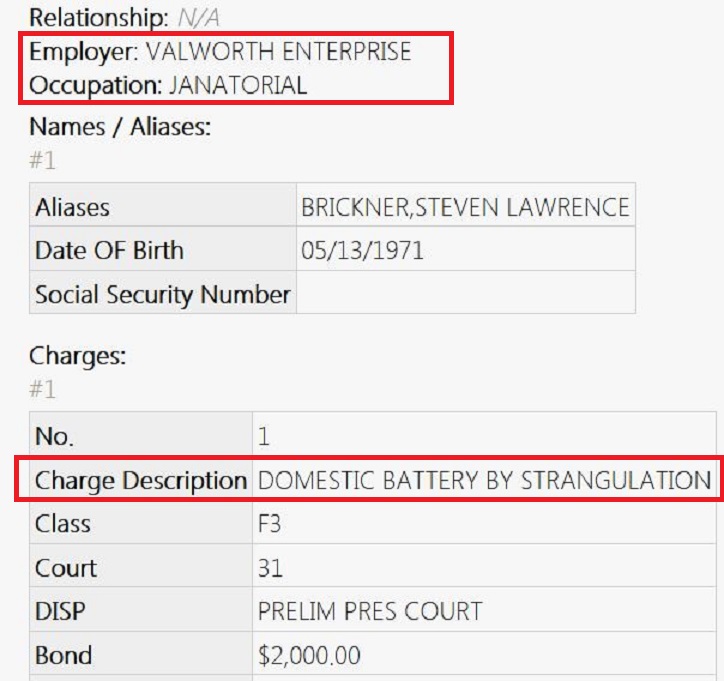

The many faces of Crooked CEO STEVE BRICKNER self-described JANITOR

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

START OF SECTION MAINTAINED BY MODERATOR WARMACHINE

NO ALTERATIONS OF THIS SECTION PERMITTED WITHOUT WRITTEN CONSENT

Warning! This company may not be making material information publicly available

Buying or selling this security on the basis of material nonpublic material information is prohibited under Section 10(b) of the

Securities Exchange Act of 1934 and Rules 10b-5 and 10b5-1 thereunder. Violators may be subject to civil and criminal penalties.

Pink No Information

Pink No Information companies are not able or willing to provide disclosure to the public markets -

either to a regulator, an exchange or OTC Markets Group.

Delinquent SEC Reporting

https://www.otcmarkets.com/stock/STSC/security

END SECTION MAINTAINED BY WARMACHINE

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |